Академический Документы

Профессиональный Документы

Культура Документы

Pension

Загружено:

Fayaz KhanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pension

Загружено:

Fayaz KhanАвторское право:

Доступные форматы

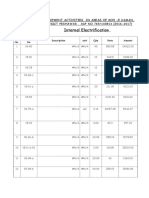

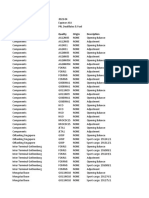

120 ILLUSTRATIONS - Pension Illustration 1 Pensionable emoluments Workout pensionable emoluments of an officer B-20 working in civil secretariat Peshawar

, from the following particulars. S# Pay & allowances P.M S# Pay & allowances 1 Basic Pay 44485 7 Special Pay 2 House Rent Allowance 10505 8 Senior Post Allowance 3 Conveyance Allowance 2480 9 Deputation Allowance 4 Adhoc relief 2634 10 Entertainment Allowance 5 Special Additional Allow; 2719 11 Orderly-allowance 6 Qualification Pay 0f NIPA 500 12 Special relief Allowance Solution Pensionable emoluments S# Pay & allowances P.M 1 Basic Pay 44485 2 Qualification Pay 500 3 Special Pay 300 4 Senior Post Allowance 1100 Total 46385 Note:-Orderly allowance is part of gross pension if he opts for not maintaining orderly at his residence Illustration 2 Retiring Pension,family pension Date of Birth 1/9/1948 Date of Joining Service 8/10/1970 Date of retirement/death/invalidation 1/9/2008 Remained under Suspension 1 year From 1-1-1982 To 1-12-1982 Availed Extra-Ordinary Leave 4 years From1-7-1984 To 30-06-1988 Pay on 1-7-2008 44485 Qualification Pay 500 Special Pay 300 Senior Post Allowance 1100 Total Pensionable Emoluments 46385 Work out Superannuation pension and commuted value of an officer from the following particular. a) If he retired on Superennuation pension b) If he died on 01-08-2008 c) if he died on 01-10-2008 i.e After getting the pension in case of (a) above. d) if He died after rendering 8 years & 6 months service. Solution: Qualifying service Length of service From 8-10-1969 to 31-08-2007 37years 10 Months 24 days Add: Military service if any allowed to count for pension Deduct: Spells of service not qualifying for pension 4 years Net qualifying service 33 years 10 Months 24 days Say 30 Years Last pay/pensionable emoluments 46385

P.M 300 1100 6000 600 3000 2634

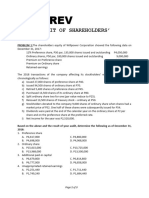

121 PENSION A B C D Gross Pension (Last payxServisex7/300) 32,469.50 32,469.50 32,469.50 Less commuted portion of pension up to 35% OR 11,364.33 11,364.33 Less th (in case for death while in service) 8,117.38 Net pension 21,105 21,105 Net pension (in case for death while in service) 16,235 Net pension ( died after getting the pension) 10,553 Commuted value of pension or Gratuity in case of family pension. a) Amount of pension to be commuted/surrendered 11,364.33 8,117.38 Age next birthday 60 years 60 years b) Rate of commuted value/gratuity for every one rupee 148.4628 148.4628 (see commutation table) Commuted value of pension/gratuity (axb) 1,687,180 1,205,128 Gratuity Total qualifying service (Years) 9 Pensionable emoluments 1-1/2 months pay 69,577.50 Amount of gratuity (in case where qualifying 626,198 Service is 5 years or more but less than 10 years) Amount of gratuity on discharge from temporary Service where qualifying service is 10 years or more but less than 25 years Illustration 3 Pension Contribution. Work out pension contribution for the month of August,2008 in respect of an Officer BPS-20 who was deputed to SDA w.e.f. 1-9-2005 to 31-08-2008. In addition to his pay he was drawing the following emoluments. 1 Senior Post Allowance Rest. 1100/- PM 2 Qualification Pay for advance course in NIPA Rs.500/- PM Solution BPS-20 23345 1510 44485 Mean of the scale (23345+44485/ 2 33915 Add Senior Post Allowance 850 Qualification Pay 500 Total Pensionable emoluments 35265 Pension contribution 35265*33.33% 11755 Illustration 4 Qualifying Service/Non-Qualifying Service Place a check mark in the appropriate column to indicate whether the following kinds of service are qualifying or non-qualifying. S# Service Non-qualifying Qualifying 1 All types of leave other than E.O.L. 2 Period of suspension followed by compulsory retirement. 3 Joining time. 4 Extraordinary leave. 5 Period of training before joining service. 6 Overstayal of joining time. 7 Service after attaining the age of superannuation. 8 Suspension followed by reinstatement. 9 Half period of apprenticeship. 10 Military service if pension is not received. 11 Foreign service subject to recovery of pension contribution. 12 Period of previous service after resignation/dismissal 13 Intervening period between abolition of post & joining a new post. 14 Overstayal of leave. 15 Probation period followed by confirmation. 16 Period condoned by competent authority. 17 Unauthorized absence from duty. 18 Leave on full pay 19 Leave on half pay Solution:-The service at serial No 3, 8, 9, 10, 11, 12.14, 19, & 20 are qualifying.

120 ILLUSTRATIONS - Pension Illustration 1 Pensionable emoluments Workout pensionable emoluments of an officer B-20 working in civil secretariat Peshawar , from the following particulars. S# Pay & allowances P.M S# 1 Basic Pay 44485 7 2 House Rent Allowance 10505 8 3 Conveyance Allowance 2480 9 4 Adhoc relief 2634 10 5 Special Additional Allow; 2719 11 6 Qualification Pay 0f NIPA 500 12 Solution Pensionable emoluments S# Pay & allowances P.M 1 Basic Pay 44485 2 Qualification Pay 500 3 Special Pay 300 4 Senior Post Allowance 1100 5 Incurrement 6 months services 1510 Total 47895 Note:-Orderly allowance is part of gross pension if he opts for not maintaining orderly at his residence Illustration 2 Retiring Pension,family pension Date of Birth 1/9/1948 Date of Joining Service 8/10/1970 Date of retirement/death/invalidation 1/9/2008 Remained under Suspension 1 year From 1-1-1982 To 1-12-1982 Availed Extra-Ordinary Leave 4 years From1-7-1984 To 30-06-1988 Pay on 1-7-2008 45995 Qualification Pay 500 Special Pay 300 Senior Post Allowance 1100 Total Pensionable Emoluments 47895 Work out Superannuation pension and commuted value of an officer from the following particular. a) If he retired on Superennuation pension b) If he died on 01-08-2008 c) if he died on 01-10-2008 i.e After getting the pension in case of (a) above. d) if He died after rendering 8 years & 6 months service. Solution: Qualifying service Length of service From 8-10-1969 to 31-08-2007 37years 10 Months Add: Military service if any allowed to count for pension Deduct: Spells of service not qualifying for pension 4 years Net qualifying service 33 years 10 Months Say 30 Years Last pay/pensionable emoluments 47895

PENSION A B Gross Pension (Last payxServisex7/300) 33,526.50 33,526.50 Less commuted portion of pension up to 35% OR 11,734.28 Less th (in case for death while in service) 8,381.63 Net pension 21,792 Net pension (in case for death while in service) 16,763 Net pension ( died after getting the pension) Commuted value of pension or Gratuity in case of family pension. a) Amount of pension to be commuted/surrendered 11,734.28 8,381.63 Age next birthday 60 years 60 years b) Rate of commuted value/gratuity for every one rupee 148.4628 148.4628 (see commutation table) Commuted value of pension/gratuity (axb) 1,742,103 1,244,360 Gratuity Total qualifying service (Years) Pensionable emoluments 1-1/2 months pay Amount of gratuity (in case where qualifying Service is 5 years or more but less than 10 years) Amount of gratuity on discharge from temporary Service where qualifying service is 10 years or more but less than 25 years Illustration 3 Pension Contribution. Work out pension contribution for the month of August,2008 in respect of an Officer BPS-20 who w to SDA w.e.f. 1-9-2005 to 31-08-2008. In addition to his pay he was drawing the following emoluments. 1 Senior Post Allowance Rest. 1100/- PM 2 Qualification Pay for advance course in NIPA Rs.500/- PM Solution BPS-20 23345 1510 Mean of the scale (23345+44485/ 2 Add Senior Post Allowance Qualification Pay Total Pensionable emoluments Pension contribution 35265*33.33% Illustration 4 Qualifying Service/Non-Qualifying Service Place a check mark in the appropriate column to indicate whether the following kinds of service are qualifying or non-qualifying. S# Service 1 All types of leave other than E.O.L. 2 Period of suspension followed by compulsory retirement. 3 Joining time. 4 Extraordinary leave. 5 Period of training before joining service. 6 Overstayal of joining time. 7 Service after attaining the age of superannuation. 8 Suspension followed by reinstatement. 9 Half period of apprenticeship. 10 Military service if pension is not received. 11 Foreign service subject to recovery of pension contribution. 12 Period of previous service after resignation/dismissal 13 Intervening period between abolition of post & joining a new post. 14 Overstayal of leave. 15 Probation period followed by confirmation. 16 Period condoned by competent authority. 17 Unauthorized absence from duty. 18 Leave on full pay 19 Leave on half pay Solution:-The service at serial No 3, 8, 9, 10, 11, 12.14, 19, & 20 are qualifying.

Pensionable emoluments g in civil secretariat Peshawar Pay & allowances Special Pay Senior Post Allowance Deputation Allowance Entertainment Allowance Orderly-allowance Special relief Allowance P.M 300 1100 6000 600 3000 2634

or not maintaining orderly at his residence Retiring Pension,family pension

an officer from the following particular.

24 days

24 days

C 33,526.50 11,734.28 21,792 10,896

9 71,842.50 646,583

Pension Contribution. gust,2008 in respect of an Officer BPS-20 who was deputed y he was drawing the following emoluments.

44485

33915 850 500 35265 11755 Qualifying Service/Non-Qualifying Service

Non-qualifying

Qualifying

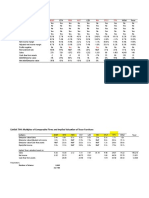

120 ILLUSTRATIONS - Pension Illustration 1 Pensionable emoluments Workout pensionable emoluments of an officer B-20 working in civil secretariat Peshawar , from the following particulars. S# Pay & allowances P.M S# 1 Basic Pay 44485 7 2 House Rent Allowance 10505 8 3 Conveyance Allowance 2480 9 4 Adhoc relief 2634 10 5 Special Additional Allow; 2719 11 6 Qualification Pay 0f NIPA 500 12 Solution Pensionable emoluments S# Pay & allowances P.M 1 Basic Pay 44485 2 Qualification Pay 500 3 Special Pay 300 4 Senior Post Allowance 1100 5 Increment 6 months services 1510 Total 47895 Note:-Orderly allowance is part of gross pension if he opts for not maintaining orderly at his residence Illustration 2 Retiring Pension,family pension Date of Birth 1/9/1948 Date of Joining Service 8/10/1970 Date of retirement/death/invalidation 1/9/2008 Remained under Suspension 1 year From 1-1-1982 To 1-12-1982 Availed Extra-Ordinary Leave 4 years From1-7-1984 To 30-06-1988 Pay on 1-7-2008 45995 Qualification Pay 500 Special Pay 300 Senior Post Allowance 1100 Total Pensionable Emoluments 47895 Work out Superannuation pension and commuted value of an officer from the following particular. a) If he retired on Superennuation pension b) If he died on 01-08-2008 c) if he died on 01-10-2008 i.e After getting the pension in case of (a) above. d) if He died after rendering 8 years & 6 months service. Solution: Qualifying service Length of service From 8-10-1969 to 31-08-2007 37years 10 Months Add: Military service if any allowed to count for pension Deduct: Spells of service not qualifying for pension 4 years Net qualifying service 33 years 10 Months Say 30 Years Last pay/pensionable emoluments 47895 PENSION Gross Pension (Last payxServisex7/300) A B 33,526.50 33,526.50

Less commuted portion of pension up to 35% OR 11,734.28 Less th (in case for death while in service) 8,381.63 Net pension 21,792 Net pension (in case for death while in service) 25,145 Net pension ( died after getting the pension) Commuted value of pension or Gratuity in case of family pension. a) Amount of pension to be commuted/surrendered 11,734.28 8,381.63 Age next birthday 60 years 60 years b) Rate of commuted value/gratuity for every one rupee 148.4628 148.4628 (see commutation table) Commuted value of pension/gratuity (axb) 1,742,103 1,244,360 Gratuity Total qualifying service (Years) Pensionable emoluments 1-1/2 months pay Amount of gratuity (in case where qualifying Service is 5 years or more but less than 10 years) Amount of gratuity on discharge from temporary Service where qualifying service is 10 years or more but less than 25 years Illustration 3 Pension Contribution. Work out pension contribution for the month of August,2008 in respect of an Officer BPS-20 w to SDA w.e.f. 1-9-2005 to 31-08-2008. In addition to his pay he was drawing the following emoluments. 1 Senior Post Allowance Rest. 1100/- PM 2 Qualification Pay for advance course in NIPA Rs.500/- PM Solution BPS-20 23345 1510 Mean of the scale (23345+44485) / 2 Add Senior Post Allowance Qualification Pay Total Pensionable emoluments Pension contribution 35265*33.33% Illustration 4 Qualifying Service/Non-Qualifying Service Place a check mark in the appropriate column to indicate whether the following kinds of service are qualifying or non-qualifying. S# Service 1 All types of leave other than E.O.L. 2 Period of suspension followed by compulsory retirement. 3 Joining time. 4 Extraordinary leave. 5 Period of training before joining service. 6 Overstayal of joining time. 7 Service after attaining the age of superannuation. 8 Suspension followed by reinstatement. 9 Half period of apprenticeship. 10 Military service if pension is not received. 11 Foreign service subject to recovery of pension contribution. 12 Period of previous service after resignation/dismissal 13 Intervening period between abolition of post & joining a new post. 14 Overstayal of leave. 15 Probation period followed by confirmation. 16 Period condoned by competent authority.

17 Unauthorized absence from duty. 18 Leave on full pay 19 Leave on half pay Solution:-The service at serial No 3, 8, 9, 10, 11, 12.14, 19, & 20 are qualifying.

Pensionable emoluments ecretariat Peshawar Pay & allowances Special Pay Senior Post Allowance Deputation Allowance Entertainment Allowance Orderly-allowance Special relief Allowance P.M 300 1100 6000 600 3000 2634

ntaining orderly at his residence ension,family pension

180*12/365

result

rom the following particular.

24 days

24 days

C 33,526.50

11,734.28 21,792 10,896

9 71,842.50 646,583

in respect of an Officer BPS-20 who was deputed awing the following emoluments.

44485 33915 850 500 35265 11755 Service/Non-Qualifying Service

Non-qualifying

Qualifying

b.p

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Minutes of 41 BoD Meeting PDFДокумент27 страницMinutes of 41 BoD Meeting PDFFayaz KhanОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- BS-19 Seniority List 01 - 01 - 2022Документ8 страницBS-19 Seniority List 01 - 01 - 2022Fayaz KhanОценок пока нет

- Applications - English GrammarДокумент7 страницApplications - English GrammarFayaz Khan100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Adp No Sect Desc Project Description Amount Punched All Swat Schemes With Held Amount Punched (Rs. in Million)Документ6 страницAdp No Sect Desc Project Description Amount Punched All Swat Schemes With Held Amount Punched (Rs. in Million)Fayaz KhanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- BS-20 Seniority List 01-01-2022Документ7 страницBS-20 Seniority List 01-01-2022Fayaz KhanОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Audit Note ChitralДокумент23 страницыAudit Note ChitralFayaz KhanОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Case of Elimination of Bar of 33% On TSP of Daos 07.01.2022Документ14 страницCase of Elimination of Bar of 33% On TSP of Daos 07.01.2022Fayaz KhanОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- BS-22 Seniority List 01-01-2022Документ1 страницаBS-22 Seniority List 01-01-2022Fayaz KhanОценок пока нет

- 2nd Quarter DemandДокумент1 страница2nd Quarter DemandFayaz KhanОценок пока нет

- Arrival ReportДокумент1 страницаArrival ReportFayaz KhanОценок пока нет

- Advertisment of Driver ForwardingДокумент1 страницаAdvertisment of Driver ForwardingFayaz KhanОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Advance para 113Документ10 страницAdvance para 113Fayaz KhanОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- 2nd Quarter DemandДокумент1 страница2nd Quarter DemandFayaz KhanОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 2651 of CWДокумент9 страниц2651 of CWFayaz KhanОценок пока нет

- MG Phe Payroll 12-2020Документ41 страницаMG Phe Payroll 12-2020Fayaz KhanОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Physics 9th SubjectiveДокумент1 страницаPhysics 9th SubjectiveFayaz KhanОценок пока нет

- Phe Mohmand Operational Staff Payroll 12-2020Документ432 страницыPhe Mohmand Operational Staff Payroll 12-2020Fayaz KhanОценок пока нет

- Phe Batagram Payroll 01-2021Документ97 страницPhe Batagram Payroll 01-2021Fayaz KhanОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Phe Payment List 01-2021Документ28 страницPhe Payment List 01-2021Fayaz KhanОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Phe Mohmand Operational Staff 12-2020Документ4 страницыPhe Mohmand Operational Staff 12-2020Fayaz KhanОценок пока нет

- Physics 9th SubjectiveДокумент1 страницаPhysics 9th SubjectiveFayaz KhanОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Physics 9th SubjectiveДокумент1 страницаPhysics 9th SubjectiveFayaz KhanОценок пока нет

- Maths 9th SubjectiveДокумент1 страницаMaths 9th SubjectiveFayaz KhanОценок пока нет

- Criteria For Advance paraДокумент29 страницCriteria For Advance paraFayaz KhanОценок пока нет

- Science LabДокумент13 страницScience LabFayaz KhanОценок пока нет

- Maths 9th SubjectiveДокумент1 страницаMaths 9th SubjectiveFayaz KhanОценок пока нет

- Kahi DimolishДокумент2 страницыKahi DimolishFayaz KhanОценок пока нет

- Receipt Payment: Detail of Closing BalanceДокумент2 страницыReceipt Payment: Detail of Closing BalanceFayaz KhanОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Demand For Fund Under ADP No. 516Документ1 страницаDemand For Fund Under ADP No. 516Fayaz KhanОценок пока нет

- Income TaxДокумент1 страницаIncome TaxFayaz KhanОценок пока нет

- UST Case Study As of 1993: March 2016Документ19 страницUST Case Study As of 1993: March 2016KshitishОценок пока нет

- LCCI Level 3 - Advanced Business Calculations (Exam Kit)Документ332 страницыLCCI Level 3 - Advanced Business Calculations (Exam Kit)BethanyОценок пока нет

- Audit of SheДокумент3 страницыAudit of ShePrince PierreОценок пока нет

- Transfer of SharesДокумент12 страницTransfer of SharesromaОценок пока нет

- Finance & Financial Management Net Present Value & Other Investment RulesДокумент43 страницыFinance & Financial Management Net Present Value & Other Investment RulesJuan SanguinetiОценок пока нет

- Teuer B DataДокумент41 страницаTeuer B DataAishwary Gupta100% (1)

- Financial Statement AnalysisДокумент28 страницFinancial Statement AnalysisbillyОценок пока нет

- NTPC ReportДокумент15 страницNTPC ReportKaushal Jaiswal100% (1)

- YTL Buys Rival Lafarge Malaysia: Corporate NewsДокумент3 страницыYTL Buys Rival Lafarge Malaysia: Corporate NewsSatesh KalimuthuОценок пока нет

- CheatsheetДокумент2 страницыCheatsheetSafi NurulОценок пока нет

- Methodology MDG Scan 3 V 4Документ14 страницMethodology MDG Scan 3 V 4Andrew GroganОценок пока нет

- Wise & Co. Vs TanglaoДокумент5 страницWise & Co. Vs Tanglaodominicci2026Оценок пока нет

- Cover LetterДокумент2 страницыCover LetterRojim OtadoyОценок пока нет

- DP HCM (MATHS) Printable PDFДокумент81 страницаDP HCM (MATHS) Printable PDFAarzoo RatheeОценок пока нет

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Документ24 страницыKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- IBM Final PDFДокумент4 страницыIBM Final PDFpohweijunОценок пока нет

- Classes of Holders: HOLDER - The Payee or Indorsee of A Bill orДокумент46 страницClasses of Holders: HOLDER - The Payee or Indorsee of A Bill orAbby Dianne InciongОценок пока нет

- CH 01Документ20 страницCH 01Engr Moinul AhsanОценок пока нет

- Nego Digest Week 2Документ13 страницNego Digest Week 2Rufino Gerard MorenoОценок пока нет

- Twitter10 2 18 1Документ74 страницыTwitter10 2 18 1karen hudesОценок пока нет

- Diagnostic Investments QuestionsДокумент5 страницDiagnostic Investments Questionscourse heroОценок пока нет

- Practice Questions - Budget ConstraintДокумент3 страницыPractice Questions - Budget ConstraintAli ZubairОценок пока нет

- 2nd Asignment - BANK PEMBANGUNAN MALAYSA BERHADДокумент4 страницы2nd Asignment - BANK PEMBANGUNAN MALAYSA BERHADkinОценок пока нет

- 35 Powerful Candlestick PatternsДокумент21 страница35 Powerful Candlestick PatternsMarcelo_Capellotto50% (2)

- Basel II PillarДокумент123 страницыBasel II Pillarperera_kushan7365Оценок пока нет

- Project Proposal by Nigah-E-Nazar FatimiДокумент8 страницProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- 2023-04 Valuation Report - PRL Destillates & FuelДокумент6 страниц2023-04 Valuation Report - PRL Destillates & FuelJianyun ZhouОценок пока нет

- McKinsey On FinanceДокумент6 страницMcKinsey On Financegweberpe@gmailcomОценок пока нет

- Bangladesh-India DTAA PDFДокумент7 страницBangladesh-India DTAA PDFmajumdar.sayanОценок пока нет

- A Guide To Mutual Fund Investing 2014Документ8 страницA Guide To Mutual Fund Investing 2014Khai HuynhОценок пока нет