Академический Документы

Профессиональный Документы

Культура Документы

India Office Property Market Overview-3Q 2012

Загружено:

Colliers InternationalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

India Office Property Market Overview-3Q 2012

Загружено:

Colliers InternationalАвторское право:

Доступные форматы

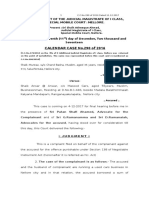

Office PrOPerty Market Overview

iNDia

QUarterLy UPDate | OctOBer | 2012

Accelerating success.

3Q 2012 | OFFICE

RESEARCH & FoRECAST REPoRT INDIA oFFICE MARkET

REsEARCh & fORECAsT REpORT sYDNEY CENTRAl BusINEss DIsTRICT

MACRO ECONOMIC OVERVIEW

Indias GDP growth has slowed to a 3 year low recorded at 5.3% in the April-June quarter of the current fiscal. The wholesale price index reached 7.81 per cent in September, and 7.55 per cent in August 2012 this year much above the RBIs comfort level. As the inflation remained higher, the central bank did not provide any repo rate cut this quarter. However, in September 2012, the RBI did reduced the (CRR) Cash Reserve Ratio by 25 basis points to induce immediate liquidity in the market in its mid year policy review. Earlier, in July 2012, the RBI also reduced its SLR (Statutory Liquidity Requirement) by 1%. Foreign direct investment (FDI) in India was around $1.76 billion in July 2012. Sectors which received large FDI inflows were services, pharmaceuticals, construction and power. In 3Q 2012, the Indian Rupee remained under pressure and closed at 54.31 to 1.00 USD on 15th Sep 2012. The INR further weekend against Euro and close at INR 71.30 to 1.00 Euro. The new Finance Minister P Chidambaram has taken a slew of reform measures such as diesel price hike, cap on the number of subsidised cooking gas cylinders per family, liberalising foreign holding norms in aviation, multi-brand retail, non-news broadcasting and power exchanges sectors, and divesting its stake in five companies. However, most of these reform measures faced strong opposition and implementation of these measures is still uncertain.

ECONOMIC INDICATORs

Gross Domestic product at factor Cost

10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0%

oct - Dec 09

oct - Dec 10

Jan - Mar 09

Jul - Sep 09

Jan - Mar 10

Apr - Jun 10

Jul - Sep 10

Jan - Mar 11

oct - Dec 11

Jul - Sep 11

Jan - Mar 12

Apr - Jun 09

ECONOMIC BAROMETER

sep-11

REPo RATE REVERSE REPo RATE CRR INFLATIoN PRIME LENDING RATE DEPoSIT RATE (<1 YEAR) FoREIGN ExCHANGE INR - USD 47.55 54.31 8.50% 7.00% 6.00% 9.78% 10.00% - 10.75% 7.75% - 9.50%

sep-12

8.00% 7.00% 4.50% 7.81% 10.00% - 10.50% 8.00% - 9.25%

16,000 14,000 12,000 10,000 INR Crore 8,000 6,000 4,000 2,000

fDI in Real Estate

2009 - 10

2010 - 11

2005 - 06

2008 - 09

2006 - 07

2007 - 08

2011-12

BsE sensex & Realty Index

120 115 110 105 100 95 90 85 80 2-Jul-12 27-Jul-12 22-Aug-12 14-Jul-12 9-Aug-12 4-Sep-12 17-Sep-12 17-Sep-12

INR- EURo

65.60

71.30

RETuRN ON AlTERNATIVE INVEsTMENTs

sep-11 sep-12 YoY % Change

GoLD SILVER EQUITY (BSE SENSEx) REALTY INDEx 16,876 1,799 18,542 1,734 9.87% -3.61% 27,750 63,359 31,925 63,188 15.05% -0.27%

* Rebase to 100

BSE Sensex

Realty Index

120 115 110 105 100 95 90 85 1-Jul-12 14-Jul-12

Exchange Rates

27-Jul-12

9-Aug-12

22-Aug-12

Note : As on 15th of September, 2011 and September, 2012

* Rebase to 100

USD

Euro

Source: Colliers International India Research

www.colliers.com

4-Sep-12

80

April -Jun 12

Apr - Jun 12

Apr - Jun 11

iNDia | 3Q 2012 | OFFICE

MuMBAI

Approximately 9.4 million sq ft of commercial Grade A office space was available for fitout in 3Q 2012. More than 65% of this total available space was concentrated in Andheri East, Thane/LBS Marg and Lower Parel. Project launched this quarter includes one BkC by Wadhwa Developers at Bandrakurla-Complex. This Project constitutes approximately 1.2 million sq ft of Grade A office space and expected to be completed by 2Q 2015. In 3Q 2012, Grade A new supply added up to approximately 1.2 million sq ft. Project or part of project contributing to this new supply was The Capital by Wadhwa Developers at Bandra-kurla-Complex.

3Q 2012

AVAIlABlE supplY IN pRIME AREAs

Goregoan / JVLR kalina Worli / Prabhadevi 8% 1% Powai 1% 4% Malad 5% Navi Mumbai 6% CBD 1% Thane / LBS 22%

Lower Parel 19% Andheri East 24% BkC 9%

MUMBAI

3Q 2012 GRADE A AND GRADE B RENTAl VAluEs

300 250

CITY OffICE BAROMETER

2Q 2012 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE

Malad

kalina

Andheri East

Worli/Prabhdevi

Goregaon / JVLR

Thane / LBS

Lower Parel

Powai

Malad (IT)

Andheri East (IT)

Looking ahead, rental values are expected to remain stable as substantial under construction supply in the pipeline is expected to enter the market in the near future. This quarter the LBS Marg flyover has become operational, which is a part of a crucial Santacruz-Chembur Link Road. The 565 meter long and 17 meter wide flyover is expected to decongest the overall traffic by helping more than 50,000 commuters daily.

Grade A

Grade B

GRADE A AVERAGE RENTAl VAluE

245 210 175 INR per Sq ft per Month 140 105 70 35 0 2Q2008 1Q2008 3Q2008 4Q2008 1Q2009 2Q2009 3Q2009 4Q2009 1Q2011 2Q2011 3Q2011 1Q2010 2Q2010 3Q2010 4Q2010 4Q2011 1Q2012 2Q2012 3Q2012F 4Q2012F 1Q2013F 2Q2013F 3Q2013F

pRIME OffICE spACE RENTAl TREND

420 370 320 270 220 INR per Sq ft per Month 170 120 70 20 1Q2008 2Q2008 3Q2008 4Q2008 1Q2011 2Q2011 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 2Q2010 3Q2010 3Q2011 4Q2011 4Q2010 1Q2012 2Q2012 3Q2012

Forecast

CBD Lower Parel Goregaon / JVLR

Andheri East Navi Mumbai kalina

Malad Powai Thane / LBS

BkC Worli / Prabhadevi

MARKET TRANsACTIONs

CLIENT

Ceva Logistics Cipla Delta Corp. Rediffusion Tata AIG Technip kTI BUILDING NAME The Qube Peninsula Business Park FCH House Indiabulls Finance Centre Peninsula Business Park Boomerang AREA (SQ. FT.) 18,540 250,000 55,000 30,000 32,000 56,000 LoCATIoN Andheri (E) Lower Parel Lower Parel Lower Parel Lower Parel Andheri (E) TRANSACTIoN TYPE Lease Lease Lease Lease Lease Lease

Source: Colliers International India Research

COllIERs INTERNATIONAl |

Goregaon / JVLR (IT)

Navi Mumbai (IT)

Thane / LBS (IT)

Navi Mumbai

Lower Parel (IT)

Powai (IT)

Absorption in Mumbai remained upbeat during the surveyed period and a few large floor plates deals were concluded. Despite increased absorption, average rents for grade A office premises remained stable in almost all of the micro-markets.

200 150 100 50 0 CBD BkC

INR Per Sq ft Per Month

p. 3

iNDia | 3Q 2012 | OFFICE

DElhI

Approximately 1.7 million sq ft of grade A office space was ready for fit-out in 3Q 2012. The majority of this supply was located in suburban locations such as Jasola and Saket. During this quarter, the major office development completed were konnectus by Pratibha Group along Minto Road and Ambience Corporate Tower by Ambience Group at Vasant kunj. These projects jointly contributed around 0.3 million of grade A office space addition to the city total inventory.

DELHI

AVAIlABlE supplY IN pRIME AREAs

Connaught Place 2% Nehru Place 10%

Jasola 59%

Saket 29%

CITY OffICE BAROMETER

2Q 2012 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE 3Q 2012

INR per Sq Ft per Month

In 3Q 2012, new commercial projects were launched in the city including, Suncity Projects by Suncity Group at East Delhi, Ambience Towers by Ambience Group at Rohini and Redfort Capital Parsvnath Towers by Parsvnath Ltd at Connaught Place. All of these projects are expected to contribute more than 0.7 million sq ft of grade A office space to the citys total inventory. In 3Q 2012, absorption remained positive and rental values for grade A properties increased in the range of 3 to 5% quarter on quarter across the micro-markets. Looking ahead, the absorption momentum is likely to continue and rentals are expected to increase moderately due to limited addition of supply. The Delhi State Government has sanctioned INR 520 crore for the Municipal Corporation of Delhi (MCD) to redevelop 674 roads, each over 60 feet wide. The project would further improve the infrastructure of the city and is expected to complete by the end of 2014.

3Q 2012 GRADE A AND GRADE B RENTAl VAluEs

400 350 300 250 200 150 100 50 0 Nehru Place Netaji Subhash Connaught Place Jasola Saket 2Q2011 3Q2011 4Q2011 1Q2012 2Q2012

Grade A

Grade B

GRADE A AVERAGE RENTAl VAluE

300 Forecast 275 250 INR per Sq ft per Month 225 200 175 150 125 100 2Q2008 3Q2008 4Q2008 2Q2010 3Q2010 1Q2011 2Q2011 3Q2011 4Q2011 2Q2012 3Q2012F 4Q2012F 1Q2013F 2Q2013F 3Q2013F 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 4Q2010 1Q2012

pRIME OffICE spACE RENTAl TREND

450 400 350 300 INR per Sq ft per Month 250

200 150 100 50 2Q2008 3Q2008 1Q2008 3Q2009 4Q2008 2Q2009 4Q2009 1Q2009 2Q2010 3Q2010 4Q2010 1Q2010 3Q2012 0

Nehru Place Netaji Subhash

Jasola

Cannaught place

Saket

MARKET TRANsACTIONs

CLIENT

Avnet Bill and Melinda Gates Foundation Nexant TATA AIG BUILDING NAME Jasola DLF Tower A The Capital Court Vasant Square Mall kanchenjunga AREA (SQ. FT.) 2,500 8,930 2,500 10,000 LoCATIoN Jasola Munirka Vasant kunj Connaught Place TRANSACTIoN TYPE Lease Lease Lease Lease

Source: Colliers International India Research

p. 4

| COllIERs INTERNATIONAl

iNDia | 3Q 2012 | OFFICE

GuRGAON

About 12 million sq ft of Grade A office space was available for fit-out in 3Q 2012. Most of this available supply was concentrated in Golf Course Road and its extensions, Udyog Vihar and NH8 up to Manesar. Total new supply of grade A office during the quarter was .75 million sq ft. Projects / parts of projects contributing to this new supply were Platinum Tower by ABW Group, located on Sohna Road and Digital Green by Emmar MGF on Golf Course Road Extension. Projects launched during this quarter were Techopolis 2 by ocus Group located on Golf Course Road Extension and Baani City Centre by Baani Group located in sector 63. Both projects are expected to be completed by the end of 2015 and will add about 0.55 million sq ft of Grade A office space to the citys total office inventory. During this quarter rental values for Grade A properties increased in the range of 2 to 7% QoQ CBD and SBD micro-markets. However rentals in PBD locations like Golf Course Road and its Extension and Sohna Road saw a decline of 7%, while Manesar remained stable. This could primarily be due to ample supply in these areas. Due to moderate demand and ample stock availability rental values are expected to remain stable in near future.

Forecast

AVAIlABlE supplY IN pRIME AREAs

DLF Cyber City 5% NH8/ Udyog Vihar 2%

Manesar 21%

Golf Course Road/Ext / Sohna Road 61%

Institutional Sectors / Sushant Lok 5% MG Road 6%

GURGAoN

3Q 2012 GRADE A AND GRADE B RENTAl VAluEs

140 120 100 80 INR per sq ft per month 60 40 20 0 NH8/Udyog Vihar Golf Course Road /Ext /Sohna Road MG Road Manesar Institutional Sectors / Sushant Lok DLF Cyber City(IT) NH8/Udyog Vihar(IT) Golf Course Road/Ext /Sohna Road Manesar (IT) 2Q2012

CITY OffICE BAROMETER

2Q 2012 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE 3Q 2012

Grade A

Grade B

GRADE A AVERAGE RENTAl VAluE

135 120 105 90 INR per Sq ft per Month 75 60 45 30 15 2Q2008 3Q2008 4Q2008 1Q2010 2Q2010 3Q2010 4Q2010 1Q2011 2Q2011 3Q2011 4Q2011 1Q2012 2Q2012 3Q2012F 4Q2012F 1Q2013F 2Q2013F 1Q2009 2Q2009 3Q2009 4Q2009 3Q2013F 0

pRIME OffICE spACE RENTAl TREND

200 175

INR per sq ft per month

This quarter the state government initiated few infrastructure projects such as mending of potholes on all arterial roads and internal roads, remodeling, street lighting and drainage on major roads etc.

150 125 100 75 50 25 0 2Q2008 3Q2008 4Q2008 1Q2011 2Q2011 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 2Q2010 3Q2010 4Q2010 3Q2011 4Q2011 3Q2012 1Q2012

MG Road Golf Course Road/Ext /Sohna Road Institutional Sectors /Sushant Lok NH8/Udyog Vihar (IT) Manesar (IT)

DLF Cyber City (IT) Golf Course Road/ Ext /Sohna Road (IT) Manesar NH8/Udyog Vihar

MARKET TRANsACTIONs

CLIENT

Ameriprise Cap Gemini ERM India Executive Centre BUILDING NAME Prestige Corporate Park Spaze Tech Park DLF Building-10 Silverton AREA (SQ. FT.) 140,000 40,000 15,000 10,000 LoCATIoN Udyog Vihar Sohna Road TRANSACTIoN TYPE Lease Lease Lease Lease Lease Lease

Source: Colliers International India Research

DLF Cybercity

Golf Course Extn. Road Golf Course Extn. Road

HPCL Swarowski

Silverton DLF Building-10

4,500 15,000

DLF Cybercity

COllIERs INTERNATIONAl |

p. 5

iNDia | 3Q 2012 | OFFICE

NOIDA

In this quarter, more than 8 million sq ft of Grade A and Grade B office space was available for fit-out. More than 90% of this available office space was dedicated to IT / ITeS located in sectors 16 A, 62 and 125 to 143 along the NoIDA expressway. In 3Q 2012 about 0.9 million sq ft of Grade A office space was added to the citys total inventory. This new supply was contributed by Techno Heights by Techno Touch Ltd at sector 62, NSL by NSL Group at sector 143 and SB ToWER by SB Group at sector 16A.

NoIDA

AVAIlABlE supplY IN pRIME AREAs

Institutional Sectors (Sec.16A, 62, 125-142) 91.5%

Commercial Sectors (Sec 18) 0.8% Industrial Sectors (Sec. 1-9, 57-60, 63-65) (Grade B) 7.5% Commercial Sectors (Sec 18) (Grade B) 0.2%

CITY OffICE BAROMETER

2Q 2011 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE 3Q 2012

This quarter, Sunshine Business Park was launched by Sunshine Infrawell in Sector 94. The project size is around 0.5 million sq ft and is expected to be completed by the end of 2015. During the surveyed period, absorption levels remained subdued in Institutional and commercial sector, resulting in declining of rental values in the range of 1 to 4%. However, leasing activities in industrial sector remained active as these sectors were in demand from the companies looking for cheaper options. Going forward, rental values are likely to remain stable in near future despite subdued absorption conditions as most of the under construction supply is anticipated over the period of 2-3 years in peripheral areas of NoIDA.

Forecast

3Q 2012 GRADE A AND GRADE B RENTAl VAluEs

120 100 80 60 40 20 0 Institutional Sectors (Sec.16A,62, 125-142 ) Commercial Sectors (Sec 18) Institutional Sectors (Sec 16A,62 ,125142) (IT) 2Q2012 4Q2011 1Q2012 Industrial Sectors (Sec 1-9,57 -60, 63 -65) Grade B 1Q2011 2Q2011 3Q2010 4Q2010 3Q2011

INR Per SqFt Per Month

Grade A

GRADE A AVERAGE RENTAl VAluE

80 70 60 INR per Sq ft per Month 50 40 30 20 10 0 1Q2013F 2Q2013F 3Q2012F 4Q2012F 3Q2013F 1Q2011 2Q2011 3Q2011 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 2Q2010 3Q2010 4Q2010 4Q2011 1Q2012 2Q2012

pRIME OffICE spACE RENTAl TREND

140

During the quarter the state government announced New Industrial & Infrastructure Investment Policy 2012. The government has also decided to consider big investment proposals of over INR 500 crore on caseto-case basis and stated that the new policy would not impede exclusive considerations in such matters. Moreover the state government has cleared the metro connecting Noida City Centre to Sector 62 and Greater Noida West.

120 100 80 60 40 20 0 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 2Q2010 3Q2012

INR Per SqFt Per Month

Industrial Sector Commercial Sectors

Institutional Sectors (IT) Institutional Sectors (Non IT)

MARKET TRANsACTIONs

CLIENT

Emeter Info Edge Mann India Markit Naukri.com Software AG BUILDING NAME Logix Cyber Park Urbtech NPx SB Tower Green Boulevard NkG Tower Stellar IT Park AREA (SQ. FT.) 15,000 100,000 18,000 51,000 150,000 6,600 LoCATIoN Sector 62 Sector 153 Sector 16A Sector 62 Sector 132 Sector 62 TRANSACTIoN TYPE Lease Lease Lease Lease Lease Lease

Source: Colliers International India Research

p. 6

| COllIERs INTERNATIONAl

iNDia | 3Q 2012 | OFFICE

ChENNAI

Approximately 13.5 million sq ft of commercial grade A office space was available for fitout in 3Q 2012. More than half of this total available space was concentrated in oMR (IT Corridor). During this quarter, a number of new projects were launched in Chennai, including Infinite Towers and Icon Tower by Sri kausalya Constructions Ltd (SkCL) and a commercial Tower by khivaraj Group. All of these were located at Guindy and together constitute approximately 0.2 million sq ft of grade A office space.

CHENNAI

AVAIlABlE supplY IN pRIME AREAs

oMR (IT Corridor) 51%

GST Rd 3% Velachery 1% Vadapalini 0%

CBD 14% Ambattur 24%

Guindy (SBD) 6%

CITY OffICE BAROMETER

2Q 2011 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE 3Q 2012

INR per sq ft per month

In 3Q 2012, Chennai grade A new supply totals approximately 0.8 million sq ft. projects/ parts of Projects contributing to this new supply were Prestige Polygon by Prestige Group at Nandanam and Design Square by Sri kausalya Constructions Ltd (SkCL) at Guindy. oMR (IT Corridor) and Guindy remained the most preferable location/area for grade A office space. However due to slowdown in the economy and the IT sector overall demand for the grade A office space has reduced as compared to the previous two quarter. Companies are deferring their decision to lease/ buy real estate. Average rental values for Grade A office premises remained stable in almost all of the micro-markets barring Guindy where rental values appreciated by around 4% Quarter on quarter due to healthy demand. Looking ahead, rental values are expected to remain stable as significant supply is projected to enter the market in the near future.

3Q 2012 GRADE A IT AND NON IT RENTAl VAluEs

80 70 60 50 40 30 20 10 0 Ambattur Guindy (SBD) oMR (IT Corridor) GST road 3Q2011 4Q2011 1Q2012 2Q2012 CBD

NoN IT

IT

GRADE A AVERAGE RENTAl VAluE

80 70 60 50 40 30 20 10 0

pRIME OffICE spACE RENTAl TREND

Forecast

90 80 70 INR per sq ft per month 60 50 40 30 20 1Q2008 2Q2008 3Q2008 4Q2008 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 2Q2010 3Q2010 4Q2010 1Q2011 2Q2011 3Q2012

INR per Sq ft per Month

1Q2008

2Q2008

3Q2008

4Q2008

1Q2011

2Q2011

3Q2011

1Q2009

2Q2009

3Q2009

4Q2009

2Q2010

3Q2010

4Q2011

2Q2012

3Q2012F

4Q2012F

1Q2013F

2Q2013F

1Q2010

4Q2010

1Q2012

3Q2013F

Ambattur oMR (IT Corridor)

GST road

CBD

Guindy (SBD)

MARKET TRANsACTIONs

CLIENT

Ajuba Solutions India Pvt Ltd GE Capital Services ISGN NITEo technologies Sutherland Global Services BUILDING NAME AkDR Tower Agnito Park Tek Towers Bascon IT Park Tek Towers AREA (SQ. FT.) 30,000 58,000 33,000 11,000 33,000 LoCATIoN IT Corridor IT Corridor IT Corridor T.Nagar IT Corridor TRANSACTIoN TYPE Lease Lease Lease Lease Lease

Source: Colliers International India Research

COllIERs INTERNATIONAl |

p. 7

iNDia | 3Q 2012 | OFFICE

BENGAluRu (BANGAlORE)

Approximately 8.8 million sq ft of commercial Grade A office space was available for fit-out in 3Q 2012. About 57% of this total available space was concentrated in EPIP Zone and Whitefield. During this quarter, a number of new projects were launched in Bengaluru, including Mfar Manyata Tech Park by MFAR Constructions and Vaswani Presidio by Vaswani Group, both along the outer Ring Road; Hinduja SEZ by Hinduja Group and NCC Zenith by NCC both located at Yelahankha; HM Blossom by HM Group on off Sarjapur Road, Commercial Complex by kolte Patil Group at koramangala, Bhartiya SEZ Block 1 by Bhartiya on Bagaluru Road and Golden Supreme Tech Park II by a local developer at Electronic City. All of these projects together would add approximately 3.2 million sq ft of Grade A office space. In 3Q 2012, Bengalurus Grade A new supply totaled approximately 0.8 million sq ft. Projects or part of projects contributing to this new supply were Prestige Tech Park II Etamin Block by Prestige Group, VRC Tower by VRC Corp and Condor by a local developer. In this quarter, the commercial office space market witnessed subdued occupier demand in comparison to the previous two quarters. This could be attributed to cautious occupier sentiments due to economic uncertainty. Average rents for grade A office premises remained stable in almost all of the micromarkets. Going forward, rental values are expected to remain stable as substantial supply is projected to enter the market in the near future.

1Q2008 2Q2008 3Q2008 4Q2008 1Q2010 2Q2010 3Q2010 4Q2010 1Q2011 2Q2011 3Q2011 4Q2011 1Q2012 2Q2012 3Q2012F 4Q2012F 1Q2013F 2Q2013F 3Q2013F 1Q2009 2Q2009 3Q2009 4Q2009

AVAIlABlE supplY IN pRIME AREAs

Electronic City 16% Bannerghatta Road 3%

outer Ring Road 14%

CBD 6%

EPIP Zone/ Whitefield 57%

Hosur Rd 4%

BENGALURU

3Q 2012 GRADE A AND GRADE B RENTAl VAluEs

100 90 80 70 60 INR Per SqFt Per Month 50 40 30 20 10 0 Hosur Road Electronic City(IT) CBD Bannerghatta Road outer Ring Road 4Q2011 1Q2012 2Q2012 3Q2012 EPIP Zone/ Whitefield Grade A

CITY OffICE BAROMETER

2Q 2012 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE 3Q 2012

Grade B

GRADE A AVERAGE RENTAl VAluE

pRIME OffICE spACE RENTAl TREND

100 90 80 70 60 INR Per SqFt Per Month 50 40 30 20 10 0 1Q2008 2Q2008 3Q2008 4Q2008 1Q2009 3Q2009 1Q2010 2Q2010 3Q2010 4Q2010 1Q2011 2Q2011 2Q2009 4Q2009 3Q2011

60

Forecast

50

40 INR per Sq ft per Month

30

20

10 0

CBD Hosur Road EPIP Zone / Whitefield

Bannerghatta Road Electronic City outer Ring Road

MARKET TRANsACTIONs

CLIENT

Dexler Exilant Technologies Happiest Minds Loreal Mitsubishi Price Waterhouse Coopers BUILDING NAME Prestige Corniche Chambers Mantri Independent Building Bearys Global Research Triangle Brigade Hulkul Brigade Hulkul AREA (SQ. FT.) 8,900 40,000 50,000 25,000 8,570 8,570 LoCATIoN Richmond Road Richmond Road Electronic City Whitefield Lavalle Road Lavalle Road TRANSACTIoN TYPE Lease Lease Lease Lease Lease Lease

Source: Colliers International India Research

p. 8

| COllIERs INTERNATIONAl

iNDia | 3Q 2012 | OFFICE

KOlKATA

In 3Q 2012, 0.6 million sq ft was added to the Grade A office stock in kolkata. Projects / parts of projects contributing to this supply included Infinity BNkE by Infinity Group at Sector 5, Wood Square by Srijan Realty at Narendrapur, PS IxL and PS Maestro, both by PS Group at New Town and Topsia, respectively. Projects launched during the quarter included Ideal Unique Centre by Ideal Group at EM By-pass and Inia by a local developer at Matheswartala Road. Both projects are expected to be completed by the end of 2015.

koLkATA

NEW supplY IN pRIME AREAs

Ballygunge Circular RD 4% Sector-5 31%

East kolkata 65%

CITY OffICE BAROMETER

2Q 2012 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE 3Q 2012

INR per sq ft per month

Demand for Grade A commercial office space remained sluggish; however, a few small commercial leases were signed during the quarter. Ample stock availability in major commercial hubs such as Rajarhat, and Sector 5; and subdued demand kept rental values stable across the city. In near future, absorption of Grade A commercial office space is likely to remain moderate and rental values are expected to remain stable. In this quarter for the first time in the state, a land parcel measuring 2 acres was sold via an e-auction. The plot is situated in Rajarhat New Town and was sold for a consideration of INR 10.10 crore for the establishment of an educational facility. The e-auction was conducted by The West Bengal Housing Infrastructure Development Corporation (HIDCo).

3Q 2012 GRADE A AND GRADE B RENTAl VAluEs

140 120 100 80 60 40 20 0

Ballygunge -Circular RD

East kolkata

CBD (Park St, Camac St,AJC Bose Rd)

PBD (New Town, Rajarhat

Sector-5

Sector-5 (IT)

Grade A

Grade B

GRADE A AVERAGE RENTAl VAluE

pRIME OffICE spACE RENTAl TREND

160 140 120 100 INR per sq ft per month 80 60 40 20 1Q2008 2Q2008 3Q2008 4Q2008 1Q2010 3Q2010 1Q2011 1Q2009 2Q2009 3Q2009 4Q2009 2Q2010 4Q2010 2Q2011 3Q2011 4Q2011 1Q2012

140 120 100 INR per Sq ft per Month 80 60 40 20 0 1Q2008 2Q2008 3Q2008 4Q2008 1Q2009 2Q2009 3Q2009 4Q2009 1Q2011 2Q2011 3Q2011 1Q2010 2Q2010 3Q2010 4Q2010 4Q2011 1Q2012 2Q2012 3Q2012F

Forecast

4Q2012F

1Q2013F

2Q2013F

3Q2013F

CBD (Park St,Camac St, AJC Bose Rd) Ballygunge Circular Rd PBD (New Town, Rajarhat

East kolkatta Sector 5

MARKET TRANsACTIONs

CLIENT

Anshian Software CMC ITD Cementation Nova Speciality Surgery Praxair BUILDING NAME Globsyn Building Godrej Waterside Godrej Waterside PS Space DLF IT Park 1 AREA (SQ. FT.) 30,000 13,000 10,000 10,000 10,000 LoCATIoN Sector 5, Saltlake New Town New Town Topsia New Town TRANSACTIoN TYPE Lease Lease Lease Lease Lease

Source: Colliers International India Research

COllIERs INTERNATIONAl |

PBD New Town, Rajarhat (IT)

p. 9

iNDia | 3Q 2012 | OFFICE

puNE

In 3Q 2012 more than 5.4 million sq ft of Grade A office space was available for fitout. About 59% of this supply was located in the Hinjewadi, Hadapsar / Fursungi and kharadi micro-markets. In this quarter, Marvel Realtors launched several new commercial projects including Marvel Fuego and Marvel Sentinel at Magarpatta, Marvel Trueno at Viman Nagar, Marvel Boulevard at NIBM and Marvel Vista at Lulla Nagar. All these projects would collectively add to around 1 million sq ft of Grade A office supply. Apart from this Bramha Corp and Vikram Developer have also launched Pune one and Vikram Monarch at Connaught Road and University Road, respectively.

3Q 2012

supplY IN pRIME AREAs

kharadi 21 % Hadapsar/Fursungi 11%

Baner 6% Bund Garden 4% Airport road/ pune station 4% Aundh 3% Hinjewadi 27% Senapati Bapat Road 2% Bavdhan 4% kalyani Nagar 6% Nagar Road 12%

PUNE

3Q 2012 GRADE A IT AND NON IT RENTAl VAluEs

90 80

CITY OffICE BAROMETER

2Q 2012 VACANCY ABsORpTION CONsTRuCTION RENTAl VAluE

INR Per SqFt Per Month

New supply in Punes Grade A office space for 3Q 2012 accounts for approximately 0.3 million sq ft. The project contributing to this new supply was Techno Space by Teerth Developer at Baner. During 3Q 2012, occupier demand for Grade A office space has reduced, primarily due to prevailing cautions sentiments. Rental values for Grade A office space increased in the range of 6 to 7% quarter-onquarter (QoQ) in the Hinjewadi, Hadapsar / Fursungi and kharadi micro-markets primarily due to limited supply. Though, rental values in all other micro-markets remained stable. The Maharashtra State Government has sanctioned INR200 crore for the construction of the first phase of a new International Airport at Rajgurunagar. The airport will be developed by the Maharashtra Airport Development Company (MADC) with a total estimated cost of INR1,000 crore. Earlier, the airport was planned near Chakan.

70 60 50 40 30 20 10 Senapati Bapat Road kalyani Nagar Baner Bund Garden Airport road/ pune station Nagar Road Hinjewadi Bavdhan Aundh Hadapsar/Fursungi 4Q2011 1Q2012 0 kharadi 2Q2012 3Q2012

IT

Non IT

GRADE A AVERAGE RENTAl VAluE

pRIME OffICE spACE RENTAl TREND

130 120 110 100 90 INR Per SqFt Per Month 80 70 60 50 40 30 1Q2008 2Q2008 3Q2008 4Q2008 3Q2010 1Q2011 2Q2011

Baner khardi

100 90 80 70 INR per Sq ft per Month 60 50 40 30 20 10 0 2Q2008 3Q2008 1Q2011 3Q2011 1Q2008 4Q2008 1Q2009 2Q2009 3Q2009 4Q2009 1Q2010 2Q2010 3Q2010 4Q2010 2Q2011 4Q2011 1Q2012 2Q2012 3Q2012F

Forecast

1Q2009

2Q2009

3Q2009

4Q2009

1Q2010

2Q2010

4Q2012F

1Q2013F

2Q2013F

3Q2013F

Bavdhan Bund Garden kalyani Nagar Hinjewadi

Aundh Nagar Road Senapati Bapat Rd

4Q2010

Airport road/pune station

Hadapsar/Fursungi

MARKET TRANsACTIONs

CLIENT

Automatic Data Processing BNY Mellon Bristlecone Citi Bank HCL Johnson Control India BUILDING NAME SP Infocity Commerzone Binarius Eon IT Park Commerzone Devi IT Park AREA (SQ. FT.) 30,000 30,000 35,000 100,000 31,000 100,000 LoCATIoN Phursungi Yerwada Yerwada kharadi Yerwada Pimpri TRANSACTIoN TYPE Lease Lease Lease Lease Lease Lease

Source: Colliers International India Research

p. 10

| COllIERs INTERNATIONAl

3Q2011

20

iNDia | 3Q 2012 | OFFICE

OffICE suBMARKETs

Mumbai The major business locations in Mumbai are the CBD (Nariman Point, Fort and Ballard Estate), Central Mumbai (Worli, Lower Parel and Parel), Bandra kurla Complex (BkC) and Andheri kurla stretch. Powai, Malad and Vashi are the preferred IT/ITES destinations, while Airoli at Navi Mumbai and Lal Bahadur Shastri Marg are emerging as new office and IT/ITES submarkets. Delhi The commercial areas in New Delhi metropolitan area can be broadly classified into the CBD (Connaught Place), SBD Nehru Place, Bhikaji Cama Place, Netaji Subhash Place, Jasola and Saket . Gurgaon The prime business locations in Gurgaon are MG Road, Golf Course Road, Cyber City and Udyog Vihar. Manesar on the outskirts of Gurgaon is also emerging as the citys new office destination. NOIDA NoIDA market is comprised of sectors broadly classified as institutional, industrial and commercial sectors. Institutional sectors include sec 16A, 62 and 125-142, industrial sectors include sec 1-9, 57-60 and 63- 65 while sector 18 is the most developed commercial sector. Chennai Prime office properties in Chennai are located in four principal sub-markets: the CBD, the IT Corridor, the SBD and the PBD. The SBD comprises Guindy, Manapakkam, Velachery and other areas. The PBD primarily includes Ambattur and GST Road, while the IT Corridor is the old Mahaballipuram Road (oMR) in south Chennai. Bengaluru (Bangalore) Prime office properties in Bengaluru can be divided into three principal sub-market CBD, the SBD consisting of Banerghatta Road & outer Ring Road (oRR) and PBD including Hosur Road, EPIP Zone, Electronic City and Whilefield. Pune The prime office sub-markets of Pune include Deccan Gymkhana, Senapati Bapat Road & Camp (SBD), while the PBD includes Aundh, Bund Garden, Airport Road and kalyani Nagar, among other locations. The eastern corridor, along with Nagar Road and kharadi, have emerged as a preferred location for financial and IT/ITES companies. Kolkata The major business locations in kolkata are CBD (Park Street, Camac Street, Chowranghee Rd), SBD (AJC Bose Rd, Ballygunge circular Rd, East kolkata), East kolkata and PBD (New Town & Rajarhat). The area around Park Street, Camac Street and AJC Bose road houses number of high-rises commercial buildings such as Chatterjee International Centre, Tata Centre, Everest House and Industry House among others.

CITY BAROMETER

Increasing as compared to previous quarter Decreasing as compared to previous quarter Remained stable from previous quarter

COllIERs INTERNATIONAl |

p. 11

iNDia | 3Q 2012 | OFFICE

Colliers International (India) provides property services to property Investors and occupiers. We deliver customised service solutions utilising local and global knowledge in partnership with our clients via our property Investment and occupier service lines. These service lines include - office Services, Facility Management, Project Management, Residential Services, Investment Services and Valuation & Advisory Services. www.colliers.com/india For national offices services related queries please contact: George Mckay, South Asia Director office & Integrated Services George.mckay@colliers.com Tel: +91 22 4050 4553 Mumbai Vikas kalia, National Director office Services Vikas.kalia@colliers.com Tel: +91 124 456 7531 522 offices in 62 countries on 6 continents United States: 147 Canada: 37 Latin America: 19 Asia Pacific: 201 EMEA: 118 $1.8 billion in annual revenue 2.55 billion square feet under management over 12,300 + professionals

: Prabhu Raghavendra, office Director Prabhu.raghavendra@colliers.com 31/A, 3rd floor, Film Center, 68, Tardeo Road, Mumbai, India - 400 034. Tel : +91 22 4050 4500, fax : +91 22 2351 4272

AUTHORS

Amit Oberoi MRICS National Director, Valuation & Advisory; Research Email: Amit.oberoi@colliers.com Surabhi Arora MRICS Associate Director, Research Email: Surabhi.arora@colliers.com Sachin Sharma Assistant Manager, Research Email: Sachin.sharma@colliers.com Heliana Mano Assistant Manager,Valuation & Advisory Email: Heliana.mano@colliers.com For general queries and feedback : India.Research@colliers.com Tel: +91 124 456 7580

Delhi NCR : Ajay Rakheja, office Director Ajay.rakheja@colliers.com New Delhi : Statesman House, 4th Floor, Barakhamba Road, Connaught Place, New Delhi, India - 110001 Tel : +91 11 3044 6423, fax : +91 11 3044 6500 Gurgaon : Technopolis Building, 1st floor, DLF Golf Course Main Road, Sector 54, Gurgaon, India - 122002 Tel : +91 124 456 7500, fax : +91 124 456 7502 Bengaluru : Goutam Chakraborthy, office Director Goutam.chakraborthy@colliers.com Prestige Garnet, Level 2, Unit No.201/202, 36 Ulsoor Road, Bengaluru, India - 560 042 Tel : +91 80 4079 5500, fax : +91 80 4112 3131 Pune : Suresh Castellino, office Director Suresh.castellino@colliers.com Hotel Le Meridian, 101, R.B.M. Road, Pune, India - 411 001 Tel : +91 20 4120 6438, fax : +91 20 4120 6434 : kaushik Reddy, office Director kaushik.reddy@colliers.com Heavitree Complex, Unit 1C, 1st floor, 23, Spurtank Road, Chetpet, Chennai, India - 600 031 Tel : +91 44 2836 1064, fax : +91 44 2836 1377 : Soumya Mukherjee , office Director Soumya.mukherjee@colliers.com Infinity Business Centre, Infinity Benchmark, Room No 13, Level 18, Plot G - 1, Block EP & GP, Salt Lake Sector V, kolkata - 700 091 West Bengal, India Tel : +91 33 2357 6501, fax : +91 33 2357 6502

Chennai

Kolkata

This report and other research materials may be found on our website at www.colliers.com/India. Questions related to information herein should be directed to the Research Department at the number indicated above. This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. Copyright 2012 - 2013 All Rights Reserved.

Recent Reports :

INDIA oFFICE INDIA RESIDENTIAL APAC oFFICE GLoBAL INDUSTRIAL

SECOND HALF 2011 | INDUSTRIAL

GLoBAL oFFICE

SECOND HALF 2011 | OFFICE

INDIA BUDGET

Q1 2012 | RESEARCH

HIGHLIGHTS

GLOBAL INDUSTRIAL

HIGHLIGHTS

GLOBAL OFFICE

A SNEAK PREVIEW

Global Warehouse Demand Shows Consistent Growth

JAMES COOK Director of Research | USA

GLOBAL INDUSTRIAL CAPITALIZATION RATES (Prime Yield/Percent) MARKET (Select Markets)

Hong Kong Singapore London (Heathrow) Tokyo Los Angeles Inland Empire, CA Chicago, IL Paris Munich Vancouver, BC Marseilles New Jersey Northern Dallas-Ft. Worth, TX Shanghai Seoul Madrid Sydney Mexico City Prague Athens Bucharest

Global Office Demand Growth Slow and Steady

JAMES COOK Director of Research | USA

Global Office Trend Forecast Global office vacancies will continue their decline, due to steady demand and low levels of new construction in North America and Europe. The flight to quality trend will continue in many major markets, with occupiers trading up to higher-quality space or a better location as their leases expire. The European sovereign debt crisis will likely push the Eurozone into a mild recession in early 2012. This contraction will be felt most profoundly in a handful of commercial property markets within the most troubled nations. Economic prospects in the Eurozone have slightly reduced overall positive global expectations for market performance in 2012. We expect continuing modest demand for office space, with most cities seeing a drop in vacancy rates. But global averages do not speak to the nuances of individual markets, andwhile we expect positive absorption due to business growth and expansion in the United States, China and Australiasome Eurozone countries may see negative absorption and increased vacancy as the region enters a mild recession. Latin America Boasts the Tightest Office Markets Some of the worlds lowest office vacancy rates are found in Latin American cities. Santiago, Chile; Rio de Janeiro, Brazil; So Paulo, Brazil; and Lima, Peru all have vacancy rates below three percent, resulting in a market that strongly favors landlords, prompts new construction and might squeeze some tenants that desire to expand. For the most part, we expect the strength of these markets to persist. While decreases in European demand for its commodities will likely hurt Latin America, this will be tempered by continued demand from China. In So Paolo, heightened demand has spurred the highest rates of new development in the region, which will eventually put downward pressure on asking rents. each has shown apparent decline in rents between June and December of 2011, when quoted in U.S. dollars. Substantial declines, in fact: led by a $10.87 USD drop in Parisian Class A rents. But how significant are these figures? The change in London and Paris rents is due to the strengthening dollar relative to the euro and pound sterling. In local currency, prime rents in these markets are holding ground. Although smaller, the decline in Hong Kong of $7.56 USD ($5.10 HKD) per square foot may be a more important indicator of things to come, as demand from the banking and financial sector continue to weaken.

GLOBAL CAPITALIZATION RATES / PRIME YIELDS: 10 LOWEST CITIES MARKET (Ranked by Dec 2011)

Taipei Hong Kong Vienna London West End Zurich Singapore Geneva Beijing Paris Munich Tokyo

UNION BUDGET 2012 -13

Budget Highlights | Real Estate

MARKET REACTION TO BUDGET

Company

BSE SENSEX Realty Index Anant Raj Inds D B Realty DLF Godrej Properties HDIL Hubtown Ltd. Indiabulls Real Estate Mahindra Lifespaces Orbit Corp. Parsvnath Developers Peninsula Land Phoenix Mills Sobha Developers Sunteck Realty Unitech

Change (%)

-1.19 -1.26 -6.04 -2.02 0.15 -2.82 -5.21 -4.13 -1.95 -0.72 -3.37 -4.04 -3.18 -2.65 3.04 -1.13 -1.68

Global Industrial Trend Forecast Growing global trade will steady demand for quality warehouse space in many regions.

DEC 2011

. . . . . . . . . . . . . . . . . . . .

we expect overall warehouse rents in the So Paulo region to rise by as much as four percent in the coming year. Mexico City saw a three percent decrease in its industrial vacancy rate in the second half of 2011, down to 4.8 percent. Mexico was more negatively affected by the recession than most countries in North America, and its economic future is largely tied to that of its key trading partner, the United States. But with U.S. growth on the upswing, Mexico too is poised to grow at a modest rate and we expect that vacancies could make further drops in the country. Steady Demand in North America Since peaking in 2010, growth in the manufacturing and distribution industry has kept the U.S. vacancy rate dropping in a mostly regular fashion. Vacancy dropped to 9.72 percent in Q4 2011. With construction proceeding at low levels, we expect vacancies to continue to drop at a measured rate into 2013. Toronto, Canadas biggest industrial market, saw 13.7 million square feet of industrial space absorbed in 2011, and the citys prime warehouse rents grew by 7.1 percent in the second half of 2011. Dropping Vacancies in Most Asian Markets Asia Pacific saw dropping vacancies in nearly every market. Prime warehouse rents grew in more than half of the markets, and observers in more than half of those markets expect that warehouse rents will continue to climb over the next six months. Australian industrial has been especially strong in most major markets. Retail purchases, made more attractive by the relatively strong Australian dollar, have pushed up demand for large warehouse space in several port markets. While there is growing demand for large modern warehouse

Continued on page 8

REGION Asia Pacific Asia Pacific EMEA Asia Pacific NA NA EMEA EMEA NA EMEA NA NA Asia Pacific Asia Pacific EMEA Asia Pacific LATAM EMEA EMEA EMEA

DEC 2010

. . . . . . . . . . . . . . . . . . . .

Industrial vacancy rates will further drop in most markets. Some markets, U.S. and Australia among them, will experience a lack of new supply in the face of growing demand. Prime warehouse rents will climb in most Asia Pacific markets, remain stable in EMEA and LATAM, and continue to strengthen in North American markets. Citing deteriorating financial conditions and dimming growth prospect, the International Monetary Funds (IMF) revised its September 2011 World Economic Outlook growth projections downward in January 2012. However, the IMF still forecasts that global trade volume will rise by 3.8 percent in 2012 and 5.4 percent in 2013; as global trade rises, so too will demand for warehouse space. While warehouse rents have stabilized in most EMEA and Latin American markets, prime warehouse rents quoted in local currencies increased in the majority of Asia Pacific and North American markets in 2011 over the previous year. We expect this trend to continue, with prime warehouse rents climbing in most Asia Pacific and North American markets in the next year. Latin American Rents Poised to Stabilize In Latin America, prime warehouse rental rates took a fall. In 71.4 percent of the markets we track, year-end rents decreased in 2011 from a year earlier. However, we expect warehouse rents in Latin America to stabilize in the coming year. So Paulo saw a 12.4 percent drop in warehouse rents in local currency, due to increased supply. However, with absorption set to outpace supply,

CBD CAP RATE (%) DEC 2011 . . . . . . . . . . . JUNE 2011 . . . . . . . . . . . DEC 2010 . . . . . . . . . . .

Finance Minister Pranab Mukherjee started his budget speech 2012-13 in the backdrop of challenging macroeconomic scenario. The finance minister projects the economy to grow by 7.6% in the next fiscal up from 6.9% in 2011-12. He mentioned that due to adverse global economic sentiments there has been a slowdown in the Indian Economy but the fact is India still remains among the front runners in the economic growth in any cross country comparison. The budget aims at faster, sustainable and more inclusive growth across sectors emphasizing on five focus areas including revival of domestic consumption, rapid revival of high growth in private investment, removal of supply bottlenecks, addressing malnutrition in 200 high burden districts and expedite improvement in delivery system, governance and transparency. From a real estate perspective, the budget remained silent on most of the major issues including status of STPIs (Software Technology Parks of India), Real Estate Regulatory Bill, Land Bill etc. however, it mentioned that efforts are on to arrive at a political consensus on the issue of allowing 51% Foreign Direct Investment (FDI) in multi-brand retail. THE KEY HIGHLIGHTS OF THE BUDGET WHICH MAY IMPACT REAL ESTATE SECTOR ARE AS FOLLOWS: - External Commercial Borrowings (ECB) for low cost affordable housing projects. Impact: Real estate companies developing large affordable housing projects with large fund requirements will benefit the most from the easing of external commercial borrowing (ECB) norms as interest rate charged is lower in case of external borrowings in comparison to rates charged by domestic institutions. - Increase in provision under Rural Housing Fund to INR 4,000 crore from the existing INR 3,000 crore.Impact: It will provide housing finance to targeted groups in rural areas at competitive rates. - Extension of the existing scheme of interest subvention of 1% on housing loans up to INR 15 lakh where the cost of the house does not exceed INR 25 lakh for another year. Impact: This will boost the affordable housing segment by providing cheaper loan to the end users.

OFFICE PROPERTY MARKET OVERVIEW

INDIA

QUARTERLY UPDATE | JULY | 2012

Residential Property Market Overview

INDIA

QUARTERLY UPDATE | AUGUST | 2012

Source: www.bseindia.com | Mar 16, 2012

GLOBAL OFFICE OCCUPANCY COSTS: TOP 10 CITIES

CLASS A / NET RENT (USD/SQ FT)

ASIA PACIFIC OFFICE MARKET OVERVIEW

2Q 2012

GLOBAL TOP TEN INDUSTRIAL WAREHOUSE RENTS

(USD/ PSF/Year)

RENT

MARKET

Tokyo London (Heathrow) Hong Kong Singapore Zurich Oslo Moscow Geneva So Paulo Helsinki Marseilles Paris

REGION

Asia Pacific EMEA Asia Pacific Asia Pacific EMEA EMEA EMEA EMEA LATAM EMEA EMEA EMEA

6-MONTH CHANGE*

-.% .% .% .% .% .% .% -.% -.% .% .% .%

*Local currency

MARKET (Ranked by Dec 2011)

Hong Kong Paris Rio de Janeiro Moscow London City Perth Singapore Geneva So Paulo

DEC 2011 . . . . . . . . .

JUNE 2011 . . . . . . . . . .

DEC 2010 . . . . . . . . . .

Accelerating success.

Accelerating success.

. . . . . . . . . . . .

London West End .

EMEA and Asia Pacific Lead Global Construction A significant percentage of the office space under Select Asia Pacific Markets See Big Vacancy Drops The global trend in dropping vacancy rates should be evi- construction is in Europe, the Middle East and Africa dent in Asia and continue through 2012. Markets that saw (EMEA), and much of that is occurring in Moscow and a drop in vacancy in the second half of 2011 outnumbered Dubai. While both of these markets should expect strong by a two-to-one margin those where vacancy increased. economic growth in 2012, the fact that Dubaiwith a vacancy rate of 50 percentis constructing at such a pace Of the worlds most populous markets, those with the most leads us to expect that supply will continue to outpace significant declines in six-month vacancy rates were nearly demand in that market. all in the Asia Pacific region. Chengdu, propelled by its strong manufacturing sector, saw its vacancy rate drop by The other two top markets for office construction are in the GuangzhouChinas leading 7.8 percent in the period, and Shanghai saw a 3.2 percent Asia Pacific region. commercial port cityand Tokyo have 19.6 and 15.6 million drop in vacancy. square feet under construction respectively. Asian economic Two other large Asian markets saw vacancy rates drop by growth rates will remain strong in the coming months, with 1.5 percent or more: Jakarta, which has also seen China and India leading the pack. Rents are on the rise in sustained growth in CBD rental rates and renewed global most cities in the region. However, dropping rents in Seoul investor interest; and Singapore, where occupancies are and Hong Kong are a potential indicator of global economic expected to stabilize. uncertainty. In Tokyo, where new supply has been increasing for the past three years, we expect construction to peak and Marquee Markets See Rent Decline begin to decline in the coming year. While Hong Kong, Londons West End and Paris command the top three highest asking rents for Class A office space,

P. 1 | COLLIERS INTERNATIONAL

Accelerating success.

WWW.COLLIERS.COM

WWW.COLLIERS.COM

www.colliers.com/india

This book is printed on 100% Recyclable paper

Accelerating success. Accelerating success.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- India Residential Property Market Overview - Feb 2016Документ17 страницIndia Residential Property Market Overview - Feb 2016Colliers InternationalОценок пока нет

- India Office Report 2015 - ColliersДокумент23 страницыIndia Office Report 2015 - CollierssmbhattaОценок пока нет

- Mumbai Office Property Market Overview April 2015Документ3 страницыMumbai Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Workspace Trends in India 2015Документ5 страницWorkspace Trends in India 2015Colliers InternationalОценок пока нет

- PUNE Residential Property Market Overview - May 2015Документ2 страницыPUNE Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- India Office Property Market Overview April 2015 PDFДокумент20 страницIndia Office Property Market Overview April 2015 PDFColliers InternationalОценок пока нет

- NOIDA Residential Property Market Overview - May 2015Документ2 страницыNOIDA Residential Property Market Overview - May 2015Colliers International100% (1)

- NOIDA Office Property Market Overview April 2015Документ3 страницыNOIDA Office Property Market Overview April 2015Colliers International100% (1)

- Pune Office Property Market Overview April 2015Документ3 страницыPune Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- MUMBAI Residential Property Market Overview - May 2015Документ2 страницыMUMBAI Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Kolkata Office Property Market Overview April 2015Документ3 страницыKolkata Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Kolkata Office Property Market Overview April 2015Документ3 страницыKolkata Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- India Office Property Market Overview April 2015 PDFДокумент20 страницIndia Office Property Market Overview April 2015 PDFColliers InternationalОценок пока нет

- India Residential Research & Forecast Report - Feb - 2015Документ13 страницIndia Residential Research & Forecast Report - Feb - 2015Colliers InternationalОценок пока нет

- DELHI Residential Property Market Overview - May 2015Документ2 страницыDELHI Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Gurgaon Office Property Market Overview April 2015Документ3 страницыGurgaon Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- DELHI Residential Property Market Overview - May 2015Документ2 страницыDELHI Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Gurgaon Residential Property Market Overview - May 2015Документ2 страницыGurgaon Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Delhi Office Property Market Overview April 2015Документ3 страницыDelhi Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Chennai Residential Property Market Overview - May 2015Документ2 страницыChennai Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Bengaluru Office Property Market Overview April 2015Документ3 страницыBengaluru Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- India Office Rental Insight - Apr 2015Документ6 страницIndia Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Bengaluru Residential Property Market Overview - May 2015Документ2 страницыBengaluru Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Mumbai Office Rental Insight - Apr 2015Документ1 страницаMumbai Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Pune Office Rental Insight - Apr 2015Документ1 страницаPune Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Bengaluru Office Property Market Overview April 2015Документ3 страницыBengaluru Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Kolkata Office Rental Insight - Apr 2015Документ1 страницаKolkata Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Chennai Office Rental Insight - Apr 2015Документ1 страницаChennai Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Bengaluru Office Rental Insight - Apr 2015Документ1 страницаBengaluru Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- y Yc 6 QHP9 R1 S Ps 64 GДокумент8 страницy Yc 6 QHP9 R1 S Ps 64 GDinesh SarkarОценок пока нет

- RBI Regulatory SandboxДокумент13 страницRBI Regulatory Sandboxbharat rathodОценок пока нет

- 12 Ac December 01-31 2019 by @naukriaspirant PDFДокумент442 страницы12 Ac December 01-31 2019 by @naukriaspirant PDFAmit PrasadОценок пока нет

- Doing Business India (WB)Документ153 страницыDoing Business India (WB)Jyotpreet SinghОценок пока нет

- Onsumer ComplaintsДокумент6 страницOnsumer Complaintsz_k_j_vОценок пока нет

- Top 5 Major Objectives of Development Banks in IndiaДокумент2 страницыTop 5 Major Objectives of Development Banks in Indiababa3673Оценок пока нет

- Gold Business Account StatementДокумент4 страницыGold Business Account StatementAnna Hofisi80% (5)

- FINC3014 Topic 11 - Solutions: Current issues in Trading & DealingДокумент5 страницFINC3014 Topic 11 - Solutions: Current issues in Trading & Dealingsuitup100Оценок пока нет

- Companies Guide 2010 - 11-24-2010 11 - 22 - 43 AMДокумент157 страницCompanies Guide 2010 - 11-24-2010 11 - 22 - 43 AMChandrashekar KumarОценок пока нет

- Accounting: Accounting Equation/ Balance SheetДокумент4 страницыAccounting: Accounting Equation/ Balance SheetDhea Angela A. CapuyanОценок пока нет

- Michael Burry Op-Ed Contributor - I Saw The Crisis Coming. Why Didn't The FedДокумент3 страницыMichael Burry Op-Ed Contributor - I Saw The Crisis Coming. Why Didn't The FedArthur O'KeefeОценок пока нет

- Merchant BankДокумент50 страницMerchant BankGOVIND JANGIDОценок пока нет

- ACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnДокумент13 страницACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnashikОценок пока нет

- A Look at The STX Deal With GhanaДокумент12 страницA Look at The STX Deal With GhanaGabriel Owusu AnsahОценок пока нет

- Certificates of DepositДокумент3 страницыCertificates of DepositJitendra VirahyasОценок пока нет

- Auto Loan - Product - N - FeaturesДокумент9 страницAuto Loan - Product - N - FeaturesAyushi LalwaniОценок пока нет

- Republic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.Документ14 страницRepublic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.CristineОценок пока нет

- Referance of Merger & AcquitionДокумент3 страницыReferance of Merger & Acquitionsujal_sharma28Оценок пока нет

- Ratio Analysis: Bachelor of Business Administration TO South Gujrat University, SuratДокумент6 страницRatio Analysis: Bachelor of Business Administration TO South Gujrat University, Suratsumesh8940% (1)

- Bank of America V Associated Citizens BankДокумент4 страницыBank of America V Associated Citizens BankJuhainah Lanto TanogОценок пока нет

- Exam Financial ManagementДокумент10 страницExam Financial ManagementShrief MohiОценок пока нет

- Guide To Cost-Benefit Analysis of Infrastructure ProjectsДокумент133 страницыGuide To Cost-Benefit Analysis of Infrastructure ProjectstegelinskyОценок пока нет

- JOB ANALYSIS: A KEY HR TOOLДокумент70 страницJOB ANALYSIS: A KEY HR TOOLVenkata Siva Reddy75% (4)

- Test Business English Banking VocabularyДокумент10 страницTest Business English Banking VocabularyTijana Doberšek Ex Živković100% (2)

- Art collection values over timeДокумент6 страницArt collection values over timeMohit LukhiОценок пока нет

- PNB vs. Sayo - GR 129918 - Full TextДокумент36 страницPNB vs. Sayo - GR 129918 - Full TextJeng PionОценок пока нет

- Financial AccountigДокумент19 страницFinancial Accountigalbertoca990Оценок пока нет

- Macquarie Indian ECommerce+ - +LONGTERMGRP+Документ83 страницыMacquarie Indian ECommerce+ - +LONGTERMGRP+ratithaneОценок пока нет

- Around The World in 80 DaysДокумент179 страницAround The World in 80 DaysEllenXxXZenaОценок пока нет

- Display - PDF - 2019-06-27T084756.696Документ19 страницDisplay - PDF - 2019-06-27T084756.696SureshОценок пока нет