Академический Документы

Профессиональный Документы

Культура Документы

Difference Between Provision and Reserve

Загружено:

Śáńtőśh MőkáśhíИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Difference Between Provision and Reserve

Загружено:

Śáńtőśh MőkáśhíАвторское право:

Доступные форматы

Difference Between Provision And Reserve Quite a number of us use the word provision and reserves interchangeably as if they

are the same but actually there is a very great difference between them. SO LETS LOOK AT WHAT IS CALLED A PROVISION: A Provision: Is an amount written off to provide for depreciation, or diminution in value of assets or retained to provide for a known liability. Provisions made for expected losses and contingencies are charges against profits The liability should be a present obligation whether legal or constructive which has arisen as a result of a past event and where payment is probable ( more likely than not) and the amount can be estimated reliably. Arises from the accrual and prudence principles Examples of these liabilities appearing in the liabilities side of the balance sheet are: Provision for retirement benefits Provisions for reorganization or severance : this provision is recorded when a company announces a plan to change its organization structure, which will incur significant costs, including termination of personnel However, take note that the provisions can also be classified on the asset side of the balance sheet which are then known as negative assets with the objective to decrease the value of other assets of the company. Examples of provision as negative assets: Bad debt provision provision decreasing the value of receivables, because their recoverability is doubtful. Mostly recorded based on aging of the receivables, older receivables are more doubtful that new ones. Provision for product returns / credit note provision provision decreasing the value of receivables due to expected sales returns. Normally recorded based on historical experience as a percentage of recent sales. Provision for excessive, obsolete or damaged inventory decreasing the value of inventory with uncertain marketability (due to its obsoletness, damages or excessive volume on stock)

Impairment provisions generally any provisions recorded when a book value of an asset is significantly higher than its fair value SO WHAT IS RESERVES? Reserves are appropriations of profit namely when profits have been ascertained after deducting all expenses which includes provision and others. Reserves are residual earnings after all expenses and taxation which belongs to the owners namely the shareholders. There are essentially two(2) types of Reserves: Capital Reserves Revenue Reserves Capital Reserves: Are appropriation from profits which cannot be distributed by way of cash dividends. These capital reserves arises mainly from (i) equity transactions between the enterprise and its shareholders; (ii) from adjustments arising in accounting for business combinations; (iii) from differences arising on translation of foreign currency operations; (iv) from surpluses arising from asset revaluation; (iv) any unrealized gain which has not been included in income. Examples of capital reserves includes: share premium, capital redemption reserves, capital reserves arising on merger and acquisition, statutory reserves, asset revaluation reserve and exchange fluctuation reserves. Revenue Reserves are: Are appropriation from profit which can be distributed by way of cash dividends although some may be set aside for other purposes. Examples like retained profits and general reserves. RECAP: MAIN DIFFERENCE BETWEEN PROVISION AND RESERVE Remember that provision is a charge to the profit whilst a reserve is an appropriation to the profit. Reserves belongs to the owners equity side while provision can be on a liability side or on the assets side but as a negative asset Reserves 1. It is created by debiting the profit and loss appropriation account.

2. It is created to meet an unknown liability, or to strengthen the financial position of the company or for equalization of dividends etc. 3. A reserve is created only when there is profit in the business. 4. It can be distributed among shareholders as dividend. 5. The reserve is created without taking into consideration the actual amount required except in the case of redemption of debentures when a definite sum is set aside. 6. Creation of reserve depends upon the financial policy of the business and discretion of its management. 7. It is usually shown on the liability side of the balance sheet as it is not a specific reserve. Provisions 1. It is created by debiting the profit and loss account. 2. It is created to meet a known liability or a specific contingency, e.g.. provision for bad and doubtful debts, or provision for depreciation etc. 3. A provision is created irrespective of whether there is profit or loss in the business. 4. It is not available for distribution as dividend among shareholders. 5. A provision is made for a definite amount and, therefore, a definite sum is set aside every year to meet the known contingency. 6. Making of a provision is a must to meet known liability or contingency. 7. The provision is generally shown on the assets side of the balance sheet. Distinction between general reserve and specific reserve General reserve 1. It is created for a specific purpose. 2. It is utilized for that specific purpose, for which it was created. 3. Whether profit or no profits, it must be created. 4. It is necessary to create in order to ascertain profit. 5. It is shown on the debit side of profit and loss account. 6. Net profits are reduced because of it. Specific Reserve 1. It is created not for any specific purpose but for meeting future contingencies. 2. It can be utilized for meeting any future loss. 3. It is created only when there are sufficient profit. 4. They are created only when there are profits i.e. they depend upon profits. 5. It is shown on the debit side of profit and loss appropriation account. 6. Only distributable profits are reduced because of it.

Difference Between Provision and Reserve:

The points of difference between provision and reserve are stated in the tabular form: 1. It is a possible loss so it is created by debiting profit and loss account. It is a charge against profit 1. It is a portion of profit earned by business. It is created by debiting profit and loss appropriation account. It is an appropriation of profit. 2. Profit and loss account discloses true profit/loss, even if no reserve is created. 3. It is meant for meeting any unknown loss or liability. It is generally created with a portion of profit earned by business.

Profit and loss account will not disclose true profit/loss, unless provision is created. 3. It is created to meet specific loss or liability. But the amount of loss or liability cannot be determined exactly. So the amount of provision is an estimated amount. 4. It must be created irrespective of whether 4. It cannot be created unless there is there is a profit or loss. In other words its a sufficient profit. Its creation is the creation is obligatory. discretion of management. In other words, it is not obligatory. 5. Profit or loss is effected by its creation 5. It does not effect profit or loss, profit decreases or loss increases. since it is created after ascertaining profit. 6. Dividend cannot be paid out of it. 6. Dividend can be paid out of it. 7. Its amount must be sufficient to meet the 7. Its amount is generally determined loss or liability. by management on the basis of the amount of profit earned. 8. It cannot increase working capital - it is 8. It increases working capital and utilized for meeting the specific loss or thereby strengthen the financial liability. position of the business concern. 9. The owner of the business cannot have 9. The owner can claim it, since it is any claim over it, since it is created for created out of profit. meeting a specific loss or liability. 10. It is shown on asset side of the balance 10. It is shown on liability side of the sheet as deduction from the concerned balance sheet as a separate item. asset, e.g., provision for doubtful debts is shown as deduction from sundry debtors. 11. It is used for the specific purpose for 11. It can be used for the purpose which is has been created. whatsoever. 12. Auditors must check its adequacy. 12. Auditors are not required to check adequacy. In spite of the above distinction between provision and reserve it may be noted that both of them are created out of the same source, i.e. revenue of the business. Again, if there be any surplus provision after meeting the liability or loss for which it was created, such surplus provision is as good as reserve. For example, a provision of $500 is created in this year for doubtful debts. But actual bad debts in the next year comes to $400 only leaving a surplus provision of $100 (500 - 400). This surplus will be credited to profit and loss account. In other words, it becomes payable to the owner of business like reserves.

2.

Definition of Provision in Accounting

In general words provision means system to complete any work . But accounting provides very technical definition of provision . In small business like shop , general store , there is no need to make any provision , so you will find minimum reference in

basic accounting books but from time to time business expands and reaches at corporate level . It needs to understand the real meaning of provision and what is its importance and how can it implement in business accounting . In very simple accounting term , " Provision is that action of business in which business organisation reserves his money for future losses for safeguarding business ." Now from this definition we get idea that it is the part of profit or money which we receive from sale or from debtors because money of sale , money of debtor and even money of other fixed asset which is saved and reserve for fulfilling losses due to bad debts , depreciation , income tax and other losses which we can not forecast . But for any loss we make different provision accounts like provision for doubtful debts , provision for depreciation , provision for income tax . Because in real sense this is the part of profit of shareholder which should be give to shareholders in the form of dividend but we did not give them due to security of business , so it must be shown in the liability side of business with that given % and should also provide footnote that this is provision and taken for "________" purposes .

Definition of Reserves

Reserves are accounting terms. In general, it is saving of money, but in accounting terminology , it has different meaning. According to accounting technician, Reserves are that funds which withdraw from general or special profit of business and keep it in safe pocket of company. This sum is used when any loss happens in business. " Accounting Experts always in favor to keep some money or retain some fund for future losses, because future is uncertain and for increasing working capital of business, accountant should retain some money out of total profit before distribution it to shareholders. It is shown in profit and loss appropriation account. Indian company lawhas fixed it and in other countries , their company laws fix it and from time to time change it due to changing business environment.

Вам также может понравиться

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОт EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОценок пока нет

- FINANCIAL ACCOUNTING LLДокумент197 страницFINANCIAL ACCOUNTING LLArhin EmmanuelОценок пока нет

- Provisions and ReservesДокумент3 страницыProvisions and ReservesNidhi NayakОценок пока нет

- NIOS Class 12 ACC Most Important QuestionДокумент8 страницNIOS Class 12 ACC Most Important QuestionKaushil SolankiОценок пока нет

- 12 Provisions and ReserveДокумент6 страниц12 Provisions and ReserveShanu SinghОценок пока нет

- Prov. & ReservesДокумент9 страницProv. & ReservesanuradhaОценок пока нет

- Block 5 ECO 02 Unit 2Документ9 страницBlock 5 ECO 02 Unit 2HozefadahodОценок пока нет

- Book Keeping TheoryДокумент16 страницBook Keeping TheoryamitОценок пока нет

- Amity Business School: MBA Class of 2015, Semester IДокумент10 страницAmity Business School: MBA Class of 2015, Semester Igappu007Оценок пока нет

- Theory For Reserves and ProvisionsДокумент1 страницаTheory For Reserves and ProvisionsCarol DanielОценок пока нет

- Chapter 17Документ16 страницChapter 17soniadhingra1805Оценок пока нет

- Reserve and ProvisionДокумент3 страницыReserve and ProvisionKrishna KumarОценок пока нет

- KG College of Arts and Science Coimbatore: Assignment-IДокумент6 страницKG College of Arts and Science Coimbatore: Assignment-IkmkesavanОценок пока нет

- 320 Accountancy Eng Lesson15Документ12 страниц320 Accountancy Eng Lesson15divyaОценок пока нет

- Provisions and ReservesДокумент9 страницProvisions and Reservessujan BhandariОценок пока нет

- Loss Reserving WiserДокумент76 страницLoss Reserving WiserTeodelineОценок пока нет

- Accenture - 1 B Com ProfileДокумент7 страницAccenture - 1 B Com ProfileTHIMMAIAH B CОценок пока нет

- Q/A: 4 Ways Investment Firms Make Money: Investment Banking Investing and Lending Client Services Investment Management 1. What Is Investment BankingДокумент4 страницыQ/A: 4 Ways Investment Firms Make Money: Investment Banking Investing and Lending Client Services Investment Management 1. What Is Investment BankingkrstupОценок пока нет

- Provision and ReserveДокумент4 страницыProvision and ReservePrabhakar TripathiОценок пока нет

- Chapter 6 SolutionsДокумент58 страницChapter 6 Solutionsclevereuphemism100% (1)

- Master of Business Administration-MBA Semester 2 MB0045 - Financial ManagementДокумент9 страницMaster of Business Administration-MBA Semester 2 MB0045 - Financial ManagementGunjan BanerjeeОценок пока нет

- FM Theory PDFДокумент55 страницFM Theory PDFJeevan JazzОценок пока нет

- Name Harsha Registration / Roll No. Course Master of Business Administration (MBA) Subject Semester Semester 2 Subject NumberДокумент20 страницName Harsha Registration / Roll No. Course Master of Business Administration (MBA) Subject Semester Semester 2 Subject NumberKumar GauravОценок пока нет

- Finance ManagementДокумент12 страницFinance ManagementSoumen SahuОценок пока нет

- Interpretetion of AccountsДокумент17 страницInterpretetion of AccountsLittle JainОценок пока нет

- Financial LiteracyДокумент4 страницыFinancial LiteracyFarhan KhanОценок пока нет

- Equity and LiabilitiesДокумент11 страницEquity and LiabilitiesLaston MilanziОценок пока нет

- BF (Summary Act)Документ2 страницыBF (Summary Act)Dorothy Libo-onОценок пока нет

- Presentation On Contingent Assets and LiabilitiesДокумент24 страницыPresentation On Contingent Assets and Liabilitiesअतुल सिंहОценок пока нет

- Retained Earnings: Accumulated Losses, Retained Losses or Accumulated Deficit, or Similar TerminologyДокумент3 страницыRetained Earnings: Accumulated Losses, Retained Losses or Accumulated Deficit, or Similar TerminologyAndrew CharlesОценок пока нет

- Capital & RevenueДокумент14 страницCapital & RevenueNeha KumariОценок пока нет

- IGNOU MBA MS04 Solved AssignmentsДокумент10 страницIGNOU MBA MS04 Solved AssignmentstobinsОценок пока нет

- Fundamentals of Advanced Accounting 4Th Edition Hoyle Solutions Manual Full Chapter PDFДокумент67 страницFundamentals of Advanced Accounting 4Th Edition Hoyle Solutions Manual Full Chapter PDFhorsecarbolic1on100% (12)

- Fundamentals of Advanced Accounting 4th Edition Hoyle Solutions ManualДокумент49 страницFundamentals of Advanced Accounting 4th Edition Hoyle Solutions Manualeffigiesbuffoonmwve9100% (27)

- SCRIPTДокумент5 страницSCRIPTJohn LucaОценок пока нет

- Balance Sheet PDFДокумент10 страницBalance Sheet PDFavinash singhОценок пока нет

- Definition of The 'Going Concern' Concept: AccountingДокумент4 страницыDefinition of The 'Going Concern' Concept: Accountingmhrscribd014Оценок пока нет

- Reserve and ProvisionДокумент19 страницReserve and ProvisionRojesh BasnetОценок пока нет

- Valuation of Goodwill Cost AssignmentДокумент12 страницValuation of Goodwill Cost AssignmentShubashPoojari100% (1)

- 30 March Assignment 1500 WordsДокумент5 страниц30 March Assignment 1500 Wordsmishal chОценок пока нет

- Financial Management - ResumosДокумент10 страницFinancial Management - ResumosBeatriz BastosОценок пока нет

- Provision & ReserveДокумент4 страницыProvision & Reservedivya shreeОценок пока нет

- Fin. Acounting Project 2022Документ14 страницFin. Acounting Project 2022Sahil ParmarОценок пока нет

- Task 2Документ18 страницTask 2Yashmi BhanderiОценок пока нет

- Accounting Methods For GoodwillДокумент4 страницыAccounting Methods For GoodwillaskmeeОценок пока нет

- Window DressingДокумент10 страницWindow DressingMansi JainОценок пока нет

- Aug 10, AccountingДокумент7 страницAug 10, AccountingDiane NatividadОценок пока нет

- Key Terms and Chapter Summary-16Документ1 страницаKey Terms and Chapter Summary-16mariassketches12Оценок пока нет

- Business Combinations and Consolidated Financial Statements As Per Accounting Standards (Latest and Simple)Документ9 страницBusiness Combinations and Consolidated Financial Statements As Per Accounting Standards (Latest and Simple)dsp varmaОценок пока нет

- MB0045 Financial Management: C C C CДокумент10 страницMB0045 Financial Management: C C C CDinesh Reghunath RОценок пока нет

- Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other IssuesДокумент51 страницаVariable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other IssuesJordan YoungОценок пока нет

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manual 1Документ36 страницFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manual 1toddvaldezamzxfwnrtq100% (26)

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manual 1Документ53 страницыFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manual 1audra100% (36)

- Friedlan4e SM Ch05Документ57 страницFriedlan4e SM Ch05NischalaGunisettiОценок пока нет

- Admission of A PartnerДокумент5 страницAdmission of A PartnerTimothy BrownОценок пока нет

- Top 7 Biggest If Rs MistakesДокумент18 страницTop 7 Biggest If Rs MistakesKyleRodSimpsonОценок пока нет

- Account Unit3 MbaДокумент27 страницAccount Unit3 MbaAnantha KrishnaОценок пока нет

- Corporate FininanceДокумент10 страницCorporate FininanceMohan KottuОценок пока нет

- Understanding Financial Statements - Making More Authoritative BCДокумент6 страницUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyОценок пока нет

- MCGM PF SlipДокумент2 страницыMCGM PF SlipŚáńtőśh Mőkáśhí100% (3)

- Group 4Документ34 страницыGroup 4Śáńtőśh MőkáśhíОценок пока нет

- The India of My DreamsДокумент1 страницаThe India of My DreamsŚáńtőśh MőkáśhíОценок пока нет

- To Do On Daily Basis: MccafeДокумент1 страницаTo Do On Daily Basis: MccafeŚáńtőśh MőkáśhíОценок пока нет

- Where Do Roses GrowДокумент3 страницыWhere Do Roses GrowŚáńtőśh MőkáśhíОценок пока нет

- Corruption Is One of The Biggest Threat ToДокумент2 страницыCorruption Is One of The Biggest Threat ToŚáńtőśh MőkáśhíОценок пока нет

- Display Raj PatraДокумент2 страницыDisplay Raj PatraŚáńtőśh MőkáśhíОценок пока нет

- Badminton: Cleanliness SloganДокумент3 страницыBadminton: Cleanliness SloganŚáńtőśh MőkáśhíОценок пока нет

- Maharashtra Rain Ahawal + 2 PhotosДокумент2 страницыMaharashtra Rain Ahawal + 2 PhotosŚáńtőśh MőkáśhíОценок пока нет

- At Home + School + PlaygroundДокумент1 страницаAt Home + School + PlaygroundŚáńtőśh MőkáśhíОценок пока нет

- Front PageДокумент4 страницыFront PageŚáńtőśh MőkáśhíОценок пока нет

- 10 Common Plants in EuropeДокумент7 страниц10 Common Plants in EuropeŚáńtőśh MőkáśhíОценок пока нет

- BirdsДокумент5 страницBirdsŚáńtőśh MőkáśhíОценок пока нет

- Swami Vivekananda: Bengali: BengaliДокумент1 страницаSwami Vivekananda: Bengali: BengaliŚáńtőśh MőkáśhíОценок пока нет

- Water Supply and Sanitation: Railway Advantages: 1. DependableДокумент2 страницыWater Supply and Sanitation: Railway Advantages: 1. DependableŚáńtőśh MőkáśhíОценок пока нет

- IndiaДокумент3 страницыIndiaGanesh KaleОценок пока нет

- Car Revese HornДокумент8 страницCar Revese HornŚáńtőśh MőkáśhíОценок пока нет

- Lec5 6Документ35 страницLec5 6priyasanthakumaranОценок пока нет

- Curriculum Vitae: Personal ProfileДокумент2 страницыCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíОценок пока нет

- Curriculum Vitae: Personal ProfileДокумент2 страницыCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíОценок пока нет

- Instituteinformation2011 Engg PDFДокумент113 страницInstituteinformation2011 Engg PDFŚáńtőśh MőkáśhíОценок пока нет

- App 27802794462079Документ2 страницыApp 27802794462079Śáńtőśh MőkáśhíОценок пока нет

- Curriculum Vitae: Sushant Suresh VajeДокумент3 страницыCurriculum Vitae: Sushant Suresh VajeŚáńtőśh MőkáśhíОценок пока нет

- No 2-Part2-4 India PDFДокумент27 страницNo 2-Part2-4 India PDFŚáńtőśh MőkáśhíОценок пока нет

- Rohan Dilip Milkhe: Residential & Permanent AddressДокумент2 страницыRohan Dilip Milkhe: Residential & Permanent AddressŚáńtőśh MőkáśhíОценок пока нет

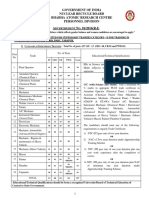

- Government of India Nuclear Recycle Board Bhabha Atomic Research Centre Personnel Division A N - 01/2016 (R-I)Документ7 страницGovernment of India Nuclear Recycle Board Bhabha Atomic Research Centre Personnel Division A N - 01/2016 (R-I)Śáńtőśh MőkáśhíОценок пока нет

- Curriculum Vitae: Personal ProfileДокумент2 страницыCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíОценок пока нет

- Curriculum Vitae: Personal ProfileДокумент2 страницыCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíОценок пока нет

- Curriculum Vitae: Personal ProfileДокумент2 страницыCurriculum Vitae: Personal ProfileŚáńtőśh MőkáśhíОценок пока нет

- Baithe KhelДокумент1 страницаBaithe KhelŚáńtőśh MőkáśhíОценок пока нет

- MGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentДокумент8 страницMGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentKaran TrivediОценок пока нет

- BudgetДокумент14 страницBudgetPaul fernandezОценок пока нет

- F&A Best - SAPOSTДокумент23 страницыF&A Best - SAPOSTsheikh arif khan100% (2)

- 1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYДокумент7 страниц1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDin Rose Gonzales50% (2)

- Lithuanian Association of Basketball CoachesДокумент1 страницаLithuanian Association of Basketball CoachesLietuvos Krepšinio Trenerių AsociacijaОценок пока нет

- 100% Free - Forex MetaTrader IndicatorsДокумент5 страниц100% Free - Forex MetaTrader IndicatorsMuhammad Hannan100% (1)

- MMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MДокумент55 страницMMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MRuby ButiОценок пока нет

- Case - A Survey of Capital Budgeting Techniques by US FirmsДокумент8 страницCase - A Survey of Capital Budgeting Techniques by US FirmsYatin PushkarnaОценок пока нет

- Product Costing Material Ledger1Документ31 страницаProduct Costing Material Ledger1Anand NcaОценок пока нет

- UNIBIC Foods India PVT LTDДокумент8 страницUNIBIC Foods India PVT LTDkalimaniОценок пока нет

- CashflowДокумент3 страницыCashflowsikandar aОценок пока нет

- Crown Valley Financial Plaza 100% Leased!Документ2 страницыCrown Valley Financial Plaza 100% Leased!Scott W JohnstoneОценок пока нет

- Advanced CandlestickPatterns 2Документ23 страницыAdvanced CandlestickPatterns 2jcferreiraОценок пока нет

- Inflation and UnemploymentДокумент55 страницInflation and UnemploymentShubham AgarwalОценок пока нет

- ConsolidateДокумент40 страницConsolidatePopeye AlexОценок пока нет

- Hotel ProjectДокумент38 страницHotel ProjectMelat MakonnenОценок пока нет

- Ubte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Документ18 страницUbte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Jyiou YimushiОценок пока нет

- CFNetworkDownload EuhV1D.tmpДокумент2 страницыCFNetworkDownload EuhV1D.tmpCiera StuverОценок пока нет

- RY-Expected Optimal Exercise TimeДокумент10 страницRY-Expected Optimal Exercise TimeryaksickОценок пока нет

- 48168321-2013-International Hotel Corp. v. Joaquin Jr.Документ16 страниц48168321-2013-International Hotel Corp. v. Joaquin Jr.Christine Ang CaminadeОценок пока нет

- Brooks Financial mgmt14 PPT ch11Документ60 страницBrooks Financial mgmt14 PPT ch11Jake AbatayoОценок пока нет

- سلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارДокумент30 страницسلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارIlhem BelabbesОценок пока нет

- Fin 311 Chapter 02 HandoutДокумент7 страницFin 311 Chapter 02 HandouteinsteinspyОценок пока нет

- Business Studies Paper 1 June 2011 PDFДокумент5 страницBusiness Studies Paper 1 June 2011 PDFPanashe MusengiОценок пока нет

- Tutorial Istisna (Soalan)Документ2 страницыTutorial Istisna (Soalan)Nurul Farah Mohd FauziОценок пока нет

- Specimen of WillДокумент2 страницыSpecimen of WillKamboj OfficeОценок пока нет

- Institutional Support For SSIДокумент11 страницInstitutional Support For SSIRideRОценок пока нет

- STANDARD BANK Co Applicant Application FormДокумент4 страницыSTANDARD BANK Co Applicant Application Formpokipanda69100% (1)

- HR Functions and ProceduresДокумент7 страницHR Functions and ProceduresSandeep KumarОценок пока нет

- Course Outline S1 2022Документ5 страницCourse Outline S1 2022Woon TNОценок пока нет