Академический Документы

Профессиональный Документы

Культура Документы

10000000966

Загружено:

Chapter 11 Dockets0 оценок0% нашли этот документ полезным (0 голосов)

119 просмотров34 страницыAPPLICATION of Debtors pursuant to 28 U.S.C. SS 156(C) AND LOCAL RULE 2002-1(F) FOR AUTHORIZATION TO (1) Employ and Retain Omni MANAGEMENT GROUP, LLC. "Omni" or the "Firm" does not believe that Omni is a "professional person" within the meaning of section 327(a) of title 11, chapter 11 of, United

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAPPLICATION of Debtors pursuant to 28 U.S.C. SS 156(C) AND LOCAL RULE 2002-1(F) FOR AUTHORIZATION TO (1) Employ and Retain Omni MANAGEMENT GROUP, LLC. "Omni" or the "Firm" does not believe that Omni is a "professional person" within the meaning of section 327(a) of title 11, chapter 11 of, United

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

119 просмотров34 страницы10000000966

Загружено:

Chapter 11 DocketsAPPLICATION of Debtors pursuant to 28 U.S.C. SS 156(C) AND LOCAL RULE 2002-1(F) FOR AUTHORIZATION TO (1) Employ and Retain Omni MANAGEMENT GROUP, LLC. "Omni" or the "Firm" does not believe that Omni is a "professional person" within the meaning of section 327(a) of title 11, chapter 11 of, United

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 34

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re

CLEARPOINT BUSINESS RESOURCES,

INC., et al.,

1

Debtors.

Chapter 11

Case No. 10-12037

(Joint Administration Requested)

APPLICATION OF DEBTORS PURSUANT TO 28 U.S.C. 156(C) AND LOCAL

RULE 2002-1(F) FOR AUTHORIZATION TO (1) EMPLOY AND RETAIN OMNI

MANAGEMENT GROUP, LLC AS CLAIMS, BALLOTING, NOTICING AND

ADMINISTRATIVE AGENT FOR THE DEBTORS AND

(2) APPOINT OMNI MANAGEMENT GROUP, LLC AS AGENT

OF THE BANKRUPTCY COURT NUNC PRO TUNC TO THE PETITION DATE

The above-captioned debtors and debtors in possession (the Debtors)

hereby apply to the Court for an order, in the form attached to this Application, pursuant

to 28 U.S.C. 156, employing Omni Management Group, LLC (Omni or the Firm),

effective nunc pro tunc as of the Petition Date (defined below), as claims, balloting,

noticing and administrative agent and appointing Omni as agent of the Bankruptcy Court

(the Application). The Debtors do not believe that Omni is a professional person

within the meaning of section 327(a) of title 11, chapter 11 of, United States Code, as

amended (the Bankruptcy Code); nonetheless, as set forth herein and in the

Declaration of Paul Deutch in Support of the Application of Debtors for Authorization to

(1) Employ and Retain Omni Management Group, LLC As Claims, Balloting, Noticing

and Administrative Agent for The Debtors and (2) Appoint Omni Management Group,

LLC as Agent of The Bankruptcy Court Nunc Pro Tunc to The Petition Date attached as

1

The Debtors, along with the last four digits of their federal tax identification numbers, are:

ClearPoint Business Resources, Inc. (4371) and ClearPoint Resources, Inc. (9869). The Debtors mailing

address for purposes of these cases is P.O. Box 3400. Easton, PA. 18045.

Exhibit A to this Application (the

Deutch Declaration), the Debtors respectfully submit

that Omni is a disinterested person under section 101 of the Bankruptcy Code. In support

of the Application, the Debtors respectfully state as follows:

Jurisdiction, Venue & Statutory Predicate

The Court has jurisdiction over this matter pursuant to 28 U.S.C.

1334(b). Venue is proper pursuant to 28 U.S.C. 1408 and 1409. This matter is a core

proceeding within the meaning of 28 U.S.C. 157(b)(2).

The statutory predicate for the relief requested herein is 28 U.S.C.

156(c), 11 U.S.C. 363(b) and Del. Bankr. L. R. 2002-1(f).

Background

On June 23, 2010 (the Petition Date), the Debtors each filed with the

Court a voluntary petition for relief under chapter 11 of the Bankruptcy Code. The

Debtors continue to operate their businesses and manage their property as debtors in

possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

No creditors committee has been appointed in these cases. No trustee or

examiner has been appointed.

The factual background relating to the Debtors, including their current and

historical business operations and the events precipitating the chapter 11 filings, are set

forth in detail in the Declaration of Christine Doelp in Support of the Debtors Chapter

11 Petitions and First Day Pleadings (the Doelp Declaration) filed concurrently with

this Application and incorporated herein by reference.

2

Relief Requested

By this Application, the Debtors seek an order (i) retaining Omni, at the

expense of the estate and effective as of the Petition Date, as claims, balloting, noticing

and administrative agent pursuant to 28 U.S.C. 156(c), and (ii) appointing Omni as

agent of the Bankruptcy Court. The proposed terms of Omnis employment are set forth

in the engagement agreement between the Debtors and Omni (the Engagement

Letter), a copy of which is attached hereto as Exhibit B.

Basis for Relief

Omni is Well-Qualified to Act as Administrative Agent

Omni is one of the countrys leading chapter 11 administrators with

expertise in noticing, claims processing, claims reconciliation and distribution and ballot

tabulation. Omni has acted as claims and noticing agent in hundreds of bankruptcy cases

and is well qualified to provide the Debtors with experienced services as claims, noticing,

balloting and administrative agent in connection with these chapter 11 cases. Among

some of the larger chapter 11 cases in which Omni has acted, or currently is acting, as

notice agent, claims agent and/or balloting agent to the debtor, are: Monaco Coach

Corporation, Robbins Bros., WL Homes, LLC, eToys Direct 1, LLC, Three As Holding,

Owens Corning, Maxide Acquisition, Inc., Peregrine Systems, Inc., Service Merchandise

2

Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the

Deutch Declaration.

Company; Federal Employees Distributing Company, d/b/a Fedco., Inc.; The Singer

Company; Incomnet Communications, Inc.; Pacific Gas & Electric; Advanced

Environmental; and Sabratek Corporation. In light of the Firms experience and the

efficient and cost-effective methods that it has developed, the Debtors estates and

creditors will clearly benefit from the appointment of the Firm as the claims and noticing

agent in these Chapter 11 cases.

The Services to be Provided by the Firm for the Estates

The creditor matrices in the Debtors cases aggregate over 2,700 parties to

whom certain notices must be sent. Such an extremely large number of creditors and

parties in interest will undoubtedly impose heavy administrative and other burdens on the

Court and the Office of the Clerk of the Court (the Clerks Office). The Debtors will

also need assistance in managing and addressing the myriad of administrative issues that

will likely arise in these cases. In addition, in connection with any plan of reorganization

proposed by the Debtors, the Debtors have determined that they will require the services

of Omni to act as solicitation agent with respect to, inter alia, the mailing of a disclosure

statement, the plan and related ballots, and maintaining and tallying ballots in connection

with the voting on such plan. To relieve and assist with these burdens, the Debtors

request the appointment of the Firm as claims, balloting, noticing and administrative

agent in these Chapter 11 cases.

Under Bankruptcy Rule 2002(a), the Bankruptcy Court may direct that a

person other than the clerk serve notices upon creditors and parties in interest. Moreover,

28 U.S.C. 156(c), which governs the staffing and expenses of the Court, authorizes the

Court to procure the services of third parties to assist with noticing and other chapter

11 administrative matters:

Any court may utilize facilities or services, either on or off

of the courts premises, which pertain to the provision of

notices, dockets, calendars, and other administrative

information to parties in cases filed under the provisions

of title 11, United States Code, where the cost of such

facilities or services are paid for out of the assets of the

estate and are not charged to the United States. The

utilization of such facilities or services shall be subject to

such conditions and limitations as the pertinent circuit

council may prescribe.

28 U.S.C. 156(c).

Moreover, Rule 2002-1(f) of the Local Rules of Bankruptcy Practice and

Procedure for the United States Bankruptcy Court for the District of Delaware (the

Local Rules) requires, in all cases with more than 200 creditors, that the debtor file a

motion to retain a noticing agent on the first day of the case or within ten (10) days

thereafter. Del. Bankr. L.R. 2002-1(f).

The Debtors seek an order appointing Omni to render, in accordance with

the Engagement Letter, the following services as claims, noticing and balloting agent,

without being exhaustive:

Upon the Debtors request, preparing and serving required notices

in these Chapter 11 cases, including:

notice of the commencement of these Chapter 11 cases and

the initial meeting of creditors under section 341(a)

of the Bankruptcy Code;

notice of the claims bar date;

notices of objections to claims;

notices of any hearings on a disclosure statement and

confirmation of a plan of reorganization; and

such other miscellaneous notices as the Debtors or Court

may deem necessary or appropriate for an orderly

administration of these Chapter 11 cases.

After the service of a particular notice by Omni, filing with the

Clerks Office a certificate or affidavit of service that includes (i) a copy of the notice

served, (ii) an alphabetical list of persons on whom the notice was served, along with

corresponding addresses and (iii) the date and manner of service;

Maintaining copies of all proofs of claim and proofs of interest

filed in these cases;

Maintaining official claims registers in these cases by docketing all

proofs of claim and proofs of interest in a claims database that includes the following

information for each such claim or interest asserted:

the name and address of the claimant or interest holder and

any agent thereof, if the proof of claim or proof of

interest was filed by an agent;

the date the proof of claim or proof of interest was received

by Omni and/or the Court;

the claim number assigned to the proof of claim or proof of

interest; and

the asserted amount and classification of the claim.

Implementing necessary security measures to ensure the

completeness and integrity of the claims registers;

Transmitting to the Clerks Office a copy of the claims registers on

a weekly basis, unless requested by the Clerks Office on a more or less frequent basis;

Maintaining an up-to-date mailing list for all entities that have filed

proofs of claim or proofs of interest and making such list available upon request to the

Clerks Office or any party in interest;

Providing access to the public for examination of the proofs of

claim or proofs of interest filed in these cases without charge during regular business

hours;

Recording all transfers of claims pursuant to Rule 3001(e) of the

Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules) and providing notice of

such transfers as required by Bankruptcy Rule 3001(e), if directed to do so by the Court;

Complying with applicable federal, state, municipal and local

statues, ordinances, rules, regulations, orders and other requirements in connection with

its activities in these cases;

Providing temporary employees to process claims, as necessary;

Promptly complying with such further conditions and requirements

as the Clerks Office or the Court may at any time prescribe;

Acting as balloting agent for any plan of reorganization filed by

the Debtors;

n. Provide the Debtors with an informational website which

will provide access to general case information, the official claims registry, and the

ability for creditors to submit inquiries electronically; and

Providing such other claims processing, noticing, balloting, and

related administrative services as may be requested from time to time by the Debtors.

The Debtors also request that the Clerk of the Court release all filed claims directly to the

Firm.

In connection with its appointment as administrative agent, the Debtors

understand and the Firm acknowledges that, among other things that:

it will not consider itself employed by the United States

government and shall not seek any compensation from the United States government in

its capacity as Claims and Noticing Agent in these Chapter 11 cases;

by accepting employment in these Chapter 11 cases, Omni waives

any rights to receive compensation from the United States government;

in its capacity as Claims and Noticing Agent in these Chapter 11

cases, Omni will not be an agent of the United States and will not act on behalf of the

United States;

Omni will not misrepresent any fact to the public; and

Omni will not employ any past or present employees of the

Debtors in connection with its work as Noticing Agent in these Chapter 11 cases.

Compensation of the Firm

The compensation to be provided by the Debtors to the Firm for services

rendered is set forth in detail in the Engagement Letter and incorporated herein for all

purposes.

The Debtors seek authorization to compensate Omni for services rendered

and to reimburse Omni for expenses incurred upon the Debtors receipt of reasonably

detailed statements of fees and expenses, without further order of this Court and without

any requirement to file interim or final applications. Payments are to be based upon the

submission to the Debtors by Omni of a billing statement, which includes a detailed listing of

services, expenses and supplies, at the end of each calendar month. The Firm charges for

its services at the following hourly rates: Senior Consultants ($195 - $295); Consultants

and Project Specialists ($75 - $150); Programmers ($130 - $185); and Clerical Support

($35 - $95). Omni reviews and revises its billing rates on January 2nd of each year.

Omni has relationships with and may periodically use, with the Debtors

prior written consent and approval, independent contractors with specialized skills and

abilities to assist in this engagement; provided, however, that Omni shall be responsible

for the actions and activities of such independent contractors and ensure that such

independent contractors comply with all of the terms of the Engagement Letter.

If Omni finds it desirable to augment its professional staff with

independent contractors (an I/C) in these cases, (i) Omni will file, and require the I/C to

file, 2014 affidavits indicating that the I/C has reviewed the list of the interested parties in

these cases, disclosing the I/Cs relationships, if any, with the interested parties and

indicating that the I/C is disinterested; (ii) the I/C must remain disinterested during the

time that Omni is involved in providing services on behalf of the Debtor; and (iii) the I/C

must represent that he/she will not work for the Debtors or other parties in interest in

these cases during the time Omni is involved in providing services to the Debtors.

Omnis standard practice is to charge for an I/Cs services at the Omni rate for a

professional of comparable skill and experience, which rate typically exceeds the

compensation provided by Omni to such I/C.

As an administrative agent and an adjunct to the Court, the Debtors do not

believe that Omni is a professional whose retention is subject to section 327 of the

Bankruptcy Code or whose compensation is subject to approval under sections 330 and

331 of the Bankruptcy Code. Specifically, the Debtors propose to compensate Omni on a

monthly basis for those services performed by Omni during the preceding calendar

month, on or after that date which is ten calendar days following service of the relevant

monthly invoice on each of the Debtors, counsel for the Debtors, the Office of the United

States Trustee, counsel for the Committee, and counsel to the Secured Lender

(collectively, the Notice Parties). In the event that one or more of the Notice Parties

objects to the invoice within the ten day period following service of a monthly invoice as

provided for herein, the Debtors will pay Omni only the undisputed portion of the

invoice, if any. If an objection to an invoice is made, the objecting party shall schedule a

hearing before the Court to consider the disputed invoice or the disputed portion thereof,

as applicable. The Debtors shall pay the disputed portion of any such invoice to Omni

only upon authorization of the Court that such disputed portion, or a sub-portion thereof,

shall be paid, following notice and hearing thereon.

In the 90 days prior to the Petition Date, the Firm received a $10,000

prepetition retainer (the Retainer) from the Debtors, and incurred fees and expenses in

the aggregate prepetition amount of approximately $1,559.90. The Firms prepetition fees

and expenses, which were incurred primarily in connection with the Firms providing

administrative support in relation to back office accounting processes and administration

of new information systems in relation to assets, liabilities, creditors and other

information necessary for the operations and administration of the Debtors and the

preparations for their bankruptcy case filings were pre-paid via the Retainer. There are

no amounts owed to the Firm as of the Petition Date. The Firm is currently holding the

approximately $8,440.10 remaining amount of the Retainer.

There are no arrangements between the Firm and any other entity for the

sharing of compensation received or to be received in connection with these cases, except

insofar as such compensation may be shared among the Firms employees.

To the best of the Debtors knowledge, and based upon and except as set

forth in the Deutch Declaration attached as Exhibit A to this Application, the Firm does

not (i) represent any interest adverse to the Debtors or the estate; (ii) have any connection

with the Debtors, their creditors, any other party in interest, their respective attorneys and

accountants, the United States Trustee, or any person employed in the office of the United

States Trustee; or (iii) employ any person that is related to a judge of this Court or the

United States Trustee for the District of Delaware. In addition, to the best of the Debtors

knowledge and based on the Deutch Declaration, the Firm is a disinterested person

under applicable sections of the Bankruptcy Code.

After considering its quality of performance in other cases, the Debtors

concluded that Omni was the best choice for Claims and Noticing Agent in these cases.

The Debtors believe that the Engagement Letter contemplates compensation at a level

that is reasonable and appropriate for services of this nature, and is consistent with the

compensation arrangement charged by Omni in other cases in which it has been retained

to perform similar services. The Debtors need to employ a claims agent with proven

competence and believes that Omni so qualifies. It is therefore respectfully submitted

that approval of the Engagement Letter is in the best interests of the Debtors, their estates

and their creditors.

Notice

Notice of this Application has been given to the following parties or, in

lieu thereof, to their counsel, if known: (a) the Office of the United States Trustee, (b) the

Debtors prepetition lenders, and (c) the Debtors consolidated Top 30 unsecured

creditors. As the Application is seeking first day relief, within two business days of the

hearing on the Motion, the Debtors will serve copies of the Application and any order

entered respecting the Application as required by Del. Bankr. LR 9013-1(m). The

Debtors submit that, in light of the nature of the relief requested, no other or further

notice need be given.

No Prior Request

No prior motion for the relief requested herein has been made to this or

any other court.

[The Remainder of the Page is Intentionally Blank]

WHEREFORE, the Debtors respectfully request that this Court enter an

order: (a) authorizing the Debtors to employ the Firm, effective as of the Petition Date, as

churns, balloting, noticing and administrative agent pursuant to 28 U.S.C. 156(c), 11 U.S.C.

363(b) and DeL Bankr. LR. 2002-1 (f); (b) appointing Oroni as agent of the Bankruptcy Court;

and (c) granting such further relief as the Court deems just and proper.

Dated: 2010

{BA Y:Ol5&0749v2}

ClearPoint Business Resources, Inc.

(for itself and on behalf of its affiliated

Debtors and Debtors in Possession)

By: .

Name: {!,l/,ett1tAI# Doet.:P

Title: /fferlc>eiiJ1

13

EXHIBIT A

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re

CLEARPOINT BUSINESS RESOURCES,

INC., et al.,

1

Debtors.

Chapter 11

Case No. 10-12037

(Joint Administration Requested)

DECLARATION OF PAUL DEUTCH IN SUPPORT OF THE APPLICATION OF

DEBTORS PURSUANT TO 28 U.S.C. 156(c) AND LOCAL RULE 2002-1(f) FOR

AUTHORIZATION TO (1) EMPLOY AND RETAIN OMNI MANAGEMENT

GROUP, LLC AS CLAIMS, BALLOTING, NOTICING AND ADMINISTRATIVE

AGENT FOR THE DEBTORS AND (2) APPOINT OMNI MANAGEMENT

GROUP, LLC AS AGENT

OF THE BANKRUPTCY COURT NUNC PRO TUNC TO THE PETITION DATE

PAUL DEUTCH of Omni Management Group, LLC makes this

Declaration pursuant to 28 U.S.C. 1746 and states:

2

I am a Senior Consultant of Omni Management Group LLC, formerly

known as Robert L. Berger & Associates, Inc. (Omni), a data processing company

specializing in the administration of bankruptcy cases. I have been a bankruptcy

professional since 1995.

I submit this declaration in support of the Application of Debtors for

Authorization to (1) Employ and Retain Omni Management Group, LLC As Claims,

Balloting, Noticing and Administrative Agent for The Debtors and (2) Appoint Omni

Management Group, LLC as Agent of The Bankruptcy Court Nunc Pro Tunc to The

Petition Date (the Application) filed by the above-captioned debtors and debtors in

1

The Debtors, along with the last four digits of their federal tax identification numbers, are:

ClearPoint Business Resources, Inc. (4371) and ClearPoint Resources, Inc. (9869). The Debtors mailing

address for purposes of these cases is P.O. Box 3400. Easton, PA. 18045.

2

Certain of the disclosures herein relate to matters within the knowledge of other members at Omni and

are based on information provided by them.

possession in the above-referenced chapter 11 cases (the Debtors). Except as otherwise

noted, I have personal knowledge of the matters set forth herein.

3

Omni is one of the countrys leading chapter 11 administrators with

expertise in noticing, claims processing, claims reconciliation and distribution and ballot

tabulation. Omni has acted as claims and noticing agent in hundreds of bankruptcy cases

and is well qualified to provide the Debtors with experienced services as claims, noticing,

balloting and administrative agent in connection with these chapter 11 cases. Among

some of the larger chapter 11 case in which Omni has acted, or currently is acting, as

notice agent, claims agent and/or balloting agent to the debtor, are: Monaco Coach

Corporation, Robbins Bros., WL Homes, LLC, eToys Direct 1, LLC, Three As Holding,

Owens Corning, Maxide Acquisition, Inc., Peregrine Systems, Inc., Service Merchandise

Company; Federal Employees Distributing Company, d/b/a Fedco., Inc.; The Singer

Company; Incomnet Communications, Inc.; Pacific Gas & Electric; Advanced

Environmental; and Sabratek Corporation. In light of the Firms experience and the

efficient and cost-effective methods that it has developed, the Debtors estates and

creditors will clearly benefit from the appointment of the Firm as the claims and noticing

agent in these Chapter 11 cases.

I am informed and believe that the creditor matrices in the Debtors cases

aggregate over 2,700 parties to whom certain notices must be sent.

3

Certain of the disclosures herein relate to matters within the knowledge of other members at Omni and are

based on information provided by them.

To the best of my knowledge, information and belief, insofar as I have

been able to ascertain after reasonable inquiry by myself or other Omni employees, other

than in connection with this engagement, neither I, nor Omni, nor any of its managing

directors, employees, agents or affiliates, have any connection with the Debtors, their

creditors, the United States Trustee for the District of Delaware, or any other party with

an actual or potential interest in these chapter 11 cases, or its respective attorneys or

accountants, except as set forth below:

Omni is not employed by, and has not been employed by, any entity other

than the Debtors in matters related to these chapter 11 cases.

Fromtime to time, Omni has provided services, and likely will continue to

provide services, to certain creditors of the Debtors and various other

parties adverse to the Debtors in matters wholly unrelated to these chapter

11 cases. As described below, however, Omni has undertaken a detailed

search to determine, and to disclose, whether it is providing or has

provided, services to any significant creditor, investors, insider or other

party in interest in such unrelated matters.

Omni provides services in connection with numerous cases, proceedings

and transactions unrelated to these chapter 11 cases. Those unrelated

matters involve numerous attorneys, financial advisors and creditors, some

of whom may be claimants or parties with actual or potential interests in

these chapter 11 cases, or may represent such parties.

Omnis personnel may have business associations with certain creditors of

the Debtors unrelated to these chapter 11 cases. In addition, in the

ordinary course of its business, Omni may engage counsel or other

professionals in unrelated matters who now represent, or who may in the

future represent, creditors or other parties in interest in these chapter 11

cases.

Omni searched its client database to determine whether it had any

relationships with the following:

the Debtors and their affiliates;

the officers and directors of the Debtors;

the Debtors largest vendors, contract parties, litigation parties and lessors;

the Debtors consolidated top 20 unsecured creditors;

The attorneys and other professionals of the Debtors;

The significant pre-petition lenders of the Debtors and their professionals;

The proposed post-petition lender(s) to the Debtors and their

professionals;

Parties believed to hold material amounts of the Debtors stock and other

securities; and

Other potentially adverse parties.

Based on that search, Omni represents that, to the best of its knowledge,

Omni knows of no fact or situation that would represent a conflict of interest for Omni

with regard to the Debtors. Based on the information available to me, I believe that Omni

is a disinterested person within the meaning of section 101(14) of the Bankruptcy Code

in that Omni and its personnel:

are not creditors, equity security holders or insiders of the Debtors;

are not and were not, within two years before the date of the filing

of the Debtors Chapter 11 petitions, directors, officers or

employees of the Debtors; and

do not have an interest materially adverse to the interests of the

Debtors estate or any class of creditors or equity security holders,

by reason of any direct or indirect relationship to, connection with,

or interest in, the Debtors or any investment banker for an

outstanding security of the Debtors.

Omni submits that it holds no adverse interest as to the matters for which

it has been employed by the Debtors. Certain individuals affiliated with Omni may

render claims, noticing and balloting services to the Debtors on a part time basis, while

others have been and/or will continue to be engaged full time. To the extent such

individuals are employed on a part-time basis, Omni submits that there are no

simultaneous or prospective engagements existing which would constitute a conflict or

adverse interest as to the matters for which it has been employed by the Debtors, nor

would Omni staff such part-time temporary staff on any future matter that would

constitute a conflict or adverse interest to these matters.

Omni has represented and may in the future represent certain interested

parties in matters wholly unrelated to these chapter 11 cases, either individually or as part

of representation of a committee of creditors or interest holders.

Omni represents, among other things, that:

(a) It will not consider itself employed by the United States

government and shall not seek any compensation from the

United States government in its capacity as Claims and

Noticing Agent;

(b) By accepting employment in these bankruptcy cases, Omni

waives any right to receive compensation from the United

States government;

(c) In its capacity as Claims and Noticing Agent, Omni will

not be an agent of the United States and will not act on

behalf of the United States; and

(d) Omni will not employ any past or present employees of the

Debtors in connection with its work as Claims and

Noticing Agent.

According to the books and records of Omni, in the 90 days prior to the

Petition Date, the Firm received a $10,000 prepetition retainer (the Retainer) from the

Debtors, and incurred fees and expenses in the aggregate prepetition amount of

approximately $1,559.90. The Firms prepetition fees and expenses, which were incurred

primarily in connection with the Firms providing administrative support in relation to

back office accounting processes and administration of new information systems in

relation to assets, liabilities, creditors and other information necessary for the operations

and administration of the Debtors and the preparations for their bankruptcy case filings,

were pre-paid via the Retainer. There are no amounts owed to the Firm as of the Petition

Date. The Firm is currently holding the $8,440.10 remaining amount of the Retainer.

Subject to the Courts approval, the Debtors have agreed to compensate

Omni for services rendered in connection with these Chapter 11 cases pursuant to the

Engagement Letter entered into by and between the Debtors and Omni, a true and correct

copy of which is attached as Exhibit Bto the Application. Payments are to be based upon the

submission to the Debtors by Omni of a billing statement, which includes a detailed listing of

services, expenses and supplies, at the end of each calendar month. Omni will apply the

remaining balance of the Retainer against postpetition petition fees and expenses

incurred by Omni.

As an administrative agent and an adjunct to the Court, Omni is not a

professional whose retention is subject to section 327 of the Bankruptcy Code or whose

compensation is subject to approval under sections 330 and 331 of the Bankruptcy Code.

Specifically, the Debtors propose to compensate Omni on a monthly basis for those

services performed by Omni during the preceding calendar month, on or after that date

which is ten calendar days following service of the relevant monthly invoice on each of

the Debtors, counsel for the Debtors, the Office of the United States Trustee, counsel for

the Committee and counsel to the Secured Lender (collectively, the Notice Parties). In

the event that one or more of the Notice Parties objects to the invoice within the ten day

period following service of a monthly invoice as provided for herein, the Debtors will

pay Omni only the undisputed portion of the invoice, if any. If an objection to an invoice

is made, the objecting party shall schedule a hearing before the Court to consider the

disputed invoice or the disputed portion thereof, as applicable. The Debtors shall pay the

disputed portion of any such invoice to Omni only upon authorization of the Court that

such disputed portion, or a sub-portion thereof, shall be paid, following notice and

hearing thereon.

The compensation arrangement provided for in the Engagement Letter is

consistent with and typical of arrangements entered into by Omni and other such firms

with respect to rendering similar services for clients such as the Debtors.

Despite the efforts described above to identify and disclose Omnis

connections with parties in interest in these chapter 11 cases, Omni is unable to state with

certainty that every client relationship or other connection has been disclosed. In this

regard, if Omni discovers additional information that requires disclosure, Omni will file a

supplemental disclosure with the Court.

Omni reserves the right to supplement this Declaration in the event that

Omni discovers any facts bearing on matters described in this Declaration regarding

Omnis employment with the Debtors.

Omni will comply with all requests of the Clerk of the Court and the

guidelines promulgated by the Judicial Conference of the United States for the

implementation of 28 U.S.C. 156(c).

Pursuant to 28 U.S.C. 1746, I declare under penalty of perjury that, to the best

of my knowledge and after reasonable inquiry, the foregoing is true and correct.

~ 0

"

Executed thi$C4- day of June, 20 I 0 at ~ r z . ork,

@

OMNI

MANAGEMENT GROUP

Christine Doelp

President

ClearPoint Business Resources, Inc.

ClearPoint Resources, Inc.

1600 Manor Drive, Ste 110

Chalfont, PA 18914

June 23,2010

Re: Retention of Omni Management Group

Dear Ms Doelp:

This letter will acknowledge that you have requested Omni Management Group,

LLC ("Omni") to provide services to ClearPoint Business Resources, Inc. and ClearPoint

Resources, Inc. (collectively, the "Companies") in preparation of, and in connection with,

the Companies' anticipated chapter 11 filings. Omni will make itself available to the

Companies, as requested, for the purposes of assisting the Companies with case

administration matters including preparation and management of the creditor matrix,

noticing, the development and maintenance of an informational website, and any other

services requested by the Companies.

The services rendered by Omni will be billed at our normal hourly rates which

range from $35.00 to $295.00 per hour as per the attached rate sheet Rates are adjusted

annually on January 2nd of each year, and are subject to increases not to exceed ten (10%)

percent per annum. Increases greater than ten (I 0%) percent per annum will be discussed

with you before becoming effective.

For all such services rendered, we require a $10,000 deposit. All charges will be

on a portal to portal basis plus out-of-pocket expenses. Omni shall be compensated on a

monthly basis for those services performed by Omni during the preceding calendar

month. Invoices are payable upon submission.

1120 AVENUE OF THE AMERICAS, 4TH FLOOR. NEW YORK. NEW YORK 10036 212.302.3580 TEL 212.302.3820 FAX

16501 VENTURA BOULEVARD. SUITE 440, ENCINO, CALIFORNIA 91436-2068 818.906.8300 TEL 818.783.2737 FAX

WWW.OMNIMGT.COM

Christine Doelp

June 23,2010

Page2

@

OMNI

MANAGEMENT GROUP

Each of Omni and the Companies, on behalf of themselves and their respective

employees, agents, professionals and representatives, agrees to keep confidential all non-

public records, systems, procedures, software and other information received ftom the

other party in connection with the services provided tinder this Agreement; provided,

however, that if either party reasonably believes that it is required to produce any such

information by order of any governmental agency or other regulatory body it may, upon

not less than five (5) business days' written notice to the other party, release the required

information.

Please acknowledge the above by signing and returning a copy of this letter.

Should you have any questions regarding the above, please do not hesitate to call me.

cc: Robert Berger

Eric Schwarz

Paul H. Deutch

RECEIVED AND AGREED TO: ClearPoint Business Resources, Inc.

ClearPoint Resources, Inc.

Date: By:

~ - - - - - - - - - - - - - - - - - -

Christine Doelp

1120 AVENUE OF THE AMERICAS, 4TH FLOOR. NEW YORK. NEW YORK 10036 212.302.3580 TEL 212.302.3820 FAX

16501 VENTURA BOULEVARD. SUITE 440. ENCINO. CALIFORNIA 91436-2068 818.906.8300 TEL 818.783.2737 FAX

WWW.OMNI MGT. COM

Christine Doelp

June 23, 2010

Page2

.(Q)

OMNI

MANAGEMENT GROUP

.f..a(;h of Omni and the Companies, on behalf of tbem$elves and their respective

agents, professionals and representatives, agrees to keep confidential all non-

public records, systems, procedures, software and other infonnati.on received :from the

other party in coJlllection with the services provided tinder this. Agreement; provided, .

however, that if either. party reasonably believes that it is required to produce any 8uch

information by otder of any governtnetltal agency or other regulatory body it may, Upotl

not less than five (5) business days' written notice. to the other party, release the requited

information.

Please acknowledge the above by signing and retuming a copy of this Jetter.

Should you have any quc:stions regarding the above, please do not hesitate to call me.

cc: Robert Berger

Eric Schwarz

Paul H. Deutch

RECEIVED AND AGREED TO: ClearPoint Business Resources, Inc,

ClearPoint Resources, Inc.

1120 AVENUE OF THI AMERICAS, 4TH FlOOR. NEW YORK. NEW YORK 10036 212.302.3580 TEl 212.302.3820 FAX

16501 VfNTUAA 80[JLEVARD, SUITE 440. ENCINO. CALIFORNIA '71436-2068 818.906.8300 TEt 818.783.2737 FAX

WWW.OMNIMOT..COM

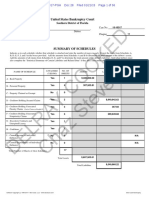

OMNI. MANAGEMENT GROUP, LLC

www.omnimgt.com

HOURLY RATES FOR STANDARD AND CUSTOM SERVICES

Senior Consultants

Consultants/Project SpeeiaUsts

Programmillll

Clerical Support

Quality Assurance

I PRINTING :t\.ND NOTICING SERVICES

CoP'J

Document fOlding_ and inserUon

E-mail noticing

Facsimile noticina

Postaae

Envelopes

NEWSPAPER LEGAL NO_TICE PUBLISHING

Coordinate and PUblish Legal Notice

CLAIMS MANAGEMENl

Inputting proofs of daim

I

Scanning

Remote Internet Access for claims manag_emem

Setup

Access

Add'l users

CREDITOR DATABASE

Data Storage

TIONAL WEBSITE

Creation, configuration and initial setup

Data entryllnformation updates

Programming and customlzation

Debtor Website Hosting

Committee Website Hosting

Scanning

VIRTUAl. DATA fiOOMS

CALL CENTERS I DEDICATED LINE

Creation configuration and initial setup

Hosting Fee

Usage

SeiVice rates (actual talk and time)

CASE DOCKET/CI.AIMSBEGISTER

.SOLICITATION AND TABULATION

Plan and Disclosure Statement Mailings

Ballot Tabulation

SCHEDULES/SoFA

Preparation and updatina of Schedules and SoFAs

PRE-PETITION CONSULI!NG SERVICES

(e.g . preparation of cash flow, analysis of cash management system,

evaluation of insurance coverage, assist with payroll, assist procurement

and of cashiers Checks)

Rate Sheet

Rates Effective: January 2, 2010

RATE/COST

$195.00 -$295.00 per hour

$75.00.$150.00

$130.00-$185.00 oerhour

$35.00 - $95.00

$35.00- $75.00 hoU!

$.10 per image

$0.05

$.07each

$50.00 per 1,000

$.20/lmage

At cos

(Advance payment required for postage charges

over $10,0001

Varies by size

Quote prior to

$1.50 perdaim

(These are flat rate charges; no hourly rates are

IIQPIIed to the lnRQttina of claims)

$.30/lmage

No charge

$250 per month per debtor (3 user$

$70.00 per add'l user/per month

$.07 per creditor per month

No Charge

$75 - $95 per hour

$130-$200 per hou

$200 per month

NoeharQE

$.30/lmage

Quote U!)_On_r@C!Ues1

No chargE

$5.50 per month

$.0825 per minute

$75.00

No chal}iE

Quoted Prior to printing

Standard service rates apply

$65.00-$265.00 per hour

Standard serviCe rates apply

1 of2

OMNI MANAGEMENT GROUP, LLC

www.omnfmgt.com

UST REPORTING COMPLIANCE

(e.g., assist debtors to meet satisfy jurisdicatlonal requirements,

preparation of monthly operating and post-conflnnation reports)

UQUmATINGJDISBlJ RSING AGENT

(e.g., comply with Plan requirements, preparation of disbursement

payout calculations, check generation, bank reconciliations)

MISCELLANEOUS

Telephone charges

Delivery

Archival DVD/CD-Rom

2of2

Rate Sheet

Rates Effective: January 2, 2010

Standard service rates apply

Standard service rates

At cost

Ateosl

$40.00 per

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re

CLEARPOINT BUSINESS RESOURCES,

INC., et al.,

1

Debtors.

Chapter 11

Case No. 10-12037

(Joint Administration Requested)

ORDER GRANTING APPLICATION OF THE DEBTORS PURSUANT TO

28 U.S.C. 156(c) AND LOCAL RULE 2002-1(f) FOR AUTHORIZATION TO

(1) EMPLOY AND RETAIN OMNI MANAGEMENT GROUP, LLC AS

CLAIMS, BALLOTING, NOTICING AND ADMINISTRATIVE AGENT FOR

THE DEBTORS AND (2) APPOINT OMNI MANAGEMENT GROUP, LLC AS

AGENT

OF THE BANKRUPTCY COURT NUNC PRO TUNC TO THE PETITION DATE

Upon the application (the Application)

2

of the above-captioned debtors

(the Debtors), (i) seeking authorization to employ and retain Omni Management

Group, LLC (Omni or the Firm) as claims, noticing and balloting agents to the

Debtors, and (ii) appointing Omni as agent of the Bankruptcy Court, nunc pro tunc to the

Petition Date; and upon the Declaration of Paul Deutch in Support of the Application of

Debtors for Authorization to (1) Employ and Retain Omni Management Group, LLC as

Claims, Balloting, Noticing and Administrative Agent for the Debtors and (2) Appoint

Omni Management Group, LLC as Agent of the Bankruptcy Court Nunc Pro Tunc to the

Petition Date (the Deutch Declaration), which was submitted concurrently with the

Application; and the Court being satisfied, based on the representations made in the

Application and the Deutch Declaration, that Omni represents or holds no interest

adverse to the Debtors or the Debtors estate with respect to the matters upon which it is

1

The Debtors, along with the last four digits of their federal tax identification numbers, are:

ClearPoint Business Resources, Inc. (4371) and ClearPoint Resources, Inc. (9869). The Debtors mailing

address for purposes of these cases is P.O. Box 3400. Easton, PA. 18045.

2

Capitalized terms, unless otherwise defined herein, shall have the meanings ascribed to them in the

Application.

to be engaged, and is disinterested as that term is defined under section 101(14) of the

Bankruptcy Code, as modified by section 1107(b) of the Bankruptcy Code, and that the

employment of Omni is necessary and in the best interests of the Debtors and the

Debtors estate; and it appearing that the Court has jurisdiction to consider the

Application; and it appearing that due notice of the Application has been given and no

further notice need be given; and upon the proceedings before the Court; and after due

deliberation and good and sufficient cause appearing; it is

ORDERED that the Application is granted as provided herein; and it is

further

ORDERED that pursuant to 28 U.S.C. 156, 11 U.S.C. 363(b) and Del.

Bankr. L. R. 2002-1(f), the Debtors are authorized to employ and retain Omni

Management Group, LLC as its claims agent, noticing agent and administrative agent,

effective nunc pro tunc to the Petition Date, on the terms set forth in the Application and

the Engagement Letter, such terms being subject to the provisions of this Order; and it is

further

ORDERED that Omni shall be authorized to perform such tasks as the

Debtors request in the Application and Engagement Letter as well as to receive the list of

creditors and receive, maintain, record and otherwise administer and catalog any and all

Proofs of Claim relating to these chapter 11 cases; provided, however, that Omni is not

authorized to serve as the Debtors disbursing agent in connection with any plan process;

provided further, that the services to be provided by Omni pursuant to the catch-all

provision in the Application shall be limited to those ministerial services incident to the

firms role as claims agent; and it is further

ORDERED that Omni is designated as the authorized recipient and

repository for all Proofs of Claim as custodian for the Clerks office, and Omni is

authorized to maintain as agent for the Clerks office an official claims register, and to

provide the Clerks office with a certified duplicate thereof on a monthly basis; and it is

further

ORDERED that the Clerk of the Bankruptcy Court is authorized to

transmit to Omni all Proofs of Claim heretofore filed in these Chapter 11 cases, and to

transmit to Omni all Proofs of Claim hereafter received by the Clerks office; and it is

further

ORDERED that Omni shall maintain a Claims Register which shall reflect

in sequential order the claims filed in these chapter 11 cases, specifying (i) the claim

number, (ii) the date such claim was received by the Clerks office (if such claim was not

time-stamped by the Clerk, then the date on which Omni receives such claim shall be

indicated), (iii) the name and address of the claimant and the agent, if any, that filed such

proof of claim, (iv) the amount of said claim, and (v) the classification(s) of such claim

(e.g., secured, unsecured, priority, etc.); and it is further

ORDERED that Omni is authorized to perform all related tasks to process

the Proofs of Claim and maintain a Claims Register, including, without limitation,

recording transfers of claims; and it is further

ORDERED that upon termination of the firms engagement or the close of

these chapter 11 cases (whichever occurs first), Omni shall return or transfer all Proofs of

Claim received by it and other engagement-related data on terms acceptable to, and as

directed by, the Clerks office; and it is further

ORDERED that the Debtors are authorized to execute such documents,

take such action and do such things as may be necessary to implement and effectuate the

terms of this Order; and it is further

ORDERED that pursuant to section 503(b)(1)(A) of the Bankruptcy Code,

Omnis fees and expenses incurred pursuant to the Engagement Letter are to be treated as

an administrative expense of the Debtors chapter 11 estate, and upon the receipt of

reasonably detailed statements of expenses and charges, the Debtors are is authorized and

empowered to compensate Omni without further Court order for services rendered, plus

reimbursement of all reasonable and necessary expenses incurred, in accordance with the

Engagement Letter; provided, however, that Omni will serve monthly invoices on the

Debtors, counsel for the Debtors, the Office of the United States Trustee, the Debtors

secured lenders, and any official committees that may be appointed in these cases, and

any dispute between Omni and the aforementioned parties with respect to fees and

expenses that cannot be resolved shall be presented to the Court for resolution thereof;

provided further, that Omni shall draw down on its retainer prior to seeking additional

payments from the Debtors on account of allowed fees and expenses; and it is further

ORDERED that neither the Debtors nor Omni shall terminate the retention

of Omni in these proceedings without further order of the Court after notice. If Omnis

services are terminated, Omni shall perform its duties until the transition with the

Bankruptcy Court clerks office or any successor claim/noticing agent; and it is further

ORDERED, that nothing herein obligates a successor chapter 7 trustee or

chapter 11 trustee to employ Omni; and it is further

ORDERED that this Court shall retain jurisdiction over any issues arising

from the implementation or interpretation of this order.

Dated: June __, 2010

__________________________________

_____________________________

United States Bankruptcy Judge

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ28 страницAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ47 страницAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Wochos V Tesla OpinionДокумент13 страницWochos V Tesla OpinionChapter 11 DocketsОценок пока нет

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ69 страницAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- SEC Vs MUSKДокумент23 страницыSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ38 страницAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumДокумент22 страницыUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsОценок пока нет

- PopExpert PetitionДокумент79 страницPopExpert PetitionChapter 11 DocketsОценок пока нет

- Roman Catholic Bishop of Great Falls MTДокумент57 страницRoman Catholic Bishop of Great Falls MTChapter 11 DocketsОценок пока нет

- Republic Late Filed Rejection Damages OpinionДокумент13 страницRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- City Sports GIft Card Claim Priority OpinionДокумент25 страницCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsОценок пока нет

- National Bank of Anguilla DeclДокумент10 страницNational Bank of Anguilla DeclChapter 11 DocketsОценок пока нет

- Zohar 2017 ComplaintДокумент84 страницыZohar 2017 ComplaintChapter 11 DocketsОценок пока нет

- Energy Future Interest OpinionДокумент38 страницEnergy Future Interest OpinionChapter 11 DocketsОценок пока нет

- NQ Letter 1Документ3 страницыNQ Letter 1Chapter 11 DocketsОценок пока нет

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncДокумент5 страницDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsОценок пока нет

- Kalobios Pharmaceuticals IncДокумент81 страницаKalobios Pharmaceuticals IncChapter 11 DocketsОценок пока нет

- Quirky Auction NoticeДокумент2 страницыQuirky Auction NoticeChapter 11 DocketsОценок пока нет

- NQ LetterДокумент2 страницыNQ LetterChapter 11 DocketsОценок пока нет

- Zohar AnswerДокумент18 страницZohar AnswerChapter 11 DocketsОценок пока нет

- Home JoyДокумент30 страницHome JoyChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasДокумент4 страницыUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsОценок пока нет

- APP ResДокумент7 страницAPP ResChapter 11 DocketsОценок пока нет

- APP CredДокумент7 страницAPP CredChapter 11 DocketsОценок пока нет

- GT Advanced KEIP Denial OpinionДокумент24 страницыGT Advanced KEIP Denial OpinionChapter 11 DocketsОценок пока нет

- Fletcher Appeal of Disgorgement DenialДокумент21 страницаFletcher Appeal of Disgorgement DenialChapter 11 DocketsОценок пока нет

- Licking River Mining Employment OpinionДокумент22 страницыLicking River Mining Employment OpinionChapter 11 DocketsОценок пока нет

- Farb PetitionДокумент12 страницFarb PetitionChapter 11 DocketsОценок пока нет

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesДокумент1 страницаSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Washington Mutual (WMI) - Objection of The TPS Consortium To Confirmation PlanДокумент100 страницWashington Mutual (WMI) - Objection of The TPS Consortium To Confirmation PlanmeischerОценок пока нет

- Purdue Chapter 11-Expedited Motion Re Stay of Confirmation OrderДокумент12 страницPurdue Chapter 11-Expedited Motion Re Stay of Confirmation OrderKirk HartleyОценок пока нет

- 10000000301Документ92 страницы10000000301Chapter 11 DocketsОценок пока нет

- 10000026640Документ3 страницы10000026640Chapter 11 DocketsОценок пока нет

- Relativity SuitДокумент56 страницRelativity SuitFortune100% (1)

- US BAN INSB 1 14bk00461 D139727242e3680 Chapter 11 Voluntary Petition Filed by Meredith RДокумент5 страницUS BAN INSB 1 14bk00461 D139727242e3680 Chapter 11 Voluntary Petition Filed by Meredith RThiago TruthОценок пока нет

- Motion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsДокумент16 страницMotion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsJun MaОценок пока нет

- Benevis Bankruptcy Doc 82 - Master Serv List PDFДокумент6 страницBenevis Bankruptcy Doc 82 - Master Serv List PDFDentist The MenaceОценок пока нет

- Motion For Joint Administration of Entities Doc 3Документ12 страницMotion For Joint Administration of Entities Doc 3Dentist The MenaceОценок пока нет

- 10000020383Документ77 страниц10000020383Chapter 11 DocketsОценок пока нет

- WCI Bankruptcy - Debtors Preliminary Objections To Motion For Leave To File Class Proof of Claim and Certification of ClassДокумент30 страницWCI Bankruptcy - Debtors Preliminary Objections To Motion For Leave To File Class Proof of Claim and Certification of ClassKirk HartleyОценок пока нет

- Cooked Chaz Stevens: United States Bankruptcy CourtДокумент56 страницCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionОценок пока нет

- POR7 Voting Results 0812229120213000000000026Документ389 страницPOR7 Voting Results 0812229120213000000000026joeMcoolОценок пока нет

- Guo Wengui Aka Miles Kwok Chapter 11 Petition Dated Feb 15 2022Документ14 страницGuo Wengui Aka Miles Kwok Chapter 11 Petition Dated Feb 15 2022jpeppardОценок пока нет

- Objection Preliminary Objection of The Ad H - ObjectionДокумент18 страницObjection Preliminary Objection of The Ad H - ObjectionDistressedDebtInvestОценок пока нет

- Tops Bankruptcy DocumentsДокумент83 страницыTops Bankruptcy DocumentsAnonymous vhwDL2u100% (1)

- Insolvency Laws in India - PDF NotesДокумент200 страницInsolvency Laws in India - PDF Notessandeep AhujaОценок пока нет

- Rapid American Asbestos Bankruptcy Listing of Unpaid Asbestos Settlements by Law Firm and Aggregate Amount Per FirmДокумент4 страницыRapid American Asbestos Bankruptcy Listing of Unpaid Asbestos Settlements by Law Firm and Aggregate Amount Per FirmKirk HartleyОценок пока нет

- Lehman Bankruptcy DocketДокумент2 480 страницLehman Bankruptcy Docketpowda1120Оценок пока нет

- 292-Debtors Opposition To Automatic StayДокумент29 страниц292-Debtors Opposition To Automatic StayDentist The Menace100% (2)

- Sienna Biopharmaceuticals Approval of Sale of AssetsДокумент29 страницSienna Biopharmaceuticals Approval of Sale of AssetsTradeHawkОценок пока нет

- Markell Fall-1Документ37 страницMarkell Fall-1Ma FajardoОценок пока нет

- FTX Lawyers' Motion To Call Sam Bankman-Fried Relatives To ExaminationДокумент14 страницFTX Lawyers' Motion To Call Sam Bankman-Fried Relatives To ExaminationChefs Best Statements - NewsОценок пока нет

- Creating Value Through Corporate Restructuring - 2012 - GilsonДокумент827 страницCreating Value Through Corporate Restructuring - 2012 - GilsondavidОценок пока нет

- Introduction Distressed InvestingДокумент20 страницIntroduction Distressed Investingvondeburg100% (2)

- BinderДокумент17 страницBinderMy-Acts Of-SeditionОценок пока нет

- United States Bankruptcy Court District of NevadaДокумент19 страницUnited States Bankruptcy Court District of NevadaChapter 11 DocketsОценок пока нет

- The New Barbarians at The Gate - Debt-Based TakeoversДокумент61 страницаThe New Barbarians at The Gate - Debt-Based TakeoversWho's in my Fund100% (1)

- Nevada Cancer Disclosure StatementДокумент221 страницаNevada Cancer Disclosure Statementbankrupt0Оценок пока нет

- Ebook PDF The Legal Environment Today 9th Edition PDFДокумент41 страницаEbook PDF The Legal Environment Today 9th Edition PDFrhea.brewster813100% (32)