Академический Документы

Профессиональный Документы

Культура Документы

,oCI JF

Загружено:

Chapter 11 DocketsИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

,oCI JF

Загружено:

Chapter 11 DocketsАвторское право:

Доступные форматы

CERTIFICATE OF MAILING

I, the undersigned, am over the age of eighteen and an employee of Omni Management Group, I

do hereby certify:

That I, in performance of my duties served a copy of the Notice of Transferred Claim by

Jcpositing it in the United States mail at Encino, California, on the date shown below, in a sealed

envelope with postage thereon fully prepaid, addressed as set forth below.

Date:

By:

-1?

~ 1 / ! .

Name:

AJ ,oCI.Jf 0-- 9

Transteror: D' ARTAGNAN, INC

280 WILSON A VENUE

NEWARK, NJ 07105

Transteree: SIERRA LIQUIDITY FUND, LLC

RE: 0' ART AGNAN, INC

2699 WHITE ROAD, SUITE 255

IRVINE, CA 92614

Addressee: D' ARTAGNAN, INC

280 WILSON AVENUE

NEWARK, NJ 07105

Omni Management Group, LLC

Claims Agent For Grand Prix Floating Lessee LLC

16161 Ventura Blvd., Suite C, PMB #606- Encino, CA 91436

Telephone (818) 906-8300- Facsimile (818) 783-2737

Notice of Transferred Claim

October 29,2010

Transferor: D' ARTAGNAN, INC

280 WILSON A VENUE

NEWARK, NJ 07105

Transferee: SIERRA LIQUIDITY FUND, LLC

RE: D' ARTAGNAN, INC

2699 WHITE ROAD, SUITE 255

IRVINE, CA 92614

To Whom It May Concern,

Please be advised that a Notice was received that your claim in the above mentioned case has been

transferred; please see attached. The document states that the above named transferor has transferred

this claim to the above named transferee.

Case: Grand Prix Floating Lessee LLC (Case No: 10-13826)

Scheduled Claim No.: 15139

Amount of Claim: $2,320.85

Amount of Transfer: $2,320.85

Re: Docket# 608

Pursuant to Bankruptcy Rule 300 I( e) (2) of the Federal Rules of Bankruptcy Procedures you are

advised that if you wish to object to the above, you must do so within 21 days of the date of this

notice or within any additional time allowed by the court. Unless an objection and request for hearing

is tiled in writing with the U.S. Bankrutpcy Court- Southern District ofNew York Manhattan

Division One Bowling Green New York, NY 10004, the aforementioned claim will be deemed

transferred.

U.l kdM_

d Y . l & ~ - - ~ - - - - ~ ~ - - - - - -

Yelena Bederman

Omni Management Group, LLC

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

In re:

GRAND PRIX FLOATING LESSEE LLC

INNKEEPERS USA TRUST, eta/.

Dchtors

Chapter 11

Case # 10-13826 & 10-13800

NOTICE OF TRANSER OF CLAIM PURSUANT TO

F.R.B.P. RULE 300l(E) (1)

Transferor: D' Artagnan, Inc.

280 Wilson A venue

Newark, NJ 07105

Your claim in the amount of $2,320.85 against the Debtors has been transferred to:

Transferee: Sierra Liquidity Fund, LLC

2699 White Road, Suite 255

Irvine, CA 92614

No action is required if you do not object to the transfer of your claim. However, IF YOU

OBJECT TO THE TRANSFER OF YOUR CLAIM, WITHIN 20 DAYS OF THE DATE OF

THIS NOTICE, YOU MUST:

FILE A WRITTEN OBJECTION TO THE TRANSFER with:

United States Bankruptcy Court

Alexander Hamilton Custom House

Attn: Bankruptcy Clerk

One Bowling Green

New York, NY 10004-1408

SEND A COPY OF YOUR OBJECTION TO THE TRANSFEREE:

Refer to INTERNAL CONTROL No. __ in your objection.

If you file an objection, a hearing will be scheduled.

IF YOUR OBJECTION IS NOT TIMELY FILED, THE TRANSFEREE WILL BE

SUBSTITUTED ON OUR RECORDS AS THE CLAIMANT.

FOR CLERK'S OFFICE ONLY:

This notice was mailed to the first party, by first mail, postage prepaid on ___ , 20_.

INTERNAL CONTROL NO. ______ _

Copy: (check) Claims Agent __ Transferee ____ Debtor's Attorney __ _

Deputy Clerk

l ~ f L l { t O

Transfer of Claim

INNI(EEPERS USA TRUST,eta/.

a/k/a GRAND PRIX FIXED LESSEE LLC & GRAND PRIX FLOATING

LESSEE LLC & GRAND PRIX ANAHEIM ORANGE LESSEE LLC

lh1s il!,;n:cment (the "Agreement") is entered into between _Q,A __ ("Ass1gnor")

and Sierra Liquidity Fund, LLC or assignee ("Assignee") with regard to the following matters:

I. Assignor in cunsidcmtiun of the sum of rccnt) of the current amount outstanding In lJ.S. l>ollars on the Assignor's

trade claim (the "Purchase Price"), docs hereby transfer to Assignee all of the Assignor's right, title and interest in and to all of the claims of

111cluding the right to amounts owed under any executory contract and any respective cure amount related to the potential assumption

and cure of such a contract (the "Claim"), against Innkeepers USA Trust, et a/. (affiliates, subsidiaries and other related debtors) (the

"I lcbtor"), in proceedings for rcorganitatlon (the "Proceedings") in the United States Bankruptcy Court, Southern District of New York, in the

current amount of not less tl .. ------Jinsert the amount due, which shall be defined as

''the Claim Amount"], ami all rights and benefits of the Ass1gnor relating to the Claim including, wllhout limitat10n. Assignor's rights to

rc<.:c1vc Interest, penalties and fees, if any, which may be paid with respect to the Claim, and all cash, securities, instruments, cure payments,

and other property which may be p;ud or issued by the Debtor in satisfaction of the Claim, right to litigate, receive lit1gation proceeds and any

and all voting rights related to the Claim . The Claim is based on amounts owed to Assignor by Debtor as set forth below and this assignment

is an absolute and unconditional assignment of ownership of the Claim, and shall not be deemed to create a security interest.

2. Assignee shall he entitled to all distributions made by the Debtor on account of the Claim, even distributions made and attributable to the

Chum being allowed in the Debtor's case, in an amount in excess of the Claim Amount. Assignor represents and warrants that the amount of

the Claim is not less than the Claim Amount, that this amount is the true and correct amount owed by the Debtor to the Ass1gnor, and that no

valid defense or nght of set-off to the Claim exists.

_\. Ass1gnor further represents and wammts that no payment has been received by Assignor or hy any third party claiming through Ass1gnor. 1n

full or partial satisfaction of the Claim, that Assignor has not previously assigned, sold or pledged the Claim, in whole or in part, to any third

party, that Assignor owns ;md has title to the Claim free and clear of llllY and all liens, security interests or encumbrances of any kind or nature

whatsoever, and that there arc no offsets or defenses that have been or may be asserted by or on behalf of the Debtor or llllY other party to

reduce the amount of the Claun or to impair its value.

l. Should it be determined that any transfer by the Debtor to the Assignor is or could hnve been avoided as a preferential payment, i\ss1gnor

slwll repay such transfer to the Debtor in a timely manner. Should Assignor fail to repay such transfer to the Debtor, then Assignee, solely at lis

own opt1on, shall be cntlllcd to make said payment on account of the avoided transfer, and the Assignor shall indemnify the Assignee for any

amounts paid to the Debtor. To thc extent necessary, Assignor grants to Assignee a Power of Attomey whereby the Assignee is authorized nt

:\ssigncc's own expense to dctend against all avoidance actions, preferential payment suits, and fiaudulcnt conveyance actions for the benefit of

the Assignor and the Ass1gnec; however Assignee has no obligation to defend against such actions. If the Bar Date for tiling a Proof of Claun

has passed, Assignee reserves the right, hut not the obligation, to purchase the Trade Claim for tht amount published in the Schedule F.

5. Assignor is aware that the Purchase Price may differ from the amount ultimately distributed in thC' Proceedings with respect to the Clatm and that

o;uch amount may not he absolutely determined until entry of a final order confirming a plan of reorganization. Assignor acknowledges that. except

:->et Iilith in this agreement, neither Assignee nor any agent or representative of Assignee has made any representation whatsoever to Assignor rcgurd1ng

the status of the the condition of the Debtor (financial or otherwise), any other matter relating to the proceedings. the Debtor, or the

I ikclihood ot' recovery of the Claim. Assignor represents that it has adequate information concerning the business and financial condition of the Dehtor

and the status of the Proceedings to make an informed decision regarding its sale of the Claim.

6. Assignee will assume all of the recovery risk in terms of the amount paid on the Claim, if any, at emergence from bankruptcy or liq111dation.

Assignee docs not assume any of the risk relating to the amount of the claim attested to by the Assignor. In the event that the Cla1111 1s

disallowed, reduced, subordinated or impaired for any reason whatsoever, Assignor agrees to immediately refund and pay to Assignee, a pro-

rata share of the Purchase Price equal to the ratio of the amount of the Claim disallowed divided by the Clnim, plus 8% interest per annum from

the date of this Agreement until the date of repayment. The Assignee, as set forth below, shall have no obligation to otherwise defend the

Clann, and the refund obligatton of the Assignor pursuant to this section shall be absolutely payable to Assignee without regard to whether

.-\ss1gnce defends the Claun. The Assignee or Assignor shall have the right to defend the claim, only at its own expense and shall not look to

the counterpart)' for any reimbursement for legal expenses.

7. To the extent that it may be required by applicable law, Assignor hereby irrevocably appoints Assignee or James S. Riley as lis true and

lawful attorney , as the true and lawful ngcnt and special attomeys-in-fact of the Assignor with respect to the Claim, with full power of

substitution (such power of attorney being deemed to be an iJTevocahle power coupled with an interest), and authorizes Assignee or James S.

Riley to act in Assignor's stead, to demand, sue for, compromise and recover all such amounts as now arc, or may hereafter become, due and

payable for or on ac.:count of the Claim, litignte for any damages, omissions or other related to this claim, vote in any proceedings, or any other

16. 1010 12: No. 2/84 l

actions that may enhance recovery or protect the interests of the Claim. Assignor grants unto Assignee full authority to do all things necessary

to enforce the Claim 1111d Assignor's rights there under. Assignor 11gree.1 that the powers granted by this paragraph ru-o discretionzuy in nature

and that the Assignea may exercise or decline to exercise such powers at Assignee's sole opllon. Assignee shall have no obligation to take 11ny

11c.:tion to prove or dofend the Claim's validity or amount in tho Proceedings or in any other dispute arl$ing out of or relating to the Claim,

whether or not suit or other proceedings are commenced, and whether in medii\tlon, Mbitrfttion, 1\t trial, on appeal, or in administrative

proceedings. Assignor Agtees to rake such reasonAble further action, as may be necessary or desirable to effect the Asslgrunent of lhe Claim

and any p11yment.s or distributions on account of the Claim to Assignee includlng, without hmitalion, the execution of appropriate transfet

powers, corporate resolutions and consents. Tho Power of Attorney shall includes without limitation, (1) the right to vote, lilspeet books and

records. (2) the right to execute on behalf of Assignor, all certiflcllt03, documents and instruments that may be required for tl\e

purpose of tmnsferring the Claim owned by the Assignor, (3) the right to deliver cash. securities and other instruments distributed on account of

the- Claim, together with all accompanying evidences of transfer And authenticity to, or upon the order of, the Assignee; and (4) the tight after

th'e date of this Agreement to receive all benefits lllld cash distributions, endorse checks payable to the Assignor and otherwise exercise all

rights of beneficial ownership of the Claim. Tho shall not bo required to post a bond of any nature in coMectlon ,vith this power of

nttomey.

8. Assignor shall forward to Assignee all notices received from the Uebtor, the conrt or any third party with rMpect to the Claim, including any

ballot with regard to voting the Claim in the Proceeding, and shall tl\ke such action with respect to the Claim in tho proceedings, as Assignee

may request from time to rime, including the provision ro the Assignee of all necessacy supporting documentation evidencing the validity of t11e

Assignor's claim. Assignor acknowledges that MY distribution received by Assignor on 11ccount of the Claim from any source, whether in

fonn of cash, securiliea, Instrument or any other property or right, is the ptoperty of Md absolutely owned by the Assignee, that Assignor holds

11nd will hold such property in trust for the benefit of Assignee and will, I\ I Its own expense, promptly deliver to Assignee any such property in

the sqme fonn received, together with any endorsements or documents necessiUy to transfer such property to Assignee.

9. In the event of any dispute arising out of or relating to this Agreement, whether or not suit or other proceedings is commencc:d, and whether

in mediation, arbitration, at trllll, on appeal, in adrninisttative proceedings, or in bankl'uptcy (including, without limitation, any adversary

proceeding or contested matter in any bankruptcy case filed on account of the Assignor), the prevailing party shall be entitled 10 its costs and

expensea incurred, including fees.

10. J1le terms of this Agreement shall be binding upon, and shall inure to lhe benefit of Assignor. Assignee and their respective s11cce.ssors and

assigns.

11. hereby acknowledges that Assignee may at any time further assign the Claim together with all rights, tillo and intercst.s of Assignee under

this Agreement. All representations and warranties of the Assignor made herein shall survive the execution and delivery of this Agreement, This

Agreement may be executed in counterparts and all such counterparts taken togc:lh'er shall be deemed to constil\lto a single agreement.

. '.; . : '- . . . . . . . . . . , ;'

12, This contraCt is not :Viilid and enforceable wiUwut acceptance of this Agreeriimt \vitJi all necessary supporting "documentS by rhe.Assignee,

as evidenced by a countersignature of t11is Agreement. The Assignee mAy reject the proffer of U1is contrAct for any whatsoeve:r.

13. This Agreement shall bo governed by and construed In accordance with the laws of the State of California. Any action arising under or relating to

this Agreemenl may be brought in any state or federal court in California, imd Assignor consents. to and oonfers personal jurisdiction over

Assignor by such court or courts and agrees that service or process may be upon Assignor by mailing a c6py of said process 10 Assignor 11t the

set forth in this Agreement, and in any action hereunder, Assignor and Assign eo waive any right to demand a trial by jury.

You must include invoices, purchase orders, and/or proofs of delivery that relate to the claim.

Assignor hereby acknowledges 11nd consents to all of the terms set forth in this Agreement and hereby waives its right to raise any objection

thereto and its right to receive notice pursuant to rulo 3001 of tho rules of the BMkruptcy procedure.

IN WITNESS WHEREOF, the undersigned Assignor hereto sets his hand day of Oc-Wbg(, 2010.

Phone Number

Sierral:.iquidity;Ptmd,.LLC e( a/.

2699 White Rd, Ste 255, Irvine, CA 92614

949-660"1I44 x 10 ot22; fax: 949-660-0632

2. &J

Street Add1ess

cU"fL ) rv-s DJt os

City, State & Zip

1<67o

Email

10/1212010

Вам также может понравиться

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsОт EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsРейтинг: 5 из 5 звезд5/5 (12)

- HR Compliance ChecklistДокумент5 страницHR Compliance ChecklistPragat Naik100% (2)

- Diamonds+in+the+Sky PDFДокумент70 страницDiamonds+in+the+Sky PDFRaffi Delic100% (5)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ28 страницAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Major Issues Relating To Infrastructure of Indian RailwaysДокумент80 страницMajor Issues Relating To Infrastructure of Indian Railwayssri103120% (5)

- Emerson Process Management - Employee Onboarding PlanДокумент18 страницEmerson Process Management - Employee Onboarding PlanSneha Singh100% (1)

- N:Fal: : Nam-E - Ro (J:L :: PДокумент5 страницN:Fal: : Nam-E - Ro (J:L :: PChapter 11 DocketsОценок пока нет

- Arctica Ice Cream Street Miami, FL 33179: 500 NE 185thДокумент3 страницыArctica Ice Cream Street Miami, FL 33179: 500 NE 185thChapter 11 DocketsОценок пока нет

- Purpose of AuditДокумент5 страницPurpose of Auditannisa radiОценок пока нет

- Forrester Service Catalog 2013 PDFДокумент23 страницыForrester Service Catalog 2013 PDFenergitixОценок пока нет

- Management AccountingДокумент304 страницыManagement AccountingRomi Anton100% (2)

- 1 CISSP 1er Dummy Examen Respuestas y Explicaciones - QAДокумент58 страниц1 CISSP 1er Dummy Examen Respuestas y Explicaciones - QAIvan MartinezОценок пока нет

- Project Management Bo Tonnquist ENGДокумент168 страницProject Management Bo Tonnquist ENGIgor Brodin63% (8)

- Dear Customer Welcome To JS Bank E-Statement !Документ3 страницыDear Customer Welcome To JS Bank E-Statement !Murtaza AhmedОценок пока нет

- Cost Analysis and Control Hyundai Motors India Limited (HMIL) 2014Документ94 страницыCost Analysis and Control Hyundai Motors India Limited (HMIL) 2014ravikumarreddyt100% (2)

- 1 (2/l'J/rt LДокумент5 страниц1 (2/l'J/rt LChapter 11 DocketsОценок пока нет

- Nam - e - : - YY/o:: - : :# ' - ' (I:: - : V: I ,: QVL...Документ5 страницNam - e - : - YY/o:: - : :# ' - ' (I:: - : V: I ,: QVL...Chapter 11 DocketsОценок пока нет

- 10000003920Документ5 страниц10000003920Chapter 11 DocketsОценок пока нет

- Nam E: YY/cA: ' - ""Y .J e V Z.Документ5 страницNam E: YY/cA: ' - ""Y .J e V Z.Chapter 11 DocketsОценок пока нет

- 10000005244Документ5 страниц10000005244Chapter 11 DocketsОценок пока нет

- 6l2JI/l /: Lr/uv - ft/2nДокумент5 страниц6l2JI/l /: Lr/uv - ft/2nChapter 11 DocketsОценок пока нет

- Uvi T"OvfДокумент5 страницUvi T"OvfChapter 11 DocketsОценок пока нет

- In In: Tol:phДокумент5 страницIn In: Tol:phChapter 11 DocketsОценок пока нет

- N/Cof: Fdcl2Документ5 страницN/Cof: Fdcl2Chapter 11 DocketsОценок пока нет

- u/ZI/fl: DateДокумент5 страницu/ZI/fl: DateChapter 11 DocketsОценок пока нет

- Nam - e - : - +G::::: - 1) - J:, ' 'A"lДокумент5 страницNam - e - : - +G::::: - 1) - J:, ' 'A"lChapter 11 DocketsОценок пока нет

- Q !F - J.J-/ - IL - : Certificate of MailingДокумент5 страницQ !F - J.J-/ - IL - : Certificate of MailingChapter 11 DocketsОценок пока нет

- 10000005239Документ5 страниц10000005239Chapter 11 DocketsОценок пока нет

- In in inДокумент5 страницIn in inChapter 11 DocketsОценок пока нет

- In in In: Nam-E: - t0W4 0 - 1) Ja - 7Документ5 страницIn in In: Nam-E: - t0W4 0 - 1) Ja - 7Chapter 11 DocketsОценок пока нет

- N/coioДокумент5 страницN/coioChapter 11 DocketsОценок пока нет

- Jhs/u: - o /C T (I - E - 7) - JanДокумент5 страницJhs/u: - o /C T (I - E - 7) - JanChapter 11 DocketsОценок пока нет

- 10000005259Документ5 страниц10000005259Chapter 11 DocketsОценок пока нет

- P.O .. BoxДокумент5 страницP.O .. BoxChapter 11 DocketsОценок пока нет

- JLJF,) - : N - E: - o - e - .-D-Ia - 1Документ5 страницJLJF,) - : N - E: - o - e - .-D-Ia - 1Chapter 11 DocketsОценок пока нет

- Name:O Z : 1) Icrj..RДокумент5 страницName:O Z : 1) Icrj..RChapter 11 DocketsОценок пока нет

- 10000003926Документ5 страниц10000003926Chapter 11 DocketsОценок пока нет

- I, The Undersigned, Am Over The Age of Eighteen and An Employee of Omni Management Group, I, DoДокумент5 страницI, The Undersigned, Am Over The Age of Eighteen and An Employee of Omni Management Group, I, DoChapter 11 DocketsОценок пока нет

- Loj 2 B/IoДокумент5 страницLoj 2 B/IoChapter 11 DocketsОценок пока нет

- VH Cbae: QuesДокумент5 страницVH Cbae: QuesChapter 11 DocketsОценок пока нет

- Q' L/Ultl: Iji, OДокумент5 страницQ' L/Ultl: Iji, OChapter 11 DocketsОценок пока нет

- Et AlДокумент3 страницыEt AlChapter 11 DocketsОценок пока нет

- Debtors &: The Water Man 115 S. Euclid StreetДокумент3 страницыDebtors &: The Water Man 115 S. Euclid StreetChapter 11 DocketsОценок пока нет

- Et Al. Debtors: 730 SW Street Renton, WA 98057Документ3 страницыEt Al. Debtors: 730 SW Street Renton, WA 98057Chapter 11 DocketsОценок пока нет

- Your Claim in The Amount of $751.38 Against The Debtors Has Been Transferred ToДокумент3 страницыYour Claim in The Amount of $751.38 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- In Re:: Debtor'sДокумент3 страницыIn Re:: Debtor'sChapter 11 DocketsОценок пока нет

- Innkeepers Usa Trust, Et Al.: Has Been ToДокумент3 страницыInnkeepers Usa Trust, Et Al.: Has Been ToChapter 11 DocketsОценок пока нет

- In ReДокумент3 страницыIn ReChapter 11 DocketsОценок пока нет

- Prinova: Your Claim in The Amount Of$499.37 Against The Debtors Has Been Transferred ToДокумент3 страницыPrinova: Your Claim in The Amount Of$499.37 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- Et At.: in ReДокумент3 страницыEt At.: in ReChapter 11 DocketsОценок пока нет

- In Re:: Your Claim in The Amount Of$1,130.09 Against The Debtors Has Been Transferred ToДокумент3 страницыIn Re:: Your Claim in The Amount Of$1,130.09 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- In Re:: Your Claim in The Amount of $2,346.57 Against The Debtors Has Been Transferred ToДокумент3 страницыIn Re:: Your Claim in The Amount of $2,346.57 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- Your Claim in The Amount of $300.50 Against The Debtors Has Been TransferredДокумент3 страницыYour Claim in The Amount of $300.50 Against The Debtors Has Been TransferredChapter 11 DocketsОценок пока нет

- In Re:: Your Claim in The Amount of $463.81 Against The Debtors Has Been Transferred ToДокумент3 страницыIn Re:: Your Claim in The Amount of $463.81 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- Deobtors Case #10-13825 10-13800: Chap-Rer 11Документ3 страницыDeobtors Case #10-13825 10-13800: Chap-Rer 11Chapter 11 DocketsОценок пока нет

- Innkeepers Usa Trust,: 730 SW 34thДокумент3 страницыInnkeepers Usa Trust,: 730 SW 34thChapter 11 DocketsОценок пока нет

- Your Claim in The Amount Of$885.04 Against The Debtors Has Been Transferrecl ToДокумент3 страницыYour Claim in The Amount Of$885.04 Against The Debtors Has Been Transferrecl ToChapter 11 DocketsОценок пока нет

- Prinova 30925 Wiegman RoadДокумент3 страницыPrinova 30925 Wiegman RoadChapter 11 DocketsОценок пока нет

- In Re: DebtorsДокумент3 страницыIn Re: DebtorsChapter 11 DocketsОценок пока нет

- Crystal Flowers: New NYДокумент3 страницыCrystal Flowers: New NYChapter 11 DocketsОценок пока нет

- COU T: DebtorsДокумент3 страницыCOU T: DebtorsChapter 11 DocketsОценок пока нет

- Et At.: Please Note That Your Claim in The Amount Of$751.38 Has Been Partially Transferred in The Amount ofДокумент3 страницыEt At.: Please Note That Your Claim in The Amount Of$751.38 Has Been Partially Transferred in The Amount ofChapter 11 DocketsОценок пока нет

- Prinova: in ReДокумент3 страницыPrinova: in ReChapter 11 DocketsОценок пока нет

- In Re:: Your Claim in The Amount Ofs339.18 Against The Debtors Has Been TransferredДокумент3 страницыIn Re:: Your Claim in The Amount Ofs339.18 Against The Debtors Has Been TransferredChapter 11 DocketsОценок пока нет

- In Re:: Your Claim in The Amount of $4,847.72 Against The Debtors Has Been Transferred ToДокумент3 страницыIn Re:: Your Claim in The Amount of $4,847.72 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- Et Al.: Crystal Flowers 2020 West El Camino RealДокумент3 страницыEt Al.: Crystal Flowers 2020 West El Camino RealChapter 11 DocketsОценок пока нет

- Your Claim in The Amount Of$243.75 Against The Debtors Has Been Transferred ToДокумент3 страницыYour Claim in The Amount Of$243.75 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- Debtors &: Et AlДокумент3 страницыDebtors &: Et AlChapter 11 DocketsОценок пока нет

- In Re:: The Transterred Amount $216.24 Represents An Amount Sold Avid Airline Products of RI, Inc., ToДокумент3 страницыIn Re:: The Transterred Amount $216.24 Represents An Amount Sold Avid Airline Products of RI, Inc., ToChapter 11 DocketsОценок пока нет

- Et Al.: Washington Automated, IncДокумент3 страницыEt Al.: Washington Automated, IncChapter 11 DocketsОценок пока нет

- In Re:: Your Claim in The Amount Of$280.00 Against The Debtors Has Been Transferred ToДокумент3 страницыIn Re:: Your Claim in The Amount Of$280.00 Against The Debtors Has Been Transferred ToChapter 11 DocketsОценок пока нет

- Case 5 #: Et AlДокумент3 страницыCase 5 #: Et AlChapter 11 DocketsОценок пока нет

- Wochos V Tesla OpinionДокумент13 страницWochos V Tesla OpinionChapter 11 DocketsОценок пока нет

- SEC Vs MUSKДокумент23 страницыSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintДокумент84 страницыZohar 2017 ComplaintChapter 11 DocketsОценок пока нет

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ47 страницAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- PopExpert PetitionДокумент79 страницPopExpert PetitionChapter 11 DocketsОценок пока нет

- National Bank of Anguilla DeclДокумент10 страницNational Bank of Anguilla DeclChapter 11 DocketsОценок пока нет

- Kalobios Pharmaceuticals IncДокумент81 страницаKalobios Pharmaceuticals IncChapter 11 DocketsОценок пока нет

- NQ LetterДокумент2 страницыNQ LetterChapter 11 DocketsОценок пока нет

- Energy Future Interest OpinionДокумент38 страницEnergy Future Interest OpinionChapter 11 DocketsОценок пока нет

- Home JoyДокумент30 страницHome JoyChapter 11 DocketsОценок пока нет

- Zohar AnswerДокумент18 страницZohar AnswerChapter 11 DocketsОценок пока нет

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncДокумент5 страницDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasДокумент4 страницыUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsОценок пока нет

- Quirky Auction NoticeДокумент2 страницыQuirky Auction NoticeChapter 11 DocketsОценок пока нет

- Informed Manufacturing: Reaching For New HorizonsДокумент20 страницInformed Manufacturing: Reaching For New HorizonsCognizantОценок пока нет

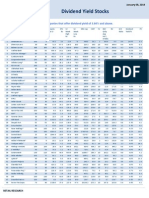

- High Dividend Yield StocksДокумент3 страницыHigh Dividend Yield StockskaizenlifeОценок пока нет

- 2013 May Skpi-TesttubeДокумент370 страниц2013 May Skpi-TesttubeAngelica Sta. MariaОценок пока нет

- Question-01: What Are The Basic Steps in Strategic Planning For A Merger? AnswerДокумент6 страницQuestion-01: What Are The Basic Steps in Strategic Planning For A Merger? AnswerAnkur BhavsarОценок пока нет

- 1930 Hobart DirectoryДокумент82 страницы1930 Hobart DirectoryAnonymous X9qOpCYfiBОценок пока нет

- Description: Proprietary Timber Roof Truss SystemДокумент7 страницDescription: Proprietary Timber Roof Truss SystemWEIQIN CHANОценок пока нет

- Isj 045Документ36 страницIsj 0452imediaОценок пока нет

- Material CasesДокумент15 страницMaterial Casesvinay sharmaОценок пока нет

- Indoco Annual Report FY16Документ160 страницIndoco Annual Report FY16Ishaan MittalОценок пока нет

- Gr. Reggane Nord - Tender No - cfb-0295-20 - Provision of Tubular Running ServicesДокумент1 страницаGr. Reggane Nord - Tender No - cfb-0295-20 - Provision of Tubular Running ServicesOussama AmaraОценок пока нет

- Aped Manual Volume I 2012Документ463 страницыAped Manual Volume I 2012Arif Ahmed100% (1)

- C C CCCCCCCCCДокумент39 страницC C CCCCCCCCCBiswajeet Gogoi75% (4)

- Sem-1 Syllabus Distribution 2021Документ2 страницыSem-1 Syllabus Distribution 2021Kishan JhaОценок пока нет

- International Parity Relationships & Forecasting Exchange RatesДокумент33 страницыInternational Parity Relationships & Forecasting Exchange Ratesavya86Оценок пока нет

- OSHA 3000 - Employer Rights and ResponsibilitiesДокумент28 страницOSHA 3000 - Employer Rights and ResponsibilitiesWahed Mn ElnasОценок пока нет

- Summer Internship File Very ImportantДокумент32 страницыSummer Internship File Very ImportantYash SharmaОценок пока нет

- Aqeeq-Far East - Special DirectДокумент2 страницыAqeeq-Far East - Special DirectRyan DarmawanОценок пока нет

- Week 4: The Service EncounterДокумент20 страницWeek 4: The Service EncounterAyu Anggraeni DwijayantiОценок пока нет

- D&O - Chubb D&O Loss PreventionДокумент35 страницD&O - Chubb D&O Loss PreventionAlin Iustinian ToderitaОценок пока нет