Академический Документы

Профессиональный Документы

Культура Документы

10000003998

Загружено:

Chapter 11 DocketsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

10000003998

Загружено:

Chapter 11 DocketsАвторское право:

Доступные форматы

CERTIFICATE OF MAILING

I, the undersigned, am over the age of eighteen and an employee ofOmni Management Group, I

do hereby certify:

That I, in performance of my duties served a copy of the Notice of Transferred Claim by

depositing it in the United States mail at Encino, California, on the date shown below, in a sealed

envelope with postage thereon fully prepaid, addressed as set forth below.

Date: By:

Name:

Transferor: GAl'S NORTHWEST BAKERIES

FILE 74829

P.O. BOX 60000

SAN FRANCISCO, CA 94160

Transferee: SIERRA LIQUIDITY FUND, LLC

RE: GAl'S NORTHWEST BAKERIES

2699 WHITE ROAD, SUITE 255

IRVINE, CA 92614

Addressee: GAl'S NORTHWEST BAKERIES

FILE 74829

P.O. BOX 60000

SAN FRANCISCO, CA 94160

Omni Management Group, LLC

Chtims Agent For Grand Prix Fixed Lessee LLC

16161 Ventura Blvd., Suite C, PMB #606- Encino, CA 91436

Telephone (818) 906-8300- Facsimile (818) 783-2737

Notice of Transferred Claim

October 29, 20 I 0

Transferor: GAl'S NORTHWEST BAKERIES

FILE 74829

P.O. BOX 60000

SAN FRANCISCO, CA 94160

Transferee: SIERRA LIQUIDITY FUND, LLC

RE: GAl'S NORTHWEST BAKERIES

2699 WHITE ROAD, SUITE 255

IRVINE, CA 92614

To Whom It May Concern,

Please be advised that a Notice was received that your claim in the above mentioned case has been

transferred; please see attached. The document states that the above named transferor has transferred

this claim to the above named transferee.

Case:

Scheduled Claim No.:

Amount of Claim:

Amount of Transfer:

Re: Docket#

Grand Prix Fixed Lessee LLC (Case No: I 0-13 825)

14753

$1,612.00

$1,227.89

617

Pursuant to Bankruptcy Rule 300 I (e) (2) of the Federal Rules of Bankruptcy Procedures you are

advised that ifyou wish to object to the above, you must do so within 21 days of the date ofthis

notice or within any additional time allowed by the court. Unless an objection and request for hearing

is tiled in writing with the U.S. Bankrutpcy Court- Southern District ofNew York Manhattan

Division One Bowling Green New York, NY 10004, the aforementioned claim will be deemed

transferred.

Yelena Bederman

Omni Management Group, LLC

j

V''

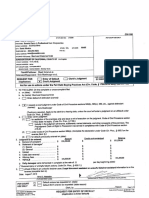

UNITED ST /\TES BANKRUPTCY COURT

SOUTHERN DISTRI.C,::T OF NEW YORK

In re:

to/.U{tV

Chapter 11

GRAND PRIX FIXED LESSEE LLC

INNKEEPERS USA TRUST, eta/.

Debtors

Case# 10-13825 & 10-13800

Transferor:

NOTICE OF TRANSER OF CLAIM PURSUANT TO

F.R.B.P. RULE 3001(E) (1)

Gal's Northwest Bakel'ies- Franz Family Bakeries

File 74829- PO Box 60000

Snn Francisco, CA 94160

Please note that your claim in the amount of $1,612.00 has been partially transferred in the amount of

$1,227.89 (unless previously expunged by court order) to:

Transferee: Sierra Liquidity Fund, LLC

2699 White Road, Suite 255

Irvine, CA 92614

The transferred amount of $1 ,227.89 represents an amount sold by Gal's Northwest Bakeries- Franz

Family Bakeries to Sierra Liquidity Fund, LLC.

No action is required if you do not object to the transfer of your claim. However, IF YOU

OBJECf TO THE TRANSFER OF YOUR CLAIM, WITHIN 20 DAYS OF THE DATE OF

TillS NOTICE, YOU MUST:

FILE A WRITTEN OBJECTION TO THE TRANSFER with:

United States Bankruptcy Court

Alexander Hamilton Custom House

Attn: Bankruptcy Clerk

One Bowling Green

New York, NY 10004-1408

SEND A COPY OF YOUR OBJECTION TO THE TRANSFEREE:

Refer to INTERNAL CONTROL No. __ in your objection.

If you file an objection, a hearing will be scheduled.

IF YOUR OBJECTION IS NOT TlMEL Y FILED, THE TRANSFEREE WILL BE

SUBSTITUTED ON OUR RECORDS AS THE CLAIMANT.

FOR CLERK'S OFFICE ONLY:

This notice was mailed to the first party, by first mail, postage prepaid on ___ , 20_

INTERNAL CONTROL NO. ______ _

Copy: (check) Claims Agent __ Transferee ____ Debtor's Attorney __ _

Deputy Clerk

Transfer of Claim

INNKEEPERS USA TRUST, etat.

a/1</a GRAND PRIX FIXED LESSEE LLC & GRAND PRIX FLOATING

LESSEE LLC & GRAND PRIX ANAHEIM ORANGE LESSEE LLC

.

I his agrccmc11l (the ":\grccmcnt") is entered imo between h?\..V\ '2,., .

aml Sierra Liquidity Fund, LLC or assignee ("Assignee") with regard to the following matte :

,d I / /:. I 4 A/If) tJ;;J!;mJ

e' S {::;/1Z- rAssignor")

I. Assignor in consideration of the sum of he current nmounl outstanding in U.S. IJollnrs on the

tr:ulc claim (the "Purchase Price"), docs hereby transfer to Assignee all of the Assignor's right, title and interest in and to all of the claims of

AssiKnor, including the right to amounts owed under any executory contract and any respective cure amount related to the potential

and cure of such a contract (the "Claim"), against Innkeepers USA Trust, et a/. (aftililltcs, subsidiaries and other related debtors) (the

")}chtor"), in proceedings t" I the "Proceedings") in the Unite 'tales Bankruptcy Court, Southern District of New York, in the

:u.nount of not _less .......

, .linsert be llc11ncd ns

"the U:um Amount"!, and all nghts and bcnehts of the Ass1gnor relnturg to the Claun 111cludmg, without hmllallon, Assignor's nghts to

n;ceive interest. penalties and fees, if any, which may be paid with respect to the Claim, and all cash, securities, cure payments,

and other property which may be paid or issued by the Debtor in satisfaction of the Claim. right to litigate, receive litigation proceeds and any

and all voting rights related to the Claim . The Claim is based on amounts owed to Assignor by Debtor as set forth below and this assignment

is an absolute and unconditional assignment of ownership of the Claim, and shall not be deemed to create a security interest.

.!. Assignee shall be entitled to all distributions made by tbe Debtor on account of the Claim, even distributions ntnde and attributllble to the

Claim being allowed in the Debtor's case, in an amount in excess of the Claim Amount. Assignor represents and warrants that the amount of

the Claim is not less than the Claim Amount, that this amount is the true and correct amount owed by the Debtor to the Assignor, and that no

valid defense or right ofset-offto the Claim exists.

3. Assignor further represents and warrants that no payment has been received by Assignor or by an}' third party claiming through Assignor, in

full or partial satisHH;tion of the Claim, that Assignor has not previously assigned, sold or pledged the Claim, in whole or in part, to any third

party, that Assignor owns and has title to the Claim free and clear of any and all liens, security interests or encumbrances of any kind or nAture

wluusocvcr, and that there arc no offsets or defenses that have been or may be asserted by or on behalf of the Debtor or any other party to

rlducc the amount of the Claim or to impair its value.

1. Should it be determined that any transfer by the Debtor to the Assignor is or could have been avoided as a preferential payment, Assignor

shall repay such transfer to the Debtor in a timely manner. Should Assignor fail to repay such translcr to the Debtor, then Assignee, solely at its

own option, shall be entitled to make said payment on account of the avoided trunsfcr, and the Assignor shall indemnify the Assignee for any

alllounts paid to the Debtor. To the extent necessary, Assignor grants to Assignee a Power of Attorney whereby the Assignee is authorized at

,\ssignee's own expense to defend against all avoidance actions, preferential payment suits, and fraudulent conveyance actions for the benefit of

the Assignor and the Assignee; however Assignee has no obligation to defend against such actions. If the Bar Date lor filing a Proof of Claim

lias passed, Assignee rcst:rvcs the right, but not the obligt1tion, to purchase the Trade Claim for the amount published in the Schedule F.

5. ,\ssignor is :nvarc that the Purchase Price may differ from the amount ultimately distributed in the Proceedings with respect to the Claim and that

such amount may not be absolutely determined until entry of o tina I order confirming a plan of reorganization. Assignor acknowledges that, except as

:i<:l fm1h in this agreement, neither Assignee nor any agent or representative of Assignee hns made any representation whntsoever to Assignor regarding

the >talus of the Proceedings, the condition of the Debtor (linancial or otherwise), any other matter relating to the proceedings, the Debtor, or the

likelihood of n:covery of the Claim. Assignor represents that it has adequate information concerning the business and financial condition of the Debtor

and the stntus of the l'roccedings to make an intormed decision regarding its sale of the Claim.

6. ,\ssignec will assume all of the recovery risk in terms of the amount paid on the Claim, if any, at emergence from bankruptcy or liquidation.

,\ >s1gncc docs not assume any of the risk relating to the amount of the claim attested to by the Assignor. In the event that the Claim is

disallowed, reduced. subordinated or impaired lor any reason whatsoever, Assignor agrees to immediately refund and pay to Assignee, a pro-

r;tta slwrc of the Purchase Price equal to the ratio of the amount of the Claim disallowed divided by the Claim, plus 8% interest per annum from

the date of this Agreement until the date of repayment. The Assignee, as set torth below, shall have no obligation to otherwise defend the

Claim, and the refund obligation of the Assignor pursuant to this section shall be absolutely payable to Assignee without regard to whether

Assignee defends the Claim. The Assignee or Assignor shall have the right to delcnd the claim, only at its own expense and shall not look to

the counterparty for any rcimhursement for legal expenses.

7. To the extent that it may be required by applicable law, Assignor hereby irrevocably appoints Assignee or James S. Riley as its true and

lawful attorney . as the true and lawflil agent and special attorneys-in-fact of the Assignor with respect to the Claim, with full power of

suhslitutiun (such power of atturncy being deemed to be an irrevoc<1ble power coupled with an interest), and authorizes Assignee or .lames S.

l<iley to act in Assignor's stead. to demand, sue for, compromise and recover all such amounts ns now nrc, or may hereafter become, due and

payable for or on account of the Claim, litigate for any damages, omissions or other related to this claim, vote in any proceedings, or any other

actions that may cnlwncc recovery or protect the interests of the Claim. Assignor grants unto Assignee full authority to do nil things necessary

to .:nfnrcc the Claim and Assignor's there under. ,\ssignor agrees that the powers granted by this pamgraph are discretionRry in nature

and tiHit the Assignee may or decline to exercise such powers at Assignee's sole option. Assignee shnll hnvc no nbligntion to take any

.tel ion to prove or defend the Cl<tim's vuliuity or amount in the Proceedings or in any other dispute arising out of or relating to the Claim,

whether nr not suit or other proceedings are commenced, and whether in mediation, arbitration, at trial, on appeal, or in administrative

proceedings. Assignor agrees to take such reasonable litrther action, as may be necessmy or desirable to effect tho Assignment of the Claim

;md payments or distributions on account of the Claim to Assignee including, without limitation, the execution of appropriate transfer

powers, corporate resolutions and consents. The Power of Attorney shall include without limitation, (I) the right to vote, inspect books and

records, (2) the right to execute on behalf of Assignor, all assignments, certificates, documents nnd instruments that may be required for the

purpose oftrnnsfcning the Claim owned by the Assignor, (3) the right to deliver cash, securities and other instruments distributed on account of

the Claim. together with all accompanying evidences of transfer and authenticity to, or upon the order ot: the Assignee; and (4) the right afler

the date of this Agreement to receive all benetits and cash distributions, endorse checks payable to the Assignor and otherwise exercise all

rights of benelicial ownershill of the Claim. The Purchaser shall not be required to post a bond of any nature in connection with this power of

attomey.

X. ,\ssignor >hall limvard to Assil!nee all notices received 11om the Debtor, the court or nny third party with respect to the Claim, including nny

ballot with regard to voting the Claim in the Proceeding, and shall take such action with respect to the Claim in the proceedings, as Assignee

tnay request from time to tirne, including the provision to the Assignee of all necessary supporting documentation evidencing the validity of the

,\ssignor's claim. Assignor ncknowledges that any distribution received by Assignor on account of the Claim from any source, whether in

form of cash, securities, instrument or any other property or right, is the property of and absolutely owned by the Assignee, that Assignor holds

and will hold such property in trust for the benefit of Assignee nnd will, at ils own expense, promptly deliver to Assignee any such property in

the same limn received, together with any endorsements or documents necessary to trnnster such property to Assignee.

9. In the event of any dispute arising out of or relating to this Agreement, whether or not suit or other proceedings is commenced, and whether

in 111cdiation, arbitration. at trial, on <lppeal, in administrative proceedings, or in bankruptcy (including, without limitation, any adversary

proceeding or contested matter in any bankruptcy case liled on account of the Assignor}, the prevailing party shall be entitled to costs and

e.xpcnscs incurred, inc lulling reasonable attorney Ices.

I 0. The tenns of this Agreement shall be binding upon, and shall inure to the benefit of Assignor, Assignee and their respective successors and

assigns.

II ... \ssignor hereby that Assignee may at any time further assign the Claim together with all rights, title and interests of Assignee under

this Agrcemenr. All representations and warnnties of the Assignor made herein shall survive the execution nnd delivery of this Agreement. !'his

, \grccmcnt may he cx.:-cutcd in counterparts rutd all such counteq,arts tuken together shu II be deemed to constitute a single agreement.

1.2. This contract is not valid and enforceable without acceptance of this Agreement with all necessary supporting documents by the Assignee,

;1s evidenced by a countersignature oftl1is Agreement. The Assignee may reject the proffer of this contract tor any reason whatsoever.

11. This Agreement shall be governed by and construed in accnrrlancc with the laws of the Stntc of Califomin. Any action arising under or relating to

this Agreement may be brought in any state or federal court located in California, and As$ignor consents to und confers personal jurisdiction over

1\ssignor hy such court or courts and agrees that service of process may he upon Assignor hy mailing a copy of said process to Assignor at the autlress

set forth in this Agreement. and in any uction hereunder. Assignor and Assignee waive any right lu demand a trial hy jury.

Y nu must include invoices, tmrchase orders, and/or proofs of delivea=y that relate to the claim.

1\ssignor hereby acknowledges and consents to all of the terms set forth in this Agreement and hereby waives its right to raise any objection

thereto and its right to receive notice pursuant to rule 300 I of the rules oft he 13ankruptcy procedure.

WITNESS WHEREOF, the undersigned Assignor hereto sets his hand this C)fc day of ()C;JD\:JO...r. 2010.

ATTEST

[Print Name and Title) \).

--

Phone Number

Sierra Liquidity Fund, LLC eta/.

:2(J99 White Rd. Stc 255, Irvine. CA 9261,1

9<19-660-1 I '14 x I 0 or 22: fax: 949-660-0632

<;_a It l!Ust(<ilsieiTn funds. com

_frcLV\Z lLL't\.}ie,r1e .3 /(;IlL 5

Name of Company ..) .

.. J35 N_t;; __ j;;<-t: (319-Jt.t-1 f..f

Street Address

-t ___ Et:_IJ- :SJ

'3-l(o (oW C)

l'aXNumb.r.. -t

___ /11.f!..:.LL:>2fl .. a.YuJ:i}L e---rU

Agreed and -cJ

Sierra Liquidity . C /.112120 I 0

Вам также может понравиться

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ28 страницAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Wochos V Tesla OpinionДокумент13 страницWochos V Tesla OpinionChapter 11 DocketsОценок пока нет

- SEC Vs MUSKДокумент23 страницыSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintДокумент84 страницыZohar 2017 ComplaintChapter 11 DocketsОценок пока нет

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ47 страницAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- PopExpert PetitionДокумент79 страницPopExpert PetitionChapter 11 DocketsОценок пока нет

- National Bank of Anguilla DeclДокумент10 страницNational Bank of Anguilla DeclChapter 11 DocketsОценок пока нет

- Kalobios Pharmaceuticals IncДокумент81 страницаKalobios Pharmaceuticals IncChapter 11 DocketsОценок пока нет

- NQ LetterДокумент2 страницыNQ LetterChapter 11 DocketsОценок пока нет

- Energy Future Interest OpinionДокумент38 страницEnergy Future Interest OpinionChapter 11 DocketsОценок пока нет

- Home JoyДокумент30 страницHome JoyChapter 11 DocketsОценок пока нет

- Zohar AnswerДокумент18 страницZohar AnswerChapter 11 DocketsОценок пока нет

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncДокумент5 страницDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasДокумент4 страницыUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsОценок пока нет

- Quirky Auction NoticeДокумент2 страницыQuirky Auction NoticeChapter 11 DocketsОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Hill v. Alabama Department of Corrections (INMATE1) - Document No. 4Документ5 страницHill v. Alabama Department of Corrections (INMATE1) - Document No. 4Justia.comОценок пока нет

- 18 Malinias Vs ComelecДокумент7 страниц18 Malinias Vs ComelecAirelle AvilaОценок пока нет

- Session 2 Elements of Crime, Intention Vs MotiveДокумент13 страницSession 2 Elements of Crime, Intention Vs MotiveAyushi RajputОценок пока нет

- Al. Entry Court Judgment: Superior Court of California, County ofДокумент2 страницыAl. Entry Court Judgment: Superior Court of California, County ofGigi RodarteОценок пока нет

- Law On Obligations Articles 1156 To 1230 Civil Code.Документ10 страницLaw On Obligations Articles 1156 To 1230 Civil Code.Reggie SimpeloОценок пока нет

- Property Law and PracticeДокумент556 страницProperty Law and PracticeNadine100% (2)

- 19 Delsan Transport Lines vs. American Home Assurance, G.R. 149019Документ10 страниц19 Delsan Transport Lines vs. American Home Assurance, G.R. 149019blessaraynesОценок пока нет

- CLJ FC 2022Документ24 страницыCLJ FC 2022Tonet Salago CantereОценок пока нет

- People v. Masinag Vda. de Ramos, G. R. No. 144621.may 9, 2003Документ3 страницыPeople v. Masinag Vda. de Ramos, G. R. No. 144621.may 9, 2003Anna BarbadilloОценок пока нет

- People v. Miyake - 279 SCRA 180Документ1 страницаPeople v. Miyake - 279 SCRA 180ashyyОценок пока нет

- Frias vs. AlcaydeДокумент17 страницFrias vs. AlcaydeDindo RoxasОценок пока нет

- Carrion v. SantiagoДокумент9 страницCarrion v. SantiagoBillboardОценок пока нет

- Practice CourtДокумент15 страницPractice CourtKarenandaleonОценок пока нет

- Protection of Pakistan OrdinanceДокумент9 страницProtection of Pakistan OrdinanceMuhammad NaseemОценок пока нет

- 13 Ganzon Vs AndoДокумент1 страница13 Ganzon Vs Andomarmiedyan9517Оценок пока нет

- Denr V United Planners Consultants Inc (Upci) Facts: and The Petitioner Did Not OpposeДокумент1 страницаDenr V United Planners Consultants Inc (Upci) Facts: and The Petitioner Did Not OpposeSchool of Law TSUОценок пока нет

- Shoumik Islam QuizДокумент3 страницыShoumik Islam Quizafsana zoyaОценок пока нет

- Civil Appeal 3 of 2018Документ4 страницыCivil Appeal 3 of 2018JamesОценок пока нет

- Tax 2 Case Digest 5Документ1 страницаTax 2 Case Digest 5Leo NekkoОценок пока нет

- Sheridan v. Flexpoint Funding Corporation - Document No. 13Документ2 страницыSheridan v. Flexpoint Funding Corporation - Document No. 13Justia.comОценок пока нет

- People v. de Los ReyesДокумент2 страницыPeople v. de Los ReyesElaine Belle OgayonОценок пока нет

- WALLS v. BLACKWELL - Document No. 2Документ6 страницWALLS v. BLACKWELL - Document No. 2Justia.comОценок пока нет

- Robert Cook LawsuitДокумент19 страницRobert Cook LawsuitThe Daily LineОценок пока нет

- Burger King Corporation v. Pilgrim's Pride Corporation, Pilgrim's Pride Corporation v. Burger King Corporation, 15 F.3d 166, 11th Cir. (1994)Документ4 страницыBurger King Corporation v. Pilgrim's Pride Corporation, Pilgrim's Pride Corporation v. Burger King Corporation, 15 F.3d 166, 11th Cir. (1994)Scribd Government DocsОценок пока нет

- TY SHANABERG V Licking CountyДокумент9 страницTY SHANABERG V Licking CountyLaw&CrimeОценок пока нет

- F.D. Illegal AgreementsДокумент18 страницF.D. Illegal AgreementsTejas KumarОценок пока нет

- Debt Collector - Sample Response Notice To Dunning Letter (1!5!14)Документ1 страницаDebt Collector - Sample Response Notice To Dunning Letter (1!5!14)ldamasco1Оценок пока нет

- B.E. San Diego, Inc. vs. Alzul DigestДокумент2 страницыB.E. San Diego, Inc. vs. Alzul DigestMarie Chielo100% (3)

- Agan JR Vs Philippine International Air Terminals Co (PIATCO)Документ4 страницыAgan JR Vs Philippine International Air Terminals Co (PIATCO)Mariel D. Portillo50% (2)

- Slum Clearance and RedevelopmentДокумент7 страницSlum Clearance and RedevelopmentAnwar SalahadinОценок пока нет