Академический Документы

Профессиональный Документы

Культура Документы

United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009

Загружено:

Chapter 11 DocketsИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009

Загружено:

Chapter 11 DocketsАвторское право:

Доступные форматы

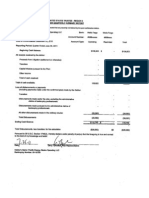

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELA WARE

rn re: Pacific Energy Alaska Holdings. Inc. Debtor

Case No. 09- 10787

Reporting Period: Mav 2009

MONTHLY OPERATING REPORT

Document Attached

Explanation AffdaviUSupplement

REQUIRED DOCUMENTS Schedule of Cash Receipts and Disbursements Bank Reconcilation (or copies of debtor's bank reconciliations) Schedule of Professional Fees Paid

Copies .of bank statements

ForI No

Attached Attached

N/A N/A N/A N/A N/A N/A NJA N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

MOR-! MOR-I a

./ ./

MOR-lb

...........

./

N/A N/A

Cash disbursements journals Statement ofOocrations .alance Sheet Status of Posipetition Taxes Copies of rRS Form 6123 or payment receipt

Copies of tax returns fied

,..../,:.'i......:..-/MOR-2

MOR.-3

MOR-4

. .\

..... '. .

'.

./ ./ ./

N/A N/A

during i'eporting period

.):-:.....-......,......:,.

petition Debts of aged accounts payable Accounts R.eceivable Reconcilation and Aging Debtor ~uestioniiaire

Summaryof Unpaid Post Listing

MOR-4 MOR-4 MOR-S MOR"5

./ ./

./ ./

are uue and correct

I declare uiider penalty of pe~iury (28 V.S.C. Section 1746) thatlhis report and the attached documents to the liest of iiy knowledge and belief.

Signature of Debtor

Date

Dale

Si

~l1D!01

)( II P-rt-hL

Tiile of Authorized Individual

.Authonzed individual must be an offcer. director or shareholder if debtor is:i corporation: a ",Irlner i( debtor

is. p.nncrsiip; 1\ .nan.geror member i(debtor is a limited Iiabiliiycoiipay.

~IOR lOllO7,

In re; Pacific Ener~y Alaska Holdin2s. Inc. Debtor

Cae No. 09.10787

Reporting Penod:_May 2009_

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

CASH INL",C OF MONTH

OPER. PA YRoi TAX OT

I

RECEIP

I I II

BANK ACCOUN

II

i i II

ACJAL PROIECl AClAL PROJECTD

II

CURRENT MONTH CUMULATIVE FILING TO DATE

Pacific Energy Ala.ka Hotcllngs. Ino. clGs nol maIntain any cash accounl..

TOTAl. RECIlIPT

DISBURSEMENTS

L"..,"_~~

I I t; :11

II

j I I-I II

II

II

II

TIlE FOLLOWING SECTION \-UST BE COMPLETED

D1SBURSBMENTS FOR CALCULA TINC U.S. TRUSTEE OUARTBRL Y FE:

(FROM CURRENT

MONTIl AClALCOLUM/l1

SO.OO

TOTAl. DISBURSEM&-'TS

LESS; TRANSFES TO DEBTOR IN POEStON ACCOUNTS

PLUS; ES ATE DISBURSEMENTS MADE Y OUTSIDE SOURCES (i,e, Irom ""row accounts)

SO.OO SO.OO SO.OO

TOTAL D1SBURSE,\IlS'lS FOR CALClILA TI,sC U.S. TRUSTEE 0UARTERL Y FEE

ffRM:.UR.!

(0M)

In re: Pacific Energy Alaska Holdings. Inc. Debtor

Case

No. 09,10787

Reporting Period:_May 2009_

BAl\'K RECONCJLIATIONS

ConInu.lionSh.el for MOR.!

Oprating

!BALA...CE PER BOOKS

BAl\K BALANCE

(+) DEPOSITS 1:- 'lRAl'SIT (ATTACH USTj

1#

I

paill

1#

I I

Tax

1#

I

Other

1#

I

H OirTANDlliGCHECKS (ATIACH LlSn

ADJUSTD BANK BALANCE' . Adjuste bank bal.nce mu,. tquat

balance De, boo~s

Pacific Energy Alaska Holdings, Inc. does nol maintain any cash accounts.

FORM MOR-Ii

(O.l7)

In re: Pacific Energy Alaska Holdings. Inc. Debtor

Case No. 09-10787 Reporting Peiiod:_May 2009_

SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

Payee

Payor

Period Covered

Amount Approved

Check Number Date

Fees

Amount Paid Expenses

Y ear- To-Date

Fee

Expenses

No profesional fees were paid post-petition.

FORM MOR-) b

(047)

In re: Pacific Energy Alaska Holdings. Inc.

Debtor

Case No. 09- 10787

Reporting Period:_May 2009_

STATEMENT OF OPERATIONS

(Income Statement)

REVENUES Oil and iias production revenue

Royalt uavmenlS

Cumulalive

Month

S

- I

Fill! to Dale

Net Revenue

OPERATING EXPENSES

Repairs and maimenanee

Salaries/commissions/fees Transportation expense Utilities Insurance

Employee benefit oro2rams Taxes - ol"oduetion

Inveniorv ehaniie

Rent and lease expense Travel and entertai nment Suoplies Advertisinl! Auto and truck

Bad debt

Conlrbutions

Insider compensation

ManagCineni feeslonuses

Officc expenses Pension& vrofit shannl! olans

Taxes - oayroll

Taxes - real estate Taxes - other

General and administrative

Depreciation, depletion and amortization Net Profit (Los) Before Other Income & Expenses

OTHER INCOME AND (EXPENSES)

Accreiion of diseouiisand amortization of deferred finam::inii costs

Interest exoense- Ilon-easli - oaid i ri kind

Stock compensation exiiense Interest and dividends

Realized iiain/(Ioss) on derivatives

i nlerest exoense- cash

Other revenue General exiiloraon exvense

Income from eauitv investmeni

Imoairment exoense Net Profit (Los) Before Reariianization Items

(587.00

-

(63.000)

-

REORGANIZATION ITEMS

Professional Pees Reorl!anization Interest

U.S. Trustee OU31terly Pees

(587.000)

-

(63,000)

-

Interest Hamed on Accumulated Cash from Chapter i i Gain (Loss) from Sale of EauiDment Oiher Reorl!anization EXDenses (attach schedule) Income taxes Net Profit (Loss)

(587,000) $

(63,000)

Note: The Cumulatiye filing to Date income statement above refleet the Company's activity for the entire month of March.

FORM MOR-2

(0410)

In reo Pacific Merev Alaska Holdinii. Inc.

Debior

Case ~o.~

Reponing Period:_May 2009_

BALANCE SHEET

CURR ASSET

Uoririled Cash and Equivalents

ASETS

BOOK VALUE AT EN OF CUEl\'l REPORTING MONTH

Resicied Cash and (,ns EouivaJenls

Accounts Rea:ivabJe (Nell Inventories Prepaid Exiinses Professional Reiiiners Other Oirreni AsselS (Sce Allached Schedule) TOTAL CURRENT ASSETS PROPERTY AND EQUIPMEl'l Proved Proiirties Including Leas and Well Eouiprnni Assi Reiiremeni COSIS

In Procss Developmeni

$

S

50.355,273 50,355,273

Unprod Properlies

Offee Eouipnient and Software Vehicles Othr Equipmeni and Leasehold Improveninis

Piiitine Eiuipment

Less Accumulaed Depreciniion TOTAL-PROPERTY & EQUIPMENT

S

OTHER ASSET Oiher Assls like Aiiached Schedule)

$ $

BOOK VALUE AT El'D

11.522.816

TOTAL ASETS

6t.878.89

OF

LIABILITIES AND OWNE EQUITY LIABILIT NOT SUBJEC TO COMPROMISE CPostpellllon)

AeeounlS Payable and Accred Uabiliies

Taxes Payable

Wages Pawble

CU REPORTING MONTII

$

:-oIes Payable - Debtor.in-possession financing

Rent I Leases - Building/uipnini

Secule Det I AdeQuale Proteeiion Pavinenis

Pro(essionat Fees lniercomoony Payables Asset Retirement Obligaiions

Accrued tnieresl

Other !lbilties .

OTAI. POSTPETITlON LIABILITIES

LIABILlTIES SUBJHCl TO COMPROMISE (Prt-Pelition)

Sccired Debi

Priorty Debi Unsecured Debt

Inlcreompny Payiies

$

S

TOTAL PRE-PETITION LIABILITES

ITOTAL L1ABIl.lTES

OWNER eQuIT

Share COpil"1

1$

S

-I

-

Contnbuied Surlus \Varrants Additional Paid In Copital

Accumulated Oibtr Comprehensive Lo l'rlners' Capi:i Aecouni

Owner's &lulv Account

62,118.089

-

Reuined E.imiogs - Pr-Peiition Retained E.'loings - Posioeiiion Adjustment tn owner Eiuity launch schedute) Postpeiiioo Couinbulions (Distrbutions (Dmws) (aUoch schedule) NET SHAREHlDERS' EQUITY

S

(177001 (63,00)

-

61,878.089

TOTAL LIILITI AN OWNS' EQUITY

$

61.878,89

FOR.'f ~IOR..l to'U7J

In re: Paeific Energy Alaska Holdings, Inc.

Debtor

Case No. 09-10787

Reporting Period:_May 200_

BALANCE SHEET. continuation sheet

Other Current Assets Iniereomoaiiv Receivables Derivative Assels Advances

Other Reci vables

ASSETS

S

BOOK VALUE

AT EN

OF

CURNT REORTING MONTH

50,355.273

-

Total Other Current Assets O!her Assets Investnienis-PEAO Invesiments-CIPL Total Other Assets

S

S

50,355,273

-

11,522.816 i 1,522,816

FOR~l MOii.) Co.Yr'D

iO~7)

Iii re: Pacific Energy Alaska Holdings. lne. Debtor

Case No. 09-10787 Reporting Period:_May 2009

STA TUS OF POSTPETITION TAXES

Beginning Tax

Antount

Withheld or

Federa

Wilhholding

FICA. Employee

Liabilty

I

Accrued

J

Amount Paid

I

Date Paid

I

Check No.

Ending Tax

or EFT

I

Liabilty

FICA-Employer Unemployment Income

Not Applicable

I

Total Federa Taxes State and Local

Withholding Sales Excise Unemployment

.

Real Propert

Personal Property Total Slate- and Loal

I

I I I

Not Applicable-

Total Taxes

I I

I I

I I

SUMMARY OF UNPAID POSTPETITION DEBTS

Number of

Days Past Duc

Total

I I I

Accoullls Payable

Waiies Payable

Current

I

0-30

I

31.60 61-90 Over 90

Taxes Payable

Rent/Leases-Building

Rentlses-EauiDment

Secured DebtAdequaie Protection Payments Professional Fees

Not Applicable

Total Postpeliion Debts

I I

I I

I

I

I I

FORM MOR.~

104/()

In re; Pacific Energy Alaska Holdings. Inc. Debtor

Case No. 09- 10787

Reporting Period:_May 20

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Accounts Receivable Reconciliation

Total Accounts Receivable at the beginning of

the reporting period

Amount

I

+ Amounts biled during the period - Amounts collected during the period Total Accounts Receivable at the end of the reporting period

Not Applicable

A tsR (blAj ccoun e gnJi

ece va

o - 30 days old 31 - 60 days old 61 - 90 days old 91+ days old Total Accounts Receivable Accounts Receivable (Net)

T Amount

I

Not Applicable

DEBTOR QUESTIONNAIRE

Must be completed each month

I. Hiive any assets been sold or tmnsferred ouiside the norma! cours of business

ihis rcponing period? If yes, provide an explanation below_

Yes/o

No No

2. Have any funds been disbursed from any account other than a debtor in possession

accoiintihis reponing peiiod? If yes, provide an explanation below.

3. Have all postpctiiion taii rcturns been iimely fied? If no, provide an explanation

below.

4. Are workers eoinpensation, general liabilty

N/A

Yes

and other nceessary insurance

coverages in effeei? If no, provide an explanation below.

5. Has any bank lICCOunl ben opened during the reporting period? If yes. provide

documentation identifying the opened accouni(s). If an investment account has been opened

No

provide ihe required doumeiiation pursuanlio the Delaware Local Rule 400 r .3.

FOR~ MOR-5

(0410)

Вам также может понравиться

- N/A N/A: T'DwonluisДокумент9 страницN/A N/A: T'DwonluisChapter 11 DocketsОценок пока нет

- Date (L I: 5 (Vi R-C (ÓДокумент9 страницDate (L I: 5 (Vi R-C (ÓChapter 11 DocketsОценок пока нет

- Debtor: ReturnsДокумент9 страницDebtor: ReturnsChapter 11 DocketsОценок пока нет

- Monthly Operating ReportДокумент9 страницMonthly Operating ReportChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of Delaware: MOR (041W)Документ9 страницUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsОценок пока нет

- Debtor: Unjted States Bankruptcy Court District of DelawareДокумент9 страницDebtor: Unjted States Bankruptcy Court District of DelawareChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of DelawareДокумент9 страницUnited States Bankruptcy Court District of DelawareChapter 11 DocketsОценок пока нет

- At Eli.y: I 'Foio A AebdДокумент9 страницAt Eli.y: I 'Foio A AebdChapter 11 DocketsОценок пока нет

- Mor-3 VДокумент9 страницMor-3 VChapter 11 DocketsОценок пока нет

- Documentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedДокумент9 страницDocumentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedChapter 11 DocketsОценок пока нет

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqДокумент11 страницQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsОценок пока нет

- Doeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsДокумент9 страницDoeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsChapter 11 DocketsОценок пока нет

- In Re: Petrocal Acquisition Corp.: If Is Is CompanyДокумент9 страницIn Re: Petrocal Acquisition Corp.: If Is Is CompanyChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaДокумент9 страницUnited States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaChapter 11 DocketsОценок пока нет

- Reouired Do (Ijmfn Is Form No T1iachclДокумент9 страницReouired Do (Ijmfn Is Form No T1iachclChapter 11 DocketsОценок пока нет

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyДокумент14 страницGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsОценок пока нет

- Debtor: I I I IДокумент9 страницDebtor: I I I IChapter 11 DocketsОценок пока нет

- L R L¡ V-C (Ó: Attchd Attch DДокумент9 страницL R L¡ V-C (Ó: Attchd Attch DChapter 11 DocketsОценок пока нет

- Required) Ocuments: I Na EhДокумент11 страницRequired) Ocuments: I Na EhChapter 11 DocketsОценок пока нет

- Monthly Operating ReportДокумент12 страницMonthly Operating ReportChapter 11 DocketsОценок пока нет

- N, Il ¡ /-Y¡: Requid DocumntsДокумент9 страницN, Il ¡ /-Y¡: Requid DocumntsChapter 11 DocketsОценок пока нет

- Reqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Документ9 страницReqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Chapter 11 DocketsОценок пока нет

- Monthly Operating ReportДокумент12 страницMonthly Operating ReportChapter 11 DocketsОценок пока нет

- Si ,,LL: I/l HfoДокумент9 страницSi ,,LL: I/l HfoChapter 11 DocketsОценок пока нет

- VT ¡Cfõ: Requidí) OcusДокумент9 страницVT ¡Cfõ: Requidí) OcusChapter 11 DocketsОценок пока нет

- R!Iet Qrocumnts.. Sinq: 1Hcd N/AДокумент9 страницR!Iet Qrocumnts.. Sinq: 1Hcd N/AChapter 11 DocketsОценок пока нет

- United States Bankrupt (:Y Court District of Delaware: An Is A orДокумент9 страницUnited States Bankrupt (:Y Court District of Delaware: An Is A orChapter 11 DocketsОценок пока нет

- .7 Imor 4: Ui - CH Irfd I1 ('IДокумент9 страниц.7 Imor 4: Ui - CH Irfd I1 ('IChapter 11 DocketsОценок пока нет

- 10000003278Документ16 страниц10000003278Chapter 11 DocketsОценок пока нет

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormДокумент11 страниц..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsОценок пока нет

- Status: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AДокумент9 страницStatus: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AChapter 11 DocketsОценок пока нет

- Monthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiДокумент11 страницMonthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiChapter 11 DocketsОценок пока нет

- 10000016855Документ9 страниц10000016855Chapter 11 DocketsОценок пока нет

- Requid Documnts Attched Attched: DocentДокумент9 страницRequid Documnts Attched Attched: DocentChapter 11 DocketsОценок пока нет

- R'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntДокумент9 страницR'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntChapter 11 DocketsОценок пока нет

- Doeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedДокумент11 страницDoeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedChapter 11 DocketsОценок пока нет

- Monthly Operating Report: MOR (O4fl)Документ12 страницMonthly Operating Report: MOR (O4fl)Chapter 11 DocketsОценок пока нет

- TFF-RF: O, QL O/a¡Документ11 страницTFF-RF: O, QL O/a¡Chapter 11 DocketsОценок пока нет

- Monthly Operating Report: MOR (O47)Документ11 страницMonthly Operating Report: MOR (O47)Chapter 11 DocketsОценок пока нет

- Petters Bankruptcy Monthly Operating ReportДокумент24 страницыPetters Bankruptcy Monthly Operating ReportCamdenCanaryОценок пока нет

- Mstrict of Uela Ware: Attached AttachedДокумент11 страницMstrict of Uela Ware: Attached AttachedChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент11 страницUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- This Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorДокумент2 страницыThis Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorChapter 11 DocketsОценок пока нет

- Office of The: OperatingДокумент2 страницыOffice of The: OperatingChapter 11 DocketsОценок пока нет

- C2003 006 InstructionsДокумент5 страницC2003 006 InstructionsJekBrionesОценок пока нет

- Cash and Cash EquivalentДокумент54 страницыCash and Cash EquivalentHello Kitty100% (1)

- Debtor: District of Dela WareДокумент11 страницDebtor: District of Dela WareChapter 11 DocketsОценок пока нет

- 1 The Accounting Equation Accounting Cycle Steps 1 4Документ6 страниц1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalОценок пока нет

- $"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtДокумент9 страниц$"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtChapter 11 DocketsОценок пока нет

- 01 Accounting PrinciplesДокумент27 страниц01 Accounting PrinciplesLin Xian XingОценок пока нет

- Balance sheet example: Understanding assets, liabilities, equity on financial statementsДокумент4 страницыBalance sheet example: Understanding assets, liabilities, equity on financial statementsLegogie Moses AnoghenaОценок пока нет

- January 14Документ51 страницаJanuary 14Nick ReismanОценок пока нет

- Exp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Документ12 страницExp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Chapter 11 DocketsОценок пока нет

- Eq'Ujr1'Bocljments Yjo":: CH ofДокумент12 страницEq'Ujr1'Bocljments Yjo":: CH ofChapter 11 DocketsОценок пока нет

- This Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorДокумент2 страницыThis Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorChapter 11 DocketsОценок пока нет

- Steven Meldahl Operating Report 10-31-13Документ11 страницSteven Meldahl Operating Report 10-31-13CamdenCanaryОценок пока нет

- Trial Balance, Financial Reports and StatementsДокумент19 страницTrial Balance, Financial Reports and StatementsRoselie CuencaОценок пока нет

- Office of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportДокумент2 страницыOffice of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportChapter 11 DocketsОценок пока нет

- SEC Vs MUSKДокумент23 страницыSEC Vs MUSKZerohedge100% (1)

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ69 страницAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ28 страницAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Roman Catholic Bishop of Great Falls MTДокумент57 страницRoman Catholic Bishop of Great Falls MTChapter 11 DocketsОценок пока нет

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ38 страницAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ47 страницAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Wochos V Tesla OpinionДокумент13 страницWochos V Tesla OpinionChapter 11 DocketsОценок пока нет

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumДокумент22 страницыUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsОценок пока нет

- Energy Future Interest OpinionДокумент38 страницEnergy Future Interest OpinionChapter 11 DocketsОценок пока нет

- National Bank of Anguilla DeclДокумент10 страницNational Bank of Anguilla DeclChapter 11 DocketsОценок пока нет

- Zohar 2017 ComplaintДокумент84 страницыZohar 2017 ComplaintChapter 11 DocketsОценок пока нет

- PopExpert PetitionДокумент79 страницPopExpert PetitionChapter 11 DocketsОценок пока нет

- City Sports GIft Card Claim Priority OpinionДокумент25 страницCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsОценок пока нет

- Republic Late Filed Rejection Damages OpinionДокумент13 страницRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- NQ Letter 1Документ3 страницыNQ Letter 1Chapter 11 DocketsОценок пока нет

- NQ LetterДокумент2 страницыNQ LetterChapter 11 DocketsОценок пока нет

- GT Advanced KEIP Denial OpinionДокумент24 страницыGT Advanced KEIP Denial OpinionChapter 11 DocketsОценок пока нет

- Farb PetitionДокумент12 страницFarb PetitionChapter 11 DocketsОценок пока нет

- Home JoyДокумент30 страницHome JoyChapter 11 DocketsОценок пока нет

- Zohar AnswerДокумент18 страницZohar AnswerChapter 11 DocketsОценок пока нет

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesДокумент1 страницаSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasДокумент4 страницыUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsОценок пока нет

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncДокумент5 страницDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsОценок пока нет

- Kalobios Pharmaceuticals IncДокумент81 страницаKalobios Pharmaceuticals IncChapter 11 DocketsОценок пока нет

- Quirky Auction NoticeДокумент2 страницыQuirky Auction NoticeChapter 11 DocketsОценок пока нет

- APP CredДокумент7 страницAPP CredChapter 11 DocketsОценок пока нет

- Licking River Mining Employment OpinionДокумент22 страницыLicking River Mining Employment OpinionChapter 11 DocketsОценок пока нет

- Fletcher Appeal of Disgorgement DenialДокумент21 страницаFletcher Appeal of Disgorgement DenialChapter 11 DocketsОценок пока нет

- APP ResДокумент7 страницAPP ResChapter 11 DocketsОценок пока нет

- Commodity Channel IndexДокумент45 страницCommodity Channel IndexVarlei Rezer100% (2)

- Bharat Forge LTD Investor Update FY 2003Документ12 страницBharat Forge LTD Investor Update FY 2003Mayukh SinghОценок пока нет

- Srinivas Kannan: Case Study - SASДокумент3 страницыSrinivas Kannan: Case Study - SASSrinivas Kannan100% (1)

- PFRS For SMEsДокумент13 страницPFRS For SMEsJennifer RasonabeОценок пока нет

- Year Overview 2012 FinalДокумент65 страницYear Overview 2012 FinalArjenvanLinОценок пока нет

- AP 5902 Liability Supporting NotesДокумент6 страницAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- Present Value and Future Value ProblemsДокумент6 страницPresent Value and Future Value ProblemsBhanu SharmaОценок пока нет

- Tutorial ContДокумент25 страницTutorial ContJJ Rivera75% (4)

- Problem Set 1 SolutionsДокумент5 страницProblem Set 1 SolutionsvishakhaОценок пока нет

- Words of InsuranceДокумент2 страницыWords of InsuranceVeronicaGelfgren100% (2)

- Macys CaseДокумент14 страницMacys CasePavitra0% (1)

- SIRA1H11Документ8 страницSIRA1H11Inde Pendent LkОценок пока нет

- Introduction GenpactДокумент7 страницIntroduction GenpactchoudharynehaОценок пока нет

- Kim Hoff PAR 117 JDF 1115 Separation AgreementДокумент9 страницKim Hoff PAR 117 JDF 1115 Separation AgreementlegalparaeagleОценок пока нет

- EECO - Problem Set - Annuities and PerpetuitiesДокумент10 страницEECO - Problem Set - Annuities and PerpetuitiesWebb PalangОценок пока нет

- Capital Budgeting DCFДокумент38 страницCapital Budgeting DCFNadya Rizkita100% (4)

- Analysis of Home Loan in Bassein Catholic Co-Operative Bank Ltd. (Scheduled Bank)Документ58 страницAnalysis of Home Loan in Bassein Catholic Co-Operative Bank Ltd. (Scheduled Bank)Nikhil BhaleraoОценок пока нет

- New York-Presbyterian Q2 2019 Financial StatementsДокумент57 страницNew York-Presbyterian Q2 2019 Financial StatementsJonathan LaMantia0% (1)

- Wellex Group vs. SandiganbayanДокумент3 страницыWellex Group vs. SandiganbayanKling KingОценок пока нет

- Dhirubhai Ambani'S Impact On Reliance'S Managerial Practices and Their Positive Impact On BusinessДокумент3 страницыDhirubhai Ambani'S Impact On Reliance'S Managerial Practices and Their Positive Impact On BusinessqwertyОценок пока нет

- Cba Annual Report 2018 PDFДокумент306 страницCba Annual Report 2018 PDFsrikanthОценок пока нет

- Incident Report - Mehmet Soner Calis - 800357651Документ4 страницыIncident Report - Mehmet Soner Calis - 800357651api-403222332Оценок пока нет

- Accounting Cycle (I) : Journalizing Posting and Preparing Trial BalanceДокумент17 страницAccounting Cycle (I) : Journalizing Posting and Preparing Trial BalancemansiОценок пока нет

- Applied Value Investing (Kontos, Gramm) FA2016Документ3 страницыApplied Value Investing (Kontos, Gramm) FA2016darwin12Оценок пока нет

- Cost curves and their types in economicsДокумент25 страницCost curves and their types in economicsviveksaurav1984Оценок пока нет

- Net Present Value MethodДокумент3 страницыNet Present Value MethodTawanda KurasaОценок пока нет

- CA IPCC Audit ScannerДокумент10 страницCA IPCC Audit Scannercheranjit0% (1)

- CIMA F3 Notes - Financial Strategy - Chapters 1 and 2 PDFДокумент29 страницCIMA F3 Notes - Financial Strategy - Chapters 1 and 2 PDFLuzuko Terence Nelani100% (8)

- HBLДокумент33 страницыHBLRaza0230% (1)

- Importance of Logistics in International TradeДокумент8 страницImportance of Logistics in International TradeSammir MalhotraОценок пока нет