Академический Документы

Профессиональный Документы

Культура Документы

10000016855

Загружено:

Chapter 11 DocketsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

10000016855

Загружено:

Chapter 11 DocketsАвторское право:

Доступные форматы

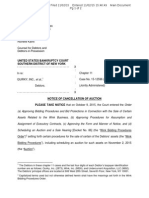

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE In re: Gotland Oil, Inc.

Debtor MONTHLY OPERATING REPORT Case No. 09-10792 Reporting Period: November2010

kO1J11ED

Schedule of Cash Receipts and Disbursements Bank Reconciliation (or copies of debtors bank reconciliations) Schedule of Professional Fees Paid Copies of bank statements Cash disbursements journals Statement of Operations Balance Sheet Status of Postpetition Taxes of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Postpetition Debts Listing of aged accounts payable Accounts Receivable Reconciliation and Aging Debtor Questionnaire

MOR-I MOR-la MOR-lb

I

/

MOR-2 MOR-3 MOR-4

V V V

/

N/A N/A MOR-4 MOR-4 MOR-5 MOR-5

/ /

V V

N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

N/A N/A N/A N/A N/A N/A N/A N N/A N/A N/A N/A N/A N/A

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

Signature of Debtor

Date

Signature of Joint Debtor

Date

SifAuthized Individual*

December 21, 2010 Date

Jennifer Kuntz Printed Name of Authorized Individual

Treasurer Title of Authorized Individual

Authonzed individual must bean officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member ifdebtor is a limited liability company.

MOR

(OO7)

In re: Gotland Oil. Inc. Debtor

Case No. 09-10792 Reporting Period: November 2010

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

II

Gotland Oil. Inc. does not maintain any cash accounts. TOTAL RECEIPTS

TOTAL DISBURSEMEN1S S

rr

THE FOLLOWING SECTION MUST BE COMPLETED

FOSMMOR- I (O4O1)

In to: Gotland Oil. inc. Debtor BANK RECONCILIATIONS Continuation Sheet for MOR-I

Case No, 09.10792 Reporting Period: November2010

FBALANCE PER BOOKS

I

BANK BALANCE

1 +)DEPOSITS

11 TN TRANSIT (ATTACH LIST)

(-)OUTSTANDING CHECKS (ATTACK LIST) ADJUSTED BANK BALANCE Adjusted bank balance must equal balance per books tj

Gotland Oil, Inc. does not maintain any cash accounts.

FORM MOe.!,

(oeu

hare: Gotland Oil, Inc. Debtor SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

Case No. 09-10792 Reporting Period: November 20l

rrJx

post-petition. No profesional fees wereiJT

FORM MOR-ib (04/07)

In re: Gotland Oil, Inc. Debtor

Case No. 09-10792 Reporting Period: November 2010 STATEMENT OF OPERATIONS

(Income Statement)

-. vn

Oil and gas production revenue Royalty payments Not Revenue

RON-

0V1rNG

Repairs and maintenance Salaries/commissions/fees Transportation expense Utilities Insurance mployee benefit programs Taxes productiou I nventory change Rent and lease expense Travel and entertainment S upplies Advertising Auto and truck Bad debt Contributions I nsider compensation Management fees/bonuses Office expenses Pensioii& profit sharing plans Taxes - payroll Taxes - real estate Taxes - other General and administrative Depreciation, depletion and amortization Net Profit (Loss) Before Other Income & Expenses Accretion of discounts and amortization of deferred financing costs

Interest expense- non-cash - paid in kind S tock compensation expense I nterest and dividends Realized gain/(loss) on derivatives

Interest expense- cash Other revenue General exploration expense Net Profit (Loss) Before Reoranization Items Professional Fees Reorganization Interest Net Profit (Loss)

$ $

FORM MOM (04/07)

In to: (lolland Oil. Debtor

IncBALANCE SHEET

Case No. 09-10792 Repotljtsg Penod: November 2010

M, 4

1

Unrestricted Ce1- and Equivalents IRes tri cted Cash and Cash Equivalents Accounts Receivable (Net) Inventories Prepaid Expenses Expenses (epiona1 Retainers I0cherCnt Assets (See Attached Schedule) TOTAL CURRENT ASSETS

400 400

S S

frepycd Properties Including lease and Well Equipment

Asset Retirement Costs Its Process Development Unproved Properties Office Equipment and Software Vehicles Other Equipment and Leasehold Improvements Pipeline Equipment Lass Acctsniulated Depreciation TOTAL PROPERTY & EU!PMENT

MIR

OTth8T4 AS8r

Other Assets (See Attached Schedule?

UTO Accounts Payable and Accrued Liabilities Taxes Payable Wages Payable Notes Payable. Deblor-in-possession financing Rent /Leases - Building/Equipment Secured Debt /Adequate Protection Payments Professional Fees Intercompany Payables Asset Relireinent Obligations Accrued Interest Other Liabilities TOTAL POSTPETITION Se=ed Debt Priority Debt Unsecured Debt Intercompany Paysbles TOTAL PRE-PETITION LIABILITIES

LIABILITIES$

} -

I

TOTAL LIABILITIES Ishure Capital IContabeted Surplus Warrants Additional Paid In Capital 1AcI1nuIated Other Comprehensive Loss !Partners Capital Account Qps Equity Account c!ined Eamin8s - Pre-Petilion Retained Earnings - Posipelition Adjustment to owner Equity (attach schedule) Postpeition Contributions (Distributions (Draws) (attach scliedale) NET SHAREHOLDERS EQUITY

S

ii)

iI

Is

$

400

$

V

400

TOThLLLB1LTE8 A N U OQ(fly..

MW

YMM Mott.)

In re: Gotland Oil, Inc. Debtor

Case No. 09-10792 Reporting Period: _Novernber 2010_

BALANCE SHEET - continuation sheet

:

Intercompany Receivables Derivative Assets Advances Other Receivables Total Other Current Assets

400

-

400

FORM MOR-3 CONID

(04)07)

In re: Gotland Oil, Inc. Debtor STATUS OF POSTPETITION TAXES

Case No. 09-10792 Reporting Period: November 2010

Withholding FICA-Employee FICA-Employer Unemployment Income Total Federal Taxes tate idc Withholding Sales Excise Unemployment Real Property Personal Property Total State and Local Total Taxes

N Not Applicable

ry

Not Applicable

SUMMARY OF UNPAID POSTPETITION DEBTS

IN

Accounts Payable Wages Payable Taxes Payable Rent/Leases-Building RcntlLeases-Eguipment Secured Debt/Adequate Protection Payments Professional Fees Total Postpetltion Debts

I

Not Applicable

FORM MOR-4 (04107)

In re: Gotland Oil, Inc. Debtor

Case No. 09-10792 Reporting Period: November 2010

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Total Accounts Receivable at the beginning of the reporting period + Amounts billed during the period - Amounts collected during the period Total Accounts Receivable at the end of the reporting period

I

Not Applicable

0-30 days old 31 - 60 days old 61- 90 days old 91+ days old Total Accounts Receivable Accounts Receivable (Net)

I

Not Applicable

I

DEBTOR QUESTIONNAIRE

1. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. 2. Have any fluids been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. 3. Have all postpetition tax returns been timely filed? If no, provide an explanation below. 4. Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. Note: We carry only fiduciary liability insurance. Company has no employees. Workers comp not requred. 5. Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3.

No

No

Yes Yes

No

FORM MOR.S (04107)

Вам также может понравиться

- Status: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AДокумент9 страницStatus: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AChapter 11 DocketsОценок пока нет

- Monthly Operating Report: MOR (O4fl)Документ12 страницMonthly Operating Report: MOR (O4fl)Chapter 11 DocketsОценок пока нет

- .7 Imor 4: Ui - CH Irfd I1 ('IДокумент9 страниц.7 Imor 4: Ui - CH Irfd I1 ('IChapter 11 DocketsОценок пока нет

- Debtor: Unjted States Bankruptcy Court District of DelawareДокумент9 страницDebtor: Unjted States Bankruptcy Court District of DelawareChapter 11 DocketsОценок пока нет

- R'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntДокумент9 страницR'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntChapter 11 DocketsОценок пока нет

- In Re: Petrocal Acquisition Corp.: If Is Is CompanyДокумент9 страницIn Re: Petrocal Acquisition Corp.: If Is Is CompanyChapter 11 DocketsОценок пока нет

- R!Iet Qrocumnts.. Sinq: 1Hcd N/AДокумент9 страницR!Iet Qrocumnts.. Sinq: 1Hcd N/AChapter 11 DocketsОценок пока нет

- Debtor: I I I IДокумент9 страницDebtor: I I I IChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of DelawareДокумент9 страницUnited States Bankruptcy Court District of DelawareChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of Delaware: MOR (041W)Документ9 страницUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsОценок пока нет

- United States Bankrupt (:Y Court District of Delaware: An Is A orДокумент9 страницUnited States Bankrupt (:Y Court District of Delaware: An Is A orChapter 11 DocketsОценок пока нет

- Monthly Operating ReportДокумент9 страницMonthly Operating ReportChapter 11 DocketsОценок пока нет

- N/A N/A: T'DwonluisДокумент9 страницN/A N/A: T'DwonluisChapter 11 DocketsОценок пока нет

- Monthly Operating ReportДокумент12 страницMonthly Operating ReportChapter 11 DocketsОценок пока нет

- Doeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsДокумент9 страницDoeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsChapter 11 DocketsОценок пока нет

- Debtor: ReturnsДокумент9 страницDebtor: ReturnsChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaДокумент9 страницUnited States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaChapter 11 DocketsОценок пока нет

- Reqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Документ9 страницReqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Chapter 11 DocketsОценок пока нет

- At Eli.y: I 'Foio A AebdДокумент9 страницAt Eli.y: I 'Foio A AebdChapter 11 DocketsОценок пока нет

- Documentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedДокумент9 страницDocumentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedChapter 11 DocketsОценок пока нет

- Mor-3 VДокумент9 страницMor-3 VChapter 11 DocketsОценок пока нет

- Monthly Operating ReportДокумент12 страницMonthly Operating ReportChapter 11 DocketsОценок пока нет

- Requid Documnts Attched Attched: DocentДокумент9 страницRequid Documnts Attched Attched: DocentChapter 11 DocketsОценок пока нет

- Reouired Do (Ijmfn Is Form No T1iachclДокумент9 страницReouired Do (Ijmfn Is Form No T1iachclChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Документ9 страницUnited States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Chapter 11 DocketsОценок пока нет

- Required) Ocuments: I Na EhДокумент11 страницRequired) Ocuments: I Na EhChapter 11 DocketsОценок пока нет

- Date (L I: 5 (Vi R-C (ÓДокумент9 страницDate (L I: 5 (Vi R-C (ÓChapter 11 DocketsОценок пока нет

- Si ,,LL: I/l HfoДокумент9 страницSi ,,LL: I/l HfoChapter 11 DocketsОценок пока нет

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqДокумент11 страницQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsОценок пока нет

- 'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Документ12 страниц'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Chapter 11 DocketsОценок пока нет

- VT ¡Cfõ: Requidí) OcusДокумент9 страницVT ¡Cfõ: Requidí) OcusChapter 11 DocketsОценок пока нет

- N, Il ¡ /-Y¡: Requid DocumntsДокумент9 страницN, Il ¡ /-Y¡: Requid DocumntsChapter 11 DocketsОценок пока нет

- Exp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Документ12 страницExp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Chapter 11 DocketsОценок пока нет

- Accoun1 SpaceДокумент25 страницAccoun1 SpacePerlas Flordeliza100% (1)

- Eq'Ujr1'Bocljments Yjo":: CH ofДокумент12 страницEq'Ujr1'Bocljments Yjo":: CH ofChapter 11 DocketsОценок пока нет

- L R L¡ V-C (Ó: Attchd Attch DДокумент9 страницL R L¡ V-C (Ó: Attchd Attch DChapter 11 DocketsОценок пока нет

- I) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedДокумент12 страницI) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedChapter 11 DocketsОценок пока нет

- U.S. Government Standard General Ledger Chart of Accounts: Fiscal Year 2012 Reporting Supplement Section IДокумент22 страницыU.S. Government Standard General Ledger Chart of Accounts: Fiscal Year 2012 Reporting Supplement Section IMirela LeonteОценок пока нет

- Office of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportДокумент2 страницыOffice of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportChapter 11 DocketsОценок пока нет

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyДокумент14 страницGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsОценок пока нет

- Balance Sheet As Per New Schedule ViДокумент11 страницBalance Sheet As Per New Schedule ViVelayudham ThiyagarajanОценок пока нет

- ./ N/a ./ N/aДокумент9 страниц./ N/a ./ N/aChapter 11 DocketsОценок пока нет

- Pac Ver Finalans KeyДокумент10 страницPac Ver Finalans KeyArun LalОценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент11 страницUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- 6018 P3 Lembar Jawaban Kosong AkuntansiДокумент54 страницы6018 P3 Lembar Jawaban Kosong AkuntansiEvanya Rachma OctavyaОценок пока нет

- Petters Bankruptcy Monthly Operating ReportДокумент24 страницыPetters Bankruptcy Monthly Operating ReportCamdenCanaryОценок пока нет

- Accounting in Kazakhstan (Draft)Документ67 страницAccounting in Kazakhstan (Draft)PREMIER ICT CONSULTING (PICTC)Оценок пока нет

- $"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtДокумент9 страниц$"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtChapter 11 DocketsОценок пока нет

- Monthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiДокумент11 страницMonthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiChapter 11 DocketsОценок пока нет

- DRRAДокумент2 страницыDRRAShahaan ZulfiqarОценок пока нет

- Reporting: DebtorДокумент15 страницReporting: DebtorChapter 11 DocketsОценок пока нет

- Chart of Accounts and Budgetary AccountsДокумент27 страницChart of Accounts and Budgetary AccountsErika MonisОценок пока нет

- Ding of Accounting Standards 1-15Документ25 страницDing of Accounting Standards 1-15Moeen MakОценок пока нет

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormДокумент11 страниц..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsОценок пока нет

- Chapter 2 Homework Template (Fixed)Документ15 страницChapter 2 Homework Template (Fixed)chanyoung4951100% (1)

- Financial StatementsДокумент20 страницFinancial StatementsOmnath Bihari100% (1)

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BДокумент5 страницThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburОценок пока нет

- Monthly Operating Report: N/A N/AДокумент12 страницMonthly Operating Report: N/A N/AChapter 11 DocketsОценок пока нет

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ28 страницAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Zohar 2017 ComplaintДокумент84 страницыZohar 2017 ComplaintChapter 11 DocketsОценок пока нет

- SEC Vs MUSKДокумент23 страницыSEC Vs MUSKZerohedge100% (1)

- Wochos V Tesla OpinionДокумент13 страницWochos V Tesla OpinionChapter 11 DocketsОценок пока нет

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ47 страницAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Energy Future Interest OpinionДокумент38 страницEnergy Future Interest OpinionChapter 11 DocketsОценок пока нет

- PopExpert PetitionДокумент79 страницPopExpert PetitionChapter 11 DocketsОценок пока нет

- National Bank of Anguilla DeclДокумент10 страницNational Bank of Anguilla DeclChapter 11 DocketsОценок пока нет

- NQ LetterДокумент2 страницыNQ LetterChapter 11 DocketsОценок пока нет

- Kalobios Pharmaceuticals IncДокумент81 страницаKalobios Pharmaceuticals IncChapter 11 DocketsОценок пока нет

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncДокумент5 страницDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsОценок пока нет

- Quirky Auction NoticeДокумент2 страницыQuirky Auction NoticeChapter 11 DocketsОценок пока нет

- Home JoyДокумент30 страницHome JoyChapter 11 DocketsОценок пока нет

- Zohar AnswerДокумент18 страницZohar AnswerChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasДокумент4 страницыUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsОценок пока нет

- TikTok SlidesДокумент17 страницTikTok SlidesCelebiОценок пока нет

- DrillsДокумент4 страницыDrillsKRISTINA DENISSE SAN JOSEОценок пока нет

- Business Development Manager UBMДокумент2 страницыBusiness Development Manager UBMLiz StanleyОценок пока нет

- ICE # 4 - WebДокумент12 страницICE # 4 - WebLauren KlaassenОценок пока нет

- SAP Help - bpc10 PDFДокумент102 страницыSAP Help - bpc10 PDFcooldude_ricoОценок пока нет

- USA Eco ProjectДокумент18 страницUSA Eco ProjectAnubhav GaurОценок пока нет

- IIF Addressing Priority Issues in Cross Border Resolution May 2011Документ63 страницыIIF Addressing Priority Issues in Cross Border Resolution May 2011feaoceОценок пока нет

- EY Optimize Network Opex and CapexДокумент12 страницEY Optimize Network Opex and Capexjhgkuugs100% (1)

- 413 Marketing of ServicesДокумент94 страницы413 Marketing of ServicesAishwarya ChauhanОценок пока нет

- Module 3B - ACCCOB2 - Receivables - PPT FHVДокумент46 страницModule 3B - ACCCOB2 - Receivables - PPT FHVCale Robert RascoОценок пока нет

- Nature and Development of EntrepreneurshipДокумент5 страницNature and Development of Entrepreneurshiprakeshmachhi50% (8)

- Naftogaz: Breach of Covenant & Debt Restructuring?Документ5 страницNaftogaz: Breach of Covenant & Debt Restructuring?Alex VedenОценок пока нет

- Dmart JPMorganДокумент50 страницDmart JPMorganRavi KiranОценок пока нет

- Sri Lanka Real Estate Market Brief Jan 2012 (Softcopy)Документ10 страницSri Lanka Real Estate Market Brief Jan 2012 (Softcopy)nerox87Оценок пока нет

- DE1734859 Central Maharashtra Feb'18Документ39 страницDE1734859 Central Maharashtra Feb'18Adesh NaharОценок пока нет

- Meridium APM Now: Questions?Документ2 страницыMeridium APM Now: Questions?SANDRA TORRESОценок пока нет

- Nama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Документ5 страницNama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Putri NabilahОценок пока нет

- Cashflow and Fund FlowДокумент17 страницCashflow and Fund FlowHarking Castro ReyesОценок пока нет

- Chapter-01 An Overview of Corporate Finance NotesДокумент19 страницChapter-01 An Overview of Corporate Finance NotesShuvo ExceptionОценок пока нет

- The Power of Momentum, Divergence & ConvergenceДокумент13 страницThe Power of Momentum, Divergence & ConvergenceCandra100% (2)

- Five Minute InvestingДокумент68 страницFive Minute InvestingRajiv GandhiОценок пока нет

- Pure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECДокумент25 страницPure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECBob ReeceОценок пока нет

- Lecture 3 Overview of Bond Sectors and InstrumentsДокумент98 страницLecture 3 Overview of Bond Sectors and InstrumentsAsadОценок пока нет

- Admas University: Answer SheetДокумент6 страницAdmas University: Answer SheetSamuel100% (2)

- Accounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFДокумент67 страницAccounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (17)

- Case Study On National BankДокумент12 страницCase Study On National BankMasuk HasanОценок пока нет

- Fintech in IndiaДокумент56 страницFintech in Indiansrivastav1100% (1)

- The Mile Gully To Greenvale RoadДокумент32 страницыThe Mile Gully To Greenvale RoadShane KingОценок пока нет

- Bora AmusementДокумент69 страницBora Amusementabere100% (2)

- Aileron Market Balance: Special Reference Issue: Money ManagementДокумент10 страницAileron Market Balance: Special Reference Issue: Money ManagementDan ShyОценок пока нет