Академический Документы

Профессиональный Документы

Культура Документы

10000026971

Загружено:

Chapter 11 DocketsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

10000026971

Загружено:

Chapter 11 DocketsАвторское право:

Доступные форматы

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION,

et al., ) ) Debtors. ) ) ) ) __________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

CORRECTED LIMITED OBJECTION TO DEBTORS MOTION FOR THE ENTRY OF ORDERS APPROVING BIDDING PROCEDURES, SALE OF CERTAIN OF THE ASSETS OF THE DEBTORS INTERIORS PLASTICS GROUP FREE AND CLEAR OF LIENS, CLAIMS, ENCUMBRANCES AND INTERESTS AND RELATED RELIEF The Travelers Indemnity Company and St. Paul Surplus Lines Insurance Company (collectively, Travelers), by their undersigned attorneys, object to the Debtors Motion for the Entry of Orders Approving Bidding Procedures, Sale of Certain of the Assets of the Debtors Interiors Plastics Group Free and Clear of Liens, Claims, Encumbrances and Interests and Related Relief filed as of April 2, 2007 (the Sale Motion) by Collins & Aikman Corporation and its various co-debtors (collectively, the Debtors) and states as follows: INTRODUCTION 1. Travelers objects on a limited basis to the Sale Motion because the Debtors seek

entry of an order that both implicitly and explicitly provides for an assignment of rights under certain insurance contracts issued by Travelers, which may impose greater obligations on Travelers than those contracts or applicable law allow. Because such an assignment is prohibited by applicable law and Travelers insurance contracts, the Court should not approve proposed sale. Alternatively, the Court should make clear in any Sale Order that it has not prejudged or

0W[;'%.

0555927070514000000000034

Bl

made any determination regarding the effectiveness or validity of any assignment of rights under Travelers insurance contracts.1 BACKGROUND 2. The Debtors propose to sell certain assets which make up substantially all of the

Debtors Interiors Plastics Group. As set forth above, the proposed Asset Purchase Agreement calls for the sale and assignment of certain rights under insurance policies under which one or more of the Debtors may claim a right to coverage. 3. Specifically, the Sale Motion requests, inter alia, entry of: (B) an order, substantially in the form of Exhibit B, (the Sale Order) (i) authorizing and approving the asset purchase agreement, substantially in the form of Exhibit C, (the Asset Purchase Agreement) or such other form of purchase agreement between the Debtors and the successful bidder at the auction, (ii) authorizing and approving the sale of certain of the assets of the Interiors Plastics Group subject to such agreement free and clear of all liens, claims, encumbrances and other interests, (iii) authorizing and approving the assumption and assignment of certain executory contracts and unexpired leases and (iv) granting certain related relief. The proposed Asset Purchase Agreement purports (impermissibly for the reasons set forth below) to assign certain interests in the certain scheduled insurance contracts,2 including: (xxi) (A) all rights to proceeds under insurance policies (other than those arising under an executory contract or unexpired lease that is not an Assumed Agreement and any proceeds or insurance policies covering directors and officer liability) which relate to claims either (1) based on events or circumstances related to the Business or Purchased Assets which events or circumstances occurred prior to the Closing, or (2) for products liability for any parts produced by Sellers or their Affiliates prior to Closing, in each case to the All capitalized terms not otherwise defined shall have the meanings set forth in the Sales Procedure Motion. The Asset Purchase Agreement attached to the Sales Procedure Motion does not include the proposed schedule of insurance contracts. See discussion at 4 infra.

2 1

-2-

extent such proceeds relate to damages for which Purchaser is liable whether by judgment, settlement, compromise or otherwise, or costs, incurred by Purchaser, and (B) rights to make and pursue claims under such insurance See Asset Purchase Agreement, Ex. C to Sale Motion, at 2.1(a) (xxi). In addition, the proposed Sale Order approving the sale purports to validate any such transfer of insurance rights. It provides that: The transfer of each of the Purchased Assets to the Purchaser will be as of the Closing Date a legal, valid and effective transfer of such assets, and vests, or will vest, the Purchaser with all right, title and interest of the Debtors to the Purchased Assets free and clear of all Liens accruing, arising or relating to any time prior to the Closing Date, except for any Permitted Exceptions and Assumed Liabilities under the Asset Purchase Agreement. Proposed Order, Ex. B. to Sale Motion, at p. 7, T. 4. Travelers issued a number of insurance policies under which one or more of the

Debtors may claim a right to coverage (Travelers Policies). It is unclear which of these policies will be included on Schedule 5.19 of the Asset Purchase Agreement, because Debtors did not include Schedule 5.19 with the Sale Motion when it was originally filed. Despite repeated requests, the Debtors have still not filed or provided Schedule 5.19 to Travelers. Thus, at this point, Travelers has been left to assume that all of the Travelers Policies will be subject to the purported transfer of rights described above. 5. Among the Travelers Policies are certain primary general liability insurance

policies issued between 1975 and 1979. Each of these policies was issued by Travelers and delivered to the named insured in California. As is typical of policies of this sort, each contains a provision barring assignment. For example, Travelers Policy No. TL-N8L-133T700-1-75,

-3-

provides that: Assignment of interest under this policy shall not bind the company until its consent is endorsed hereon. See declaration of George R. Calhoun.3 6. More than one entity claims coverage under the Travelers Policies. For example,

the Debtors pending disclosure statement concerning the Plan [Docket No. 4160] (the Disclosure Statement) discloses the following: . . . the Debtors agreed to give Wickes [I]nc. access to their general liability insurance policies referenced above to cover [certain asbestos-related] liabilities. Wickes, Inc. filed a voluntary petition for reorganization under chapter 11 of the Bankruptcy Code in early 2004. As of the filing date in that case, there were approximately 4,000 claims pending against Wickes Inc. Disclosure Statement, art III(I)(8). The Wickes chapter 11 proceedings remain pending in the United States Bankruptcy Court for the Northern District of Illinois under Case No. 04 B 02221. The automatic stay in that case has not been modified to permit the proposed assignment of insurance policies in which Wickes asserts an interest. See 11 U.S.C. 362(a)(3) (staying any act to obtain possession of property of the estate or of property from the estate or to exercise control over property of the estate.). 7. In addition, while the proposed sale order purports to give rights under the various

insurance policies to the purchaser, the pending plan of reorganization in this case [Docket No. 4162] (the Plan) provides that tort claims against the Debtors estates will be treated through available recoveries, if any, from applicable insurance policies. See Plan, art. IV.

ARGUMENT 8. The Debtors seek approval of an Asset Purchase Agreement which purports to

assign certain rights under insurance policies. Assignment of insurance rights is often a hotly contested issue, and there are numerous published decisions dealing with this issue. Ordinarily,

3

The other Travelers Policies contain similar, if not identical, provisions.

-4-

the mere execution of a contract containing a purported assignment even if part of a courtapproved sale does not determine whether such an assignment is valid and effective. Indeed, as discussed below, unless the affected insurer consents, an assignment is not valid and effective. Here, however, the Debtors also ask the Court to pre-judge this hotly contested issue without an evidentiary record. Fortunately, the Court need not determine whether the proposed assignment is valid in order to approve the sale. 9. A provision prohibiting assignment of interests under the contract without insurer

consent is a common feature in insurance policies. Such provisions are generally considered valid and enforceable due to the personal nature of an insurance contract. See Couch on Insurance 35:5-7 (3d ed. 2004); 2A-70 Appleman on Insurance 1193 (2005). Courts will uphold anti-assignment provisions as a bargained-for right of the insurer, designed to protect a insurer from exposure to risks that it did not undertake to assume in the insurance contract. See Couch on Insurance 35:3 (The object [is] to prevent an increase of risk and hazard of loss by a change of ownership without the knowledge of the insurer). 10. Michigan and California law both recognize the validity of contractual provisions

against assignment of contracts, including provisions such as those contained in the Travelers Policies.4 See Employers Mut. Liab. Ins. Co. v. Mich. Mut. Auto. Ins. Co., 101 Mich.App. 697, 702, 300 N.W.2d 682 (1980) (holding that an assignment in violation of an anti-assignment clause voided coverage under the policy); Edwards v. Concord Dev. Corp., No. 174487, 1996 WL 33358104, at *1-2 (Mich.Ct.App. Sept.17, 1996) (per curiam) (concluding that an assignment by the insured without the insurer's written consent as required by the policy was not The Travelers Policies appear to have been issued in California, and thus California law is likely to apply. Based on the information currently known, and because California and Michigan law do not differ for the purposes of this objection, a choice of law analysis is not required.

4

-5-

binding upon the insurer); Century Indem. Co. v. Aero-Motive Co., 318 F.Supp.2d 530, 537 (W.D. Mich. 2003), affd per curiam, 155 Fed. Appx. 833 (6th Cir. 2005); Henkel Corp. v. Hartford Accident and Indemnity Co., 29 Cal.4th 934, 129 Cal.Rptr.2d 828, 62 P.3d 69 (2003). 11. The prohibition on assignment is binding even in circumstances where an asset

sale may arguably give rise to successor liability claims: An insured-insurer relationship is a matter of contract. Successor liability is a matter of tort duty and liability. It is one thing to deem the successor corporation liable for the predecessor's torts; it is quite another to deem the successor corporation a party to insurance contracts it never signed, and for which it never paid a premium, and to deem the insurer to be in a contractual relationship with a stranger. Century Indem. Co. v. Aero-Motive Co., supra, 318 F.Supp.2d at 537, quoting General Accident Insurance Co. of America v. Superior Court, 55 Cal.App.4th 1444 (1997). 12. The Debtors or prospective purchaser may take a different position. Although

Travelers contends that no assignment is ever valid without its consent, some courts have allowed limited assignments when all that is being assigned are rights with respect to a loss that has already occurred. See, e.g, Action Auto Stores, Inc. v. United Capitol Ins. Co., 845 F.Supp. 417, 423 (W.D. Mich.1993) (allowing assignment after entry of judgment). Here, however, the assignment contemplated by the Asset Purchase Agreement is not an assignment after loss. Rather, the proposed Asset Purchase Agreement provides that the purchaser will be able to make and pursue new claims against Collins & Aikmans insurers in connection with events or circumstances that occurred prior to the Closing and for any parts produced by Sellers or their Affiliates prior to Closing, regardless of whether the insurer has prior to the sale consented to a settlement or there has been a judgment after trial. Stated differently, the Debtors are assigning insurance rights related to losses that may arise in the future as a result of pre-sale conduct, rather than insurance rights relating to actual loss that occurred prior to Closing. -6-

13.

Moreover, even if the prospective purchaser were to later contend that the consent

to assignment provisions do not apply because a future claim is based on a loss that allegedly occurred prior to the purported assignment, this argument fails for the same reasons that it failed in Century Indem. Co. v. Aero-Motive Co. 14. First, the Asset Purchase Agreement purports to transfer rights in liability

insurance policies. For such policies, there is no loss until a claim has been asserted that gives rise to a duty to defend, or a settlement has been reached or a judgment entered that gives rise to a duty to indemnify, under the policies. There may be genuine issues of material fact as to whether such a loss occurred before or after the sale of Collins & Aikmans assets. The Court cannot possibly resolve such issues because the Sale Motion is entirely silent with respect to such facts. 15. Second, even if (for example) a future claimants exposure to a Collins & Aikman

product resulted in bodily injury prior to the assignment, as noted above the loss associated with the such events may not be incurred, and will not be assessed, until after the proposed asset sale. Even if the anti-assignment clause did not prohibit an assignment by the Debtors of rights under the Travelers Policies, the Debtors cannot assign rights that do not yet exist. As stated above, however, the Debtors are purporting to assign rights related to pre-sale conduct regardless of whether related loss has occurred. For that same reason, the California Supreme Court in Henkel Corp. v. Hartford Accident and Indemnity Co., supra, another factually similar case, rejected a successor corporation's argument that an assignment was effective to transfer rights under a liability policy, notwithstanding a consent-to-assignment clause. The court reasoned that at the time of the assignment, the insurers' duty to defend and indemnify had not become an accrued cause of action because the claims had not been reduced to a sum of money

-7-

due or to become due under the policy [and the insurers] had not breached any duty to defend or indemnify. 29 Cal.4th at 944, 62 P.3d at 75. 16. Third, such an assignment may expose Travelers to a risk of defending two

insureds simultaneously. As noted above, the Plan provides that tort claims against the Debtors estates will be treated through available recoveries, if any, from applicable insurance policies. See Plan, art. IV. Giving effect to the assignment without Travelers' consent would thus increase Travelers risk under the policies by forcing it to defend not only Collins & Aikman (or its Plan successor for purposes of such claims) but also the asset purchaser. Given the fact that Wickes also claims rights in at least some of the Travelers Policies (see 6 supra), depending on the nature of the claim Travelers may be obligated to represent as many as three entities. As stated in Henkel: If both assignor and assignee were to claim the right to defense, the insurer might effectively be forced to undertake the burden of defending both parties. In view of the potential for such increased burdens, it is reasonable to uphold the insurer's contractual right to accept or reject an assignment. 29 Cal.4th at 945, 62 P.3d at 75; see also Quemetco Inc., 24 Cal.App.4th at 503, 29 Cal.Rptr.2d 627 (In the instant case, both Old Quemetco and New Quemetco assert coverage under respondents' policies. Therefore, unless the consent clauses are enforced, respondents would be faced with the increased risk of having to defend two corporations.). This is exactly the situation presented here. 17. As set forth above, there is at a minimum substantial doubt as to the Debtors

ability to assign rights under the insurance policies issued by Travelers, or this Courts ability to sanction such an assignment. Accordingly, this Court should deny the Sales Motion in its current form, without prejudice to its being refiled on the basis of an Asset Purchase Agreement that does not contain the attempted transfer of insurance rights.

-8-

18.

Travelers believes that the purported assignment is unlawful. Nonetheless, if the

Court otherwise believes that the Sales Motion is appropriate, Travelers would have no objection to the Sales Motion if the Sale Order makes clear that Travelers has not consented to any such assignment, and approval of the sale does not constitute a judicial determination of the validity or efficacy of any such assignment. This can be accomplished by the inclusion in the Sale Order of the language set forth on Appendix A attached hereto. This language will effectively operate to reserve all of the parties rights as to the validity and efficacy of the assignment, and will allow the sale to go forward without wasting estate resources litigating collateral albeit important issues. CONCLUSION As set forth above, the Sale Motion seeks approval of an Asset Purchase Agreement containing an impermissible assignment of insurance rights in policies issued by Travelers. Accordingly, the Sale Motion should be denied to the extent that it seeks such relief. Alternatively, the Court should include in any Order approving a sale the language set forth on the attached Appendix A. Dated: May 14, 2007 Respectfully submitted,

PLUNKETT & COONEY, P.C. By: /s/DAVID A. LERNER 38505 Woodward Ave., Ste. 2000 Bloomfield Hills, MI 48304 (248) 901-4010 dlerner@plunkettcooney.com P44829 - and -

-9-

By: /s/ James E. Rocap, III James E. Rocap, III George R. Calhoun, V STEPTOE & JOHNSON LLP 1330 Connecticut Ave., N.W. Washington, D.C. 20036 202.429.3000 202.429.3902 (fax) jrocap@steptoe.com gcalhoun@steptoe.com Counsel for The Travelers Indemnity Company and St. Paul Surplus Lines Insurance Company

- 10 -

APPENDIX A LANGUAGE FOR INCLUSION IN PROPOSED SALE ORDER Findings: There has been no adjudication, finding, conclusion or determination as to whether the Asset Purchase Agreement or any of its terms, including without limitation Section 2.1(a), effectively operates to assign rights to, create rights in, or bestow rights on, the Purchaser under any insurance policy, or effectively operates to create obligations, or impose obligations on, any insurer under any insurance policy. No insurer has waived any objection to, or otherwise approved, acquiesced in, or consented to the Asset Purchase Agreement, including without limitation Section 2.1(a) or any other terms in the Asset Purchase Agreement relating to, or purporting to assign, transfer, create or bestow rights on the Purchaser under, any insurance policy. No insurer has consented to the assignment of any insurance policy, or any rights under any insurance policy, to the Purchaser. There has been no adjudication, finding, conclusion or determination as to whether any insurance policy provides coverage for any obligation undertaken by the Debtors under the Asset Purchase Agreement. The Debtors and the Purchaser do not intend by the Asset Purchase Agreement or any term therein, or by this Order, to amend, modify or alter the terms of any insurance policy, or to make an assignment of any insurance policy to the Purchaser. Decretal Paragraphs: 1. Nothing in this Order or in the Asset Purchase Agreement shall: a. b. operate as, or shall be deemed to operate as, an assignment, amendment, modification or alteration of any insurance policy; constitute, or be deemed to constitute, an adjudication establishing the rights or obligations of the Debtors, the Purchaser, any insurer, or any other person or entity under any insurance policy, or a construction or interpretation of any insurance policy; constitute, or be deemed to constitute, a finding, conclusion or determination as to whether the Asset Purchase Agreement or any of its terms, including without limitation Section 2.1(a), effectively operates to assign to, create in, or bestow rights on, the Purchaser under any insurance policy, or effectively operates to create obligations, or to impose obligations on, any insurer under any insurance policy;

c.

- 11 -

d.

constitute, or be deemed to constitute, a finding, conclusion or determination as to whether any insurance policy provides coverage for any obligation undertaken by the Debtors under the Purchase Agreement.

2.

No insurer has, or shall be deemed to have: a. waived any objection to, or otherwise approved, acquiesced in, or consented to the Asset Purchase Agreement, including without limitation Section 2.1(a) or any other terms in the Asset Purchase Agreement relating to, or purporting to assign, transfer, create or bestow rights on the Purchaser under, any insurance policy. consented to the assignment of any insurance policy, or any rights under any insurance policy, to the Purchaser.

b. 3.

The Debtors, the Purchaser and all insurers have effectively reserved all rights with respect to any and all disputes between or among them or anyone claiming through or under them with respect to all insurance policies. Notwithstanding anything to the contrary in this Order, the Asset Purchase Agreement, or any other document in connection with the Sale, nothing in this Order, the Asset Purchase Agreement or any related document (including any other provision that purports to be preemptory or supervening), shall in anyway operate to, or have the effect of, impairing Travelers' legal, equitable or contractual rights, if any. The rights of Travelers shall be determined under the Travelers Policies.

4.

Blmfield.06900.70293.872898-1

- 12 -

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Cooking - Sauces and Marinade RecipesДокумент96 страницCooking - Sauces and Marinade Recipesagape_1st7100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ28 страницAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Buck 1948Документ9 страницBuck 1948Carlos Mora100% (1)

- Register Environmental ImpactsДокумент7 страницRegister Environmental ImpactsArmand LiviuОценок пока нет

- Abas 3 Chapter 5Документ62 страницыAbas 3 Chapter 5GF David SalasОценок пока нет

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ38 страницAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- Psychological Aspects of Stress and Adaptation - AmolДокумент12 страницPsychological Aspects of Stress and Adaptation - Amoldanimon1984Оценок пока нет

- One Stop English - Cornish Village - Pre-IntermediateДокумент5 страницOne Stop English - Cornish Village - Pre-Intermediatec_a_tabetОценок пока нет

- ASTM D1123 Contenido Agua en Glicol PDFДокумент5 страницASTM D1123 Contenido Agua en Glicol PDFdianacalixtogОценок пока нет

- Trabeculectomy Complications: Characteristics and ManagementДокумент31 страницаTrabeculectomy Complications: Characteristics and ManagementalfarizyjefryОценок пока нет

- SEC Vs MUSKДокумент23 страницыSEC Vs MUSKZerohedge100% (1)

- NQ Letter 1Документ3 страницыNQ Letter 1Chapter 11 DocketsОценок пока нет

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ69 страницAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- NQ LetterДокумент2 страницыNQ LetterChapter 11 DocketsОценок пока нет

- Zohar 2017 ComplaintДокумент84 страницыZohar 2017 ComplaintChapter 11 DocketsОценок пока нет

- Wochos V Tesla OpinionДокумент13 страницWochos V Tesla OpinionChapter 11 DocketsОценок пока нет

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Документ47 страницAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsОценок пока нет

- City Sports GIft Card Claim Priority OpinionДокумент25 страницCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsОценок пока нет

- Republic Late Filed Rejection Damages OpinionДокумент13 страницRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- Kalobios Pharmaceuticals IncДокумент81 страницаKalobios Pharmaceuticals IncChapter 11 DocketsОценок пока нет

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumДокумент22 страницыUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsОценок пока нет

- Roman Catholic Bishop of Great Falls MTДокумент57 страницRoman Catholic Bishop of Great Falls MTChapter 11 DocketsОценок пока нет

- National Bank of Anguilla DeclДокумент10 страницNational Bank of Anguilla DeclChapter 11 DocketsОценок пока нет

- PopExpert PetitionДокумент79 страницPopExpert PetitionChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasДокумент4 страницыUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsОценок пока нет

- Energy Future Interest OpinionДокумент38 страницEnergy Future Interest OpinionChapter 11 DocketsОценок пока нет

- APP ResДокумент7 страницAPP ResChapter 11 DocketsОценок пока нет

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncДокумент5 страницDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsОценок пока нет

- Zohar AnswerДокумент18 страницZohar AnswerChapter 11 DocketsОценок пока нет

- Home JoyДокумент30 страницHome JoyChapter 11 DocketsОценок пока нет

- Quirky Auction NoticeДокумент2 страницыQuirky Auction NoticeChapter 11 DocketsОценок пока нет

- APP CredДокумент7 страницAPP CredChapter 11 DocketsОценок пока нет

- GT Advanced KEIP Denial OpinionДокумент24 страницыGT Advanced KEIP Denial OpinionChapter 11 DocketsОценок пока нет

- Farb PetitionДокумент12 страницFarb PetitionChapter 11 DocketsОценок пока нет

- Fletcher Appeal of Disgorgement DenialДокумент21 страницаFletcher Appeal of Disgorgement DenialChapter 11 DocketsОценок пока нет

- Licking River Mining Employment OpinionДокумент22 страницыLicking River Mining Employment OpinionChapter 11 DocketsОценок пока нет

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesДокумент1 страницаSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsОценок пока нет

- RC14001® & RCMS®: Your Guide To Implementing A Responsible Care® Management SystemДокумент4 страницыRC14001® & RCMS®: Your Guide To Implementing A Responsible Care® Management SystemMohammed MehranОценок пока нет

- I. Objectives:: Vicente Andaya Sr. National High SchoolДокумент3 страницыI. Objectives:: Vicente Andaya Sr. National High SchoolJosal Mariano JacintoОценок пока нет

- TDDДокумент4 страницыTDDJay VibhaniОценок пока нет

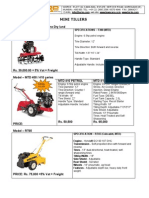

- Optimize soil preparation with a versatile mini tillerДокумент2 страницыOptimize soil preparation with a versatile mini tillerRickson Viahul Rayan C100% (1)

- Quality and Functionality of Excipients-Art (Alumnos-S) PDFДокумент14 страницQuality and Functionality of Excipients-Art (Alumnos-S) PDFLaura PerezОценок пока нет

- Advantest R3131 Spectrum Analyzer Operator ManualДокумент277 страницAdvantest R3131 Spectrum Analyzer Operator ManualMartin Argay100% (1)

- Face Port Port Retainer Nose Block HiДокумент7 страницFace Port Port Retainer Nose Block HiOzan EgemenОценок пока нет

- Betriebsanleitung Operating Instructions GLOBALlift R ATE V01R00 EN 2Документ14 страницBetriebsanleitung Operating Instructions GLOBALlift R ATE V01R00 EN 2Alexandru RizescuОценок пока нет

- Frontline ArticleДокумент7 страницFrontline Articleapi-548946265Оценок пока нет

- The Baking and Frozen Dough MarketДокумент4 страницыThe Baking and Frozen Dough MarketMilling and Grain magazineОценок пока нет

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Документ1 страницаForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamОценок пока нет

- ERAS DR - TESAR SP - AnДокумент26 страницERAS DR - TESAR SP - AnAhmad Rifai R AОценок пока нет

- Bio Exp 4Документ2 страницыBio Exp 4Yi Ling GohОценок пока нет

- D 2144 - 01 - RdixndqДокумент4 страницыD 2144 - 01 - RdixndqjayakumarОценок пока нет

- F6003 5W40 Synthetic Oil Technical Data SheetДокумент1 страницаF6003 5W40 Synthetic Oil Technical Data SheetValeriy ValkovetsОценок пока нет

- Confined Space Planning ChecklistДокумент3 страницыConfined Space Planning ChecklistKB100% (1)

- 631 500seriesvalves PDFДокумент2 страницы631 500seriesvalves PDFsaiful_tavipОценок пока нет

- Multiple Bank Accounts Registration FormДокумент2 страницыMultiple Bank Accounts Registration FormAjith JainОценок пока нет

- LENZE E84AVxCx - 8400 StateLine-HighLine-TopLine 0.25-45kW - v9-0 - ENДокумент291 страницаLENZE E84AVxCx - 8400 StateLine-HighLine-TopLine 0.25-45kW - v9-0 - ENClaudioОценок пока нет

- Ethics Zoo EssayДокумент2 страницыEthics Zoo EssayChanel SalinasОценок пока нет

- Everything You Want To Know in ChennaiДокумент428 страницEverything You Want To Know in ChennaiBalamuruganОценок пока нет

- Dasar Genetik GandumДокумент282 страницыDasar Genetik GandumAlekkyОценок пока нет