Академический Документы

Профессиональный Документы

Культура Документы

Course Outline FA

Загружено:

moon1377Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Course Outline FA

Загружено:

moon1377Авторское право:

Доступные форматы

DEPARTMENT OF MANAGEMENT SCIENCES ISLAMIA UNIVERSITY BAHAWALPUR

TITLE OF DEGREE PROGRAM :

BBA

COURSE OFFERED:

Semester 3

COURSE TITLE: COURSE INSTRUCTOR

Financial Accounting M. USMAN ARSHAD

Course Objectives and Outcomes: This course introduces the basic concepts, standards, and practices of financial reporting. It is oriented towards the user of these reports, and establishes the understanding needed to assimilate, analyze, and present relevant financial data. The course is devoted to the basic financial statements, the analysis and recording of transactions, and the underlying concepts and procedures, with an eye toward the financial statement analysis. The course begins with an overview of the procedures necessary to prepare and understand the basic financial statements. The remainder of the course examines the accounting for the most common and significant transactions of a firm, including revenue and accounts receivable, sales and inventories, longterm fixed assets, bonds and other long-term debt, and stockholders equity. How Program Content Meets The Program Objectives? Students must read the assigned readings thoroughly and are expected to come to the class fully prepared. In addition, students are required to apply themselves diligently to the course of study, and to prepare class and homework assignments as given. Regular attendance is strongly advised. Text Books: ESSENTIAL TEXT: Accounting the Basis for Business Decisions- Thirteenth Edition by Williams, Haka and Bettner Accounting the basis for business decisions 9th edition by Robert F. Meigs and Walter B. Meigs

Lectures: The medium of instruction will be English. Instructional methods will vary with each instructor. However, some suggested techniques are Quizzes and other tests with feedback and discussions; Problem Solving Lectures and class discussions; Power Point Presentations; Guests Speaker; Group Activities; Oral reports and other student presentations; Web based assignments and activities

General Rules and Procedures 1. Students unable to submit an assignment on the due date should discuss the matter in advance with the professor. At the professors discretion, late assignments may not be accepted. Where late assignments are accepted, the professor will apply a late penalty. 2. Test dates and assignment due dates are announced in class. Students are responsible for keeping track of these dates. There will be no makeup quiz, mid-term or final for any reason whatsoever. 3. Success in this course is based heavily on in-class participation and assignments, therefore; attendance and active in-class participation is essential to a students success. All in-class assignments must be completed in-class; they cannot be made up with a takehome. Failure to attend these classes will therefore result in zero in that particular assignment. Course Assessment Midterm exam Assignments, Projects Quizzes Final 30% 10% 10% 50%

What is expected of you? The course is taught using predominantly a classroom lecture format; group learning activities are strongly encouraged. Students are expected to ask for assistance through Office hours, Students are expected to take an active part in the learning process through participation in classroom discussion. Students will be expected to enhance the knowledge learned in the text by further reading, solving practical problems in forms of exercises. Students are expected to timely complete their assignments, and prepare quizzes; exams .They should be able to apply different concepts to real life problem solving.

Weeks 1

Contents Overview of Accounting, International Accounting Standards Overview of financial accounting and accounting cycle Accounting Concepts, Professional judgments, Classified Balance sheet, Income Statement, Forms of Business Organizations, Sole proprietorship, its Characteristic and, Liability Accounting for Sole Proprietorship, Partnership, General Partnership, Limited and unlimited partnership Financial Statements of Partnership Accounting for new partnership, Admission and retirement of partners, Additional investment and drawing accounts, Partnership profits and taxes, Dissolution of partnership Corporation, advantages and disadvantages of corporations, Formation of Corporation, Authorization and issuance of Capital stocks, Common stocks and preferred stocks Corporation, Shareholder Liability, Retained earnings, Accounting for Dividend, Numeric problems, Stock holders Equity statement, Stock value, Measuring Corporation Income, and Earnings per Share, Acquisition of plant assets, depreciation methods Depreciation methods, Disposal of plant assets, Intangible and natural resources Revision, Midterm exam Discussion on midterm paper, Accounting for liabilities Accounting for liabilities, Bonds, Accounting for bond payable Tax benefits of bonds, Present value of bond, Bonds issued at premium and discount, Operational lease and capital lease, Numerical Problems Accounting for Account Receivable, Allowance for and Writing off Uncollectable A/R Statement of Cash Flows, Its purpose, formats of statement of cash flows (Direct Method. Indirect Method) Formats of statement of cash flows (Direct Method, Indirect Method), Preparation of Cash flow statement Preparation of Cash flow statement, Analysis of Financial Statements Analysis of Financial Statements, Sources of information, comparative financial statements, Tools and analysis, Ratios Revision

Suggested Reading Chapter Chapter

Chapter 12

Chapter

Chapter

8 9 10

Chapter Chapter

11 12 13 14 15 16

Chapter Chapter Chapter Chapter Chapter

Вам также может понравиться

- Course Outline For Accounting 1Документ3 страницыCourse Outline For Accounting 1Ahmad Malik100% (1)

- AF5115 Jul 2014Документ3 страницыAF5115 Jul 2014AwesomeОценок пока нет

- FA MBA Quarter I SNU Course Outline 2020Документ7 страницFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajОценок пока нет

- Financial AccountingДокумент5 страницFinancial AccountingHafiz WaqasОценок пока нет

- Course Objectives & Competences To Be AcquiredДокумент2 страницыCourse Objectives & Competences To Be AcquiredHussen AbdulkadirОценок пока нет

- Course Outline Intermediate and Advanced Accounting1 Revised 2Документ5 страницCourse Outline Intermediate and Advanced Accounting1 Revised 2Amde GetuОценок пока нет

- BSBFIM501A - Manage Budgets and Financial PlansДокумент4 страницыBSBFIM501A - Manage Budgets and Financial Plansbluemind200517% (6)

- ACCT224Документ9 страницACCT224thinkstarzОценок пока нет

- Course Outline: Business 2257: Accounting and Business AnalysisДокумент9 страницCourse Outline: Business 2257: Accounting and Business AnalysistigerОценок пока нет

- Financial Accounting Applications UO Autumn 2015 FinalДокумент3 страницыFinancial Accounting Applications UO Autumn 2015 FinalGokul Kumar0% (1)

- FA - SNU - Course Outline - Monsoon 2023Документ6 страницFA - SNU - Course Outline - Monsoon 2023heycontigo186Оценок пока нет

- Financial Management (FN-550) : Course IntroductionДокумент5 страницFinancial Management (FN-550) : Course IntroductionAsadEjazButtОценок пока нет

- 2015-2016 Rotman Fact SheetДокумент114 страниц2015-2016 Rotman Fact SheetRichmond LauОценок пока нет

- Business Finance OutlineДокумент4 страницыBusiness Finance OutlineSalahuddin SultanОценок пока нет

- SFAD - Course OutlineДокумент10 страницSFAD - Course OutlineMuhammad Shariq SiddiquiОценок пока нет

- ACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Документ4 страницыACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Hohoho134Оценок пока нет

- Principles of Accounting Course OutlineДокумент4 страницыPrinciples of Accounting Course OutlinefuriousTaherОценок пока нет

- BAC306 - 05 Advanced Financial Accounting and ReportingДокумент2 страницыBAC306 - 05 Advanced Financial Accounting and ReportingldlОценок пока нет

- Accounting - Foundation Course 2023-24Документ5 страницAccounting - Foundation Course 2023-24Zoom MailОценок пока нет

- Accounting 2Документ104 страницыAccounting 2Ayo AleshОценок пока нет

- Accounting 2 Course OutlineДокумент3 страницыAccounting 2 Course OutlinejaberalislamОценок пока нет

- Financial Statement and AnalysisДокумент10 страницFinancial Statement and Analysisjiao0001Оценок пока нет

- ACC203Документ7 страницACC203waheedahmedarainОценок пока нет

- UT Dallas Syllabus For Aim6201.mbc.07f Taught by Suresh Radhakrishnan (Sradhakr)Документ11 страницUT Dallas Syllabus For Aim6201.mbc.07f Taught by Suresh Radhakrishnan (Sradhakr)UT Dallas Provost's Technology GroupОценок пока нет

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Документ7 страниц1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelОценок пока нет

- Course Guide Sem. 1 2011Документ6 страницCourse Guide Sem. 1 2011sir bookkeeperОценок пока нет

- ACCT1511 Accounting and Financial Management 1B S12015Документ16 страницACCT1511 Accounting and Financial Management 1B S12015Bob CaterwallОценок пока нет

- BAF3MI2023 Course OutlineДокумент3 страницыBAF3MI2023 Course Outlinel7627302Оценок пока нет

- ACC201 Seminar 1 - T06 - Grace KangДокумент102 страницыACC201 Seminar 1 - T06 - Grace Kang潘 家德Оценок пока нет

- Acct101 - Charmayne HighfieldДокумент5 страницAcct101 - Charmayne Highfieldrachel.mack.2022Оценок пока нет

- Advanced FA I Course OutlineДокумент4 страницыAdvanced FA I Course Outlinebekelesolomon828Оценок пока нет

- Module 1 - IntAcc1Документ7 страницModule 1 - IntAcc1kakimog738Оценок пока нет

- Mpu 3353Документ22 страницыMpu 3353herueuxОценок пока нет

- FINN 200 - Intermediate Finance-Bushra NaqviДокумент4 страницыFINN 200 - Intermediate Finance-Bushra NaqviazizlumsОценок пока нет

- Examiner's Interview: F3 - Financial Accounting: Accounting. The Examiner, Nicola Ventress, Has Provided AnswersДокумент12 страницExaminer's Interview: F3 - Financial Accounting: Accounting. The Examiner, Nicola Ventress, Has Provided AnswersNouman KhanОценок пока нет

- Agw610 Course Outline Sem 1 2013-14 PDFДокумент12 страницAgw610 Course Outline Sem 1 2013-14 PDFsamhensemОценок пока нет

- Acct 110 Ol2 - Fall 2018 - Marie ConnellyДокумент8 страницAcct 110 Ol2 - Fall 2018 - Marie Connellydocs4me_nowОценок пока нет

- ACCT 354 WinterSummer2020Документ10 страницACCT 354 WinterSummer2020Nguyen NguyenОценок пока нет

- BAT4M Course Outline 2020-2021Документ3 страницыBAT4M Course Outline 2020-2021IlamasОценок пока нет

- Principles of AccountingДокумент4 страницыPrinciples of AccountingjtopuОценок пока нет

- FIN 202 SyllabusДокумент15 страницFIN 202 SyllabusmadhuОценок пока нет

- Syllabus MK VHW (New Version) 20130211Документ5 страницSyllabus MK VHW (New Version) 20130211RyanSudiroОценок пока нет

- Eastern Samar State University Borongan City, Eastern Samar: Accounting 514 Accounting Review Part 1 (Taxation)Документ7 страницEastern Samar State University Borongan City, Eastern Samar: Accounting 514 Accounting Review Part 1 (Taxation)Peter Daniel Cinco BugtasОценок пока нет

- UoS Outline ACCT6007 SEM1 2013 ApprovedДокумент9 страницUoS Outline ACCT6007 SEM1 2013 ApprovedSweetCherrieОценок пока нет

- Outline New Financial Management by Farah YasserДокумент6 страницOutline New Financial Management by Farah YasserLaiba KhalidОценок пока нет

- ACCT 215 - Introductory Financial Accounting I: Course DescriptionДокумент5 страницACCT 215 - Introductory Financial Accounting I: Course DescriptionJayden FrosterОценок пока нет

- AC 506 R 2009Документ10 страницAC 506 R 2009lhaelieОценок пока нет

- Fin 440 Course Outline Fall 2017Документ4 страницыFin 440 Course Outline Fall 2017Tasnim Mahmud Rana 1921142630Оценок пока нет

- UoS Outline ACCT6007 SEM2 2013 ApprovedДокумент9 страницUoS Outline ACCT6007 SEM2 2013 ApprovedSweetCherrieОценок пока нет

- S2 Course OutlineДокумент19 страницS2 Course OutlineNovels4lyfОценок пока нет

- MBA-FN635 - Financial Statement Analysis-EL 5Документ7 страницMBA-FN635 - Financial Statement Analysis-EL 5Snober FarrukhОценок пока нет

- Financial Management 1st Sem 15-16 HOДокумент3 страницыFinancial Management 1st Sem 15-16 HOGopi SatyaОценок пока нет

- Course Book TAKTKTДокумент201 страницаCourse Book TAKTKTHạ MộcОценок пока нет

- ACCT2542 Corporate Financial Reporting and Analysis S22014Документ26 страницACCT2542 Corporate Financial Reporting and Analysis S22014Piyal HossainОценок пока нет

- Course Outline Cost AccountingДокумент7 страницCourse Outline Cost AccountingBilal ShahidОценок пока нет

- Retention Policy On The Accountancy Program of Rogationist College A Basis For Retention Preparedness ProgramДокумент9 страницRetention Policy On The Accountancy Program of Rogationist College A Basis For Retention Preparedness Programraymart copiarОценок пока нет

- ACCT2542 Corporate Financial Reporting and Analysis S22012 PartAДокумент16 страницACCT2542 Corporate Financial Reporting and Analysis S22012 PartAAngela AuОценок пока нет

- Steps Academics Can Take Now to Protect and Grow Their PortfoliosОт EverandSteps Academics Can Take Now to Protect and Grow Their PortfoliosОценок пока нет

- Theoretical Driving Handbook Trainee-MoroorДокумент240 страницTheoretical Driving Handbook Trainee-Moroormoon137750% (2)

- 2018 - Paci Fi C-Basin Finance Journal How Pro Fi Tability Di FF Ers Between Conventional and Islamic Banks A Dynamic Panel Data ApproaДокумент13 страниц2018 - Paci Fi C-Basin Finance Journal How Pro Fi Tability Di FF Ers Between Conventional and Islamic Banks A Dynamic Panel Data ApproaRicky KurniawanОценок пока нет

- JCR Impact Factors List 2013Документ674 страницыJCR Impact Factors List 2013Ali KhanОценок пока нет

- 456 PDFДокумент1 страница456 PDFmoon1377Оценок пока нет

- Corporate Tax Rate As A Determinant of Systematic RiskДокумент6 страницCorporate Tax Rate As A Determinant of Systematic Riskmoon1377Оценок пока нет

- Asset Prices, Exchange Rates and The Current AccountДокумент16 страницAsset Prices, Exchange Rates and The Current Accountmoon1377Оценок пока нет

- KSE100 - Market Capitalization Calculation MethodДокумент24 страницыKSE100 - Market Capitalization Calculation MethodsuhailkiyaniОценок пока нет

- Determinents of FDI in PakistanДокумент14 страницDeterminents of FDI in PakistanGhulam MujtabaОценок пока нет

- Jasoosi Digest September 2011Документ141 страницаJasoosi Digest September 2011moon1377100% (1)

- Marketing Management Concepts Yesterday and TodayДокумент6 страницMarketing Management Concepts Yesterday and Todaymoon1377Оценок пока нет

- Corporate GovernanceДокумент16 страницCorporate Governancemoon1377Оценок пока нет

- Critical Success FactorsДокумент12 страницCritical Success Factorsmoon1377Оценок пока нет

- Page 1Документ172 страницыPage 1moon1377Оценок пока нет

- Post IndustrializationДокумент3 страницыPost IndustrializationgdhssjjssjОценок пока нет

- Reasoning Question Paper With AnswerДокумент128 страницReasoning Question Paper With AnswerEduZone ClassesОценок пока нет

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Документ37 страниц(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Devanshi GoyalОценок пока нет

- Kakasuleff, Chris - Predicting Market Trends Using The Square of 9Документ4 страницыKakasuleff, Chris - Predicting Market Trends Using The Square of 9Mohamed ElAgamy100% (4)

- Measure Progress Using Working HoursДокумент3 страницыMeasure Progress Using Working HoursLaiqueShahОценок пока нет

- BlueDart PresentationДокумент26 страницBlueDart PresentationSwamiОценок пока нет

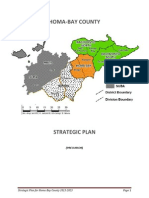

- Homabay County Draft Strategic PlanДокумент107 страницHomabay County Draft Strategic PlanCyprian Otieno Awiti86% (7)

- Running Head: Business Ethics - Week 5 Assignment 1Документ4 страницыRunning Head: Business Ethics - Week 5 Assignment 1MacNicholas 7Оценок пока нет

- Irrelevant-Potential Socio-Economic Implications of Future Climate Change and Variability For Nigerien Agriculture-A Countrywide Dynamic CGE-Microsimulation AnalysisДокумент15 страницIrrelevant-Potential Socio-Economic Implications of Future Climate Change and Variability For Nigerien Agriculture-A Countrywide Dynamic CGE-Microsimulation AnalysisWalaa MahrousОценок пока нет

- Warsh (2007) 387 Knowledge & Wealth of NationsДокумент381 страницаWarsh (2007) 387 Knowledge & Wealth of NationsFazal RahmanОценок пока нет

- Professional Photographer Bank StatementДокумент6 страницProfessional Photographer Bank StatementDhiraj Kumar PradhanОценок пока нет

- Recruitment of A StarДокумент8 страницRecruitment of A StarAshok Kumar VishnoiОценок пока нет

- Second Grading Examination - Key AnswersДокумент21 страницаSecond Grading Examination - Key AnswersAmie Jane Miranda100% (1)

- Foreign Exchange TranscationДокумент7 страницForeign Exchange TranscationBooth NathОценок пока нет

- Basic Cash Flow Management NotesДокумент125 страницBasic Cash Flow Management NotesJeam Endoma-ClzОценок пока нет

- Noise Flair BillДокумент2 страницыNoise Flair BillShrinivethika BalasubramanianОценок пока нет

- HRM Assignment 1Документ5 страницHRM Assignment 1Laddie LMОценок пока нет

- Phase 2 - 420 & 445Документ60 страницPhase 2 - 420 & 445SОценок пока нет

- Engineering Education in Leather A Case Study Dr. S. SadullaДокумент26 страницEngineering Education in Leather A Case Study Dr. S. Sadullaapi-3849090Оценок пока нет

- Civil Engineering - Challenges and OpportunitiesДокумент6 страницCivil Engineering - Challenges and OpportunitiessmwОценок пока нет

- Kgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGДокумент10 страницKgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGPradeep Kumar VaddiОценок пока нет

- Musembi 2017 Commercial BanksДокумент82 страницыMusembi 2017 Commercial Banksvenice paula navarroОценок пока нет

- Egyptian Processed Food Sector Development Strategy - ENДокумент442 страницыEgyptian Processed Food Sector Development Strategy - ENReyes Maria Kristina Victoria100% (1)

- Week 4: Sto. Tomas College of Agriculture, Sciences and TechnologyДокумент12 страницWeek 4: Sto. Tomas College of Agriculture, Sciences and TechnologyHannah Jean Lapenid LemorenasОценок пока нет

- Paper Tigers, Hidden Dragons - Chapter-1Документ35 страницPaper Tigers, Hidden Dragons - Chapter-1Daniel Chan Ka LokОценок пока нет

- Tejas UCLEntrepreneurshipДокумент4 страницыTejas UCLEntrepreneurshiprahul jainОценок пока нет

- Temporary Employment ContractДокумент2 страницыTemporary Employment ContractLancemachang Eugenio100% (2)

- 2019 CIMIC Group Annual Report - 4 February 2020Документ252 страницы2019 CIMIC Group Annual Report - 4 February 2020SAMUEL PATRICK LELIОценок пока нет

- Motorcycle To Car Ownership The Role of Road Mobility Accessibility and Income InequalityДокумент8 страницMotorcycle To Car Ownership The Role of Road Mobility Accessibility and Income Inequalitymèo blinksОценок пока нет

- Poc AdamjeeДокумент67 страницPoc AdamjeePREMIER INSTITUTEОценок пока нет