Академический Документы

Профессиональный Документы

Культура Документы

CorpFDigest 26OctRevised

Загружено:

Athena LouiseИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CorpFDigest 26OctRevised

Загружено:

Athena LouiseАвторское право:

Доступные форматы

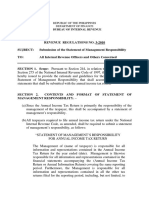

Corporation Law Finals Case Digests (Atty.

Quimson)

Bayla v. Silang Traffic Doctrine: Whether a particular contract is a subscription or a sale of stock is a matter of construction and depends upon its terms and the intention of the parties. A subscription, properly speaking, is the mutual agreement of the subscribers to take and pay for the stock of a corporation, while a purchase is an independent agreement between the individual and the corporation to buy shares of stock from it at a stipulated price. Facts: Petitioners herein entered into an agreement with Silang Traffic Co entitled Agreement for installment sale of shares in the Silang Traffic Co wherein the petitioners (denominated in the contract as subscribers) promised to pay the company P1,500 for the purchase of 15 shares of capital stock (5% down payment; and the remainder was to be paid by installments). In said agreement, the subscriber agreed that if he fails to pay any of the installment when due, the shares are to revert to the seller and the payments already made are to be forfeited in favor if the seller. Petitioners failed to pay hence, the shares automatically reverted to the Corporation. However, the Board of Directors of Silang issued a resolution, dated August 1, 1937 which released the subscriber of its capital stock from the obligation to pay for shares. In a case filed for the recovery of sum of money initiated by petitioners, it is contended by the seller corporation that the August 1, 1937 resolution was not applicable to the petitioners since according to jurisprudence, a corporation has no legal capacity to release an original subscriber to its capital stock from the obligation to pay for shares and any agreement to this effect is invalid. Furthermore, it is contended that the shares automatically reverted to the corporation, hence, the installments paid by them had already been forfeited. The trial court and court of appeals interpreted, in their decisions, that the said agreement was a contract of subscription. Issue: Whether the contract is one of subscription or a sale of stock. Whether or not the failure to pay one of the installments due gave rise to the forfeiture of the amounts already paid and the reversion of the shares to the corporation. Ratio: It seems clear from the terms of the contract in question that they are contracts of sale and NOT of subscription. The contract was entitled an agreement for installment sale of shares and while the purchaser was designated as a subscriber, the corporation was described as seller. Moreover, the agreement was entered into long after the incorporation and organization of the corporation (1927), and the price of the stock was payable in quarterly installments spread over a period of five years. A subscription to stock in an existing corporation is, as between the subscriber and the corporation, simply a contract of purchase and sale. In some particulars, the rules governing subscriptions and sales of shares are different. For instance, the provisions of the corporation law regarding calls for unpaid subscription and assessment of stock do not apply to a purchase of stock. Likewise, the rule that a corporation has no legal capacity to release an original subscriber to its capital stock from the obligation to pay for his shares, is inapplicable to a contract of purchase of shares. The contention that the shares were automatically reverted to the corporation is untenable. The contract did not expressly provide that the failure of the purchaser to pay any installment would give rise to the forfeiture and cancellation without necessity of any demand from the seller. The Civil Code, furthermore, provides that the persons obliged to deliver something or do something are not in default until the moment the creditor demands them, unless the obligation or law expressly provides that demand shall not be necessary in order that default may arise.

Erandio, Athena Louise 2A | Batch 2014 | 1

Corporation Law Finals Case Digests (Atty. Quimson)

Velasco v. Poizat Doctrine: A stock subscription is a contract between the corporation on one side, and the subscriber on the other, and courts will enforce it for or against either. It does not require an express promise to pay the amount subscribed, as the law implies a promise to pay on the part of the subscriber. A corporation has no legal capacity to release an original subscriber to its capital stock from the obligation of paying for his shares, in whole or in part. Facts: Poizat, defendant, was a stock holder in the Philippine Chemical Product (PCP) from inception of the enterprise. While serving in his capacity as treasurer and manager, he called in and collected all subscriptions to the capital stock of the company, except the 15 shares subscribed by himself and another 15 shares owned by one Infante. The company, being at the brink of insolvency, held a Board of Directors meeting and raised 2 propositions, 1) that Poizat should be required to pay the amount of his subscription for which he was still indebted to the company; and 2) Infante be released from his obligation . When Poizat was notified of this, he averred that he had been given to understand, by some members of the board of directors, that he was to be relieved from his subscription upon the terms conceded to Infante. He further stated that he preferred to lose the whole of the 25% of what he already paid than to continue investing more money in the company. The company soon went into voluntary insolvency and Velasco was named as the companys assignee. As assignee, Velasco filed a case seeking to recover from Poizat the sum of P1,500 for the subscription made by him to the corporate stock of the company. Issue: Whether or not Poizat is liable upon this subscription. Whether or not Infante and Poizat could be validly relieved from the obligations of paying their subscriptions Ratio: Poizat is liable upon his subscription. A stock subscription is a subsisting liability from the time the subscription is made, since it requires the subscriber to pay interest quarterly from that date unless he is relieved from such liability by the by-laws of the corporation. In cases of unpaid subscriptions, there are two remedies for the enforcement given to the corporation. One is the most special remedy given by the statute consisting in permitting the corporation to put up the unpaid stock for sale and dispose of it for the account of the delinquent subscriber. The other remedy is by action in court. The assignee of the insolvent corporation succeeds to all the corporate rights of action vested in the corporation prior to its insolvency. Therefore, the assignee has the same freedom to sue upon the stock subscription as the directors themselves would have had under the law. When insolvency supervenes, all unpaid subscriptions become payable on demand, and are at once recoverable in an action instituted by the assignee or receiver appointed by court. The receiver or assignee could himself proceed to collect the subscription without the necessity of any prior call whatever. In releasing Infante, the board transcended its powers and he no doubt STILL REMAINED LIABLE on such of his shares are were not taken up and paid for by other persons. The general doctrine is that the corporation has no legal capacity to release an original subscriber to its capital stock from the obligation of paying for his shares, in whole or in part. Consequently, the contention of Poizat to the effect that he understood that he was relieved upon the same terms as Infante is of no merit even if agreement to that effect had been duly proved. Trillana v. Quezon College Doctrine: If the fulfillment of the condition should depend upon the exclusive will of the debtor, the conditional obligation shall be void. If it should depend upon chance, or upon the will of a third person, the obligation shall produce all its effects in accordance with the provisions of this code Facts: Damasa Crisostomo sent a letter to the Board of Trustees of Quezon College which contained the following terms: Please enter my subscription to 200 shares of your capital stock. Enclosed herein you will find (babayaran kong lahat pagkatapos na ako ay makapang-huli ng isda) pesos as my initial payment and the balance in accordance with the rules and regulations of the Quezon College

Erandio, Athena Louise 2A | Batch 2014 | 2

Corporation Law Finals Case Digests (Atty. Quimson)

When she died, and there being no payments maid, Quezon College presented a claim before the CFI of Bulacan in her testate proceeding for the collection of the sum of P20,000. The administrator opposed said claim on the ground that the subscription was neither registered nor authorized by the SEC. Issue: Whether or not Damasa Crisostomo is liable for the stock subscription. Ratio: No. It appears that the application sent was written on a general form indicating that the applicant will enclose an amount as initial payment and will pay the balance. However, the applicant did not enclose any initial payment. She further indicated that she will pay pagkatapos na ako ay makapanghuli ng isda. There is nothing on record that will show that the College accepted the term of payment suggested by Damasa. The application was obviously in variance with the terms evidenced in the form letter. There is an absolute necessity on the part of the College to express its agreement to the offer. In the absence of the acceptance, the counter offer of Damasa had not ripened into an enforceable contract. The need for express acceptance is further strengthened by the fact that Damasa proposed to pay after she has harvested fish, a condition obviously dependent upon her sole will and therefore, facultative in nature, rendering the obligation void under the Civil Code. National Exchange v. Dexter Doctrine: A corporation has the power to accept subscriptions upon any special terms not prohibited by positive law or contrary to public policy, provided they are not such as to require the performance of acts which are beyond the powers conferred upon the corporation by its character and provided they do not constitute fraud upon other subscribers or stockholders, or upon persons who are or may become creditors of the corporation. No corporation shall issue stock or bonds except in exchange for actual cash paid to the corporation or for property actually received by it at a fair valuation equal to the par value of the stock or bonds so issued. Facts: Defendant Dexter signed a written subscription to the corporate stock of CS Salmon Co. which stated that the subscription of 300 shares of its capital stock shall be payable from the first dividends declared on any and all shares of said company owned by Dexter at the time the dividends are declared until the full amount has been paid. Pursuant to this, P15,000 was paid from dividends declared. However, beyond this, nothing has been paid and no further dividends were declared. Thus, the company initiated a case for the purpose of recovering the balance of the shares with interests and costs. Issue: Whether the stipulation contained in the subscription to the effect that the subscription is payable from the first dividends declared on the shares has the effect of relieving the subscriber from the personal liability in an action to recover the value of the shares. Ratio: No. In the Organic Act of July 1902, it has already been declared that all franchises, privileges or concessions granted under the act shall forbid the issue of stock or bonds except in exchange for actual cash or for property at a fair valuation equal to the par value of the stock or bonds so issued. Pursuant to such, the Commission inserted in the Corporation Law that no corporation shall issue stock or bonds except in exchange for actual cash to the corporation or for property actually received by it at a fair valuation equal to the par value of the stock or bonds so issued. If it is unlawful to issue otherwise than as stated, it is self evident that a stipulation such as that now under consideration, in a stock subscription, is illegal, for this stipulation obligates the subscriber to pay nothing for the shares except as dividends may accrue upon the stock. In the contingency that dividends are not paid, there is no liability at all. This is a discrimination in favor of the particular subscriber, hence unlawful. Conditions attached to subscriptions which, if valid, lessen the capital of the company, are a fraud upon the grantor of the franchise, and upon those who may become creditors of the corporation, and upon unconditional stockholders.

Erandio, Athena Louise 2A | Batch 2014 | 3

Corporation Law Finals Case Digests (Atty. Quimson)

All like are bound to pay full value in cash or its equivalent, and any attempt to discriminate in favor of one subscriber by relieving him of this liability wholly or in part is forbidden. Escano v. Filipinas Mining Doctrine: The requirement of registration of transfers of shares of stock upon the books of the corporation as a condition precedent to their validity against the corporation and third parties, is also applicable to unissued shares held by the corporation in escrow. Facts: Antonio Escano, plaintiff appellee, obtained a judgment in his favor against one Silverio Salvosa whereby the latter was ordered to transfer and deliver to Escano 116 active shares and an undetermined number of shares in escrow of the Filipinas Mining Corporation with the proviso that the escrow shares shall be transferred and delivered to the plaintiff only after they shall have been released by the company. A writ of garnishment was served by the sheriff to said corporation and on July 29, 1937, the corporation advised the sheriff that according to its books, the judgment debtor, Silverio Salvosa, was the registered owner of 1000 active shares and about 22,139 unissued shares held in escrow by the said corporation. However, it appears that after the complaint in the original case was fled , but before judgment Salvosa already sold to one Bengzon all his rights to said shares of stocks held in escrow. Subsequently, Bengzon sold and transferred said shares held in escrow to Standard Investment of the Philippines. Such sale was not noted or recorded in the books of the corporation. It is the position of the defendants herein that there should be a line drawn between the issued shares evidenced by certificates of stock and unissued shares held in escrow in that while the transfer of the former is subject to the condition that it be registered, that of the latter is not. Issue: Whether or not the issuance of the said shares of stocks held in escrow to the Standard Investment of the Philippines by virtue of the sale made by Escano then Bengzon was valid as against the attaching judgment creditor. Whether or not the attaching creditor is guilty of laches. Ratio: The issuance is invalid. There is o valid reason for treating unissued shares held in escrow differently from issued shares insofar as their sale and transfer is concerned. In both cases, there is a possibility of fictitious or fraudulent transfers. The requirement of registration is for the purpose of: 1. Enabling the corporation to know at all times who its actual stockholders are 2. Affording to the corporation an opportunity to object r refuse its consent to the transfer in case it has any claim against the stock sought to be transferred, or for any other valid reason 3. To avoid fictitious or fraudulent transfers. Moreover, it seems illogical and unreasonable to old that inactive or unissued shares still held by the corporation in escrow pending receipt of authorization from the government to issue them, may be negotiated or transferred unrestrictedly and more freely than active or issued shares evidenced by certificates of stock. Appellees are not guilty of laches. The plaintiff as execution creditor had the right to wait for the release or issuance of said shares before having the same sold at a public auction, so long as the period of 5 years within which to execute his judgment had not yet lapsed. Moreover, the judgment itself provided that the escrow shares shall be transferred only after they have been released by the company. Razon v. IAC Doctrine: For an effective transfer of shares of stock, the mode and manner of transfer as prescribed by law must be followed. It may be transferred by delivery to the transferee of the certificate properly indorsed. Title may be vested in the transferee by the delivery of the duly indorsed certificate of stock. No transfer shall be valid except as between the parties until the transfer is properly recorded in the books of the corporation. Facts: E. Razon was organized in 1962 by petitioner herein Enrique Razon for the purpose of participating in the bidding for the arrastre services in South Harbor, Manila. According to the petitioner, some incorporators withdrew from the corporation. Thus, he distributed the stocks previously placed in the names of the withdrawing

Erandio, Athena Louise 2A | Batch 2014 | 4

Corporation Law Finals Case Digests (Atty. Quimson)

incorporators to some friends, among them was the late Juan Chuidian to whom he gave 1,500 shares of stock. The shares were registered under the name of Chuidian as a nominal stockholder and with the agreement that the shares of the stock were owned and held by the petitioner (Razon) but Chuidian was given the option to buy the same. Because of this arrangement, Chuidian delivered the certificate of stock to Razon (without indorsement) and since then, Razon has been in possession of the certificate. Upon death of Chiudian, his administrator initiated a complaint which prayed that Razon be ordered to deliver the certificate of stocks back and to restrain Razon from disposing of the said shares of stock. Issue: Whether or not Chiudian is considered as the owner of the 1,500 shares of stock in the company. Ratio: Chiudian is the owner of said shares. There is no dispute in this case that the certificate is in the name of the late Chiudian. Moreover, the records show that during his lifetime, he was elected as the member of the Board of Directors. Such clearly shows that he was a stockholder of the corporation. In view of this, the petitioner must show that the same were transferred to him by proving that all the requirements of the effective transfer of shares of stock in accordance with the corporations b laws, if any, were followed. The law is clear that in order for a transfer to be effective, the certificate must be properly indorsed and that title to such certificate of stock is vested in the transferee by delivery of the duly indorsed certificate of stock. The asservation that he did not require the indorsement because of their intimate friendship cannot overcome the failure to follow the procedure required by law or the proper conduct of business even among friends. Indorsement of the certificate is a mandatory requirement of law for an effective transfer of a certificate of stock. Rural Bank of Salinas v. CA Doctrine: In transferring stock, the secretary of a corporation acts in purely ministerial capacity and does not try to decide the question of ownership. The duty of the corporation to transfer is ministerial and if it refuses to make such transaction without good cause, it may be compelled to do so by mandamus. The right of a transferee/assignee to have stocks transferred to his name is an inherent right flowing from his ownership of the stocks. Facts: Celemente Guerrero, president of Rural Bank of Salinas, executed a special power of attorney in favor of his wife granting the latter the power to sell or dispose or mortgage 473 shares of stocks of the bank registered in his name. Pursuant to said power of attorney, Melania Guerrero executed deeds of assignment covering said shares of stocks. Subsequently, she presented to the Rural Bank of Salinas the deeds of assignment for registration with a request for the transfer in the banks stock and transfer book of the 473 shares of stock so assigned, the cancellation of the stock certificates in the name of Celemente and the issuance of new stock certificates covering the transferred shares of stocks in the name of the new owners thereof. The Bank denied the request of the respondent. Melania filed an action for mandamus against the rural bank with the SEC. The bank, in its answer with counterclaim, alleged that upon the death of Clemente, the properties should first be settled and liquidated before any distribution can be effected. The SEC Hearing Officer, the SEC en banc and the CA all ruled in favor of Melania granting the writ of mandamus and directing the cancellation of the certificates and the issuance of new ones in favor of the new owners. Issue: Whether or not the respondent court erred in sustaining the SEC when it compelled by mandamus the registration of the stocks. Ratio: The court did not err. Whenever a corporation refuses to transfer and register stock in cases like the present, mandamus will lie to compel the officers of the corporation to transfer said stock in the books of the corporation. A

Erandio, Athena Louise 2A | Batch 2014 | 5

Corporation Law Finals Case Digests (Atty. Quimson)

corporation, either by its board, its by-laws, or the act of its officers cannot create restrictions in stock transfers. The right of a transferee/assignee to have stocks transferred to his name is an inherent right flowing from his ownership of the stocks. In transferring stock, the secretary of a corporation acts in purely ministerial capacity and does not try to decide the question of ownership. The duty of the corporation to transfer is ministerial and if it refuses to make such transaction without good cause, it may be compelled to do so by mandamus. For petitioner Rural Bank to refuse the registration of the transferred shares in its stock and transfer book, which duty is ministerial on its part, is to render nugatory and ineffectual the spirit and intent of Section 63 of the Corporation Code. China Banking Corporation v. CA Doctrine: The term unpaid claim refers to any unpaid claim arising from unpaid subscription and not to any indebtedness which a subscriber or stockholder may owe the corporation arising from any other transaction. Facts: Calapatia was a stockholder of Valley Golf and Country Club (VGCCI). He pledged his stock certificate to ChinaBank. Such pledge was recorded in VGCCIs corporate books. Subsequently, Calapatia obtained a loan from ChinaBank, payment of which was to be secured by the aforestated pledge agreement still existing between Calapatia and ChinaBank. Calapatia failed to pay his obligations, hence ChinaBank filed a petition for extrajudicial foreclosure. When VGCCI was informed of this, it wrote to ChinaBank and expressed its inability to accede to the request of transfer of stock since Calaptia has unsettled accounts with the club. Despite the foregoing, the public auction was held and consequently, ChinaBank was issued the corresponding certificate of sale. VGCCI sent Calapatia a notice demanding the payment of his debts to the club. Unheeded, VGCCI published in the newspaper a notice of auction sale of Calapatias stock certificates. Upon knowledge of this, Chinabank advised VGCCI that it is the new owner of the stock certificates and requested that a new certificate be issued in its name. VGCCI, however, replied that for reason of delinquency, Calapatias stock was sold at a public auction. Issue: Whether or not the said shares of stocks fall under Section 63 of the Corporation Code. Ratio: No. Section 63 does not apply. The term unpaid claim refers to any unpaid claim arising from unpaid subscription and not to any indebtedness which a subscriber or stockholder may owe the corporation arising from any other transaction. In the case at bar, the subscription for the share in question has been fully paid as evidenced by the issuance of the membership certificate. What Calapatia owed the corporation were merely monthly dues. Bitong v. CA Facts: Bitong herein initiated a derivative suit, allegedly, as a stockholder and for the benefit of Mr&Mrs Publishing (Publishing Co) to hold respondent Sps. Apostol liable for fraud, misrepresentation, disloyalty, evident bad faith, conflict of interest and mismanagement in directing the affairs of the Publishing Co. Bitong alleges that she has been the treasurer and member of the Board of Directors of the company at the time it was incorporated in 1976 to 1989 and was the registered owner of 1000 shares of stocks. On the other hand, Spouses Apostol refute the allegations of Bitong and claims that the latter is merely a holder-in-trust of JAKA shares. However, because of their strained relationship due to political differences, Biton refused to speak and became openly critical of the management of Apostol. Bitong claims that by virtue of a deed of sale, she became the registered and beneficial owner of the shares of stocks herein. Said deed was executed and recorded in July 25, 1983. Petitioner further posits that upon the recording in the books, the corporation is bound by it and is stopped to deny the fact of transfer of said shares. She alleges that even in the absence of a stock certificate, a stockholder, solely on the strength of the recording in the stock and transfer book, can exercise all the rights as a stockholder, including the right to file a derivative suit in the name of the corporation.

Erandio, Athena Louise 2A | Batch 2014 | 6

Corporation Law Finals Case Digests (Atty. Quimson)

On the other hand, Spouses Apostol herein refute the statements of petitioner and avers that she was not a stockholder at that time since the certificate of stock was only signed on March 17, 1989. Moreover, since the stock and transfer book presented as evidence was not registered with the SEC, the entries therein including the Certificate of Stock in question were fraudulent. Issue: Whether or not Bitong has personality to file this derivative suit. Ratio: No. Section 63 of the code envisions a formal certificate of stock which can be issued only upon compliance of certain requisites. 1. The certificates must be signed by the president or the vicepresident, countersigned by the secretary or assistant secretary and sealed with the seal of the corporation. 2. Delivery of the certificate (essential element of its issuance) 3. The par value, as to par value shares, or the full subscription as to no par value shares, must be first fully paid. 4. The original certificate must be surrendered where the person requesting the issuance of a certificate is a transferee from a stockholder. The certificate of stock itself is at least a prima facie evidence that it was legally issued in the absence of evidence to the contrary. Such may be rebutted. They are not conclusive even against the corporation. Parole evidence may be admitted to supply omissions in the records, explain ambiguities or show what transpired where no records were kept, or in some cases where such records were contradicted. In this case there is overwhelming evidence that despite what appears on the certificate of stock and transfer book, petitioner was not a bona fide stockholder before March 1989 or at the time the complained acts were committed to qualify her to institute a stockholders derivative suit against private respondents. There is no truth to the statement in the certificate of stock that the same was issued and signed on July 25, 1983 by its duly authorized officers specifically, the president and the corporate secretary because the actual date of signing thereof was March 17, 1989. It cannot be considered issued in contemplation of law unless signed by the president, the vice president and countersigned by the secretary or assistant secretary. Hence, the certificate has no evidentiary value for the purpose that Bitong was a stockholder since 1983 to 1989. The real party in interest herein is JAKA, not Bitong. Fua Cun v. Summers Doctrine: In the absence of a special agreement to the contrary, a subscriber for a certain number of shares of stock does not, upon payment of one half of the subscription price, become entitled to the issuance of certificates for onehalf the number of shares subscribed for. Facts: Chua Soco subscribed for 500 shares of stock of the defendant Banking Corporation at a par value of P100 per share, paying one half of the subscription price, in cash, for which a receipt was issued under the following terms: "Upon receipt of the balance of the said subscriptionduly executed certificates for said 500 shares of stock will be issued to the order of the subscriber. It is expressly understood that the total number of shares specified in this receipt is subject to sale by the China Banking Corporation for the payment of any unpaid subscriptions, should the subscriber fail to pay the whole or any part of the balance of his subscription upon 30 days notice issued by the Board of Directors." Subsequently, Chua executed a promissory note in favor of one Fua Cun for the sum of P25,000. Such note was secured with a chattel mortgage on the subject shares of stock subscribed by him who also endorsed the receipt abovementioned and delivered it to Fua Cun. Fua Cun brought the receipt to ChinaBank to inform them about the transaction but was told to await action by the Board of Directors. Meanwhile, Chua became indebted to ChinaBank in an action brought by the latter for dishonored acceptances of commercial paper. As a result of this action, the shares of stocks were attached and the receipt was seized by the sheriff. Thus, Fua Cun instituted an action contending that since Chua has already paid half of the subscription, Chua became the owner of 250

Erandio, Athena Louise 2A | Batch 2014 | 7

Corporation Law Finals Case Digests (Atty. Quimson)

shares and prayed that his lien on the shares be declared to hold priority over the claim of the defendant Banking Corporation. Issue: Whether or not payment of half of the price of the subscription entitles Chua to 250 shares, upon which shares the plaintiff holds a lien superior to that of ChinaBank. Ratio: To hold that the plaintiff is the owner of 250 shares of stock is incorrect. The plaintiff's rights consist in an equity in 500 shares and upon payment of the unpaid portion of the subscription price, he becomes entitled to the issuance of certificate for said 500 shares in his favor. In the absence of a special agreement to the contrary, a subscriber for a certain number of shares of stock does not, upon payment of one half of the subscription price, become entitled to the issuance of certificates for one-half the number of shares subscribed for. The court further held that the banking corporation does not have a lien over the shares of stocks herein attached for if banking corporations were given such lien on their own shares for the indebtedness of stockholders, the prohibition against granting loans or discounts upon the security of stock would become largely ineffective. Lao v. Lao Doctrine: A certificate of stock is the evidence of a holder's interest and status in a corporation. It is a written instrument signed by the proper officer of a corporation stating or acknowledging that the person named in the document is the owner of a designated number of shares of its stock. It is a prima facie evidence that the holder is a shareholder of a corporation. Facts: David and Jose Lao claims that they are stockholders (because they prayed that they be issued certificates and to be allowed to examine the corporation books) of PFSC (Pacific Foundry Shop Corporation) based on the General Information Sheet filed with the SEC in which they are named as such. David claims that he acquired 446 shares from his father which shares were previously purchased from Hipolito Law. On the other hand, Jose Lao claims that he acquired 33 shares from one Dionisio Lao. However, respondent denies David and Jose's claim for the reason that their names were allegedly included in the General Information sheet inadvertently. Respondent also posits that they did not acquire any shares in the corporation by any of the modes recognized by law, namely subscription, purchase or transfer. Issue: Whether or not David and Jose can be considered as stockholders based merely on the General Information Sheet filed with the SEC. Ratio: Petitioners David and Jose failed to prove that they are shareholders of PFSC. Records disclose that petitioners have no certificates of shares in their name neither is there any written document that there was a sale of the shares as claimed by the petitioners. A certificate of stock is the evidence of a holder's interest and status in a corporation. It is a written instrument signed by the proper officer of a corporation stating or acknowledging that the person named in the document is the owner of a designated number of shares of its stock. It is a prima facie evidence that the holder is a shareholder of a corporation. Absent any written document, petitioners must prove, at the very least, possession of the certificates of shares in the name of their alleged seller. They fail to prove possession. They failed to prove due delivery of the certificates of stocks of the sellers to them as provided for in Section 63 of the Corporation Code (which states that shares of stocks issued may be transferred by delivery of the certificates indorsed by the owner). In contrast, respondent was able to prove that he had in his possession the certificates of stocks of Hipolito Lao, properly endorsed to him. The mere inclusion as a shareholder of the petitioners in the General Information Sheet is insufficient proof that they are shareholders of the company. This document alone does not prove that they are shareholders of the PFSC. As between the General Information Sheet and the corporate books, it is the latter that is controlling. The burden of proof is on the petitioners herein to show that they are the shareholders of the corporation. This is so because they do not have any certificates of shares in their name. Moreover, they do not

Erandio, Athena Louise 2A | Batch 2014 | 8

Corporation Law Finals Case Digests (Atty. Quimson)

appear in the corporate books as registered shareholders. There is no written document evidencing their claimed purchase of shares. Nava v. Peers Marketing Corporation Doctrine: Without the stock certificate, which is the evidence of ownership of the stock, the assignment of corporate shares is effective only between the parties o the transaction. The delivery of the stock certificate, which represents the shares to be alienated, is essential for the protection of both the corporation and its stockholders. Facts: Teofilo Po, as an incorporator, subscribed to 80 shares of Peers Marketing Corporation (PMC). He paid 25% of the total amount of his subscription and no certificate of stock was issued to him or, for that matter, to any incorporator, subscriber or stockholder. Some time later, Po sold to Nava 20 of his shares of stocks in a deed of sale which represented that Po was the absolute owner and registered owner of said 20 shares. Nava tried to register this said shares in the corporation but he was denied registration since Po has not yet fully paid his subscription. Thus, Nava filed a mandamus action to compel corporation to register the shares under his name. In their answer, the respondent corporation pleaded the defense that no shares of stock against which a corporation holds unpaid claim are transferable in the books of the corporation. Issue: Whether or not the shares of stocks were validly transferred to Nava despite the fact that the corporation has an unpaid claim on Po's subscription and that the 20 share are not covered by any stock certificate. Ratio: There is no clear legal duty on the part of the officers of the corporation to register the shares in the name of Nava since there was no valid transfer of the share. The usual practice is for the stockholder to sign the form on the back of the stock certificate. Thereafter, it may be transferred from one person to another. Then he delivers the certificate to the secretary of the corporation so that it my be entered in the corporation's books. The certificate is then surrendered and a new one is issued to the transferee. The procedure cannot and was not followed in this case since the 20 shares in dispute are not covered by certificates of stocks. Moreover, the corporation has a claim on the said shares for the unpaid balance of Po's subscription. A stock subscription is a subsisting liability from the time the subscription is made. The subscriber is as much bound t pay his subscription as he would pay any other debt. Without the stock certificate, which is the evidence of ownership of the stock, the assignment of corporate shares is effective only between the parties o the transaction. The delivery of the stock certificate, which represents the shares to be alienated, is essential for the protection of both the corporation and its stockholders. Apodaca v. NLRC Facts: Petitioner herein was employed in respondent corporation. He was persuaded to subscribe to 1500 shares of the respondent corporation and he made an initial payment of 37,500. Thereafter, he was appointed as President and General Manager. He later resigned. Some time later, petitioner instituted with the NLRC a complaint against the respondents for the payment of his unpaid wages, cost of living allowance, balance of his gasoline, representation expenses, and bonuses. In their answer, the respondents admit that there are unpaid wages but these were applied to the unpaid balance of petitioners subscription. Petitioner now questions the set off alleging that there was no call or notice for the payment of the unpaid subscription and that accordingly, the alleged obligation is not enforceable. Issue: Whether or not the unpaid wages can be applied to the unpaid subscription of petitioner. Ratio: The unpaid subscription are not due and payable until a call is made by the corporation for payment. Private respondents herein have not presented a resolution of the board of directors of the respondent corporation calling for the payment of the unpaid

Erandio, Athena Louise 2A | Batch 2014 | 9

Corporation Law Finals Case Digests (Atty. Quimson)

subscription. It does not even appear that a notice of such call has been sent to the petitioner by the respondent corporation. The set-off was without lawful basis, if not premature. As there was no notice or call for the payment of unpaid subscription, the same is not yet due and payable. Furthermore, NLRC cannot validly set it off against the wages since set off is allowable only in cases allowable by Art. 113 of the Labor Code. PNB v. Bitulok Sawmill, Inc. Doctrine: Subscriptions to the capital of a corporation constitute a fund to which creditors have a right to look for satisfaction of their claims and that the assignee in insolvency can maintain an action upon any unpaid stock subscription in order to realize assets for the payment of its debts. A corporation has no power to release an original subscriber to its capital stock from the obligation of paying for his shares, without a valuable consideration for such release; and as against creditors a reduction of the capital stock can take place only in the manner and under the conditions prescribed by the statute or the charter of the articles of incorporation. Facts: Philippine Lumber Distributing Agency was organized upon the insistence and initiative of President Manuel Roxas who, for the purpose, called several conferences between him and the subscribers and organizers of the said corporation. He convinced the lumber producers to form a lumber cooperative and to pool their resources together in order to wrest the retail trade from aliens who were acting as middlemen in the distribution of lumber. He made it clear that such a cooperative agency would not be successful without a substantial working capital which the lumber producers could not entirely shoulder and as inducement he promised and agreed to finance the agency by making the Government invest P9.00 per peso that the members would invest therein. However, the Philippine Government did not invest the said P9.00 for every peso. The loan extended to the Philippine Lumber Distributing Agency by the PNB was not paid. Thus, the stockholders herein are asked to shoulder the loan as debtors. Issue: Whether or not the plaintiffs herein can be made to pay the balance of their subscriptions to shoulder the loan extended to PNB despite the fact that the government failed to fulfill its commitment to invest in said agency. Ratio: Yes. Subscriptions to the capital of a corporation constitute a fund to which creditors have a right to look for satisfaction of their claims and that the assignee in insolvency can maintain an action upon any unpaid stock subscription in order to realize assets for the payment of its debts. A corporation has no power to release an original subscriber to its capital stock from the obligation of paying for his shares, without a valuable consideration for such release; and as against creditors a reduction of the capital stock can take place only in the manner and under the conditions prescribed by the statute or the charter of the articles of incorporation. It would be unwarranted to ascribe to the late president the view that the payment of the stock subscriptions, as required by law, could be condoned in the event that the counterpart fund to be invested by the government would not be available. It is a well-settled that with all the vast powers lodged in the executive, he is still devoid of the prerogative of suspending the operation of any statute or any of its terms. Velasco v. Poizat Doctrine: It evidently cannot be permitted that a subscriber should escape his lawful obligation by reason of the failure of the officers of the corporation to perform their duty in making a call and when the original mode of making the call becomes impracticable, the obligation must be treated as due upon demand. When insolvency supervenes all unpaid subscriptions become at one due and enforceable. The corporation has no legal capacity to release an original subscriber to its capital stock from the obligation for paying his shares in whole or in part. Facts: Velasco, as assignee in insolvency of the Philippine Chemical Product (PCP) is seeking to recover from the defendant, Poizat, the sum of the subscription made by him to the corporate stock of the said company.

Erandio, Athena Louise 2A | Batch 2014 | 10

Corporation Law Finals Case Digests (Atty. Quimson)

The defendant subscribed for 20 shares of the stock of the company. The action was brought to recover the amount subscribed upon the remaining shares. Before the company became insolvent the board held a meeting which resolved to release one Infante from his obligations to his unpaid subscriptions. On the other hand, in the same board meeting, Poizat was required to pay the amount of his subscription and in case he should refuse to make such payment, the management of the corporation should be authorized to undertake judicial proceedings against him. Issue: Whether or not the call made by said board of directors for Poizat to pay his unpaid subscriptions is in accordance with the requirements in the Corporation Code. Ratio: Poizat is liable upon his subscription. It s a contract between the corporation and the subscriber and the courts will enforce it against either. It is a subsisting liability from the time the subscription is made since it required the subscriber to pay interests quarterly from that date unless he is relieved from such liability by the by-laws of the corporation. He is bound to pay the amount of the share subscribed by him as he would be to pay any other debt, and the right of the company to demand payment is no less incontestable. All unpaid stock subscriptions become payable on demand and are at once recoverable in an action instituted by the assignee or receiver appointed by the court. This rule had its origin in a recognition of the principle that a court of equity, having jurisdiction of the insolvency proceedings, could, if necessary, made the call itself, in its capacity as successor to the powers exercised by the board of directors of the defunct company. A court of equity may enforce payment of the stock subscriptions, although there have been no calls for them by the company. When the corporation becomes insolvent with proceedings instituted by the creditors to wind up and distribute its assets, no call or assessment is necessary before the institution of suits to collect unpaid balances on subscription. The resolution to release Infante from his obligation to pay is not valid since the corporation has no legal capacity to release an original subscriber to its capital stock from the obligation for paying his shares in whole or in part. Consequentially, Poizat's claim that he, too, is relieved in the same way as Infante is, cannot be sustained. De Silva v. Aboitiz & Co. Doctrine: There are 2 remedies for accomplishing the purpose of having the subscriber pay for unpaid subscriptions. The first and foremost remedy given by the statute consists in permitting the corporation to put up the unpaid stock for sale and dispose of it for the account of the delinquent subscriber. The other remedy is by action in court. Facts: Plaintiff subscribed for 650 shares of stock of the defendant corporation of which he paid only the total value of 200 shares. On April 22, he was notified by the secretary of the corporation of a resolution adopted by the board declaring the unpaid subscriptions to the capital stock of the corporation to have become due and payable on May 31st. If the shares shall have not been paid by then, such shares will be declared delinquent, advertised for sale at a public auction and sold on June 16th for the purpose of paying the amount of the subscription and accrued interest. Plaintiff filed a complaint with the court alleging that in the by-laws, if the shares are not paid for, it shall be paid out of the 70% of the profit obtained distributable among the stockholders in equal parts. Hence, in ordering that the unpaid subscription is due and payable and to be subsequently sold in a public auction, the corporation exceeded its authority (it, in effect, violated the operative method of paying contained in the by-laws). Issue: Whether or not the corporation exceeded its authority in declaring the subscription due and payable and to be subsequently sold a public auction if not paid. Ratio: No. There are 2 remedies for accomplishing the purpose of having the subscriber pay for unpaid subscriptions. The first and foremost remedy given by the statute consists in permitting the corporation to

Erandio, Athena Louise 2A | Batch 2014 | 11

Corporation Law Finals Case Digests (Atty. Quimson)

put up the unpaid stock for sale and dispose of it for the account of the delinquent subscriber. The other remedy is by action in court. In the instant case, the board elected to avail itself of the first of the said 2 remedies. It made use of its discretionary power granted to it by the law and declared that the plaintiff's subscription of 450 shares which have not been paid by him delinquent. It cannot be maintained that the by-laws has prescribed an operative method for the payment of the said subscriptions. It is not the sole and exclusive method for that purpose. The plaintiff has no right to prevent the board of directors from following any other method than that mentioned in the said article for the very reason that the same does not give the stockholders any right in connection with the determination of question of whether or not there should be deducted from the 70% of the profit distributable among the stockholders such amount as may be deemed fit for the payment of subscriptions due and unpaid. Pardo v. Hercules Lumber Co. and Ferrer Facts: Antonio Pardo is a stockholder in Hercules Lumber Company seeking to obtain a writ of mandamus to compel the respondents to permit him and his duly authorized agent and representative to examine the records and business transactions of the company. Pardo is being refused access to said records for the reason that the board of said company passed a resolution which provided that "the books of the company are at their disposition from the 15th to the 25th of March for examination in appropriate hours" and it is being contended that since Pardo has not availed himself of his right to inspect during mentioned dates, his right to inspection and examination is lost, at least for this year. Issue: Whether or not the corporation can validly passed aforementioned resolution. Ratio: No. It is admitted that officials in charge of a corporation may deny inspection when sought at unusual hours or under other improper conditions, but neither executive officers nor the board of directors have the power to deprive a stockholder of his right altogether. The statutory right of inspection is not affected by the adoption by the board of directors of a resolution providing for the closing of transfer books 30 days before an election. The phrase in the law which says that the "right of inspection can be exercised at reasonable hours" only means reasonable hours on business days throughout the year and NOT merely during some arbitrary period of a few days chosen by the directors. Veraguth v. Isabel Sugar Co. Doctrine: Pretexts may not be put forwards by the officers of a corporation to keep a director or shareholder from inspecting the books and minutes of the corporation and the right of inspection is not to be denied on the ground that the director or shareholder is on unfriendly terms with the officers of the corporation whose records are sought to be inspected. A director or stockholder can make copies, abstracts and memoranda of documents, books and papers as an incident to the right of inspection, but CANNOT, without an order of a court, be permitted to take the books from the office of the corporation. A director or stockholder has no absolute right to secure certified copies of the minutes of a corporation until these minutes have been written up and approved by the directors. Facts: Eugenio Veraguth was a director and stockholder of Isabela Sugar Company praying that the court require the respondent corporation and its officers to show cause why they refuse to notify the petitioner and to place at his disposal at reasonable hours, the minutes, documents and books of the corporation for his inspection as director and stockholder and to issue, upon payment of the fees certified copies of any documentation in connection with the said minutes. Prior to the filing of this case, Veraguth telegraphed the secretary of the corporation asking the latter to forwards in the shortest possible time a certified copy of the resolution of the board of directors concerning the payment of attorney's fees in a case which the corporation was involved with. The secretary made an answer by letter stating that since the minutes of the meeting has not yet been signed by the directors present, a copy could not be furnished and that as to other proceedings of the stockholders, a request should be made to the president of the

Erandio, Athena Louise 2A | Batch 2014 | 12

Corporation Law Finals Case Digests (Atty. Quimson)

Isabela Sugar Co. Furthermore, the board adopted a resolution which requires that the authority of the president of the corporation be previously obtained in case an inspection of the books and taking of copies are requested. Issue: Whether or not the resolution which requires the authority of the president before inspection and taking is required. Whether or not the certified copy of the minute should be furnished to petitioner. Ratio: No. Pretexts may not be put forward by officers of corporations to keep a director or shareholder from inspecting the books and minutes of the corporation and the right of inspection is not to be denied on the ground that the director or shareholder is unfriendly with the officers of the corporation whose records are sought to be inspected. There is no absolute right to secure certified copies of the minutes of the corporation until the same has been written up and approved by the directors. Philpotts v. Philippine Manufacturing Co. and Berry Doctrine: The right of examination into corporate affairs which is conceded to the stockholder may be exercised by the stockholder in person or by any duly authorized representative. Facts: Philpotts is a stockholder in the Philippine Manufacturing Company seeking to obtain a writ of mandamus to compel the respondents to permit him in person or by some authorized agent or attorney to inspect and examine the records of the business transacted by said company since 1918. Issue: Whether or not the right can be exercised by a proper agent or attorney of the stockholder as well as by the stockholder in person. Ratio: The right of inspection can be exercised either by himself or by any proper representative or attorney-in-fact, and either with or without the attendance of the stockholder. What a man may do in person he may do through another. The provisions of the law pertaining to the right of inspection are to be liberally construed and that said right may be exercised through any other properly authorized person. The right may be regarded as personal in the sense that only a stockholder may enjoy it but the inspection and examination may be made by another. But the rule above is not too sweeping in a sense that there are some things which a corporation may undoubtedly keep secret notwithstanding the right of inspection given by law to the stockholder (e.g. secret formulas or processes). There is however nothing in the instant case which would indicate that the petitioner is seeking to discover anything which the corporation is entitled to keep secret. Gonzales v. Philippine National Bank Doctrine: The right of inspection granted to a stockholder are the following: 1) records must be kept at the principal office of the corporation; 2) inspection must be made on business days; 3) he may demand a copy of the excerpts of the records or minutes; 4) refusal to allow such inspection shall subject the erring officer to civil and criminal liabilities. However, it is now expressly required as a condition that one requesting must not have been guilty of using improperly any information secured and that the person asking for such examination must be acting in good faith and for a legitimate purpose in making his demand. The Philippine National bank is not an ordinary corporation. Having a charter of its own, it is not governed by the Corporation Code of the Philippines. Corporations shall be governed primarily by the provisions of the special law or charter creating them or applicable to them, supplemented by the Corporation Code insofar as they are applicable. Facts: Ramon Gonzales requested the Philippine National Bank to allow him to look into the books and records of the respondent bank in order to satisfy himself as to the truth of published reports that the respondent bank has guaranteed the obligation of Southern Negros Development Corporation, that the bank is a financer of the construction of the Cebu-Mactan bridge, and the construction of a certain Sugar Mill in Iloilo. He stated that his request is for the reason that he wants to inquire into the validity of the transactions, as a stockholder of the said bank. Having been denied this request, he filed a petition for mandamus in court, which was also denied for the reason that he has an improper

Erandio, Athena Louise 2A | Batch 2014 | 13

Corporation Law Finals Case Digests (Atty. Quimson)

motive in asking for an examination of the books and records which disqualifies him to such right. Issue: Whether or not he has the right, solely as a stockholder, to an examination of the books and records of the bank. Ratio: Under the old law, BP 68, the right of inspection is granted to a stockholder. However, this has been modified under the present Corporation Code. The right of inspection granted to a stockholder are the following: 1) records must be kept at the principal office of the corporation; 2) inspection must be made on business days; 3) he may demand a copy of the excerpts of the records or minutes; 4) refusal to allow such inspection shall subject the erring officer to civil and criminal liabilities. However, it is now expressly required as a condition that one requesting must not have been guilty of using improperly any information secured and that the person asking for such examination must be acting in good faith and for a legitimate purpose in making his demand. Being so, he is disqualified from inspecting the books and records. Admittedly, he sought to be a stockholder in order to pry into the transactions entered into by the bank. His obvious purpose was to arm himself with materials which he can use against the bank for acts done by the latter when he was a total stranger to the same. Also, the Philippine National Bank is not governed by the Corporation Code since it has its own charter. According to its charter, it is not allowed to disclose information relative to the fund in its custody to any person except the President of the Philippines or the Secretary of Finance and the Board of Directors. They are only compelled to disclose when there is an order issued by a court of competent jurisdiction. The Philippine National bank is not an ordinary corporation. Having a charter of its own, it is not governed by the Corporation Code of the Philippines. Corporations shall be governed primarily by the provisions of the special law or charter creating them or applicable to them, supplemented by the Corporation Code insofar as they are applicable. Lanuza v. Court of Appeals Doctrine: The articles of incorporation has been described as one that defines the charter of the corporation and the contractual relationships between the State and the corporation, the stockholders and the State, and between the corporation and its stockholders. A stock and transfer book is not in any sense a public record and thus is not exclusive evidence of the matters and things which ordinarily are or should be written therein. It may be impeached or even contradicted by other competent evidence. Facts: PMMSi was incorporated with 770 founder's shares and 76 common shares as its initial capital stock subscription reflected in the articles of incorporation (total of 776 shares). However, private respondents herein (Nolasco et. al) registered the company's stock and transfer book for the first time recording only 33 common shares as the only issued and outstanding shared of PMMSI (contrary to the articles of incorporation). Based on the record in the transfer book, a special stockholders meeting was held where a quorum of 27 common shares were present which represented more than 2/3 of the common shares issued and outstanding, based on the record in the transfer book, not the articles of incorporation. Petitioners Lanuza thereafter filed a petition with the SEC questioning the validity of the said meeting alleging that the quorum should not be based on the transfer book records, but on the initial subscribed capital stock of 776 shares as reflected in the Articles of Incorporation. Issue: Whether or not the basis of the quorum should be the articles of incorporation and not the transfer book. Ratio: The stock and transfer book of PMMSI cannot be used as the sole basis for determining the quorum as it does not reflect the totality of shares which have been subscribed, more so when the articles of incorporation show a significantly larger amount of shares and outstanding as compared to that listed in the stock and transfer book. A quorum is based on

Erandio, Athena Louise 2A | Batch 2014 | 14

Corporation Law Finals Case Digests (Atty. Quimson)

the totality of shares which have been subscribed to and issued whether it be founder's or common shares. The articles of incorporation has been described as one that defines the charter of the corporation and the contractual relationships between the State and the corporation, the stockholders and the State, and between the corporation and its stockholders. PMMSI's articles being in compliance with the requirements of law, the contents of the articles are binding not only on the corporation, but also on the shareholders. At the time of incorporation, the corporation had 77 issued and outstanding shares. To base the shares on the transfer book, completely disregarding the articles would work injustice to the owners and successors in interest of the said shares. One who is a stockholder cannot be denied his right to vote by the corporation merely because the corporate officers failed to keep its records accurately. Associated Bank v. Court of Appeals Doctrine: Ordinarily in the merger of two or more existing corporations, one of the combining corporations survives and continues the combined business, while the rest are dissolved and all their rights, properties and liabilities are acquired by the surviving corporation. Although there is a dissolution of the absorbed corporation, there is no winding up of their affairs or liquidation of their assets because the surviving corporation automatically acquires all their rights, privileges, powers and liabilities. The merger, however, does not become effective upon the mere agreement of the constituent corporations. It is required that the approval of the SEC of the articles of merger be acquired which, in turn, must have been duly approved by a 2/3 majority of the respective stockholders of the constituent corporation. It is effective only upon the issuance of the certificate of merger. The effectivity date of the merger is crucial for determining when the merged or absorbed corporation ceases to exist and when the rights, privileges, powers and liabilities pass on to the surviving corporation. Facts: On September 16, 1975, Associated Banking Corporation and Citizens Bank merged to form just one banking corporation known as the Associated Citizens Bank. Later, it changed back its corporate name to Associated Bank by virtue of the Amended Articles of Incorporation. 2 years later, the defendant in this case executed a promissory note whereby the former undertook to pay the latter a sum of money. Said promissory note remained unpaid. Upon filing of a complaint in court, the corporation raised the special defense that the defendant's complaint states no valid cause of action since the corporation is not the proper party in interest because the promissory note was executed in favor of Citizens Bank. Issue: Whether or not the promissory note executed in favor of Citizens Bank 2 years after the merger may be enforced against the merged corporation (Associated Bank) . Ratio: Yes. The fact that the promissory note was executed after the effectivity date of the merger does not militate against the petitioner since the merger agreement clearly provides that all contracts irrespective of the date of the execution entered into in the name of Citizens Bank shall be understood as pertaining to the surviving bank. The clause was deliberately included in the agreement in order to protect the interests of the combining banks, specifically to avoid giving the merger agreement a farcical interpretation aimed at evading fulfillment of a due obligation. The reference to Citizens Bank in the note shall be construed as a reference to the Associated Bank (surviving bank) for all intents and purposes. Chinese YMCA v. Ching Doctrine: The courts cannot strip a member of a non-stock, non-profit corporation of his membership therein without cause. Otherwise, that would be an unwarranted and undue interference with the well established right of a corporation to determine its membership. Facts: Victor Ching filed an action for Mandamus against petitioners Chinese YMCA and its officers anchored on the fact that only 175 applications for membership were submitted in the Chinese YMCA's membership campaign. On the other hand, petitioners allege that 249 applications were submitted including 106 which were submitted through Ching during the campaign period. Furthermore, the Chinese YMCA avers that there was no counting and/or approval of membership applications since under the Constitution and the By-Laws of the corporation, membership applications had to be screened by its

Erandio, Athena Louise 2A | Batch 2014 | 15

Corporation Law Finals Case Digests (Atty. Quimson)

membership committee, endorsed favorable to the Board and approved by the latter by 2/3 majority vote. Chinese YMCA claims that of the 249 applications, only 174 were favorably endorsed and were subsequently approved. 75 of the applications submitted by Ching were not approved for the reason that Ching had given stop-payment orders on the checks submitted by him and some others to cover payment of the fees corresponding to these 75 applications. For this reason, the court annulled the membership campaign and declared invalid the approval by YMCA of the 174 applications and the 75 membership applications submitted by Ching (allegedly because they were filed out of time). Issue: Whether or not the nullification of the membership applications was proper. Ratio: No. No evidence could be cited by the court to rebut the well nigh conclusive documentary evidence other than the respondent's unsupported suspicion which the trial court adopted in a negative manner with its statement that "some of the applications were filed after the deadline". If there were any applications filed after the deadline, they certainly should have been positively pin-pointed and specifically annulled. What is worse is that the 175 applications which were filed within the deadline, were nullified by the questioned decision without the individuals concerned having been impleaded or heard. Thus, the appealed decision contravened the established principle that the courts cannot strip a member of a non-stock non-profit corporation of his membership without cause. Otherwise, that would be an unwarranted and undue interference with the well established right of a corporation to determine its membership. In order that membership may be acquired in a non-stock corporation, compliance with provisions of the charter, constitution or by-laws must be complied with except insofar as they are waived. The action of the board of directors approving the 174 membership application of old and new members constituting its active membership as duly processed and screened by the authorized committee must be deemed a waiver on its part of any technicality or requirement of form, since otherwise the association would be practically paralyzed and deprived of the substantial revenues from the membership dues. Lions Club International v. Amores Doctrine: The courts will not interfere with the internal affairs of an unincorporated association as to settle disputes between the members, or questions of policy, discipline, or internal government, so long as the government of the society is fairly and honestly administered in conformity with its law and the laws of the land, and not property or civil rights are invaded. Under such circumstances, the decision of the governing body or established private tribunal of the association is binding and conclusive and not subject to review or collateral attack in the courts. The general rule of non-interference in the internal affairs of association is, however, subject to exceptions but the power of review is extremely limited. The courts will exercise power to interfere in the internal affairs of an association where law and justice so require and the proceedings of the association are subject to judicial review where there is fraud, oppression or bad faith or where the action complained of is capricious, arbitrary or unjustly discriminatory. Also, the courts will usually entertain jurisdiction to grant relief in case property or civil rights are invaded, although it has also been held that the involvement of property rights does not necessarily authorize judicial intervention, in the absence of arbitrariness, fraud or collusion. Moreover, the courts will intervene where the proceedings in question are violative of the laws of the society, or the law of the land, as by depriving a person of due process of law. Facts: The principal adversaries in this controversy are respondent Josefa of the Manila Traders Lions Club and petitioner So of the Manila Centrum Lions Club (both duly organized, chartered and affiliated with Lions Club International). Josefa filed a complaint for quo warranto alleging that both Josefa and So filed their certificate of candidacy for the position of district governor for the fiscal year of 1982-1983 and the before the elections an agreement was executed between them whereby the latter withdrew his certificate of candidacy in favor of Josefa. However, news items were published conveying the idea that So had not withdrawn from the gubernatorial race. But these news items were controverted by the fact that according to the Lions Club, So, indeed, withdrew his candidacy.

Erandio, Athena Louise 2A | Batch 2014 | 16

Corporation Law Finals Case Digests (Atty. Quimson)

However, some of the members of the Council of Past District Governors arbitrarily set aside said withdrawal and proclaimed So as a qualified candidate which was objected to by some of the members present since there was no proper quorum. The complaint likewise alleged that all this time, armed men by force and intimidation prevented known leaders and followers of Josefa from entering the plenary session. Josefa alleges that So and some members of the Past District Governors continued to hold and supervise illegal election at the old site where voting and non-voting delegates and alternates were allowed to cast their votes without ballot. Issue: Whether or not the election dispute between So and Josefa for the position is justiciable. Ratio: The court finds for the petitioners and adopted the general rule that courts will not interfere with the internal affairs of an unincorporated association as to settle disputes between the members, or questions of policy, discipline, or internal government, so long as the government of the society is fairly and honestly administered in conformity with its law and the laws of the land, and not property or civil rights are invaded. Under such circumstances, the decision of the governing body or established private tribunal of the association is binding and conclusive and not subject to review or collateral attack in the courts. In accordance with the general rules as to judicial interference, the decision of an incorporated association on the question of an election to office is a matter peculiarly and exclusively to be determined by the association, and in the absence of fraud, is final and binding on the courts. The instant case falls squarely within the ambit of the rule of judicial non-intervention or non-interference. The elections in dispute, the manner by which it was conducted and the results thereof is strictly the internal affair that concerns only the association. The same is to be resolved within the organization in accordance with the constitution and by-laws which are not immoral, unreasonable, and contrary to public policy or in contravention of the laws of the land. San Juan Structural and Steel Fabricators Inc. v. Court of Appeals Doctrine: The property of the corporation is not the property of its stockholders or members and may not be sold by the stockholders or members without express authorization from the corporation's board of directors. Unless duly authorized, the treasurer, whose powers are limited, cannot bind the corporation in a sale of its assets. It is foreign to the treasurer's function, which generally has been described as to "to receive and keep the funds of the corporation and to disburse them in accordance with the authority given by hi the board or properly authorized officers." When they exceed their authority, their actions cannot bind the corporation unless it has ratified such acts or is estopped from disclaiming them. Close corporations are those whose articles of incorporation provide that: 1. All of the corporation's issued stock of all classes, exclusive of treasury shares shall be held of record by not more than a specified number of persons, not exceeding 20; 2. All of the issued stock of all classes shall be subject to one or more specified restrictions or transfer permitted by the title on close corporations; 3. The corporation shall not list in any stock exchange or make any public offering of any stock of any class. It shall not be considered as a close corporation when at least 2/3 of the voting stock or voting rights is owned or controlled by another corporation which is not a close corporation. It does not become a close corporation just because a man and his wife owns substantially all of its subscribed capital stock. Facts: It is alleged in this case that San Juan Structural and Steel Fabricators (San Juan Corp) entered into an agreement with Motorich Sales Corporation (Motorich) for the transfer to the former of a parcel of land. In the said transaction, Motorich acted through its corporate treasurer, Nenita Gruenberg. Upon payment of the earnest money and the remaining balance, Motorich refused to execute the Deed of Absolute Sale in favor of San Juan Corp. Later, it was also discovered that Motorich entered into another sale concerning the land in dispute with another company. San Juan Corp filed a suit.

Erandio, Athena Louise 2A | Batch 2014 | 17

Corporation Law Finals Case Digests (Atty. Quimson)

In its defense, it is alleged by Motorich that the president of the corporation did not sign the agreement and that only the corporate treasurer's signature can be seen. In effect, it was inadequate to bind the corporation. San Juan Corp, on the other hand, contends that despite the fact that there was no signature of the president of the corporation, the agreement was still binding on the corporation since it is a close corporation and almost all of the capital stock was owned by the treasurer (99.866%). Accordingly, Gruenberg needed no authorization from the president since the corporation can be bound by the acts of its principal stockholder. Issue: Whether or not there is a valid contract of sale between San Juan Corp and Motorich. Whether or not Motorich is a close corporation. Ratio: There is no valid and binding contract because it was signed by the corporate treasurer only and was never authorized or ratified by the corporation. A corporation may act only through its board if directors or when authorized by its bylaws or by its board resolution, through its officers or agents in the normal course of business. Unless duly authorized, a treasurer, whose powers are limited, cannot bind the corporation in a sale of its assets. The treasurer is not cloaked with actual or apparent authority to buy or sell real property, an activity which falls way beyond the scope of her general authority. Petitioner has the burden of proving that the treasurer was authorized in the transaction. Since there is no such proof of the authority, the contract does not bind the corporation. Neither was there any proof that there was ratification, express or implied. The receipt of the payment does not prove the fact of ratification since it is a handwritten one and not a corporate receipt, and bears only the name of the treasurer. The document alone does not prove that the acts were authorized or ratified by Motorich. Motorich is not a close corporation. It does not contain, in its articles or bylaws, any provision stating that: 1. Its stockholders shall not exceed 20; 2. Preemption of shares is restricted in favor of any stockholder of the corporation 3. Listing of its stocks in any stock exchange making a public offering of such stocks is prohibited. It does not become one just because the treasurer and her spouse own 99. 866% of the subscribed capital stock. The mere ownership by a single stockholder or by another corporation of all or nearly all the capital stock of a corporation is not of itself a sufficient ground for disregarding the separate corporate personalities. The Court is not unaware that there are exceptional cases where an action by a director, who singly is the controlling stockholder, may be considered as a binding corporate act and a board action as nothing more than a mere formality. The case at hand is not one of them. Manuel R. Dulay Enterprises Inc. v. Court of Appeals Doctrine: In a close corporation, a board resolution authorizing the sale of mortgage of the subject property is not necessary to bind the corporation for the action of its president. At any rate, a corporate action taken at a board meeting without proper call or notice in a close corporation is deemed ratified by the absent director unless the latter promptly files his written objection with the secretary of the corporation after having knowledge of the meeting. Although a corporation is an entity which has a personality distinct and separate from its individual stockholders or members, the veil of corporate fiction may be pierced when it is used to defeat public convenience, justify wrong, protect fraud or defend crime. The privilege of being treated as an entity distinct and separate from its stockholders is therefore confined to its legitimate use and is subject to certain limitations to prevent the commission of fraud or other illegal or unfair act. Facts: Manuel Dulay is the president, treasurer and general manager of Dulay Enterprises. The corporation owned an apartment unit which it sold, through Manuel Dulay, to Sps. Veloso as evidence by a Deed of Absolute Sale with Right of Repurchase. Subsequently, without knowledge of Dulay, Spouses Veloso mortgaged the property to one Manuel Torres. It was foreclosed and was sold to the latter in a public auction as the highest bidder. Torres filed a case in court praying for the issuance of a writ of possession. But, Virgilio Dulay, one of the stockholders of the corporation, appeared in court to

Erandio, Athena Louise 2A | Batch 2014 | 18

Corporation Law Finals Case Digests (Atty. Quimson)