Академический Документы

Профессиональный Документы

Культура Документы

Designs For High Growth and Income

Загружено:

rvaidya2000Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Designs For High Growth and Income

Загружено:

rvaidya2000Авторское право:

Доступные форматы

Designs for high growth and income

THE HINDU BUSINESS LINE, Friday, December 28, 2001 G. Ramachandran R. Vaidyanathan INDIA is zealously struggling to transform itself from a weak-strong model to a strong-weak model of economic governance. The strong-weak model is characterised by the primacy of households and the private sector in determining consumption, production, s avings and investment in a high-growth and high-income setting. The government is an indispensable part of such a setting but does not make microeconomic decisions. It supplies the facilitating economic, legal and regulatory environment with zeal and ear nestness. Traditional models of economic governance are undergoing rapid and involuntary change. The change has been forced by sluggish growth in demand for a range of goods and the declining ability of the Government to support a higher magnitude of capital outla ys and useful consumption expenditure through tax and other sources of revenue. The simultaneous impoverishment of households, businesses and government has exposed the limitations of governance based on supply-side economics and public spending. The zealous struggle towards the strong-weak model of economic governance could be regarded as the most useful result of the first generation of economic reforms. The secondgeneration reforms should focus on strengthening household demand and the facili tating economic, legal and regulatory environment. India has fortuitously preserved its entrepreneurial resourcefulness to fuel the transformation to the strong-weak model of economic governance. The simultaneous impoverishment has raised the likelihood of successful transformation. Four economic models In a weak state, the government pursues no conscious development strategy. Its primary economic role is to provide a supportive macroeconomic, social, legal and regulatory climate for the participants in the economy. If the government succeeds in providi ng a supportive environment, it engenders the strong-weak model of economic governance. Australia, Britain and the US are examples of the strong-weak model. If the government fails to prove a supportive environment, the economy fails. Governments failure leads to a weak-weak model. Argentina is an example of the weak-weak model. In a strong state, the government pursues a conscious economic development strategy. The strong state as in Cuba, China, France, India and Japan is characterised by public intervention. The government often supplants the market. Decisions are informed by longterm market developments that are anticipated through scenario planning. The government aggregates pools of public money into pliant banks and investment intermediaries, invests in particular sectors, sanctions low-cost loans to some firms, and sub sidises the production and consumption of some targeted products. These are typically responses to centrallyplanned strategic guidelines. The macroeconomic, social, legal and regulatory environment is then designed to comply with the strategic guideline s.

If the government succeeds in supplanting the market and in providing a dynamically supportive environment, the economy succeeds. It has a strong-strong model in place. Cuba has for long possessed many properties of the strong-strong model. If the govern ment fails in one or both dimensions, the economy fails. The governments failure leads to a weak-strong model. China, India and Japan are important examples of the weak-strong model of economic governance. They show that political ideologies and constitutional characteristics of governance do not bestow any fa vours on countries in their struggle for economic success. Moreover, supplanting the market is a necessary but not a sufficient condition for the success of the strong-state model. India was never an example of the strong-strong model though the former Prime Minister, Indira Gandhi, had an excellent understanding of the two sets of conditions necessary for success. Japan had a strong-strong model for a while when Mr Yasuhiro Nakaso ne was Prime Minister. It is now struggling to retain its status as an economic superpower. It is difficult to supplant the market and simultaneously have the wisdom and the boldness to supply the necessary supportive environment. It is not always possib le for government to influence long-term developments through scenario planning. Too many degrees of freedom need to be sacrificed in order to mimic the market and to provide the necessary economic environment. Strong-weak model Britain, under its Tory Prime Minister in the 1980s, was among the first to emphatically reject the strong-state model. The struggle towards the weak-state model, initiated by Margaret Thatcher (now Lady Thatcher), was both profound and illustrative. Bri tain discovered that a move to a weak-state could unleash several degrees of economic freedom. It is now an excellent example of the strong-weak model. The tony demeanour of Mr Tony Blair, Labour Prime Minister, reflects Britains successful transformatio n. Indias transformation can be as successful as Britains. India has five forces (Business Line, December 6) that can be exploited to support the transformation to a strong-weak model. The five forces are demand, resources, savings, talent and trust. It can displace China and Japan to become the worlds second largest economy in purchasing power parity terms. China and Japan are plagued by many problems. Japan has mimicked and exploited the market well but has failed to dynamically manage the macroeconomic and regulatory climate. China has had better success in such management. However, its strategies to supp lant and mimic the market are likely to fail over the long-term. China has had little success in mimicking the market for agriculture and services. India has little need to supplant and mimic the market for agriculture and a raft of services. The strong-state model was imposed on organised manufacturing, mining, and utilities such as electricity and railways. It was imposed on organised banking, ins urance and financial intermediation but left untouched agriculture and a range of customer-friendly services provided by the private sector. Indias transformation into a strong-weak economy should be predicated on agriculture and services because they ar e at the forefront of the struggle.

Poignant stage Rajiv Gandhi, Indias Prime Minister between 1984 and 1989, tentatively launched the first phase of the struggle in 1985. Mr P. V. Narasimha Rao, Prime Minister between 1991 and 1996, revived the struggle in 1991. The second phase sought to undo the adver se effects of the imposition of the strong-state model on manufacturing but failed to inspire growth through agriculture and services. Moreover, insufficient support within the Congress party for the weak-state model sapped the reform programme. However, the gains since 1984 in understanding the macroeconomic, social, legal and regulatory environment have been significant. The struggle has reached a poignant stage in 2001. Households, businesses and government are simultaneously poor relative to their aspirations. Many households and businesses would collapse if they were subjected to higher rates of taxes. Market fees at 2 per cent of prices in the grains and oilseeds markets are the economic equivalent of a modal, extortionate tax rate of 77 per cent on farm incomes. Government would collapse if it had to play its traditional role of benefactor with unlimited generosity . Increased public spending would drag the economy into further distress. The struggle has reached a poignant stage because growth and incomes in other economies whose models are similar as well as dissimilar to the Indian model have outpaced growth and incomes in India. Government spending is higher in the strong-state econom ies that were regarded as role models for more than 40 years. Households, businesses and governments in the strong-state economies have performed well. Households, businesses and governments in the weak-state economies have performed remarkably well. Gov ernment spending is higher in the weak-state economies too. India had at one time held weak-state economies in low esteem because of their emphasis on the entrepreneurial effort of the individual. It now seeks their savings and technology. Nourish fundamental impulses Indias strong-state model has failed to deliver goods and services at a price that can be afforded by all. Its investments in manufacturing, mining and industrial utilities have failed to impact the economy and its households decisively. The per capita c onsumption of steel, cement, motor spirit, diesel, electricity, rubber and plastics are among the lowest in the world. Its investments in banking and insurance too have failed to penetrate most households. State-owned companies dominate banking and insur ance. Yet the penetration of banking, and life and medical insurance is among the lowest in the world. Agriculture and services related to the agrarian economy and households are the principal drivers of income, growth and quality of life in the aggregate economy. But the strong-state model has failed to nourish the fundamental impulses that keep the econ omy in motion because agriculture and services did not fit the strong-state models assumptions and objectives. Therefore, the unorganised financial sector meets more than 83 per cent of the credit needs of agriculture, construction, trucking, and wholesa ling and retailing. The fundamental growth impulses may be nourished in one of two ways. Agriculture and services may be modified to fit the strong-state models assumptions and objectives. Or, the macroeconomic, social, law and order, legal and regulatory environment may be modified earnestly and enthusiastically so that it allows agriculture and services to flourish spiritedly. The first course of action would kill Indias entrepreneurial resourcefulness.

The second would reinforce the entrepreneurial resourcefulness of ho useholds and the private sector. It would lead to high growth and high incomes. The choice is clear. Ring in the strong-weak model in 2002. (G. Ramachandran is a financial analyst. R. Vaidyanathan is professor of finance at the Indian Institute of Management Bangalore.)

Вам также может понравиться

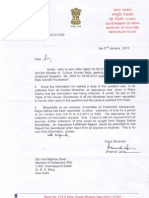

- Letter To Prof R VaidyanathanДокумент2 страницыLetter To Prof R Vaidyanathanrvaidya2000Оценок пока нет

- RESERVE BANK OF INDIA - : Investment in Credit Information CompaniesДокумент1 страницаRESERVE BANK OF INDIA - : Investment in Credit Information Companiesrvaidya2000Оценок пока нет

- NOV 2008 India PR ApprovingInvestmentДокумент6 страницNOV 2008 India PR ApprovingInvestmentrvaidya2000Оценок пока нет

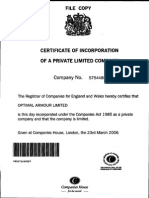

- Composite Resin Corporate FilingsДокумент115 страницComposite Resin Corporate FilingsPGurus100% (2)

- National Herald NarrativeДокумент2 страницыNational Herald Narrativervaidya2000Оценок пока нет

- Letter To PMДокумент3 страницыLetter To PMrvaidya2000Оценок пока нет

- Subramanian Testimony 31313Документ25 страницSubramanian Testimony 31313PGurusОценок пока нет

- Ahmedabad Press Conference Nov 19 2015Документ5 страницAhmedabad Press Conference Nov 19 2015PGurus100% (1)

- NGO's A Perspective 31-01-2015Документ29 страницNGO's A Perspective 31-01-2015rvaidya2000Оценок пока нет

- Letter and Invitaion Give To Mr. r.v19!06!2015Документ2 страницыLetter and Invitaion Give To Mr. r.v19!06!2015rvaidya2000Оценок пока нет

- SGFX FinancialsДокумент33 страницыSGFX FinancialsPGurusОценок пока нет

- Brief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Документ17 страницBrief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Srini KalyanaramanОценок пока нет

- Vimarsha On Indian Economy - Myth and RealityДокумент1 страницаVimarsha On Indian Economy - Myth and Realityrvaidya2000Оценок пока нет

- Optimal Armour Corporate FilingsДокумент198 страницOptimal Armour Corporate FilingsPGurusОценок пока нет

- Aranganin Pathaiyil ProfileДокумент5 страницAranganin Pathaiyil Profilervaidya2000Оценок пока нет

- How Did China Take Off US China Report 2012 "Uschinareport - Com-Wp-Con... Ds-2013!05!23290284.PDF" (1) .PDF - 1Документ25 страницHow Did China Take Off US China Report 2012 "Uschinareport - Com-Wp-Con... Ds-2013!05!23290284.PDF" (1) .PDF - 1rvaidya2000Оценок пока нет

- Secular Assault On The SacredДокумент3 страницыSecular Assault On The Sacredrvaidya2000Оценок пока нет

- Why The Retail Revolution Is Meeting Its NemesisДокумент3 страницыWhy The Retail Revolution Is Meeting Its Nemesisrvaidya2000Оценок пока нет

- Representation To PMДокумент31 страницаRepresentation To PMIrani SaroshОценок пока нет

- GrantsДокумент1 страницаGrantsrvaidya2000Оценок пока нет

- Why Sub-Prime Is Not A Crisis in IndiaДокумент4 страницыWhy Sub-Prime Is Not A Crisis in Indiarvaidya2000Оценок пока нет

- Sec 66AДокумент5 страницSec 66Arvaidya2000Оценок пока нет

- Why India Needs To Prepare For The Decline of The WestДокумент4 страницыWhy India Needs To Prepare For The Decline of The Westrvaidya2000Оценок пока нет

- TVEs Growth Engines of China in 1980s - 1990s "WWW - Geoffrey-Hodgson - Inf... - Brakes-chinese-Dev - PDF"Документ24 страницыTVEs Growth Engines of China in 1980s - 1990s "WWW - Geoffrey-Hodgson - Inf... - Brakes-chinese-Dev - PDF"rvaidya2000Оценок пока нет

- Timetable & AgendaДокумент6 страницTimetable & Agendarvaidya2000Оценок пока нет

- Shamelessness Is Paraded As ModernДокумент2 страницыShamelessness Is Paraded As Modernrvaidya2000Оценок пока нет

- Why The Indian Housewife Deserves Paeans of PraiseДокумент3 страницыWhy The Indian Housewife Deserves Paeans of Praiservaidya2000Оценок пока нет

- Decline of The West Is Good For Us and Them - 11 Oct 2011Документ4 страницыDecline of The West Is Good For Us and Them - 11 Oct 2011rvaidya2000Оценок пока нет

- FDI in Retail - Facts & MythsДокумент128 страницFDI in Retail - Facts & Mythsrvaidya2000Оценок пока нет

- Humbug Over KashmirДокумент4 страницыHumbug Over Kashmirrvaidya2000Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)