Академический Документы

Профессиональный Документы

Культура Документы

Sales To Inventory Ratio

Загружено:

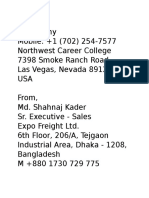

Md. Shahnaj KaderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sales To Inventory Ratio

Загружено:

Md. Shahnaj KaderАвторское право:

Доступные форматы

Sales to Inventory Ratio: Sales to inventory ratio provide a measurement for comparing stock-to-sales ratios of a businesswith others in the

same industry. Sales to Inventory Ratio = Annual Net Sales / Inventor

The sales to inventory ratio for Beximco Pharma has increased in 2007 due to the balance in thevalue of the annual net sales. The inventory value has decreased in 2008 but due to the increase inthe annual net sales there is a higher sale to inventory ratio. This shows that it is able to sell aconsiderable amount of inventory and maintains a low inventory figure relative to the annual netsales

Liquidity Ratios: Liquidity Ratios measures the company's ability to turn short-term assets into cash to cover debtsis of the utmost importance when creditors are seeking payment. 2.1.3.1 Current Ratio:

The current ratio is the most basic liquidity test which signifies a company's ability to meet itsshort-term liabilities with its short-term assets. A current ratio greater than or equal to oneindicates that current assets should be able to satisfy near-term obligations

he current ratio of Beximco Pharma has increased in 2007 but decreased in 2008 from the year 2006. However As the ratio value is more than 1; it shows that the amount of current asset isgreater than the current liabilities. But the current liabilities of it are increasing and it is not agood indication. 2.1.3.2 Quick Ratio: The quick ratio is a tougher test of liquidity than the current ratio. It eliminates inventories and prepaid expenses that may be more difficult to convert to cash. Like the current ratio, the higher the ratio, the more liquid it is, and the better able the company will be to ride out any downturn inits business.Quick Ratio = (Current Assets Inventory) / Current Liabilities

The quick ratio value is decreasing year by year from 2006 to 2008, showing the financialweakness of Beximco Pharma is increasing. This is because the quick ratio compares the currentliabilities with the current asset without the value of the inventories. It also shows that the firm isnot so liquid at this time. Working Capital Management Policy of the Company The Working Capital Management Policy of a company basically brings into focus level of current assets a company has and how it finances them. Managing the Working Capital is vital for a company and managing basically are the decisions regarding the level of inventories to be kept,time period for which Accounts Receivables should be kept outstanding and also the period of time for payments of Accounts Payables.Two major components of managing Working Capital are the estimations of the Operating Cycleand the Cash Cycle. For the estimation of Operating Cycle and Cash Cycle the estimations of Accounts Receivables Period, Accounts Payable Period and Inventory Period are required.Table 18: Illustrating the values of the variables required for Working Capital Management

Вам также может понравиться

- Invoice Mal 155 2017 TurkeyДокумент17 страницInvoice Mal 155 2017 TurkeyMd. Shahnaj KaderОценок пока нет

- ToДокумент1 страницаToMd. Shahnaj KaderОценок пока нет

- Basic Analysis Procedures and Analytical MixДокумент36 страницBasic Analysis Procedures and Analytical MixMd. Shahnaj KaderОценок пока нет

- TOCARETEXДокумент1 страницаTOCARETEXMd. Shahnaj KaderОценок пока нет

- Credit Rating SIBLДокумент1 страницаCredit Rating SIBLMd. Shahnaj KaderОценок пока нет

- Overall Business Activities of CEPZДокумент13 страницOverall Business Activities of CEPZMd. Shahnaj KaderОценок пока нет

- Customer Satisfaction Surveys of Social Islami Bank LTDДокумент1 страницаCustomer Satisfaction Surveys of Social Islami Bank LTDMd. Shahnaj KaderОценок пока нет

- Final Structure RabiulДокумент6 страницFinal Structure RabiulMd. Shahnaj KaderОценок пока нет

- Internship Report of Jamuna Bank About Loans & AdvanceДокумент60 страницInternship Report of Jamuna Bank About Loans & AdvanceMd. Shahnaj Kader100% (3)

- SME Banking PracticeДокумент51 страницаSME Banking PracticeMd. Shahnaj KaderОценок пока нет

- Case 3Документ1 страницаCase 3Md. Shahnaj KaderОценок пока нет

- Definition of International MarketingДокумент15 страницDefinition of International MarketingvatsgauravОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Property LawДокумент6 страницProperty LawPrince RajОценок пока нет

- Burda6e - PPT - ch13 (2) 1Документ58 страницBurda6e - PPT - ch13 (2) 1Nikola KrivokapićОценок пока нет

- Financial Statement PreparationДокумент60 страницFinancial Statement PreparationAngel Anne De JuanОценок пока нет

- Credit Transactions MCQДокумент3 страницыCredit Transactions MCQeinsteinspy100% (1)

- Foreign Exchange Spot MarketsДокумент41 страницаForeign Exchange Spot MarketsVikku AgarwalОценок пока нет

- Motion To Dismiss-Fleury Chapter 7 BankruptcyДокумент5 страницMotion To Dismiss-Fleury Chapter 7 Bankruptcyarsmith718Оценок пока нет

- Answer KeysДокумент7 страницAnswer KeysBruno Teixeira Nery0% (1)

- Table 4.4 Common Size Balance Sheet Statement: 45 Source ComputedДокумент1 страницаTable 4.4 Common Size Balance Sheet Statement: 45 Source ComputedManoj KumarОценок пока нет

- Credit LineДокумент6 страницCredit LineUday UddantiОценок пока нет

- EDC Relief PolicyДокумент2 страницыEDC Relief PolicyMayank JainОценок пока нет

- A Study On 269SS & 269 TДокумент4 страницыA Study On 269SS & 269 TsivaranjanОценок пока нет

- Macroeconomics Assignment 2Документ4 страницыMacroeconomics Assignment 2reddygaru1Оценок пока нет

- IFM TB Ch07Документ18 страницIFM TB Ch07Hussain Anwar Almarhoon50% (2)

- Billing PlanДокумент55 страницBilling PlanSourav Kumar100% (5)

- The Small Print in ICICI BondsДокумент3 страницыThe Small Print in ICICI BondsBharat SahniОценок пока нет

- Indian Oversea Bank and Development Credit Bank of India: Presented by Group 10Документ13 страницIndian Oversea Bank and Development Credit Bank of India: Presented by Group 10Karan GujralОценок пока нет

- Accountants Formulae BookДокумент47 страницAccountants Formulae BookVpln SarmaОценок пока нет

- Internal ReconstructionДокумент26 страницInternal ReconstructionGaurav SharmaОценок пока нет

- Business 2257 Tutorial #1Документ12 страницBusiness 2257 Tutorial #1westernbebeОценок пока нет

- Expenditure Switching PoliciesДокумент5 страницExpenditure Switching PoliciesAkashdeep GhummanОценок пока нет

- BUSANA1 Chapter2 - Compound InterestДокумент101 страницаBUSANA1 Chapter2 - Compound InterestIzzeah RamosОценок пока нет

- Negotiable Instruments Act, 1881Документ37 страницNegotiable Instruments Act, 1881bhn_chanduОценок пока нет

- Foreign Direct InvestmentДокумент2 страницыForeign Direct InvestmentMustakkima Afreen Mouly100% (2)

- IS-LM Model: The Derivation of The IS and LM CurvesДокумент16 страницIS-LM Model: The Derivation of The IS and LM CurvesLinda WendОценок пока нет

- Trust Receipt - Application Form (ENG)Документ2 страницыTrust Receipt - Application Form (ENG)Asharp TohirОценок пока нет

- Financial Accounting Chapter 13Документ59 страницFinancial Accounting Chapter 13Waqas MazharОценок пока нет

- 14 Interest Rate and Currency SwapsДокумент45 страниц14 Interest Rate and Currency SwapsJogendra BeheraОценок пока нет

- Collection Letter.Документ16 страницCollection Letter.Nanda Sukma100% (1)

- Sa 110Документ2 страницыSa 110coolmanzОценок пока нет

- PZ Financial AnalysisДокумент2 страницыPZ Financial Analysisdewanibipin100% (1)