Академический Документы

Профессиональный Документы

Культура Документы

Descriptio N Amount (Rs. Million) : Type Period Ending No. of Months

Загружено:

VALLIAPPAN.PИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Descriptio N Amount (Rs. Million) : Type Period Ending No. of Months

Загружено:

VALLIAPPAN.PАвторское право:

Доступные форматы

Type Period Ending No.

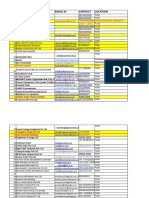

of Months Descriptio n Net Sales / Interest Earned / Operating Income Other Income Expenditure Interest Profit Before Depreciatio n and Tax Depreciatio n Profit before Tax Tax Profit after Tax Extraordina ry Items Net Profit Equity Capital Reserves Basic EPS after Extraordina ry items Diluted EPS after Extraordina ry items Nos. of Shares Public Percent of SharesPublic Operating Profit Margin Net Profit Margin Cash EPS

Audited 31-Mar-12 12

Audited 31-Mar-11 12

Audited 31-Mar-10 12

Amount (Rs. million)

3299040 61,920.00 -2962850 -26,670.00

2481700 30,520.00 -2100440 -23,280.00

1924610 24,600.00 -1618800 -19,970.00

371440 -113940 257500 -57,100.00 200400 0 200400 32,710.00 1596980

388500 -136080 252420 -49,560.00 202860 0 202860 32,730.00 1428000

310440 -104970 205470 -43,110.00 162360 0 162360 32,700.00 1250970

61.2

62

49.7

61.2

62

49.7

1,80,71,00,000.00

1,80,95,00,000.00 1,80,65,00,000.00

55.25

55.28

55.24

12.07 6.07 96.1

16.59 8.17 103.56

17.17 8.44 81.75

Audited 31-Mar-09 12

on)

1418470 20,600.00 -1185340 -17,450.00

329904 6192 -296285 -2667

248170 3052 -210044 -2328

192461 2460 -161880 -1997

141847 2060 -118534 -1745

236280 -51,950.00 184330 -31,240.00 153090 3,280.00 156370 15,740.00 1129450

37144 -11394 25750 -5710 20040 0 20040 3271 159698

38850 -13608 25242 -4956 20286 0 20286 3273 142800

31044 -10497 20547 -4311 16236 0 16236 3270 125097

23628 -5195 18433 -3124 15309 328 15637 1574 112945

96.8

96.8

74,82,00,000.00

47.54

17.89 11.02 132.35

Profit and Loss Account 1 2 3=1+2 4 5=3-4 6 7=5-6 8 9=7-8 10 11 = 9 - 10 12 13 = 11 - 12 14 15 100* (PBIDT / Total Income) PBIDT / Interest PAT after EO + Depreciation Operating Income Other Income Total Income Operating Expenditure PBIDT Interest PBDT Depreciation PBT Tax PAT before EO EO: Extra ordinary Items PAT after EO Equity Share Capital Reserves and Surplus

16 = 100* (5/3) PBIDT Margins (%) 17 = 5 / 6 Interest coverage 18 = 13 + 8 Cash Profit

Profit and Loss Account 2011-12 2010-11 2009-10 2008-09 329904 248170 192461 141847 6192 3052 2460 2060 336096 251222 194921 143907 296285 210044 161880 118534 39811 41178 33041 25373 2667 2328 1997 1745 37144 38850 31044 23628 11394 13608 10497 5195 25750 25242 20547 18433 5710 4956 4311 3124 20040 20286 16236 15309 0 0 0 328 20040 20286 16236 15637 3271 3273 3270 1574 159698 142800 125097 112945 61.3 62.0 49.7 97.3 11.8% 16.4% 17.0% 17.6% 14.9 17.7 16.5 14.5 31434 33894 26733 20832

1 2 3=1+2 4 5 6 7 8 = 5 + 6+ 7 9=3 +8

10 11 12 13 14 15 16 17 18 19 = 13 + 14 + 15 + 16 + 17 + 18 20 21 22 23 = 20 + 21 + 22 24 = 19 - 23 25 = 10 + 11 + 24

Balance Sheet as of 31st March Liabilities 2012 2011 Share Capital 3271 3273 Reserves & Surplus 162825 148267 Share Holders Funds 166096 151540 Loans Long Term Borrowings Short Term Borrowings Deferred Tax Liability Total Borrowings Total Capital Employed

Current Ratio Quick / Acid Test Ratio Cash Ratio Interval Measure

2.3 1.7 1.1 119

1.6 1.1 0.7 115

48034 10593 12122 70749 236845

51124 12304 11562 74990 226530

Operating expenses are treated as cost of goods sold + sellin Net Working Capital Ratio Assets 2012 Fixed Assets 135817 Long term Investments 26979 Current Assets Current Investments 27029 Inventoreis 35955 Trade Receivables 18424 Cash and Bank Balances 39598 Short term loans and advances 11089 Other current Assets 249 Total Current Assets 132344 Less: Current Liabilities Trade Payables 40324 Other Current Liabilities 13713 Short term provisions 4258 Current Liabilities 58295 Net Current Assets 74049 Net Assets 236845 2011 165633 23209 14443 29825 17442 27135 6833 199 95877 34844 18735 4602 58181 37696 226538 74049

Current assets / current liabilities (Current Assets - Inventories) / Current Liabilities (Cash + Marketable securities)/ Current liabilities We have taken current investments as marketable securities (Current assets - Inventories) / (cost of goods sold + selling administrative and general expenses excluding non cash expenditure like depreciation))/ 365 ost of goods sold + selling, administrative and general expenses)

Ratios Liquidity Ratios Leverage Ratios Coverage Ratios Activity Ratios Profitability Ratios

chaitanyanallani@gmail.com

Ratios

Activity Ra

Inventory T

Days of Inv

Debtors tur

Average co

Ratios

Assets Turn Net Assets

Total Asset

Fixed Asset

Current Ass

Working Ca

Note: Sales Ratios

Profitability

Gross Profi

Net Profit M

Operating e

Operating e Ratios

Return ratio

Return on I

Return on c

Return on E

Ratios

Ratios of in

Earnings pe

Price - Earn

Dividend Pe

Dividend Pa

Dividend Yi Net worth

Book Value

Market valu

Ratios Liquidity Ratios are based on only balance Sheet items Current Ratio Current Assets / Current Liabilities Quick / Acid Test Ratio (Current Assets - Inventories) Current Liabilities Cash Ratio (Cash + Marketable Securities) / Current Liabilities Interval Measure 365* (Current Assets - Inventories) /(COGS + SGA excluding depn) Net Working Capital Ratio Net Working Capital / Net Assets Ratios Leverage Ratios are based on only balance sheet items Debt Ratio Total Debt /(Total Debt + Net worth) Debt Equity Ratio Total Debt / Net worth Capital Employed to Net Worth Ratio Capital Employed / Net Worth Capital Employed to Net Worth = 1 + Debt Equity Ratio Capital Employed = Net Assets = Net Worth + Total Debts Ratios Coverage ratios involve items in Profit and loss account as well as Balance Sheet Debt Service Coverage Ratio Net profit + interest + lease rent + non cash expenses / Instalments due + Lease Rentals Instalments due include principal and interest due for the period Interest Coverage Earnings before interest tax, depreciation and amortisation / Interest

Ratios Activity Ratios involve items in profit and loss as well as Balance Sheet Inventory Turnover Ratio Cost of goods sold / Average Inventory (or) Sales / Inventory 365 * inventory / sales Credit sales / average debtors (or) Sales / Debtors 365* Debtors / Sales

Days of Inventory holdings Debtors turnover ratio

Average collection period

Ratios Assets Turnover ratio involve items in profit and loss aas well as Balance Sheet Net Assets Turnover Ratio Total Assets Turnover Ratio Fixed Assets Turnover ratio Current Assets Turnover Ratio Working Capital Turnover Ratio Sales / Net Assets Sales / Total Assets Sales / Net Fixed Assets Sales / Current Assets Sales / Net Current Assets

Note: Sales will be the Numerator in all turnover ratios Ratios Profitability ratio generally involve only Profit and Loss account items Gross Profit Margin Net Profit Margin Operating expenses ratio (Sales - Cost of Goods Sold ) / Sales Profit after Tax / Sales Operating expenses / Sales

Operating expenses = cost of goods sold + SGA Ratios Return ratios involve both Profit and Loss account and Balance Sheet items Return on Investment Return on capital employed Return on Equity Earnings before interest and tax / Total Assets Earnings before interest and tax / Net Assets or Capital employed Profit after tax / Net worth

Ratios Ratios of interest to investors and capital markets Earnings per share (Profit after tax - preference dividiend) / No. of Equity Shares o/s

Price - Earnings Ratio

Market Value Per Share / Earnings Per Share or Market Capitalisation / Net profit after preference dividend Dividend to equity holders / No. of equity shares outstanding Equity dividend / Profit after tax Dividend Per share / Market Value per share Equity Capital + Total Reserves and Surplus Exclude revaluation reserves in reserves and surplus Also reduce miscellaneous expenses not written off, if any Debit balance of Profit and loss account is negative reserve Net Worth / No. of Equity Shares Market Value per share / Book Value per share

Dividend Per Share Dividend Pay out ratio Dividend Yield Net worth

Book Value Market value to Book Value

A excluding depn)

mortisation /

Capital employed

quity Shares o/s

ence dividend outstanding

Вам также может понравиться

- Equity ValuationДокумент2 424 страницыEquity ValuationMuteeb Raina0% (1)

- Fiscal Year Is January-December. All Values ZAR MillionsДокумент14 страницFiscal Year Is January-December. All Values ZAR MillionsRavi JainОценок пока нет

- Vardhman Textiles Balance Sheet AnalysisДокумент11 страницVardhman Textiles Balance Sheet AnalysisRОценок пока нет

- Business Activities and Financial StatementsДокумент23 страницыBusiness Activities and Financial StatementsUsha RadhakrishnanОценок пока нет

- MBTC and BPI RatiosДокумент11 страницMBTC and BPI RatiosarianedangananОценок пока нет

- Total Application of Funds Fixed Assets Fixed AssetsДокумент14 страницTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiОценок пока нет

- Pro Forma Models - StudentsДокумент9 страницPro Forma Models - Studentsshanker23scribd100% (1)

- Corporate Finance: Assignment No 1Документ3 страницыCorporate Finance: Assignment No 1Ali AhmedОценок пока нет

- Pepsi Co - Calculations - FinalДокумент46 страницPepsi Co - Calculations - FinalMelissa HarringtonОценок пока нет

- Fiscal Year Is January-December. All Values USD Millions.: AssetsДокумент29 страницFiscal Year Is January-December. All Values USD Millions.: AssetsHubert Luis Madariaga ManyaОценок пока нет

- Balance Sheet of John Limited As OnДокумент19 страницBalance Sheet of John Limited As OnAravind MaitreyaОценок пока нет

- Square Pharma Valuation ExcelДокумент43 страницыSquare Pharma Valuation ExcelFaraz SjОценок пока нет

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSДокумент7 страницIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22Оценок пока нет

- K P I T Cummins Infosystems Limited: Financials (Standalone)Документ8 страницK P I T Cummins Infosystems Limited: Financials (Standalone)Surabhi RajОценок пока нет

- Preeti 149Документ16 страницPreeti 149Preeti NeelamОценок пока нет

- Engro Fertilizer - Financial RatiosДокумент2 страницыEngro Fertilizer - Financial RatiosFarah Nawaz QabulioОценок пока нет

- Analyze Financial Ratios to Evaluate Safal Ltd's PerformanceДокумент26 страницAnalyze Financial Ratios to Evaluate Safal Ltd's PerformanceDeepika D. MisalОценок пока нет

- K Mart (Ratio Analysis)Документ2 страницыK Mart (Ratio Analysis)Akela TanhaОценок пока нет

- Annual report 2010-11 financial ratiosДокумент1 страницаAnnual report 2010-11 financial ratiosAbhishek RampalОценок пока нет

- Corporate Finance AAE 2013Документ22 страницыCorporate Finance AAE 2013Oniga AdrianОценок пока нет

- Analysis of Financial StatementДокумент4 страницыAnalysis of Financial StatementArpitha RajashekarОценок пока нет

- Statement Date No. of MonthsДокумент6 страницStatement Date No. of MonthscallvkОценок пока нет

- Aplicación Del MNT Multifilamentos 2010Документ17 страницAplicación Del MNT Multifilamentos 2010Juan KsanovaОценок пока нет

- Operating assets ROI analysis 2010-2013Документ6 страницOperating assets ROI analysis 2010-2013gogaОценок пока нет

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Документ6 страниц"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855Оценок пока нет

- Financial Statements Review Q4 2010Документ17 страницFinancial Statements Review Q4 2010sahaiakkiОценок пока нет

- 8100 (Birla Corporation)Документ61 страница8100 (Birla Corporation)Viz PrezОценок пока нет

- Work Sample Siemens - Financial ModelДокумент45 страницWork Sample Siemens - Financial ModelDasariSaiCharanОценок пока нет

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationДокумент6 страницFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraОценок пока нет

- Keyratio 2011Документ6 страницKeyratio 2011Nikhil YadavОценок пока нет

- Penjualan Bersih Beban Pokok Penjualan Laba KotorДокумент3 страницыPenjualan Bersih Beban Pokok Penjualan Laba KotorlaksmitadewiasastaniОценок пока нет

- Projet PGPM RatioДокумент16 страницProjet PGPM RatioViren PatelОценок пока нет

- Factset Data Sheet Financial Statements and AnalysisДокумент22 страницыFactset Data Sheet Financial Statements and Analysischandan.hegdeОценок пока нет

- Woof Junction Inc. Balance Sheet and Income Statement 2011-2015Документ13 страницWoof Junction Inc. Balance Sheet and Income Statement 2011-2015Uzma KhanОценок пока нет

- Financial PlanДокумент6 страницFinancial PlanRishika ShuklaОценок пока нет

- Fin Feasibiltiy Zubair Reg 54492Документ9 страницFin Feasibiltiy Zubair Reg 54492kzubairОценок пока нет

- Krakatau A - CGAR, BUMN, DupontДокумент27 страницKrakatau A - CGAR, BUMN, DupontJavadNurIslamiОценок пока нет

- Financial Model OverviewДокумент20 страницFinancial Model OverviewShawn PantophletОценок пока нет

- Financial Planning and ForecastingДокумент17 страницFinancial Planning and Forecastinglove_a123100% (1)

- Trading ComsДокумент264 страницыTrading Comsavinashtiwari201745Оценок пока нет

- Copy of Trading ComsДокумент265 страницCopy of Trading Comsavinashtiwari201745Оценок пока нет

- Ratio Analysis of M&M and Eicher MotorsДокумент16 страницRatio Analysis of M&M and Eicher MotorsGs AbhilashОценок пока нет

- Financial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Документ11 страницFinancial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Sakhamuri Ram'sОценок пока нет

- 6.3.1 EditedДокумент47 страниц6.3.1 EditedPia Angela ElemosОценок пока нет

- MCB Consolidated For Year Ended Dec 2011Документ87 страницMCB Consolidated For Year Ended Dec 2011shoaibjeeОценок пока нет

- GAIL Financial Ratios and AnalysisДокумент9 страницGAIL Financial Ratios and Analysishari_mohan_7Оценок пока нет

- Key Financial Ratios BreakdownДокумент25 страницKey Financial Ratios Breakdownwinnerme100% (1)

- Valuasi Saham MppaДокумент29 страницValuasi Saham MppaGaos FakhryОценок пока нет

- Colcap EstadosДокумент528 страницColcap EstadosJosé TenjicaОценок пока нет

- Boeing: I. Market InformationДокумент20 страницBoeing: I. Market InformationJames ParkОценок пока нет

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Документ15 страниц(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Оценок пока нет

- TCS - NSE Valuation FileДокумент53 страницыTCS - NSE Valuation Fileshreyjain75Оценок пока нет

- Different: ... and Better Than EverДокумент4 страницыDifferent: ... and Better Than EverViral PatelОценок пока нет

- Hayleys Fabric PLC Comprehensive IncomeДокумент23 страницыHayleys Fabric PLC Comprehensive IncomeRanga PrasadОценок пока нет

- Adam Sugar LTD Financial AnalysisДокумент20 страницAdam Sugar LTD Financial AnalysiswamiqrasheedОценок пока нет

- Asian Paints - Financial Modeling (With Solutions) - CBAДокумент47 страницAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745Оценок пока нет

- Shoppers Stop P&L AnalysisДокумент25 страницShoppers Stop P&L AnalysisJigyasu PritОценок пока нет

- Business Metrics and Tools; Reference for Professionals and StudentsОт EverandBusiness Metrics and Tools; Reference for Professionals and StudentsОценок пока нет

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryОт EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- SBI ReasoningДокумент112 страницSBI ReasoningVALLIAPPAN.PОценок пока нет

- Multibagger Stock Ideas PDFДокумент16 страницMultibagger Stock Ideas PDFVALLIAPPAN.PОценок пока нет

- Inside Job - Movie Review (The Story of Global Recession 2008) PDFДокумент21 страницаInside Job - Movie Review (The Story of Global Recession 2008) PDFVALLIAPPAN.P100% (2)

- IIMCorporate BrochurefinalДокумент60 страницIIMCorporate BrochurefinalVALLIAPPAN.PОценок пока нет

- Guidelines For Students Applying New PassportДокумент14 страницGuidelines For Students Applying New PassportVALLIAPPAN.P100% (2)

- Iim A Case Studies Just A Click AwayДокумент3 страницыIim A Case Studies Just A Click AwayVALLIAPPAN.PОценок пока нет

- Final PPT With ChangesДокумент28 страницFinal PPT With ChangesVALLIAPPAN.PОценок пока нет

- Project Report On "Student & Alumni Management Information System in NIT - Warangal"Документ26 страницProject Report On "Student & Alumni Management Information System in NIT - Warangal"VALLIAPPAN.PОценок пока нет

- 5 Abstract UniversityДокумент1 страница5 Abstract UniversityVALLIAPPAN.PОценок пока нет

- Beta Times Markets Edition11Документ4 страницыBeta Times Markets Edition11VALLIAPPAN.PОценок пока нет

- Common MITC Sep10Документ6 страницCommon MITC Sep10VALLIAPPAN.PОценок пока нет

- Sulabh Case Studies IimДокумент21 страницаSulabh Case Studies IimAnand RajОценок пока нет

- Depreciation Methods ExplainedДокумент2 страницыDepreciation Methods ExplainedAnsha Twilight14Оценок пока нет

- PfizerWorks structure improves efficiencyДокумент2 страницыPfizerWorks structure improves efficiencyDigitizedReaper73% (11)

- Mr. Arshad Nazer: Bawshar, Sultanate of OmanДокумент2 страницыMr. Arshad Nazer: Bawshar, Sultanate of OmanTop GОценок пока нет

- Project Proposal: Retail Environment Design To Create Brand ExperienceДокумент3 страницыProject Proposal: Retail Environment Design To Create Brand ExperienceMithin R KumarОценок пока нет

- Instructions Manual Skatey 150/250/400/600Документ19 страницInstructions Manual Skatey 150/250/400/600Denys GavrylovОценок пока нет

- Statement of Purpose Lanka Venkata Raghava Ravi TejaДокумент2 страницыStatement of Purpose Lanka Venkata Raghava Ravi TejaRavi Teja LvrОценок пока нет

- G.R. No. 226140 - People Vs EspirituДокумент24 страницыG.R. No. 226140 - People Vs EspirituAlfred Robert BabasoroОценок пока нет

- Thesis Statement About Plastic BagsДокумент7 страницThesis Statement About Plastic Bagslyjtpnxff100% (2)

- Is 4032 - 1985Документ45 страницIs 4032 - 1985yogeshbadyalОценок пока нет

- 244256-Exabeam Security Content in The Legacy Structure-Pdf-EnДокумент142 страницы244256-Exabeam Security Content in The Legacy Structure-Pdf-EnYoussef MohamedОценок пока нет

- Recognition & Derecognition 5Документ27 страницRecognition & Derecognition 5sajedulОценок пока нет

- Energy Efficiency Existing Ship Index (Eexi) : Regulatory DebriefДокумент8 страницEnergy Efficiency Existing Ship Index (Eexi) : Regulatory DebriefSalomonlcОценок пока нет

- Research Paper About Cebu PacificДокумент8 страницResearch Paper About Cebu Pacificwqbdxbvkg100% (1)

- 1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFДокумент12 страниц1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFmehralsmenschОценок пока нет

- Unit 4: A World of Ideas: Learning CompassДокумент3 страницыUnit 4: A World of Ideas: Learning CompassRica Mae Lepiten MendiolaОценок пока нет

- Lecture Notes in Airport Engineering PDFДокумент91 страницаLecture Notes in Airport Engineering PDFMaya RajОценок пока нет

- My Sweet Beer - 23 MaiДокумент14 страницMy Sweet Beer - 23 Maihaytem chakiriОценок пока нет

- Efectele Crizei Economice Asupra Politicilor Pietei Muncii Din RomaniaДокумент24 страницыEfectele Crizei Economice Asupra Politicilor Pietei Muncii Din Romaniacristian_incaltarauОценок пока нет

- TT1 2lecture SpinningДокумент29 страницTT1 2lecture SpinninghaiОценок пока нет

- Indian companies involved in trade dispute caseДокумент15 страницIndian companies involved in trade dispute caseakshay daymaОценок пока нет

- Company BackgroundДокумент17 страницCompany Backgroundzayna faizaОценок пока нет

- Business Study Quarterly Paper by Vijay SirДокумент3 страницыBusiness Study Quarterly Paper by Vijay Sirmonish vikramОценок пока нет

- Opening Up The Prescriptive Authority PipelineДокумент10 страницOpening Up The Prescriptive Authority PipelineJohn GavazziОценок пока нет

- Company Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiДокумент65 страницCompany Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDhruv Parekh100% (1)

- Frito LaysДокумент6 страницFrito LaysElcamino Torrez50% (2)

- 47-Article Text-201-1-10-20180825Документ12 страниц47-Article Text-201-1-10-20180825kevin21790Оценок пока нет

- EasementДокумент10 страницEasementEik Ren OngОценок пока нет

- Optimization TheoryДокумент18 страницOptimization TheoryDivine Ada PicarОценок пока нет

- Foreign Direct Investment in Mongolia An Interactive Case Study (USAID, 2007)Документ266 страницForeign Direct Investment in Mongolia An Interactive Case Study (USAID, 2007)Oyuna Bat-OchirОценок пока нет

- Online Job Interviews For International Careers: Business MeetingДокумент8 страницOnline Job Interviews For International Careers: Business Meetingintercultural_c2593Оценок пока нет