Академический Документы

Профессиональный Документы

Культура Документы

Deriving The Gold Lease Rate

Загружено:

jpkoningОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Deriving The Gold Lease Rate

Загружено:

jpkoningАвторское право:

Доступные форматы

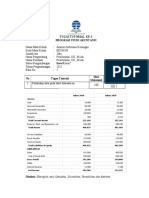

Deriving the gold lease rate

1993

1,800

John Paul Koning

Financial Graph & Art www.financialgraphart.com

January 2012

2011

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

1. Gold Price

1,000 Gold in $US 800 Gold in Euros 400

The gold forward offered rate (GOFO) is the rate at which the nine market making members of the London Bullion Market Association are willing to borrow cash in London, submitting gold as collateral. A gold forward transaction functions much like a swap, one bank exchanges cash for gold with another bank for some period of time before the transaction is reversed. Rates are quoted for terms of 1, 2, 3, 6, and 12 months. There is almost no correlation between the gold price in the top chart and GOFO in the second chart. The gold forward rate has almost always been above zero.This means that those who agree to temporarily accept gold in exchange for cash expect to be compensated for the inconvenience of bearing this transaction.This inconvenience relates to the higher cost of storing gold relative to cash and golds inferior liquidity. On those rare occasions when GOFO has gone negative - for instance October 1999 - banks have temporarily treated golds conveniences as superior to cash and, as a result, have been willing to pay a premium to own it. The London Interbank Offered Rate (LIBOR) is the rate at which sixteen major banks can borrow cash in London on an unsecured basis. As chart 3 shows, LIBOR and GOFO generally move together, although LIBOR has typically been quoted higher than GOFO.This is because a lender prefers to make loans on a secured basis than on an unsecured basis since the former is much safer. A gold forward transaction - essentially a cash loan secured by gold - is less risky for a lending bank to conduct than an unsecured loan. Thus, banks lending on gold collateral will usually be willing to set GOFO below LIBOR. The gold lease rate is the rate at which gold is lent out on an unsecured basis.While LIBOR and GOFO are generally available, lease rates are usually not publically quoted. Nevertheless, a hypothetical lease rate can be derived from LIBOR and GOFO. Say a major bank borrows gold and pays the lease rate, then swaps this gold for cash for six months with another major bank, paying GOFO. It invests this cash at LIBOR. The cost of this transaction - the sum of the lease rate and GOFO - cannot be less than the LIBOR return. For if it were less, banks would simply borrow the gold and sell it forward for cash, investing the proceeds at LIBOR thereby earning themselves risk-free profits. In a competitive market, this risk-free opportunity will be arbitraged away so that the following conditions always holds: lease rate + GOFO = LIBOR.Thus, knowing GOFO and LIBOR, the lease rate can be calculated. As chart four shows, the derived gold lease rate has typically been positive. Banks who lend gold expect to receive a return on the loan, and borrowing banks have been willing to provide that return. However, since 2009 derived lease rates have frequently fallen into negative territory, especially the three-month rate. Somewhat counter-intuitively, those borrowing gold for short periods now expect to receive a fee, and those lending are willing to pay this fee. One reason that lending banks might be willing to incur a negative lease rate is that storage costs have risen. By paying other banks to take on the burden of storing their gold, gold owners avoid these costs while continuing to enjoy the benefit of exposure to the gold price. Gold lease rates are almost always at a discount to LIBOR. It is more convenient to hold cash than gold due to golds high storage costs and inferior liquidity.Therefore, lenders require a higher interest rate to compensate them for foregoing the superior conveniences of cash. October 1999 was a rare exception, with lease rates rising above LIBOR.

200

8%

2. Gold Forward Offered Rate (GOFO)

6%

4%

2%

3 month 6 month 12 month

0%

-2%

-4%

3. London Interbank Offered Rate (LIBOR) and GOFO

8% The di erence between LIBOR and GOFO equals the derived lease rate 6%

4%

2%

6 month GOFO

LIBOR

0%

6-month

-2%

10%

4. Derived Lease Rate

8%

6%

4%

LIBOR

2%

6-month

3 month 6 month 12 month

0%

-2%

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

John Paul Koning, 2012

Gold price data from the World Gold Council. LIBOR and GOFO from the London Bullion Market Association

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Alchian and Klein - 1973 - On A Correct Measure of InflationДокумент20 страницAlchian and Klein - 1973 - On A Correct Measure of Inflationjpkoning100% (1)

- Kaldor - 1939 - Speculation and Economic StabilityДокумент28 страницKaldor - 1939 - Speculation and Economic Stabilityjpkoning100% (1)

- Reserve Bank of Zimbabwe Monetary Policy Statement 2015Документ73 страницыReserve Bank of Zimbabwe Monetary Policy Statement 2015Business Daily ZimbabweОценок пока нет

- Wrap Sheet - Oct 26, 2011Документ2 страницыWrap Sheet - Oct 26, 2011jpkoningОценок пока нет

- Liu - 2005 - A Liquidity Augmented Capital Asset Pricing ModelДокумент41 страницаLiu - 2005 - A Liquidity Augmented Capital Asset Pricing ModeljpkoningОценок пока нет

- Wrap Sheet - Jun 17, 2011Документ2 страницыWrap Sheet - Jun 17, 2011jpkoningОценок пока нет

- Silber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsДокумент18 страницSilber - 1984 - Marketmaker Behavior in An Auction Market, An Analysis of Scalpers in Futures MarketsjpkoningОценок пока нет

- The Precipitation and Fall of Mess. Douglas, Heron and Co, Late Bankers in Air With The Causes of Their Distress and Ruin Investigated and ConsideredДокумент180 страницThe Precipitation and Fall of Mess. Douglas, Heron and Co, Late Bankers in Air With The Causes of Their Distress and Ruin Investigated and ConsideredjpkoningОценок пока нет

- Selgin - 1994 - On Ensuring The Acceptability of A New Fiat MoneyДокумент20 страницSelgin - 1994 - On Ensuring The Acceptability of A New Fiat MoneyjpkoningОценок пока нет

- Wrap Sheet - July 12, 2012Документ2 страницыWrap Sheet - July 12, 2012jpkoningОценок пока нет

- Clower - 1967 - A Reconsideration of The Microfoundations of Monetary TheoryДокумент8 страницClower - 1967 - A Reconsideration of The Microfoundations of Monetary TheoryjpkoningОценок пока нет

- Wrap Sheet - Feb 14, 2012Документ2 страницыWrap Sheet - Feb 14, 2012jpkoningОценок пока нет

- Cowen - The New Monetary EconomcsДокумент25 страницCowen - The New Monetary EconomcsjpkoningОценок пока нет

- Money in An Economy Without Banks - The Case of IrelandДокумент10 страницMoney in An Economy Without Banks - The Case of Irelandjpkoning100% (1)

- Hamilton - 1988 - The Role of The Gold Standard in Propogating The Great DepressionДокумент23 страницыHamilton - 1988 - The Role of The Gold Standard in Propogating The Great DepressionjpkoningОценок пока нет

- Bear Markets ComparisonsДокумент1 страницаBear Markets ComparisonsjpkoningОценок пока нет

- Managed Currency - The People's Bank of China Balance Sheet Since 2002Документ1 страницаManaged Currency - The People's Bank of China Balance Sheet Since 2002jpkoningОценок пока нет

- Monetary Explanations of The Weimar Republic's HyperinflationДокумент17 страницMonetary Explanations of The Weimar Republic's HyperinflationjpkoningОценок пока нет

- Fortin - 1996 - The Great Canadian SlumpДокумент28 страницFortin - 1996 - The Great Canadian SlumpjpkoningОценок пока нет

- Credit Suisse On The Interdistrict Settlement Vs Target2 ComparisonДокумент10 страницCredit Suisse On The Interdistrict Settlement Vs Target2 ComparisonjpkoningОценок пока нет

- Oct 2010 Wrap: Gold Bubble and Google SearchesДокумент2 страницыOct 2010 Wrap: Gold Bubble and Google SearchesjpkoningОценок пока нет

- Hutt - 1952 - The Yield From Money HeldДокумент11 страницHutt - 1952 - The Yield From Money HeldjpkoningОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Corporate Finance NotesДокумент24 страницыCorporate Finance NotesAkash Gupta100% (1)

- What Are Financial Markets?: Key TakeawaysДокумент2 страницыWhat Are Financial Markets?: Key Takeawayskate trishaОценок пока нет

- Assets Management in Botswana Wealth Creation or Wealth Dissipation?Документ65 страницAssets Management in Botswana Wealth Creation or Wealth Dissipation?Tsehay SenghorОценок пока нет

- Critique of Jollibee Foods Corporation Financial StatementsДокумент10 страницCritique of Jollibee Foods Corporation Financial StatementsBest Girl RobinОценок пока нет

- Pricing Strategy: Midterm ExaminationДокумент6 страницPricing Strategy: Midterm ExaminationAndrea Jane M. BEDAÑOОценок пока нет

- Laporan Keuangan Triwulan 1 Good PDFДокумент102 страницыLaporan Keuangan Triwulan 1 Good PDFRudi Cawir Tuahta GintingОценок пока нет

- SABV Topic 5 QuestionsДокумент5 страницSABV Topic 5 QuestionsNgoc Hoang Ngan NgoОценок пока нет

- ch14 Kieso IFRS4 PPTДокумент75 страницch14 Kieso IFRS4 PPT1234778Оценок пока нет

- Accounting NotesДокумент4 страницыAccounting NotesMedinaHashimliОценок пока нет

- Aat 3 A 45 K 5 XДокумент50 страницAat 3 A 45 K 5 Xphfznvkau2Оценок пока нет

- HFAC130 1 Jan June2023 FA1 Memo LVN V2 20230203Документ18 страницHFAC130 1 Jan June2023 FA1 Memo LVN V2 20230203nkemokoh.noОценок пока нет

- Intelligent Alchemy: LCH - Clearnet Launches Synapse, Powered by Tcs B NCSДокумент28 страницIntelligent Alchemy: LCH - Clearnet Launches Synapse, Powered by Tcs B NCSMiraz GalibОценок пока нет

- شرح شابتر 3Документ27 страницشرح شابتر 3Ahmad RahhalОценок пока нет

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Документ11 страницExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%rufik der100% (2)

- Tugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Документ4 страницыTugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Doni Jogja0% (1)

- Sample ProblemsДокумент7 страницSample ProblemsArvin Kim AriateОценок пока нет

- PT Bakrieland Development Tbk. Dan Entitas Anak / and SubsidiariesДокумент173 страницыPT Bakrieland Development Tbk. Dan Entitas Anak / and SubsidiariesShikadai NaraОценок пока нет

- FRM Part 1 Study Plan May 2017Документ3 страницыFRM Part 1 Study Plan May 2017msreya100% (1)

- Joint Venture Accounts Solved ProblemsДокумент5 страницJoint Venture Accounts Solved ProblemsAnonymous duzV27Mx350% (2)

- BV2018 - MFRS 5 Non Current Assets Held For Sale and Discontinued OperationsДокумент22 страницыBV2018 - MFRS 5 Non Current Assets Held For Sale and Discontinued OperationsAndrew ChongОценок пока нет

- Accounting EquationДокумент14 страницAccounting EquationDindin Oromedlav LoricaОценок пока нет

- General Tyre Balance Sheet Analysis (2006-1010)Документ48 страницGeneral Tyre Balance Sheet Analysis (2006-1010)Shazil AhmadОценок пока нет

- Debt M-RДокумент1 152 страницыDebt M-RMD ABUL KHAYER0% (1)

- Balance Sheet ProvisionalДокумент2 страницыBalance Sheet ProvisionalRaja AdhikariОценок пока нет

- Emerging Value Capital Management, LLC: February 2009 Letter To InvestorsДокумент5 страницEmerging Value Capital Management, LLC: February 2009 Letter To InvestorsL032090Оценок пока нет

- Final DataДокумент63 страницыFinal Dataaurorashiva1Оценок пока нет

- Mastery in Business MathДокумент2 страницыMastery in Business MathglaizacoseОценок пока нет

- Full Download Book Entrepreneurial Finance PDFДокумент41 страницаFull Download Book Entrepreneurial Finance PDFsandra.reimer521100% (16)

- Corporate Financial Planning and Business DevelopmentДокумент9 страницCorporate Financial Planning and Business DevelopmentNazim NazmulОценок пока нет

- Municipal BondДокумент5 страницMunicipal Bondashish_20kОценок пока нет