Академический Документы

Профессиональный Документы

Культура Документы

Matt V HSBC STMNT Facts 10-30-2012

Загружено:

chunga85Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Matt V HSBC STMNT Facts 10-30-2012

Загружено:

chunga85Авторское право:

Доступные форматы

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 1 of 7

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MASSACHUSETTS JODI B. MATT, Plaintiff, v. HSBC BANK USA, N.A., et al., Defendants. CERTAIN DEFENDANTS STATEMENT OF UNDISPUTED MATERIAL FACTS IN SUPPORT OF THEIR MOTION FOR SUMMARY JUDGMENT Pursuant to Local Rule 56.1, Defendants Bank of America, N.A., successor by merger to BAC Home Loans Servicing, LP, formerly known as Countrywide Home Loans Servicing, LP (Bank of America), HSBC Bank USA, N.A. (HSBC), HSBC Bank USA, N.A., on Behalf of the Trust Fund and for the Benefit of ACE Securities Corp. Home Equity Loan Trust Series 2005-HE4 Asset Backed Pass Through Certificates (HSBC as Trustee), Countrywide Securities Corporation (Countrywide), Wells Fargo Bank, N.A. (Wells Fargo) and ACE Securities Corp. (ACE) (collectively, the Moving Defendants) submit this Statement of Undisputed Material Facts in Support of their Motion for Summary Judgment, which seeks summary judgment on all counts of the Complaint filed by Plaintiff Jodi B. Matt (Plaintiff). Deposition transcript excerpts, deposition exhibits and documents referenced herein are attached as exhibits to the Affidavit of Maria Osinski in Support of the Moving Defendants Motion for Summary Judgment and the Affidavit of Courtney Benson in Support of the Moving Defendants Motion for Summary Judgment. As required by Local Rule 5.3, all personal data identifiers in the exhibits have been redacted. STATEMENT OF UNDISPUTED MATERIAL FACTS 1.

LIBA/2338701.2

Civil Action No. 1:10-cv-11621-PBS

Plaintiff applied for a mortgage loan with Northeast Mortgage Corporation

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 2 of 7

(Northeast) on or around March 18, 2005. See Deposition of Jodi Matt (Matt Dep.) 20:4-9, Sept. 26, 2012. The initial Truth-in-Lending Disclosure Statement that Northeast provided to Plaintiff on March 18, 2005 indicated that the mortgage loan could bear an annual percentage rate (APR) of 8.158% and an initial monthly payment of $1,329.26. See March 18, 2005 Truth-in-Lending Disclosure Statement, Exh. A. See id.; see also Matt Dep. 21:8-18. 2. On or around April 6, 2005, Plaintiff executed an adjustable rate promissory note

(the Note) for $200,000 in favor of Northeast. See Note, Exh. B. The Note is secured by a mortgage (the Mortgage, together with the Note, the Mortgage Loan) that Plaintiff also executed on or around April 6, 2005 in favor of Northeast. See Mortgage, Exh. C. The Mortgage is secured by the Property. See id. The Note provided for an initial monthly payment in the amount of $1,429.37 and interest rate of 7.725%. See Note, Exh. B. The Truth-inLending Disclosure Statement provided to Plaintiff at closing also indicated that the initial monthly payment would be $1,429.37, and it informed Plaintiff of the 10.528% APR. See April 6, 2005 Truth-in-Lending Disclosure Statement, Exh. D. 3. On the same date that Plaintiff obtained the Mortgage Loan from Northeast, April

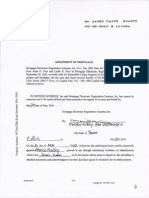

6, 2005, Northeast assigned the Mortgage to New Century Mortgage Corporation (New Century). See Affidavit of Courtney L. Benson (Benson Aff.) 6; see also Assignment to New Century, Exh. 4. The assignment was recorded in the Norfolk County Registry of Deeds at Book 24374, Page 436 on or around December 19, 2006. See id. 4. Note, Exh. B. 5. New Century assigned the Mortgage to HSBC as Trustee on or around November The Note was endorsed from Northeast to New Century without recourse. See

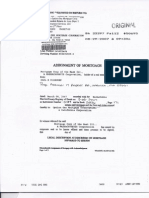

6, 2007. See Benson Aff. 8; see also Assignment to HSBC as Trustee, Exh. 6. The assignment

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 3 of 7

was recorded in the Norfolk County Registry of Deeds at Book 25302, Page 102 on or around November 16, 2007. See id. 6. 7. New Century then endorsed the Note in blank. See id. Bank of America, N.A., successor by merger to BAC Home Loans Servicing, LP,

formerly known as Countrywide Home Loans Servicing, LP (Bank of America), serviced the Mortgage Loan until October 1, 2012, when the servicing rights transferred to Select Portfolio Servicing, Inc. See Affidavit of Maria Osinski (Osinski Aff.) 3. 8. Plaintiff initially defaulted on the Mortgage Loan by failing to timely make her

October 2005 monthly payment. See Payment History, Exh. E; see also Osinski Aff. 9. After bringing her loan current in January 2007, Plaintiff again defaulted in April 2007. See Osinski Aff. 9. Plaintiff sought to refinance with Countrywides Full Spectrum Lending Division in or around February 2007. See Letter to Matt, Feb. 28, 2007, Exh. F. Countrywide provided Plaintiff with terms of the proposed refinance. See id. Plaintiff chose not to refinance, however. See Matt Dep. 56:3-57:1. Instead, Plaintiff reinstated her loan in April 2008 by making a lump sum payment of $34,898.35. See Letter to Matt from Stanton & Davis, Apr. 4, 2008, Exh. G; see also Matt Dep. 64:13-65:4; see also Osinski Aff. 9. Plaintiff defaulted again in May 2008. 9. Plaintiff has not made a single payment on the Mortgage Loan since August 2008.

See Payment History, Exh. E; see also Osinski Aff. 9. 10. Plaintiff applied for, and Bank of America offered Plaintiff, a loan modification in

June 2009. See Modification Offer, June 5, 2009, Exh. H. Plaintiff did not accept the loan modification offer because she did not believe Bank of America could establish ownership of the Mortgage Loan. See Pl.s Response to Def. Bank of Americas Interrogatory No. 11, Exh. 2. Plaintiff also stated that she believed the modification offer should have contained a 6.99%

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 4 of 7

interest rate, with no escrow, and with arrears calculated from the date of her default based on communications from time to time with BOA. See Pl.s Response to Def. Bank of Americas Interrogatory No. 7, Exh. 2. 11. Bank of America sent Plaintiff a Notice of Intention to Foreclose on September

14, 2009. See Letter to Matt, Sept. 14, 2009, Exh. I. The Notice provided Plaintiff the opportunity to cure her default. See id. Plaintiff did not cure the default. See Matt Dep. 74:1623. 12. Certain mortgage loans, including the Plaintiffs Mortgage Loan, was deposited

into ACE Securities Corp. Home Equity Loan Trust Series 2005-HE4 Asset Backed Pass Through Certificates Trust (the Trust) by either the Trusts Closing Date, June 29, 2005, or by the end of the Trusts Pre-Funding Period, September 27, 2005. See Benson Aff. 7; see also Affidavit of Timothy P. Crowley, Exh. 5. Plaintiffs Mortgage Loan is listed at line 4893 on the Mortgage Loan Schedule. See id. Plaintiffs Mortgage Loan was deposited into the Trust by September 27, 2005. See id. 13. Prior to the execution of the assignment of the Mortgage from New Century to

HSBC as Trustee, New Century filed for Chapter 11 bankruptcy in the United States District Court for the District of Delaware, and, as a part of the bankruptcy, the court approved a stipulation between New Century and Countrywide Home Loans, Inc. See Benson Aff. 9; see also Order, Exh. 7. The stipulation states that on November 11, 2002, New Century and Countrywide Home Loans, Inc. entered into a Limited Power of Attorney agreement. See id. Pursuant to the Limited Power of Attorney, Countrywide Home Loans, Inc. was appointed as New Centurys true and lawful attorney-in-fact. See id. It granted Countrywide Home Loans, Inc. the ability to exercise powers on behalf of New Century, including executing assignments

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 5 of 7

of mortgage[s] and to do any other act or complete any other document that arises in the normal course of servicing. See id. The approved stipulation also modified the automatic stay to the extent necessary for Countrywide Home Loans, Inc. to initiate and pursue foreclosure proceedings, including to execute and file assignments. See id. 14. Countrywide Home Loans, Inc. authorized a certain list of employees to take

actions on behalf of the Corporation, for the purpose of signing foreclosure documents, including but not limited to, Substitutions of Trustee, affidavits, assignments, and warranty deeds, and related documents and instruments, and carrying out such other day-to-day operational and/or administrative functions in connection with the servicing of mortgage loans via a Designation and Authorization by an Authorized Officer dated October 25, 2007. See Designation, Exh. J. Kimberly Dawson, the Countrywide Home Loans, Inc. employee who executed the assignment from New Century to HSBC on November 6, 2007 is listed as one of the authorized officers on the designation. See id. 15. Plaintiff cannot identify evidence supporting her alleged belief that the

Defendants worked together to induce her into the Mortgage Loan. See Pl.s Response to Def. HSBC as Trustees Interrogatory No. 15, Exh. 3. 16. Plaintiff claims that the agreement she alleges existed between the Defendants to

commit a wrongful act is articulated in the Plaintiffs [sic] Complaint. See Pl.s Response to Def. HSBC as Trustees Interrogatory No. 3, Exh. 3. 17. Plaintiff claims that the agreement to commit a wrongful act that existed between

the Defendants and Bank of America was that BOA and its predecessors has [sic] at all times collected or sought mortgage payments from Plaintiff on behalf of entities that it knew or should have known did not have the right of collections. See Pl.s Response to Def. Bank of Americas

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 6 of 7

Interrogatory No. 16, Exh. 2. 18. Plaintiff states that HSBC as Trustee directed unspecified conduct of the Moving

Defendants. See Pl.s Response to Def. HSBC as Trustees Interrogatory No. 1, Exh. 3. 19. Plaintiff stated that she received two (2) copies of the Notice of the Right to

Cancel and other documentation, as provided in exhibit 2 of the Plaintiffs verified complaint within a couple of days of the closing of the Mortgage Loan. See Pl.s Response to Def. HSBC as Trustees Interrogatory No. 8, Exh. 3. Exhibit 2 of the Complaint contains a Truth-in-Lending Disclosure. See Compl. Exh. 2. 20. Plaintiff stated that she did not receive copies of any documents at the closing of

the Mortgage Loan because Tomasello claimed she was sick and pregnant and needed to use [Plaintiffs] bathroom. She appeared to be rushed and said she would send us the documents. See Pl.s Response to Def. HSBC as Trustees Interrogatory No. 7, Exh. 3. 21. Plaintiff claims that she detrimentally relied on HSBC as Trustees alleged false

statements by being [f]orced to defend the land court action and the instant action [d]ue to the defendants assertion of the ownership of [sic] note and mortgage. See Pl.s Response to Def. HSBC as Trustees Interrogatory No. 14, Exh. 3. 22. Plaintiff stated that the basis for her belief that Bank of America misrepresented

that it would evaluate her Mortgage Loan for a modification requires speculation. See Pl.s Response to Def. Bank of Americas Interrogatory No. 10, Exh. 2. 23. Plaintiff stated that she did not accept the June 5, 2009 loan modification because

BOA could not provide any evidentiary foundation to support its claim of ownership of the Note and Mortgage and because BOA would not agree to indemnify the Plaintiff against any future claims to the said note and mortgage. See Pl.s Response to Def. Bank of Americas

Case 1:10-cv-11621-PBS Document 117 Filed 10/30/12 Page 7 of 7

Interrogatory No. 9, Exh. 2. 24. Plaintiff stated that her basis for believing that the defendants induced her to enter

into the Mortgage Loan agreement was that she started out owing Northeast Mortgage and has since had defendants either claiming to service, own or have some involvement in the collection of the loan. See Pl.s Response to Def. Bank of Americas Interrogatory No. 15, Exh. 2.

Dated: October 30, 2012

Respectfully submitted, BANK OF AMERICA, N.A., HSBC BANK USA, N.A., HSBC AS TRUSTEE, COUNTRYWIDE SECURITIES CORPORATION, WELLS FARGO BANK, N.A. AND ACE SECURITIES CORP., By their attorneys, /s/ Courtney Benson Courtney L. Benson (BBO# 675679) Chad W. Higgins (BBO# 668924) GOODWIN PROCTER LLP Exchange Place 53 State Street Boston, MA 02109 Tel. 617-570-1000 Fax. 617-523-1231 courtneybenson@goodwinprocter.com chiggins@goodwinprocter.com

CERTIFICATE OF SERVICE I hereby certify that this document filed through the ECF system will be sent electronically to the registered participants as identified on the Notice of Electronic Filing (NEF) and paper copies will be sent to those indicated as non-registered participants on October 30, 2012.

/s/ Courtney Benson

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- DEED OF HEIRSHIP AND SALE - FonolleraДокумент2 страницыDEED OF HEIRSHIP AND SALE - FonollerarjpogikaayoОценок пока нет

- BIR Ruling (DA-670-07) Lotto OutletДокумент3 страницыBIR Ruling (DA-670-07) Lotto OutletMonica Soriano100% (2)

- Membership in The Knights of ColumbusДокумент2 страницыMembership in The Knights of ColumbusamericanpapistОценок пока нет

- Lawyer and The Legal ProfessionДокумент72 страницыLawyer and The Legal ProfessionEllyssa TimonesОценок пока нет

- MELISSA A. JUÁREZ v. SELECT PORTFOLIO SERVICING Et Al 2 - 12 - 2013Документ27 страницMELISSA A. JUÁREZ v. SELECT PORTFOLIO SERVICING Et Al 2 - 12 - 2013chunga85100% (1)

- Nego-International Bank v. GuecoДокумент3 страницыNego-International Bank v. GuecoIrish GarciaОценок пока нет

- Dalisay V ConsolacionДокумент1 страницаDalisay V Consolaciongenel marquezОценок пока нет

- G.R. No. 198450 People vs. Fernando Ranche Havana A.K.A. Fernamdo Ranche AbanaДокумент2 страницыG.R. No. 198450 People vs. Fernando Ranche Havana A.K.A. Fernamdo Ranche AbanaKling KingОценок пока нет

- Chavez Vs National Housing Authority, 530 SCRA 235 Case Digest (Administrative Law)Документ2 страницыChavez Vs National Housing Authority, 530 SCRA 235 Case Digest (Administrative Law)AizaFerrerEbina100% (2)

- Heirs of Magdaleno Ypon v. RicaforteДокумент2 страницыHeirs of Magdaleno Ypon v. RicaforteSean Galvez100% (1)

- Antone Vs Beronilla G.R. No.-183824Документ3 страницыAntone Vs Beronilla G.R. No.-183824Teacher April CelestialОценок пока нет

- MERS Top Dog Robert M BrochinДокумент55 страницMERS Top Dog Robert M Brochinchunga85Оценок пока нет

- Marley Vs BAC Appeal January 8 2014Документ3 страницыMarley Vs BAC Appeal January 8 2014chunga85Оценок пока нет

- Bank of New York Mellon V Gertude Hammond 2-18-2013Документ5 страницBank of New York Mellon V Gertude Hammond 2-18-2013chunga85Оценок пока нет

- RI General Assembly Press Release Anti MERS Bill Picks Up Steam 2013 S 0547Документ20 страницRI General Assembly Press Release Anti MERS Bill Picks Up Steam 2013 S 0547chunga85Оценок пока нет

- RI Supreme Court Response To City of Providence Amicus Curiae 3-21-2013Документ1 страницаRI Supreme Court Response To City of Providence Amicus Curiae 3-21-2013chunga85Оценок пока нет

- Robo-Signing - Continuing Practice by Settlement Banks in Massachusetts ForeclosuresДокумент12 страницRobo-Signing - Continuing Practice by Settlement Banks in Massachusetts Foreclosureschunga85Оценок пока нет

- Christopher P. Olson Fraudulent Foreclosure House Flipper MAДокумент6 страницChristopher P. Olson Fraudulent Foreclosure House Flipper MAchunga85Оценок пока нет

- RI Rep Donald Lally Fraud Bill H5434 2 - 13 - 2013Документ5 страницRI Rep Donald Lally Fraud Bill H5434 2 - 13 - 2013chunga85Оценок пока нет

- Bucci Vs Lehman Brothers Bank Et Al 3-7-2013Документ30 страницBucci Vs Lehman Brothers Bank Et Al 3-7-2013chunga8550% (2)

- HSBC BANK USA Vs Jodi B. Matt January 14, 2013Документ8 страницHSBC BANK USA Vs Jodi B. Matt January 14, 2013chunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex AДокумент2 страницыMatt V HSBC Affidavit Osinski Ex Achunga85Оценок пока нет

- RI House Bill H 5512 January 2013Документ9 страницRI House Bill H 5512 January 2013chunga85Оценок пока нет

- JermanДокумент63 страницыJermanSCOTUSblog2100% (2)

- Matt V HSBC Affidavit - SJ - Osinski10-30-2012Документ4 страницыMatt V HSBC Affidavit - SJ - Osinski10-30-2012chunga85Оценок пока нет

- Most Outrageous MA Foreclosure of 2012Документ18 страницMost Outrageous MA Foreclosure of 2012chunga85Оценок пока нет

- Most Outrageous MA Foreclosure of 2012 AbstractДокумент10 страницMost Outrageous MA Foreclosure of 2012 Abstractchunga85Оценок пока нет

- Matt V HSBC - SJ - Memo - 10 - 30 - 2012Документ20 страницMatt V HSBC - SJ - Memo - 10 - 30 - 2012chunga85Оценок пока нет

- Matt V HSBC Affidavit - SJ - 10-30-2012Документ4 страницыMatt V HSBC Affidavit - SJ - 10-30-2012chunga85Оценок пока нет

- Harmon Law Infiltrates Registry of DeedsДокумент7 страницHarmon Law Infiltrates Registry of Deedschunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex CДокумент18 страницMatt V HSBC Affidavit Osinski Ex Cchunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex BДокумент6 страницMatt V HSBC Affidavit Osinski Ex Bchunga85Оценок пока нет

- Matt V HSBC Certain Defendants Motion SJ 10-30-2012Документ2 страницыMatt V HSBC Certain Defendants Motion SJ 10-30-2012chunga85Оценок пока нет

- Chief Justice Karyn F Scheier MA Robo JudgeДокумент4 страницыChief Justice Karyn F Scheier MA Robo Judgechunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex JДокумент2 страницыMatt V HSBC Affidavit Osinski Ex Jchunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex IДокумент2 страницыMatt V HSBC Affidavit Osinski Ex Ichunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex HДокумент6 страницMatt V HSBC Affidavit Osinski Ex Hchunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex FДокумент2 страницыMatt V HSBC Affidavit Osinski Ex Fchunga85Оценок пока нет

- Matt V HSBC Affidavit Osinski Ex GДокумент3 страницыMatt V HSBC Affidavit Osinski Ex Gchunga85Оценок пока нет

- Nabozny v. Barnhill: No. 58120 Reversed and Remanded Appellate Court of Illinois, First District. Fourth DivisionДокумент3 страницыNabozny v. Barnhill: No. 58120 Reversed and Remanded Appellate Court of Illinois, First District. Fourth DivisionBuck EagleОценок пока нет

- G.R. No. 217456, November 24, 2015Документ21 страницаG.R. No. 217456, November 24, 2015MACОценок пока нет

- 5325 (2) CaseДокумент8 страниц5325 (2) CaseMarivic EscuetaОценок пока нет

- 'Free SHS Can Become Another GYEEDA Scandal' - Ayariga Sues Akufo-Addo GovernmentДокумент8 страниц'Free SHS Can Become Another GYEEDA Scandal' - Ayariga Sues Akufo-Addo GovernmentGhanaWeb EditorialОценок пока нет

- Final Draft AsianДокумент7 страницFinal Draft Asianapi-295691859Оценок пока нет

- Republic of The Philippines National Capital Judicial Region Metropolitan Trial Court Branch 50, Caloocan CityДокумент2 страницыRepublic of The Philippines National Capital Judicial Region Metropolitan Trial Court Branch 50, Caloocan CityAACОценок пока нет

- DOH Vs CamposanosДокумент6 страницDOH Vs CamposanosKorrine FloresОценок пока нет

- VT-010-Vehicle Vessel ID VerificationДокумент2 страницыVT-010-Vehicle Vessel ID VerificationJános JuhászОценок пока нет

- NATIONAL INTERNAL REVENUE CODE OF 1997 As Amended by Republic ActДокумент4 страницыNATIONAL INTERNAL REVENUE CODE OF 1997 As Amended by Republic ActGrasya PasquinОценок пока нет

- FERMIN V PEOPLEДокумент9 страницFERMIN V PEOPLEMichael Mendoza MarpuriОценок пока нет

- 3 Lorenzo Shipping Corp. vs. BJ Marthel International, Inc.Документ23 страницы3 Lorenzo Shipping Corp. vs. BJ Marthel International, Inc.cool_peachОценок пока нет

- 21st Century LiteratureДокумент3 страницы21st Century LiteratureWigan Conda FaicolОценок пока нет

- PR Mallya Nirav and MehulfinalДокумент2 страницыPR Mallya Nirav and Mehulfinalshivani shindeОценок пока нет

- Azhar Aziz Leave To Defend App (Adj)Документ11 страницAzhar Aziz Leave To Defend App (Adj)Yahya JanОценок пока нет

- Tax Research For Compliance and Tax PlanningДокумент27 страницTax Research For Compliance and Tax PlanningArnel RemorinОценок пока нет

- Ambot Sa KinabuhiДокумент55 страницAmbot Sa Kinabuhiadonis.orillaОценок пока нет

- Digest - Article 5 of The R.P.C.Документ2 страницыDigest - Article 5 of The R.P.C.Rochelle GablinesОценок пока нет

- Civil20law20q A 201990-2006Документ119 страницCivil20law20q A 201990-2006AJ SalazarОценок пока нет

- Letter To KARE-11 TV - October 2015 Gun Control DebateДокумент2 страницыLetter To KARE-11 TV - October 2015 Gun Control DebateBryan StrawserОценок пока нет

- Torts - Abs CBN Vs CA and RbsДокумент4 страницыTorts - Abs CBN Vs CA and RbsMaria Reylan GarciaОценок пока нет