Академический Документы

Профессиональный Документы

Культура Документы

Credit News: Reason Codes... The Rest of The Story

Загружено:

Julieann ThiryИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Credit News: Reason Codes... The Rest of The Story

Загружено:

Julieann ThiryАвторское право:

Доступные форматы

Dear Client

Answer your credit questions. Page 2

Health

Healthy Living Tip. Page 3

Trivia

Its Beginning to look a lot like Christmas. Page 3

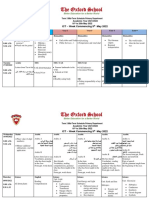

2012

Volume 1, Issue 15

Credit News

The Newsletter Thats Both Informative and Fun!

Visit us on the web... www.EliteCreditCare.com | (877) 604-4489

Reason Codes... the rest of the story

Reason Codes, Adverse Action Codes, Score Factors, Negative Factors... theyre all the same thing. These are the short sentences that appear with credit scores and help to provide clarity about a consumers score or scores.

By Attila Thiry Little is known about these codes other than the fact that theyre extremely important and can provide a roadmap for consumers to follow when theyre in a score improvement mode.

A Little History

Reason codes are not new and theyre not even relatively new. Theyre just as old as credit scoring.

Reason codes are not new and theyre not even relatively new. Theyre just as old as credit scoring. What is relatively new is the access consumers have to their own scores through retail websites and certain lender disclosures that are now required by law. The original title given to these codes was Adverse Action Codes. The codes were originally designed to give lenders an easy

way to comply with the adverse action requirements of the Fair Credit Reporting Act. The FCRA mandates that lenders provide a notice of adverse action when credit is used as a basis for some sort of adverse treatment, such as a credit declination or an adverse approval. An adverse approval is when youre approved for whatever it is youre applying for but at terms that are materially worse than the best deal the lender has to offer. These notices contain basic information about why you didnt get the deal you were looking for (or why you were denied) and where you can get a copy of the credit report

used as the basis for their decision. Most of them also contain the score factors that were generated by the credit scoring model along with your score. And because they have become a common part of adverse action notices, hence the title Adverse Action codes.

What Do They Mean?

The pretend credit experts will tell you that the reason codes are a list of the reasons why your scores are poor. That isnt an accurate definition. The codes are actually designed to tell you why your score isnt higher than it already is. Does anyone actually believe someone with

Continued on back page

Also in this issue

This Month in History pg 2 Internet Tidbit: Pageonce.com pg 2 By The Numbers: Skiing pg 3 Quotes to Live By pg 3 Quotes that make you laugh pg 3

Dear Client, Your new issue has arrived!

We hope you enjoy this months newsletter. Check out for the EXCLUSIVE content that we have put together just for YOU! Also visit us at: www.EliteCreditCare.com

This Month in History:

December 6, 1947 Everglades National Park was established on the southern Florida peninsula. December 10, 1964 Dr. Martin Luther King Jr. was awarded the Nobel Peace Prize.premiered. December 15, 1791 The Bill of Rights was adopted. December 23, 1913 The Federal Reserve System was established by an act of Congress.

Dear Client,

Dear Client, What Happened to Reason Code 22? For those of you old timers who are familiar with FICOs Reason Codes you may have noticed that one of our old friends hasnt shown up in quite some time. Go grab your list of FICO Reason Codes and look for Reason Code 22. Reason Code 22 reads: Serious delinquency, derogatory public record, or collection filed. This language is the same regardless of where code 22 shows up; FICO at Equifax, FICO at Experian or FICO at TransUnion. Its the catch-all derogatory reason code. If youve got a charge off or a lien or a collection code 22 was for you, but not any longer. Seems as if the catch all nature of reason codes isnt such a good idea. So, code 22 needed to become much more specific to the individual consumers credit report. The problem is you cannot change the language of an existing reason code unless you retrofit every single FICO score thats still in production. The number of models, if you dont know, is 49 as of late 2012. The easy fix to this problem is to simply create some new reason codes and decommission old ones, or old one as is the case with code 22. You havent seen code 22 in years. But, you have seen her offspring. Code 22 was split into three different reason codes; 38, 39 and 40. These codes read as such: 38: Serious delinquency, and public record or collection filed. 39: Serious delinquency 40: Derogatory public record or collection filed. And as with code 22 the language of 38, 39 and 40 is the same across the credit bureaus. What the splitting accomplished was to offer a more specific list of reasons why your score isnt higher. And, when it comes to credit scores specificity is good. If you see a credit report with code 38, 39 or 40 it will always be in the first position. And, you will never see more than one of those three reason codes. And, if you see one of those reason codes you can conclude that the consumers score was calculated by one of FICOs derogatory scorecards. Dear Client, Whats More Important in Your FICO Score... a Collection or the Balance of the Collection? One of the most common myths about FICO scores is that if you were to pay or settle collection accounts that your scores would improve. There are even some who believe paying a collection will lead to the removal of the collection from your credit reports. We know that neither is true. But why would a paid in full collection be essentially as damaging to your scores as an unpaid collection? Arent unpaid collections worse than paid collections? The answer is, surprisingly, no. This is more about predictive value than it is about the balance on a collection account. Credit scores dont care about balances, they care about what piece of information is going to be predictive of some human action, like missing a payment in the future. And whats most predictive about our consumer credit behaviorwhat weve done in the past. In fact, what weve done in the past is most predictive of what were going to do in the future. If you have missed payments to the point where a creditor or a service provider has sold or outsourced your account to a collection agency then thats very predictive. Youve already proven that youre willing to let debts go into default, right? So, if youve done it once then why wouldnt you be willing to do it again? It doesnt matter that you let a $500 debt go into default. It doesnt matter that you let a $50,000 debt go into default. It matters that you let ANY debt go into default. And, because credit scores arent designed to predict the balance of future defaults theyre more focused on the incident. Thats why paying a collection doesnt cause your scores to shoot through the roof. The balance wasnt terribly important in the first place. The incidentnow thats a different story.

Internet Tidbit

If you are looking for a streamlined way to manage your money and pay your bills, check out Pageonce.com. This service combines bill payment with an easy-to-use budgeting system. Pageonce is perfect for anyone who wants to manage their money on the go by connecting your bank accounts, bills, credit cards, loans, cellphone minutes, and travel rewards into one system. They offer bank-level security and a complete overview of your finances. Pageonce excels at keeping you from paying your bills late by providing warnings of upcoming due dates and keeping all your monthly statements in a single, convenient place. And since you can pay your bills directly from your Android or iPhone, you will never have a late payment again.

Would you like some extra cash for your pocket?

Im sure youre well aware that advertising for new business is very expensive. So instead of paying the local newspaper or radio station, Id much rather pay you! We recently started a Cash Bonus Referral Program for our top customers, like you!. This program allows you to earn a cash bonus for referrals we receive that turn into customers. For every referral you send our way that signs on to use our services, we will give you a bonus to use any way you see fit. Call your friends now and give our name and phone number. Be sure to have them mention your name when they call so we can send your bonus.

2 December 2012 | Elite Credit News

Trivia Quiz: Its Beginning to look a lot like Christmas

1. Where was Jesus born?

A. Bethlehem B. Egypt C. India D. Yemen E. Pakistan

2. Where did baby Jesus sleep?

A. B. C. D. E. A hay stack A manger Crib Cave Stroller

3. Who is not a part of Santas set of reindeers?

A. B. C. D. E. Dasher Vixen Blitzen Sleepy Cupid

4. InA Christmas Carol , who is the first ghost to appear to Scrooge?

A. The Ghost of Christmas Past B. Jacob Marley C. Jack Morse

Answers on back page

By The Numbers:

Skiing

Health & Wellness

Healthy Living Tip

By Attila Thiry

- Sixty-one percent of all skiers and snowboarders wear helmets, with over 93 percent of children 9 years old or younger donning the headgear.

- There are over 60 million skier visits to U.S. ski resorts each year. - There were 486 ski areas operating last season. - New York has the most ski areas in the United States, with 52 in operation last season. - Four states have only one ski area: Alabama, Maryland, Rhode Island, and Tennessee. Only 13 U.S. states have no ski areas.

One great way to reduce the number of colds your family gets over the winter is to focus on good nutrition. Avoiding junk food and excess calories strengthens your immune system and gives you more energy. It is easy to sneak in some extra nutrients by adding healthy foods to snack time. Your family can munch on sliced apples, whole wheat crackers with cheese, yogurt, and oranges.

Quotes to Live By:

- Never cut a tree down in the wintertime. Never make a negative decision in the low time. Never make your most important decisions when you are in your worst moods. Wait. Be patient. The storm will pass. The spring will come.

Quotes that make you laugh:

- This past Christmas, I told my girlfriend for months in advance that all I wanted was an Xbox. Thats it. Beginning and end of list, Xbox. You know what she got me? A homemade frame with a picture of us from our first date together. Which was fine. Because I got her an Xbox.

Source: National Ski Areas Association

Robert Schuller

Anthony Jeselnik

<Newsletter Title> | December 2012 3

Reason Codes... the rest of the story

continued from page 1 a FICO score of 750 has a poor score? There are 80,000,000 people who would disagree with that assertion. Yet, consumers with FICO scores that high, and higher, have reason codes. The codes are delivered in descending order of importance. That means the code that is in position one is the top reason why your score isnt higher. The code in position two is the second top reason why your score isnt higher, and so on. There are only four reason codes delivered with a FICO score despite a common myth that five can be delivered on occasion. Well clear up that myth in a bit. There are instances where a score is calculated but four reason codes are not. In those cases the score is normally very high and there simply arent four reasons why the score isnt higher. Well get to the technical

explanation in the next paragraph.

The Technical Jargon

The choice of reason codes is not arbitrary. And, the order in which theyre delivered is also not arbitrary. The reason certain codes are chosen and the order theyre delivered is determined by a function within the credit scoring model. The chosen codes and the order of delivery is determined based on the difference in the points earned for a characteristic relative to the maximum points that could have been earned for that characteristic. If the spread between those two figures is the highest relative to all other points earned versus maximum points spreads then that reason code will be in the first position. Confused yet? Heres a better way to look at it Lets say youre a credit scoring model and one of your characteristics is Whats your aggregate revolving utilization? And, just for this hypothetical lets assume that for that particular characteristic you COULD earn a maximum of 50 points. But, your utilization isnt great so you only earn 10 points. The difference between 50 points and 10 points is 40 points. If that 40 point difference in points

earned versus maximum possible points that could be earned is greater than all of the other spreads then the first reason code that would be generated with my hypothetical score would be something along the lines of Balances to limits on revolving accounts is too high.

The 5th Reason Code Myth

In many credit reports generated for lenders there appears to be a 5th reason code. That 5th code is always related to inquiries having an adverse impact to the consumers credit scores. The placement of the language suggests that its a reason code and that inquiries were the 5th most important reason why the consumers score wasnt higher. This is not the case. According to FICO, A new regulation that went into effect in July 2011 requires a fifth factor to be reported when inquiries affected the calculation of your score and inquiries were not reported as one of the first four factors. What this means is if inquires had any affect on your FICO score at all that fact has to be disclosed. Its simply cosmetic that it happens to be placed in a location that suggests it is the 5th reason code.

HAPPY HOLIDAYS AND BEST WISHES FOR 2013!

Check inside the handpicked articles, trivia, tips and offers just for you! Hurry! grab all this unvaluable content and share it with your love ones

Dear Client, We hope you enjoy this months newsletter. It is a great time to spend outdoors with your family! Respectfully, Attila Thiry Credit News is a monthly newsletter from your friends at Elite Credit Care

Elite Credit Care 2018 156th AveNE Suite 100, Bldg. F Bellevue, WA 98007

ValuedClients

Answers to the trivia: 1-A, 2-B, 3-D, 4-B Contact Us Now To Get A Free Consultation! (Valued at $200) | <Co.Phone>

Вам также может понравиться

- 40 Credit Repair SecretsДокумент8 страниц40 Credit Repair Secretswlingle11753% (19)

- I GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRОт EverandI GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRОценок пока нет

- The Credit Score Zoom Kit 2015 PDF EbooksДокумент56 страницThe Credit Score Zoom Kit 2015 PDF Ebooksrodney92% (25)

- Consumer Publishing Group - Welcome LetterДокумент166 страницConsumer Publishing Group - Welcome Lettertwocubesplz80% (5)

- Dirty Little Secrets: What the Credit Reporting Agencies Won't Tell YouОт EverandDirty Little Secrets: What the Credit Reporting Agencies Won't Tell YouРейтинг: 3.5 из 5 звезд3.5/5 (3)

- What The Credit Bureaus Don't Want You To KnowДокумент16 страницWhat The Credit Bureaus Don't Want You To KnowLarry McKinstry86% (7)

- DR Jeremiah Revelation Prophecy Chart PDFДокумент2 страницыDR Jeremiah Revelation Prophecy Chart PDFkoinoniabcn93% (14)

- The Super Secrets of Credit EbookДокумент23 страницыThe Super Secrets of Credit EbookRob0% (1)

- How to Get Started Improving Your Credit: The Inside Information You Need to Avoid Costly Mistakes and Do Things Right the First TimeОт EverandHow to Get Started Improving Your Credit: The Inside Information You Need to Avoid Costly Mistakes and Do Things Right the First TimeРейтинг: 4 из 5 звезд4/5 (3)

- 10K PrimariesДокумент25 страниц10K PrimariesCarol67% (3)

- The Five Most Devastating Credit Mistakes and How To Avoid ThemДокумент8 страницThe Five Most Devastating Credit Mistakes and How To Avoid ThemrickОценок пока нет

- How To Obtain Your Credit File and Repair Your Credit ProblemsДокумент37 страницHow To Obtain Your Credit File and Repair Your Credit ProblemsSean Dominey100% (2)

- Improve Your Credit Score Legally: Credit Score Tips You NeedОт EverandImprove Your Credit Score Legally: Credit Score Tips You NeedРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Hidden Credit Repair Secrets: How to Fix Your Credit Score and Boost it to 720+ with Credit Repair Secrets: Change Your Financial Life. Protect and Manage Your Business, Your Money and Enjoy FreedomОт EverandHidden Credit Repair Secrets: How to Fix Your Credit Score and Boost it to 720+ with Credit Repair Secrets: Change Your Financial Life. Protect and Manage Your Business, Your Money and Enjoy FreedomОценок пока нет

- Remier Ealth Trategies: The Do It Yourself Credit Repair ManualДокумент69 страницRemier Ealth Trategies: The Do It Yourself Credit Repair ManualFreedomofMindОценок пока нет

- The Everything Improve Your Credit Book: Boost Your Score, Lower Your Interest Rates, and Save MoneyОт EverandThe Everything Improve Your Credit Book: Boost Your Score, Lower Your Interest Rates, and Save MoneyОценок пока нет

- Owing WorksheetДокумент7 страницOwing Worksheetapi-273999449Оценок пока нет

- How to Fix Your Terrible Credit Score: Getting Out of Debt the Easy Way!От EverandHow to Fix Your Terrible Credit Score: Getting Out of Debt the Easy Way!Оценок пока нет

- Cleaning Up Your CreditДокумент42 страницыCleaning Up Your CreditSilvia VialeОценок пока нет

- Credit For Canadians: Fix Your Own Credit Report, Protect Yourself From Identity TheftОт EverandCredit For Canadians: Fix Your Own Credit Report, Protect Yourself From Identity TheftРейтинг: 3 из 5 звезд3/5 (1)

- How To Get Great CreditДокумент16 страницHow To Get Great Creditduckey08Оценок пока нет

- Understanding Credit: Wisconsin Department of Financial InstitutionsДокумент34 страницыUnderstanding Credit: Wisconsin Department of Financial InstitutionsshalzadhawanОценок пока нет

- Credit Secrets : The Complete Guide on How to Boost Your Credit Score 100+ Points Without Credit Repair: Improve Your Financial Life, Enjoy Freedom and IndependenceОт EverandCredit Secrets : The Complete Guide on How to Boost Your Credit Score 100+ Points Without Credit Repair: Improve Your Financial Life, Enjoy Freedom and IndependenceОценок пока нет

- DIY Credit Repair GuideДокумент21 страницаDIY Credit Repair GuideAnthony VinsonОценок пока нет

- Guide To Understanding Credit GuideДокумент11 страницGuide To Understanding Credit GuideRobert Glen Murrell JrОценок пока нет

- Credit DebtДокумент41 страницаCredit Debtbns.publishing12100% (1)

- 11 Dirty Little Secrets Your Credit CardДокумент7 страниц11 Dirty Little Secrets Your Credit CardrajivermaОценок пока нет

- Credit 1 Through 15Документ37 страницCredit 1 Through 15Mark WoodsОценок пока нет

- Repair and Boost Your Credit Score in 30 Days: How Anyone Can Fix, Repair, and Boost Their Credit Ratings in Less Than 30 DaysОт EverandRepair and Boost Your Credit Score in 30 Days: How Anyone Can Fix, Repair, and Boost Their Credit Ratings in Less Than 30 DaysОценок пока нет

- Assignment of Personal FinancingДокумент11 страницAssignment of Personal FinancingRimpy GeraОценок пока нет

- Credit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.От EverandCredit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.Оценок пока нет

- How Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaДокумент3 страницыHow Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- TrueCredit Education BrochureДокумент12 страницTrueCredit Education BrochureHameed WesabiОценок пока нет

- Improve and Increase Your Credit Score: Credit Management Strategies that Will Save You ThousandsОт EverandImprove and Increase Your Credit Score: Credit Management Strategies that Will Save You ThousandsОценок пока нет

- Reincarnated As A Sword Volume 12Документ263 страницыReincarnated As A Sword Volume 12Phil100% (1)

- ASTM E466 Uji Fatik LogamДокумент5 страницASTM E466 Uji Fatik LogamMad Is100% (1)

- Role of Communication in BusinessДокумент3 страницыRole of Communication in Businessmadhu motkur100% (2)

- Credit News 0113Документ4 страницыCredit News 0113Julieann ThiryОценок пока нет

- Exploit Loophole 609 to Boost Your Credit Score and Remove All Negative Items From Your Credit Report (Second Edition): Personal Finance, #1От EverandExploit Loophole 609 to Boost Your Credit Score and Remove All Negative Items From Your Credit Report (Second Edition): Personal Finance, #1Оценок пока нет

- Credit Sharks in SuitsДокумент16 страницCredit Sharks in SuitsedwardoughОценок пока нет

- Credit Card Debt Research PaperДокумент8 страницCredit Card Debt Research Paperfemeowplg100% (1)

- Thesis Statement For Credit Card DebtДокумент4 страницыThesis Statement For Credit Card DebtPayToWritePaperCanada100% (2)

- Must Read For A US Newcomer - Building Credit in The USAДокумент4 страницыMust Read For A US Newcomer - Building Credit in The USANaimul hassanОценок пока нет

- Olive Green Neutral Declutter Simple Living How To Guide Ebook CoverДокумент6 страницOlive Green Neutral Declutter Simple Living How To Guide Ebook Covernijhoom624Оценок пока нет

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Документ3 страницыBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NОценок пока нет

- Your Credit Score-A Number To Know: Print This PageДокумент4 страницыYour Credit Score-A Number To Know: Print This Pageray lamarОценок пока нет

- Chartered AccountancyДокумент28 страницChartered AccountancyNidhi ShrivastavaОценок пока нет

- Sampling TechДокумент5 страницSampling TechJAMZ VIBESОценок пока нет

- Film Viewing RomeroДокумент3 страницыFilm Viewing RomeroJenesis MuescoОценок пока нет

- Wardruna-Yggdrasil Bio EngДокумент3 страницыWardruna-Yggdrasil Bio EngCristian RamirezОценок пока нет

- Term 3 Mid-Term Assessment ScheduleДокумент9 страницTerm 3 Mid-Term Assessment ScheduleRabia MoeedОценок пока нет

- M-10 Content+Previous Years QuestionДокумент65 страницM-10 Content+Previous Years QuestionOnline Physics Care by Syed Al-NahiyanОценок пока нет

- R15 Aerodynamics Notes PDFДокумент61 страницаR15 Aerodynamics Notes PDFRahil MpОценок пока нет

- Detecting Port Scan Attempts With Comparative Analysis of Deep Learning and Support Vector Machine AlgorithmsДокумент4 страницыDetecting Port Scan Attempts With Comparative Analysis of Deep Learning and Support Vector Machine Algorithmskrishna reddyОценок пока нет

- Teaching by Principles OutlineДокумент3 страницыTeaching by Principles OutlineCindy Onetto0% (1)

- YSU No. 2 Heat SheetsДокумент24 страницыYSU No. 2 Heat SheetsMark DwyerОценок пока нет

- Group No. - Leader: MembersДокумент7 страницGroup No. - Leader: MembersJONATHAN NACHORОценок пока нет

- Notes Ilw1501 Introduction To LawДокумент11 страницNotes Ilw1501 Introduction To Lawunderstand ingОценок пока нет

- Afritalent Agency Seeks To Bridge Talent of The Global Diaspora With Hollywood Casting Directors and ProducersДокумент3 страницыAfritalent Agency Seeks To Bridge Talent of The Global Diaspora With Hollywood Casting Directors and ProducersPR.comОценок пока нет

- Graduate Alumni of Elvel School Class of 1991Документ3 страницыGraduate Alumni of Elvel School Class of 1991Ramón SilvaОценок пока нет

- Job AnalysisДокумент17 страницJob AnalysisMd. Mezba Uddin ShaonОценок пока нет

- DD McqsДокумент21 страницаDD McqsSyeda MunazzaОценок пока нет

- Quezon City University 673 Quirino Highway, San Bartolome, Novaliches Quezon City College of Engineering Industrial Engineering DepartmentДокумент10 страницQuezon City University 673 Quirino Highway, San Bartolome, Novaliches Quezon City College of Engineering Industrial Engineering DepartmentKavin Dela CruzОценок пока нет

- DPC Rough Draft by Priti Guide (1953)Документ6 страницDPC Rough Draft by Priti Guide (1953)Preeti GuideОценок пока нет

- Unit 11 Writing Task: Write An Email To A Friend Worksheet 1: PRE-WRITINGДокумент3 страницыUnit 11 Writing Task: Write An Email To A Friend Worksheet 1: PRE-WRITINGKhaled Ben SalmeenОценок пока нет

- Unit - 3 Consignment: Learning OutcomesДокумент36 страницUnit - 3 Consignment: Learning OutcomesPrathamesh KambleОценок пока нет

- Ijel - Mickey's Christmas Carol A Derivation That IДокумент6 страницIjel - Mickey's Christmas Carol A Derivation That ITJPRC PublicationsОценок пока нет

- Against The Legalization of Drugs - James Q. WilsonДокумент9 страницAgainst The Legalization of Drugs - James Q. WilsonOhLord VaderОценок пока нет

- Food Hydrocolloids: Eric DickinsonДокумент13 страницFood Hydrocolloids: Eric DickinsonAndres Felipe Rojas RodriguezОценок пока нет

- All State CM and Governers List 2022Документ4 страницыAll State CM and Governers List 2022Tojo TomОценок пока нет

- Cs6109 - Compiler Design: Lab AssignmentДокумент8 страницCs6109 - Compiler Design: Lab AssignmentvezhaventhanОценок пока нет