Академический Документы

Профессиональный Документы

Культура Документы

TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus Package

Загружено:

Impulsive collectorИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus Package

Загружено:

Impulsive collectorАвторское право:

Доступные форматы

16 theSun | WEDNESDAY FEBRUARY 4 2009

business Hang Seng

12,776.89

S&P/ASX200 TSEC KLCI STI KOSPI Nikkei

7,825.51

3.508 4,372.81 879.67 1,711.92 1,163.20

84.60 11.30 112.83 4.78 6.63 16.25 48.47

market summary

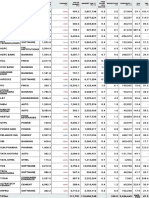

RM10bil likely for second stimulus package INDICES

FEBRUARY 3, 2009

CHANGE

FBMEMAS 5,758.16 -35.83

KUALA LUMPUR: The much-an- to further cushion the Malaysian growth and eventually cushion the on speedy implementation of the COMPOSITE 2,076.11 -4.78

ticipated second stimulus package economy from deepening global impact,” it said. projects and disbursements of pay- INDUSTRIAL 2,077.05 -22.28

is expected to be about RM10 billion credit crisis. It said public expenditure was ment to relevant economic parties. CONSUMER PROD 284.89 +0.06

on account of further savings from “Assuming the multiplier effect projected to expand by 9.4% this It said another plus for Malaysia INDUSTRIAL PROD 65.90 -0.48

the fuel subsidy – RM3 billion more of the November fiscal stimulus year, up from an estimated 6.1% was the fact that its overall financial CONSTRUCTION 165.91 +0.72

than the first package announced starts to kick in during the second last year, which meant a contribu- sector’s ability to remain relatively TRADING/SERVICES 115.35 -1.67

on Nov 4 last year. quarter of 2009 and the next stimu- tion of 2.3 percentage points to the unscathed following the US sub- FINANCE 6,932.18 +20.05

Kenanga Research, in its report, lus package in April would start country’s overall gross domestic prime debt crisis. PROPERTIES 528.00 -6.06

PLANTATIONS 4,449.48 -0.57

“Economic Outlook 2009”, released to have an impact in the fourth product growth. “This may lessen the overall MINING 249.25 UNCH

yesterday, said any increase in de- quarter 2009, we believe it would Kenaga said the impact of the adverse impact on the economy,” it FBMSHA 5,972.07 -53.38

velopment spending was expected help support domestic demand packages, however, was premised said. – Bernama FBM2BRD 3,907.90 -30.72

TECHNOLOGY 13.24 +0.11

TURNOVER VALUE

No job cuts at M’sia’s 301.26mil

Share prices

close lower

RM506.259mil

second largest bank SHARE prices on Bursa Malaysia closed

lower yesterday on selling pressure

with investors still concerned over the

uncertainties in the global economy,

dealers said.

The benchmark KLCI closed 4.78

KUALA LUMPUR: Bumiputra- CIMB-GK Pte Ltd, a wholly-owned Nazir also expects a single points lower at 879.67 led by losses on

Commerce Holdings Bhd group subsidiary. digit loan growth or 7% this year. selected heavyweight such as Tenaga

chief executive Datuk Seri Nazir Asked if the group chief “Last year our loan book grew and Sime Darby. Tenaga declined 20

Razak has given an assurance that executive would consider a sal- in the mid-teen, slightly higher sen to RM5.70 and Sime Darby slipped

there would be no job cuts at the ary cut, Nazir said that it would than what we had predicted in 10 sen to RM5.40.

country’s second largest bank. be announced at the same time the beginning of the year. But this “Investors are still not confident

“We are not looking at job as the results. “Don't steal the year, we predicting a much lower over the market. They are hoping for a

cuts. It is not in our culture of thunder,” he said in jest. growth rate,” he explained. fresh and strong catalyst on expecta-

doing business. In this environ- Asked as to whether the re- The bank currently has about tions to lift the market sentiment,” a

ment (slow economy), we want cent rates cut would affect the a RM30 billion corporate loan dealer said, adding that concerns still

to keep our people. We are look- bank’s margin, he said that the exposure. persisted as the continuous donwtrend

ing at optimising our operations new deposit rates might partly On the size of the upcoming in global oil prices had dampened senti-

in many other ways,” he told cover the impact. stimulus package, Nazir said : ment among investors.

reporters after the company’s On non-performing loans “We spend too much time talk- The KLCI is likely to be trading

meeting with stakeholders. (NPLs), he said it was very much ing about the second stimulus between the 870-890 levels today,

“However, we asked certain under control as Malaysian cheque. We are missing the point with investors continuing to look at

staff to take a salary cut. It was borrowers seem fairly resilient. if we just concentrate on writing Wall Street’s performance and the US

voluntary but somehow or rather, However, he said the bank had a bigger cheque. economic data.

they are all agreed to do so,” he built in a forecast of higher NPLs “I don’t have an estimation. He said the index is likely to trade

highlighted. for this year. “We are fully antici- This is because I don’t think it is range-bound this week, taking the cue

He said the cut was about 10- pating some deterioration in asset terribly important. It is up to the from external developments and fourth

20% in the equity section of the quality. But we have not seen that government to do the maths,” he quarter corporate financial results.

bank’s business which includes even until the end of last year.” said. – Bernama – Bernama

of 5 sen for its Public Index Fund, 0.3 M’sia third in SMS The company said with a

sen for the Public Islamic Optimal 93% mobile penetration rate,

briefs Growth Fund, 2 sen for the Public

Enhanced Bond Fund and 3 sen for

traffic in Asia Pacific

KUALA LUMPUR: Malaysia was

the Malaysian mobile market is

fast reaching saturation point

Public Money Market Fund. ranked third in the Asia Pacific, in and for the first time, broke the

In a statement yesterday, respect of the short messaging one billion mark for messaging

Public Mutual chairman Tan Sri service (SMS) traffic processed traffic over a two-day period.

Public Mutual Teh Hong Piow said the company during Christmas and New Year, “This was a 13% increase in

was pleased to be able to declare with over one billion messages. messaging growth compared

declares distributions distributions despite challenging Acision, the world’s leading to the same period last year,” it

KUALA LUMPUR: Public Bank’ market conditions. messaging company, said Ma- added.

wholly-owned subsidiary, Public Public Mutual managed 67 laysia was placed third behind Acision reported a 40%

Mutual, has declared gross funds with over two million the leader, the Philippines, with increase in messaging traffic

distributions for four of its funds accountholders. 2.36 billion and Indonesia, 1.193 during Christmas and New Year

for the financial year ended Jan 31, As at Dec 31 last year, total net billion. Malaysia recorded 1.075 across the Asia Pacific with a

2009. asset value of the funds it managed billion messages, Acision said in total of 6.37 billion messages.

It declared a gross contribution was RM23.3 billion. – Bernama a statement yesterday. – Bernama

Вам также может понравиться

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaОт EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaОценок пока нет

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanДокумент1 страницаTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorОценок пока нет

- TheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersДокумент1 страницаTheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersImpulsive collectorОценок пока нет

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieДокумент1 страницаThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorОценок пока нет

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelДокумент1 страницаThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorОценок пока нет

- TheSun 2009-01-09 Page18 TNB Open To All Energy OptionsДокумент1 страницаTheSun 2009-01-09 Page18 TNB Open To All Energy OptionsImpulsive collectorОценок пока нет

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryДокумент1 страницаThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorОценок пока нет

- Thesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierДокумент1 страницаThesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierImpulsive collectorОценок пока нет

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthДокумент1 страницаTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorОценок пока нет

- Thesun 2009-03-11 Page16 Japan Set For Double Digit Contraction in q1 SurveyДокумент1 страницаThesun 2009-03-11 Page16 Japan Set For Double Digit Contraction in q1 SurveyImpulsive collectorОценок пока нет

- TheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileДокумент1 страницаTheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileImpulsive collectorОценок пока нет

- Thesun 2009-06-01 Page14 BNM and Bot To Bolster Msian-Thai Trade IntegrationДокумент1 страницаThesun 2009-06-01 Page14 BNM and Bot To Bolster Msian-Thai Trade IntegrationImpulsive collectorОценок пока нет

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasДокумент1 страницаTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorОценок пока нет

- TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisДокумент1 страницаTheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisImpulsive collectorОценок пока нет

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Документ1 страницаTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorОценок пока нет

- TheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverДокумент1 страницаTheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverImpulsive collectorОценок пока нет

- Thesun 2009-02-12 Page16 Ipps Against Power Purchase Pact ReviewДокумент1 страницаThesun 2009-02-12 Page16 Ipps Against Power Purchase Pact ReviewImpulsive collectorОценок пока нет

- TheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerДокумент1 страницаTheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerImpulsive collectorОценок пока нет

- Thesun 2009-03-10 Page15 Bursa Likely To Open Flat This WeekДокумент1 страницаThesun 2009-03-10 Page15 Bursa Likely To Open Flat This WeekImpulsive collectorОценок пока нет

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeДокумент1 страницаThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorОценок пока нет

- SensexДокумент1 страницаSensexJatin JainОценок пока нет

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpДокумент1 страницаTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorОценок пока нет

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabДокумент1 страницаThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorОценок пока нет

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownДокумент1 страницаThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorОценок пока нет

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeДокумент1 страницаTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorОценок пока нет

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearДокумент1 страницаThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorОценок пока нет

- TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresДокумент1 страницаTheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresImpulsive collectorОценок пока нет

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyДокумент1 страницаTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorОценок пока нет

- Thesun 2009-05-18 Page13 Muslims Involvement in Halal Industry Still Low MusaДокумент1 страницаThesun 2009-05-18 Page13 Muslims Involvement in Halal Industry Still Low MusaImpulsive collectorОценок пока нет

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelДокумент1 страницаTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorОценок пока нет

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsДокумент1 страницаThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorОценок пока нет

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthДокумент1 страницаThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorОценок пока нет

- Thesun 2009-08-13 Page17 Rio Employees Formally ArrestedДокумент1 страницаThesun 2009-08-13 Page17 Rio Employees Formally ArrestedImpulsive collectorОценок пока нет

- Thesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinДокумент1 страницаThesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinImpulsive collector100% (2)

- TheSun 2009-04-09 Page16 Japan Set To Boost Stimulus To US$150bДокумент1 страницаTheSun 2009-04-09 Page16 Japan Set To Boost Stimulus To US$150bImpulsive collectorОценок пока нет

- TheSun 2008-11-06 Page27 Msia Trade Up 13.7 PCT To RM110b in SeptДокумент1 страницаTheSun 2008-11-06 Page27 Msia Trade Up 13.7 PCT To RM110b in SeptImpulsive collectorОценок пока нет

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensДокумент1 страницаTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorОценок пока нет

- Indices Other Stories:: FRI 23 DEC 2016Документ3 страницыIndices Other Stories:: FRI 23 DEC 2016JajahinaОценок пока нет

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentДокумент1 страницаThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorОценок пока нет

- Amwatch: Stock Focus of The DayДокумент4 страницыAmwatch: Stock Focus of The DayBrian StanleyОценок пока нет

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyДокумент1 страницаTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorОценок пока нет

- TheSun 2008-10-29 Page18: Deliver or Lose Licence, WiMax Operator ToldДокумент1 страницаTheSun 2008-10-29 Page18: Deliver or Lose Licence, WiMax Operator ToldImpulsive collectorОценок пока нет

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyДокумент1 страницаTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorОценок пока нет

- Thesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyДокумент1 страницаThesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyImpulsive collectorОценок пока нет

- TheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaДокумент1 страницаTheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaImpulsive collectorОценок пока нет

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBДокумент1 страницаThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorОценок пока нет

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefДокумент1 страницаTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorОценок пока нет

- TheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxДокумент1 страницаTheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxImpulsive collectorОценок пока нет

- Thesun 2008-12-22 Page20 KL Shares Likely To Be Higher This WeekДокумент1 страницаThesun 2008-12-22 Page20 KL Shares Likely To Be Higher This WeekImpulsive collectorОценок пока нет

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Документ1 страницаThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorОценок пока нет

- TheSun 2008-11-26 Page15 Msia Aims To Capture Global IT MarketДокумент1 страницаTheSun 2008-11-26 Page15 Msia Aims To Capture Global IT MarketImpulsive collectorОценок пока нет

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableДокумент1 страницаThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorОценок пока нет

- Business Standard English Mumbai 2Документ21 страницаBusiness Standard English Mumbai 2Rajan NandolaОценок пока нет

- Thesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsДокумент1 страницаThesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsImpulsive collectorОценок пока нет

- TheSun 2008-12-10 Page18 Middle East Buyers Eye Malaysian Property MarketДокумент1 страницаTheSun 2008-12-10 Page18 Middle East Buyers Eye Malaysian Property MarketImpulsive collectorОценок пока нет

- TheSun 2008-11-21 Page18 EPF Volatile Market Creates Buying OpportunituДокумент1 страницаTheSun 2008-11-21 Page18 EPF Volatile Market Creates Buying OpportunituImpulsive collectorОценок пока нет

- TheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaДокумент1 страницаTheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaImpulsive collectorОценок пока нет

- PGAS Business Presentation - MIFДокумент22 страницыPGAS Business Presentation - MIFAji PrasetyoОценок пока нет

- DMU 20180310-069 Rev1 1 PDFДокумент7 страницDMU 20180310-069 Rev1 1 PDFjason6686pОценок пока нет

- TheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekДокумент1 страницаTheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekImpulsive collectorОценок пока нет

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsДокумент5 страницIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorОценок пока нет

- KPMG CEO StudyДокумент32 страницыKPMG CEO StudyImpulsive collectorОценок пока нет

- HayGroup Job Measurement: An IntroductionДокумент17 страницHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Islamic Financial Services Act 2013Документ177 страницIslamic Financial Services Act 2013Impulsive collectorОценок пока нет

- Emotional or Transactional Engagement CIPD 2012Документ36 страницEmotional or Transactional Engagement CIPD 2012Impulsive collectorОценок пока нет

- Coaching in OrganisationsДокумент18 страницCoaching in OrganisationsImpulsive collectorОценок пока нет

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewДокумент4 страницыHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Futuretrends in Leadership DevelopmentДокумент36 страницFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Global Talent 2021Документ21 страницаGlobal Talent 2021rsrobinsuarezОценок пока нет

- HayGroup Rewarding Malaysia July 2010Документ8 страницHayGroup Rewarding Malaysia July 2010Impulsive collectorОценок пока нет

- Stanford Business Magazine 2013 AutumnДокумент68 страницStanford Business Magazine 2013 AutumnImpulsive collectorОценок пока нет

- 2012 Metrics and Analytics - Patterns of Use and ValueДокумент19 страниц2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorОценок пока нет

- Global Added Value of Flexible BenefitsДокумент4 страницыGlobal Added Value of Flexible BenefitsImpulsive collectorОценок пока нет

- Hay Group Guide Chart - Profile Method of Job EvaluationДокумент27 страницHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Strategy+Business - Winter 2014Документ108 страницStrategy+Business - Winter 2014GustavoLopezGОценок пока нет

- Flexible Working Good Business - How Small Firms Are Doing ItДокумент20 страницFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorОценок пока нет

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewДокумент15 страницHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaОценок пока нет

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesДокумент117 страницCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Compensation Fundamentals - Towers WatsonДокумент31 страницаCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Developing An Enterprise Leadership MindsetДокумент36 страницDeveloping An Enterprise Leadership MindsetImpulsive collectorОценок пока нет

- Strategy+Business Magazine 2016 AutumnДокумент132 страницыStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- 2015 Summer Strategy+business PDFДокумент104 страницы2015 Summer Strategy+business PDFImpulsive collectorОценок пока нет

- 2016 Summer Strategy+business PDFДокумент116 страниц2016 Summer Strategy+business PDFImpulsive collectorОценок пока нет

- Megatrends Report 2015Документ56 страницMegatrends Report 2015Cleverson TabajaraОценок пока нет

- Managing Conflict at Work - A Guide For Line ManagersДокумент22 страницыManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuОценок пока нет

- Talent Analytics and Big DataДокумент28 страницTalent Analytics and Big DataImpulsive collectorОценок пока нет

- HBR - HR Joins The Analytics RevolutionДокумент12 страницHBR - HR Joins The Analytics RevolutionImpulsive collectorОценок пока нет

- TalentoДокумент28 страницTalentogeopicОценок пока нет

- Deloitte Analytics Analytics Advantage Report 061913Документ21 страницаDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorОценок пока нет

- IBM - Using Workforce Analytics To Drive Business ResultsДокумент24 страницыIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorОценок пока нет

- Mujtaba Ali, Mba (Finance) : Professional ProfileДокумент4 страницыMujtaba Ali, Mba (Finance) : Professional ProfileLakisha MoonОценок пока нет

- Global Trust BankДокумент19 страницGlobal Trust BankLawi Anupam33% (6)

- PSNT of MFSДокумент8 страницPSNT of MFSPayal ParmarОценок пока нет

- At 073 ProcessesДокумент13 страницAt 073 ProcessesMaria PauОценок пока нет

- KYC Master Directions 2016 - Presentations For RefДокумент15 страницKYC Master Directions 2016 - Presentations For RefAnagha LokhandeОценок пока нет

- Credit Risk Management in Uttara BankДокумент62 страницыCredit Risk Management in Uttara Banksaif.letsdoОценок пока нет

- Green Supply ChainДокумент4 страницыGreen Supply ChainRbz Redzuan ZainuddinОценок пока нет

- Gocash - ProposalДокумент4 страницыGocash - ProposalGirishОценок пока нет

- Cash and Cash Equivalents Module Answer KeyДокумент26 страницCash and Cash Equivalents Module Answer KeyMarianne ElemosОценок пока нет

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Документ1 страницаSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanОценок пока нет

- Chapter 4 Accounting For Partnership AnswerДокумент17 страницChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Tender Datasheet PDFДокумент4 страницыTender Datasheet PDFJayachandranОценок пока нет

- Nominal & Effective Interest RatesДокумент18 страницNominal & Effective Interest RatesMUHAMMAD QASIMОценок пока нет

- SME Bank 2012 Annual ReportДокумент247 страницSME Bank 2012 Annual ReportSME Bank MalaysiaОценок пока нет

- Capital Adequacy NormsДокумент26 страницCapital Adequacy Normspuneeta chughОценок пока нет

- Case Presentation Strategic TransformationДокумент10 страницCase Presentation Strategic TransformationTarun GuptaОценок пока нет

- T24 R11 Release HighlightsДокумент61 страницаT24 R11 Release HighlightsOscar RamoОценок пока нет

- Victoria Chemical Case 20Документ4 страницыVictoria Chemical Case 20Shahzad MughalОценок пока нет

- Psychology of MoneyДокумент34 страницыPsychology of MoneyMiriam Columbro33% (3)

- DfggyuujjДокумент2 страницыDfggyuujjJornel MandiaОценок пока нет

- How To Configure SSL For SAP HANA XS Engine Using SAPCryptoДокумент4 страницыHow To Configure SSL For SAP HANA XS Engine Using SAPCryptopraveenr5883Оценок пока нет

- Atul LTDДокумент27 страницAtul LTDFast SwiftОценок пока нет

- Ajau Kumar RawatДокумент2 страницыAjau Kumar Rawatarkhan251441Оценок пока нет

- Teachers ATM Cards As Loan Collateral: The In-Depth Look Into ATM "Sangla" SchemeДокумент17 страницTeachers ATM Cards As Loan Collateral: The In-Depth Look Into ATM "Sangla" SchemeJan Reindonn MabanagОценок пока нет

- Project Report of Share KhanДокумент111 страницProject Report of Share Khanchintan782% (11)

- Customer Relationship and Wealth ManagementДокумент65 страницCustomer Relationship and Wealth ManagementbistamasterОценок пока нет

- NJ Compost Operator Certification & Alternate Recycling Certification Programs - 2012-13Документ2 страницыNJ Compost Operator Certification & Alternate Recycling Certification Programs - 2012-13RutgersCPEОценок пока нет

- Kalpana Bisen Paper On Dress CodeДокумент19 страницKalpana Bisen Paper On Dress CodeKalpana BisenОценок пока нет

- 97-98 Property Bar Q and AДокумент11 страниц97-98 Property Bar Q and Ajohnptabladello038Оценок пока нет

- Research Report The Contribution of Micro Finance Banks in The Empowerment of Small-Scale BusinessДокумент59 страницResearch Report The Contribution of Micro Finance Banks in The Empowerment of Small-Scale BusinessAvik BarmanОценок пока нет