Академический Документы

Профессиональный Документы

Культура Документы

Further Ratio Interpretation

Загружено:

Dushtogirl RoshomalaiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

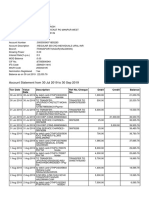

Further Ratio Interpretation

Загружено:

Dushtogirl RoshomalaiАвторское право:

Доступные форматы

Further ratio analysis interpretation Ratio Return on shareholders funds (%) Interpretation Higher ROSF is generally better, as it indicates

higher profitability, BUT these returns are also affected by the levels of financial gearing. Higher levels of financial gearing also make this ratio higher. Higher ROCE indicates better financial performance. This is explained further by profitability or efficiency ratios. A higher margin indicates more profitability and is therefore good. A higher margin indicates more profitability and is therefore good. A lower overhead : sales ratio indicates good control of operating expenses (or overheads) and so is good for profitability. A higher SRCE ratio indicates a more efficient use of capital employed. A higher SRNCA ratio indicates a more efficient use of non-current assets. A higher SRWC ratio indicates a more efficient use of working capital, but this can be difficult to interpret as working capital may be very close to zero or negative. A CR of 2.0 is considered necessary for traditional manufacturing companies. This is not true for service and retail companies that often have CR < 1.0 and this does not indicate liquidity problems. A QR of > 1.0 is considered to imply a safe liquidity position for traditional manufacturing companies. This is not true for service and retail companies that often have QR < 1.0 and this does not indicate liquidity problems. Financial gearing measures the level of financial risk a company has taken. A ratio of < 30% is often considered to indicate a safe level of gearing. Some

Return on Capital Employed (%)

Operating profit margin or Return on Sales (%) Gross Margin (%) Overhead: Sales %

Sales revenue to capital employed Sales revenue to non current assets Sales revenue to working capital

Current Ratio

Quick Ratio

Gearing Ratio (%)

suggest that a ratio of >50% indicates high (risky) levels of financial gearing. Debt-Equity Ratio The D-E ratio is similar to the gearing ratio and also measures the level of financial risk a company has taken. A gearing ratio of 30% corresponds to a D-E ratio of 43% and a gearing ratio of 50% corresponds to a D-E ratio of 100%. This measures how easily operating profits cover interest expense. If this is < 1.0 then the companys profit is turned into a loss before tax. Safer levels are given by an interest cover of > 3 or 4. Interest cover is affected by both the companys level of debt and its profitability. This measures how easily profit after tax covers the dividend charge for the year. If this is < 1.0 then the companys profit is turned into a retained loss. Safer levels are given by a dividend cover of > 2, but this is hard to interpret and will be affected by both the companys dividend policy and its profitability. One would expect most shareholders to be happier with higher levels of DPS, although this may depend on their personal tax position. One would expect most shareholders to be happier with higher levels of dividend yield, although this may depend on their personal tax position. Dividend is only one benefit of owning shares and total shareholder returns measures the full benefit. EPS is a very popular measure of profitability for shareholders. Higher EPS is considered as good news for shareholders. A higher PE ratio is considered to indicate increased stock market confidence and is so considered good. The interpretation of this ratio is complicated by having an earnings figure as the denominator and so a high PE ratio may also reflect low earnings, which could be bad. This measures the total return to the shareholder from investing in a company. This is both the dividend and the increase (or decrease) in share price. Higher returns

Interest Cover

Dividend Cover

Dividend per Share

Dividend Yield (%)

Earnings per Share

Price-Earnings Ratio

Total Shareholder Returns (%)

are good for shareholders. According to finance theory the returns of the market as a whole should on average exceed the risk free rate of return by 6-9% per annum. Inventories turnover period (in days) This measure the level of inventory at the accounting year end. For many manufacturing companies an inventory turnover period of 30-60 days is considered normal, but if they are operating a just-in-time system this would be expected to be lower. Retailers usually have lower inventory turnover periods than manufacturers, as they do not hold raw material or work in progress. Service companies would be expected to have very limited inventory. Settlement period for trade receivables (in days) This will depend on the credit terms offered by the company. 30 or 60 days are quite common for manufacturers, but retailers are usually paid in cash and so have very low settlement periods.

Settlement period for trade payables This will depend on the credit terms offered by the (in days) companys suppliers. 30 or 60 days are quite common.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Ratio Analysis of BEXTEXДокумент14 страницRatio Analysis of BEXTEXDushtogirl RoshomalaiОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Questionnaire 23333Документ3 страницыQuestionnaire 23333Dushtogirl RoshomalaiОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Underlying Facts and Critical Contributions of Gatt & Wto: Prepared ForДокумент1 страницаUnderlying Facts and Critical Contributions of Gatt & Wto: Prepared ForDushtogirl RoshomalaiОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Main Body EcoДокумент5 страницMain Body EcoDushtogirl RoshomalaiОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Period List Compound)Документ1 страницаPeriod List Compound)Raisa UronchondiОценок пока нет

- CPI in BDДокумент1 страницаCPI in BDDushtogirl RoshomalaiОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Has Globalization Succeeded in Removing The Gap Between Rich and Poor Economics? Explain Your Answer. AnswerДокумент3 страницыHas Globalization Succeeded in Removing The Gap Between Rich and Poor Economics? Explain Your Answer. AnswerDushtogirl RoshomalaiОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Table of Ooocontents - 2013 - 06 - 09 - 05 - 56 - 23 - 968Документ1 страницаTable of Ooocontents - 2013 - 06 - 09 - 05 - 56 - 23 - 968Dushtogirl RoshomalaiОценок пока нет

- FffssssДокумент5 страницFffssssDushtogirl RoshomalaiОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Ratio Analysi1Документ13 страницRatio Analysi1Dushtogirl RoshomalaiОценок пока нет

- Ratio AnalysisДокумент7 страницRatio AnalysisDushtogirl RoshomalaiОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- My Home Raka Price ListДокумент1 страницаMy Home Raka Price ListManohar Reddy MavillaОценок пока нет

- Prelim NotesДокумент164 страницыPrelim NotesShaina Monique RangasanОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Capsa UnitedДокумент12 страницCapsa Unitedvenkat rajОценок пока нет

- Why Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabreraДокумент2 страницыWhy Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabrerathecenseireportОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Vikram Singh Negi SBI Bank StatementДокумент4 страницыVikram Singh Negi SBI Bank StatementArushi SinghОценок пока нет

- Long Lived Assets L1Документ37 страницLong Lived Assets L1heisenbergОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Chapter 04 NotesДокумент5 страницChapter 04 NotesNik Nur MunirahОценок пока нет

- LK TPM 31 Mar 2023 PDFДокумент67 страницLK TPM 31 Mar 2023 PDFAnonymous waj9QU06Оценок пока нет

- Summary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789Документ4 страницыSummary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789NKОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Case Study 4Документ4 страницыCase Study 4Nenad MazicОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Midterm Exam in Business LogicДокумент5 страницMidterm Exam in Business LogicMaguan, Vincent Paul A.Оценок пока нет

- TNPSC Group 1 Maths Solution by Appolo Study CenterДокумент19 страницTNPSC Group 1 Maths Solution by Appolo Study CenterKUMARESANОценок пока нет

- Sealand Coins ListДокумент6 страницSealand Coins Listsubrata.chakrabarti2544Оценок пока нет

- Tax Invoice: Account For Professional FeesДокумент1 страницаTax Invoice: Account For Professional FeesVinh DuongОценок пока нет

- Blackbook Topics TybbiДокумент2 страницыBlackbook Topics Tybbiankit chauhan100% (1)

- Go v. BSPДокумент2 страницыGo v. BSPBananaОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Andleeb Abbas - Declaration of Assets Liabilities - Dec 2013Документ4 страницыAndleeb Abbas - Declaration of Assets Liabilities - Dec 2013PTI Official100% (1)

- Annuity CalculatorДокумент2 страницыAnnuity CalculatorBlueQuillОценок пока нет

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I The Accounting EquationДокумент11 страницACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I The Accounting EquationAyana Mae BaetiongОценок пока нет

- 15 Multiples AnalysisДокумент100 страниц15 Multiples AnalysisSkander lakhalОценок пока нет

- Security Analysis and Portfolio Management by Rohini SinghДокумент442 страницыSecurity Analysis and Portfolio Management by Rohini SinghNishant Dogra67% (3)

- Research # 3 Karachi Inter Bank Offer Rate (KIBOR)Документ6 страницResearch # 3 Karachi Inter Bank Offer Rate (KIBOR)Abdullah Tabba100% (1)

- RiskДокумент3 страницыRiskChaucer19Оценок пока нет

- Past Year ACC106 Oct 2012 PDFДокумент11 страницPast Year ACC106 Oct 2012 PDFShamОценок пока нет

- Sole Proprietorship Accounting TransactionsДокумент17 страницSole Proprietorship Accounting TransactionsErica Mae GuzmanОценок пока нет

- Treasury Rules TR STRДокумент407 страницTreasury Rules TR STREngr Rameez PatoliОценок пока нет

- LAS ABM - FABM12 Ia B 1 Week 1Документ9 страницLAS ABM - FABM12 Ia B 1 Week 1ROMMEL RABOОценок пока нет

- Ch07 ShowДокумент57 страницCh07 ShowBagus ZijlstraОценок пока нет

- 18security Trading StatisticsДокумент410 страниц18security Trading StatisticsYasith WeerasingheОценок пока нет

- Mcom Exam Form Acknowledgment - Sem 3 PDFДокумент2 страницыMcom Exam Form Acknowledgment - Sem 3 PDFMansi KotakОценок пока нет