Академический Документы

Профессиональный Документы

Культура Документы

Daily Technical Report 21st Dec 2012

Загружено:

Angel BrokingАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Daily Technical Report 21st Dec 2012

Загружено:

Angel BrokingАвторское право:

Доступные форматы

Daily Technical Report

December 21, 2012

Sensex (19454) / NIFTY (5916)

Yesterday, our benchmark indices opened on flat note and witnessed a mild correction during the first half. However, a recovery in the second half led the indices to close firmly above 5900 mark. The Gujarat and Himachal Pradesh assembly elections results had no significant impact on the market sentiments. During the session, Consumer Durables, Auto and Capital Goods sectors remained under pressure. However, the Metal, Teck and IT counters ended with minor gains. The advance to decline ratio was strongly in favor of declining counters (A=1312 D=1578) (Source www.bseindia.com).

Exhibit 1: Nifty Daily Chart

Formation

The 20-day EMA and the 20-week EMA are placed at 19209 / 5844 and 18573 / 5642 levels, respectively. On the weekly chart, we are witnessing a breakout from Downward Sloping Trend Line joining two significant swing highs of 19811 / 5944 (April 2011) and 19137 / 5815 (Oct 2012) at 19050 / 5800 level. The 38.20% and 50% Fibonacci retracement levels of the rise from 18255 / 5548 (low on November 20, 2012) to 19612 / 5965 (high on December 11, 2012) are at 19100 18930 / 5806 5755, respectively.

Source: Falcon:

Trading strategy:

Looking at the price action of previous two trading sessions, it can be construed that our markets are struggling for direction at this juncture. Yesterdays price pattern on the daily chart suggests indecisiveness prevailing at current levels. Also, the momentum oscillators on the daily and hourly chart are portraying a mix picture. Hence we reiterate our view that 19612 / 5965 level remains to be a key resistance for the bulls. On the flipside, a breach of yesterdays low of 19336 / 5881 would trigger intraday pessimism in the market. In this scenario, indices may test the next support level of 19149 / 5823.

Actionable points:

View for the day Resistance Level Support Levels Neutral 5965 5881 - 5823

www.angelbroking.com

Daily Technical Report

December 21, 2012

Bank Nifty Outlook - (12487)

Yesterday, Bank Nifty opened on a flat note and traded with extreme volatility throughout the session. We are now witnessing a minor negative divergence in momentum oscillator RSI on the daily chart. Thus we reiterate our view that the Bank Nifty is likely to undergo further consolidation in the range of 12570 12197. Going forward yesterdays low of 12385 is a key support level for intraday traders. A sustainable move below this level may lead the index to drift lower towards 12306 12277 level. On the other hand, a move above 12570 level will attract buying interest among the market participants. In this scenario the index is likely to test 12700 level.

Exhibit 2: Bank Nifty Daily Chart

Actionable points:

View for the day Resistance Levels Support Levels Neutral 12570 12385 - 12306 Source: Falcon:

www.angelbroking.com

Daily Technical Report

December 21, 2012

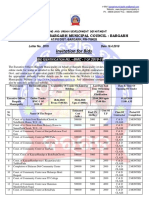

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT LUPIN M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SBIN SESAGOA SIEMENS SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS ULTRACEMCO WIPRO S2 19,252 5,856 12,333 1,387 200 4,363 1,289 2,071 836 306 227 340 312 414 349 217 1,826 346 3,179 629 818 677 1,862 125 516 1,123 173 2,264 284 450 99 653 1,591 605 935 1,500 152 262 832 115 507 824 513 2,318 189 662 724 299 105 409 1,217 1,985 372 S1 19,353 5,886 12,410 1,395 203 4,404 1,304 2,092 848 311 229 345 316 419 353 222 1,836 349 3,203 634 824 680 1,886 129 524 1,132 174 2,282 285 460 100 657 1,604 610 944 1,510 153 263 841 115 510 831 518 2,350 194 666 736 302 107 420 1,234 1,999 377 PIVOT 19,437 5,912 12,462 1,405 207 4,451 1,322 2,118 856 315 231 352 321 424 357 225 1,848 351 3,226 641 830 684 1,910 131 529 1,138 175 2,296 288 468 102 663 1,624 616 957 1,520 154 265 850 116 514 836 522 2,374 198 670 756 306 107 427 1,245 2,014 384 R1 19,538 5,942 12,539 1,413 210 4,491 1,337 2,139 868 320 234 357 325 430 360 229 1,858 354 3,251 646 837 687 1,934 135 538 1,146 177 2,314 289 478 103 667 1,637 621 967 1,530 155 267 860 117 517 843 527 2,406 203 673 767 309 109 438 1,262 2,028 389 R2 19,622 5,968 12,592 1,424 214 4,538 1,355 2,166 876 324 235 364 331 435 364 232 1,870 356 3,273 653 843 690 1,957 138 543 1,153 178 2,328 292 485 105 673 1,656 627 980 1,540 156 268 868 117 521 849 531 2,430 207 677 787 312 109 445 1,273 2,044 396

www.angelbroking.com

Daily Technical Report

December 21, 2012

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

www.angelbroking.com 4

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- How To Look Up Vendor FBL1NДокумент9 страницHow To Look Up Vendor FBL1NPop AdrianОценок пока нет

- LQ 1 - Set B SolutionДокумент14 страницLQ 1 - Set B SolutionRyan Joseph Agluba Dimacali100% (1)

- Answer: D. This Is A Function of Banks or Banking InstitutionsДокумент6 страницAnswer: D. This Is A Function of Banks or Banking InstitutionsKurt Del RosarioОценок пока нет

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Technical & Derivative Analysis Weekly-14092013Документ6 страницTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanДокумент2 страницыSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingОценок пока нет

- Metal and Energy Tech Report November 12Документ2 страницыMetal and Energy Tech Report November 12Angel BrokingОценок пока нет

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Commodities Weekly Tracker 16th Sept 2013Документ23 страницыCommodities Weekly Tracker 16th Sept 2013Angel BrokingОценок пока нет

- Commodities Weekly Outlook 16-09-13 To 20-09-13Документ6 страницCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingОценок пока нет

- Technical Report 13.09.2013Документ4 страницыTechnical Report 13.09.2013Angel BrokingОценок пока нет

- Market Outlook 13-09-2013Документ12 страницMarket Outlook 13-09-2013Angel BrokingОценок пока нет

- Derivatives Report 16 Sept 2013Документ3 страницыDerivatives Report 16 Sept 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Sugar Update Sepetmber 2013Документ7 страницSugar Update Sepetmber 2013Angel BrokingОценок пока нет

- TechMahindra CompanyUpdateДокумент4 страницыTechMahindra CompanyUpdateAngel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- IIP CPIDataReleaseДокумент5 страницIIP CPIDataReleaseAngel BrokingОценок пока нет

- MetalSectorUpdate September2013Документ10 страницMetalSectorUpdate September2013Angel BrokingОценок пока нет

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- MarketStrategy September2013Документ4 страницыMarketStrategy September2013Angel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- Daily Agri Tech Report September 06 2013Документ2 страницыDaily Agri Tech Report September 06 2013Angel BrokingОценок пока нет

- Paper 16Документ71 страницаPaper 16pkaul1Оценок пока нет

- Interpretation of WarrantiesДокумент8 страницInterpretation of WarrantiesverairОценок пока нет

- Senate Hearing, 112TH Congress - The Financial Stability Oversight Council Annual Report To CongressДокумент278 страницSenate Hearing, 112TH Congress - The Financial Stability Oversight Council Annual Report To CongressScribd Government DocsОценок пока нет

- BankingДокумент50 страницBankingKishore MallarapuОценок пока нет

- New Business Certificate PDFДокумент1 страницаNew Business Certificate PDFAnonymous l6Jd1sQRОценок пока нет

- Invitation For Bids: Office of The Bargarh Municipal Council: BargarhДокумент3 страницыInvitation For Bids: Office of The Bargarh Municipal Council: BargarhANJANI KUMAR SRIWASОценок пока нет

- Memorandum of UnderstandingДокумент2 страницыMemorandum of UnderstandingFantania BerryОценок пока нет

- 424 434Документ2 страницы424 434Kim Balauag100% (1)

- Finding A Bank For The BrennansДокумент4 страницыFinding A Bank For The Brennansrichard100% (1)

- Profit Distribution MethodsДокумент20 страницProfit Distribution MethodsYoucef Grimes100% (1)

- Final Presentation Sem2Документ15 страницFinal Presentation Sem2api-380584678Оценок пока нет

- Suffolk Federal Credit Union, Plaintiff, vs. Federal National Mortgage Association Defendant.Документ29 страницSuffolk Federal Credit Union, Plaintiff, vs. Federal National Mortgage Association Defendant.Foreclosure FraudОценок пока нет

- Airtel PDFДокумент2 страницыAirtel PDFNoorОценок пока нет

- ACCOUNTS Manager JD KPI KRAДокумент3 страницыACCOUNTS Manager JD KPI KRACA AMIT JAIN50% (2)

- Indian Money MarketДокумент0 страницIndian Money MarketaasisranjanОценок пока нет

- Environmental AnalysisДокумент7 страницEnvironmental Analysisprantik420Оценок пока нет

- Certificate of Inward RemittanceДокумент1 страницаCertificate of Inward RemittanceLauriz EsquivelОценок пока нет

- Project Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oДокумент79 страницProject Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oanreshaОценок пока нет

- Finance Sector NAДокумент4 страницыFinance Sector NADIVYANSHU SHEKHARОценок пока нет

- Clinton Iraq EmailДокумент4 страницыClinton Iraq EmailandrewperezdcОценок пока нет

- RUAEA Website RUAEA & Local ChaptersДокумент2 страницыRUAEA Website RUAEA & Local ChaptersTHE THIZZОценок пока нет

- Basic Finance ExercisesДокумент3 страницыBasic Finance ExerciseskunheiОценок пока нет

- Bar Graph Unit MonthДокумент2 страницыBar Graph Unit MonthshrikantОценок пока нет

- Dunlop India Limited 2012 PDFДокумент10 страницDunlop India Limited 2012 PDFdidwaniasОценок пока нет

- BPI v. Suarez DigestДокумент18 страницBPI v. Suarez DigestBryce KingОценок пока нет

- Income Tax 2Документ12 страницIncome Tax 2You're WelcomeОценок пока нет

- 13 May 2022 To 11 Aug 2022 FCMB StatementДокумент8 страниц13 May 2022 To 11 Aug 2022 FCMB StatementCwfc GloryОценок пока нет