Академический Документы

Профессиональный Документы

Культура Документы

Amy Kuhner Sentencing Memo

Загружено:

Helen BennettОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Amy Kuhner Sentencing Memo

Загружено:

Helen BennettАвторское право:

Доступные форматы

UNITED STATES DISTRICT COURT

DISTRICT OF CONNECTICUT

UNITED STATES OF AMERICA :

v. : 3:12CR168 (AWT)

AMY KUHNER : DECEMBER 20, 2012

GOVERNMENTS MEMORANDUM IN AID OF SENTENCING

The defendant, Amy Kuhner, stands before the Court having been convicted of one count

of making false statements, in violation of 18 U.S.C. 1001(a)(2). For the reasons set forth

below, the Government respectfully submits that the defendant should be sentenced in a manner

consistent with the operation of the Sentencing Guidelines.

I. DISCUSSION: FACTS OF THE OFFENSE

Although the parties have agreed to a stipulation of offense conduct in the plea

agreement, in order to assist the Court in fashioning an appropriate sentence, the stipulated

conduct needs to be placed in a broader factual context.

According to the defendant, at some point in the 1990s, she decided to change the

direction of her life and to attend the Yale Divinity School. She brought a considerable

education and resum to her new field. She had graduated from Georgetown University, later

obtained an M.B.A. from UCLA, and thereafter worked for JP Morgan Chase in its foreign

exchange division. She ultimately completed her studies at Yale and obtained her Master of

Divinity degree in 1996.

1

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 1 of 21

According to Kuhner, at or about the time she was at Yale, she conceived of creating a

hospice for terminally ill children. In 1996, she set up a non-profit organization known as

Sunshine House, and assembled a three-member board of trustees. She began fund raising

efforts and to research technical aspects of the project, including licensure, legislative approvals,

and regulatory issues.

The Federal Grant From HRSA

According to Kuhner, in approximately 2000, working with staff members from

Connecticuts congressional delegation, she received preliminary indications that Sunshine

House might be eligible for a federal grant to pay for part of the costs of constructing the hospice.

The grant was administered by the Health Resources Services Administration (HRSA), an agency

of the U.S. Department of Health and Human Services.

In June 2001, Kuhner submitted an initial application for the grant. She signed the

application for the grant as Executive Director of Sunshine House, and at all times Kuhner

remained the sole point of contact between Sunshine House and HRSA. In the initial

application, Sunshine House applied for $836,190 in federal funds.

In order to submit the grant, Kuhner reviewed a Grant Program Guide issued by HRSA.

The Guide contained the following paragraph:

Drawing Down of Grant Funds

Grants under this program will be awarded using the SMARTLINK access of the

Payment Management System. Funds may be drawn down as project costs are

incurred, in the same proportion as the grant is to the projected total costs.

For instance, consider a project in which the governments share is 80 percent

($400,000 grant/$500,000 total costs). The amount of funds that can be requested

for each draw request cannot be more than 80 percent of the cost incurred.

Therefore, when $50,000 of costs are incurred, $40,000 may be drawn down from

the grant. The balance should be paid for by the Grantees other sources of funds.

2

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 2 of 21

HRSA Grant Program Guide, Appendix to Governments Memorandum in Aid of Sentencing

(hereinafter App.) at A1, A10-A11 (emphasis in original).

In the initial application, Sunshine House did not provide a detailed budget for the

project, explaining, Until a site is identified, numbers provided here would merely be

academic. The application did set forth estimates of $1,000,000 for site/acquisition costs;

$250,000 for Soft Costs related to site; and $5,000,000 for Facility Construction. Because

HRSA required a grant application to provide detailed budget, on July 16, 2011, Kuhner faxed

revisions to Sunshine Houses application, in which Kuhner stated that the total cost of

constructing the minimum 20,000 square feet Sunshine House facility would be $7,806,250.

App. at A12-A14. After deducting costs that were not allowable under the grant, the total

allowable costs for construction would be $6,721,200, and the $836,190 grant would therefore be

used to fund approximately 12.44% of the total project. App. at A13. Under the line item of

1

Administrative and legal expenses, Kuhner budged $250,000 of total costs, of which $191,200

was allowable. Id.

Kuhner also submitted cash basis income statements for Sunshine House for 1999 and

2000 showing that Sunshine Houses annual income for each of those years was approximately

$65,000. App. at A16-A17. According to the income statements, Sunshine House operated at a

modest loss each year, ending 2000 with $1,844 cash on hand. Id. In her detailed budget,

Kuhner stated that the non-grant portion of the construction costs would be funded by $850,000

The Government is unaware of detailed estimates to support the figures on the budget

1

form Kuhner prepared. It appears that the overall figures may in part have been arrived at by

deriving figures that would result in the $836,190 grant funding between 10-15% of the overall

costs. In other words, the initial detailed budget demonstrated a familiarity with grant

requirements and a facility with deriving figures to justify the grant.

3

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 3 of 21

in noncash assets, and $6,120,060 from other sources. App. at A18.

On September 13, 2001, HRSA notified Sunshine House that the grant had been

approved. App. at A21-A23. The grant was a construction grant, meaning that HRSA agreed to

fund a percentage of the costs of construction of Sunshine House. App. at A36. The Notice of

Grant Award again stated that Grant funds can only be drawn down from [The Payment

Management System] as costs are incurred, in the same proportion as the grant is to the

total project cost. App. at A30 (emphasis in original). Consistent with the budget Kuhner

submitted, the federal share was no more than 12.44 % of the project costs, and the drawdown

percentage was 10.71% of actual costs. App. at A36. In the two-page Specifics of Grant

document Kuhner signed as Executive Director of Sunshine House, the paragraph under

Restriction on Use of Grant funds stated Grant funds are not eligible for participation in . . .

administrative overhead. App. at A37. The Specifics of Grant provided that if the grantee had

not entered into a construction contract approved by HRSA within one year of the grant award

date, HRSA could consider withdrawing the grant. Id.

The initial period of the grant was about one year, from September 13, 2001 to September

22, 2002. The grant period was extended on at least two occasions, to September 31, 2005, then

finally to September 30, 2006. During 2006, it became clear that Sunshine House was not going

to meet any deadlines for beginning, let alone completing, construction. See App. at A39.

According to Kuhner, the delay was due to the inability to locate a site and obtaining the proper

property arrangements. As a result, at Sunshine Houses request, on August 15, 2006 the scope

and purpose of the grant were changed to a design only project. See App. at A39-A44. With

this designation, the grant could be used to pay expenses related to the design portion of the

4

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 4 of 21

project. When Kuhner requested this change, she submitted a revised detailed budget that set the

eligible allowable costs for administrative and legal expenses at $83,000; architectural and

other engineering fees at $30,000 and other architectural and engineering fees as $723,190.

App. at A40.

Kuhners Salary

According to minutes of Sunshine Houses board of trustees meetings, the board had

approved an annual salary for Kuhner dating back to September 1996. Kuhners initial annual

salary was set at $36,000, and she was to provide her own health insurance. As it became clear

that Sunshine House did not have funds to pay Kuhners salary, it was agreed that Kuhner could

obtain retroactive compensation when funds became available. In December 1996, the board

voted Kuhner a retroactive salary increase to $43,000 annually, plus a monthly allowance of $150

for health insurance. Her salary was increased to $50,000 on June 1, 1997, and on August 1,

1998 to $75,000, plus payment of 80% of insurance. The August 1, 1998 resolution stated that if

funds were not available to pay Kuhner, Sunshine House could defer the obligation or be

discharged in full. On the boards meeting on February 22, 2006, Kuhner submitted an article

from The Nonprofit Times concerning the salaries of executive directors of nonprofit

organizations. The article stated that the average nonprofit executive directors salary was

expected to surpass $100,000 in 2006, and that the nonprofits in the health category had the

highest annual salaries, at approximately $139,000 in 2005. Kuhner also provided an analysis

showing that if her $75,000 salary had increased since 1998 at the average annual salary

increases from Money Magazine, her salary would be approximately $97,000. At that meeting,

the board voted to approve a cost of living adjustment for Kuhner increasing her salary to

5

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 5 of 21

$97,000 effective January 1, 2006. On July 16, 2007, the board increased Kuhners salary to

$100,600 effective July 1, 2007. Kuhner was the only employee ever listed or paid by Sunshine

House.

As set forth below, during the early years of the federal grant period (2001-2004), Kuhner

did not receive her full salary, but in later years, she received her salary, any amount deferred,

and additional compensation, virtually all from the grant funds.

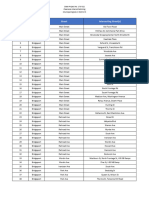

Drawdowns on the Federal Grant

The $836,190 in grant money was drawn down using the Payment Management System

(PMS), a web-based program. In order to make a drawdown, Kuhner logged into a web-based

program and transferred money from the grant to Sunshine Houses bank account, based on

Kuhners request and representation that Sunshine House had actually incurred eligible costs in

the requested amount. Kuhner was the only person from Sunshine House who handled the grant

funds and virtually the only one responsible for the bank account. Beginning on September 23,

2003 and through September 27, 2006, the grant was drawn down in 41 separate occasions, in

various amounts ranging from approximately $3,300 to $36,000. App. at A45.

How the Grant Money Was Used

During the grant period of 2001 to 2006, the $836,190 was by far the main source of

revenue for Sunshine House. Based on financial records, the Government has identified

approximately $100,000 obtained from private donations during this period as the only other

income for Sunshine House. These financial records establish that the grant funds were used

mainly to pay Kuhners salary and her health benefits, along with the employer share of taxes.

The timing of the drawdowns and salary payments to Kuhner establish that the grant funds were

6

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 6 of 21

used in this fashion. Sunshine House used a payroll processing service to generate the payments

to Kuhner and related tax payments. During the period that drawdowns from the grant were

made, Kuhner received the following salary and benefits (in round amounts):

Gross Net Employer Health

Drawdown period Salary Salary Taxes Insurance

9/23/03-12/31/03 $ 93,772 65,423 7,193 2,073

2004 135,937 96,739 24,118 7,120

2005 121,491 87,514 8,352 6,276

1/1/06-9/27/06 66,732 51,980 10,822 6,827

TOTAL: 417,932 301,656 50,487 22,294

TOTAL GROSS SALARY, EMPLOYER TAXES AND HEALTH INSURANCE: $490,714

Kuhner drew these funds down and paid the amounts to herself, through the payroll

company. Except for relatively minor expenses, described below, Sunshine House did not incur

any costs other than Kuhners salary. The architect on the project had provided his services free

of charge. At Kuhners request, he agreed to accept a $20,000 token payment.

As can be seen, Kuhners annual salary exceeded the amount approved by the board of

trustees. In order to determine the basis for the salary drawn by Kuhner, the Government

attempted to determine the amount of approved salary Kuhner had deferred or not been paid

during the grant period. At the end of 2002, assuming a $75,000 annual salary in for 2001-2002,

Kuhner had been paid only a total of about $41,491, leaving a deferred amount of

approximately $108,500. Beginning in 2003, however, Kuhner began drawing an amount in

excess of the annual salary approved by the board, and as a result had wiped out any arrearage by

sometime in 2005. The following chart shows that Kuhner used grant funds to pay not only her

salary, but deferred compensation from years that predated the grant:

7

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 7 of 21

Year Approved Paid Deferred Cumulative

Salary Salary Salary Deferred

2001 $ 75,000 25,540 49,460 49,460

2002 75,000 15,951 59,049 108,509

2003 75,000 99,272 (24,272) 84,236

2004 75,000 135,937 (60,937) 23,299

2005 75,000 121,481 (46,491) (23,191)

2006 97,000 96,264 736 (22,455)

2007 98,800 99,534 (734) (23,189)

2008 100,600 69,849 30,753 7,560

In sum, Kuhner used the grant funds to essentially pay 100% of her salary and benefits,

including deferred compensation, even though that was not the purpose of the grant. The grant

was initially to pay about 10.71% of actually incurred construction costs (App. at A36), and

following the amendment of the scope, to be used to pay for the technical costs of the design of

Sunshine House. At no time did HRSA agree to pay the full-time salary of Sunshine Houses

executive director, especially at an annual income that exceeded six figures and included health

benefits, nor did HRSA agree to pay Kuhner any deferred compensation she was due from

Sunshine House at the time she applied for the grant.

The rule of thumb for construction or design grants is that funding for administrative

expenses are limited to approximately 10% of any project, and it is clear Kuhner knew this. The

initial application Kuhner submitted budgeted administrative costs of approximately $92,000.

When Kuhner applied to have the nature of the grant changed to a design-only grant in August

2006, she listed $83,000 (10% of the $836,190 grant) as the allowable administrative expenses

for Sunshine House under its budget for the grant. App. at A40. The salary and benefits Kuhner

obtained from grant funds exceeded the 10% figure ($83,000) in 2003 alone, the first year she

began to use grant funds to pay herself.

8

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 8 of 21

Kuhners misuse of the grant funds was not limited merely to the nature of the

expenditures; it extended to the timing of her use of the funds. HRSA had advised Sunshine

House the grant period would finally close at the end of September, 2006, and that grant funds

could only be used for actual expenses incurred before that date. As the grant period was

closing, Kuhner continued to draw down the grant funds, even though she had not incurred any

expenses, including her salary. Kuhner then began to transfer tens of thousands of dollars out of

Sunshine Houses bank account, and into a money market account. On May 31, 2006, she

transferred $116,000 into the money market account; on June 30, 2006, another $95,000, and

then $45,000 more on July 31, 2006. Over time, this money was transferred back to Sunshine

House and used mainly to pay Kuhners salary and benefits following the end of the grant on

September 27, 2006, including into 2007 and 2008. All told, the following chart sets forth the

amount Kuhner received from Sunshine House, in round figures:

Gross Net Employer Health

Year Salary Salary Taxes Insurance

2003 $ 99,272 70,523 7,193 6,289

2004 135,937 96,739 24,118 7,120

2005 121,491 87,514 8,352 6,272

2006 96,264 75,848 12,578 7,489

2007 99,534 76,796 7,641 9,698

2008 69,849 57,555 5,726 6,411

TOTAL: 622,348 464,976 65,612 43,282

GROSS SALARY, EMPLOYER TAXES, AND HEALTH INSURANCE: $ 731,242

Kuhners False Statements to HRSA

Toward the end of the drawdown period and as the grant was closing, HRSA asked

Sunshine House to provide an accounting for its expenditures of grant funds. HRSA also asked

9

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 9 of 21

for a copy of Sunshine Houses Owner-Architect agreement. According to the architect on the

project, during this time Kuhner approached him with one page from a standard American

Institute of Architects (AIA) contract showing his fixed lump sum fee for Preliminaries and

Construction Document preparation for Sunshine House to be $723,190, the amount Kuhner

had previously stated to HRSA constituted Other architectural and engineering fees. See App.

at A40. The architect recalled Kuhner as being in a panic because Kuhner was afraid she

would lose the federal grant money if she didnt show she had a contract with an architect. Even

though he had been paid only $20,000, the architect did not want or expect to be paid any

additional fees at that time, having understood his services to be pro bono. He nonetheless

signed the page stating that the value of his services on the project would be $723,190, and

Kuhner submitted this document to HRSA. App. at A46.

HRSAs review of the grant continued into July 2007. Through a series of emails,

Kuhner suggested to the architect that the value of his services to Sunshine House through July

2007 was approximately $594,225. Kuhner derived this figure by suggesting the final cost of the

project to be $18 million, with the architects design fee as 6%, with 55% of the project being

completed, for a end result of $594,225. The architect responded via email, sure, if only I could

get that in the real world and suggested a completion percentage of 47.5%. At Kuhners

request, the architect prepared a Statement of Account on his letterhead stating that the value

of his services to date were $594,225. In order to agree with the $594,225 figure, the architects

fee was changed to 6.95% of the construction costs. App. at A48.

In response to HRSAs inquiry, on July 27, 2007 Kuhner provided HRSA with a written

statement that Sunshine House incurred the following Costs to Date:

10

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 10 of 21

1. Administrative and legal expenses: Includes $ 83,000

costs of grant administration and some costs of

administrative time supporting technical aspects

of this project.

2. Architectural and engineering: Includes costs of $594,225

architectural services and design process work.

3. Other architectural and engineering fees: Includes $ 61,274

costs of engineering services and environmental

assessment.

App. at A47. To support the $594,225 figure, Kuhner provided the architects Statement of

Account document generated at her request. App. at A48.

The Costs to Date statement made it appear as though Sunshine House had incurred

architectural costs in the amount of $594,225, which was not true. Kuhner submitted the

Statement of Account from the architect to support the $594,225 figure, even though the

architect had received only $20,000 and was not going to be paid any additional fees. The

$61,274 figure in Other architectural and engineering fees was supported by actual invoices

from vendors for work done at Sunshine House. As noted above, it is significant that Kuhner

2

used the rule of thumb calculation of 10% of the grant amount for administrative or overhead

costs.

HRSA also asked for a financial statement from Sunshine House for the grant period in

order to verify any costs Sunshine House claimed to have incurred. Kuhner met with an

accountant who was familiar with Sunshine House because the accountant had lost a child at a

Some of the invoices were for work done after the grant had closed in September 2006.

2

Because these costs were not actually incurred during the grant period, they would ordinarily

not be allowable under the terms of the grant. For purposes of this case and sentencing, however,

HRSA and the Government have treated all of the invoiced costs as allowable, which reduces any

loss amount attributable to Kuhner.

11

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 11 of 21

young age. Kuhner provided the accountant with a Statement of Income and Expenditures for

Sunshine House for the grant period, September 2001 through September 2006, and asked for

assistance in typing up the final version of the statement. The accountant attempted to tie out the

various entries on the statement using Sunshine Houses records, but Kuhner prepared and typed

the final version of the statement that was submitted to HRSA. In the Income section of the

statement sent to HRSA, Kuhner had added in, under donations, the value of the architects

donated services of $723,190, and then listed that same figure in Expenditures as having

been expended for Architectural Design Fees. App. at A49. The statement also included

$545,563 in Employee Salaries, Taxes, Benefits. By misleadingly listing the donated

architectural work as income and then falsely deducting it as an expenditure, Kuhner was able to

disguise the fact that the grant funds were the bulk of Sunshine Houses income, and that the

grant had been used mainly to pay the salary of Sunshine Houses sole employee, Kuhner.

During the investigation of this case in 2011, the accountant reviewed the Statement of Income

and Expenditures Kuhner had provided to HRSA and described the statement as very misleading.

After receiving and reviewing these figures, HRSA began to realize that Sunshine House

appeared to have drawn down more grant funds than seemed justified, and the project had still

not been completed. An investigation was opened thereafter.

II. GUIDELINE CALCULATION

Section 2B1.1 of the Guidelines is used to determine the offense level for violations of 18

U.S.C. 1001. Under 2B1.1, for purposes of the Guidelines, loss is the greater of actual or

intended loss. U.S.S.G. 2B1.1, Application Note 3. Actual loss is defined as the

reasonably foreseeable pecuniary harm that resulted from the offense. Id, n. 3(A)(i).

12

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 12 of 21

According to HRSA, their actual loss is $671,916, which is the amount of money HRSA would

disallow under the grant and seek to recoup. App. at A53-A54. HRSA essentially credited

Sunshine House with $83,000 for allowable administrative expenses, the $61,274 in actual

vendor costs, and the $20,000 Sunshine House paid to the architect. Id. The remaining amount,

most of which was used to pay Kuhners salary, is HRSAs loss under their calculations.

This loss was reasonably foreseeable to Kuhner. When HRSA began to audit the grant,

Kuhner realized she was in trouble. She knew that the grant was not intended to be used to pay

her salary, and that she could not establish that the money had been spent for any other purpose.

In an attempt to hide the use of the grant funds, Kuhner solicited statements from the architect

that made it appear that he had been paid by Sunshine House, or that Sunshine House had

incurred actual expenses for the architects work. She submitted these misleading documents and

statements based on them to HRSA in an attempt to hide the fact that she had paid herself with

the grant funds. There is no doubt that Kuhner foresaw that if she told HRSA the truth, HRSA

would at the very least seek to recoup the funds. The false statements were designed to hide

HRSAs loss from the agency.

The alternate calculation of loss under the Guidelines is intended loss, which is defined

as the pecuniary harm that was intended to result from the offense. U.S.S.G. 2B1.1,

Application Note 3(A)(ii). It may well be that in the early stages of her misuse of the funds,

Kuhner had not intended to harm HRSA. By the time the grant closed, however, and Kuhner was

making the false statements to HRSA, she plainly intended to hide her diversion of the grant

funds. She intended to hide the full amount of her salary and benefits from HRSA when she told

them Sunshine House had incurred $594,225 in architectural and other fees, and when she

13

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 13 of 21

provided a false income and expenditure statement.

In her sentencing memorandum, Kuhner argues that her reimbursements for salary and

benefits may have been contrary to the terms of the grant, but that does not make them criminal

or losses attributable to the retrospective accounting. Deft. Sent. Mem. [doc. no. 22] at 3. This

argument seeks to divorce the false statement from the reason the statement was made. The

intent of the statement was to prevent HRSA from knowing where the money went. When

Kuhner was falsely drawing down the grant funds, in effect representing to HRSA that Sunshine

House had actually incurred expenses and, prior to the change in scope of the grant in August

2006, had actually incurred construction expenses those false statements were surely causing a

loss to HRSA. Kuhner provides no support for her claim that conduct predating the actual false

statement cannot be considered as relevant conduct under 1B1.3 of the Guidelines. The mere

fact that when asked, Kuhner did not immediately tell HRSA the grant funds were used to pay

her salary and benefits indicates that her use of the funds was knowingly wrongful at the time it

occurred, and was not a well-intentioned mistake. Contrary to her argument here, Kuhners own

actions indicate that the false statement was part of a continuing course of conduct.

The Government acknowledges that in pleading guilty to the false statement charge,

Kuhner has not admitted to possessing an intent to defraud at the time she drew down the grant

funds. Kuhner must acknowledge, however, that her use of the funds to pay her salary was a

material omission to HRSA, and that her representations to HRSA each time she drew down the

funds were materially false. The false statement charged in the Information came at the end of

other untruthful statements used to get the funds in the first place, and cannot be separated from

them. By way of contrast, if Sunshine House had received all of the $836,190 in a lump sum at

14

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 14 of 21

the outset of the contract and placed that money in a bank account from which Kuhner later drew

her salary, her argument that her false statement at the conclusion of the grant was unrelated to

any loss might arguably be stronger. In this case, however, every time Kuhner drew down on the

grant, she was representing to HRSA that Sunshine House had actually incurred those costs in

eligible expenses, and that the grant could be used to pay a percentage of those expenses.

Moreover, assuming arguendo that one were to credit Kuhners assertion that she had not

knowingly acted wrongfully in using grant funds to pay her salary, there are no circumstances by

which Kuhner can justify her drawing down grant funds before Sunshine House had incurred any

expenses (including her salary) and moving those funds to the money market account. When

Kuhner drew down funds in large amounts in 2006, then moved a total of $256,000 into the

money market account between May 31, 2006 and July 31, 2006, she was plainly acting without

any good faith whatsoever. She has no justification for asserting that she believed that HRSA

agreed under the grant to pay for her salary in 2007 and 2008, long after the grant period had

closed, or that she had any authority to draw down funds in advance of Sunshine House incurring

any costs.

In sum, it is plain that Kuhners false statements were designed to conceal relevant

conduct under the Guidelines. Even if the guideline loss amount were not HRSAs claimed

actual loss, Kuhners false statements were designed in a criminal manner to conceal misuse of a

some portion of the grant funds. The Guidelines provide that in determining loss for Guidelines

purposes, the Court need only make a reasonable estimate of the loss, (U.S.S.G. 2B1.1,

application note 3(C)), and given the advisory nature of the Guidelines, an expanded range

would be sufficient to guide the Court. See United States v. Crosby, 397 F.3d 103, 112 (2d Cir.

15

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 15 of 21

2005) (sentencing court need not resolve disputed issues to determine which of two ranges

actually applies). Using HRSAs actual loss figure of $671,916 results in a total offense level of

17 after credit for acceptance, for a range of 24 to 30 months before any adjustments. Before

receiving HRSAs calculation of its actual loss, the PSR calculated the Guideline loss as

Kuhners gross salary and benefits ($622,348 + 43,282 $665,630) minus an allowable $83,000,

resulting in a loss of $582,630 and the same total offense level of 17. (This method uses

approximately the gross gain to the defendant as the loss amount). An alternate loss figure may

be the $256,000 which Kuhner drew down in advance of incurring any expenses and transferred

to the money market account, for which there can be no justification. A loss amount of between

$200,000 and $400,000 yields an offense level of 15 and a range of 18 to 24 months. The

Government submits that the combined range of 18 to 30 months is a sufficient starting point

from which the Court can begin to consider any arguments concerning departures. See Crosby,

397 F.3d at 112 (sentencing court may consider two adjacent guideline ranges without resolving

disputed issues); U.S.S.G. 2B1.1 application note 3(C) (sentencing court need only make a

reasonable estimate of loss for Guidelines purposes).

III. DISCUSSION

This case presents the Court with somewhat unusual facts that operate at cross purposes

when weighed using the factors the Court must consider in determining the sentence to be

imposed under 18 U.S.C. 3553(a). The Government acknowledges that this defendant is

3

In relevant part, 18 U.S.C. 3553(a) provides as follows:

3

(a) Factors to be considered in imposing a sentence. -- The court shall impose a

sentence sufficient, but not greater than necessary, to comply with the purposes set forth in

paragraph (2) of this subsection. The court, in determining the particular sentence to be imposed,

shall consider --

16

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 16 of 21

highly unlikely to reoffend, and that at other times in her life, by all appearances seems to be

motivated by a genuine compassion for others and a desire to serve and heal those in need,

perhaps more so since her conviction. She came to commit her crime while engaged in a

laudable effort, and one to which she brought significant effort and dedication.

It cannot be, however, that those praiseworthy ends obscure the wrongful means and

significant legal and ethical breaches the defendant knowingly committed in her work. The

public certainly has a right to expect that public funds will be properly handled, and not diverted

from the general purpose of helping seriously ill children to the specific purpose of helping one

individual. At a time when federal dollars, and in particular federal grant dollars, are both

scarcer and needed more than in long memory, misuse of such funds is a serious offense that

cannot go unsanctioned. When Amy Kuhner founded Sunshine House and obtained a federal

grant to help build a childrens hospice, she was not entitled to be supported at a significant

salary and benefits with taxpayer dollars, especially when those very same dollars were supposed

(1) the nature and circumstances of the offense and the history and characteristics of the

defendant;

(2) the need for the sentence imposed --

(A) to reflect the seriousness of the offense, to promote respect for the law, and to

provide just punishment for the offense;

(B) to afford adequate deterrence to criminal conduct;

(C) to protect the public from further crimes of the defendant; and

(D) to provide the defendant with needed educational or vocational training,

medical care, or other correctional treatment in the most effective manner;

(3) the kinds of sentences available;

(4) the kinds of sentences and the sentencing range established for --

(A) the applicable category of offense committed by the applicable category of

defendant as set forth in the guidelines ...

(5) any pertinent policy statement [issued by the Sentencing Commission]..

(6) the need to avoid unwarranted sentence disparities among defendants with similar

records who have been found guilty of similar conduct; and

(7) the need to provide restitution to any victims of the offense.

17

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 17 of 21

to be used to pay professionals like architects and construction workers to bring the hospice into

actual existence. Having obtained the federal grant to assist in the endeavor, it was incumbent

upon Kuhner either to get a job to support herself, or to raise donations or other grants to pay

Sunshine Houses administrative costs, including her salary. Instead, Kuhner took the ethical and

legal shortcut, if not to enrich herself, certainly to ensure that she had no worries about her

personal financial circumstances.

Kuhner engaged in this conduct despite being surrounded by individuals who not only

were every bit as committed to the vision of Sunshine House as she was, but who felt a personal

bond and respect for Kuhner. At no time during the four-plus years that Kuhner used grant funds

to pay herself did she approach trustees or others involved to explain what she had done and seek

to make it right. Even when given the opportunity by HRSA to simply tell the truth about where

the grant money had gone, she lied, and caused others involved in supporting Sunshine House,

including the architect and an accountant, to unknowingly aid her in creating her false statements.

Given Kuhners extensive educational training and her life experience, there is no doubt

that she clearly understood the grant restrictions and the proper use of the funds. The project

guidelines and communications from HRSA are written in plain English and are not complex.

Kuhner herself drafted the grant application, and displayed a sophistication in her dealings with

HRSA. The manner in which she reverse-engineered the amount she claimed to have paid the

architect, and her skillful manipulation of the figures on the income statement she provided to

HRSA show that this was not a case of mere negligence or inattention. In fact, Kuhners

competence led others involved in Sunshine House to trust in her day-to-day management of the

project and to defer to her explanations concerning grant funds or other financial matters. This

18

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 18 of 21

deference provided Kuhner with the opportunity to commit her crime without interference or

oversight, and enabled her to conceal it.

Thus, the nature and circumstances of Kuhners offense belie any assertion that she was

misled by complex grant rules or merely exceeded suggested caps on certain categories of

expenses under the grant. Rather, she appears to have been motivated by the same mixture of

self-righteous entitlement that motivates other white collar criminals to, for example, lie on their

income tax forms because they believe they are overtaxed, or upcode claims for their medicals

services because they believe they are underpaid by insurance companies, or to violate securities

laws to realize larger profits. And as is the case in those crimes, the salient point to be

4

considered in imposing sentence is general deterrence, which 3553(a) casts as the need to

promote respect for the law. The vast majority of citizens pay their fair share of taxes, or submit

accurate clams for payment, and adhere to the law because they believe that those who do not

will be punished. As a result, the tax system and the federal grant system function by trusting in

the truthfulness of citizens who follow the honor codes inherent in those systems. A lack of

appropriate sanction for criminal acts affecting those programs skews the calculus of those who

may be tempted to engage in dishonorable or illegal conduct.

Moreover, the defendants offense involved the defendants failure to tell the truth about

how she had handled hundreds of thousands of dollars in taxpayer funds over a period of several

Such conduct cannot accurately be described as more of a consequence of [a] self-

4

described compulsion to over-achieve than any criminal intent. Cf. PSR 74, Deft. Sent. Mem.

at 9. Anyone who knows right from wrong and that certainly includes highly educated over-

achievers is not entitled to blame deliberately criminal conduct on a desire to succeed or

achieve, any more than a strong desire to win the game exonerates one who cheats. To believe

otherwise is to hold highly motivated and skilled criminals less culpable than their lazier

counterparts.

19

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 19 of 21

years. The scope of her conduct and her abuse of the public fisc clearly involved a serious crime,

and the need for the sentence to provide just punishment for the offense should reflect these

facts.

The Government acknowledges that this case differs from criminal cases where a

defendant venally from the outset intends to defraud his victim through utter falsehoods, or

embezzles from his employer in order to finance an extravagant lifestyle. In this regard, because

the guideline range encompasses such other crimes, it may be that the range slightly overstates

the severity of this particular offense. In addition, given the nature of her crime, the defendant has

already felt a particular public disapprobation that, while the sign of healthy community,

nonetheless meaningfully humbles individuals who might otherwise be respected as women of

accomplishment. The Presentence Report and letters submitted to the Court indicate a profound

period of reflection by the defendant on her conduct and the circumstances that led her to this

point. By all appearances, after serving her sentence, the defendant will resume the law-abiding

path she traveled for nearly all of her life.

The sentence should, however, reflect the distinct importance of federal grant funds and

the serious consequences that must result from misrepresentations about the use of such funds.

To require those to whom grant funds are entrusted to simply tell the truth about what they did

with the money is a basic and obvious legal standard, rightfully expected by the taxpayers who

provide the funds. As a result, an individuals violation of that elementary requirement should

result in a period of confinement in order to deter others from misusing or misleadlingly

accounting for federal funds, regardless of the particular personal circumstances of the individual

who committed the violation.

20

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 20 of 21

In other words, the need for the sentence to provide general deterrence and just

punishment for the offense outweighs Amy Kuhners individual circumstances. Based on

Kuhners talents and motivations, a sentence that provides her an opportunity for a substantial

period of community service as part of supervised release may assist her in becoming established

and setting out in the right direction to the betterment of her fellow citizens.

IV. CONCLUSION

For all of the foregoing reasons, the Government respectfully submits that the Court

should sentence the defendant to a period of confinement and supervised release, consistent with

the operation of the Guidelines and the considerations of 18 U.S.C. 3553(a).

Respectfully submitted,

DAVID B. FEIN

UNITED STATES ATTORNEY

/s/

DAVID J. SHELDON

ASSISTANT UNITED STATES ATTORNEY

Fed. Bar No. ct07997

157 Church Street, 23d Floor

New Haven, CT 06510

(203) 821-3700

fax: (203) 773-5378

david.sheldon@usdoj.gov

CERTIFICATION

I hereby certify that on December 20, 2012, a copy of the foregoing was filed

electronically and served by mail on anyone unable to accept electronic filing. Notice of this

filing will be sent by e-mail to all parties by operation of the Courts electronic filing system or

by mail to anyone unable to accept electronic filing as indicated on the Notice of Electronic

Filing. Parties may access this filing through the Courts CM/ECF System.

/s/

DAVID J. SHELDON

ASSISTANT UNITED STATES ATTORNEY

21

Case 3:12-cr-00168-AWT Document 23 Filed 12/20/12 Page 21 of 21

UNITED STATES DISTRICT COURT

DISTRICT OF CONNECTICUT

UNITED STATES OF AMERICA :

v. : 3:12CR168 (AWT)

AMY KUHNER : DECEMBER 20, 2012

APPENDIX TO

GOVERNMENTS MEMORANDUM IN AID OF SENTENCING

Table of Contents

Excerpt from HRSA Grant Program Guide A1

Sunshine House Supplemental Grant Application A12

HRSA Notice of Grant Award A21

Specifics of Grant Acceptance A37

Application for Change of Scope to Grant A39

List of Drawdowns on Sunshine House Grant A45

Signature Page of AIA Document Submitted to HRSA A46

Costs to Date Submitted by Kuhner A47

Statement of Income and Expenditures for Grant Period A49

HRSA Statement of Loss A53

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 1 of 56

A1

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 2 of 56

A2

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 3 of 56

A3

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 4 of 56

A4

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 5 of 56

A5

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 6 of 56

A6

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 7 of 56

A7

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 8 of 56

A8

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 9 of 56

A9

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 10 of 56

A10

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 11 of 56

A11

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 12 of 56

A12

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 13 of 56

A

1

3

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 14 of 56

A14

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 15 of 56

A15

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 16 of 56

A16

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 17 of 56

A17

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 18 of 56

A18

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 19 of 56

A19

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 20 of 56

A20

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 21 of 56

A21

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 22 of 56

A22

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 23 of 56

A23

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 24 of 56

A24

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 25 of 56

A25

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 26 of 56

A26

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 27 of 56

A27

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 28 of 56

A28

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 29 of 56

A29

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 30 of 56

A30

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 31 of 56

A31

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 32 of 56

A32

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 33 of 56

A33

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 34 of 56

A34

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 35 of 56

A35

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 36 of 56

A36

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 37 of 56

A37

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 38 of 56

A38

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 39 of 56

A39

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 40 of 56

A

4

0

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 41 of 56

A41

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 42 of 56

A42

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 43 of 56

A43

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 44 of 56

A44

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 45 of 56

1

INQUIRY: Payment Data Listing Subaccts(if any), else same as PAY DATE: 2010

TIME: 03:11:07 PM

*** SEARCH PARAMETERS ***********************************

PIN:

*********************************************************

*ACCT** *PIN* ****EIN***** *****DUNS***** ********Organization Name********

Sunshine House, Inc.

HHS-REG: 01 STATE: CT PMT: ACH STOP: N MAN-REV: N 272: File GROUP: F21 USER: VNK5PA

T/C* ***DEBIT** **POSTED** ******AMOUNT****** *DATE**SCHED* **CONFIRM*

927 09/27/2006 09/26/2006 30,178.00 060926 93900 4031734687

927 07/19/2006 07/18/2006 16,200.00 060718 73599 4031656960

927 07/03/2006 06/30/2006 25,600.00 060630 63534 4031641401

927 06/23/2006 06/22/2006 35,800.00 060622 63497 4031595086

927 05/26/2006 05/25/2006 27,150.00 060525 53385 4031564695

927 05/15/2006 05/12/2006 34,200.00 060512 53332 4031551298

927 05/01/2006 04/28/2006 13,700.00 060428 43271 4031535232

927 04/25/2006 04/24/2006 29,680.00 060424 43246 4031527264

927 04/11/2006 04/10/2006 14,760.00 060410 43188 4031512287

927 04/06/2006 04/05/2006 36,420.00 060405 43171 4031507689

927 03/21/2006 03/20/2006 23,370.00 060320 33097 4031488426

927 02/27/2006 02/24/2006 32,500.00 060224 23000 4031462365

927 01/31/2006 01/30/2006 18,850.00 060130 13889 4031431773

927 12/30/2005 12/29/2005 6,975.00 051229 123769 4031399418

927 12/29/2005 12/28/2005 10,715.00 051228 123764 4031397848

927 12/14/2005 12/13/2005 9,450.00 051213 123702 4031381223

927 11/23/2005 11/22/2005 19,170.00 051122 113621 4031359317

927 11/15/2005 11/14/2005 24,310.00 051114 113585 4031348847

927 10/31/2005 10/28/2005 22,923.00 051028 103525 4031331577

927 09/29/2005 09/28/2005 9,298.00 050928 93395 4031294581

927 08/30/2005 08/29/2005 7,503.00 050829 83270 4031260670

927 06/30/2005 06/29/2005 12,656.00 050629 63021 1074237664

927 05/26/2005 05/25/2005 10,686.00 050525 53878 1104879243

927 04/26/2005 04/25/2005 17,415.00 050425 43744 1053139200

927 04/01/2005 03/31/2005 17,642.00 050331 33641 1055696597

927 02/28/2005 02/25/2005 10,769.00 050225 23497 1104560327

927 01/28/2005 01/27/2005 11,452.00 050127 13380 1104478929

927 12/30/2004 12/29/2004 8,110.00 041229 123262 1095562249

927 12/17/2004 12/16/2004 17,462.00 041216 123214 1095561021

927 09/29/2004 09/28/2004 16,508.00 040928 93893 1095272660

927 08/27/2004 08/26/2004 22,779.00 040826 83763 1043543558

927 07/30/2004 07/29/2004 26,055.00 040729 73647 1046106063

927 06/29/2004 06/28/2004 24,853.00 040628 63515 1043330156

927 05/12/2004 05/11/2004 17,338.00 040511 53324 1043225991

927 03/31/2004 03/30/2004 13,970.00 040330 33145 1048366791

927 02/13/2004 02/12/2004 7,914.00 040212 23956 1042933207

927 12/31/2003 12/30/2003 3,364.00 031230 123789 1033957611

927 12/11/2003 12/10/2003 18,374.00 031210 123712 1033912502

927 10/31/2003 10/30/2003 21,547.00 031030 103552 1033785321

927 10/27/2003 10/24/2003 88,000.00 031024 103528 2078172077

927 09/23/2003 09/22/2003 20,544.00 030922 93388 1036286443

PIN:A3281 ACC:A3281G1 836,190.00 Total Advances Listed Pay Hits: 41

A45

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 46 of 56

A46

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 47 of 56

A47

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 48 of 56

A48

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 49 of 56

A49

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 50 of 56

A50

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 51 of 56

A51

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 52 of 56

A52

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 53 of 56

A53

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 54 of 56

A54

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 55 of 56

CERTIFICATION

I hereby certify that on December 20, 2012, a copy of the foregoing was filed

electronically and served by mail on anyone unable to accept electronic filing. Notice of this

filing will be sent by e-mail to all parties by operation of the Courts electronic filing system or

by mail to anyone unable to accept electronic filing as indicated on the Notice of Electronic

Filing. Parties may access this filing through the Courts CM/ECF System.

/s/

DAVID J. SHELDON

ASSISTANT UNITED STATES ATTORNEY

Case 3:12-cr-00168-AWT Document 23-1 Filed 12/20/12 Page 56 of 56

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- TBL LTR ReprimandДокумент5 страницTBL LTR ReprimandHelen BennettОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- West Hartford Proposed Budget 2024-2025Документ472 страницыWest Hartford Proposed Budget 2024-2025Helen BennettОценок пока нет

- 17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Документ22 страницы17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Helen BennettОценок пока нет

- Analysis of Impacts of Hospital Consolidation in CT 032624Документ41 страницаAnalysis of Impacts of Hospital Consolidation in CT 032624Helen BennettОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PURA 2023 Annual ReportДокумент129 страницPURA 2023 Annual ReportHelen BennettОценок пока нет

- Pura Decision 230132re01-022124Документ12 страницPura Decision 230132re01-022124Helen BennettОценок пока нет

- 75 Center Street Summary Suspension SignedДокумент3 страницы75 Center Street Summary Suspension SignedHelen BennettОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- National Weather Service 01122024 - Am - PublicДокумент17 страницNational Weather Service 01122024 - Am - PublicHelen BennettОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Finn Dixon Herling Report On CSPДокумент16 страницFinn Dixon Herling Report On CSPRich KirbyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Hunting, Fishing, and Trapping Fees 2024-R-0042Документ4 страницыHunting, Fishing, and Trapping Fees 2024-R-0042Helen BennettОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 20240325143451Документ2 страницы20240325143451Helen BennettОценок пока нет

- Commission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Документ4 страницыCommission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Helen BennettОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Final West Haven Tier IV Report To GovernorДокумент75 страницFinal West Haven Tier IV Report To GovernorHelen BennettОценок пока нет

- District 4 0174 0453 Project Locations FINALДокумент6 страницDistrict 4 0174 0453 Project Locations FINALHelen BennettОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- CT State of Thebirds 2023Документ13 страницCT State of Thebirds 2023Helen Bennett100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- South WindsorДокумент24 страницыSouth WindsorHelen BennettОценок пока нет

- 2024 Budget 12.5.23Документ1 страница2024 Budget 12.5.23Helen BennettОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Hartford CT Muni 110723Документ2 страницыHartford CT Muni 110723Helen BennettОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Be Jar Whistleblower DocumentsДокумент292 страницыBe Jar Whistleblower DocumentsHelen BennettОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Crime in Connecticut Annual Report 2022Документ109 страницCrime in Connecticut Annual Report 2022Helen BennettОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- District 1 0171 0474 Project Locations FINALДокумент7 страницDistrict 1 0171 0474 Project Locations FINALHelen BennettОценок пока нет

- District 3 0173 0522 Project Locations FINALДокумент17 страницDistrict 3 0173 0522 Project Locations FINALHelen BennettОценок пока нет

- Voices For Children Report 2023 FinalДокумент29 страницVoices For Children Report 2023 FinalHelen BennettОценок пока нет

- No Poach RulingДокумент19 страницNo Poach RulingHelen BennettОценок пока нет

- University of Connecticut Audit: 20230815 - FY2019,2020,2021Документ50 страницUniversity of Connecticut Audit: 20230815 - FY2019,2020,2021Helen BennettОценок пока нет

- PEZZOLO Melissa Sentencing MemoДокумент12 страницPEZZOLO Melissa Sentencing MemoHelen BennettОценок пока нет

- PEZZOLO Melissa Govt Sentencing MemoДокумент15 страницPEZZOLO Melissa Govt Sentencing MemoHelen BennettОценок пока нет

- 04212023final Report MasterДокумент25 страниц04212023final Report MasterHelen BennettОценок пока нет

- 2023lco07279 R00 AmdbДокумент8 страниц2023lco07279 R00 AmdbHelen BennettОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Hurley Employment Agreement - Final ExecutionДокумент22 страницыHurley Employment Agreement - Final ExecutionHelen BennettОценок пока нет

- Assignment of SQLДокумент5 страницAssignment of SQLRaghvendra Pal100% (1)

- Union of Filipro Vs VivarДокумент7 страницUnion of Filipro Vs VivarXryn MortelОценок пока нет

- National Officer SalaryДокумент6 страницNational Officer SalarytaolawaleОценок пока нет

- This Chart of Accounts Is Provided in A "Flat" Format To Allow For Importing Please Reference PDF Versions For GroupingsДокумент10 страницThis Chart of Accounts Is Provided in A "Flat" Format To Allow For Importing Please Reference PDF Versions For GroupingsblackghostОценок пока нет

- Ashok Kumar RamakrishnanpadmanabanДокумент2 страницыAshok Kumar Ramakrishnanpadmanabanudayasankar KОценок пока нет

- HRM370 ReportДокумент18 страницHRM370 ReportF.T. BhuiyanОценок пока нет

- Business Model TemplateДокумент5 страницBusiness Model TemplatethecluelessОценок пока нет

- Sanjay Venkataraaman Individual AssignmentДокумент10 страницSanjay Venkataraaman Individual Assignmentraghul raghavanОценок пока нет

- Chapter 9Документ14 страницChapter 9Melissa NagyОценок пока нет

- Innocent, Impact AssessmentДокумент66 страницInnocent, Impact AssessmentJennifer sofienlОценок пока нет

- Kumkum PresentationДокумент37 страницKumkum PresentationMonirul IslamОценок пока нет

- Kribhco Summer Trainning ReportДокумент106 страницKribhco Summer Trainning ReportMihir Patel0% (1)

- Hotel Operating Expense List - 0Документ1 страницаHotel Operating Expense List - 0nikhiltalrejaОценок пока нет

- Impact of Transformational Leadership On Business PerformanceДокумент10 страницImpact of Transformational Leadership On Business Performancematthew lomongoОценок пока нет

- What Is TDS?: Tax Deducted at Source (TDS)Документ8 страницWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootОценок пока нет

- Health Sector Reform LawДокумент85 страницHealth Sector Reform LawDJNiyiОценок пока нет

- Fiscal Planning and The New Maintenance of Effort Law: Companion Document For Council PresentationДокумент39 страницFiscal Planning and The New Maintenance of Effort Law: Companion Document For Council PresentationParents' Coalition of Montgomery County, MarylandОценок пока нет

- Pay Standards & Practices: Business Process OutsourcingДокумент3 страницыPay Standards & Practices: Business Process OutsourcingsamОценок пока нет

- Compensation Is The Total Cash and NonДокумент4 страницыCompensation Is The Total Cash and NonAamil Rafi KhanОценок пока нет

- Omnibus Rules Implementing The Labor Code - Book 1Документ35 страницOmnibus Rules Implementing The Labor Code - Book 1chitru_chichruОценок пока нет

- Factors Affecting Pay LevelsДокумент27 страницFactors Affecting Pay LevelsS- Ajmeri100% (1)

- 0450 - 1.5 Business Objectives and Stakeholder ObjectivesДокумент11 страниц0450 - 1.5 Business Objectives and Stakeholder ObjectivesCherylОценок пока нет

- 106 HRM - All - in - OneДокумент281 страница106 HRM - All - in - OneDilip GoliyaОценок пока нет

- EMP & DEPT Table Related QueriesДокумент2 страницыEMP & DEPT Table Related QueriesNarayana VenkatasubbasatyanarayanaОценок пока нет

- This Study Resource Was: The Rights and Privileges of Teachers in The PhilippinesДокумент5 страницThis Study Resource Was: The Rights and Privileges of Teachers in The PhilippinesHanna IgnacioОценок пока нет

- My Project PresentationДокумент12 страницMy Project Presentationkarunasand15Оценок пока нет

- 4 Grant of Bonus Full CaseДокумент36 страниц4 Grant of Bonus Full CasedaryllОценок пока нет

- Org Man - Q2-M4Документ21 страницаOrg Man - Q2-M4Jhoanna OllerОценок пока нет

- Handal - Chapter 14 Case AssignmentДокумент4 страницыHandal - Chapter 14 Case AssignmentRodolfo Handal100% (2)

- 1.5 - International RewardДокумент18 страниц1.5 - International RewardDghxbzxeeОценок пока нет

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansОт EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansРейтинг: 4 из 5 звезд4/5 (19)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenОт EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenРейтинг: 3.5 из 5 звезд3.5/5 (37)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIОт EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIРейтинг: 4 из 5 звезд4/5 (20)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.От EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Рейтинг: 5 из 5 звезд5/5 (45)

- A Special Place In Hell: The World's Most Depraved Serial KillersОт EverandA Special Place In Hell: The World's Most Depraved Serial KillersРейтинг: 4 из 5 звезд4/5 (55)

- Tinseltown: Murder, Morphine, and Madness at the Dawn of HollywoodОт EverandTinseltown: Murder, Morphine, and Madness at the Dawn of HollywoodОценок пока нет

- The Gardner Heist: The True Story of the World's Largest Unsolved Art TheftОт EverandThe Gardner Heist: The True Story of the World's Largest Unsolved Art TheftОценок пока нет