Академический Документы

Профессиональный Документы

Культура Документы

History and Functions of SEBI

Загружено:

Vishal SharmaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

History and Functions of SEBI

Загружено:

Vishal SharmaАвторское право:

Доступные форматы

History

It was formed officially by the Government of India in 1992 with SEBI Act 1992 being passed by the Indian Parliament. SEBI is headquartered in the business district of Bandra Kurla Complex in Mumbai, and has Northern, Eastern, Southern and Western regional offices in New Delhi,Kolkata, Chennai and Ahmedabad. Controller of Capital Issues was the regulatory authority before SEBI came into existence; it derived authority from the Capital Issues (Control) Act, 1947. Initially SEBI was a non statutory body without any statutory power. However in 1995, the SEBI was given additional statutory power by the Government of India through an amendment to the Securities and Exchange Board of India Act 1992. In April, 1998 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India. The SEBI is managed by its members, which consists of following: a) The chairman who is nominated by central government. b) Two members, i.e. officers of central ministry. c) One member from the RBI. d) The remaining five members are nominated by the central government, out of whom at least three shall be whole-time members. The office of SEBI is situated at SEBI Bhavan, Bandra Kurla Complex, Bandra East, Mumbai400051, with its regional offices at Kolkata, Delhi,Chennai & Ahmedabad. It has recently opened local offices at Jaipur and Bangalore and is planning to open offices at Guwahati, Bhubaneshwar, Patna, Kochi and Chandigarh.

Functions and responsibilities

SEBI has to be responsive to the needs of three groups, which constitute the market: the issuers of securities the investors the market intermediaries.

SEBI has three functions rolled into one body: quasi-legislative, quasi-judicial and quasiexecutive. It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders in its judicial capacity. Though this makes it very powerful, there is an appeals process to create accountability. There is a Securities Appellate Tribunal which is a three-member tribunal and is presently headed by a former Chief Justice of a High court - Mr. Justice NK Sodhi. A second appeal lies directly to the Supreme Court.

Powers

For the discharge of its functions efficiently, SEBI has been invested with the necessary powers which are: 1. 2. to approve bylaws of stock exchanges. to require the stock exchange to amend their bylaws.

3. inspect the books of accounts and call for periodical returns from recognized stock exchanges. 4. 5. inspect the books of accounts of a financial intermediaries. compel certain companies to list their shares in one or more stock exchanges. levy fees and other charges on the intermediaries for performing its functions. grant license to any person for the purpose of dealing in certain areas. delegate powers exercisable by it. prosecute and judge directly the violation of certain provisions of the companies power to impose monetry penalties.

6.

7. 8. 9. Act. 10.

Вам также может понравиться

- C C CM: MMMMMMДокумент4 страницыC C CM: MMMMMMGaurav RauthanОценок пока нет

- Securities and Exchange Board of IndiaДокумент5 страницSecurities and Exchange Board of IndiaKanna RajeshОценок пока нет

- SEBIДокумент1 страницаSEBIApurva DipnaikОценок пока нет

- SEBI India's Securities Market RegulatorДокумент6 страницSEBI India's Securities Market RegulatorPawan LohanaОценок пока нет

- SEBI India Regulator Securities MarketДокумент6 страницSEBI India Regulator Securities MarketSiddhi PatwaОценок пока нет

- SEBIДокумент2 страницыSEBIAkash ShrivastavaОценок пока нет

- SEBI Regulates Indian Capital MarketsДокумент7 страницSEBI Regulates Indian Capital MarketsAshish ThengariОценок пока нет

- Securities and Exchange Board of IndiaДокумент73 страницыSecurities and Exchange Board of IndiaSurya ParkashОценок пока нет

- Regulators of IndiaДокумент29 страницRegulators of IndiaPoonam KumariОценок пока нет

- Securities and Exchange Board of IndiaДокумент10 страницSecurities and Exchange Board of IndiajaseelekaОценок пока нет

- History: The Securities and Exchange Board of India Act, 1992Документ4 страницыHistory: The Securities and Exchange Board of India Act, 1992Arulmani MurugesanОценок пока нет

- SEBI[1]Документ8 страницSEBI[1]anandminz35Оценок пока нет

- Securities and Exchange Board of IndiaДокумент21 страницаSecurities and Exchange Board of IndiaDeepa A PoojaryОценок пока нет

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesДокумент4 страницыUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaОценок пока нет

- Module 04 Investment N Securities Law-6Документ76 страницModule 04 Investment N Securities Law-6Kirti DОценок пока нет

- Sebi'S Background: Securities and Exchange Board of IndiaДокумент15 страницSebi'S Background: Securities and Exchange Board of IndiaAnjaliОценок пока нет

- SEBI IntroductionДокумент48 страницSEBI Introductiontanisq10100% (2)

- SEBI regulates India's securities marketДокумент6 страницSEBI regulates India's securities marketShashank HatleОценок пока нет

- Sebi Power and FunctionДокумент13 страницSebi Power and Functionaman kadriОценок пока нет

- Corporate Law-Ii Important QuestionsДокумент26 страницCorporate Law-Ii Important QuestionsNishaath ShareefОценок пока нет

- SEBI - Regulator of Indian securities marketsДокумент37 страницSEBI - Regulator of Indian securities marketsBhushan KharatОценок пока нет

- Introductio 1Документ2 страницыIntroductio 1Anil ShelarОценок пока нет

- SEBI: Regulations, Objectives and FunctionsДокумент35 страницSEBI: Regulations, Objectives and FunctionsRohan FodnaikОценок пока нет

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Документ12 страницRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanОценок пока нет

- SEBIДокумент25 страницSEBIsumant singhОценок пока нет

- Security and Exchange Board of IndiaДокумент7 страницSecurity and Exchange Board of IndiaBharath BangОценок пока нет

- Security Exchange & Board of IndiaДокумент11 страницSecurity Exchange & Board of IndiaLyco BhardwajОценок пока нет

- SEBI's functions and powers as market regulatorДокумент10 страницSEBI's functions and powers as market regulatorNavin PamnaniОценок пока нет

- SEBI: History, Establishment and OrganizationДокумент55 страницSEBI: History, Establishment and OrganizationSaurabh sarojОценок пока нет

- Difference Between Money Markets and Capital MarketsДокумент4 страницыDifference Between Money Markets and Capital MarketsSachin TiwariОценок пока нет

- 1.7 Business Legal Systems: Mfa 1 SemesterДокумент53 страницы1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaОценок пока нет

- Investment and Securities AssignmentДокумент16 страницInvestment and Securities Assignmentkhusboo kharbandaОценок пока нет

- SEBI - Regulator of India's Financial MarketsДокумент5 страницSEBI - Regulator of India's Financial MarketsSoni GuptaОценок пока нет

- Financial Markets Assignment Sem-2Документ14 страницFinancial Markets Assignment Sem-2Prerna BhansaliОценок пока нет

- SebiДокумент26 страницSebiHitesh MendirattaОценок пока нет

- Sebi Functional ReportДокумент7 страницSebi Functional ReportRohan Pawar61% (18)

- Securities and Exchange Board of India (SEBI)Документ10 страницSecurities and Exchange Board of India (SEBI)Utkarsh SethiОценок пока нет

- Assignment On SebiДокумент17 страницAssignment On SebiSUFIYAN SIDDIQUIОценок пока нет

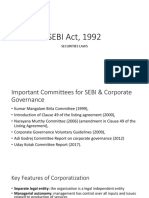

- SEBI Act, 1992: Securities LawsДокумент25 страницSEBI Act, 1992: Securities LawsAlok KumarОценок пока нет

- Securities Exchange Board of IndiaДокумент24 страницыSecurities Exchange Board of IndiaasdОценок пока нет

- Role of SEBI in Primary MarketДокумент19 страницRole of SEBI in Primary MarketTwinkle RajpalОценок пока нет

- Ministry of Corporate AffairsДокумент10 страницMinistry of Corporate AffairsAzim SamnaniОценок пока нет

- Index: S. No. Title No. Remark SДокумент17 страницIndex: S. No. Title No. Remark SSiddhi PatwaОценок пока нет

- Securities and Exchange Board of IndiaДокумент32 страницыSecurities and Exchange Board of IndiaMohan kashyapОценок пока нет

- Functional Report of SEBIДокумент9 страницFunctional Report of SEBIAMIT K SINGH100% (1)

- CLASS - 1 Introduction of SEBIДокумент7 страницCLASS - 1 Introduction of SEBIPawas SinghОценок пока нет

- Investment Law PresentationДокумент11 страницInvestment Law PresentationNanda SurajОценок пока нет

- SEBI as a regulator of the capital marketДокумент25 страницSEBI as a regulator of the capital marketraj vardhan agarwalОценок пока нет

- Sebi PresentatationДокумент21 страницаSebi PresentatationDeepikaОценок пока нет

- SEBI Introduction and RoleДокумент3 страницыSEBI Introduction and RoleAnkush PoojaryОценок пока нет

- Sebi LawДокумент75 страницSebi LawTUSHAR SHERMALEОценок пока нет

- Name-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)Документ6 страницName-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)MechiluhoОценок пока нет

- SEBI Role Capital Markets IndiaДокумент12 страницSEBI Role Capital Markets IndiaDeepika BorgaonkarОценок пока нет

- SECPДокумент18 страницSECPAli JumaniОценок пока нет

- FMR AssignmentДокумент8 страницFMR AssignmentABHISHEK MARORIAОценок пока нет

- SEB LawДокумент19 страницSEB LawHimanshu KumarОценок пока нет

- Sebi Sensex Nifty Bse NseДокумент47 страницSebi Sensex Nifty Bse NseKushal WaliaОценок пока нет

- Muzaffarpur Rally Jan 2019 Hindi and English PublicationДокумент15 страницMuzaffarpur Rally Jan 2019 Hindi and English PublicationVishal SharmaОценок пока нет

- 22984medical Result-14 PDFДокумент2 страницы22984medical Result-14 PDFVishal SharmaОценок пока нет

- 22984medical Result-14 PDFДокумент2 страницы22984medical Result-14 PDFVishal SharmaОценок пока нет

- HussДокумент1 страницаHussVishal SharmaОценок пока нет

- Public Officers Who Are Prohibited To Practice LawДокумент13 страницPublic Officers Who Are Prohibited To Practice LawRacheal SantosОценок пока нет

- Rem Rev FTДокумент93 страницыRem Rev FTSam B. PinedaОценок пока нет

- Relationship Between Union and StatesДокумент9 страницRelationship Between Union and StatesSurya KumarОценок пока нет

- Rule 112: No grave abuse of discretionДокумент5 страницRule 112: No grave abuse of discretionJovi BigasОценок пока нет

- 1935 CONSTITUTION - Dacumos and ValdezДокумент20 страниц1935 CONSTITUTION - Dacumos and ValdezBJ AmbatОценок пока нет

- Meehan v. Indiana State of Et Al - Document No. 5Документ3 страницыMeehan v. Indiana State of Et Al - Document No. 5Justia.comОценок пока нет

- G. R. No. 149617Документ5 страницG. R. No. 149617Kelly ThompsonОценок пока нет

- MOTION TO Visit-GanoДокумент2 страницыMOTION TO Visit-GanoPj TignimanОценок пока нет

- Jeffrey Denner ADDENDUMДокумент4 страницыJeffrey Denner ADDENDUMJeffrey DennerОценок пока нет

- Macbeth On Trial Group Writing AssignmentsДокумент2 страницыMacbeth On Trial Group Writing AssignmentsLee Ann SpillaneОценок пока нет

- 6 HDO Issued by Judge Madronio, MTC Manaoag, PangasinanДокумент1 страница6 HDO Issued by Judge Madronio, MTC Manaoag, PangasinanJoshua AbadОценок пока нет

- Subdivision Developers and SellersДокумент456 страницSubdivision Developers and SellersJoy BuarОценок пока нет

- Agcaoili Vs Farinas - JTijam - Ilocos6 - Legislative Inquiry - Limited To Aid Legislation in Accordance To Published Rules of Procedure and Protection of Rights of Those QuestionedДокумент32 страницыAgcaoili Vs Farinas - JTijam - Ilocos6 - Legislative Inquiry - Limited To Aid Legislation in Accordance To Published Rules of Procedure and Protection of Rights of Those Questionedsandra mae bonrustroОценок пока нет

- TwinTowers Condominium Corporation vs. Court of AppealsДокумент14 страницTwinTowers Condominium Corporation vs. Court of AppealsJoshua CuentoОценок пока нет

- Cengage Advantage Books Business Law The First Course Summarized Case Edition 1st Edition by Miller ISBN Test BankДокумент13 страницCengage Advantage Books Business Law The First Course Summarized Case Edition 1st Edition by Miller ISBN Test Bankvincenza100% (18)

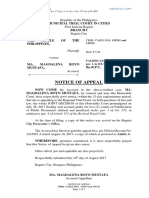

- GRP 1 NOTICE OF APPEAL MustafaДокумент2 страницыGRP 1 NOTICE OF APPEAL MustafaIan ConcepcionОценок пока нет

- An overview of France's administrative justice systemДокумент6 страницAn overview of France's administrative justice systemIqraОценок пока нет

- Public Corruption by Clerk of Courts and Prothonotary Re Case No. Cp-36-Sa-0000219-2016 Summary Appeal and Case No. CI-16-08472 October 17, 2016Документ85 страницPublic Corruption by Clerk of Courts and Prothonotary Re Case No. Cp-36-Sa-0000219-2016 Summary Appeal and Case No. CI-16-08472 October 17, 2016Stan J. CaterboneОценок пока нет

- Civil Service Commission v. Andal, G.R. No. 185749, December 16, 2009Документ9 страницCivil Service Commission v. Andal, G.R. No. 185749, December 16, 2009Ryuzaki HidekiОценок пока нет

- SC Judgement On Speedy Disposal of Cheque Bounce CasesДокумент21 страницаSC Judgement On Speedy Disposal of Cheque Bounce CasesLatest Laws Team100% (5)

- Supreme Court Ruling on Anti-Graft Case Against Former Leyte GovernorДокумент14 страницSupreme Court Ruling on Anti-Graft Case Against Former Leyte GovernorDelia PeabodyОценок пока нет

- Anguilla June 2020 - Updated PDFДокумент2 страницыAnguilla June 2020 - Updated PDF10711458Оценок пока нет

- Nilo H Raymundo Vs Court of Appeals and Galleria de MagallanesДокумент2 страницыNilo H Raymundo Vs Court of Appeals and Galleria de MagallanesJoshua EmmanuelОценок пока нет

- Petition For BailДокумент2 страницыPetition For BailJoAizaDОценок пока нет

- Rule 115: Rights of The AccusedДокумент2 страницыRule 115: Rights of The AccusedWitch BRIONNEОценок пока нет

- Criminal Procedure Case Digests 14jan201Документ39 страницCriminal Procedure Case Digests 14jan201vann126Оценок пока нет

- February 2009 Physician Licensure Examination Room AssignmentsДокумент114 страницFebruary 2009 Physician Licensure Examination Room Assignmentsderic100% (3)

- USA V Loehrke - DGA-MJ Case Docket ReportДокумент2 страницыUSA V Loehrke - DGA-MJ Case Docket ReportFile 411Оценок пока нет

- INTERNSHIP REPORT (1) - Organized PDFДокумент51 страницаINTERNSHIP REPORT (1) - Organized PDFAkshita yadavОценок пока нет

- Finals Mock ExamДокумент6 страницFinals Mock ExamGerald MesinaОценок пока нет

![SEBI[1]](https://imgv2-2-f.scribdassets.com/img/document/721752910/149x198/dae9c77a5b/1712749762?v=1)