Академический Документы

Профессиональный Документы

Культура Документы

Bir Ruling No. 322-87

Загружено:

matinikkiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bir Ruling No. 322-87

Загружено:

matinikkiАвторское право:

Доступные форматы

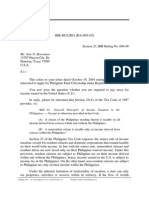

October 19, 1987 BIR RULING NO.

322-87 21 (a) 34 (b) 119-84 322-87 Gentlemen : This refers to your letter dated July 23, 1987 stating that your company is a trading concern and at present it is in the process of liquidation; and that your individual stockholders will receive their liquidating dividends in excess of their investment.

In reply, I have the honor to inform you that since the individual stockholders of your company will receive upon its complete liquidation all its assets as liquidating dividends, they will thereby realize capital gain or loss. The gain, if any, derived by the individual stockholders consisting of the difference between the fair market value of the liquidating dividends and the adjusted cost to the stockholders of their respective shareholdings in the said corporation (Sec. 83 (a), Sec. 256, Income Tax Regulations) shall be subject to income tax at the rates prescribed under Section 21(a) of the Tax Code, as amended by Executive Order No. 37. cda Moreover, pursuant to Section 34(b) of the Tax Code, as amended by Executive Order No. 37, only 50% of the aforementioned capital gain is reportable for income tax purposes if the shares were held by the individual stockholders for more than twelve months and 100% of the capital gains if the shares were held for less than twelve months. Very truly yours, (SGD.) BIENVENIDO A. TAN, JR. Commissioner

C o p y r i g h t 2 0 0 8 C D T e c h n o l o g i e s A s i a, I n c.

Вам также может понравиться

- Bir Ruling Da 095 05Документ2 страницыBir Ruling Da 095 05RB BalanayОценок пока нет

- 3M PhilippinesДокумент2 страницы3M PhilippinesKarl Vincent Raso100% (1)

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFДокумент2 страницы2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoОценок пока нет

- Pansacola v. CIRДокумент3 страницыPansacola v. CIRSean GalvezОценок пока нет

- Bir Ruling No. 144-85Документ1 страницаBir Ruling No. 144-85matinikkiОценок пока нет

- Philamlife V Cta Case DigestДокумент2 страницыPhilamlife V Cta Case DigestAnonymous BvmMuBSwОценок пока нет

- BIR Ruling No. 206-90Документ2 страницыBIR Ruling No. 206-90Raiya Angela100% (2)

- II. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Документ37 страницII. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Polo MartinezОценок пока нет

- BIR Ruling (DA-287-07) May 8, 2007Документ3 страницыBIR Ruling (DA-287-07) May 8, 2007Raiya AngelaОценок пока нет

- Bir 123-13Документ1 страницаBir 123-13Lizzette Dela PenaОценок пока нет

- ITAD Ruling 102-2002 May 28, 2002Документ5 страницITAD Ruling 102-2002 May 28, 2002Aine Mamle TeeОценок пока нет

- c.11. Filipinas Synthetic Fiber Corp v. CAДокумент1 страницаc.11. Filipinas Synthetic Fiber Corp v. CAArbie LlesisОценок пока нет

- ITAD Ruling No 018-09Документ11 страницITAD Ruling No 018-09Peggy SalazarОценок пока нет

- Tax Digest Mobil Philippines Vs City Treasurer of MakatiДокумент2 страницыTax Digest Mobil Philippines Vs City Treasurer of MakatiCJОценок пока нет

- Roxas Vs RaffertyДокумент3 страницыRoxas Vs RaffertyChelle BelenzoОценок пока нет

- Sony v. CIRДокумент2 страницыSony v. CIRMaya Julieta Catacutan-EstabilloОценок пока нет

- City of Baguio v. Fortunato de Leon GR L-24756Документ1 страницаCity of Baguio v. Fortunato de Leon GR L-24756Charles Roger RayaОценок пока нет

- CIR vs. Lednicky (1964)Документ1 страницаCIR vs. Lednicky (1964)Emil BautistaОценок пока нет

- BIR Ruling No 274-87Документ3 страницыBIR Ruling No 274-87Peggy SalazarОценок пока нет

- BIR Ruling 274-1987 September 9, 1987Документ4 страницыBIR Ruling 274-1987 September 9, 1987Raiya Angela100% (1)

- 9 - Commissioner vs. PalancaДокумент1 страница9 - Commissioner vs. Palancacmv mendozaОценок пока нет

- Kuenzle v. CIRДокумент2 страницыKuenzle v. CIRTippy Dos Santos100% (2)

- BIR Ruling No. 006-00Документ2 страницыBIR Ruling No. 006-00glg-phОценок пока нет

- RR 8-00Документ3 страницыRR 8-00matinikkiОценок пока нет

- BIR Ruling No. 522-2017Документ7 страницBIR Ruling No. 522-2017liz kawiОценок пока нет

- Javier v. AnchetaДокумент1 страницаJavier v. AnchetaGSSОценок пока нет

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Документ1 страницаCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoОценок пока нет

- ALEXANDER HOWDEN & CO., LTD Vs CIRДокумент2 страницыALEXANDER HOWDEN & CO., LTD Vs CIRMariz GalangОценок пока нет

- Aguinaldo Vs CIR #Tax-1Документ2 страницыAguinaldo Vs CIR #Tax-1Earl TagraОценок пока нет

- CIR v. Vda de PrietoДокумент3 страницыCIR v. Vda de Prietoevelyn b t.Оценок пока нет

- RR 1-79Документ9 страницRR 1-79matinikkiОценок пока нет

- Consolidated Mines V CIR DigestДокумент2 страницыConsolidated Mines V CIR Digestcookbooks&lawbooksОценок пока нет

- Lopez vs. City of ManilaДокумент2 страницыLopez vs. City of ManilaDeniel Salvador B. MorilloОценок пока нет

- 1 - Conwi vs. CTA DigestДокумент2 страницы1 - Conwi vs. CTA Digestcmv mendozaОценок пока нет

- Commissioner of Internal Revenue v. Manila Jockey Club, 108 Phil 281Документ2 страницыCommissioner of Internal Revenue v. Manila Jockey Club, 108 Phil 281Charles Roger Raya100% (1)

- CIR Vs Glenshaw Glass CoДокумент2 страницыCIR Vs Glenshaw Glass CoMCОценок пока нет

- Afisco Insurance Corporation Vs Court of AppealsДокумент2 страницыAfisco Insurance Corporation Vs Court of AppealsLorelieОценок пока нет

- Revenue Regulations No. 01-79: Regulations Governing The Taxation of Non-Resident CitizensДокумент3 страницыRevenue Regulations No. 01-79: Regulations Governing The Taxation of Non-Resident Citizenssaintkarri100% (1)

- CIR vs. Procter and Gamble - BrinezДокумент2 страницыCIR vs. Procter and Gamble - BrinezMichelleОценок пока нет

- Bantillo - CIR Vs PNBДокумент3 страницыBantillo - CIR Vs PNBAto TejaОценок пока нет

- BPI vs. CIRДокумент5 страницBPI vs. CIRmatinikki100% (1)

- Collector Vs Batangas Transportation Co.Документ2 страницыCollector Vs Batangas Transportation Co.Lisa GarciaОценок пока нет

- Atlas Vs CIRДокумент2 страницыAtlas Vs CIRRoyalhighness18Оценок пока нет

- NPC V Provincial Treasurer of Benguet GR No 209303Документ3 страницыNPC V Provincial Treasurer of Benguet GR No 209303Trem GallenteОценок пока нет

- Commissioner Vs CastanedaДокумент6 страницCommissioner Vs CastanedaLizzette Dela PenaОценок пока нет

- CIR V CTA Smith Kilne & Fresh OverseasДокумент2 страницыCIR V CTA Smith Kilne & Fresh OverseasGRОценок пока нет

- Phil Refining Co Vs CA - Fernandez Hermanos Inc Vs CIRДокумент2 страницыPhil Refining Co Vs CA - Fernandez Hermanos Inc Vs CIRPatrick RamosОценок пока нет

- Citibank Vs CabamonganДокумент2 страницыCitibank Vs Cabamongancmv mendozaОценок пока нет

- 13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestДокумент1 страница13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestHarleneОценок пока нет

- Philamlife v. Cir SP No. 31283Документ2 страницыPhilamlife v. Cir SP No. 31283Emmanuel YrreverreОценок пока нет

- Case 59 CS Garments Vs CirДокумент3 страницыCase 59 CS Garments Vs CirJulian Guevarra0% (1)

- IBC Vs Amarilla Tax Case DigestДокумент3 страницыIBC Vs Amarilla Tax Case DigestCJОценок пока нет

- Marcelo Steel Corporation vs. Collector of Internal RevenueДокумент2 страницыMarcelo Steel Corporation vs. Collector of Internal RevenuesakuraОценок пока нет

- Spouses Tan Vs BanteguiДокумент2 страницыSpouses Tan Vs BanteguiPaul EsparagozaОценок пока нет

- 5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wДокумент2 страницы5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wCarlo AlfonsoОценок пока нет

- BIR Ruling 322Документ1 страницаBIR Ruling 322RavenFoxОценок пока нет

- Republic Act No. 9504Документ4 страницыRepublic Act No. 9504Xyril Ü LlanesОценок пока нет

- Chamber of Real Estate and Builders' Associations, Inc. v. The Hon. Executive SecretaryДокумент14 страницChamber of Real Estate and Builders' Associations, Inc. v. The Hon. Executive SecretaryJohn Basil ManuelОценок пока нет

- 10.mat and AmtДокумент17 страниц10.mat and AmtShailendra SainwalОценок пока нет

- Mat and Amt: Objective of Levying MATДокумент16 страницMat and Amt: Objective of Levying MATaОценок пока нет

- RR 16-99Документ6 страницRR 16-99matinikkiОценок пока нет

- RR 30-03Документ8 страницRR 30-03matinikkiОценок пока нет

- RR 19-86Документ29 страницRR 19-86matinikkiОценок пока нет

- RR 16-86Документ2 страницыRR 16-86matinikki100% (1)

- RR 16-05Документ32 страницыRR 16-05matinikki100% (1)

- RR 10-08Документ30 страницRR 10-08matinikki100% (1)

- RR 16-08Документ5 страницRR 16-08matinikkiОценок пока нет

- RR 13-98Документ13 страницRR 13-98matinikkiОценок пока нет

- RR 14-02Документ9 страницRR 14-02matinikkiОценок пока нет

- RR 20-01Документ5 страницRR 20-01matinikkiОценок пока нет

- RR 15-02Документ5 страницRR 15-02matinikkiОценок пока нет

- RR 14-01Документ9 страницRR 14-01matinikkiОценок пока нет

- RR 9-99Документ2 страницыRR 9-99matinikkiОценок пока нет

- RR 6-08Документ19 страницRR 6-08matinikkiОценок пока нет

- RR 13-99Документ10 страницRR 13-99matinikkiОценок пока нет

- RR 12-01Документ6 страницRR 12-01matinikkiОценок пока нет

- RR 10-76Документ4 страницыRR 10-76matinikkiОценок пока нет

- RR 12-98Документ3 страницыRR 12-98matinikki100% (1)

- RR 2-98Документ41 страницаRR 2-98matinikki100% (2)

- RR 10-98Документ2 страницыRR 10-98matinikkiОценок пока нет

- RR 10-02Документ5 страницRR 10-02matinikkiОценок пока нет

- RR 9-98Документ5 страницRR 9-98matinikkiОценок пока нет

- RR 8-00Документ3 страницыRR 8-00matinikkiОценок пока нет

- RR 1-99Документ7 страницRR 1-99matinikkiОценок пока нет

- RR 10-00Документ3 страницыRR 10-00matinikkiОценок пока нет

- RR 3-98Документ6 страницRR 3-98matinikkiОценок пока нет

- RR 8-98Документ3 страницыRR 8-98matinikkiОценок пока нет

- RR 5-76Документ8 страницRR 5-76matinikkiОценок пока нет

- RR 6-01Документ15 страницRR 6-01matinikkiОценок пока нет

- RR 1-95Документ9 страницRR 1-95matinikki0% (1)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooОт EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooРейтинг: 5 из 5 звезд5/5 (2)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersОт EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersОценок пока нет

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorОт EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorРейтинг: 4.5 из 5 звезд4.5/5 (132)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsОт EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsОценок пока нет

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorОт EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorРейтинг: 4.5 из 5 звезд4.5/5 (63)

- Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global EliteОт EverandSecrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global EliteРейтинг: 4.5 из 5 звезд4.5/5 (6)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessОт EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessРейтинг: 5 из 5 звезд5/5 (1)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsОт EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsРейтинг: 5 из 5 звезд5/5 (24)

- Indian Polity with Indian Constitution & Parliamentary AffairsОт EverandIndian Polity with Indian Constitution & Parliamentary AffairsОценок пока нет

- Contract Law in America: A Social and Economic Case StudyОт EverandContract Law in America: A Social and Economic Case StudyОценок пока нет

- International Business Law: Cases and MaterialsОт EverandInternational Business Law: Cases and MaterialsРейтинг: 5 из 5 звезд5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseОт EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseОценок пока нет

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementОт EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementРейтинг: 4.5 из 5 звезд4.5/5 (20)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistОт EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistРейтинг: 4 из 5 звезд4/5 (34)

- The Curse of Bigness: Antitrust in the New Gilded AgeОт EverandThe Curse of Bigness: Antitrust in the New Gilded AgeРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Side Hustles for Dummies: The Key to Unlocking Extra Income and Entrepreneurial Success through Side HustlesОт EverandSide Hustles for Dummies: The Key to Unlocking Extra Income and Entrepreneurial Success through Side HustlesОценок пока нет

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersОт EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersОценок пока нет