Академический Документы

Профессиональный Документы

Культура Документы

Summer Training Reporton Dabur India Ltd. (Working Capital Analysis of Major FMCG Companies) For Bba and Mba Students

Загружено:

sandeep sheoranОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Summer Training Reporton Dabur India Ltd. (Working Capital Analysis of Major FMCG Companies) For Bba and Mba Students

Загружено:

sandeep sheoranАвторское право:

Доступные форматы

P a g e | 28

SUMMER TRAINING REPORT ON DABUR INDIA LTD. (WORKING CAPITAL ANALYSIS OF MAJOR FMCG COMPANIES)

Submitted to MAHARSHI DAYANAND UNIVERSITY, ROHTAK IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF THE DEGREE OF BACHELOR OF BUSINESS ADMINISTRATION (INDUSTRY INTEGRATED) (II SEMESTER) SUBMITTED BY NAME : SANDEEP SHEORAN REGN. NO. : ROLL NO. :

JAGANNATH INSTITUTE OF MANAGEMENT SCIENCES (34,RING ROAD,LAJPAT NAGAR IV,NEW DELHI-24)

P a g e | 28

CERTIFICATE

This is to certify that SANDEEP SHEORAN, a student of the Maharshi Dayanand University, Rohtak, has prepared his training report entitled WORKING CAPITAL ANALYSIS OF MAJOR FMCG COMPANIES at Jagannath institute of management sciences, under my guidance. He has fulfilled all requirements leading to award of the degree of BBA(Industry integrated). This report is the record of bonafide training undertaken by him and no part of it has been submitted to any other University or Educational Institution for award of any other degree/diploma/fellowship or similar titles or prizes.

I wish him all success in life.

P a g e | 28

STUDENTS DECLARATION

I hereby declare that the Training Report conducted at DABUR INDIA LTD, SHAHIBABAD Under the guidance of ( MR R.S DANI )

Submitted in Partial fulfillment of the requirements for the Degree of BACHELOR OF BUSINESS ADMINISTRATION (Industry Integrated) To MAHARSHI DAYANAND UNIVERSITY, ROHTAK

is my original work and the same has not been submitted for the award of any other Degree/diploma/fellowship or other similar titles or prizes.

SANDEEP SHEORAN REGN. NO. : PLACE: DATE: ROLL NO. :

P a g e | 28

ACKNOWLEDGEMENT

I am grateful to Mr. R.S Dani, Dabur India Ltd. For being a constant source of guidance during my training period. His support helped me to accomplish the project.

I am very confident that this project will help me in my future.

Sandeep Sheoran BBA- B JIMS, Lajpat nagar

P a g e | 28

CONTENTS

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. About company Dabur at a glance History of the dabur Dabur group Board of directors Objectives of study Methodology Findings Calculation of Net Working Capital Conclusion Table of net working capital Bibliography Page 1 Page 2 Page 4 Page 8 Page 9 Page 11 Page 12 Page 16 Page 31 Page 41 Page 46 Page 47

P a g e | 28

ABOUT COMPANY

"What is that life worth which cannot bring comfort to others"

The doorstep 'Daktar' The story of Dabur began with a small, but visionary endeavour by Dr. S. K. Burman, a physician tucked away in Bengal. His mission was to provide effective and affordable cure for ordinary people in farflung villages. With missionary zeal and fervour, Dr. Burman undertook the task of preparing natural cures for the killer diseases of those days, like cholera, malaria and plague.

Soon the news of his medicines traveled, and he came to be known as the trusted 'Daktar' or Doctor who came up with effective cures. And that is how his venture Dabur got its name - derived from the Devanagri rendition of Daktar Burman.

Dr. Burman set up Dabur in 1884 to produce and dispense Ayurvedic medicines. Reaching out to a wide mass of people who had no access to proper treatment. Dr. S. K. Burman's commitment and ceaseless efforts resulted in the company growing from a fledgling medicine manufacturer in a small Calcutta house, to a household name that at once evokes trust and reliability.

P a g e | 28

Dabur At-a-Glance

Dabur India Limited has marked its presence with significant achievements and today commands a market leadership status. Our story of success is based on dedication to nature, corporate and process hygiene, dynamic leadership and commitment to our partners and stakeholders. The results of our policies and initiatives speak for themselves.

Leading consumer goods company in India with a turnover of Rs. 2874.60 Crore (FY10) 3 major strategic business units (SBU) - Consumer Care Division (CCD), Consumer Health Division (CHD) and International Business Division (IBD) 3 Subsidiary Group companies - Dabur International, Fem Care Pharma and newu and 8 step down subsidiaries: Dabur Nepal Pvt Ltd (Nepal), Dabur Egypt Ltd (Egypt), Asian Consumer Care (Bangladesh), Asian Consumer Care (Pakistan), African Consumer Care (Nigeria), Naturelle LLC (Ras Al KhaimahUAE), Weikfield International (UAE) and Jaquline Inc. (USA). 17 ultra-modern manufacturing units spread around the globe Products marketed in over 60 countries Wide and deep market penetration with 50 C&F agents, more than 5000 distributors and over2.8 million retail outlets all over India

Consumer Care Division (CCD) adresses consumer needs across the entire FMCG spectrum through four distinct business portfolios of Personal Care, Health Care, Home Care & Foods

Master brands: Dabur - Ayurvedic healthcare products Vatika - Premium hair care Hajmola - Tasty digestives Ral - Fruit juices & beverages Fem - Fairness bleaches & skin care products 9 Billion-Rupee brands: Dabur Amla, Dabur Chyawanprash,Vatika, Ral, Dabur Red Toothpaste, Dabur Lal Dant Manjan,Babool, Hajmola and Dabur Honey Strategic positioning of Honey as food product, leading to market leadership (over 75%) in branded honey market Dabur Chyawanprash the largest selling Ayurvedic medicine with over 65% market share. Vatika Shampoo has been the fastest selling shampoo brand in India for three years in a row Hajmola tablets in command with 60% market share of digestive tablets category. About 2.5 crore Hajmola tablets are consumed in India every day Leader in herbal digestives with 90% market share

P a g e | 28

Consumer Health Division (CHD) offers a range of classical Ayurvedic medicines and Ayurvedic OTC products that deliver the age-old benefits of Ayurveda in modern ready-touse formats

Has more than 300 products sold through prescriptions as well as over the counter Major categories in traditional formulations include: - Asav Arishtas - Ras Rasayanas - Churnas - Medicated Oils Proprietary Ayurvedic medicines developed by Dabur include: - Nature Care Isabgol - Madhuvaani - Trifgol Division also works for promotion of Ayurveda through organised community of traditional practitioners and developing fresh batches of students

International Business Division (IBD) caters to the health and personal care needs of customers across different international markets, spanning the Middle East, North & West Africa, EU and the US with its brands Dabur & Vatika

Growing at a CAGR of 33% in the last 6 years and contributes to about 20% of total sales Leveraging the 'Natural' preference among local consumers to increase share in perosnal care categories Focus markets: - GCC - Egypt - Nigeria - Bangladesh - Nepal - US High level of localization of manufacturing and sales & marketing

P a g e | 28

HISTORY

1884 - Established by Dr. S K Burman at Kolkata 1896 - First production unit established at Garhia 1919 - First R&D unit established Early 1900s - Production of Ayurvedic medicines Dabur identifies nature-based Ayurvedic medicines as its area of specialisation. It is the first Company to provide health care through scientifically tested and automated production of formulations based on our traditional science. 1930 - Automation and upgradation of Ayurvedic products manufacturing initiated 1936 - Dabur (Dr. S K Burman) Pvt. Ltd. Incorporated 1940 - Personal care through Ayurveda Dabur introduces Indian consumers to personal care through Ayurveda, with the launch of Dabur Amla Hair Oil. So popular is the product that it becomes the largest selling hair oil brand in India. 1949 - Launched Dabur Chyawanprash in tin pack Widening the popularity and usage of traditional Ayurvedic products continues. The ancient restorative Chyawanprash is launched in packaged form, and becomes the first branded Chyawanprash in India. 1957 - Computerisation of operations initiated 1970 - Entered Oral Care & Digestives segment Addressing rural markets where homemade oral care is more popular than multinational brands, Dabur introduces Lal Dant Manjan. With this a conveniently packaged herbal toothpowder is made available at affordable costs to the masses. 1972 - Shifts base to Delhi from Calcutta 1978 - Launches Hajmola tablet Dabur continues to make innovative products based on traditional formulations that can provide holistic care in our daily life. An Ayurvedic medicine used as a digestive aid is branded and launched as the popular Hajmola tablet. 1979 - Dabur Research Foundation set up 1979 - Commercial production starts at Sahibabad, the most modern herbal medicines plant at that time

P a g e | 28

1984 - Dabur completes 100 years 1988 - Launches pharmaceutical medicines 1989 - Care with fun The Ayurvedic digestive formulation is converted into a children's fun product with the launch of Hajmola Candy. In an innovative move, a curative product is converted to a confectionary item for wider usage. 1994 - Comes out with first public issue 1994 - Enters oncology segment 1994 - Leadership in health care Dabur establishes its leadership in health care as one of only two companies worldwide to launch theanti-cancer drug Intaxel (Paclitaxel). Dabur Research Foundation develops an eco-friendly process to extract the drug from its plant source 1996 - Enters foods business with the launch of Real Fruit Juice 1996 - Real blitzkrieg Dabur captures the imagination of young Indian consumers with the launch of Real Fruit Juices - a new concept in the Indian foods market. The first local brand of 100% pure natural fruit juices made to international standards, Real becomes the fastest growing and largest selling brand in the country. 1998 - Burman family hands over management of the company to professionals 2000 - The 1,000 crore mark Dabur establishes its market leadership status by staging a turnover of Rs.1,000 crores. Across a span of over a 100 years, Dabur has grown from a small beginning based on traditional health care. To a commanding position amongst an august league of large corporate businesses. 2001 - Super specialty drugs With the setting up of Dabur Oncology's sterile cytotoxic facility, the Company gains entry into the highly specialised area of cancer therapy. The state-of-the-art plant and laboratory in the UK have approval from the MCA of UK. They follow FDA guidelines for production of drugs specifically for European and American markets. 2002 - Dabur record sales of Rs 1163.19 crore on a net profit of Rs 64.4 crore

P a g e | 28

2003 - Dabur demerges Pharmaceuticals business Dabur India approved the demerger of its pharmaceuticals business from the FMCG business into a separate company as part of plans to provider greater focus to both the businesses. With this, Dabur India now largely comprises of the FMCG business that include personal care products, healthcare products and Ayurvedic Specialities, while the Pharmaceuticals business would include Allopathic, Oncology formulations and Bulk Drugs. Dabur Oncology Plc, a subsidiary of Dabur India, would also be part of the Pharmaceutical business. Maintaining global standards As a reflection of its constant efforts at achieving superior quality standards, Dabur became the first Ayurvedic products company to get ISO 9002 certification. Science for nature Reinforcing its commitment to nature and its conservation, Dabur Nepal, a subsidiary of Dabur India, has set up fully automated greenhouses in Nepal. This scientific landmark helps to produce saplings of rare medicinal plants that are under threat of extinction due to ecological degradation. 2005 - Dabur aquires Balsara As part of its inorganic growth strategy, Dabur India acquires Balsara's Hygiene and Home products businesses, a leading provider of Oral Care and Household Care products in the Indian market, in a Rs 143-crore all-cash deal. 2005 - Dabur announces bonus after 12 years Dabur India announced issue of 1:1 Bonus share to the shareholders of the company, i.e. one share for every one share held. The Board also proposed an increase in the authorized share capital of the company from existing Rs 50 crore to Rs 125 crore. 2006 - Dabur crosses $2 bln market cap, adopts US GAAP. Dabur India crosses the $2-billion mark in market capitalisation. The company also adopted US GAAP in line with its commitment to follow global best practices and adopt highest standards of transparency and governance. 2006 - Approves FCCB/GDR/ADR up to $200 million Moving forward on the inorganic growth path, Dabur India decides to

P a g e | 28

raise up to $200 million from the international market through Bonds, FCCBs, GDR, ADR, QIPs or any other securities.The capital raised will be used to fund Dabur's aggressive growth ambitions and acquisition plans in India and abroad. 2007 - Celebrating 10 years of Real Dabur Foods unveiled the new packaging and design for Real at the completion of 10 years of the brand. The new refined modern look depicts the natural goodness of the juice from freshly plucked fruits. 2007 - Foray into organised retail Dabur India announced its foray into the organised retail business through a wholly-owned subsidiary, H&B Stores Ltd. Dabur will invest Rs 140 crores by 2010 to establish its presence in the retail market in India with a chain of stores on the Health & Beauty format. 2007 - Dabur Foods merged with Dabur India Dabur India decides to merge its wholly-owned subsidiary Dabur Foods Limited with itself to extract synergies and unlock operational efficiencies. The integration will also help Dabur sharpen focus on the high growth business of foods and beverages, and enter newer product categories in this space. 2008 - Acquires Fem Care Pharma Dabur India acquires Fem Care Pharma, a leading player in the women's skin care market. Besides an entry into the high-growth skin care market with an established brand name FEM, this transaction also offers Dabur a strong platform to enter newer product categories and markets. 2009 - Dabur Red Toothpaste joins 'Billion Rupee Brands' club Dabur Red Toothpaste becomes the Dabur's ninth Billion Rupee brand. Dabur Red Toothpaste crosses the billion rupee turnover mark within five years of its launch.

P a g e | 28

Dabur Group

With a basket including personal care, health care and food products, Dabur India Limited has set up subsidiary Group Companies across the world that can manage its businesses more efficiently. Given the vast range of products, sourcing, production and marketing have been divested to the group companies that conduct their operations

independently:

P a g e | 28

Board of Directors

Dabur has an illustrious Board of Directors who are committed to take the company to newer levels of corporate governance. The Board comprises of:

Chairman Dr Anand Burman

Vice Chairman Mr Amit Burman

Whole Time Directors

Mr. P.D. Narang

Mr. Sunil Duggal

Mr. Pradip Burman

Non Whole Time Promoters, Directors

Mr. Mohit Burman

P a g e | 28

Independent Directors

Mr. Bert Paterson

Mr. P. N. Vijay

Mr. R C Bhargava

Dr. S. Narayan

Mr. Analjit Singh

Dr. Ajay Dua

P a g e | 28

Objectives of Study

To analyze the financial position of DABUR. To analyze the liquidity position of DABUR.

P a g e | 28

Methodology

Working capital analysis of major FMCG companies Working capital

Working capital (abbreviated WC) is a financial metric which represents operating liquidity available to a business, organization, or other entity, including governmental entity. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. Net working capital is calculated as current assets minus current liabilities. It is a derivation of working capital that is commonly used in valuation techniques such as DCFs (Discounted cash flows). If current assets are less than current liabilities, an entity has a working capital deficiency, also called aworking capital deficit.

Net Working Capital = Current Assets Current Liabilities Net Operating Working Capital = Current Assets Non Interest-bearing Current Liabilities Equity Working Capital = Current Assets Current Liabilities Long-term Debt

A company can be endowed with assets and profitabilitybut short of liquidity if its assets cannot readily be converted into cash. Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts receivable and payable, and cash.

Current Assets

In accounting, a current asset is an asset on the balance sheet which can either be converted to cash or used to pay current liabilities within 12 months. Typical current assets include cash, cash equivalents, short-term investments, accounts receivable, inventory and the portion of prepaid liabilities which will be paid within a year.

P a g e | 28

On a balance sheet, assets will typically be classified into current assets and long-term assets. The current ratio is calculated by dividing total current assets by total current liabilities. It is frequently used as an indicator of a company's liquidity, its ability to meet short-term obligations.

Current liabilities

In accounting, current liabilities are often understood as all liabilities of the business that are to be settled in cash within the fiscal year or the operating cycle of a given firm, whichever period is longer. A more complete definition is that current liabilities are obligations that will be settled by current assets or by the creation of new current liabilities. An operating cycle for a firm is the average time that is required to go from cash to cash in producing revenues. For example, accounts payable for goods, services or supplies that were purchased for use in the operation of the business and payable within a normal period of time would be current liabilities. Bonds, mortgages and loans that are payable over a term exceeding one year would be fixed liabilities or long-term liabilities. However, the payments due on the long-term loans in the current fiscal year could be considered current liabilities if the amounts were material. The proper classification of liabilities provides useful information to investors and other users of the financial statements. It may be regarded as essential for allowing outsiders to consider a true picture of an organization's fiscal health. One application is in the current ratio, defined as the firm's current assets divided by its current liabilities. A ratio higher than one means that current assets, if they can all be converted to cash, are more than sufficient to pay off current obligations. All other things equal, higher values of this ratio imply that a firm is more easily able to meet its obligations in the coming year.

Calculation

Current assets and current liabilities include three accounts which are of special importance. These accounts represent the areas of the business where managers have the most direct impact:

accounts receivable (current asset) inventory (current assets), and

P a g e | 28

accounts payable (current liability)

The current portion of debt (payable within 12 months) is critical, because it represents a short-term claim to current assets and is often secured by long term assets. Common types of short-term debt are bank loans and lines of credit. An increase in working capital indicates that the business has either increased current assets (that is has increased its receivables, or other current assets) or has decreased current liabilities, for example has paid off some short-term creditors. Implications on M&A: The common commercial definition of working capital for the purpose of a working capital adjustment in an M&A transaction (i.e. for a working capital adjustment mechanism in a sale and purchase agreement) is equal to: Current Assets Current Liabilities excluding deferred tax assets/liabilities, excess cash, surplus assets and/or deposit balances. Cash balance items often attract a one-for-one purchase price adjustment.

Working capital management

Decisions relating to working capital and short term financing are referred to as working capital management. These involve managing the relationship between a firm's short-term assets and its short-term liabilities. The goal of working capital management is to ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upcoming operational expenses.

Decision criteria

By definition, working capital management entails short term decisions - generally, relating to the next one year period - which are "reversible". These decisions are therefore not taken on the same basis as Capital Investment Decisions (NPV or related, as above) rather they will be based on cash flows and / or profitability.

One measure of cash flow is provided by the cash conversion cycle - the net number of days from the outlay of cash for raw material to receiving payment from the customer. As a management tool, this metric makes explicit the inter-relatedness of decisions relating to inventories, accounts receivable and payable, and cash. Because this number effectively corresponds to the time that the firm's cash is tied up in operations and unavailable for other activities, management generally aims at a low net count.

P a g e | 28

In this context, the most useful measure of profitability is Return on capital (ROC). The result is shown as a percentage, determined by dividing relevant income for the 12 months bycapital employed; Return on equity (ROE) shows this result for the firm's shareholders. Firm value is enhanced when, and if, the return on capital, which results from working capital management, exceeds the cost of capital, which results from capital investment decisions as above. ROC measures are therefore useful as a management tool, in that they link short-term policy with long-term decision making. See Economic value added (EVA).

Credit policy of the firm: Another factor affecting working capital management is credit policy of the firm. It includes buying of raw material and selling of finished goods either in cash or on credit. This affects the cash conversion cycle.

Management of working capital

Guided by the above criteria, management will use a combination of policies and techniques for the management of working capital. These policies aim at managing the current assets (generally cashand cash equivalents, inventories and debtors) and the short term financing, such that cash flows and returns are acceptable.

Cash management. Identify the cash balance which allows for the business to meet day to day expenses, but reduces cash holding costs. Inventory management. Identify the level of inventory which allows for uninterrupted production but reduces the investment in raw materials - and minimizes reordering costs - and hence increases cash flow. Besides this, the lead times in production should be lowered to reduce Work in Progress (WIP) and similarly, the Finished Goods should be kept on as low level as possible to avoid over production - see Supply chain management; Just In Time (JIT); Economic order quantity(EOQ); Economic quantity Debtors management. Identify the appropriate credit policy, i.e. credit terms which will attract customers, such that any impact on cash flows and the cash conversion cycle will be offset by increased revenue and hence Return on Capital (or vice versa); see Discounts and allowances. Short term financing. Identify the appropriate source of financing, given the cash conversion cycle: the inventory is ideally financed by credit granted by the supplier; however, it may be necessary to utilize a bank loan (or overdraft), or to "convert debtors to cash" through "factoring".

P a g e | 28

Findings

Fundamentals of Major FMCG Giants Dabur India Ltd.

Yearly Results of Dabur India Mar '06 ------------------- in Rs. Cr. ------------------Mar '07 Mar '08 Mar '09 Mar '10

Sales Turnover Other Income Total Income Total Expenses Operating Profit Extraordinary Income/Expenses Tax On Extraordinary Items Net Extra Ordinary Income/Expenses Gross Profit Interest PBDT Depreciation Depreciation On Revaluation Of Assets PBT Tax Net Profit Prior Years Income/Expenses Depreciation for Previous Years Written Back/ Provided Equity Dividend rate Earnings Per Share Book Value Equity Reserves Face Value

1,369.68 5.35 1,375.03 1,135.97 233.71 0.51 --239.06 5.66 233.91 19.05 -214.86 25.78 189.08 --175 3.30 -57.33 390.54 1.00

1,778.02 16.51 1,794.53 1,477.41 300.61 ---317.12 4.43 312.69 28.47 -284.22 32.14 252.08 --141 2.92 -86.29 316.90 1.00

2,083.40 27.91 2,111.31 1,706.16 377.24 ---405.15 8.55 396.60 31.42 -365.18 48.41 316.77 -0.86 -150 3.67 -86.40 441.92 1.00

2,417.91 21.32 2,439.23 1,973.47 444.44 ---465.76 13.34 452.42 27.42 -425.00 51.44 373.56 --175 4.32 -86.51 651.69 1.00

2,874.60 15.11 2,889.71 2,325.17 549.43 ---564.54 5.60 558.76 31.91 -526.85 93.70 433.15 -0.18 -200 4.98 -86.90 662.48 1.00

P a g e | 28

Profit and loss account (Dabur India Ltd.)

Mar ' 10 Income Operating income Expenses Material consumed Manufacturing expenses Personnel expenses Selling expenses Adminstrative expenses Expenses capitalised Cost of sales Operating profit Other recurring income Adjusted PBDIT Financial expenses Depreciation Other write offs Adjusted PBT Tax charges Adjusted PAT Non recurring items Other non cash adjustments Reported net profit Earnigs before appropriation Equity dividend Preference dividend Dividend tax Retained earnings 2,867.42 1,384.29 58.17 212.34 474.79 187.90 2,317.49 549.93 14.85 564.78 13.28 31.91 5.66 513.93 93.70 420.23 13.10 -0.19 433.14 862.08 173.60 29.50 658.98 Mar ' 09 2,408.33 1,232.85 54.22 167.32 358.75 153.67 1,966.81 441.52 10.72 452.24 14.47 27.42 3.94 406.41 51.44 354.97 18.58 -0.72 372.84 696.07 151.39 25.73 518.95 Mar ' 08 2,093.63 1,023.94 54.02 149.69 337.69 138.69 1,704.03 389.60 9.76 399.36 10.92 25.75 5.67 357.01 48.40 308.61 8.16 -0.86 315.92 545.07 129.60 22.03 393.44 Mar ' 07 1,745.14 778.27 39.24 118.66 403.42 100.90 1,440.48 304.66 3.14 307.80 4.43 21.98 6.49 274.90 32.15 242.76 9.32 -0.13 251.94 426.95 122.13 17.13 287.70 Mar ' 06 1,345.50 582.43 27.10 98.31 316.46 80.24 1,104.55 240.95 1.05 242.01 5.73 19.05 4.26 212.97 25.78 187.19 1.90 0.21 189.29 314.52 100.32 14.07 200.13

P a g e | 28

Balance sheet (Dabur India Ltd.)

Mar ' 10 Sources of funds Owner's fund Equity share capital Share application money Preference share capital Reserves & surplus Loan funds Secured loans Unsecured loans Total Uses of funds Fixed assets Gross block Less : revaluation reserve Less : accumulated depreciation Net block Capital work-in-progress Investments Net current assets Current assets, loans & advances Less : current liabilities & provisions Total net current assets Miscellaneous expenses not written Total Notes: Book value of unquoted investments Market value of quoted investments Contingent liabilities Number of equity shares outstanding (Lacs) Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

86.76 0.14 662.48 24.27 81.80 855.45

86.51 651.69 8.26 130.72 877.17

86.40 441.92 16.45 0.24 545.01

86.29 316.90 19.28 0.26 422.73

57.33 390.54 19.23 1.25 468.35

687.23 236.28 450.95 23.31 348.51 941.77 911.83 29.94 2.74 855.45 98.60 250.52 173.48 8675.86

518.77 210.45 308.32 51.71 232.05 973.42 696.97 276.45 8.64 877.17 319.12 118.48 174.15 8650.76

467.93 189.77 278.17 16.26 270.37 576.82 610.57 -33.75 13.95 545.01 67.99 205.19 171.24 8640.23

404.30 168.97 235.33 3.71 145.35 397.78 379.27 18.52 19.82 422.73 65.99 80.82 153.25 8628.84

328.23 142.46 185.77 13.07 275.08 285.68 324.12 -38.44 32.87 468.35 234.43 43.43 190.02 5733.03

P a g e | 28

ITC Ltd.

Yearly Results of ITC Mar '06 Sales Turnover Other Income Total Income Total Expenses Operating Profit Extraordinary Income/Expenses Tax On Extraordinary Items Net Extra Ordinary Income/Expenses Gross Profit Interest PBDT Depreciation Depreciation On Revaluation Of Assets PBT Tax Net Profit Prior Years Income/Expenses Depreciation for Previous Years Written Back/ Provided Equity Dividend Rate Earnings Per Share Book Value Equity Reserves Face Value 9,790.53 286.08 10,076.61 6,463.15 3,327.38 -45.02 --3,613.46 11.93 3,556.51 332.34 -3,224.17 988.82 2,235.35 --265 5.95 -375.52 8,626.77 1.00 ------------------- in Rs. Cr. ------------------Mar '07 12,369.30 336.49 12,705.79 8,412.89 3,956.41 ---4,292.90 3.28 4,289.62 362.92 -3,926.70 1,226.73 2,699.97 --310 7.18 -376.22 10,003.78 1.00 Mar '08 13,947.53 610.90 14,558.43 9,543.59 4,403.94 ---5,014.84 4.61 5,010.23 438.46 -4,571.77 1,451.67 3,120.10 --350 8.28 -376.86 11,624.69 1.00 Mar '09 15,582.73 340.31 15,923.04 10,529.57 5,053.16 ---5,393.47 18.32 5,375.15 549.41 -4,825.74 1,562.15 3,263.59 --370 8.65 -377.44 13,302.55 1.00 Mar '10 18,382.24 374.33 18,756.57 12,079.19 6,303.05 ---6,677.38 53.36 6,624.02 608.71 -6,015.31 1,954.31 4,061.00 --1000 10.64 -381.82 13,628.17 1.00

P a g e | 28

Profit and loss account (ITC Ltd.)

Mar ' 10 Income Operating income Expenses Material consumed Manufacturing expenses Personnel expenses Selling expenses Adminstrative expenses Expenses capitalised Cost of sales Operating profit Other recurring income Adjusted PBDIT Financial expenses Depreciation Other write offs Adjusted PBT Tax charges Adjusted PAT Non recurring items Other non cash adjustments Reported net profit Earnigs before appropriation Equity dividend Preference dividend Dividend tax Retained earnings 18,567.45 7,588.23 801.13 1,014.87 1,238.24 1,864.54 -71.88 12,435.13 6,132.32 496.27 6,628.59 90.28 608.71 5,929.60 1,965.43 3,964.17 48.78 48.65 4,061.60 4,919.74 3,818.18 634.15 467.41 Mar ' 09 14,985.81 6,234.66 797.00 903.37 1,067.83 1,133.48 -72.55 10,063.79 4,922.02 422.80 5,344.82 47.65 549.41 4,747.76 1,565.13 3,182.63 3.41 81.52 3,267.56 3,992.01 1,396.53 237.34 2,358.14 Mar ' 08 14,032.20 6,275.33 383.42 745.00 1,044.40 1,266.57 -112.75 9,601.97 4,430.23 479.82 4,910.05 24.61 438.46 4,446.98 1,480.97 2,966.01 36.68 117.41 3,120.10 3,767.63 1,319.01 224.17 2,224.45 Mar ' 07 12,313.83 5,484.52 318.32 630.15 803.29 1,116.23 -42.52 8,309.99 4,003.84 300.14 4,303.98 16.04 362.92 3,925.02 1,263.07 2,661.95 -23.92 61.94 2,699.97 3,262.03 1,166.29 198.21 1,897.53 Mar ' 06 9,798.33 4,130.04 295.25 541.40 627.00 853.39 -15.78 6,431.30 3,367.03 273.22 3,640.25 21.10 332.34 3,286.81 1,027.57 2,259.24 -70.02 46.13 2,235.35 2,846.76 995.12 139.58 1,712.06

P a g e | 28

Balance sheet (ITC Ltd.)

Mar ' 10 Sources of funds Owner's fund Equity share capital Share application money Preference share capital Reserves & surplus Loan funds Secured loans Unsecured loans Total Uses of funds Fixed assets Gross block Less : revaluation reserve Less : accumulated depreciation Net block Capital work-in-progress Investments Net current assets Current assets, loans & advances Less : current liabilities & provisions Total net current assets Miscellaneous expenses not written Total Notes: Book value of unquoted investments Market value of quoted investments Contingent liabilities Number of equity sharesoutstanding (Lacs) Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

381.82 377.44 376.86 376.22 13,628.17 13,302.55 11,624.69 10,003.78 11.63 5.57 60.78 107.71 165.92 208.86 140.10 14,117.70 13,857.54 12,215.98 10,580.88

375.52 8,626.79 25.91 93.82 9,122.04

11,967.86 10,558.65 54.39 55.09 3,825.46 3,286.74 8,088.01 7,216.82 1,008.99 1,214.06 5,726.87 2,837.75

8,959.70 56.12 2,790.87 6,112.71 1,126.82 2,934.55

7,134.31 57.08 2,389.54 4,687.69 1,130.20 3,067.77

6,227.17 59.17 2,065.44 4,102.56 399.97 3,517.01 5,228.49 4,125.99 1,102.50 9,122.04

8,463.31 8,450.99 7,306.99 6,281.07 9,169.48 5,862.08 5,265.09 4,585.85 -706.17 2,588.91 2,041.90 1,695.22 14,117.70 13,857.54 12,215.98 10,580.88 5,108.69 1,355.62 258.73 38181.77 2,861.88 9.12 261.36 37744.00 2,958.68 13.42 308.08 37686.10

3,091.90 3,541.14 13.30 13.46 129.56 98.72 37622.23 37551.79

P a g e | 28

Godrej Consumer Products Ltd.

Yearly Results of Godrej Consumer Products Mar '06 Sales Turnover Other Income Total Income Total Expenses Operating Profit Extraordinary Income/Expenses Tax On Extraordinary Items Net Extra Ordinary Income/Expenses Gross Profit Interest PBDT Depreciation Depreciation On Revaluation Of Assets PBT Tax Net Profit Prior Years Income/Expenses Depreciation for Previous Years Written Back/ Provided Equity Dividend Rate Earnings Per Share Book Value Equity Reserves Face Value 657.32 8.66 665.98 519.88 137.44 ---146.10 4.04 142.06 10.79 -131.27 10.57 120.70 0.50 -350 21.38 -22.58 53.57 4.00 ------------------- in Rs. Cr. ------------------Mar '07 758.52 5.30 763.82 611.09 147.43 10.13 --152.73 5.84 157.02 12.49 -144.53 12.37 132.16 --375 5.85 -22.58 88.32 1.00 Mar '08 887.59 8.70 896.29 702.55 185.04 ---193.74 8.82 184.92 15.70 -169.22 21.12 148.10 --411 6.56 -22.58 127.91 1.00 Mar '09 1,088.01 10.26 1,098.27 924.03 163.98 0.64 --174.24 -26.05 200.93 14.37 -186.56 25.01 161.55 --401 6.29 -25.70 511.22 1.00 Mar '10 1,267.88 50.60 1,318.48 1,001.93 265.95 ---316.55 3.66 312.89 13.75 -299.14 51.02 248.12 --408 8.05 -30.82 796.65 1.00

P a g e | 28

Profit and loss account (Godrej Consumer Products Ltd.)

Mar ' 10 Income Operating income Expenses Material consumed Manufacturing expenses Personnel expenses Selling expenses Adminstrative expenses Expenses capitalised Cost of sales Operating profit Other recurring income Adjusted PBDIT Financial expenses Depreciation Other write offs Adjusted PBT Tax charges Adjusted PAT Non recurring items Other non cash adjustments Reported net profit Earnigs before appropriation Equity dividend Preference dividend Dividend tax Retained earnings 1,274.20 567.56 53.29 120.94 216.95 41.86 1,000.60 273.60 40.27 313.87 3.66 13.75 296.46 51.03 245.43 2.68 248.12 346.26 125.86 21.39 199.02 Mar ' 09 1,095.87 627.65 53.75 58.44 145.52 40.11 925.47 170.41 39.82 210.23 8.82 14.37 187.04 25.01 162.02 -1.11 0.64 161.55 234.79 102.98 17.50 114.30 Mar ' 08 891.92 422.80 40.58 54.60 136.04 39.24 693.27 198.65 5.32 203.97 10.38 15.70 177.89 21.12 156.77 -8.66 148.12 196.61 92.76 15.76 88.09 Mar ' 07 760.85 372.13 37.47 40.50 115.67 42.83 608.59 152.26 4.06 156.32 7.59 12.49 136.24 17.18 119.06 8.29 4.81 132.16 159.12 84.69 12.72 61.72 Mar ' 06 655.62 307.72 30.60 43.15 99.47 36.30 517.24 138.38 7.10 145.48 4.44 10.78 130.25 10.57 119.68 1.02 0.50 121.20 129.24 79.05 11.09 39.11

P a g e | 28

Balance sheet (Godrej Consumer Products Ltd.)

Mar ' 10 Sources of funds Owner's fund Equity share capital Share application money Preference share capital Reserves & surplus Loan funds Secured loans Unsecured loans Total Uses of funds Fixed assets Gross block Less : revaluation reserve Less : accumulated depreciation Net block Capital work-in-progress Investments Net current assets Current assets, loans & advances Less : current liabilities & provisions Total net current assets Miscellaneous expenses not written Total Notes: Book value of unquoted investments Market value of quoted investments Contingent liabilities Number of equity sharesoutstanding (Lacs) Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

30.82 796.65 12.40 839.86

25.70 511.22 14.89 48.00 599.81

22.58 127.91 40.59 94.00 285.09

22.58 88.32 47.86 65.00 223.77

22.58 53.57 4.87 81.03

273.80 108.24 165.56 0.84 521.88 552.75 401.16 151.59 839.86 521.88 79.41 3081.90

266.54 96.75 169.79 2.50 97.89 607.24 277.61 329.64 599.81 97.89 45.42 2569.54

265.56 110.98 154.58 71.58 77.61 263.74 285.28 -21.54 2.87 285.09 77.61 48.93 2258.44

243.65 95.52 148.13 39.81 71.79 195.68 231.64 -35.96 223.77 71.79 67.99 2258.44

159.21 86.39 72.82 7.06 50.01 122.32 171.19 -48.87 81.03 50.01 55.64 564.61

P a g e | 28

Marico Ltd.

Yearly Results of Marico Mar '06 Sales Turnover Other Income Total Income Total Expenses Operating Profit Extraordinary Income/Expenses Tax On Extraordinary Items Net Extra Ordinary Income/Expenses Gross Profit Interest PBDT Depreciation Depreciation On Revaluation Of Assets PBT Tax Net Profit Prior Years Income/Expenses Depreciation for Previous Years Written Back/ Provided Equity Dividend Rate Earnings Per Share Book Value Equity Reserves Face Value 1,044.91 3.71 1,048.62 905.81 139.10 ---142.81 0.61 142.20 33.23 -108.97 7.83 101.14 -2.28 -1 62 -58.00 219.36 10.00 ------------------- in Rs. Cr. ------------------Mar '07 1,371.66 4.23 1,375.89 1,178.31 193.35 ---197.58 11.60 185.98 35.19 -150.79 28.43 122.36 -6.19 -1 64.13 -60.90 122.60 1.00 Mar '08 1,568.78 10.07 1,578.85 1,372.60 196.18 1.24 --206.25 15.29 192.20 18.93 -173.27 29.85 143.42 --1 65.50 -60.90 219.34 1.00 Mar '09 1,921.85 10.14 1,931.99 1,667.15 254.70 -47.87 --264.84 28.92 188.06 17.03 -171.03 28.91 142.12 --1 65.50 -60.90 306.82 1.00 Mar '10 2,030.85 15.50 2,046.35 1,710.27 320.58 ---336.08 18.30 317.78 25.21 -292.57 57.55 235.02 --1 65.99 -60.93 510.75 1.00

P a g e | 28

Profit and loss account (Marico Ltd.)

Mar ' 10 Income Operating income Expenses Material consumed Manufacturing expenses Personnel expenses Selling expenses Adminstrative expenses Expenses capitalised Cost of sales Operating profit Other recurring income Adjusted PBDIT Financial expenses Depreciation Other write offs Adjusted PBT Tax charges Adjusted PAT Non recurring items Other non cash adjustments Reported net profit Earnigs before appropriation Equity dividend Preference dividend Dividend tax Retained earnings 2,001.50 1,085.10 81.52 103.11 324.00 74.75 1,668.48 333.02 15.39 348.41 18.30 25.21 304.90 57.55 247.35 -4.79 -7.54 235.02 468.12 40.21 6.83 421.08 Mar ' 09 1,921.85 1,157.03 78.80 84.18 268.07 64.37 1,652.45 269.40 10.06 279.46 28.92 17.03 233.51 52.37 181.14 -57.36 18.32 142.10 293.98 39.89 6.78 247.31 Mar ' 08 1,575.99 892.89 68.74 77.18 266.01 62.11 1,366.93 209.06 6.73 215.79 19.75 18.93 177.11 29.86 147.25 -3.84 143.41 212.89 39.89 6.78 166.22 Mar ' 07 1,373.27 749.58 61.08 66.83 251.59 55.03 1,184.11 189.16 9.93 199.09 20.01 35.19 143.89 28.43 115.46 -7.14 7.84 116.16 307.52 39.06 1.65 5.71 261.10 Mar ' 06 1,045.16 574.06 45.84 62.16 180.23 48.02 910.31 134.85 5.94 140.79 5.02 33.23 102.54 7.83 94.71 1.93 2.22 98.86 242.25 35.96 5.04 201.25

P a g e | 28

Balance sheet (Marico Ltd.)

Mar ' 10 Sources of funds Owner's fund Equity share capital Share application money Preference share capital Reserves & surplus Loan funds Secured loans Unsecured loans Total Uses of funds Fixed assets Gross block Less : revaluation reserve Less : accumulated depreciation Net block Capital work-in-progress Investments Net current assets Current assets, loans & advances Less : current liabilities & provisions Total net current assets Miscellaneous expenses not written Total Notes: Book value of unquoted investments Market value of quoted investments Contingent liabilities Number of equity sharesoutstanding (Lacs) Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

60.93 510.73 99.61 277.31 948.58

60.90 306.78 107.51 201.02 676.21

60.90 219.33 121.23 184.36 585.82

60.90 122.59 50.48 116.77 350.74

58.00 219.36 203.25 20.26 500.87

294.45 164.48 129.97 109.96 209.11 792.53 292.99 499.54 948.58 198.04 812.01 167.90 6093.26

262.16 146.25 115.91 45.61 112.58 635.50 233.39 402.11 676.21 112.58 26.32 6090.00

228.89 131.90 96.99 49.10 106.52 582.24 249.03 333.21 585.82 106.52 21.04 6090.00

213.87 118.81 95.06 8.97 80.91 494.18 328.38 165.80 350.74 80.91 16.18 6090.00

402.11 112.56 289.55 18.97 36.39 329.35 173.39 155.96 500.87 36.39 16.78 580.00

P a g e | 28

Nestle India Ltd.

Yearly Results of Nestle India Dec '06 Sales Turnover Other Income Total Income Total Expenses Operating Profit Extraordinary Income/Expenses Tax On Extraordinary Items Net Extra Ordinary Income/Expenses Gross Profit Interest PBDT Depreciation Depreciation On Revaluation Of Assets PBT Tax Net Profit Prior Years Income/Expenses Depreciation for Previous Years Written Back/ Provided Equity Dividend Rate Earnings Per Share Book Value Equity Reserves Face Value 2,816.06 20.61 2,836.67 2,289.03 527.03 -0.39 --547.64 0.44 546.81 66.28 -480.53 165.43 315.10 --255 32.68 -96.42 292.47 10.00 ------------------- in Rs. Cr. ------------------Dec '07 3,504.35 25.44 3,529.79 2,808.08 696.27 -17.51 --721.71 0.85 703.35 74.74 -628.61 214.80 413.81 --330 42.92 -96.42 322.01 10.00 Dec '08 4,335.11 23.02 4,358.13 3,480.29 854.82 ---877.84 12.66 865.18 92.36 -772.82 238.74 534.08 --425 55.39 -96.42 376.94 10.00 Dec '09 5,149.99 17.18 5,167.17 4,137.53 1,012.46 ---1,029.64 1.40 1,028.24 111.27 -916.97 261.97 655.00 --485 67.93 -96.42 484.85 10.00 Dec '10 6,273.64 23.76 6,297.40 5,007.18 1,266.46 -16.29 --1,290.22 1.07 1,272.86 127.75 -1,145.11 326.45 818.66 --485 84.91 -96.42 759.00 10.00

P a g e | 28

Profit and loss account (Nestle India Ltd.)

Dec ' 10 Income Operating income Expenses Material consumed Manufacturing expenses Personnel expenses Selling expenses Adminstrative expenses Expenses capitalised Cost of sales Operating profit Other recurring income Adjusted PBDIT Financial expenses Depreciation Other write offs Adjusted PBT Tax charges Adjusted PAT Non recurring items Other non cash adjustments Reported net profit Earnigs before appropriation Equity dividend Preference dividend Dividend tax Retained earnings 6,260.21 3,084.51 330.11 433.44 623.14 543.60 5,014.80 1,245.42 36.46 1,281.87 1.07 127.75 1,153.04 326.45 826.60 -7.93 818.66 961.19 467.62 77.20 416.37 Dec ' 09 5,141.90 2,472.64 252.92 432.38 516.55 452.03 4,126.52 1,015.39 27.63 1,043.02 1.40 111.27 930.35 261.97 668.37 -13.37 655.00 755.11 467.62 79.47 208.02 Dec ' 08 4,328.65 2,122.74 233.21 314.58 449.40 371.77 3,491.70 836.95 32.91 869.86 1.64 92.36 775.86 238.74 537.12 -3.03 534.08 546.60 409.77 69.64 67.19 Dec ' 07 3,500.96 1,692.53 186.09 269.44 340.20 329.73 2,817.99 682.97 25.13 708.10 0.85 74.74 632.50 214.80 417.70 -3.89 413.81 424.28 318.17 52.21 53.90 Dec ' 06 2,819.16 1,334.79 168.21 216.16 278.33 289.75 2,287.24 531.92 20.61 552.53 0.44 66.28 485.80 165.43 320.37 -5.28 315.10 322.32 245.86 34.48 41.98

P a g e | 28

Balance sheet (Nestle India Ltd.)

Dec ' 10 Sources of funds Owner's fund Equity share capital Share application money Preference share capital Reserves & surplus Loan funds Secured loans Unsecured loans Total Uses of funds Fixed assets Gross block Less : revaluation reserve Less : accumulated depreciation Net block Capital work-in-progress Investments Net current assets Current assets, loans & advances Less : current liabilities & provisions Total net current assets Miscellaneous expenses not written Total Notes: Book value of unquoted investments Market value of quoted investments Contingent liabilities Number of equity sharesoutstanding (Lacs) Dec ' 09 Dec ' 08 Dec ' 07 Dec ' 06

96.42 759.00 855.41

96.42 484.85 581.27

96.42 376.93 0.82 474.17

96.42 322.01 2.87 421.30

96.42 292.47 16.27 405.16

1,854.70 841.96 1,012.74 348.91 150.68 1,094.70 1,751.61 -656.91 855.41 150.68 964.16

1,640.79 744.59 896.20 79.63 203.26 903.36 1,501.18 -597.82 581.27 203.26 63.07 964.16

1,404.85 1,179.77 651.85 577.96 752.99 601.81 109.17 73.70 34.90 94.40 836.86 678.69 1,259.75 1,027.31 -422.89 -348.61 474.17 421.30 34.90 84.90 964.16 94.40 63.27 964.16

1,058.27 516.48 541.80 38.24 77.77 583.45 836.10 -252.65 405.16 77.77 35.93 964.16

P a g e | 28

DABUR INDIA LTD. FY MAR 06

Net Working Capital = Current Assets Current Liabilities Current assets = 285.68 Current liabilities = 324.12 Net Working Capital = 285.68 324.44 = -38.44 cr

FY MAR 07

Net Working Capital = Current Assets Current Liabilities Current assets = 397.78 Current liabilities = 379.27 Net Working Capital = 397.78 379.27 = 18.52 cr

FY MAR 08

Net Working Capital = Current Assets Current Liabilities Current assets = 576.82 Current liabilities = 610.57 Net Working Capital = 576.82 610.57 = -33.75 cr

P a g e | 28

FY MAR 09

Net Working Capital = Current Assets Current Liabilities Current assets = 973.77 Current liabilities = 696.97 Net Working Capital = 973.77 696.97 = 276.45 cr

FY MAR 10

Net Working Capital = Current Assets Current Liabilities Current assets = 941.77 Current liabilities = 911.83 Net Working Capital = 941.77 911.83 = 29.94 cr

P a g e | 28

ITC INDIA LTD. FY MAR 06

Net Working Capital = Current Assets Current Liabilities Current assets = 5,228.49 Current liabilities = 4,125.99 Net Working Capital = 5,228.49 4,125.99 = 1,102.50cr

FY MAR 07

Net Working Capital = Current Assets Current Liabilities Current assets = 6,281.07 Current liabilities = 4,585.85 Net Working Capital = 6,281.07 4,585.85 = 1,695.22 cr

FY MAR 08

Net Working Capital = Current Assets Current Liabilities Current assets = 7,306.99 Current liabilities = 5,265.09 Net Working Capital = 7,306.99 5,265.09 = 2,041.90 cr

P a g e | 28

FY MAR 09

Net Working Capital = Current Assets Current Liabilities Current assets = 8,450.99 Current liabilities = 5,862.08 Net Working Capital = 8,450.99 5,862.08 = 2,588.91 cr

FY MAR 10

Net Working Capital = Current Assets Current Liabilities Current assets = 8,463.31 Current liabilities = 9,169.48 Net Working Capital = 8,463.31 9,9169.48 = -706.17 cr

P a g e | 28

GODREJ CONSUMER PRODUCTS LTD. FY MAR 06

Net Working Capital = Current Assets Current Liabilities Current assets = 122.32 Current liabilities = 171.19 Net Working Capital = 122.32 171.19 = -48.87 cr

FY MAR 07

Net Working Capital = Current Assets Current Liabilities Current assets = 195.68 Current liabilities = 231.64 Net Working Capital = 195.68 231.64 = -35.96 cr

FY MAR 08

Net Working Capital = Current Assets Current Liabilities Current assets = 263.74 Current liabilities = 285.28 Net Working Capital = 263.74 285.28 = -21.54 cr

P a g e | 28

FY MAR 09

Net Working Capital = Current Assets Current Liabilities Current assets = 607.24 Current liabilities = 277.61 Net Working Capital = 607.24 277.61 = 329.64 cr

FY MAR 10

Net Working Capital = Current Assets Current Liabilities Current assets = 552.75 Current liabilities = 401.16 Net Working Capital = 552.75 401.16 = 151.59 cr

P a g e | 28

MARICO LTD. FY MAR 06

Net Working Capital = Current Assets Current Liabilities Current assets = 329.35 Current liabilities = 173.39 Net Working Capital = 329.35 173.39 = 155.96 cr

FY MAR 07

Net Working Capital = Current Assets Current Liabilities Current assets = 494.18 Current liabilities = 328.38 Net Working Capital = 494.18 328.38 = 165.80 cr

FY MAR 08

Net Working Capital = Current Assets Current Liabilities Current assets = 582.24 Current liabilities = 249.03 Net Working Capital = 582.24 249.03 = 333.21 cr

P a g e | 28

FY MAR 09

Net Working Capital = Current Assets Current Liabilities Current assets = 635.50 Current liabilities = 233.39 Net Working Capital = 635.50 233.39 = 402.11 cr

FY MAR 10

Net Working Capital = Current Assets Current Liabilities Current assets = 792.53 Current liabilities = 292.99 Net Working Capital = 792.53 292.99 = 499.54 cr

P a g e | 28

NESTLE INDIA LTD. FY MAR 06

Net Working Capital = Current Assets Current Liabilities Current assets = 583.45 Current liabilities = 836.10 Net Working Capital = 583.45 836.10 = -252.65 cr

FY MAR 07

Net Working Capital = Current Assets Current Liabilities Current assets = 678.69 Current liabilities = 1,027.31 Net Working Capital = 678.69 1,027.31 = -348.61 cr

FY MAR 08

Net Working Capital = Current Assets Current Liabilities Current assets = 836.86 Current liabilities = 1,259.75 Net Working Capital = 836.86 1,259.75 = -422.89 cr

P a g e | 28

FY MAR 09

Net Working Capital = Current Assets Current Liabilities Current assets = 903.36 Current liabilities = 1,501.18 Net Working Capital = 903.36 1,501.18 = -597.82 cr

FY MAR 10

Net Working Capital = Current Assets Current Liabilities Current assets = 1,094.70 Current liabilities = 1,751.61 Net Working Capital = 1,094.70 1,751.61 = -656.91 cr

P a g e | 28

CONCLUSION

Dabur India Ltd.

Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short term debt and upcoming operational expenses. An increase in working capital indicates that the business has either increased current assets or has decreased current liabilities.

It is clear from the above chart that Working Capital(%) of Dabur has increased in 2007 then there is a certain fall in 2008 and then an increase in 2009 and again a fall in 2010. The Working Capital is maximum in 2009.

P a g e | 28

ITC Ltd.

It is clear from the above chart that Working Capital is constantly increasing from 2006 to 2009 and a sudden fall in 2010

P a g e | 28

Godrej Consumer Products Ltd.

In the above chart, it is clear that in 2006 to 2008, the working capital is in negative and it has increased in 2009 and then decreased in 2010.

P a g e | 28

Marico Ltd.

It is clear from the above chart that the working capital is constantly showing increase from 2006 to 2010.

P a g e | 28

Nestle India Ltd.

It is clear from the above chart that the working capital is constantly showing decrease from 2006 to 2010.

P a g e | 28

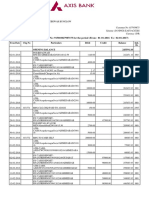

TABLE OF NET WORKING CAPITAL (Rs in crores) Years 2006 2007 2008 2009 2010 TOTAL DABUR -38.44 18.52 -33.75 276.45 29.94 252.72 ITC 1102.50 1695.22 2041.90 2588.91 -706.17 6722.36 GODREJ -48.87 -35.96 -21.54 329.64 151.59 374.86 MARICO 155.96 165.80 333.21 402.11 499.54 1556.62 NESTLE -252.65 -348.61 -422.89 -597.82 -656.91 -2278.88

Hence, By the help of data analysis conducted on the results of major FMCG giants, it has been found that companies like ITC and Marico have higher net working capital as compared to other FMCG giants during 2006-2010 followed by Godrej, Dabur and Nestle. So, on the basis of above Table , a ranking scale is developed by which the ranks are assigned to the companies on the basis of their net working capital as:-

RANK

RANK 1 RANK 2 RANK 3 RANK 4 RANK 5

COMPANIES

ITC LTD. MARICO LTD. GODREJ CONSUMER PRODUCTS LTD. DABUR INDIA LTD. NESTLE INDIA LTD.

P a g e | 28

BIBLIOGRAPHY

WWW.DABUR.COM WWW.ITC.COM WWW.MARICO.COM WWW.NESTLE.COM

WWW.GODREJCP.COM WWW.MONEYCONTROL.COM WWW.GOOGLE.COM WWW.MONEY.REDIFF.COM

Вам также может понравиться

- Green Products A Complete Guide - 2020 EditionОт EverandGreen Products A Complete Guide - 2020 EditionРейтинг: 5 из 5 звезд5/5 (1)

- Entrepreneurship ProjectДокумент21 страницаEntrepreneurship Projectmansi_2460% (5)

- Dabur India PresentationДокумент28 страницDabur India Presentationg_dhruvОценок пока нет

- Amity Business School: Submitted by Tanya Sharma M.B.A (HR) 2008-2010 (A0102308288)Документ68 страницAmity Business School: Submitted by Tanya Sharma M.B.A (HR) 2008-2010 (A0102308288)Chaiten GuptaОценок пока нет

- Dayananda Sagar Academy of Technology and Management: Topic: An Organizational Report On MK Agrotech PVT LTDДокумент17 страницDayananda Sagar Academy of Technology and Management: Topic: An Organizational Report On MK Agrotech PVT LTDSRIRAMA VK100% (1)

- Report Mother DairyДокумент48 страницReport Mother Dairymuralimadhavareguriguptha100% (1)

- PROJECT REPORT ON Slice Soft DrinkДокумент10 страницPROJECT REPORT ON Slice Soft DrinkSaurabh Kumar Tiwari100% (1)

- MBA:1 Semester It Skills Lab-1 Sushil Kumar Assistant ProfessorДокумент22 страницыMBA:1 Semester It Skills Lab-1 Sushil Kumar Assistant Professormba08061 DEEPAK TRIPATHI100% (1)

- Marketing Strategies and Consumer Perception of Real JuiceДокумент70 страницMarketing Strategies and Consumer Perception of Real JuiceAlok kumarОценок пока нет

- United Phosphorus LTDДокумент90 страницUnited Phosphorus LTDAashish PrajapatiОценок пока нет

- Dabur Re Positioning StrategyДокумент23 страницыDabur Re Positioning StrategyVishesh Iyer0% (1)

- WiproДокумент22 страницыWiprosonu_saisОценок пока нет

- The Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDДокумент78 страницThe Performance Appraisal System of HDFC SLIC by Parshuram Sahoo IILM BS HYDsahoo_iilm80% (5)

- A Study On Distribution Channel of Britannia Itc and Parle Biscuits in BangaloreДокумент12 страницA Study On Distribution Channel of Britannia Itc and Parle Biscuits in BangaloreKhushboo AryaОценок пока нет

- Casestudy Kalsi AgroДокумент3 страницыCasestudy Kalsi AgroGPLОценок пока нет

- Financial Project On Microtek (1) 2Документ65 страницFinancial Project On Microtek (1) 2Rohit Chanana0% (1)

- Pepsi Project ReportДокумент92 страницыPepsi Project ReportRaza SiddiquiОценок пока нет

- PFR Report FINALДокумент30 страницPFR Report FINALSohini Mitra100% (1)

- Final ProjectДокумент64 страницыFinal ProjectJaspreet Sondhi100% (1)

- "CRM System For Spicejet and Business Cycle": Submitted byДокумент11 страниц"CRM System For Spicejet and Business Cycle": Submitted byKiran KarkiОценок пока нет

- Study On Brand Share Across The Four Wards Using Chi-Square TestДокумент16 страницStudy On Brand Share Across The Four Wards Using Chi-Square Testsunil100% (1)

- Project MaricoДокумент23 страницыProject Maricoharishma29100% (1)

- Vatika Shampoo ProjectДокумент64 страницыVatika Shampoo ProjectToufique Kazi0% (1)

- Project ReportДокумент52 страницыProject ReportMaria FatimaОценок пока нет

- MBA ReportДокумент100 страницMBA ReportAkshay JiremaliОценок пока нет

- Research Proposal For Mother DairyДокумент5 страницResearch Proposal For Mother Dairybuzzg1985Оценок пока нет

- Hindustan Coca-Cola Beverages Private Limited (Patna)Документ74 страницыHindustan Coca-Cola Beverages Private Limited (Patna)krrish11Оценок пока нет

- Final STPДокумент4 страницыFinal STPGitanjoli BorahОценок пока нет

- Marketing Management Project - Dabur VatikaДокумент43 страницыMarketing Management Project - Dabur Vatikarizwan1778% (9)

- Cadbury Module 5Документ49 страницCadbury Module 5Akshay ChavdaОценок пока нет

- Presentation On Coca Cola Industry in IndiaДокумент27 страницPresentation On Coca Cola Industry in IndiaJAGMOHAN KOTHARIОценок пока нет

- BRIDGE SOLUTIONS PVT LTD 12Документ9 страницBRIDGE SOLUTIONS PVT LTD 12ROHIT JAISWAL100% (1)

- Analysis of The Distribution Strategies of Usha Usha-Britapurification System in LucknowДокумент100 страницAnalysis of The Distribution Strategies of Usha Usha-Britapurification System in LucknowShahzad SaifОценок пока нет

- Project Report - On Videocon d2hДокумент71 страницаProject Report - On Videocon d2hvarunkatara33% (3)

- PatanjaliДокумент23 страницыPatanjaliPranav TimseОценок пока нет

- Dabur Vs ITC FinancialsДокумент6 страницDabur Vs ITC Financialssarthak.ladОценок пока нет

- Sales Strategy of DaburДокумент5 страницSales Strategy of DaburRaza MerchantОценок пока нет

- Dabur ProductДокумент47 страницDabur Productraviitlab0% (1)

- Manpreet Project NEW INTERДокумент107 страницManpreet Project NEW INTERanand kumar100% (1)

- tATA TELI SERVICEДокумент55 страницtATA TELI SERVICEanon_179532672100% (1)

- Final STPR NamrataДокумент95 страницFinal STPR NamrataNamrata KesarwaniОценок пока нет

- By: Ruchika Singh Rajat Singla Ankit PawarДокумент17 страницBy: Ruchika Singh Rajat Singla Ankit Pawarrajat_singla100% (1)

- PDF Full Project MukulДокумент80 страницPDF Full Project MukulMukul Somgade50% (2)

- LakmeДокумент9 страницLakmeAanchal MahajanОценок пока нет

- A Research Project Report On "Comparative Analysis of Marketing Strategy of Nestle, Amul & Cadbury Chocolates"Документ47 страницA Research Project Report On "Comparative Analysis of Marketing Strategy of Nestle, Amul & Cadbury Chocolates"Anonymous UWMOBhDiОценок пока нет

- Project ReportДокумент34 страницыProject ReportVishwanath RavindranОценок пока нет

- Aryan Singh Coca Cola PGFB 1909 2Документ11 страницAryan Singh Coca Cola PGFB 1909 2AryanSinghОценок пока нет

- HRA & Forensic AccountingДокумент21 страницаHRA & Forensic Accountingharish0% (1)

- Brand Awareness & Preference Regarding Havells Green CFL PDFДокумент74 страницыBrand Awareness & Preference Regarding Havells Green CFL PDFsumanth reddy donthireddy100% (1)

- Marketing Strategy of Procter & Gamble: Project Report ONДокумент44 страницыMarketing Strategy of Procter & Gamble: Project Report ONRoopendra MauryaОценок пока нет

- Research Analysis On AttaДокумент7 страницResearch Analysis On AttaKaushik Iyer100% (1)

- Dabur Project ReportДокумент77 страницDabur Project ReportDeepankar Chaudhary0% (1)

- Dabur India LimitedДокумент3 страницыDabur India LimitedRishabh SharmaОценок пока нет

- Marketing Strategy of Dabur ProductДокумент99 страницMarketing Strategy of Dabur ProductChiragSinghal100% (4)

- Dabur ReportДокумент32 страницыDabur ReportMudit MisraОценок пока нет

- ReportДокумент99 страницReportStarОценок пока нет

- The Marketing Strategy of Dabur ProductДокумент114 страницThe Marketing Strategy of Dabur ProductSwapna DasojuОценок пока нет

- 1.introduction To The Industry: I.Ihistorical Background of DaburДокумент65 страниц1.introduction To The Industry: I.Ihistorical Background of DaburRaj AmritamОценок пока нет

- Term Paper of MKTДокумент23 страницыTerm Paper of MKTnewaranilОценок пока нет

- Sourcing Manager or Supply Chain Manager or Commodity Manager orДокумент2 страницыSourcing Manager or Supply Chain Manager or Commodity Manager orapi-121441611Оценок пока нет

- Hitler'S Money: Guido Giacomo Preparata University of Washington, TacomaДокумент7 страницHitler'S Money: Guido Giacomo Preparata University of Washington, TacomaPeter LapsanskyОценок пока нет

- Unit 2 Consumer BehaviourДокумент14 страницUnit 2 Consumer Behaviournileshstat5Оценок пока нет

- PDFДокумент7 страницPDFNikhilAKothariОценок пока нет

- Approved Employers - LahoreДокумент15 страницApproved Employers - Lahoreraheel97Оценок пока нет

- Thư Tín - NN5-2020 - UpdatedДокумент60 страницThư Tín - NN5-2020 - UpdatedK59 Nguyen Minh ChauОценок пока нет

- EntrepreneurshipДокумент191 страницаEntrepreneurshipWacks Venzon50% (2)

- Student Online - MDCATДокумент1 страницаStudent Online - MDCATAmna HaniaОценок пока нет

- ASQ ISO Infographic DigitalДокумент1 страницаASQ ISO Infographic Digitalinder_sandhuОценок пока нет

- Accounting Cycle Service BusinessДокумент120 страницAccounting Cycle Service BusinessElla Mae AcostaОценок пока нет

- Strategic Assignment FullДокумент50 страницStrategic Assignment FullFitriana AnnisaОценок пока нет

- Olaf Abel Ethylene ApcДокумент32 страницыOlaf Abel Ethylene Apcasamad54Оценок пока нет

- Objectives of A FirmДокумент3 страницыObjectives of A Firmyasheshgaglani100% (1)

- NetSuite Essentials Training Data SheetДокумент4 страницыNetSuite Essentials Training Data SheetTaranvir KaurОценок пока нет

- Unit I Industrial RelationsДокумент58 страницUnit I Industrial RelationsSaravanan Shanmugam100% (2)

- Jetro Restaurant Depot AgreementДокумент28 страницJetro Restaurant Depot AgreementUFCW770Оценок пока нет

- Revenue Cycle ReportДокумент15 страницRevenue Cycle ReportKevin Lloyd GallardoОценок пока нет

- North Philippines Visitors Bureau: Department of TourismДокумент33 страницыNorth Philippines Visitors Bureau: Department of TourismdiscardmailОценок пока нет

- Lesson 6 Activity On Business Transactions and Their AnalysisДокумент3 страницыLesson 6 Activity On Business Transactions and Their AnalysisBerto ZerimarОценок пока нет

- Quiz in AgencyДокумент3 страницыQuiz in AgencyPrincessAngelaDeLeonОценок пока нет

- NOVARTIS Bangladesh Pharmaceutical Marketplace AnalysisДокумент23 страницыNOVARTIS Bangladesh Pharmaceutical Marketplace AnalysisAisha ZainОценок пока нет

- Subhiksha Case StudyДокумент9 страницSubhiksha Case StudyRavi Keshava Reddy100% (1)

- 1 - 20.09.2018 - Corriogendum 1aДокумент1 страница1 - 20.09.2018 - Corriogendum 1achtrpОценок пока нет

- Project On SunsilkДокумент11 страницProject On Sunsilktanya sethiОценок пока нет

- Building and Managing Successfully Businesses in The Middle EastДокумент12 страницBuilding and Managing Successfully Businesses in The Middle EastbooksarabiaОценок пока нет

- Hidden-City Ticketing The Cause and ImpactДокумент27 страницHidden-City Ticketing The Cause and ImpactPavan KethavathОценок пока нет

- TDS Alcomer 7199Документ2 страницыTDS Alcomer 7199PrototypeОценок пока нет

- Bim WhitepaperДокумент21 страницаBim WhitepaperpeterhwilliamsОценок пока нет

- 1930 Hobart DirectoryДокумент82 страницы1930 Hobart DirectoryAnonymous X9qOpCYfiBОценок пока нет

- Three Rivers DC Data Quality StrategyДокумент11 страницThree Rivers DC Data Quality StrategyJazzd Sy GregorioОценок пока нет