Академический Документы

Профессиональный Документы

Культура Документы

Executive Pay vs. Shareholder Return

Загружено:

danxmcgrawОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Executive Pay vs. Shareholder Return

Загружено:

danxmcgrawАвторское право:

Доступные форматы

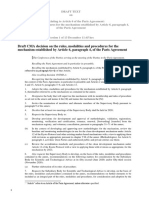

Executive pay vs.

shareholder return

Hearst analyzed executive compensation for these investor-owned electricity companies operating in Texas:

American Electric Power 1 Headquarters: Columbus, Ohio 1 Business: Electricity retailer, locally through AEP Texas 1 Customers: 1 million in Texas

Centerpoint Energy 1 Headquarters: Houston 1 Business: Electricity distribution (wire) company in Houston area 1 Customers: 2.2 million

Centrica 1 Headquarters: United Kingdom 1 Business: International electricity retailer; operates as Direct Energy in North America 1 Customers: 5.5 million in U.S. and Canada

El Paso Electric 1 Headquarters: El Paso 1 Business: Electricity distribution and transmission in west Texas and Southern New Mexico 1 Customers: 380,000

Energy Future Holdings 1 Headquarters: Dallas 1 Business: Energy holding company, including Oncor and TXU Energy

Entergy 1 Headquarters: New Orleans 1 Business: Entergy Texas is an electricity distribution company in 27 southeast Texas counties 1 Customers: 411,000 in Texas

NRG Energy 1 Headquarters: Princeton, N.J. 1 Business: One of the largest power generation and retail electricity businesses in U.S.; owns Reliant Energy in Houston 1 Customers: More than 2 million in 16 states, including Texas

Oncor 1 Headquarters: Dallas 1 Business: Electricity distribution (wire) company covering 90 counties and 400 cities from Tyler to Odessa 1 Customers: 10 million

PNM Resources 1 Headquarters: Albuquerque 1 Business: Electricity utility 1 Customers: 230,000 in Texas

Xcel Energy 1 Headquarters: Minneapolis 1 Business: Electricity holding company, includes Southwestern Public Service Co. in Texas and New Mexico 1 Customers: 3.4 million nationwide, 262,000 in Texas

Total direct compensation for top executive, 2000-2011 *

$20 million 15 10 5 0 00 $8 million 6 4 2 0 00 $2.0 million 1.5 1.0 0.5 0 00 $5 million 4 3 2 1 05 10 0 00 05 10 $60 million 50 40 30 20 10 0 00 05 10 $30 million 25 20 15 10 5 0 00 05 10 $10 million 8 6 4 2 0 00 05 10 $2.5 million 2.0 1.5 1.0 0.5 0 00 05 10 $4 million 3 2 1 0 00 $12 million 10 8 6 4 2 05 10 0 00 05 10

05

10

05

10

Annual shareholder return, 2001-2011 *

25 % 15 5 -5 -15 -25 -35 01 06 11 40 % 20 0 -20 -40 -60 01 06 11 25 % 20 15 10 5 0 -5 -10 -15 01 50 % 40 30 20 10 0 -10 -20 -30 01 40 % 30 20 10 0 -10 -20 -30 01 80 % 60 40 20 0 -20 -40 06 11 01 06 11 Public debt holder/ no stock traded 50 % 30 10 -10 -30 -50 01 06 11 80 % 60 40 20 0 -20 -40 -60 01

Public debt holder/ no stock traded

06

11

06

11

06

11

Source: Longnecker & Associates, study done for Hearst Newspapers

* Not all years available for every company

Jay Carr / Houston Chronicle

Вам также может понравиться

- Microsoft Carbon Removal - Lessons From An Early Corporate Purchase - January 2021Документ33 страницыMicrosoft Carbon Removal - Lessons From An Early Corporate Purchase - January 2021danxmcgrawОценок пока нет

- Dominion Energy RGGI Rate RequestДокумент31 страницаDominion Energy RGGI Rate RequestdanxmcgrawОценок пока нет

- US Supreme Court Overturns Biofuel Waiver Ruling in Victory For Small RefinersДокумент32 страницыUS Supreme Court Overturns Biofuel Waiver Ruling in Victory For Small RefinersdanxmcgrawОценок пока нет

- Canadian Supreme Court Upholds Legality of Federal CO2 Pricing RegimeДокумент405 страницCanadian Supreme Court Upholds Legality of Federal CO2 Pricing RegimedanxmcgrawОценок пока нет

- Dominion Energy RGGI Rider RequestДокумент51 страницаDominion Energy RGGI Rider RequestdanxmcgrawОценок пока нет

- Dominion Energy RGGI Rider RequestДокумент51 страницаDominion Energy RGGI Rider RequestdanxmcgrawОценок пока нет

- Virginia State Corporation Commission Efiling Case Document Cover SheetДокумент10 страницVirginia State Corporation Commission Efiling Case Document Cover SheetdanxmcgrawОценок пока нет

- Trump Administration Sues California Over Quebec LinkageДокумент17 страницTrump Administration Sues California Over Quebec Linkagedanxmcgraw100% (1)

- Recommendations For New Mexico Carbon Pollution Pricing Policy 11.25.2018 WebsiteДокумент22 страницыRecommendations For New Mexico Carbon Pollution Pricing Policy 11.25.2018 WebsitedanxmcgrawОценок пока нет

- US v. California - Linkage Litigation Order On MSJsДокумент30 страницUS v. California - Linkage Litigation Order On MSJsdanxmcgrawОценок пока нет

- Fed Judge Rules For ARB in ETS LinkageДокумент33 страницыFed Judge Rules For ARB in ETS LinkagedanxmcgrawОценок пока нет

- ETS Budget ProvisionДокумент2 страницыETS Budget ProvisiondanxmcgrawОценок пока нет

- Dominion Energy RGGI Rider RequestДокумент51 страницаDominion Energy RGGI Rider RequestdanxmcgrawОценок пока нет

- Draft 6.4 TextДокумент15 страницDraft 6.4 TextdanxmcgrawОценок пока нет

- Draft Text For 6.2Документ10 страницDraft Text For 6.2danxmcgrawОценок пока нет

- PG&E Restructuring PlanДокумент135 страницPG&E Restructuring PlandanxmcgrawОценок пока нет

- Judge To Consider Competing PG&E Bankruptcy ProposalДокумент4 страницыJudge To Consider Competing PG&E Bankruptcy ProposaldanxmcgrawОценок пока нет

- Ontario Court of Appeals RulingДокумент2 страницыOntario Court of Appeals RulingdanxmcgrawОценок пока нет

- Response To Comments by ARB On Leakage Under Forest ProtocolДокумент8 страницResponse To Comments by ARB On Leakage Under Forest ProtocoldanxmcgrawОценок пока нет

- FAO's Analysis On Cap-And-Trade CostДокумент31 страницаFAO's Analysis On Cap-And-Trade CostdanxmcgrawОценок пока нет

- Carbon-Pricing-Proposal December 2018Документ17 страницCarbon-Pricing-Proposal December 2018danxmcgrawОценок пока нет

- Ontario Court of Appeals On Carbon BackstopДокумент93 страницыOntario Court of Appeals On Carbon BackstopdanxmcgrawОценок пока нет

- 109479-Climate Change Resilience Measurement FrameworkДокумент8 страниц109479-Climate Change Resilience Measurement FrameworkdanxmcgrawОценок пока нет

- Ab 378Документ5 страницAb 378danxmcgrawОценок пока нет

- Draft Guidance DocumentДокумент22 страницыDraft Guidance DocumentdanxmcgrawОценок пока нет

- Pacific Legal Foundation Appeal BriefДокумент125 страницPacific Legal Foundation Appeal BriefdanxmcgrawОценок пока нет

- RFF NYISO Carbon Price AnalysisДокумент63 страницыRFF NYISO Carbon Price AnalysisdanxmcgrawОценок пока нет

- Chamber of Commerce Appeal BriefДокумент46 страницChamber of Commerce Appeal BriefdanxmcgrawОценок пока нет

- Cal Chamber OpinionДокумент81 страницаCal Chamber OpiniondanxmcgrawОценок пока нет

- AcadiaCenter - 2016 - RGGI Report - Part II - EMBARGOED PDFДокумент14 страницAcadiaCenter - 2016 - RGGI Report - Part II - EMBARGOED PDFdanxmcgrawОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Renewable Energy. Wind Resource AssessmentДокумент21 страницаRenewable Energy. Wind Resource AssessmentMathias MichaelОценок пока нет

- Smart Grids and Hybrid Energy Storage Systems: Optimization Techniques Applied in Control Strategies For Hybrid Energy Storage SystemsДокумент31 страницаSmart Grids and Hybrid Energy Storage Systems: Optimization Techniques Applied in Control Strategies For Hybrid Energy Storage SystemsAsif Rabbani100% (1)

- KPTCL Ppt's (Sahana)Документ13 страницKPTCL Ppt's (Sahana)sreekanthm00001Оценок пока нет

- Study COSTДокумент9 страницStudy COSTyrmail778Оценок пока нет

- Https Emarketing - Pwc.com ReAction Images NYM StamfordtaxforumfinalpresentationДокумент205 страницHttps Emarketing - Pwc.com ReAction Images NYM StamfordtaxforumfinalpresentationResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910Оценок пока нет

- Energies: Assessment of All-Electric General Aviation AircraftДокумент19 страницEnergies: Assessment of All-Electric General Aviation Aircraftamine bounounaОценок пока нет

- Kalika Engineering Consultant: Company ProfileДокумент16 страницKalika Engineering Consultant: Company ProfileHem ShahiОценок пока нет

- 2008 RenewableEnergyДокумент6 страниц2008 RenewableEnergyJoanna Marie SimonОценок пока нет

- Ppe MicroprojectДокумент11 страницPpe Microprojectthe grayОценок пока нет

- 0.2009 A Current and Future State of Art Development of Hybrid Energy System Using WW-PV - A Review PDFДокумент8 страниц0.2009 A Current and Future State of Art Development of Hybrid Energy System Using WW-PV - A Review PDFbdsrlОценок пока нет

- Earth's Resources: 6 GradeДокумент13 страницEarth's Resources: 6 GradeJordyn IzenstarkОценок пока нет

- s4134 Parker A279 Carroll Joint Oppose MemoДокумент3 страницыs4134 Parker A279 Carroll Joint Oppose MemoLuke ParsnowОценок пока нет

- Background of The StudyДокумент8 страницBackground of The StudyCindirella GalosОценок пока нет

- Weather Modeling and Forecasting of PV Systems Operation (2013) PDFДокумент363 страницыWeather Modeling and Forecasting of PV Systems Operation (2013) PDFAnonymous I7aUWXОценок пока нет

- Energy WebquestДокумент4 страницыEnergy WebquestDylanОценок пока нет

- Poster-02 Sample (Chatgpt)Документ2 страницыPoster-02 Sample (Chatgpt)Tafhimul IslamОценок пока нет

- The Pros and Cons of Nuclear EnergyДокумент15 страницThe Pros and Cons of Nuclear EnergyPatrick ApacibleОценок пока нет

- Chapter 1 IntroductionДокумент33 страницыChapter 1 IntroductionMamuye Busier YesufОценок пока нет

- What Is The Future Role of Conventional Refineries in The Decarbonization Transition (2022 by Ricardo)Документ90 страницWhat Is The Future Role of Conventional Refineries in The Decarbonization Transition (2022 by Ricardo)LelosPinelos123Оценок пока нет

- Low Temperature District Heating Systems - PHD Defence - Hakan İbrahim TolДокумент64 страницыLow Temperature District Heating Systems - PHD Defence - Hakan İbrahim TolHakan TolОценок пока нет

- Engineering & Automobile - 866 - Lucas - TVS - Chennai - 0 PDFДокумент42 страницыEngineering & Automobile - 866 - Lucas - TVS - Chennai - 0 PDFsreyasraj pkОценок пока нет

- Books, Journals, Periodicals and Audio-Visuals On Energy, Environment, and Sustainable DevelopmentДокумент52 страницыBooks, Journals, Periodicals and Audio-Visuals On Energy, Environment, and Sustainable Developmentsanjeev2004Оценок пока нет

- Rer Koe-074 Unit1 NotesДокумент45 страницRer Koe-074 Unit1 NotesRishabh KumarОценок пока нет

- Uttarakhand MHPДокумент10 страницUttarakhand MHPVineet SinghОценок пока нет

- Welding and Cutting SampleДокумент64 страницыWelding and Cutting SampleCalberttОценок пока нет

- All-Weather PanelДокумент21 страницаAll-Weather PanelMarceline GarciaОценок пока нет

- Dfig ThesisДокумент86 страницDfig ThesisAshwin Venkata100% (1)

- Renewable and Sustainable Energy Reviews: M.S. Gu Ney, K. KaygusuzДокумент9 страницRenewable and Sustainable Energy Reviews: M.S. Gu Ney, K. Kaygusuzcristian villegasОценок пока нет

- A PROJECT REPORT Final Year 2Документ12 страницA PROJECT REPORT Final Year 2aniket bobadeОценок пока нет

- FEASIBILITY OF ELECTRICAL ENERGY SAVING AT HUB Power Station1099 PDFДокумент109 страницFEASIBILITY OF ELECTRICAL ENERGY SAVING AT HUB Power Station1099 PDFusmanОценок пока нет