Академический Документы

Профессиональный Документы

Культура Документы

Bond and Time Value Problems

Загружено:

crystalspringОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bond and Time Value Problems

Загружено:

crystalspringАвторское право:

Доступные форматы

Bond Problems and Other Time Value of Money Problems Assume semi-annual interest payments when answering the

bond questions. 1. Today is December 15, 2007 and the price on the 6% coupon rate and the Treasury bond maturing on December 15, 2021 is priced at 115.5, and bond prices are always expressed as a percent of par. Calculate the bonds yield (to maturity). 2. Calculate the price of a 7% coupon six-year bond if its yield (to maturity) is 5%. 3. Calculate the price of a 60-day Treasury bill if its discount interest rate is 4%. The par value is $10,000. 4. A 6% coupon rate bond has a price of 105 (par 100). It paid its last coupon interest payment two months ago and will pay its next interest payment in four months. What is the approximate price including accrued interest that someone would pay to buy the bond today? 5. A 7% coupon bond is first callable in three years at 107. Draw a time line indicating the cash flows on this bond if called at 107 in three years, and calculate the yield to call if todays price is 111. 6. You want to invest in a bond to be held in your Roth IRA. There is a corporate bond yielding 5% and a tax-exempt bond yielding 3.75%. Besides the tax status, the maturity, credit risk and other details of these bonds are identical. Two part question: Which bond would be best for the Roth IRA and explain why? If the bonds will be in a taxable account, how would you decide which bond to choose? 7. There is a 6% coupon one-year bond and a 6% coupon 10-year bond that are both selling at par to yield 6%. If both yields rise 1%, what will be the price of the bonds? What does this tell you about the price volatility of short-term versus longer-term bonds? By regulation, a money market mutual fund must have an average maturity of 90 days or less. What does this tell you about the price volatility of money market funds? 8. A couple wants to buy a $200,000 home. If they can attain a 6% 30-year fixed rate conventional mortgage, what will be their monthly payment for P&I (principal and interest)? Their full monthly payment is P&I plus payments for taxes and insurance, but P&I is the largest chunk. If rates rise to 7.5%, what would be their monthly P&I payment? What does this suggest about the impact of interest rates on the amount of housing the couple can afford? 9a. A 12% coupon, 18-year noncallable bond is priced at $126.50 to yield 9%. Its duration is 8.76 years. Estimate its price change based on modified duration alone from a 0.5% increase in interest rates. b. Would the actual price after the 0.5% change in rates be higher or lower than the price predicted by the bonds modified duration? Hint: Think about the bonds convexity, that is, the curvature of the price-yield relationship on a noncallable bond.

10. Using an EXCEL spreadsheet, calculate the duration of a 15-year 4% coupon rate bond if the yield to maturity is 6%. You may assume annual payments, if desired. Print the spreadsheet. Bond & Time Value of Money Problem Answers 1. PMT = $6/2 =$3, m = 14 x 2 = 28, FV = 100, PV = 115 16 = 115.5, i = 2.248 x 2 32

= 4.50% 2. 3. 4. PMT = 7/2 = 3.5, n = 6 x 2 = 12, FV = 100, i = 5/2 = 2.5; PV = $110.26 P = 100 60 (4) = 99.333 or $9,933.33 for $10,000 par 360

You pay Price + Accrued interest Accrued interest 2 ($3) = $1. So P + accrued interest = $105 + $1 = $106 6 1 3.5 (111) 3.5 3.5 2 3.5 3.5 3 110.5 3.5 + 107

5. 0

PV = 111, PMT = 3.5, FV = 107, n = 3 x 2 = 6; i = 2.59 x 2 = 5.18% 6.a. b. Corporate bond because returns are tax exempt in Roth IRA Compare pretax return to pretax return or after-tax return to after-tax return. If marginal tax rate is 28% then 5% x .72 = 3.6% after taxes (corp) vs. 3.75% after taxes (tax-exempt) P1yr = $99.05; PMT = 3, FV = 100, i = 7%/2 = 3.5, n = 1 x 2 = 2 P10yr = $92.89; PMT = 3, FV = 100, i = 3.5, n = 10 x 2 = 20 Price sensitivity increases with maturity. So, money market funds have essentially no interest rate risk.

7.

8. PV = $200,000, i = 6%/12 = 0.5% month, n = 30 x 12 = 360 month FV = 0; PMT = $1,199.10 PV = 200,000, i = 7.5/12 = .625, n = 360, FV = 0; PMT = $1,398.4 As interest rates rise, the amount of housing a family can afford decreases.

9.a. b.

Mod D = D/(1 + i/2) = 8.76/1.045 = 8.38 years p - ModD i P = -8.38(.005)(126.50) = -$5.30 A little higher due to positive convexity of noncallable bonds.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Chapter 12 @riskДокумент42 страницыChapter 12 @riskcrystalspring100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Case Questions For Contact Utilities and IDEO Service DesignДокумент1 страницаCase Questions For Contact Utilities and IDEO Service DesigncrystalspringОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- C02 - Reilly1ce Chapter2 Investment Analysis and Portfolio ManagementДокумент41 страницаC02 - Reilly1ce Chapter2 Investment Analysis and Portfolio ManagementMalik Amin100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- C03 Reilly1ceДокумент51 страницаC03 Reilly1ceMehar SheikhОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- IT Investment Decisions That Defy ArithmeticДокумент0 страницIT Investment Decisions That Defy ArithmeticcrystalspringОценок пока нет

- Cash FlowДокумент48 страницCash FlowcrystalspringОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Bond and Time Value ProblemsДокумент3 страницыBond and Time Value ProblemscrystalspringОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- CAPM Teaching NotesДокумент3 страницыCAPM Teaching NotescrystalspringОценок пока нет

- GE Case For GE-we Bring Good Things To LifeДокумент18 страницGE Case For GE-we Bring Good Things To LifecrystalspringОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Chap 1 The Equity Method of Accounting For InvestmentДокумент14 страницChap 1 The Equity Method of Accounting For InvestmentEunice Ang100% (2)

- Morgan StanleyДокумент20 страницMorgan Stanleyim_ash75% (4)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Chap 1 The Equity Method of Accounting For InvestmentДокумент14 страницChap 1 The Equity Method of Accounting For InvestmentEunice Ang100% (2)

- Chap 1 The Equity Method of Accounting For InvestmentДокумент14 страницChap 1 The Equity Method of Accounting For InvestmentEunice Ang100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Adv II-pro 25 + 27Документ8 страницAdv II-pro 25 + 27crystalspringОценок пока нет

- ACC 433 Copley CH 01Документ42 страницыACC 433 Copley CH 01crystalspringОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- CH 6Документ1 страницаCH 6crystalspringОценок пока нет

- ACC 433 Copley CH 01Документ42 страницыACC 433 Copley CH 01crystalspringОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- General Fund Budgetary Comparison ScheduleДокумент1 страницаGeneral Fund Budgetary Comparison SchedulecrystalspringОценок пока нет

- Omni MedSci Patent Suit Targeting Apple WatchДокумент21 страницаOmni MedSci Patent Suit Targeting Apple WatchMikey Campbell100% (1)

- #Caracol Industrial Park Social and Gender Impacts of Year One of #Haiti's Newest IFI-funded Industrial ParkДокумент46 страниц#Caracol Industrial Park Social and Gender Impacts of Year One of #Haiti's Newest IFI-funded Industrial ParkLaurette M. BackerОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Bangladesh Export Processing Zones AuthorityДокумент16 страницBangladesh Export Processing Zones AuthoritySohel Rana SumonОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Tcode GTSДокумент28 страницTcode GTSKishor BodaОценок пока нет

- Sept. 2021 INSET Notice and Minutes of MeetingДокумент8 страницSept. 2021 INSET Notice and Minutes of MeetingSonny MatiasОценок пока нет

- Sahih Bukhari Aur Imam Bukhari Ahnaf Ki Nazar MeinДокумент96 страницSahih Bukhari Aur Imam Bukhari Ahnaf Ki Nazar MeinIslamic Reserch Center (IRC)Оценок пока нет

- Part List Ms 840Документ32 страницыPart List Ms 840ZANDY ARIALDO VELANDIAОценок пока нет

- Pabillo Vs ComelecДокумент4 страницыPabillo Vs ComelecChokie BamОценок пока нет

- Adverse Claim For Transferred Rights Over Real PropertyДокумент2 страницыAdverse Claim For Transferred Rights Over Real PropertyFeEdithOronicoОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Samuel-659766347-Java Paragon Hotel and Residence-HOTEL - STANDALONEДокумент3 страницыSamuel-659766347-Java Paragon Hotel and Residence-HOTEL - STANDALONEsamuel chenОценок пока нет

- Interchange FeeДокумент3 страницыInterchange FeeAnkita SrivastavaОценок пока нет

- 7P's of Axis Bank - Final ReportДокумент21 страница7P's of Axis Bank - Final ReportRajkumar RXzОценок пока нет

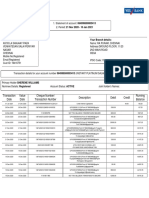

- Transaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalanceДокумент2 страницыTransaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running Balancesylvereye07Оценок пока нет

- Certificate of Conformity: No. CLSAN 080567 0058 Rev. 00Документ2 страницыCertificate of Conformity: No. CLSAN 080567 0058 Rev. 00annamalaiОценок пока нет

- Mindanao Pres Co. v. City Assessors G.R. No. L-17870Документ2 страницыMindanao Pres Co. v. City Assessors G.R. No. L-17870Liam LacayangaОценок пока нет

- Model Consortium Agreement For APPROVALДокумент34 страницыModel Consortium Agreement For APPROVALSoiab KhanОценок пока нет

- Why Baptists Are Not ProtestantsДокумент4 страницыWhy Baptists Are Not ProtestantsRyan Bladimer Africa RubioОценок пока нет

- Decongestion of PNP Lock-Up Cells DTD August 14, 2012 PDFДокумент3 страницыDecongestion of PNP Lock-Up Cells DTD August 14, 2012 PDFjoriliejoyabОценок пока нет

- Keeton AppealДокумент3 страницыKeeton AppealJason SmathersОценок пока нет

- Travel Request FormДокумент3 страницыTravel Request Formchkimkim0% (1)

- Residential Status PDFДокумент14 страницResidential Status PDFPaiОценок пока нет

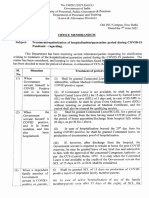

- DoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemicДокумент2 страницыDoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemictapansОценок пока нет

- Motion To Vacate Summary Eviction OrderДокумент3 страницыMotion To Vacate Summary Eviction OrderAlly MakambaОценок пока нет

- Letter To JP Morgan ChaseДокумент5 страницLetter To JP Morgan ChaseBreitbart NewsОценок пока нет

- Law University SynopsisДокумент3 страницыLaw University Synopsistinabhuvan50% (2)

- A. Abstract: "Same-Sex Adoption Rights"Документ12 страницA. Abstract: "Same-Sex Adoption Rights"api-310703244Оценок пока нет

- Mohnish Pabrai - ChecklistДокумент1 страницаMohnish Pabrai - ChecklistCedric TiuОценок пока нет

- Ballard County, KY PVA: Parcel SummaryДокумент3 страницыBallard County, KY PVA: Parcel SummaryMaureen WoodsОценок пока нет

- ASME B16-48 - Edtn - 2005Документ50 страницASME B16-48 - Edtn - 2005eceavcmОценок пока нет

- Clutario v. CAДокумент2 страницыClutario v. CAKrisha Marie CarlosОценок пока нет

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)