Академический Документы

Профессиональный Документы

Культура Документы

WEB Chapter 6 Office of The Fire Commissioner

Загружено:

Tessa VanderhartИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

WEB Chapter 6 Office of The Fire Commissioner

Загружено:

Tessa VanderhartАвторское право:

Доступные форматы

Department of Family Services and Labour Department of Finance

Ofce of the Fire Commissioner mmissioner s

Ofce of the Auditor General Manitoba

January 2013

195

Web Version V

Executive Management Carol Bellringer Brian Wirth Audit Team John Donnelly Jacqueline Ngai Dingding Song Jim Stephen

Ofce of the Fire Commissioner

Table of contents

Main points ..........................................................................................................199 Background .........................................................................................................201 Audit approach ...................................................................................................202 Findings ...............................................................................................................203

1. 2. 3. 4. 5. 6. The control environment was inadequate ................................................................ 203 The Provincial Comptroller took appropriate action ................................................. 204 Financial irregularities totalled over $300,000 ......................................................... 204 Claims did not comply with government and OFC policies ...................................... 205 Ineligible costs claimed under the Natural Resources Canada Agreement ............. 206

6.1 Oversight was inadequate ............................................................................................. 207 6.2 Tone at the top was inappropriate ................................................................................... 207 6.3 No action taken on complaint made to Human Resources ............................................. 208 6.4 Potential collusion by former senior OFC ofcials ........................................................... 208

Recommendations ..............................................................................................209 Response of ofcials ..........................................................................................210

Ofce of the Auditor General Manitoba

January 2013

197

Web Version

Governance framework failed .................................................................................. 207

Ofce of the Fire Commissioner

Main points

What we found

On July 29, 2011, the Minister of Finance requested that the Ofce of the Auditor General (OAG) perform a Special Audit of the Ofce of the Fire Commissioner (OFC) under Section 16 of The Auditor General Act. This request was made after nancial irregularities were found by the Provincial Comptroller. On August 2, 2011, we wrote a letter to the Minister of Finance accepting this request. We completed our audit in November 2012 and sent our detailed audit ndings to the Ministers of Finance and Family Services and Labour, as required by Section 16 (2) of our Act. We have prepared this summary in accordance with Section 16 (3) which allows us to submit a report to the Assembly if it is in the public interest to do so. We found nancial irregularities as described below, totalling over $300,000 for the records we were able to audit. Over several years, we believe OFC employees received payments they were not entitled to, that were supported with documents that may have been fabricated and in one instance may have been forged. Many payments were for personal expenses, amounts were claimed on more than one occasion, and in a number of instances payments were made with no supporting documentation at all or were supported by a manipulated receipt with details of the items purchased torn off the receipt. In addition, we found that OFC was not in compliance with government policy or even OFCs own policies for travel related expenses. We were also made aware of claims made to Natural Resources Canada that included salaries and other costs that did not relate to the project. The nancial irregularities involved several individuals in the OFC over an extended period of time. Our ndings suggested that the former senior OFC ofcials colluded to circumvent the requirement for the Deputy Minister to approve the former Fire Commissioners expense claims. Many accountable advances paid to the former Fire Commissioner were cleared off by expense claims submitted by other OFC staff and approved by the former Fire Commissioner. The irregularities were uncovered in 2011 when the Provincial Comptroller was notied that the former Fire Commissioners credit card was cancelled. The Provincial Comptroller took prompt action, asked the right, in-depth questions to uncover what had happened at OFC and used the services of Internal Audit and Consulting Services (IACS) to do an initial investigation and involved Labour Relations and the Civil Service Commission. In our view, the blame must be placed on the individuals directly involved in the nancial irregularities. But, it is important to analyze what went wrong in the system to permit this to take place. It is also important to discuss how the system can be strengthened to prevent and detect irregularities.

Ofce of the Auditor General Manitoba

January 2013

199

Web Version

Ofce of the Fire Commissioner

Our work to date has been focused on examining thousands of records to summarize details about the individual transactions and determine which were inappropriate. But, during the course of our work we also learned about other factors which contributed to the problem. We found that the control environment was inadequate and the governance framework failed. Oversight was inadequate, the tone at the top was inappropriate and the OFC Controllers position was changed which impacted the internal control system within OFC. The OFC Controller complained to Human Resources about these changes, but no action was taken on his complaint. We have recommended that the Minister of Finance forward our detailed audit ndings to Civil Legal Services. In addition, to ensure that the control environment across government is functioning as intended, we have recommended that the special operating agency governance model and effectiveness of The Whistleblower Protection Act be assessed and revised if necessary.

Web Version

200

Why it matters

This report shows the potential consequences to an organization where there are signicant weaknesses in its control environment and insufcient oversight over its nancial operations. A lack of adequate internal control leaves an organization vulnerable to the risk of asset misappropriation and unauthorized use of public funds.

January 2013

Ofce of the Auditor General Manitoba

Ofce of the Fire Commissioner

Background

OFC was designated as a Special Operating Agency (SOA) by regulation under The Special Operating Agencies Financing Authority Act effective April 1, 1996. At March 31, 2012, there were 17 SOAs operating in Manitoba. Each SOA produces an annual audited nancial statement. The Special Operating Agencies Financing Authority (SOAFA) consolidates the operations of the 17 SOAs in their nancial statements. According to SOAFAs Annual Report for 2011/12, SOAs are service operations within government which have been granted more direct responsibility for results and increased management exibility needed to reach new levels of performance. The aim of SOAs is to give greater authority and scope to managers and staff to enhance service and reduce the cost of government. Each SOA has an operating charter that outlines its governance and administrative arrangements. Accountability is assured through annual business plans, audits, and reports owing through its advisory board to SOAFA. SOAFA and its Chairperson operate under the direction of the Minister of Finance. OFC operates in accordance with an approved Charter within the Department of Family Services and Labour (formerly Labour and Immigration) and is bound by government policy except where specic exemptions have been provided for in its Charter. The Charter provides for an advisory board which is chaired by the Deputy Minister of Family Services and Labour. Other members to the advisory board are appointed by the Minister of Family Services and Labour. The Charter states that the role of the advisory board is to provide advice on OFCs strategic operations and on changes to its mandate, structure, business practices and nances. And, the advisory board reviews and comments on all of OFCs proposed business plans, quarterly and annual reports and charter revisions. The advisory board meets at least quarterly or at the call of the Chairperson. The Chairperson submits a copy of the approved minutes of each meeting to the Minister. OFCs mission, as stated in its Charter, is to safeguard both persons and property from re and life safety hazards through education, investigations and emergency response and code application. OFCs Charter also states that OFC continues as part of the Department of Family Services and Labour under the management and policy direction of the Deputy Minister and Minister. Further, OFCs redrafted Operating Charter now states that the Departments Executive Financial Ofcer (EFO) is responsible for the comptrollership function within the Department. As noted above, SOAFAs Annual Report states SOA accountability is assured through various reports owing through its advisory board to SOAFA. Therefore, there appears to be a contradiction between OFCs Charter and SOAFAs Annual Report concerning whether OFC is accountable to the Department or SOAFA. Finance ofcials have told us that SOAFA was never intended to have nancial accountability or comptrollership responsibilities for SOAs and that SOAFA is the nancing mechanism for SOAs only. They also stated SOAs are an arm within a Department and function on an operating and accountability basis under the direction of the Deputy Minister and Minister.

Ofce of the Auditor General Manitoba

January 2013

201

Web Version

Ofce of the Fire Commissioner

Audit approach

On July 29, 2011, the Minister of Finance requested the OAG to perform a Special Audit of OFC. On August 2, 2011, we wrote a letter to the Minister of Finance accepting this request. Following discussions with ofcials from the Department of Finance, we decided that the overall objective of the audit should be to determine the extent of funds reimbursable to the government from 5 OFC employees. The government is considering taking legal action, depending on the results of our audit. Our audit included the period from April 1, 2007 to July 31, 2011 and took place between August 2011 and November 2012. We examined expense claims, accountable advances, corporate credit card transactions, purchasing card transactions, and other travel related documentation, concerning the 5 OFC employees. We also examined email, eet vehicle and attendance reports.

Web Version

202

Our examination was performed in accordance with Investigative and Forensic Accounting (IFA) standards as recommended by the Canadian Institute of Chartered Accountants. IFA standards specically are designed for engagements that involve disputes or anticipated disputes, or where there are risks, concerns or allegations of fraud or other illegal or unethical conduct.

Scope limitation

We initially planned to examine OFC records from April 1, 2005 but our scope was limited due to OFCs Records Retention Policy to destroy records after four years. We were also unable to examine a number of expense claims that were missing from the period of our audit.

January 2013

Ofce of the Auditor General Manitoba

Ofce of the Fire Commissioner

Findings

We completed our audit in November 2012, and sent our detailed audit ndings to the Ministers of Finance and Family Services and Labour. Our ndings included evidence to support legal action against former employees of OFC. We have prepared this report for all members of the Legislature, to describe what we believe went wrong, so that they can implement appropriate changes to prevent such situations occurring elsewhere.

1.

The control environment was inadequate

Asset misappropriation schemes, in which an employee steals or misuses an organizations resources, often succeed because of inadequate internal controls. The 2012 Report to the Nations shows that asset misappropriation has the highest percentage of occurrence at 87%. Examples of asset misappropriation include expense reimbursement schemes where an employee makes a claim for reimbursement of ctitious or inated business expenses. Evidence was found that expense reimbursement schemes may have occurred at OFC. In an organization with a board of directors, management is accountable to the board. Many boards, often through its audit committee, have the authority and responsibility to question senior management regarding how they are carrying out their responsibilities and ensuring senior management are adhering to internal policies. With these powers, the board has a key role in dening expectations on integrity and ethical values and internal control responsibilities. The governance framework did not allow for sufcient oversight over OFC. The chief executive ofcer (CEO) of an organization is ultimately responsible for the effectiveness of the organizations internal control system. More than any other individual, the CEO sets the tone at the top that affects control environment factors. The former Fire Commissioner did not lead by example and showed poor leadership in his daily interactions with OFC staff. The impact that strong internal controls has in deterring fraud and limiting exposure if fraud does occur is certain, however, an internal control system, no matter how well designed

Ofce of the Auditor General Manitoba

January 2013

203

Web Version

According to the Association of Certied Fraud Examiners (ACFE) 2012 Report to the Nations on Occupational Fraud and Abuse, lack of internal controls was the most frequently cited factor that contributed to a frauds occurrence. Thirty-ve percent of respondents to the ACFE survey cited inadequate internal controls as the primary contributing factor in the frauds they investigated. Lack of internal controls was followed by override of existing internal controls (19%), lack of management review (18%) and poor tone at the top (9%) as the most important contributing factors to a fraud. All these factors from the ACFE survey were weaknesses found at OFC.

Ofce of the Fire Commissioner

and operated, can provide only reasonable assurance that fraud will be prevented. This is because even the best system of internal control cant prevent collusion between 2 or more people who are in positions to circumvent internal control procedures. But there are ways to reduce this risk, for example, by exercising proper oversight and through other mechanisms, including diligent follow-up of complaints and supporting whistleblowers. Evidence of potential collusion was found during our audit of OFC, and a complaint was not followed up.

2.

The Provincial Comptroller took appropriate action

Web Version

The Provincial Comptroller was contacted when the former Fire Commissioners credit card was cancelled because a payment had not been made. The Provincial Comptroller took prompt action. She reviewed the credit card statements and asked the right in depth questions to uncover what had happened at OFC. She used the services of Internal Audit and Consulting Services to do an initial investigation and involved Labour Relations and the Civil Service Commission. In our view, had the Provincial Comptroller accepted the initial explanations given to her, the irregularities might not have been uncovered. The government took action against the employees directly involved in the irregularities.

3.

Financial irregularities totalled over $300,000

We were only able to audit documents from April 1, 2007 to July 2011, because all previous documents were destroyed in accordance with OFCs Records Retention Policy. Also, a number of expense claims were missing. For the records we were able to audit, we found nancial irregularities totalling over $300,000. We do not know the amount for previous years and missing expense claims. We did not include other amounts that appeared to be legitimate but which may have been unnecessary had expenditures been better controlled. Over several years, individuals in OFC received payments they were not entitled to, that were supported with documents that may have been fabricated and in one instance may have been forged. Travel related expenses which we believe were fabricated, consisted of meal per diems, private accommodation, private vehicle mileage and incidental expenses, none of which require a receipt. Government vehicles were assigned or available to these staff so it is questionable why they used their own vehicle. Many payments were for personal expenses, amounts were claimed on more than one occasion, and in a number of instances payments were made with no supporting documentation at all or were supported by a manipulated receipt with details of the items purchased torn off the receipt. For a number of accountable advances, the expense claim submitted equalled the exact rounded number amount of the advance, which is very unusual.

204

January 2013

Ofce of the Auditor General Manitoba

Ofce of the Fire Commissioner

4.

Claims did not comply with government and OFC policies

SOAs, such as OFC, are bound by government policy except where specic exemptions have been provided in OFCs Operating Charter. Government policy and procedures are set out in the Financial Administrative Manual (FAM) and the General Manual of Administration (GMA). We found that OFC was not in compliance with government policy or even OFCs own polices in a number of areas. Accountable advances were frequently used. In many instances the intended purpose of accountable advances was changed when the supporting claim was submitted, without any approved formal documentation to support the change. This is in contravention of OFCs own policy on accountable advances which states that the employee is responsible for the use of the advance in accordance with the reason for the advance. Many of the advances made to the former Fire Commissioner were cleared off by an expense claim of other OFC staff members. The former Fire Commissioners expense claims were approved by the Deputy Minister. Expense claims for the other OFC staff members were approved by the former Fire Commissioner. OFCs Charter does not specically exempt OFC from the GMA concerning Travel and Related Expenses therefore the GMA and FAM policy directives apply to OFC. GMA section 2.1 - Travel and Related Expenses states that expenditures included on expense claims require original receipts, not photocopies and receipts may not be altered or defaced in any way. Complete details, including dates and details of the purchase, should appear on the receipt. OFC was not in compliance with this section of the GMA as follows: some expense claims had no supporting receipts at all. amounts were supported with debit or credit card transaction slips only so there was no evidence of the items purchased. amounts were supported with personal credit card statements only so there was no evidence of the items purchased. amounts were supported by manipulated receipts with details of the items purchased torn off the receipt. amounts were supported by photocopies of receipts.

GMA section 2.1 includes direction for claiming private accommodation expenses incurred. In part 3 of this section the GMA states that an employee will be reimbursed for necessary accommodation expenses incurred when travelling on government business and that claims may not exceed actual costs. For private accommodation, the GMA states that the employee may make a gift in the form of food, drink or related items as a thank-you to the host or hostess. Details of the nature of the kind of gift, together with the amount, must be shown on the expense account if claimed but receipts are not required. The procedure followed at OFC was that if an employee stayed with friends or relatives they would claim an amount such

Ofce of the Auditor General Manitoba

January 2013

205

Web Version

Ofce of the Fire Commissioner

as $80 for each night and pocket the money and there was no expectation that the amount claimed should have been paid to the host or hostess. OFC was not in compliance with this section of the GMA since there were no details of the nature or kind of gift documented on the expense claims for private accommodation amounts claimed. Also, if there was no actual expense incurred the amount should not have been allowed for reimbursement. GMA section 2.1 and FAM section 8B-Appendix A include policies and procedures for the American Express corporate travel charge card (Amex). The government has contracted with American Express for the provision of a corporate travel charge card system. The system is the preferred method for paying eligible travel expenses and was intended to replace the use of accountable advances for travel-related purposes. Individual cardholders are responsible for the corporate card issued in their name and should claim reimbursement for authorized expenses on expense claims. Upon reimbursement, the cardholder is responsible to pay the balance of the card on a timely basis to avoid late payment fees, which are the responsibility of the cardholders. Amex cards are to be used for legitimate business purpose only and personal expenses should be avoided at all times. Cardholders are to ensure that the card is used directly with the merchant wherever possible and cash advances should be kept to a minimum. OFC was not in compliance with the GMA and FAM since, in many instances, OFC was paying the balances on the Amex cards, not the cardholder. The former Fire Commissioner used his Amex card extensively for cash advances and personal expenses. Amex charges are available to the Procurement Services Branch (PSB) of the Department of Manitoba Infrastructure and Transportation. It was PSB that contacted the Provincial Comptroller when the former Fire Commissioners credit card was cancelled. Currently, it is a departments role to ensure Amex cardholders adhere to policy and procedure. The PSB is also in a position to conduct a more thorough review of credit card transactions to detect irregularities. IACS has made various recommendations to strengthen the oversight role of the PSB. The former Fire Commissioner also received a number of accountable advances. Air travel and most hotel charges for OFC can be processed through the OFC Business Travel Account. Also, he was assigned a government vehicle and a fuel purchase card. With all these payment options available to him it is inconceivable that he would require cash advances and accountable advances to the extent he did, for legitimate business expenses.

Web Version

5.

Ineligible costs claimed under the Natural Resources Canada Agreement

OFC and Natural Resources Canada entered into a contribution agreement under the Green Building Promotion. Over the 3 year period of the agreement, OFC submitted claims of $950,000 to Natural Resources Canada. OFC ofcials told us these claims included salaries and other costs that did not relate to the project. These claims had been prepared under the direction of former OFC staff. Current OFC ofcials advised Natural Resources Canada and

206

January 2013

Ofce of the Auditor General Manitoba

Ofce of the Fire Commissioner

discussions are taking place to determine the amount to be paid back to Natural Resources Canada. OFCs audited nancial statements for the year ended March 31, 2012, include an amount of $856,000 in accrued liabilities concerning this matter.

6.

Governance framework failed

There were a number of reasons for these nancial irregularities to occur over several years without being detected. There were governance issues, including a lack of proper oversight. There were serious leadership issues within OFC. No action was taken when OFCs Controller brought his concerns to the Departments Director of Human Resources Services. And, evidence was found that former senior OFC ofcials may have colluded to circumvent the procedure for the Deputy Minister to approve the former Fire Commissioners expenses.

6.1

Oversight was inadequate

As an SOA, OFC is allowed to establish its own policies which may differ from the GMA. OFC can establish its own bank account and can retain annual prots for future spending. This differs from government departments whose budgets are approved annually and unused funds lapse and are returned to the governments consolidated fund. OFC operates like a crown corporation, where they have more freedom to make decisions without central government approvals. SOAs are not governed by a board of directors but they do have advisory boards. OFC is housed within the Department of Family Services and Labour (formerly Labour and Immigration). The Deputy Minister and the Departments Executive Financial Ofcer (EFO) have responsibilities for nancial oversight of OFC. The Deputy Minister was also the Chair of OFCs advisory board, during our audit period. The role of OFCs advisory board is to provide advice on OFCs strategic operations and on changes to its mandate, structure, business practices and nances. This governance structure did not provide for sufcient oversight over OFC.

6.2

Tone at the top was inappropriate

The Chief Executive Ofcer, or in the case of OFC, the Fire Commissioner, is ultimately responsible for the effectiveness of the entitys internal control environment. The Fire Commissioner sets the tone at the top and should lead by example. The tone at the top extending down from senior ofcials was that OFC did not have to play the same game expected of public servants in departments. Senior OFC ofcials were under the impression the Minister and Deputy Minister would protect them even when the Provincial Comptroller began asking questions and IACS started the internal audit. The former Fire Commissioner showed poor leadership in his daily interactions with OFC staff. The former Fire Commissioners predecessor had also set a poor tone in the OFC.

Ofce of the Auditor General Manitoba January 2013 207

Web Version

Ofce of the Fire Commissioner

6.3

No action taken on complaint made to Human Resources

Several years ago, OFCs Controller went to the Director of Human Resource Services with a complaint concerning spending habits at OFC and changes being made to the normal oversight responsibilities of the Controller position. For example, the Controller was no longer responsible to examine and approve expense claims. Instead, expense claims were to be processed by an accounting clerk. The Controller believed the changes being made to his position would seriously impact the internal control system within OFC. Unfortunately, the Director of Human Resource Services did not take any action on this matter. The Director of Human Resource Services told us that he did not fully understand the seriousness and implications of the complaint brought forward by the Controller. The Director also told us that he left a voice mail message with an analyst at Treasury Board to discuss the matter but the discussion never occurred. The Controller did not pursue the matter any further and did not le a complaint under The Public Interest Disclosure (Whistleblower Protection) Act.

Web Version

The Whistleblower Protection Act has been in place since 2007. The Controller and others with concerns could have approached the Designated Ofcers in their department or the Ombudsman as provided for in the Act. We believe that it would be prudent for government to ensure that The Whistleblower Protection Act is functioning as intended.

6.4

Potential collusion by former senior OFC ofcials

Many of the advances made to the former Fire Commissioner were cleared off by an expense claim of other OFC staff members. We believe these expense claims may have been fabricated by OFC staff at the insistence of the former Fire Commissioner. Most of these potential fabricated claims consisted of meal per diems, private accommodation, private vehicle mileage and incidental expenses, none of which require a receipt. The Fire Commissioners expenses are supposed to be approved by the Deputy Minister. However, many of the former Fire Commissioners advances were cleared off by these potential falsied expense claims submitted by other OFC staff. The claims were approved by the former Fire Commissioner therefore bypassing the Deputy Ministers approval requirement.

208

January 2013

Ofce of the Auditor General Manitoba

Ofce of the Fire Commissioner

Recommendations

We believe that the following recommendations are necessary to follow up the nancial irregularities at OFC and also to prevent similar situations from occurring elsewhere. Recommendation 1: We recommend that the Minister of Finance forward our detailed audit ndings to Civil Legal Services.

Recommendation 2: We recommend that the Special Operating Agency governance model be assessed, and revised if necessary.

Recommendation 3: We recommend that The Public Interest Disclosure (Whistleblower Protection) Act be assessed, and revised if necessary.

Recommendation 4: We recommend that the Internal Audit and Consulting Services report recommendations on strengthening the oversight role of the Procurement Services Branch be implemented, as appropriate.

The Internal Audit and Consulting Services Branch of the Department of Finance has also made recommendations for improvement to the comptrollership function and control environment at OFC. We will be reviewing their work when we follow-up this report.

Ofce of the Auditor General Manitoba

January 2013

209

Web Version

Ofce of the Fire Commissioner

Response of ofcials

1. We recommend that the Minister of Finance forward our detailed audit ndings to Civil Legal Services. Response: The Province agrees with this recommendation and has provided the necessary information to Civil Legal Services for their action. 2. We recommend that the Special Operating Agency governance model be assessed, and revised if necessary. Response: We agree with the recommendation of the Auditor General. We have already taken steps to review the SOA governance structure across government, and will clarify the roles of the department, the SOA Boards, and the SOAFA in the overall accountability structure of SOAs. 3. We recommend that The Public Interest Disclosure (Whistleblower Protection) Act be assessed, and revised if necessary. Response: The government does not agree with this recommendation. Provincial legislation is continually assessed for effectiveness and improvement, and concluding that The Public Interest Disclosure (Whistleblower Protection) Act needs assessing and revising, as a result of someone not accessing it to make a disclosure, is not appropriate. The Province feels it has strong policies and procedures in place to support this legislation, and to ensure effective awareness of this legislation exists. 4. We recommend that the Internal Audit and Consulting Services report recommendations on strengthening the oversight role of the Procurement Services Branch be implemented, as appropriate. Response: The government agrees with this recommendation. Steps are already underway to implement various recommendations that will increase the functional oversight and monitoring role of the Procurement Services Branch over departments and SOAs procurement practices.

Web Version

210

January 2013

Ofce of the Auditor General Manitoba

Вам также может понравиться

- Throne Speech 2016Документ6 страницThrone Speech 2016Tessa VanderhartОценок пока нет

- Gilbert Moise Inquest Report November 4 2016 HarveyДокумент15 страницGilbert Moise Inquest Report November 4 2016 HarveyTessa VanderhartОценок пока нет

- Mainstreet/Postmedia September PollДокумент19 страницMainstreet/Postmedia September PollTessa VanderhartОценок пока нет

- Protection Orders FAQДокумент2 страницыProtection Orders FAQTessa VanderhartОценок пока нет

- CAO McNeil Employment ContractДокумент15 страницCAO McNeil Employment ContractTessa VanderhartОценок пока нет

- Hemson Report On Winnipeg Growth FeesДокумент127 страницHemson Report On Winnipeg Growth FeesTessa VanderhartОценок пока нет

- Jets Full Broadcast ScheduleДокумент1 страницаJets Full Broadcast ScheduleTessa VanderhartОценок пока нет

- City of Winnipeg Biosolids MasterplanДокумент162 страницыCity of Winnipeg Biosolids MasterplanTessa Vanderhart100% (1)

- Victim Impact Statement - MONIAS, RonaldДокумент2 страницыVictim Impact Statement - MONIAS, RonaldTessa VanderhartОценок пока нет

- WRHA Compensation Disclosure 2015Документ336 страницWRHA Compensation Disclosure 2015Tessa VanderhartОценок пока нет

- TD Winnipeg International Jazz Festival ScheduleДокумент1 страницаTD Winnipeg International Jazz Festival ScheduleTessa VanderhartОценок пока нет

- Most Dangerous City - Mainstreet/Postmedia PollДокумент35 страницMost Dangerous City - Mainstreet/Postmedia PollTessa VanderhartОценок пока нет

- City of Winnipeg Compensation Disclosure 2015Документ151 страницаCity of Winnipeg Compensation Disclosure 2015Tessa Vanderhart100% (1)

- Victim Impact Statement - MARTIN, AmandaДокумент3 страницыVictim Impact Statement - MARTIN, AmandaTessa VanderhartОценок пока нет

- Food Security IUSДокумент22 страницыFood Security IUSTessa VanderhartОценок пока нет

- Clunis Statement On RetirementДокумент1 страницаClunis Statement On RetirementTessa VanderhartОценок пока нет

- 2016-17 Jets Regular Season ScheduleДокумент1 страница2016-17 Jets Regular Season ScheduleChrisDcaОценок пока нет

- Robert Joubert Tribute (Sentencing Hearing)Документ3 страницыRobert Joubert Tribute (Sentencing Hearing)Tessa VanderhartОценок пока нет

- Rejeanne Joubert - Victim Impact Statement - February 4, 2016Документ1 страницаRejeanne Joubert - Victim Impact Statement - February 4, 2016Tessa VanderhartОценок пока нет

- Mainstreet Poll, Manitoba March 31Документ16 страницMainstreet Poll, Manitoba March 31Tessa VanderhartОценок пока нет

- NDP Costed PlatformДокумент1 страницаNDP Costed PlatformTessa VanderhartОценок пока нет

- 2015 Police Survey ResultsДокумент72 страницы2015 Police Survey ResultsMetro English CanadaОценок пока нет

- Daniel Joubert - Victim Impact Statement - February 4, 2016Документ1 страницаDaniel Joubert - Victim Impact Statement - February 4, 2016Tessa VanderhartОценок пока нет

- Victim Impact Statement Prepared by RichardДокумент2 страницыVictim Impact Statement Prepared by RichardTessa VanderhartОценок пока нет

- Christine Joubert - Victim Impact Statement - February 4, 2016Документ3 страницыChristine Joubert - Victim Impact Statement - February 4, 2016Tessa VanderhartОценок пока нет

- Mainstreet - Manitoba January 27Документ13 страницMainstreet - Manitoba January 27Tessa VanderhartОценок пока нет

- Bowman Letter To TrumpДокумент1 страницаBowman Letter To TrumpTessa VanderhartОценок пока нет

- Winnipeg School Division Safe and Caring PolicyДокумент14 страницWinnipeg School Division Safe and Caring PolicyTessa VanderhartОценок пока нет

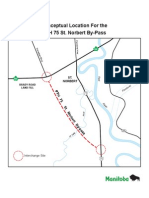

- St. Norbert BypassДокумент1 страницаSt. Norbert BypassTessa VanderhartОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Annual Reprot (PRIMETEX) 2018-2019. 03Документ84 страницыAnnual Reprot (PRIMETEX) 2018-2019. 03Trust Bank Investment LimitedОценок пока нет

- Introduction To Companies: Financial Accounting & Reporting 5Документ26 страницIntroduction To Companies: Financial Accounting & Reporting 5athirah jamaludinОценок пока нет

- Lecture Notes: Auditing Theory AT.0103-Fundamentals of Assurance and Non-Assurance EngagementsДокумент8 страницLecture Notes: Auditing Theory AT.0103-Fundamentals of Assurance and Non-Assurance EngagementsMaeОценок пока нет

- Full Test Bank For Information Technology Auditing 3Rd Edition Hall PDF Docx Full Chapter ChapterДокумент36 страницFull Test Bank For Information Technology Auditing 3Rd Edition Hall PDF Docx Full Chapter Chaptertrigraphlaudably.3i52id100% (12)

- Management Representation LetterДокумент2 страницыManagement Representation LetterrajuОценок пока нет

- ch07 Kecurangan, Pengendalian Internal, Dan KasДокумент72 страницыch07 Kecurangan, Pengendalian Internal, Dan KasEnsy QuОценок пока нет

- Risk AssessmentДокумент3 страницыRisk AssessmentsalmanОценок пока нет

- Accounting Textbook Solutions - 40Документ19 страницAccounting Textbook Solutions - 40acc-expertОценок пока нет

- PFMAR Getafe 2016Документ18 страницPFMAR Getafe 2016Jairus SociasОценок пока нет

- Field Attachment Report InsightsДокумент42 страницыField Attachment Report InsightsVictor Kamugisha73% (11)

- Completing The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/ElderДокумент41 страницаCompleting The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/ElderJohn BryanОценок пока нет

- JS Bank Annual Report 2012Документ210 страницJS Bank Annual Report 2012Toqeer Ahmad Raja100% (1)

- Formative Assessment 2 On ACAUD 2348Документ6 страницFormative Assessment 2 On ACAUD 2348kasandra lintonganОценок пока нет

- Audit Evidence, Procedures & DocumentationДокумент11 страницAudit Evidence, Procedures & DocumentationSteffany RoqueОценок пока нет

- Impact of Accounting Information Systems on Bank Performance in EthiopiaДокумент76 страницImpact of Accounting Information Systems on Bank Performance in EthiopiaAddishiwot GebeyehuОценок пока нет

- Appendix 11ABДокумент4 страницыAppendix 11ABJohn PickleОценок пока нет

- Audit OpinionДокумент39 страницAudit OpinionJerah TorrejosОценок пока нет

- Icaap Policy 2015Документ24 страницыIcaap Policy 2015Dipesh GautamОценок пока нет

- Engagement LetterДокумент2 страницыEngagement LetterNelnel GarciaОценок пока нет

- Government Auditing and Accounting SystemДокумент22 страницыGovernment Auditing and Accounting SystemKenneth Delos Santos100% (2)

- Wilcon Ar2019 PDFДокумент106 страницWilcon Ar2019 PDFJohn DoughОценок пока нет

- ISA 315 Revised 2019 Updated 2022Документ228 страницISA 315 Revised 2019 Updated 2022Lâm Nguyễn TiếnОценок пока нет

- Planning Audit Risk AssessmentДокумент8 страницPlanning Audit Risk AssessmentCiel ArvenОценок пока нет

- Auditing and Assurance Services A Systematic Approach 10th Edition Messier Test BankДокумент54 страницыAuditing and Assurance Services A Systematic Approach 10th Edition Messier Test Banka742835559Оценок пока нет

- HO2-B - Risk-Based Audit of Financial Statements Part 2 (Risk Assessment)Документ10 страницHO2-B - Risk-Based Audit of Financial Statements Part 2 (Risk Assessment)Jaynalyn MonasterialОценок пока нет

- Audit of Local Bodies PDFДокумент4 страницыAudit of Local Bodies PDFSriram BastolaОценок пока нет

- PT Berlina Tbk 2018 FinancialsДокумент159 страницPT Berlina Tbk 2018 Financialssetiadi nuryonoОценок пока нет

- Csopf Final 2019Документ580 страницCsopf Final 2019DamasceneОценок пока нет

- AIS Chapter 3 ReviewerДокумент4 страницыAIS Chapter 3 Reviewerrex martin guceОценок пока нет

- Wings of Hope 7-31-2022 Audited Financial StatementsДокумент17 страницWings of Hope 7-31-2022 Audited Financial StatementsWings of Hope EquitherapyОценок пока нет