Академический Документы

Профессиональный Документы

Культура Документы

IRS Publication 4531

Загружено:

Francis Wolfgang UrbanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IRS Publication 4531

Загружено:

Francis Wolfgang UrbanАвторское право:

Доступные форматы

401(k) Plan Checklist

This checklist is not a complete description of all plan requirements, and should not be used as a substitute for a complete plan review. every year it is important that you review the requirements for operating your 401(k) retirement plan. Use this checklist to help you keep your plan in compliance with many of the important rules. Click on (More) in any of the following questions for additional information (including examples) on how to find, fix, and avoid each mistake. see www.irs.gov/ep for online versions of the checklists, Fix-it Guides, and other resources for 401(k) and other plan types.

For Business Owners Use

(dO nOT s end This wOr ks he e T TO T he ir s )

1. has your plan document been updated within the past few years?

changes, the plan needs to be revised. (More)

Yes no

If your plan has not been updated to reflect recent law

6. were all eligible employees identified and given the opportunity to make an elective deferral election?

Yes no

By supplying your tax advisor with information regarding all employees who receive a Form W-2, you may reduce the risk of omitting eligible employees.

2. Are the plans operations based on the terms of the plan document?

problem encountered on audit. (More)

Yes no

(More)

Failure to follow the terms of the plan is a common

7. Are elective deferrals limited to the amounts under irC 402(g) for the calendar year?

Yes no

Failure to distribute deferrals in excess of the 402(g) limit

3. is the plans definition of compensation for all deferrals and allocations used correctly?

Yes no

may result in additional taxes and penalties to the participant and employer. (More)

Because your plan may use different definitions of compensation for different purposes, its important that you apply the proper definition according to your plan document. (More)

8. have you timely deposited employee elective deferrals?

gated from the employers assets. (More)

Yes no

You should deposit deferrals as soon as they can be segre-

4. were employer matching Yes no contributions made to all appropriate employees under the terms of the plan?

The terms of the plan must be followed when allocating employer matching contributions. (More)

9. do participant loans conform to the requirements of the plan document and irC 72(p)?

treated as a taxable distribution to the participant. (More)

Yes no

Defaulted loans or loans in violation of IRC 72(p) may be

5. has the plan satisfied the 401(k) Yes no nondiscrimination tests (AdP and ACP)?

Every 401(k) plan must satisfy yearly ADP/ACP nondiscrimination tests except for certain auto enrollment and 401(k) safe harbor plans. (More)

10. were hardship distributions made properly?

must be followed. (More)

Yes no

If a plan allows hardship distributions, the terms of the plan

if you answered no to any of the above questions, you may have made a mistake in the

operation of your 401(k) plan. This list is only a guide to a more compliant plan, so answering Yes to each question may not mean your plan is 100% compliant. Many mistakes can be corrected easily, without penalty and without notifying the irs.

contact your tax advisor visit the irs at www.irs.gov/ep

Publication 4531 (Rev. 11-2008) Catalog Number 48552T

call the irs at (877) 829-5500

IRS

Department of the Treasury Internal Revenue Service

Вам также может понравиться

- Research Paper On 401kДокумент4 страницыResearch Paper On 401kgw15ws8j100% (1)

- Institute and Faculty of Actuaries: Subject CT2 - Finance and Financial Reporting Core TechnicalДокумент9 страницInstitute and Faculty of Actuaries: Subject CT2 - Finance and Financial Reporting Core TechnicalPatrick MugoОценок пока нет

- Examiner's Report: F7 Financial Reporting December 2012Документ6 страницExaminer's Report: F7 Financial Reporting December 2012Selva Bavani SelwaduraiОценок пока нет

- 2010 Aicpa Newly Released Questions - Auditing: © 2010 Devry/Becker Educational Development Corp. All Rights ReservedДокумент56 страниц2010 Aicpa Newly Released Questions - Auditing: © 2010 Devry/Becker Educational Development Corp. All Rights Reservedjklein2588Оценок пока нет

- FR MJ20 Detailed CommentaryДокумент4 страницыFR MJ20 Detailed Commentarylananhgau1603Оценок пока нет

- Thesis On Internal Revenue AllotmentДокумент5 страницThesis On Internal Revenue Allotmentafkojbvmz100% (2)

- Fall 07Документ12 страницFall 07IRSОценок пока нет

- Sttart Up Company 2012 ArticleДокумент5 страницSttart Up Company 2012 ArticleResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910Оценок пока нет

- f6 Zaf PresentationДокумент26 страницf6 Zaf PresentationlmuzivaОценок пока нет

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Документ26 страницSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshОценок пока нет

- Supplemental Timekeeping Tips - 2013!12!18Документ24 страницыSupplemental Timekeeping Tips - 2013!12!18tikudesaiОценок пока нет

- Formalities For Setting Up A Small Business EnterpriseДокумент8 страницFormalities For Setting Up A Small Business EnterpriseMisba Khan0% (1)

- Examination: Subject SA3 General Insurance Specialist ApplicationsДокумент265 страницExamination: Subject SA3 General Insurance Specialist Applicationsscamardela79Оценок пока нет

- Common Audit Issues and What Do Benefits ProfessionalsДокумент78 страницCommon Audit Issues and What Do Benefits ProfessionalsAziz KhanОценок пока нет

- Edu 2015 10 Retdau Exam PMДокумент10 страницEdu 2015 10 Retdau Exam PMAyeshaAttiyaAliОценок пока нет

- Examiners' Report Principal Examiner Feedback January 2020Документ5 страницExaminers' Report Principal Examiner Feedback January 2020DURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFОценок пока нет

- QA Before Week 11 Tute PDFДокумент17 страницQA Before Week 11 Tute PDFShek Kwun HeiОценок пока нет

- Examiner's Report: P6 Advanced Taxation (UK) December 2011Документ6 страницExaminer's Report: P6 Advanced Taxation (UK) December 2011Adnan QureshiОценок пока нет

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)От EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Planning A Small-Scale Unit: Whom To Approach For What: Roject DentificationДокумент7 страницPlanning A Small-Scale Unit: Whom To Approach For What: Roject Dentificationsony0123Оценок пока нет

- Accounting QBДокумент661 страницаAccounting QBTrang VũОценок пока нет

- AF7 2022-23 Practice Test 1 (October 2019 EG) PDFДокумент25 страницAF7 2022-23 Practice Test 1 (October 2019 EG) PDFAnan Guidel AnanОценок пока нет

- WRAP ADBA AD Due Dilligence Template Final Password ProtectedДокумент46 страницWRAP ADBA AD Due Dilligence Template Final Password ProtectedJohn TauloОценок пока нет

- Planning A Small Scale UnitДокумент7 страницPlanning A Small Scale UnitShyam SharmaОценок пока нет

- Examiner's Report: Financial Reporting (FR) June 2019Документ10 страницExaminer's Report: Financial Reporting (FR) June 2019saad aliОценок пока нет

- Description: Tags: By08addevДокумент16 страницDescription: Tags: By08addevanon-574266Оценок пока нет

- Federal Incentives That Can Show You The Money & Increase Cash FlowДокумент23 страницыFederal Incentives That Can Show You The Money & Increase Cash FlowCBIZ Inc.Оценок пока нет

- Description: Tags: By08nsldsДокумент20 страницDescription: Tags: By08nsldsanon-582160Оценок пока нет

- Seattle Retirement System Request For Proposal For Private Equity ConsultantДокумент83 страницыSeattle Retirement System Request For Proposal For Private Equity ConsultantMCW0Оценок пока нет

- IAS 19, Employee Benefits - Publications - Members - ACCAДокумент3 страницыIAS 19, Employee Benefits - Publications - Members - ACCAWaqas Ahmad KhanОценок пока нет

- Framework ForДокумент32 страницыFramework ForAloy NireshОценок пока нет

- A Look at 401k Plan FeesДокумент17 страницA Look at 401k Plan Feesanalystc onsensusОценок пока нет

- Revised Methodology 23.12.2015Документ38 страницRevised Methodology 23.12.2015ykbharti101Оценок пока нет

- ATO Top 1000 - What Attracts Out AttentionДокумент15 страницATO Top 1000 - What Attracts Out Attention8nkwv7q272Оценок пока нет

- AICPA 2007 AUdit and AssuranceДокумент15 страницAICPA 2007 AUdit and AssuranceSara BautistaОценок пока нет

- Schenectady Co. IDA AuditДокумент20 страницSchenectady Co. IDA AuditCasey SeilerОценок пока нет

- C, Institute of Chartered Accountants of India (ICAI) in Its 2006 Concept Paper Expressed ItsДокумент4 страницыC, Institute of Chartered Accountants of India (ICAI) in Its 2006 Concept Paper Expressed Itssenthil3561Оценок пока нет

- AF7 2022-23 Practice Test 5 (February 2021 EG) PDFДокумент25 страницAF7 2022-23 Practice Test 5 (February 2021 EG) PDFAnan Guidel AnanОценок пока нет

- Erisa FaqДокумент2 страницыErisa FaqCA Rajendra Prasad AОценок пока нет

- Subcontractor SchedulingДокумент11 страницSubcontractor SchedulingionesqОценок пока нет

- SM ch04Документ54 страницыSM ch04Rendy Kurniawan100% (1)

- A Look at 401 (K) Plan Fees US DPT of LaborДокумент8 страницA Look at 401 (K) Plan Fees US DPT of Laborambasyapare1Оценок пока нет

- Financial Statement Analysis CourseworkДокумент8 страницFinancial Statement Analysis Courseworkpqltufajd100% (2)

- AF7 2022-23 Practice Test 3 (July 2020 EG) PDFДокумент26 страницAF7 2022-23 Practice Test 3 (July 2020 EG) PDFAnan Guidel AnanОценок пока нет

- Profit Sharing Standardized 401k Adoption AgreementДокумент2 страницыProfit Sharing Standardized 401k Adoption AgreementYiZhangОценок пока нет

- Homework Answers Hcost Accounting HandoutДокумент55 страницHomework Answers Hcost Accounting HandoutGbrnr Ia AndrntОценок пока нет

- CBDT - E-Filing - ITR-3 - Validation Rules - V2.0Документ62 страницыCBDT - E-Filing - ITR-3 - Validation Rules - V2.0aks1984Оценок пока нет

- Capital BugetingДокумент6 страницCapital BugetingMichael ReyesОценок пока нет

- f7 Examreport d13Документ6 страницf7 Examreport d13onlymfarazОценок пока нет

- Afm Examiner's Report March June 2022Документ15 страницAfm Examiner's Report March June 2022Abha AbhaОценок пока нет

- D23 SBR Examiner's ReportДокумент10 страницD23 SBR Examiner's ReportboratfordownloadОценок пока нет

- Shed PlansДокумент1 страницаShed PlansFrancis Wolfgang UrbanОценок пока нет

- Shed PlansДокумент1 страницаShed PlansFrancis Wolfgang UrbanОценок пока нет

- Shed Material List Part (1 of 9)Документ2 страницыShed Material List Part (1 of 9)nwright_besterОценок пока нет

- Figure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Документ1 страницаFigure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Francis Wolfgang UrbanОценок пока нет

- Shed PlansДокумент1 страницаShed PlansFrancis Wolfgang Urban50% (2)

- Shed PlansДокумент1 страницаShed PlansFrancis Wolfgang UrbanОценок пока нет

- Shed PlansДокумент1 страницаShed PlansFrancis Wolfgang UrbanОценок пока нет

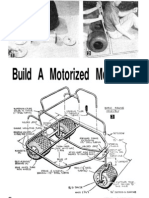

- 3 Wheel 2Документ5 страниц3 Wheel 2jii_907001Оценок пока нет

- Figure A Trusses: Inner (Common) Truss (9 Req'd)Документ1 страницаFigure A Trusses: Inner (Common) Truss (9 Req'd)Francis Wolfgang UrbanОценок пока нет

- Shed PlansДокумент16 страницShed PlansFrancis Wolfgang Urban100% (7)

- 25 Foot CabinДокумент28 страниц25 Foot Cabinapi-3708365100% (1)

- 15 Foot SailДокумент4 страницы15 Foot SailjdogheadОценок пока нет

- 10 Dollar Telescope PlansДокумент9 страниц10 Dollar Telescope Planssandhi88Оценок пока нет

- 6 Inch Reflector PlansДокумент12 страниц6 Inch Reflector PlansSektordrОценок пока нет

- 3inchrefractorДокумент6 страниц3inchrefractorGianluca SalvatoОценок пока нет

- IRS Publication Form Instructions 8853Документ8 страницIRS Publication Form Instructions 8853Francis Wolfgang UrbanОценок пока нет

- IRS Publication Form Instructions 2106Документ8 страницIRS Publication Form Instructions 2106Francis Wolfgang UrbanОценок пока нет

- IRS Publication Form Instructions 1099 MiscДокумент10 страницIRS Publication Form Instructions 1099 MiscFrancis Wolfgang UrbanОценок пока нет

- IRS Publication Form 8919Документ2 страницыIRS Publication Form 8919Francis Wolfgang UrbanОценок пока нет

- H17144 - Meghna Gupta, H17147 - Sanjana Deotale, H17164 - Shivam Sangani, H17171Документ2 страницыH17144 - Meghna Gupta, H17147 - Sanjana Deotale, H17164 - Shivam Sangani, H17171Bhoomika MansharamaniОценок пока нет

- Smoke-Free Workplace Policy & ProgramДокумент2 страницыSmoke-Free Workplace Policy & ProgramAlexcel CasanaОценок пока нет

- Work DesignДокумент47 страницWork DesignDeepali Singhai JainОценок пока нет

- Federal Bureau of Prisons Bop SeДокумент89 страницFederal Bureau of Prisons Bop SeashadОценок пока нет

- My Professional Development PlanДокумент3 страницыMy Professional Development Planapi-252938448Оценок пока нет

- 2018 ORA OHRA RevisionsДокумент2 страницы2018 ORA OHRA RevisionssuzetteОценок пока нет

- Special Topics in Construction Engineering Construction Labor and Manpower Planning Dale Angelo E. QuilatonДокумент10 страницSpecial Topics in Construction Engineering Construction Labor and Manpower Planning Dale Angelo E. Quilatonjun del rosarioОценок пока нет

- Coleman Lew + Assoc. - Response To Director of Schools Search RFPДокумент20 страницColeman Lew + Assoc. - Response To Director of Schools Search RFPDan LehrОценок пока нет

- Position Analysis Questionnaire (PAQ)Документ12 страницPosition Analysis Questionnaire (PAQ)Siam ArchaicОценок пока нет

- Kahn (1990) - Psychological Conditions of Personal Engagement and Disengagement at WorkДокумент33 страницыKahn (1990) - Psychological Conditions of Personal Engagement and Disengagement at Worknasir100% (5)

- Project Report of HRДокумент22 страницыProject Report of HRpusasrОценок пока нет

- OSHA 3124-12r 2003 - Stairways and LaddersДокумент15 страницOSHA 3124-12r 2003 - Stairways and LaddersJuan AcuñaОценок пока нет

- Theories of PersonalityДокумент33 страницыTheories of Personalitythatdendai2014100% (3)

- 20 Tips To Improve Employee Engagement and PerformanceДокумент4 страницы20 Tips To Improve Employee Engagement and PerformanceJenjen BautistaОценок пока нет

- 20140408Документ24 страницы20140408Kristy ElliottОценок пока нет

- Changes in Personal Status With Answer KeyДокумент17 страницChanges in Personal Status With Answer KeySimon Julius GozumОценок пока нет

- MGNEREGA and Rural DevelopmentДокумент5 страницMGNEREGA and Rural DevelopmentAmit kumarОценок пока нет

- ProposalДокумент3 страницыProposalMichelleОценок пока нет

- Black History OSSLT Literacy LessonsДокумент47 страницBlack History OSSLT Literacy Lessonsruinto8441Оценок пока нет

- Wasab Singh Negi (Assessment 2)Документ4 страницыWasab Singh Negi (Assessment 2)wasab negiОценок пока нет

- Project Charter Example: Appendix AДокумент5 страницProject Charter Example: Appendix ADRCB SQUARE CONSTRUCTIONОценок пока нет

- Executive Employment AgreementДокумент6 страницExecutive Employment AgreementRocketLawyerОценок пока нет

- Overview ThesisДокумент35 страницOverview ThesisCarizza Jane VergaraОценок пока нет

- 2015 Bar Examination Questionnaire For Labor LawДокумент6 страниц2015 Bar Examination Questionnaire For Labor LawJamaica Cabildo ManaligodОценок пока нет

- LPA120 Fees Exemptions RemissionsДокумент4 страницыLPA120 Fees Exemptions RemissionssriharshamysuruОценок пока нет

- Principles of Management Question BankДокумент53 страницыPrinciples of Management Question BankAruna KhanalОценок пока нет

- Police Management PhilosophyДокумент6 страницPolice Management PhilosophyNosliw NonayatnabОценок пока нет

- 1 Introduction To Labor Laws PDFДокумент56 страниц1 Introduction To Labor Laws PDFVia De JesusОценок пока нет

- FUNCTIONS OF THE ENTREPRENEUR: An Entrepreneur Performs All The Functions RightДокумент2 страницыFUNCTIONS OF THE ENTREPRENEUR: An Entrepreneur Performs All The Functions RightaminunishaОценок пока нет

- Malaysia ChinaДокумент41 страницаMalaysia ChinaLdynJfr100% (1)