Академический Документы

Профессиональный Документы

Культура Документы

Me

Загружено:

Patrick VoiceОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Me

Загружено:

Patrick VoiceАвторское право:

Доступные форматы

6-1

Chapter 6 Solutions Corporations: Redemptions & liquidations (2012) 38. a.

updated: August 8, 2011

Teal Corporation would have a taxable gain of $70,000 on the property distribution [$250,000 (fair market value) $180,000 (basis in property)]. The gain would be ordinary or capital depending on the type of property distributed. The E & P of Teal Corporation would be increased by $70,000 (the amount of gain to Teal) and decreased by $250,000 (the FMV of the property distributed). Teals E & P also would be decreased by the amount of tax due on the gain recognized. Grace would have dividend income of $250,000 and a basis in the property of $250,000. The tax consequences to Teal Corporation would be the same as in option a. Grace Corporation would have dividend income of $250,000, but only 20% of the $250,000, or $50,000, would be taxed to Grace. Because Grace Corporation has a 20% or more ownership interest in Teal Corporation, the 80% dividends received deduction is applicable. Grace Corporation would have a basis of $250,000 in the property. The tax consequences to Teal Corporation would be the same as in option a. Grace would have a capital gain of $180,000 [$250,000 (value of the property) $70,000 (basis in stock)] and a basis of $250,000 in the property received. The tax consequences to Teal Corporation would be the same as in option a. Grace Corporation would have a capital gain of $180,000 [$250,000 (value of the property) $70,000 (basis in stock)] and a basis of $250,000 in the property received. Assuming Grace is an individual, she would choose the qualifying stock redemption (option c.). If the distribution is a qualifying stock redemption, she has a capital gain of $180,000. If the distribution is a dividend, as in option a., she would have dividend income of $250,000. Her basis in the property received is the same whether the transaction is a dividend or a qualifying stock redemption. If Grace is a corporation, it would prefer that the distribution be a dividend because only 20% of the dividend would be taxed (option b.). Teal Corporation itself would have no preference because the tax consequences from the transaction are the same under each option.

b.

c.

d.

e.

pp. 6-3, 6-4, 6-12, 6-13, and 6-28 39. a. Julios tax liability would be $52,500, computed as follows: $500,000 (amount realized) $150,000 (basis in the 600 shares redeemed) = $350,000 (long-term capital gain) 15% = $52,500. Julios tax liability would be $75,000, computed as follows: $500,000 (dividend) 15% = $75,000.

b.

Example 1 40. a. Tax liability for a corporate shareholder would be $119,000, computed as follows: $500,000 (amount realized) $150,000 (basis in the stock) = $350,000 (long-term capital gain) 34% = $119,000. Corporations do not receive a preferential tax rate on long-term capital gains. Tax liability for a corporate shareholder on a $500,000 dividend from a corporation in which it has a 15% interest would be $51,000, computed as follows: $500,000 (dividend) $350,000 [70% (dividends received deduction) $500,000] = $150,000 34% = $51,000. Corporations do not receive a preferential tax rate on dividend income.

b.

Example 3 41. a. Julio may deduct the entire $110,000 capital loss carryover to offset $110,000 of the $350,000 long-term capital gain. Thus, Julio would be taxed on only $240,000 of gain.

6-2

Tax liability on the $240,000 long-term capital gain would be $36,000 ($240,000 15%). b. Julio could only deduct $3,000 of the $110,000 capital loss carryover. Julios tax liability on the $500,000 dividend received would be $75,000 ($500,000 15%). The preferred outcome in this situation is that which provides sale or exchange treatment (option a.). With a qualifying stock redemption, Julios tax liability is $39,000 less ($75,000 $36,000) than if the redemption is treated as a dividend.

c.

Example 2 42. a. The corporation could offset the entire $110,000 capital loss carryover against the $350,000 long-term capital gain. Thus, only $240,000 of the gain would be taxed. The tax liability would be $81,600 ($240,000 34%). The corporation could not deduct any of the $110,000 capital loss carryover. Corporations may only offset capital losses against capital gains. Thus, the corporation would have dividend income of $500,000 less a dividends received deduction of $350,000 (70% $500,000). The remaining $150,000 would be taxed at 34%, for a tax liability of $51,000.

b.

Example 3 and Chapter 2 43. a. Josephina owns 1,480 shares, 800 shares directly and 680 shares indirectly, in Magpie Corporation. Josephina is treated as owning the stock of her daughter (500 shares) and 60% of the 300 shares, or 180 shares, owned by Petrel Partnership. Siblings are not related parties under the 318 stock attribution rules, and the attribution rules do not apply to the stock held by a corporation if the shareholder owns less than 50% of the stock in the corporation. Josephina would now own 1,930 shares in Magpie Corporation, the 1,480 shares as computed in part a., above, plus 75% of the 600 shares, or 450 shares, owned by Tern Corporation.

b.

Exhibit 6.1 44. a. The distribution does not satisfy any of the qualifying stock redemption provisions; thus, Pedro has $175,000 of dividend income. After the redemption, Pedro owns 53.8% of the Indigo shares outstanding after the redemption [350 (postredemption shares owned) 650 (postredemption shares outstanding)]. This postredemption ownership interest fails the requirements for a disproportionate redemption or a complete termination redemption. Also, since Pedro still has dominant control of Indigo, there has not been a meaningful reduction of his ownership interest in Indigo. Thus, the transaction fails to qualify as a not essentially equivalent redemption. Pedros basis in the 350 shares redeemed attaches to the basis in his remaining Indigo shares. Thus, Pedro has a $119,000 basis in his remaining 350 shares. pp. 6-5 to 6-8 and Example 6 The distribution qualifies as a disproportionate redemption; thus, Pedro has a recognized long-term capital gain of $148,500 [$225,000 (amount realized) $76,500 (basis in shares redeemed)]. After the redemption, Pedro has an ownership interest in Indigo of 45.5% [250 (postredemption shares owned) 550 (postredemption shares outstanding)]. This ownership interest is less than 80% of his original ownership [45.5% < 56% (80% 70%)] and less than 50% of the total combined voting power. Example 9 The redemption cannot qualify as a complete termination redemption. John is deemed to own Edwards 1,000 shares, or 59% (1,000 1,700) of the remaining shares outstanding. The family attribution waiver does not apply because John failed to file the required notification agreement with his tax return for the year of the redemption.

b.

46.

a.

6-3

b.

While an acquisition by John of stock in Thrush by bequest or inheritance is not a prohibited interest, an acquisition by purchase is a prohibited interest. Even if the other requirements for the family attribution waiver are satisfied (e.g., John files the required agreement with the IRS), John has acquired a prohibited interest within the 10-year postredemption period. Thus, the redemption cannot qualify as a complete termination redemption. The redemption can qualify as a complete termination redemption. Retaining a creditor interest is not a prohibited interest. Thus, if the other requirements for the family attribution waiver are satisfied, the redemption completely terminates Johns ownership interest in Thrush.

c.

pp. 6-8 and 6-9 48. a. The transaction qualifies as a partial liquidation as to Sean, an individual shareholder. Under 302(b)(4), a distribution qualifies as a partial liquidation if it (1) is not essentially equivalent to a dividend (e.g., satisfies the termination of a business safe harbor test) and (2) is both pursuant to a plan and made within the plan (or succeeding) year. The distribution of proceeds from a sale of a trade or business that Crane Corporation owned and operated for the last five years (i.e., a qualified trade or business), coupled with the continued operation of another qualified trade or business after the distribution, satisfies the termination of a business test. Sean will receive sale or exchange treatment on the redemption resulting in a capital gain of $175,000 [$200,000 (amount realized) $25,000 (basis in stock redeemed)]. Crane Corporation reduces its E & P by $180,000 [20% (percentage of shares outstanding redeemed from Sean) $900,000 (E & P as of the date of distribution)] for the distribution to Sean. The distribution does not qualify as a partial liquidation as to Sean Corporation, because 302(b)(4) is limited to noncorporate shareholders. Instead, Sean Corporation will have dividend income equal to the entire distribution received, or $200,000. Because Sean Corporation will have a dividends received deduction of $160,000 ($200,000 80%) with respect to the redemption, only $40,000 of the distribution from Crane will be taxed. The $25,000 basis in the Crane Corporation stock redeemed attaches to Sean Corporations basis in its remaining shares of Crane stock. Crane Corporation reduces its E & P by $200,000, the amount of the dividend distribution.

b.

pp. 6-9, 6-10, and Examples 3, 14, 15, and 19 49. The distribution does not qualify as a redemption to pay death taxes as the fair market value of the Finch Corporation stock included in Tanyas estate does not exceed 35% of the value of the adjusted gross estate ($1.4 million $7 million = 20%). However, the distribution does qualify as a complete termination redemption, as all of the estates direct ownership interest in Finch is eliminated and there is no indirect (constructive) ownership in Finch attributed to the estate. (Taylor, the sole heir, has no ownership interest in Finch.) Sale or exchange treatment results and the estate recognizes no gain (or loss) [$1.4 million (amount realized) $1.4 million (stepped-up basis in stock)]. Finch Corporation reduces its E & P by $800,000 ($2 million preredemption E & P 40% stock redemption = $800,000). pp. 6-8 and 6-11 to 6-13 Since Bridgett owned a 20% or more interest in both Crane Corporation and Eagle Corporation, the fair market values of the two stocks are combined for purposes of the 35% of adjusted gross estate test. The redemption qualifies under 303 [$2,750,000 (combined stock value) exceeds $2,625,000 (35% $7.5 million adjusted gross estate)] to the extent of $750,000, the amount of death taxes and funeral and administration expenses. Since the estates basis in the Crane shares is stepped up to fair market value at date of death, the estate has no gain or loss on the stock redemption [$750,000 (proceeds qualifying for 303 treatment) $750,000 (estates basis in shares)]. pp. 6-11, 6-12, and Example 17 a. The transaction qualifies for sale or exchange treatment as a disproportionate redemption. Anns postredemption ownership interest of 29.4% [500 (postredemption

50.

51.

6-4

shares owned by Ann) 1,700 (postredemption shares outstanding)] satisfies both the 80% test [29.4% is less than 32% (80% 800/2,000) and the 50% test. As a result, Ann will recognize a long-term capital gain of $84,000 [$90,000 (amount realized) $6,000 (basis in 300 shares redeemed). Teal Corporations E & P is reduced by $90,000, the amount of the distribution {$90,000 is less than the limitation of $135,000 [15% (percentage of shares outstanding redeemed from Ann) $900,000 (E & P as of the date of distribution)]}. Examples 9 and 19 b. The transaction does not qualify for sale or exchange treatment. As a result of the stock attribution rules, Ann is deemed to own the shares owned by Bonnie, her daughter. Anns postredemption ownership interest of 64.7% [1,100 (500 postredemption shares owned directly + Bonnies 600 shares) 1,700 (postredemption shares outstanding)] fails to satisfy any of the qualifying stock redemption provisions. Ann therefore will recognize dividend income equal to the amount of the distribution, or $90,000. The $6,000 basis in the Teal Corporation stock redeemed attaches to Anns basis in her remaining shares of Teal stock. Teal Corporations E & P is reduced by $90,000, the amount of the dividend distribution. Example 10 and Chapter 4 Oriole Corporation would recognize gain of $110,000 [$420,000 (fair market value) $310,000 (basis)]. Under the general rule of 336(a), the land is treated as if it were sold for its fair market value. Since the land was a capital asset held for more than one year, Oriole has a $110,000 long-term capital gain. Oriole Corporation has a recognized long-term capital gain of $190,000 on the distribution. Under 336(b), when property distributed in a complete liquidation is subject to a liability of the liquidating corporation, the fair market value of that property is treated as not being less than the amount of the liability. Thus, the $310,000 adjusted basis in the land is subtracted from the $500,000 liability for a gain of $190,000.

56.

a.

b.

Example 23 and Chapter 2 58. Crow Corporation may recognize the entire loss realized on the distribution of the land to Ali, or $150,000 [$150,000 (value on date of distribution) $300,000 (basis)]. (The basis step-down rule does not apply, as there is no net built-in loss on the 351 transfer to Crow; thus, Crow will have a basis of $300,000 in the land.) The built-in loss limitation does not apply to the distribution to Ali, as there was a clear business reason for transferring the land to Crow Corporation. Further, the related-party loss limitation does not apply, as Ali is not a related party. pp. 6-18 to 6-22 and Example 32 The loss that occurred after the equipments acquisition by Grackle Corporation, or $90,000 [$200,000 (selling price) $290,000 (value on date of acquisition)], is recognized. The basis stepdown rules of 362(e)(2) would apply to give Grackle a $290,000 basis in the equipment [$360,000 (transferor shareholders basis) $70,000 (net built-in loss of property transferred)]. The equipment was acquired by Grackle in a contribution to capital transaction within 2 years of the adoption of the plan of liquidation and there was no clear business purpose for the acquisition. The built-in loss limitation applies to sales of such property pursuant to liquidation. However, there is no built-in loss after application of basis step-down rules. The related-party loss limitation does not apply to sales. pp. 6-18 to 6-22 and Example 31 Magenta does not recognize the loss on the distribution of assets to Fuchsia, its parent corporation. However, the $15,000 gain realized [$180,000 (fair market value) $165,000 (basis)] on the land distribution to Marta, a minority shareholder, is recognized. Fuchsia recognizes no gain or loss in the liquidation, and it has a carryover basis of $1,950,000 in the assets received. Magentas tax attributes (e.g., E & P) also carry over to Fuchsia. Fuchsias basis in the Magenta stock disappears. Marta recognizes a $145,000 gain [$180,000 (amount realized) $35,000 (basis of stock)] in the

59.

64.

6-5

liquidation, and she has a basis in the land of $180,000. pp. 6-24 to 6-27 and Concept Summary 6.2 66. Green Corporation recognizes no loss on the transfer of the land to satisfy its indebtedness to Orange Corporation. Transfers by a subsidiary corporation pursuant to a 332 liquidation are subject to the nonrecognition rules of 337. Orange Corporation, however, will recognize a gain of $15,000 [$200,000 (fair market value of the land) $185,000 (basis in the bonds)]. pp. 6-24 to 6-26 and Examples 36 and 37

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Blades in The Dark - Doskvol Maps PDFДокумент3 страницыBlades in The Dark - Doskvol Maps PDFRobert Rome20% (5)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Briefcase On Company Law Briefcase SeriesДокумент180 страницBriefcase On Company Law Briefcase SeriesAminath ShahulaОценок пока нет

- TCC Midc Company ListДокумент4 страницыTCC Midc Company ListAbhishek SinghОценок пока нет

- Cost Accounting Course GuideДокумент10 страницCost Accounting Course GuidePatrick VoiceОценок пока нет

- MineДокумент6 страницMinePatrick VoiceОценок пока нет

- Paper 2Документ1 страницаPaper 2Patrick VoiceОценок пока нет

- Job Order Vs Process Costing: Transparency Master 2-1Документ14 страницJob Order Vs Process Costing: Transparency Master 2-1Patrick VoiceОценок пока нет

- 12 4Документ2 страницы12 4Patrick VoiceОценок пока нет

- Mcom Cbcs LatestДокумент45 страницMcom Cbcs Latestanoopsingh19992010Оценок пока нет

- Ride Details Bill Details: Thanks For Travelling With Us, KarthickДокумент3 страницыRide Details Bill Details: Thanks For Travelling With Us, KarthickKarthick P100% (1)

- Perfect Substitutes and Perfect ComplementsДокумент2 страницыPerfect Substitutes and Perfect ComplementsVijayalaxmi DhakaОценок пока нет

- PUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFДокумент29 страницPUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFPraba Vettrivelu100% (1)

- Five Forces Analysis TemplateДокумент2 страницыFive Forces Analysis TemplateKedar JoshiОценок пока нет

- Five Key Sources of Critical Success FactorsДокумент2 страницыFive Key Sources of Critical Success FactorsHanako ChinatsuОценок пока нет

- Prime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutiveДокумент3 страницыPrime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutivesayalikОценок пока нет

- Book Building Process and Types ExplainedДокумент15 страницBook Building Process and Types ExplainedPoojaDesaiОценок пока нет

- Second Reading of Ordinance State Housing Law 01-05-16Документ16 страницSecond Reading of Ordinance State Housing Law 01-05-16L. A. PatersonОценок пока нет

- Mineral and Energy ResourcesДокумент4 страницыMineral and Energy ResourcesJoseph ZotooОценок пока нет

- Economics TopicsДокумент2 страницыEconomics Topicsatif_ausaf100% (1)

- FAR1 ASN01 Balance Sheet and Income Statement PDFДокумент1 страницаFAR1 ASN01 Balance Sheet and Income Statement PDFira concepcionОценок пока нет

- Reflections Fall 2010Документ84 страницыReflections Fall 2010campbell_harmon6178Оценок пока нет

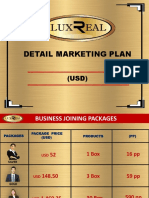

- Luxreal Detail Marketing Plan (2019) UsdДокумент32 страницыLuxreal Detail Marketing Plan (2019) UsdTawanda Tirivangani100% (2)

- 12 Jun 2019 PDFДокумент12 страниц12 Jun 2019 PDFAnonymous dy7g4jzo7Оценок пока нет

- IBM - Multiple Choice Questions PDFДокумент15 страницIBM - Multiple Choice Questions PDFsachsanjuОценок пока нет

- Stericycle Hazardous Waste LocationsДокумент2 страницыStericycle Hazardous Waste LocationsStericycleОценок пока нет

- Bank of IndiaДокумент3 страницыBank of IndiaRajesh Kumar SamalОценок пока нет

- Chapter Six: Designing Organizations For The International EnvironmentДокумент17 страницChapter Six: Designing Organizations For The International EnvironmentMohammed AlhashdiОценок пока нет

- 10.18.2017 LiabiltiesДокумент4 страницы10.18.2017 LiabiltiesPatOcampoОценок пока нет

- Blue Chip Stocks List: 3%+ Yields & 100+ Year HistoriesДокумент55 страницBlue Chip Stocks List: 3%+ Yields & 100+ Year HistoriesSonny JimОценок пока нет

- 10 Activity 1 MRLFJRDДокумент1 страница10 Activity 1 MRLFJRDMurielle FajardoОценок пока нет

- Survey highlights deficits facing India's minority districtsДокумент75 страницSurvey highlights deficits facing India's minority districtsAnonymous yCpjZF1rFОценок пока нет

- IRCTCs e-Ticketing Service DetailsДокумент2 страницыIRCTCs e-Ticketing Service DetailsOPrakash RОценок пока нет

- PRC Ready ReckonerДокумент2 страницыPRC Ready Reckonersparthan300Оценок пока нет

- 10th March: by Dr. Gaurav GargДокумент2 страницы10th March: by Dr. Gaurav GarganupamОценок пока нет

- Use The Following Information in Answering Questions 130 and 131Документ1 страницаUse The Following Information in Answering Questions 130 and 131Joanne FernandezОценок пока нет