Академический Документы

Профессиональный Документы

Культура Документы

Gaar and Fiis

Загружено:

Sunil SunitaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gaar and Fiis

Загружено:

Sunil SunitaАвторское право:

Доступные форматы

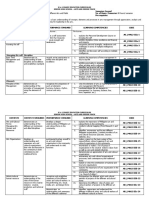

GAAR and FIIs: 5 key things you need to know

The deferral of the General Anti Avoidance Rules (GAAR) by the government to April 2016 has laid most foreign institutional investor (FII) concerns to rest as this provides enough time for investors to review their investment structures. The deferral is likely to support capital flows in the coming years. Finance Minister P Chidambaram said yesterday that GAAR would not apply to nonresident individuals who route their money through FIIs. The announcement came as a huge relief for investors who park their money in participatory notes (P-Notes) a derivative instrument that draws its value from investments made in Indian stocks floated by the FIIs. GAAR will make P-notes more attractive to foreign investors When announced in Budget 2012, investors had perceived GAAR as draconian as it targeted companies and investors routing money through tax havens such as Mauritius that allowed investors to use P-Notes for investing in India. However, the central governments approval of the major recommendations proposed by the Shome Committee now includes relief for non-resident investors using FII vehicles. While it is not clear whether investment through P-Notes will come under the antiavoidance regime, some experts believe it will surely make P-Notes more attractive to foreign investors since it hides their identity while routing black money. P-Notes allow foreign investors to invest in India without registering with the market regulator Sebi and are considered as a means of gaining quick exposure to the underlying Indian equity market. The total value of P-Notes in equity and debt currently is around 14 percent of the overall assets under the custody of FIIs. According to the latest data released by Sebi, the total value of P-Note investments in Indian markets rose to Rs 1.77 lakh crore at end-November after falling to a near three-year low of Rs 1.28 crore in May. GAAR deferral gives FIIs time to review their investment structures so that GAAR is not invoked at the time of exit

Daksha Baxi, ED-Taxation of Khaitan & Co, told CNBC-TV18 that the much awaited clarification on GAAR was a significant relief for FIIs as it gives them a chance to rejig their structures and ensure that GAAR will not be invoked when they sell. FIIs have recognised the governments need to prevent tax evasion and The clients are now getting smarter to arrange their affairs in such a manner that they can address GAAR as and when it becomes effective, Baxi added. FIIs and sub-accounts of FIIs taking advantage of tax treaty benefits will be subject to scrutiny under GAAR Tax residency certificates furnished by investors in the recently prescribed format would now be subject to verification for bonafide substance of the residency. This implies government would try and restrict the treaty benefit to investors who can prove the substance of their Mauritius residency. Under the India-Mauritius double tax avoidance treaty, capital gains can taxed in one country cant be tax in the other. Since taxes are minimal or zero in Mauritius, many investors use the Mauritius route to mitigate/nullify their tax liabilities in India. If an FII is investing from Mauritius or Cyprus or Singapore and if they claim the treaty benefit, they are prone to invocation of GAAR, explained Baxi. Pre-August 2010 investments would be grandfathered The finance minister said in a statement that only those investments made before the introduction of the Direct Taxes Code Bill 2010 in Parliament will be grandfathered meaning that investments before that date remain subject to the old rules. For such investments no questions on residency will also be asked. In other words, all those investments which have been made prior to August 2010, irrespective of when they are disposed of, will be not covered by GAAR and stand protected. Since the tax department can reopen cases from the past six years, this will ensure all investments made after August 2010 will be open to scrutiny under GAAR. GAAR will clearly overwrite tax treaties GAAR will override Indias tax treaties with countries such as Mauritius, but only if the tax arrangement is deemed impermissible. Hence, if an FII derives benefits from the double-taxation treaty, GAAR will override the treaty. This is likely to bring postbox structures and round-tripping of funds from tax havens under the scanner.

Inflation was still high and there was no room for monetary stimulus. When growth is slowing down you can stimulate the economy either by monetary easing or by fiscal stimulus, but both monetary and fiscal side have no room for stimulus. So that is the big concern, Everyone knows the difference between the Olympics and the Paralympics. In the former, we learn how the limits to human achievement are being regularly extended; in the latter, we learn the importance of being inclusive with differently-abled people. For obvious reasons, we dont mix the two games. It wouldnt be fair. The Indian stock market is a peculiar combo of the Olympics and the Paralympics where gifted and powerful athletes compete with the handicapped in the same race: the muscular foreign institutional investor (FII) competes with the skinny Indian investor. Little wonder Indians barely invest in equity. We are not pointing here to the unequal nature of the contest alone, but to the fact that if you want a genuinely robust market, the players need to be evenly matched. The Indian government has, however, been signalling repeatedly that it will not level the field for Indians. The most recent exhibit in this case is GAAR the General Anti-Avoidance Rules (GAAR) which have been deferred for two years for FIIs and anyone investing in India from the outside, directly or indirectly.

FIIs investing in India pay practically no tax now, and this will continue for two more years. Not only FIIs, but crooked Indians, who have money stashed abroad in tax havens, can use GAAR to evade Indian taxes. In short, the government in actually encouraging Indians to stash money abroad for two more years. But hapless aam Indian investors are subject to all the taxes of the land especially capital gains. The question is: why is the finance minister so indulgent towards foreign investors and nonresidents, when Indian taxpayers and investors are being told they have to pay more taxes higher taxes for the rich, strong anti-avoidance measures, possibly an estate duty on inheritance, maybe more capital gains and dividend taxes, and many other things? The answer, of course, is clear. Having run the Indian economy into the ground, where the rupee is being pulverised by a soaring current account deficit and high dollar demand, the

UPA finance minister has no option but to court foreign hot money flows and this means telling them GAAR will not apply. So, the short-term inequity in favour of FIIs is understandable. What is less acceptable is the long-term inequities built into the system, and also the dangers in depending on only FIIs for market growth. Just as it needs two legs to compete in the Olympics, it takes at least two for the Indian markets to rise to its true potential. The only way to move the markets based on genuine demand is by giving it two legs one FII and the other domestic. Heres what P Chidambaram, who is currently playing to market sentiment, can do to grow the other leg. First, he needs to convince the provident and pension funds that they should invest in equity. Indians will not invest in mutual funds due to the risks involved. But asking pension and provident funds to do so in a safe way by earmarking, say, 10 percent of the incremental corpus (or more, after obtaining subscriber consent), will minimise risk and improve returns. Currently, while the New Pension Scheme (NPS) has equity options, the Employee Provident Fund Organisation does not thanks to its composition. Many unions oppose investments in equity, but their objections can be got over with if the government can guarantee returns for the lowest-income subscribers. Second, avoid using the LIC as a dustbin for public sector stocks. Today, only the LIC has the size and long-term orientation to hold on to stocks for long periods without flinching. Unfortunately, Chidambaram is using the insurer to offload public sector stocks. The LIC has effectively been neutralised as an offset to FII funds. The market will behave in a manic-depressive way depending on which way FII funds are flowing. If they want in, we have a boom. If they want out, its out. But if domestic long-term money is available for stocks, including that of the LIC, the volatility of the stock markets will be lower. Third, taxation of capital gains can be both reduced and enhanced. If short-term and longterm capital gains are both levied tax at, say, 10 percent, the market would boom. Long-term gain can be treated slightly better by giving it cost indexation benefits. So instead of zero tax, investors would pay some tax, but it would be less than the 15 percent now paid on shortterm gains. Short-term players, now levied just 10 percent on gains, would trade more, bringing higher liquidity and paying more taxes overall.

Fourth, the securities transaction tax has worked well in India. It should not be tinkered with in the budget. Fifth, the dividend distribution tax has also worked very well. There is no need to fool around with rates as the government earns easy revenue that cannot be evaded by anyone. Sixth, all investments in any equity or balanced fund should receive the same 80C benefits as investments in equity-linked savings schemes (ELSS) or the hare-brained Rajiv Gandhi Equity Savings Scheme. The distinction between first-time investors and old investors which the latter tries to create is farcical and impossible to police. Mr Chidambaram needs to realise that India is not growing because Indians are not investing both as companies and individuals. Luring foreign players is silly when you cant get Indians themselves to invest in India. It can only increase our vulnerability to hot money flows. The Indian stock market will not grow in a healthy fashion if Indians do not invest in stocks. This should be Chidambarams prime consideration in this budget.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Systemantics - How Systems Work and Especially How They FailДокумент128 страницSystemantics - How Systems Work and Especially How They Failjoaquim_sanmarti7905100% (6)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Form 1040A Tax Credit DetailsДокумент3 страницыForm 1040A Tax Credit DetailsYosbanyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Документ15 страницPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- K to 12 Arts and Design Track Subject on Leadership and ManagementДокумент10 страницK to 12 Arts and Design Track Subject on Leadership and ManagementKarl Winn Liang100% (1)

- Freedom & MoneyДокумент16 страницFreedom & MoneyMisesWasRight100% (1)

- Beginners Guide To Financial Markets.Документ16 страницBeginners Guide To Financial Markets.AnishaAppuОценок пока нет

- Formal Offer To Sell (Napindan Property, Taguig City, Philippines)Документ5 страницFormal Offer To Sell (Napindan Property, Taguig City, Philippines)Anonymous XPcJbR56% (16)

- Cfa L1-Fra-7.1Документ27 страницCfa L1-Fra-7.1Sunil Sunita100% (1)

- Cfa L1-Fra-7.1Документ27 страницCfa L1-Fra-7.1Sunil Sunita100% (1)

- The Ultimate Sales Machine by Chet Holmes: Post NavigationДокумент7 страницThe Ultimate Sales Machine by Chet Holmes: Post NavigationPuneet MahiОценок пока нет

- Sample Balance Sheet Concierge Service IndustryДокумент12 страницSample Balance Sheet Concierge Service IndustrykpsrikanthvОценок пока нет

- Machine Learning Workflow EbookДокумент22 страницыMachine Learning Workflow EbookNguyen Thi Hoang GiangОценок пока нет

- How Does Cost of Carry Represent Bullishness or BearishnessДокумент1 страницаHow Does Cost of Carry Represent Bullishness or BearishnessSunil SunitaОценок пока нет

- How Does Cost of Carry Represent Bullishness or BearishnessДокумент1 страницаHow Does Cost of Carry Represent Bullishness or BearishnessSunil SunitaОценок пока нет

- Apple iPhone X and iPhone 8 ReviewДокумент157 страницApple iPhone X and iPhone 8 ReviewAnshul SaravgiОценок пока нет

- NiftyДокумент4 страницыNiftySunil SunitaОценок пока нет

- National in Come in IndiaДокумент41 страницаNational in Come in IndiaSunil SunitaОценок пока нет

- INFYДокумент4 страницыINFYSunil SunitaОценок пока нет

- Zinc MiniДокумент3 страницыZinc MiniSunil SunitaОценок пока нет

- NiftyДокумент4 страницыNiftySunil SunitaОценок пока нет

- BN NovДокумент1 страницаBN NovSunil SunitaОценок пока нет

- Funds Flow StatementДокумент9 страницFunds Flow StatementSunil SunitaОценок пока нет

- Unit Test 1 - Sept 2014 Bba Sem Iii Marketing Management - IiДокумент1 страницаUnit Test 1 - Sept 2014 Bba Sem Iii Marketing Management - IiSunil SunitaОценок пока нет

- Republic India CoinsДокумент4 страницыRepublic India CoinsSunil SunitaОценок пока нет

- BN OctДокумент19 страницBN OctSunil SunitaОценок пока нет

- C15.0021 Money, Banking, and Financial Markets: Professor A. Sinan Cebenoyan NYU-Stern-FinanceДокумент6 страницC15.0021 Money, Banking, and Financial Markets: Professor A. Sinan Cebenoyan NYU-Stern-FinanceSunil SunitaОценок пока нет

- ITM University's detailed academic calendar for 2014-15 Even SemesterДокумент3 страницыITM University's detailed academic calendar for 2014-15 Even SemesterSunil SunitaОценок пока нет

- 9 Juhi Ahuja 812 Research Communication MBA July 2012Документ13 страниц9 Juhi Ahuja 812 Research Communication MBA July 2012snreddy85Оценок пока нет

- Futures PrimersДокумент23 страницыFutures PrimersAnand KapadiaОценок пока нет

- SaharaДокумент3 страницыSaharaSunil SunitaОценок пока нет

- MBA-SemI Syllabus 80-20 PatternДокумент34 страницыMBA-SemI Syllabus 80-20 PatternSunil SunitaОценок пока нет

- Rupee May Be Heading Towards 70Документ3 страницыRupee May Be Heading Towards 70Sunil SunitaОценок пока нет

- Institutional Independence in IndiaДокумент39 страницInstitutional Independence in IndiaSunil SunitaОценок пока нет

- Lctr4.3 KJS UPNISHADSДокумент17 страницLctr4.3 KJS UPNISHADSSagaram ShashidarОценок пока нет

- Asia Pacific Market Report AP Equities in Correlated World June 2012Документ14 страницAsia Pacific Market Report AP Equities in Correlated World June 2012Sunil SunitaОценок пока нет

- Market Insight Risk MGMT and Macroeconomic Uncertainty October 2012Документ7 страницMarket Insight Risk MGMT and Macroeconomic Uncertainty October 2012Sunil SunitaОценок пока нет

- MITCДокумент1 страницаMITCSunil SunitaОценок пока нет

- User Manual For TR - VAT BForm ReportДокумент7 страницUser Manual For TR - VAT BForm ReportPrathamesh Bhingarde100% (1)

- Tax Invoice for Mobile Protection Plan and HandsetДокумент2 страницыTax Invoice for Mobile Protection Plan and HandsetMuhammed Jabis KОценок пока нет

- Tax Guide EstoniaДокумент9 страницTax Guide EstoniaIvan RomeroОценок пока нет

- Taxguru - In-How To Prepare Directors Report As Per Companies Act 2013Документ9 страницTaxguru - In-How To Prepare Directors Report As Per Companies Act 2013g26agarwalОценок пока нет

- Doku - Pub Entrep Business Plan ChurrosДокумент17 страницDoku - Pub Entrep Business Plan ChurrosPeejay CadizalОценок пока нет

- Top Brass RemunerationДокумент4 страницыTop Brass RemunerationJaspreetKaurОценок пока нет

- Construction Financial Business MangmentДокумент14 страницConstruction Financial Business MangmentMAGED MOHMMED AHMED QASEMОценок пока нет

- Invoice Dell PDFДокумент1 страницаInvoice Dell PDFprashant bachimattiОценок пока нет

- ACFrOgBfkBoiRJszOmdFhuS8P6k4A cO98JX2vRe4126n8qkQ 55MrwphGFcPDfwkNMXQoQ - 79H 3AybOD0Zw6MH17zIh h9b3u2CWDF4691W6dWpUdLUkpW5jZq60rrVjTzln29bnexP0mQThOP PDFДокумент14 страницACFrOgBfkBoiRJszOmdFhuS8P6k4A cO98JX2vRe4126n8qkQ 55MrwphGFcPDfwkNMXQoQ - 79H 3AybOD0Zw6MH17zIh h9b3u2CWDF4691W6dWpUdLUkpW5jZq60rrVjTzln29bnexP0mQThOP PDFCAIRA GAIL MALABANANОценок пока нет

- Nonprofit Law in The Philippines Council On FoundationsДокумент1 страницаNonprofit Law in The Philippines Council On Foundationsemployee assistanceОценок пока нет

- Ch2-Budget Constraints N ChoicesДокумент76 страницCh2-Budget Constraints N ChoicesthutrangleОценок пока нет

- TAX PART 1 Compiled PDFДокумент114 страницTAX PART 1 Compiled PDFArCee SantiagoОценок пока нет

- RMC No. 73-2018Документ3 страницыRMC No. 73-2018Madi KomoaОценок пока нет

- Topic: Consumer Attitude Towards Street Food and Restaurant FoodДокумент13 страницTopic: Consumer Attitude Towards Street Food and Restaurant FoodAnsh BajajОценок пока нет

- Lass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)Документ10 страницLass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)sandeep11116Оценок пока нет

- TAX Pages 949 969Документ4 страницыTAX Pages 949 969Ei Ar TaradjiОценок пока нет

- Hindustan Zinc Annual Report 2007-08 Highlights Industry-Leading GrowthДокумент108 страницHindustan Zinc Annual Report 2007-08 Highlights Industry-Leading GrowthabhishekiyОценок пока нет

- Emerging Trends in Retail BankingДокумент6 страницEmerging Trends in Retail Bankinganandsree12345100% (3)

- Supreme Court: Republic of The Philippines ManilaДокумент6 страницSupreme Court: Republic of The Philippines ManilaJopan SJОценок пока нет

- Sprint BillДокумент1 страницаSprint BillAveeОценок пока нет

- Heirs of Tancoco v. CAДокумент28 страницHeirs of Tancoco v. CAChris YapОценок пока нет

- Ratio Analysis of PIAДокумент16 страницRatio Analysis of PIAMalik Saad Noman100% (5)

- Plan Fiscal Del CRIMДокумент34 страницыPlan Fiscal Del CRIMEl Nuevo DíaОценок пока нет