Академический Документы

Профессиональный Документы

Культура Документы

US Elearning Market

Загружено:

im_isolatedОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Elearning Market

Загружено:

im_isolatedАвторское право:

Доступные форматы

Ambient Insight Comprehensive Report

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis

Large Revenue Opportunities and Erratic Buying Behavior in the Current Market

We Put Research into Practice

www.ambientinsight.com

Market Analysis by:

Sam S. Adkins, Chief Research Officer

Published: January 2011

To learn more about our research services, email: info@ambientinsight.com

Ambient Insight Copyright Policy: All rights reserved. All media and research data published by Ambient Insight are protected by copyright. Unauthorized use of Ambient Insight research without prior permission is prohibited. Ambient Insight research products provide valuable financial data only to the individual purchaser or the purchasing organization. Purchasers may not modify or repurpose the information and financial data in our research in any manner. Specific distribution rights are provided based on the license model granted at time of purchase. Quoting Ambient Insight Research: Permission is required to use quotes, tables, diagrams, or charts from Ambient Insight research in press releases, promotional material, external presentations, or commercial publications. Permission from Ambient Insight is required to reproduce or distribute in entirety any table, paragraph, section, or report.

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Table of Contents

List of Tables ............................................................................... 3 List of Figures .............................................................................. 5 Executive Overview ...................................................................... 7 Methodology, Scope, and Product Definitions ................................. 11

Scope .................................................................................................11 Product Definition .................................................................................12 Related Research .................................................................................13

2010-2015 Forecast and Analysis ................................................. 14

Supply-side Analysis .............................................................................14

IT-related Content .......................................................................................... 14 Non-IT Content .............................................................................................. 16 Custom Content Development Services ............................................................. 18 Learning Platform and Tool Hosting Services ...................................................... 19 Authoring Software and Tools........................................................................... 20 Installed Learning Platforms ............................................................................. 21

Demand-side Analysis ...........................................................................22

Consumer ...................................................................................................... 23 Federal Government ....................................................................................... 24

Federal Civilian Agencies .................................................................................... 25 Federal Military Agencies .................................................................................... 26

State and Local Government ............................................................................ 28

State Agencies .................................................................................................. 28 Local Government Agencies (County and Municipal) ................................................ 30

Academic and Vocational ................................................................................. 31

PreK-12 Primary and Secondary .......................................................................... 31 Tertiary, Vocational, Adult, and Higher Education ................................................... 40

Non-profit Universities and Colleges ............................................................................ 44 For-profit Career Colleges .......................................................................................... 45 For-Profit/Non-profit Vocational, Technical, & Trade Schools .......................................... 46

Corporations and Businesses ............................................................................ 48 NGOs, Non-Profits, and Associations ................................................................. 51 Healthcare ..................................................................................................... 52

Trends, Opportunities, and Threats ............................................... 57

Attracting Capital: 2009-2010 Private Investment Trends .................................... 57 Generating Revenues in a Slow Economic Recovery ............................................ 59 Deflecting the Threat of Product Substitution ..................................................... 62

Index of Suppliers ...................................................................... 64

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

List of Tables

Table 1 - 2010-2015 US Revenue Forecasts for Self-paced eLearning by Product Type (in $US Millions) .............................................................14 Table 2 - 2010-2015 US Revenue Forecasts for Self-paced eLearning IT-related Content by Buyer Segment (in $US Millions) ...............................15 Table 3 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Non-IT Content by Buyer Segment (in $US Millions) ...................................17 Table 4 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Custom Content Services by Buyer Segment (in $US Millions) .....................18 Table 5 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Platform Hosting Services by Buyer Segment (in $US Millions) .....................19 Table 6 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Authoring Software and Tools by Buyer Segment (in $US Millions) ...............20 Table 7 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Installed Learning Platforms by Buyer Segment (in $US Millions) .................21 Table 8 - 2010-2015 US Revenue Forecasts for Self-paced eLearning by Buyer Segment (in $US Millions) .........................................................22 Table 9 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Content in the Consumer Segment by Content Subject Matter (in $US Millions) ................................................................................................24 Table 10 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Combined Federal Government Segment (in $US Millions) ....................................................................................25 Table 11 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Federal Civilian Government Agency Segment (in $US Millions) .......................................................................26 Table 12 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Federal Military Government Agency Segment (in $US Millions) .......................................................................27 Table 13 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the State Government Segment (in $US Millions) ................................................................................................29 Table 14 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Local Government Segment (in $US Millions) ................................................................................................30 Table 1 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the PreK-12 Academic Segment (in $US Millions) ................................................................................................31 Table 2 Total 20102015 Number of US PreK-12 Students in Physical Classrooms and Online Schools ................................................................36

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Table 17 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Higher Education Segment (in $US Millions) ................................................................................................40 Table 18 - 2010-2015 Total Number of US Higher Education Students in Physical Classrooms Versus Online Schools ............................................41 Table 19 2010 Top Ten Higher Education Institutions by Fulltime Online Student Enrollment Totals and Annual Growth Rates ........................41 Table 20 - 2010 Top Ten Higher Education Institutions by Online Students That Take at Least One Class Online and Annual Growth Rates ....................................................................................................42 Table 21 2010-2015 Total Post-secondary Student Enrollment by Three Institution Types (in Millions) ..........................................................43 Table 22 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Non-profit Universities and Colleges (in $US Millions) .........................................................................................45 Table 23 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the For-profit Career Colleges (in $US Millions) ................................................................................................46 Table 24 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the For-Profit and Non-profit Vocational, Technical, and Trade Schools ...................................................................47 Table 25 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Corporate Segment (in $US Millions) ...............49 Table 26 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the NGO, Non-Profit, and Association Segment (in $US Millions) .......................................................................51 Table 27 - Employment of Wage and Salary Workers in Healthcare, 2008 and Projected Change, 2008-2018. (Employment in Thousands) ..........53 Table 28 - 2010-2015 US Revenue Forecasts for Self-paced eLearning Products and Services in the Healthcare Segment (in $US Millions) ..............54 Table 29 - 2010-2015 US Learning Delivery Methods in Healthcare Continuing Medical Education (CME) by Percent .........................................56 Table 30 Leading Indicators: 2009-2010 Total Private Investments Made to Self-paced eLearning Suppliers (in $US Millions) ............................58

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

List of Figures

Figure 1 2010-2015 US Self-paced eLearning Five-year Growth Rates by Product Type (across all buyers) ........................................................... 9 Figure 2 2010-2015 Worldwide Self-paced eLearning Five-year Growth Rates by Region (across all products) ............................................10 Figure 3 Ambient Insight's Learning Technology Research Taxonomy .........12 Figure 4 - The 2010-2015 US IT Training Market (in $US Millions) ................16 Figure 5 2010-2015 US Self-paced eLearning Five-year Growth Rates by Buyer Segment (across all products) ....................................................23 Figure 6 - 2010-2015 US Self-paced eLearning Five-year Revenue Growth Rates by Higher Education Institution Type ....................................44 Figure 7 - 2010 Revenue for US Vocational, Technical, and Trade Schools by Eight Content Types (in $US Billions) ........................................47 Figure 8 - 2005-2015 Historical Analysis of US Corporate Growth Rates for Self-paced eLearning Products and Services .........................................48 Figure 9 2010-2015 Top Revenue Generating Self-paced eLearning Content Areas in the US Corporate Market ................................................50 Figure 10 Factors Driving Adoption of Learning Technology in Healthcare ............................................................................................53 Figure 11 2010 US Healthcare Self-paced eLearning Supply Chain .............55 Figure 12 2010: Who is the Buyer of US Healthcare Self-paced Learning Products and Services? ..............................................................55 Figure 13 Leading Indicators: 2009-2010 Private Investment Totals by Eight Learning Product Types (in $US Millions) ......................................57 Figure 14 Longitudinal Analysis: 2005-2010 Self-paced eLearning Private Investment Totals (in $US Millions) ...............................................58 Figure 15 Revenue Opportunities in the Recession: US Professions that Require Continuing Education Credits to Maintain Licensure ..................60 Figure 16 - 2010-2015 Learning Technology Product Lifecycles and Product Substitution ...............................................................................63

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

This is a Comprehensive Report. Ambient Insight has five types of syndicated market research reports: Comprehensive Reports are 45-60 page reports that provide detailed analyses and revenue forecasts for content, content services, technology services, and technology for a specific product type and break the revenue out by multiple buyer types and segments. Targeted Reports are 25-40 page reports that provide industrywide analysis, an analysis of a particular product type, or an analysis of a specific buyer segment. Research Briefs are 15-20 page reports that highlight revenue opportunities, provide trend analyses, and forecast revenues for a particular sub-category of content, service, or technology. Radar Reports are 5-10 page competitive intelligence reports that identify leading indicators, emerging products, new buyers, promising markets, novel business models, and untapped revenue opportunities for suppliers. These reports provide recommendations on how to monetize innovation, create new customers, generate new revenue streams, and compete in emerging markets. Revenue Snapshots are 2-3 page reports that include a single revenue forecast table from a current market report. Please review the free Executive Overview for each report for a list of available tables. Contact us at info@ambientinsight.com to request a specific Revenue Snapshot.

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Executive Overview

The US market for Self-paced eLearning products and services reached $18.2 billion in 2010. The demand is growing by a five-year compound annual growth rate (CAGR) of 5.9% and revenues will reach $24.2 billion by 2015. This report forecasts five-year online learning expenditures by eight buyer segments: consumer, corporate, federal government, state and local government, PreK-12 academic, higher education, non-profits and associations, and healthcare. The five-year compound annual growth rate (CAGR) growth rate for Selfpaced eLearning across all eight of the buyer segments is 5.9%, but growth is much higher in specific segments. For example, growth rates in the PreK-12, healthcare, and association segments are 16.8%, 16.3%, and 14.3%, respectively. The rate of growth in the PreK-12 segment is due to the relentless migration to online content formats, and also due to the proliferation and success of for-profit online schools. Yet, buying behavior is erratic as schools struggle with budget cuts. The rapid growth of virtual schools, the dramatic increase in online students, the recession, and state budget cuts are acting as iterative catalysts for Self-paced eLearning in the PreK-12 segment. For example, budget cuts have prompted schools to reduce spending on summer school and classroom-based credit-recovery (making up for a failing grade) programs and increase spending on self-paced products and services. It is now more cost efficient to outsource credit-recovery programs to commercial online providers. The primary catalyst driving the strong virtual school growth in the US is the economy. State-run virtual schools used to target courses that were not offered in local districts or not available to rural students. Now, as a way to cut costs, they are targeting core curriculum and supplemental as well. The explosive growth of online enrollments in both academic segments in the US has created a boom market for Self-paced eLearning products in the PreK-12 and higher education segments. The healthcare segment has been immune to the recession. Since the recession began, the healthcare segment has added over 866,000 jobs. According to a May 2010 report by the US Bureau of Labor Statistics (BLS), the healthcare segment has been adding an average of 19,700 jobs a month over the last two years.

The academic segments are now rapidly adopting online products and are thriving markets for suppliers. A detailed analysis of both segments is included in this report.

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Obviously, there is a strong demand for training and education in the healthcare segment. A major challenge for suppliers competing in the healthcare segment is identifying the buyers. This report describes the buying behavior in this complex segment. Associations spend over $6.2 billion annually on educational events and until recently, most of those events were in physical venues. Associations were once slow adopters of learning technology in general, but this is no longer true. This segment is moving fast to Self-paced eLearning. The current forecast has been revised significantly upward from previous forecasts. In the past three years, across the entire market, the demand for Selfpaced eLearning has slowed. This general slowing is due to three market factors: Commoditization of platforms and tools Pricing pressures in the corporate segment caused by the slow economic recovery The growing tendency for buyers to purchase other types of learning technology products.

In the 2010 market, corporations are the top buyers of Self-paced eLearning. By 2015, corporations will still be the top buyer, followed by higher education and the PreK-12 buyers.

Commoditization (for any product) occurs when demand is very high and competing products lack significant differentiation in the perception of customers. Customers shop for price. Learning platforms and authoring tools are now highly commoditized, particularly in the corporate segment. Although the overall corporate growth rates are flat, demand is still quite strong, and the revenues are very high. The corporate market was an early adopter and companies continue to purchase Self-paced eLearning products. The corporate segment still represents the best revenue opportunities for suppliers. There is now clear evidence that other learning product types such as Mobile Learning and Social Learning are cannibalizing Self-paced eLearning revenues. This is particularly prevalent in the consumer and higher education segments. In the consumer segment, the growth rate for Self-paced eLearning content is now flat-to-negative at -1.9%, yet the consumer growth rate for Mobile Learning content is a healthy 18.3%. Social-based language learning sites are now very popular in the consumer segment as well. The "online population" in the higher education segment is growing at a rapid rate. Lecture Capture Systems are now in high demand in the higher education segment and are dampening the growth of Self-paced eLearning. This is called "product substitution" in a market and can be a significant threat to suppliers. Recommendations on how to deflect this threat are included in the final section of this report.

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Figure 1 2010-2015 US Self-paced eLearning Five-year Growth Rates by Product Type (across all buyers)

There are six major types of Self-paced eLearning products and services forecast in this report including: IT packaged content Non-IT packaged content Custom content development services Learning platform and tool hosting services Authoring software tools Installed learning platform technology

The growth rates for these products vary greatly across the different buying segments and a products analysis is provided for each segment. For example, the growth rate for installed learning management systems (LMS) is negative at -2.3% in the corporate segment, but positive at 8.4% in the healthcare segment. Although the demand for both IT-related content and authoring tools is negative in general, even they are experiencing positive growth in specific buying segments. One interesting new trend is the strong demand for industry-centric Webbased learning management "portals" preloaded with vertical content, particularly certification and licensure content. Best-of-breed suppliers that specialize in specific verticals also offer managed services with these portals and they are now generating significant revenues.

For more information about this report, email: info@ambientinsight.com

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Global Demand Helps US Suppliers The strong growth in specific regions of the worldwide market has created revenue opportunities for US suppliers. Self-paced English language learning is now in high demand in every region, including North America. Also, the current weakness of the US Dollar actually makes US products more competitive in the international market.

Figure 2 2010-2015 Worldwide Self-paced eLearning Five-year Growth Rates by Region (across all products)

Source: The Worldwide Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC.

North America will be the top buying region throughout the 2010-2015 forecast period. In the 2010 market, Western Europe accounted for the second largest expenditures, but by 2015, Asia will be the second largest buying region after North America. In 2010, South Korea was the second largest buying country after the US. China will be the second largest buying country after the US by 2015. This report provides detailed supply-side and demand-side analyses. The supply-side analysis provides suppliers with the total addressable market (TAM) for their product type across all buying segments. The demand-side analysis provides suppliers with insight into the buying behavior of specific buyer segments. This report provides extensive examples of competitors, products, and buying behavior to help suppliers compete in the market. These are evidence-based data designed to help suppliers create sustainable business models, develop competitive products, and generate revenues and profit. These data are indispensable in the current market characterized by variable growth rates across buyer segments and erratic buying behavior.

For more information about this report, email: info@ambientinsight.com

10

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

Methodology, Scope, and Product Definitions

Ambient Insight is an integrity-based market research firm that specializes in identifying revenue opportunities for suppliers. Principals at Ambient Insight have been tracking innovation and investment trends in the learning technology industry since the late 1990's. Ambient Insight provides market revenue forecasts based on our proprietary Evidence-based Research Methodology (ERM). The ERM is an iterative process based on predictive analytics. ERM progresses from general patterns (the big picture) to very precise granular patterns. It is used to create a forecast model comprised of relevant predictors. The forecast model is refined as additional data becomes available. Ambient Insight triangulates baseline revenues from three analysis vectors: Supply-side analysis Demand-side analysis Product and service analysis

Once the baseline revenues are triangulated, Ambient Insight uses the data to forecast the total addressable market (TAM). Ambient Insight uses the data derived from the ERM process literally as evidence to support our market forecasts. Ambient Insight gathers market and competitive intelligence from a wide spectrum of information broadly classified as leading and lagging indicators. Economic and market conditions are subject to change and the data in this report are current at the time of publication. Leading indicators signal future events and include venture capital investment trends, patent applications, technology-related legislation, technology standards development, product research trends, technology infrastructure trends, labor demand, and outsourcing demand. Lagging indicators, referred to as "rear-view mirror" data, are past events captured in data that include new vendor activity, M&A activity, executive hiring patterns, US Economic Census data, SIC and NAICS data, SEC filings, local and federal government data, Universal Commercial Code banking reports, public-domain business records, court records, press releases, and industry association information.

Scope

This report does not include revenues derived from outside the US. The major US suppliers do a significant amount of business in the international market, but those revenues are not considered part of the US market by Ambient Insight.

For more information about this report, email: info@ambientinsight.com

11

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

The multi-purpose enterprise platforms that are now known as performance management systems, human resource management systems, talent management systems, or student lifecycle systems are not included in this report. Many of these platforms do have learning management features that are used to track Self-paced eLearning content but the modules are not sold separately.

Figure 3 Ambient Insight's Learning Technology Research Taxonomy

Ambient Insight has a precise product taxonomy that narrowly defines Self-paced eLearning. This provides suppliers with clarity surrounding the demand for this product type.

This report does not include analysis of general-purpose content management systems that are now used to manage learning resources. For example, Microsoft's SharePoint platform is now being used by a growing number of corporations to manage Self-paced eLearning content. This is an example of product substitution that is actually a market inhibitor for legacy products. This report does not include forecasts for other learning technology products such as Social Learning, Mobile Learning, Simulation-based Learning, or Collaboration-based Learning products that are often marketed as "elearning" by suppliers. A detailed product taxonomy describing how Ambient Insight categorizes products is provided in: Ambient Insights 2011 Learning Technology Research Taxonomy.

Product Definition

Ambient Insight defines Self-paced eLearning as self-paced courseware products and services. This includes two major types of off-the-shelf catalog content, two types of software technologies (learning management

For more information about this report, email: info@ambientinsight.com

12

The US Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis, Ambient Insight, LLC

platforms and authoring tools), and two types of services (custom content development and platform hosting.) The defining characteristic of Self-paced eLearning is the pedagogical structure imposed by formal instructional design and the systematic development of the products to meet specific performance goals. The installed Self-paced eLearning technology includes Learning Management Systems (LMS), Classroom Management Systems, Education Management Systems, Student Information Systems, Course Management Systems, Learning Content Management Systems (LCMS), and the range of products used in PreK-12 for tracking instructional content usually called Student Information Systems (SIS). Ambient Insight defines learning platforms and tools sold via the hosted SaaS model as hosting services in our market research. Access to the products is sold as a service and customers do not actually own the products.

Packaged content includes products delivered on tangible media such as DVDs, as well as Web-based content.

Related Research

Buyers of this report may also benefit by the following Ambient Insight market research: The Worldwide Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis The US Corporate Market for Self-paced eLearning Products and Services: 2010-2015 Forecast and Analysis The US Market for Mobile Learning Products and Services: 2010-2015 Forecast and Analysis Ambient Insights 2011 Learning Technology Research Taxonomy

We Put Research into Practice

www.ambientinsight.com

For more information about this report, email: info@ambientinsight.com

13

Вам также может понравиться

- Test Preparation Market in US 2015-2019Документ64 страницыTest Preparation Market in US 2015-2019pratt1067% (3)

- Truck Stop Business PlanДокумент40 страницTruck Stop Business PlanBy Gibran Roman71% (7)

- It Key Metrics Data 2018 Key 341745Документ43 страницыIt Key Metrics Data 2018 Key 341745ccfm0310100% (4)

- Additional ProblemДокумент3 страницыAdditional ProblemthanhvanngocphamОценок пока нет

- AmbientInsight 2011 2016 Worldwide Digital English Language Learning Market OverviewДокумент19 страницAmbientInsight 2011 2016 Worldwide Digital English Language Learning Market Overviewpradeep_0113030% (1)

- Auditing and Consulting Business PlanДокумент36 страницAuditing and Consulting Business PlanHACHALU FAYE0% (1)

- Sample Feasibility StudyДокумент17 страницSample Feasibility Studyim_isolated100% (1)

- Alvar Aalto 1Документ4 страницыAlvar Aalto 1Santiago Martínez GómezОценок пока нет

- Mobile Business Intelligence - Oct 31 2011 (DAS)Документ62 страницыMobile Business Intelligence - Oct 31 2011 (DAS)deep750Оценок пока нет

- 2011 Landing Page Optimization Benchmark Report - EXCERPTДокумент20 страниц2011 Landing Page Optimization Benchmark Report - EXCERPTMarketingSherpaОценок пока нет

- Consumer Appliances in The PhilippinesДокумент29 страницConsumer Appliances in The PhilippinesHexeneОценок пока нет

- Local Governance Support ProgramДокумент346 страницLocal Governance Support ProgramRowland PasaribuОценок пока нет

- NoetidfdsДокумент16 страницNoetidfdsRajan PatelОценок пока нет

- Digital Economy G Vcs Asia 2018Документ87 страницDigital Economy G Vcs Asia 2018VISHNU GOPAL EPGDIBS 2021-22Оценок пока нет

- Dashboard Report Ibm PDFДокумент44 страницыDashboard Report Ibm PDFRadenda Manggala MustikasalehОценок пока нет

- NPS 2020 Visitor Spending EffectsДокумент70 страницNPS 2020 Visitor Spending EffectscronkitenewsОценок пока нет

- Security Intelligence Fundamentals: Student NotebookДокумент245 страницSecurity Intelligence Fundamentals: Student NotebookMohsine AzouliОценок пока нет

- Federal Spending On Information Products and Services From FY 1979 Through FY 2015 Q2Документ68 страницFederal Spending On Information Products and Services From FY 1979 Through FY 2015 Q2LJ's infoDOCKETОценок пока нет

- CP R75 SmartEvent AdminGuideДокумент82 страницыCP R75 SmartEvent AdminGuidenana2332Оценок пока нет

- Governance Institutional Risks Challenges Nepal ASIAN DEVELOPMENT BANKДокумент130 страницGovernance Institutional Risks Challenges Nepal ASIAN DEVELOPMENT BANKRanjan KCОценок пока нет

- First Quarter 2022 English 2023Документ108 страницFirst Quarter 2022 English 2023Ahmad BehzadОценок пока нет

- CommoditiesДокумент61 страницаCommoditiesMario CruzОценок пока нет

- Electronics Repair Shop Business PlanДокумент35 страницElectronics Repair Shop Business PlanHenok Desalegn100% (1)

- Machine Tooling Business PlanДокумент34 страницыMachine Tooling Business Planbackupall210Оценок пока нет

- Health Club Business PlanДокумент33 страницыHealth Club Business PlanMohamed FathiОценок пока нет

- Electronics Repair Shop Business PlanДокумент34 страницыElectronics Repair Shop Business PlanBerihun EngdaОценок пока нет

- SP21 Polimetrics 03 April 27 2021Документ125 страницSP21 Polimetrics 03 April 27 2021gmjwresearchОценок пока нет

- Government Vehicle Lease vs Purchase Cost AnalysisДокумент34 страницыGovernment Vehicle Lease vs Purchase Cost AnalysispitamberОценок пока нет

- Global Affiliate Marketing Software MarketДокумент107 страницGlobal Affiliate Marketing Software MarketJean-FrançoisОценок пока нет

- Toys and Games in India (Full Market Report)Документ30 страницToys and Games in India (Full Market Report)Tarak Pandey100% (1)

- Lemma For Electric Vehicle ChargingДокумент34 страницыLemma For Electric Vehicle ChargingRamon ColonОценок пока нет

- Creating Analytics and Reports For FinancialsДокумент122 страницыCreating Analytics and Reports For FinancialsFahd KhanОценок пока нет

- Business Strategy Report - Sony Corp.Документ43 страницыBusiness Strategy Report - Sony Corp.Dinesh Verma100% (7)

- The Handbook For Campus Safety and Security Reporting 2016 EditionДокумент265 страницThe Handbook For Campus Safety and Security Reporting 2016 Editiondpi435Оценок пока нет

- Yahoo Case StudyДокумент32 страницыYahoo Case StudyHala OthamnОценок пока нет

- SABSE3-Big Data Engineer 2021-Ecosystem-Course Guide - HighДокумент569 страницSABSE3-Big Data Engineer 2021-Ecosystem-Course Guide - HighMOHAMED AZOUZIОценок пока нет

- SIA 2012 VMS MSP Landscape ReportДокумент154 страницыSIA 2012 VMS MSP Landscape Reportashwanibharadwaj1Оценок пока нет

- BMI - Indonesia Power Report 2015 PDFДокумент70 страницBMI - Indonesia Power Report 2015 PDFmdjuitasОценок пока нет

- Description: Tags: 2004-05-rptДокумент71 страницаDescription: Tags: 2004-05-rptanon-305715Оценок пока нет

- Description: Tags: Gra pt3Документ77 страницDescription: Tags: Gra pt3anon-414078Оценок пока нет

- Creating Informed Consumers Tracking Fin 363ed549Документ52 страницыCreating Informed Consumers Tracking Fin 363ed549Rahmat Pasaribu OfficialОценок пока нет

- Purchasing Power Parities and the Real Size of World EconomiesОт EverandPurchasing Power Parities and the Real Size of World EconomiesОценок пока нет

- BMTC AnalysisДокумент68 страницBMTC AnalysisPОценок пока нет

- Lehman Aug 07 IndustryДокумент145 страницLehman Aug 07 IndustryYoujin ChoiОценок пока нет

- PEFA Regional Government of SomaliДокумент172 страницыPEFA Regional Government of SomaliGirmaye HaileОценок пока нет

- Agricultural Value Chain Lending ToolkitДокумент202 страницыAgricultural Value Chain Lending ToolkitRahul JainОценок пока нет

- SG1 English 00925084Документ321 страницаSG1 English 00925084Carla GonzalesОценок пока нет

- P 1084Документ72 страницыP 1084Vita Volunteers WebmasterОценок пока нет

- NPS 2021 Visitor Spending EffectsДокумент72 страницыNPS 2021 Visitor Spending EffectsShannon StowersОценок пока нет

- Barton InteriorsДокумент36 страницBarton InteriorsAhmed MasoudОценок пока нет

- IBM Filenet Content Manager 5.2.1 IntroductionДокумент69 страницIBM Filenet Content Manager 5.2.1 IntroductionDejene TadesaОценок пока нет

- Book of Abstract 2nd AMBEC 2020Документ58 страницBook of Abstract 2nd AMBEC 2020mahaludin polibanОценок пока нет

- Online Services Business PlanДокумент38 страницOnline Services Business Plannitin anpat0% (1)

- Steak Restaurant Business PlanДокумент49 страницSteak Restaurant Business PlanZarina ChanОценок пока нет

- Construction Engineering Business PlanДокумент38 страницConstruction Engineering Business PlanSange Castiel TwasileОценок пока нет

- Coffee Roaster Business PlanДокумент39 страницCoffee Roaster Business PlanLexico InternationalОценок пока нет

- The National Artificial Intelligence Research and Development Strategic Plan: 2019 UpdateДокумент50 страницThe National Artificial Intelligence Research and Development Strategic Plan: 2019 UpdateDarth VaderОценок пока нет

- Analytics & ReportsДокумент186 страницAnalytics & Reportspipiripau1804Оценок пока нет

- CNCS 2011 Congressional Budget Justification - Corporation For National and Community Service CBJ 2011Документ96 страницCNCS 2011 Congressional Budget Justification - Corporation For National and Community Service CBJ 2011Accessible Journal Media: Peace Corps DocumentsОценок пока нет

- Garden Nursery Business PlanДокумент31 страницаGarden Nursery Business PlanSamuel Wagaluka100% (1)

- Indoor Soccer Facility Business PlanДокумент31 страницаIndoor Soccer Facility Business PlanBlur VisualsОценок пока нет

- Steak Buffet Restaurant Business PlanДокумент47 страницSteak Buffet Restaurant Business PlanZarina ChanОценок пока нет

- The Social Marketing FunnelДокумент31 страницаThe Social Marketing FunnelMike Lewis100% (3)

- Tourism and Local Economic DevelopmentДокумент8 страницTourism and Local Economic Developmentim_isolatedОценок пока нет

- SustitucionДокумент3 страницыSustitucionserioussam69Оценок пока нет

- Marketing Plan ExampleДокумент39 страницMarketing Plan Exampleim_isolatedОценок пока нет

- Defining Your Business Through Goals and Objectives: First Steps For New EntrepreneursДокумент4 страницыDefining Your Business Through Goals and Objectives: First Steps For New Entrepreneursim_isolatedОценок пока нет

- Computing Development Strategies Business PlanДокумент6 страницComputing Development Strategies Business Planim_isolatedОценок пока нет

- A Study of Real Estate Markets in Declining CitiesДокумент84 страницыA Study of Real Estate Markets in Declining Citiesim_isolatedОценок пока нет

- Learning From Others: Benchmarking in Diverse Tourism EnterprisesДокумент7 страницLearning From Others: Benchmarking in Diverse Tourism Enterprisesim_isolatedОценок пока нет

- Microfinance Training Business PlanДокумент60 страницMicrofinance Training Business Planim_isolated100% (1)

- Maine DDS Program 4th Quarter ReportДокумент11 страницMaine DDS Program 4th Quarter Reportim_isolatedОценок пока нет

- Opportunities in US Distressed Real EstateДокумент8 страницOpportunities in US Distressed Real Estateim_isolatedОценок пока нет

- Dental CrisisДокумент12 страницDental Crisisim_isolatedОценок пока нет

- Oral Health - MAINE (2012)Документ133 страницыOral Health - MAINE (2012)im_isolatedОценок пока нет

- Sample 2 PageДокумент2 страницыSample 2 Pageim_isolatedОценок пока нет

- Sustainable Tourism Development and Promotion in The Western CapeДокумент85 страницSustainable Tourism Development and Promotion in The Western Capeim_isolatedОценок пока нет

- LeadershipДокумент31 страницаLeadershipCrystal Fairy-DustОценок пока нет

- Heritage vs Gaming for Tourist Dollars in MacaoДокумент17 страницHeritage vs Gaming for Tourist Dollars in Macaoim_isolatedОценок пока нет

- Casinos As A Tourism Redevelopment StrategyДокумент15 страницCasinos As A Tourism Redevelopment StrategyElena TabacaruОценок пока нет

- Managing BusinessДокумент15 страницManaging BusinessadillawaОценок пока нет

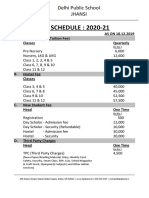

- Fee Shedule 2020-21 Final DiosДокумент2 страницыFee Shedule 2020-21 Final Diosapi-210356903Оценок пока нет

- HG12 - Module 4 - Quarter 3 - San Miguel NHSДокумент13 страницHG12 - Module 4 - Quarter 3 - San Miguel NHSChristina IgnacioОценок пока нет

- Global GuideДокумент110 страницGlobal GuideAstrid RahardjoОценок пока нет

- Classroom Language WorksheetДокумент3 страницыClassroom Language Worksheetduvan92100% (2)

- Learning What is LearningДокумент27 страницLearning What is LearningShankerОценок пока нет

- Stanford University Latex Thesis Style FileДокумент5 страницStanford University Latex Thesis Style Filejuliewebsterwashington100% (2)

- Art Therapy in MontenegroДокумент2 страницыArt Therapy in MontenegroNadaIvanovicОценок пока нет

- Science 10 9.4 The Lens EquationДокумент31 страницаScience 10 9.4 The Lens Equationjeane san cel arciagaОценок пока нет

- Interpersonal Relationship and Communication - wk7Документ14 страницInterpersonal Relationship and Communication - wk7mervin tomas100% (1)

- Lehmann HumanisticBasisSecond 1987Документ9 страницLehmann HumanisticBasisSecond 1987Rotsy MitiaОценок пока нет

- ORIENTATION On The Conduct of PHIL-IRI 2018Документ44 страницыORIENTATION On The Conduct of PHIL-IRI 2018Janine Armamento100% (1)

- Detail Requirements Spreadsheet SampleДокумент53 страницыDetail Requirements Spreadsheet SampleChinh Lê ĐìnhОценок пока нет

- Hemangioma Guide for DoctorsДокумент29 страницHemangioma Guide for DoctorshafiizhdpОценок пока нет

- Smis Journey - Illness To WellnessДокумент24 страницыSmis Journey - Illness To WellnessHarish KumarОценок пока нет

- Appendix - HWBДокумент3 страницыAppendix - HWBAndyОценок пока нет

- Cot FinalДокумент5 страницCot FinalFrennyPatriaОценок пока нет

- Michel Foucault - Poder - Conocimiento y Prescripciones EpistemológicasДокумент69 страницMichel Foucault - Poder - Conocimiento y Prescripciones EpistemológicasMarce FernandezОценок пока нет

- JEE (Advanced) 2015 - A Detailed Analysis by Resonance Expert Team - Reso BlogДокумент9 страницJEE (Advanced) 2015 - A Detailed Analysis by Resonance Expert Team - Reso BlogGaurav YadavОценок пока нет

- Emotional Intelligence: Anuj JindalДокумент19 страницEmotional Intelligence: Anuj JindalSpoorthi MeruguОценок пока нет

- International MBA Exchanges Fact Sheet 2022-23Документ4 страницыInternational MBA Exchanges Fact Sheet 2022-23pnkОценок пока нет

- How School Funding WorksДокумент20 страницHow School Funding WorksCarolyn UptonОценок пока нет

- Toaz - Info Bad Love Sue Leather PRДокумент5 страницToaz - Info Bad Love Sue Leather PRyixiang louОценок пока нет

- R22 - IT - Python Programming Lab ManualДокумент96 страницR22 - IT - Python Programming Lab ManualJasmitha BompellyОценок пока нет

- Fairytales Affect Perception of RealityДокумент3 страницыFairytales Affect Perception of RealitySrishti PrasadОценок пока нет

- Unit 2 Test B Listening, Language, Reading, Communication SkillsДокумент2 страницыUnit 2 Test B Listening, Language, Reading, Communication SkillsAnia YemelyanovaОценок пока нет

- BS en 1011-1-2005Документ15 страницBS en 1011-1-2005reezmanОценок пока нет

- 5E Lesson PlanДокумент3 страницы5E Lesson PlanMarian Alvarado100% (1)

- P6 English 2019 CA1 River Valley Exam PaperДокумент23 страницыP6 English 2019 CA1 River Valley Exam PaperiMathGenius100% (1)