Академический Документы

Профессиональный Документы

Культура Документы

Managerial Accounting

Загружено:

Paula Cxerna GacisИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Managerial Accounting

Загружено:

Paula Cxerna GacisАвторское право:

Доступные форматы

Management Accounting

SW YOO

Chapter 14 DECISION MAKING: RELEVANT COSTS AND BENEFITS

1. Decision Making Process (1) Six Steps in the Decision Making Process (a) Clarify the decision problem (b) Specify the criterion (c) Identify the alternatives (d) Develop a decision model: The model includes the criterion, the constraints, and the alternatives. (f) Collect the data (g) Select an alternative Note) Although the managerial accountant collects and presents quantitative information (e.g., cost or profit), a skilled manager should rely on his or her judgment and experience to evaluate the qualitative factors of each situation, factors which often do not easily fit into decision models. (2) Determining Usefulness of Information (a) Relevance: Information is relevant if it is pertinent to a decision problem. (b) Accuracy: Information must be precise. (c) Timeliness: Information must be available in time for a decision. (3) Managerial Accountant's Primary Role in the Decision Making Process To provide information relevant to the decisions faced by managers; That is, (a) Decide what information is relevant to each decision problem, and (b) Provide accurate and timely data, keeping in mind the proper balance between these often conflicting criteria. 2. Identifying Relevant Revenues/Costs A relevant revenue/cost is a revenue/cost that is applicable to a particular decision that should have a bearing on which alternative a manager selects. Avoidable costs are relevant costs that can be eliminated (in which or in part) as a result of choosing one alternative over another. All revenues/costs are avoidable, EXCEPT: (1) Sunk costs: A cost that has already been incurred and that cannot be avoided regardless of which course of action a manager may decide to take. (2) Future revenues/costs that do not differ between the alternative at hand. 3. Analysis of Decisions (1) Accept or Reject a Special Offer (a) With excess (idle) capacity: Only variable costs associated with the special offer are relevant. Fixed costs are usually irrelevant. (b) No excess capacity: The opportunity cost of the lost contribution margin from regular higher priced sales and variable costs associated with the special offer are relevant. (2) Make or Buy a Product or Service The key is the proper handling of fixed costs. Since the per-unit cost of a product includes a unitized portion of fixed costs (i.e., fixed costs that may continue even if the product is purchased elsewhere at a lower price), the information should be presented to emphasize that total costs will not change with the number of units produced. (3) Add or Drop a Service, Product, or Department The key is the proper handling of fixed costs & opportunity cost. (a) Ascertain whether fixed costs are avoidable or unavoidable because although a product line cannot cover ALL its fixed costs, it may be covering its AVOIDABLE fixed costs and at least contributing toward the unavoidable fixed costs; (b) The opportunity cost of lost CM, including the effects on the other operation, should be also factored into the decision. (4) Joint Products: Sell or Process Further The key is considering only the increase in process costs after split-off point (called separable processing

14-1

Management Accounting

SW YOO

cost) and comparing it to the increase in revenue the extra processing brings. The split-off point is the point in the process at which the products are distinguishable from one another. All manufacturing costs up to that point are joint costs (which are usually allocated to the each product based on relative sales value method). Those joint costs are sunk costs and irrelevant to sell now or process further decision. (5) Decisions Involving Limited Resources The key is that a decision should be made on the basis of the CM per unit of scare resource, not on the basis of the CM per product, when there are limitations on machine time, labor hours, or raw materials (scarce resources). A decision model which considers multiple scarce resources is linear programming (See appendix). (6) Techniques for Addressing the Impact of Uncertainty (a) Sensitivity analysis: A technique for determining what would happen in a decision analysis if a key prediction or assumption proves to be wrong. (b) Decisions based on expected values: The expected value of a random variable (e.g., CM) is equal to the sum of the possible values for the variable, each weighted by its probability. 4. Activity-Based Costing and Decision Making (1) The relevant-costing concepts in an activity-based-costing environment do not change. What will change is the decision makers ability to determine costs and benefits that are relevant to the decision. (2) Costs that are fixed under a conventional costing system, for example, may not be fixed when multiple (and more appropriate) cost drivers are used. 5. (1) (2) (3) (3) The Common Pitfalls in Decision Making Sunk costs are irrelevant. Fixed costs may be misleading if presented on a per-unit basis. Allocated common fixed costs may be unavoidable and irrelevant; The avoidable costs should be identify. Opportunity costs are relevant, and therefore, should be identified and included in a decision analysis.

14-2

Management Accounting

SW YOO

EXAMPLES 1. Sunk Costs are not Relevant Costs A manager at White Co. wants to replace an old machine with a new, more efficient machine. New machine: List price Annual variable expenses Expected life in years $90,000 80,000 5 Old machine: Original cost Remaining book value Disposal value now Annual variable expenses Remaining life in years $72,000 60,000 15,000 100,000 5

A manager at White Co. wants to replace an old machine with a new, more efficient machine. Whites sales are $200,000 per year. Fixed expenses, other than depreciation, are $70,000 per year. Should the manager purchase the new machine? (Analysis 1) The manger recommends that the company not purchase the new because: Remaining book value Disposal value Loss from disposal $60,000 (15,000) $45,000

(Analysis 2: Comparative income analysis) For Five Years Sales Variable expenses Other fixed expenses Depreciation - new Depreciation - old Disposal of old machine Total net income Keep Old Machine $1,000,000 Purchase New Machine $1,000,000 Difference $ -

(Short Analysis: Relevant cost analysis) Relevant Cost Analysis Savings in variable expenses provided by the new machine Cost of the new machine Disposal value of old machine Net effect

14-3

Management Accounting

SW YOO

2. Special Orders Jet, Inc. receives a one-time order that is not considered part of its normal ongoing business. Jet makes a single product with a unit variable cost of $8. Normal selling price is $20 per unit. A foreign distributor offers to purchase 3,000 units for $10 per unit. Annual capacity is 10,000 units, and annual fixed costs total $48,000, but Jet, Inc. is currently producing and selling only 5,000 units. Should Jet accept the offer? Increase in revenue Increase in variable costs Increase in fixed costs Increase in net income or

3. The Make or Buy Decision (Outsourcing) Essex manufactures part 457A that is currently used in one of its products. The unit cost to make this part is: Direct materials Direct labor Variable overhead Depreciation of special equip. Supervisor's salary General factory overhead Total cost per unit $ 9 5 1 3 2 10 $ 30

The special equipment used to manufacture part 457A has no resale value. General factory overhead is allocated on the basis of direct labor hours. The $30 total unit cost is based on 20,000 parts produced each year. An outside supplier has offered to provide the 20,000 parts at a cost of $25 per part. Should we accept the suppliers offer? Cost Per Unit Outside purchase price Direct materials Direct labor Variable overhead Depreciation of equip. Supervisor's salary General factory overhead Total cost $ 9 5 1 3 2 10 $ 30 Cost of 20,000 Units Make Buy

14-4

Management Accounting

SW YOO

4. Adding/Dropping Segments Due to the declining popularity of digital watches, Lovell Companys digital watch line has not reported a profit for several years. An income statement for last year is: Segment Income Statement Digital Watches Sales Less: variable expenses Variable mfg. costs Variable shipping costs Commissions Contribution margin Less: fixed expenses General factory overhead Salary of line manager Depreciation of equipment Advertising direct Rent - factory space General admin. expenses Net loss $ 500,000 $ 120,000 5,000 75,000

200,000 $ 300,000

60,000 90,000 50,000 100,000 70,000 30,000

400,000 $ (100,000)

Assuming all of the general expenses and depreciation are unavoidable, should Lovell retain or drop the digital watch segment? (Analysis 1: Comparative income analysis) Comparative Income Solution Keep Digital Watches Sales Less variable expenses: Mfg. expenses Freight out Commissions Total variable expenses Contribution margin Less fixed expenses: General factory overhead Salary of line manager Depreciation Advertising direct Rent - factory space General admin. expenses Total fixed expenses Net loss $ 500,000 120,000 5,000 75,000 200,000 300,000 60,000 90,000 50,000 100,000 70,000 30,000 400,000 $ (100,000)

Drop Digital Watches $ -

Difference

14-5

Management Accounting

SW YOO

(Short Analysis: Relevant cost analysis) Contribution Margin Solution Contribution margin lost if digital watches are dropped Less fixed costs that can be avoided Salary of the line manager Advertising direct Rent - factory space Net disadvantage

5. Joint Product: Sell or Process Further Sawmill, Inc. cuts logs from which unfinished lumber and sawdust are the immediate joint products. Unfinished lumber is sold as is or processed further into finished lumber. Sawdust can also be sold as is to gardening wholesalers or processed further into presto-logs. Data about Sawmills joint products includes: Per Log Lumber Sawdust $ 140 $ 40 270 50 176 24 50 20

Sales value at the split-off point Sales value after further processing Allocated joint product costs Cost of further processing

Should we process the lumber further and sell the sawdust as is? Analysis of Sell or Process Further Per Log Lumber Sales value after further processing Sales value at the split-off point Incremental revenue Cost of further processing Profit (loss) from further processing Sawdust

14-6

Management Accounting

SW YOO

6. Utilization of Scarce Resources Ensign Company produces two products and selected data is shown below: Products 1 Selling price per unit Less: variable expenses per unit Contribution margin per unit Current demand per week (units) Contribution margin ratio Processing time required on machine A1 per unit $ 60 36 $ 24 2,000 40% 1.00 min. $ 2 50 35 $ 15 2,200 30% 0.50 min.

Machine A1 is the scarce resource because there is excess capacity on other machines. Machine A1 is being used at 100% of its capacity. Machine A1 capacity is 2,400 minutes per week. Should Ensign focus its efforts on Product 1 or 2? (Step 1) Products 1 Contribution margin per unit Time required to produce one unit Contribution margin per minute min. /min. 2 min. /min.

(Step 2) Allotting Our Scarce Resource (Machine A1) Weekly demand for Product 2 Time required per unit Total time required to make Product 2 Total time available Time used to make Product 2 Time available for Product 1 Time required per unit Production of Product 1 (Step 3) Product 1 Production and sales (units) Contribution margin per unit Total contribution margin Product 2 units min. min. min. min. min. min. units

14-7

Management Accounting

SW YOO

7. From the last example (example 6), recall the contribution margin for Product 1 was $24 and $15 for Product 2. Due to uncertainty, assume Martin has the following probable contribution margins for the two products. Product 1

Possible value of CM Probability

Product 2

Possible value of CM Probability

23.00 24.00 25.00

30% 50% 20%

14.00 15.00 16.00

10% 40% 50%

Compute the expected values. Product 1

Possible value of CM Probability Expected Value Possible value of CM

Product 2

Probability Expected Value

23.00 24.00 25.00

30% 50% 20%

14.00 15.00 16.00

10% 40% 50%

14-8

Вам также может понравиться

- Chapter 1 Solutions Horngren Cost AccountingДокумент14 страницChapter 1 Solutions Horngren Cost AccountingAnik Kumar MallickОценок пока нет

- Decision MakingДокумент15 страницDecision MakingSiddhant SangalОценок пока нет

- Acca F5Документ133 страницыAcca F5Andin Lee67% (3)

- Responsibility Accounting Decision MakingДокумент32 страницыResponsibility Accounting Decision MakingChokie NavarroОценок пока нет

- U04 Cost Accumulation SystemДокумент30 страницU04 Cost Accumulation SystemIslam AhmedОценок пока нет

- Cost Accounting - Exercise 1Документ2 страницыCost Accounting - Exercise 1Anna MaglinteОценок пока нет

- M6 Short Run Decision Making Relevant CostingДокумент6 страницM6 Short Run Decision Making Relevant Costingwingsenigma 00Оценок пока нет

- Weygandt Managerial 6e SM Release To Printer Ch07 NДокумент58 страницWeygandt Managerial 6e SM Release To Printer Ch07 NNgàyMaiTrờiLạiSángОценок пока нет

- Session 7 & Ic - PGDM 2021 - 23Документ28 страницSession 7 & Ic - PGDM 2021 - 23Krishnapriya NairОценок пока нет

- Relevant Costing NotesДокумент27 страницRelevant Costing NotesAnru PienaarОценок пока нет

- MCQ 14Документ2 страницыMCQ 14Avishek BarmanОценок пока нет

- Cost Ii Chapter 5Документ13 страницCost Ii Chapter 5Biniyam TsegayeОценок пока нет

- Unit Five: Relevant Information and Decision MakingДокумент39 страницUnit Five: Relevant Information and Decision MakingEbsa AbdiОценок пока нет

- Cost AccountingДокумент40 страницCost AccountingJaypee FazoliОценок пока нет

- Chapter 5Документ37 страницChapter 5Korubel Asegdew YimenuОценок пока нет

- Cost and Management AccountДокумент7 страницCost and Management AccountMsKhan0078Оценок пока нет

- Marginal Costing: Definition: (CIMA London)Документ4 страницыMarginal Costing: Definition: (CIMA London)Pankaj2cОценок пока нет

- P1 Solution CMA June 2019Документ7 страницP1 Solution CMA June 2019Awal ShekОценок пока нет

- ACC102-Chapter10new 000Документ28 страницACC102-Chapter10new 000Mikee FactoresОценок пока нет

- CHAPTER FOUR Cost and MGMT ACCTДокумент12 страницCHAPTER FOUR Cost and MGMT ACCTFeleke TerefeОценок пока нет

- Q3Finance Notes BookДокумент13 страницQ3Finance Notes Booksebastian.vduurenОценок пока нет

- MG WE FNSACC517 Provide Management Accounting InformationДокумент9 страницMG WE FNSACC517 Provide Management Accounting InformationGurpreet KaurОценок пока нет

- CH 20 SMДокумент31 страницаCH 20 SMNafisah MambuayОценок пока нет

- CostingДокумент32 страницыCostingnidhiОценок пока нет

- Managerial Accounting by James JiambalvoДокумент52 страницыManagerial Accounting by James JiambalvoAhmed AliОценок пока нет

- Assignment 1Документ7 страницAssignment 1Ahmed SuhailОценок пока нет

- Pricing and Short Term Decision Making (Edited)Документ58 страницPricing and Short Term Decision Making (Edited)Vaibhav SuchdevaОценок пока нет

- P2 - Performance ManagementДокумент11 страницP2 - Performance ManagementWashington ShamuyariraОценок пока нет

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessДокумент10 страницChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosОценок пока нет

- CAT T7 Key NotesДокумент31 страницаCAT T7 Key NotesMariam NawazОценок пока нет

- Part1 SEC BДокумент135 страницPart1 SEC BKhel MatiasОценок пока нет

- Write Advantages and Disadvantages of Cost AccountingДокумент6 страницWrite Advantages and Disadvantages of Cost AccountingAditya ManglamОценок пока нет

- Unit 7 Cost Accumulation TechniquesДокумент21 страницаUnit 7 Cost Accumulation Techniquesestihdaf استهدافОценок пока нет

- Difference Between Absorption Costing and Marginal CostingДокумент4 страницыDifference Between Absorption Costing and Marginal CostingIndu GuptaОценок пока нет

- P2 - Performance ManagementДокумент11 страницP2 - Performance Managementmrshami7754Оценок пока нет

- Relevant Costing and Differential AnalysisДокумент32 страницыRelevant Costing and Differential AnalysisEj BalbzОценок пока нет

- Chap002 Cost TermsДокумент41 страницаChap002 Cost TermsNgái Ngủ100% (1)

- Cma Ii CH 1Документ18 страницCma Ii CH 1Mubarik HedrОценок пока нет

- Relevant Costs For Decision Making: Topic Six & SevenДокумент53 страницыRelevant Costs For Decision Making: Topic Six & Sevendanial haziqОценок пока нет

- Session 02 CostsДокумент28 страницSession 02 CostsReya ZeeОценок пока нет

- CAT T7 Key NotesДокумент30 страницCAT T7 Key NotesSeah Chooi KhengОценок пока нет

- Additional FINAL ReviewДокумент41 страницаAdditional FINAL ReviewMandeep SinghОценок пока нет

- Week 5 Lecture Handout - Sols TemplateДокумент3 страницыWeek 5 Lecture Handout - Sols TemplateRavinesh PrasadОценок пока нет

- Cost&Management Accounting Unit-2 PDFДокумент19 страницCost&Management Accounting Unit-2 PDFVishal RanjanОценок пока нет

- New CMA Part 1 Section BДокумент135 страницNew CMA Part 1 Section Bhmtairek85100% (1)

- Ma Revision Notes All Chapters Week 1 9Документ87 страницMa Revision Notes All Chapters Week 1 9fabianngxinlongОценок пока нет

- Summary and Reflection: Chapter 6: Cost-Volume-ProfitДокумент5 страницSummary and Reflection: Chapter 6: Cost-Volume-ProfitJohn Kenneth BoholОценок пока нет

- Chap. II - Relevant Information 2Документ28 страницChap. II - Relevant Information 2ybegduОценок пока нет

- Lecture Aid - Relevant Costing Sumr 15Документ2 страницыLecture Aid - Relevant Costing Sumr 15Jaira MoradaОценок пока нет

- Unit 3 Acct312-UnlockedДокумент21 страницаUnit 3 Acct312-UnlockedTilahun GirmaОценок пока нет

- MODULE 1.exercises - Answers OnlyДокумент6 страницMODULE 1.exercises - Answers OnlykonyatanОценок пока нет

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Документ50 страницCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathОценок пока нет

- Cost Accounitng NotesДокумент17 страницCost Accounitng NotesDarlene JoyceОценок пока нет

- Cost AccountingДокумент9 страницCost AccountingPuneet TandonОценок пока нет

- Chapter 3 AkmenДокумент28 страницChapter 3 AkmenRomi AlfikriОценок пока нет

- Q.9. Differentiate Direct Cost and Direct Costing?Документ10 страницQ.9. Differentiate Direct Cost and Direct Costing?Hami KhaNОценок пока нет

- MCC 202 Advanced Cost AccountingДокумент4 страницыMCC 202 Advanced Cost AccountingNeoHoodaОценок пока нет

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОт EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОценок пока нет

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageОт EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesОт EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Reviewer For PartnershipДокумент31 страницаReviewer For PartnershipJohn Michael BabasОценок пока нет

- Chapt-11 Income Tax - IndividualsДокумент10 страницChapt-11 Income Tax - Individualshumnarvios100% (4)

- Gross Income: Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersДокумент7 страницGross Income: Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersAnonymous qpUaTkОценок пока нет

- Comple CДокумент1 страницаComple CPaula Cxerna GacisОценок пока нет

- Additional Chapter AssignmentДокумент4 страницыAdditional Chapter AssignmentM GualОценок пока нет

- Social Science and Philosophy BSMAДокумент5 страницSocial Science and Philosophy BSMAKia Kristine love SilverioОценок пока нет

- BMssДокумент152 страницыBMssCfhunSaatОценок пока нет

- Chapter 19 Applied ProblemДокумент5 страницChapter 19 Applied ProblemJarrett LindseyОценок пока нет

- Ba 115Документ36 страницBa 115Paul Rainer De VillaОценок пока нет

- CA. Naresh Aggarwal's Classes: Chapter-1 Basic Concepts of Cost AccountingДокумент8 страницCA. Naresh Aggarwal's Classes: Chapter-1 Basic Concepts of Cost AccountingNistha BishtОценок пока нет

- Cpa Review School of The Philippines Manila Management Advisory Services Relevant CostingДокумент27 страницCpa Review School of The Philippines Manila Management Advisory Services Relevant CostingJessaОценок пока нет

- Fundamentals of Accounting IiДокумент14 страницFundamentals of Accounting IiNo MoreОценок пока нет

- Management Advisory Services: BudgetedДокумент26 страницManagement Advisory Services: Budgetedi hate youtubersОценок пока нет

- Cost Volume Profit Analysis SolutionsДокумент8 страницCost Volume Profit Analysis SolutionsIce Voltaire Buban GuiangОценок пока нет

- Variable Costing and Segment Reporting: Tools For Management Reporting: Tools For ManagementДокумент14 страницVariable Costing and Segment Reporting: Tools For Management Reporting: Tools For Managementemadhamdy2002Оценок пока нет

- Relevant Costs For Decision Making: Exercise 13-1 (15 Minutes)Документ18 страницRelevant Costs For Decision Making: Exercise 13-1 (15 Minutes)YHОценок пока нет

- Acn 3Документ5 страницAcn 3Navidul IslamОценок пока нет

- Akuntansi Manajemen Lanjutan: Job Order Costing Dan Process CostingДокумент16 страницAkuntansi Manajemen Lanjutan: Job Order Costing Dan Process Costingsilvia gynaОценок пока нет

- CVPДокумент2 страницыCVPDan RyanОценок пока нет

- ACCA F2 Course NotesДокумент494 страницыACCA F2 Course NotesТурал Мансумов100% (4)

- M5Документ1 страницаM5Kendrew SujideОценок пока нет

- Fnu Fee StructureДокумент83 страницыFnu Fee StructurenicksneelОценок пока нет

- Manufacturing Cost Data For Copa Company: Case A Case B Case CДокумент5 страницManufacturing Cost Data For Copa Company: Case A Case B Case Cyogi fetriansyahОценок пока нет

- UGBA 102B Section02 - Handout - SolutionsДокумент11 страницUGBA 102B Section02 - Handout - SolutionsGwendolyn Chloe PurnamaОценок пока нет

- E-Book Chapter 1Документ56 страницE-Book Chapter 1jovanaОценок пока нет

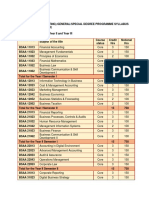

- BSC Applied Accounting Degree Programme Syllabus Programme StructureДокумент2 страницыBSC Applied Accounting Degree Programme Syllabus Programme StructureNaveen Pragash100% (1)

- Act512 - Assignment Chapter - 06Документ9 страницAct512 - Assignment Chapter - 06Rafin MahmudОценок пока нет

- MAS 9204 Product Costing Activity-Based Costing (ABC)Документ19 страницMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaОценок пока нет

- Management Accounting Study NotesДокумент39 страницManagement Accounting Study NotesAlexander TrovatoОценок пока нет

- Methods InventoryДокумент12 страницMethods InventoryJocelyn LimaОценок пока нет

- Book1 Group Act5110Документ9 страницBook1 Group Act5110SAMОценок пока нет