Академический Документы

Профессиональный Документы

Культура Документы

The Sarbanes-Oxley Act of 2002 and Capital Market Behavior Early Evidence by Jain and Rezaee (2006 CAR)

Загружено:

Eleanor RigbyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Sarbanes-Oxley Act of 2002 and Capital Market Behavior Early Evidence by Jain and Rezaee (2006 CAR)

Загружено:

Eleanor RigbyАвторское право:

Доступные форматы

I The Sarbanes-Oxley Act of 2002 and .

Capital-Market Behavior: Early Evidence*

PANKAJ K. JAIN, University of Memphis ZABIHOLLAH REZAEE, University of Memphis Abstract

The Sarbanes-Oxley Act of 2002 ("the Act") was enacted in response to numerous corporate and accounting scandals. It aims to reinforce corporate accountability and professional responsibility in order to restore investor confidence in corporate America. This study examines the capita!-market reaction to the Act and finds a positive (negative) abnormal return at the time of several legislative events that increased (decreased) the likelihood of the passage of the Act. We interpret this finding as evidence supporting the notion that the Act is wealthincreasing in the sense that its induced benefit.s significantly outweigh its imposed compliance costs. We also find that the market reaction is more positive for firms that are more compliant with the provisions of the Act prior to its enactment. Keywords Corporate govemance; Financial scandals; Market reactions; Sarbanes-Oxley Act of 2002 G14,G28,M4i

JEL Descriptors

La Loi Sarbanes-Oxley de 2002 et le comportement du marche boursier : premieres constatations Condense

Les auteurs examinent les repercussions de la reglementation sur la richesse des actionnaires. La vague de scandales financiers de la fin des annees 1990 et du debut des annees 2000 a ravive le debat sur ta reglementation de la gouvernance d'entreprise et de la profession comptable. Les inquietudes suscltees chez les investisseurs par ces scandales et la perte de confiance qu'ils ont provoquee sont frequemment evoquees comme principales raisons de I'effondrement du marche boursier en 2002 (Browning et Weil, 2QQ2). Ces scandales contribuent a expliquer I'affirmation des legislateurs et des autorit^s de r6glementation selon laquelle on ne saurait compter sur le fonctionnement autonome des marches boursiers, sans un sollde encadrement reglementaire, et la nouvelle reglementation s'imposait pour restaurer la confiance des investisseurs (Ribstein, 2002 [traduction]). Afin de restaurer la

Accepted by Peer Clarkson. We are grateful for suggestions from Rashad Abdel-Khalik, Teny Shevliti. Hassan Tehranian, Lynn Turner. James Up.son. Mohan Venkatachalam. :ind the editors, Gordon Richardson and Peter Clarkson.

Contemporary Accounting Research Vol. 23 No. 3 (Fall 2006) pp. 629-54 CAAA

630

Contemporary Accounting Research

confiance et de renforcer ['obligation de rendre compte et la responsabilit^ professionnelle des entreprises. le Congres americain adoptait la Loi Sarbanes-Oxley (ci-apr^s la Loi) en juillet 2002. Cette loi avait pour but d'ameliorer la gouvemance d'entreprise, d'accroTtre la qualite des rapports financiers, de promouvoir Tefficacite de la veritication. de cr^er le Public Company Accounting Overslgbt Board (PCAOB) pour reglementer la profession de verification, et d'accroitre la responsabilite crlminelle et civile des contrevenants aux lois regissanl les valeurs mobiiiferes. La Loi porte sur la conduite el la responsabilite professionnelle des personnes qui produisent, certifient, v^rifient. analysent et utilisent Tinformation tinanciere que publient les entreprises. La Loi est interpretee conime etant un effort, destine a corriger les extemalites du marcbe, d'une ampleur equivalente a celle de toute legislation adoptee par le gouvemement federal dans I'bistoire recente [...j elle vise la fagon d'agir des gens, et non la destination des valeurs mobilieres (Wiesen, 2003, p. 429 [traduction]). Les preuves empiriques (CRA, 2005 ; Turner, 2005) revelent que. si la Loi a procure aux investisseurs des avantages appreciabies. elle a egalement impose des couts de conformite importants. Ces couts representent pour les societes ouvertes environ 0.1 pour cent de leur chiftre d'affaires total. Les auteurs etoffeni le debat de donnees issues d'une analyse des repercussions de la Loi sur la Hchesse des actionnaires ei des determinants possibles de ces repercussions. Le but de la presente etude est double. Premierement, les auteurs examinent les repercussions de la Loi sur la ricbesse des actionnaires. Us etudient les reactions du marcbe financier a plusieurs mesures, prises par le Congres. qui out mene a l'adoptioii de cette Loi. Deuxi^mement, ils se demandent si les attributs propres a Tentreprise {fonctions de gouvernance. d'information financiere et de verification) sont a.ssocies aux reactions du marcbe observees. Comme de precedents cbercheurs (Espahbodi, Espabbodi. Rezaee et Tehranian. 2002 ; Ali et Kallapur, 2001). les auteurs utilisent de multiples sources pour d^finir douze mesures legislatives importantes ayant mene a Tadoption de la Loi. En s'inspirant de la strategie utilisee par SchipperetTbompson (1983) et par Ali el Kallapur (2001). ils classent ces douze mesures en trois categories, selon la probabilile qu'elles modifient les attentes relatives a I'adoption de la Loi : I) les mesures ambigues dont l'incidence sur la probability estimee d'adoption de la Loi est soit nulle. soit neutre. 2) les mesures ddfavorables qui diminuent la probabilite estimee d'adoption de la Loi et 3) les mesures favorables qui augmentent la probabilite estimee d'adoption de la Loi. Les auteurs prevoient que les marches financiers auront reagi de fa^on positive aux mesures legislatives qui augmentent la probabilite d'adoption de la Loi et que cette reaction sera plus accentuee dans le cas des societes deja dotees, avant I'adoption de la Loi. de fonctions de gouvemance, d'information financiere et de verification plus efficaces. La Loi s'applique a toutes les societes faisant appel public a I'epargne. Par consequent, les auteurs s'attendent a ce que le marcbe boursier dans son ensemble ait rdagi de fa^on positive (negative) aux mesures favorables (defavorables), dans la periode entourant I "adoption de la Loi. Le test initial des auteurs porte sur deux indices boursiers diversifies, soit I'indice S&P 5(X) et I'indice Value-Line a ponderation equivalente. Le test des mesures s'^cbelonne de fevrier h juillet 2002. Pour cbaque indice. les rendements anorniaux dans la periode entourant les mesures en question sont calcules a I'aide du module de rendement moyen constant. La periode d'estimation dans le cas du rendement normal (rendement de reference) commence 142 jours de bourse avant le 2 fevrier 2002 et se termine 21 jours de bourse avant

CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

631

cette date. Les auteurs calculent ensuite les rendements anormaux jour-mesure (AR) en soustrayant le rendement normal du rendement brut du jour. 11s obtiennent les rendemenls anormaux cumulatifs sur troi.s jours {CAR) en additionnant les rendements anormaux du jour de la mesure, du jour pr^cedant la mesure et du Jour suivant la mesure. Les auteurs procedent a une analyse transversale afin de determiner les caracteristiques propres a Tenireprise qui influent sur I'ampleur de la reaction des cours boursiers aux mesures du Congres qui augmentent la probability d'adoption de la Loi. Cet exercice livre de Pinformation concluante en ce qui a trait aux determinants des repercussions de la Loi sur la richesse des actionnaires. Les auteurs rel&vent un rendement anormal positif (negatif) a la date de plusieurs mesures legislatives qui augmentent (diminuent) la probabilite d'adoption de la Loi. L'analyse des mesures realisee par les auteurs a I'^chelon des portefeuilles revele que les marches boursiers ont eu une reaction positive aux mesures du Congres qui ont mene a Tadoption de la Loi en creant des extemalites positives {augmentation de la confiance des investisseurs). Les conclusions des auteurs viennent etayer la perception generale seton laquelle la Loi atteint le but vise, soit de resiaurer la confiance des investisseurs. Cette constatation donne a penser que la Loi a cree un environnement favorisant une solide integrite du marche et que les investisseurs ont accueilli favorablement son adoption. Les auteurs jettent egalement un eclairage sur les determinants de la reaction observee du marche, a I'aide des variables propres aux entreprises. 11s constatent que la Loi a eu une incidence plus positive sur les entreprises qui se conformaient mieux aux prescriptions de la Loi avant meme l'adoption de cette demiere grace a une gouvemance plus efficace, des rapports financiers fiables et transparents, et une fonction de verification plus credible que sur les autres entreprises. Les auteurs notent que la Loi a, en moyenne. favorise Taugmentation de la richesse et que la reaction du marche a ete plus positive pour les entreprises dont le mode de fonctionnement se confomiait davantage aux exigences de la Loi (conformite mesuree selon les fonctions de gouvemance d'entreprise, d'information financiere et de verification), avant meme ["adoption de cette demidre. Les resultats de I'^tude r^sistent au controle d'autres attributs des entreprises comme ceux de la taille, de la performance, des honoraires de verification et du levier financier. Ces resultats ont des consequences pour les soci^tes ouvertes, les investisseurs, les chercheurs et les responsables de I'elaboration des politiques. Selon une interpretation des constatations des auteurs. meme si toutes les entreprises beneficient egalement de la Loi, cette demifere impose des couts de conformite sup^rieurs aux entreprises dont la gouvemance laisse a desirer et dont les normes d'information sont moins rigoureuses. La Loi a eu pour effet de stimuler les initiatives visant a r^tablir la confiance des investisseurs dans les fonctions de gouvemance d'entreprise. d'information financiere et de verification. Dans I'ensemble, les resultats de I'etude portent a croire que les avantages de la Loi excedent de beaucoup les couts de conformite qu'elle impose, si Ton en juge par les cours boursiers.

1. Introduction The wave of financial scandals in the late 1990s and the early 2000s has reinvigorated the debate on regulating corporate governance and the accounting profession. Investors' concerns about these scandals and the resulting loss of confidence are commonly cited as primary reasons for the stock-market slump in 2002 (Browning CAR Vol. 23 No. 3 (Fall 2006)

632

Contemporary Accounting Research

and Weil 2002). To restore investor confidence and reinforce corporate accountability and professional responsibility. Congress passed the Sarbanes-Oxley Act ("'the Act") in July 2002. The Act is aimed at improving corporate governance, enhancing the quality of financial reports, promoting audit effectiveness, creating the Public Company Accounting Oversight Board (PCAOB) to regulate the auditing profession, and increasing criminal and civil liability for violations of securities laws. The Act addresses the conduct and professional accountability of those who produce, certify, audit, analyze, and use public financial information. The Act is considered "as broad an attempt to correct free-market externalities as any legislation passed by the federal government in recent memory ... it deals with what people do. not where securities go" (Wiesen 2003, 429). Anecdotal evidence (Charles River Associates [CRAJ 2005; Turner 2005) indicates that although the Act has induced significant benefits to investors, it has also imposed substantial compliance costs. These costs for public companies are about 0.1 percent of total revenues. This study contributes evidence to this debate by investigating shareholder wealth effects of the Act and possible determinants of such effects. The purpose of this study is twofold. First, it examines the effect of the Act on shareholder wealth. We investigate the capital-market reactions to several congressional events leading up to its enactment. Second, it investigates whether firm-specific attributes (corporate govemance. financial reporting, and audit functions) are associated with the detected market reactions. We detect a positive (negative) abnormal return at the time of several legislative events that increased (decreased) the likelihood of the passage of the Act. Our portfolio-level event analysis reveals that the capital markets reacted positively to congressional events leading up to the passage of the Act by creating positive externalities (improvement in investor confidence). The results support the general perception that the Act is achieving its intended purpose of restoring investor confidence.' We find that the Act is wealth-increasing, on average, and that the market reaction is more positive for firms that were closer to compliance to the Act (measured by their corporate governance, financial reporting, and audit functions) prior to its enactment. Our results are robust after controlling for otber firm attributes such as size, performance, audit fees, and leverage. The results of this study have implications for public companies, investors, researchers, and policymakers. The remainder of the paper proceeds as follows. The next section reviews the related literature. A discussion of possible shareholder wealth effects of the Act, the events leading to the passage of the Act, and the hypothesis development are presented in section 3. Section 4 discusses our research design. Results are presented in section 5, and section 6 concludes the paper. 2. Related research Two contemporaneous studies examine the effects of the reported financial scandals and the congressional responses (the Act) on investor confidence. Cohen. Dey, and Lys (2004) document that earnings-management activities of public companies increased substantially during the financial scandal period. This trend reversed following the passage of the Act, which indicates that increased eamings manageCAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

633

ment contributed to the erosion of investor confidence, and the Act led to the restoration of that confidence. Jain, Kim, and Rezaee (2004) find: (a) wider spreads, lower depths, and higher adverse-selection components of spreads during the financial scandal period, causing a deterioration of market quality: and (b) evidence indicating improvements in market liquidity measures after the passage of the Act both in the short and the long term. Three related studies (Li, Pincus, and Rego 2004; Engel, Hayes, and Wang 2004; Zhang 2005) were conducted after our initial study. Li et al. find that the Act has a net beneficial effect of improving the quality of financial reports while imposing greater costs on firms that were less compliant with its provisions regarding auditor independence, audit committee role, and earnings management. Engel et al. find that the detected abnormal return surrounding events that increased the likelihood of the passage of the Act were positively associated with the firm's size and share turnover, suggesting that compliance costs were more burdensome for smaller and less liquid firms, which in turn caused many of them to go private. Zhang documents overall negative market reactions to many legislative events pertaining to the Act in the sense that investors view the implementation of provisions of the Act including restriction of nonaudit services, enhanced corporate governance, and internal control reporting to be costly to businesses. Although the related research provides insights into the effects of regulations on capital markets, earnings-management activities, compliance costs, and market liquidity, it does not address the determinants of such effects, including firm-level issues of corporate govemance, financial reporting, and audit functions. 3. Shareholder wealth effects of the Act The process and rationale underlying the legislation The wave of financial scandals in the early 2000s encouraged lawmakers and regulators to argue that capital markets could not be trusted "to work on their own without strong regulatory support and [thus] new regulation was needed to restore investor confidence" (Ribstein 2002). Consistent with prior research (Espahbodi, Espahbodi, Rezaee, and Tehranian 2002; Ali and Kallapur 2001), we use multiple sources to identify the significant legislative events leading up to the passage of the Act. To identify key events, we began by searching the Securities and Exchange Commission (SEC) and congressional websites and looked for press releases pertaining to the Act. We next searched the Wall Street Journal index (WSJI), the Wall Street Journal (WSJ), and the New York Times (NYT) to confirm and/or identify the event dates.2 Each of the 12 identified events potentially inform investors of the likelihood of the passage of the Act and its possible impact on corporate governance, financial reporting process, and audit functions. Following the strategy used by Schipper and Tbompson 1983 and Ali and Kallapur 2001, we classify these 12 events into three categories based on their likelihood to alter expectations about the passage of the Act: (a) ambiguous events that had either no effect or a neutral effect on the Act's assessed probability of enactment, (b) unfavorable events that decreased the Act's assessed probability of enactment, and CAR Vol. 23 No. 3 (Fall 2006)

634

Contemporary Accounting Research

2 o8

T3 -a

:i 6

<

K IS g

"a

g= ^

C= 15 ,c o E > c S oo o lU 3 ?3 (- j : ^ o 2

aid ientCleor; don

ugust

-5

E E

3 -O

3 S

:S ^

?.l t

.5 .5

00 O j

l)

2 J^,, E .^ ig y Q

O C N

U 3

= ES

S ^

op

t

.^ -

Q. O

<

00 "^

o s < u .S =

11

XI

a 3 o o O

1)

E

Kl

lnsi

:^

U>

_C

= 2

. 23 No. 3 (Fall 2006)

age

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

635

2

W

^

C

p ~ Hi

a(J F 5

.2 ^ 1 U .p 3 .2 2 o E

d " bx

M .2 g _ ^ O O g c

^ E -E s

= " S ^ ^ ^ S &) E c c d ^ ^ .Sf o c a. w 5 o !n C O

x>

'^

III!

*-

00

a.

e

S o

^ 5 .S ^

?; " S

ID

II

< ou

11 S

n 11^II ^^^. II

.i>l:2'5

II

o c c

-3 c _^ ^ f I g

c fc .E .^S tn C 5 .i "P o

E id c

oj

X c

II

I"X

a

Q.

O.

Vol. 23 No. 3 (Fall 2006)

636

Contemporary Accounting Research

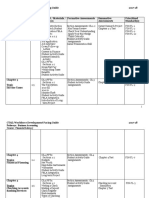

(c) favorable events that increased the Act's assessed probability of enactment, as discussed in the following sections. Figure 1 illustrates the time-line of these legislative events, along vt'ith their anecdotal evidence, provisions, and our predictions of possible security price reactions. Ambiguous events Legislators and regulators initially attributed reported financial scandals of the early part of 2002 (Enron, Global Crossing, Adelphia) as "a few rotten apples" requiring no regulatory responses (Cunningham 2003). During this period, investors were frustrated with the wave of financial scandals, yet they either were not convinced of the widespread effects of scandals or considered them unrelated events, as evidenced by a relatively stable investor confidence index around a value of 85 (U.S. General Accounting Office [GAO] 2002). Revelations of further corporate and accounting scandals started in March 2002, continued through June, and were galvanized with the SEC complaint against WorldCom on June 26,2002. The reported financial scandals in May and June 2002 caused the UBS/Gallup index for investor confidence to decline to an all-time low of 46 in June (GAO 2002). During this period of ambiguity, more than 30 reform bills were introduced by legislators and regulators (Schroeder 2002). In essence, there were three competing refonn proposals. Senator Paul Sarbanes, Democratic chair of the Senate Banking Committee, sponsored a bill that would (a) impose tougher rules on the accounting profession and financial analysts, (b) boost the budget of the SEC and strengthen its power to discipline corporate executives, and (c) create an oversight board with broad powers to oversee audit functions. This bill was viewed as a sensible regulation but was strongly criticized as being too prescriptive. The second proposed reform was a Republican bill sponsored by Congressman Michael Oxley that would create an independent audit oversight board, similar to that proposed by Sarbanes but with far fewer powers. This bill was viewed as a regulation with no teeth and an enshrinement of the status quo. The third proposal was the SEC's plan for a private regulatory board to regulate public accounting firms. During this ambiguous period of intensive legislative debate, market participants received conflicting signals from tbe House, the Senate, the SEC, and the White House regarding the content, substance, and likelihood of the passage of any congressional refonn. Thus, we do not make predictions for the three legislative events during the ambiguous period. Unfavorable events Two versions of the reform bill received congressional attention and public support. The Republican-backed House bill (Oxley) was favored by the accounting profession and considered by many as a weaker reform. The tougher bill proposed in the Senate (Sarbanes) was viewed as being too prescriptive and harsh to the financial community and corporations. There were, however, considerable uncertainties over which one would prevail and whether either one would be passed by Congress (Geewax 2002a). The Senate considered the Sarbanes bill in the first week of July 2002. President Bush made a highly publicized speech to Wall Street on CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

637

July 9, 2002, which was viewed by many as simply tinkering with the SEC plan for a private regulatory board and other proposals to regulate public accounting firms (Kulish 2002). The extent of disagreements between the Senate and the House bills, the limited time to compromise on these differences in the Hrst part of July 2002, and the ineffectiveness of the president's proposal created significant doubt that any reform bill would pass before Congress departed Washington for the August recess (Geewax 2002a; Oppel 2002). The possibility of the passage of a meaningful reform bill was remote, primarily because "lobbyists and some leading Republicans had pledged to rewrite the bill when it got to conference committee" (Oppel 2002, AI). We posit that investors perceived these differences as a signal of a decreasing likelihood of the passage of the Act (events of July 9, 15, 16, and 19, 2002), and thus we predict negative market reactions to these events. Favorable events . ' , ^ The Act emerged under circumstances that virtually ensured its passage in the last week of July 2002. First, because 2002 was a mid-term election year. Democrats used reported financial scandals as an opportunity to push for a broader regulatory agenda. Second, the pervasiveness of reported financial scandals made it difficult and risky for any politician, particularly pro-business Republicans, to block its passage especially after a July 24 Conference report of a joint House-Senate committee received approval. Third, the bill was finally renamed the Sarbanes-Oxley Act by the Conference committee on July 24 and included a majority of provisions from the perceived tougher Senate bill, which made the Act a symbolic victory for Democrats. Fourth. President Bush said on July 24 that "he would .sign the SarbanesOxley Act of 2002, which he called a victory for America's shareholders and employees" (Geewax 2002b). Finally, Congress moved rather swiftly to pass the Act after the wave of financial scandals eroded investor confidence in the capital markets. Fvents pertaining to the Conference report on July 24, the congressional legislation on July 25. 2002, sending the compromised bill to the president on July 26, 2002, and all rumors about the president signing the compromised bill sent signals to the market suggesting the increasing likelihood of the passage of the Act and the resolution of uncertainty about its provisions. We posit that investors viewed these events as favorable, and the capita! markets reacted to them positively. Theoretical argument and hypothesis development In this section, we describe the theoretical argument that motivates our hypothesis development and empirical analysis. The Act provides a compelling setting for assessing the shareholder wealth effects of mandatory disclosure and corporate govemance regulations for several reasons. First, the Act applies equally to, and is intended to benefit, all publicly traded companies. Some of the provisions of the Act, which were not previously practiced by public companies, and which are intended to benefit all companies, are (a) creating the PCAOB to oversee the audit of public companies and to improve the perceived ineffectiveness of the self-regulatory environment for the auditing profession; (b) improving corporate governance through more vigilant boards of directors and responsible executives; (c) enhancCAR Vol. 23 No. 3 (Fall 2006)

638

Contemporary Accounting Research

ing the quality, reliability, transparency, and timeliness of financial disclosures through executive certifications of both financial statements and internal controls; (d) prohibiting nonaudit services; (e) regulating the conduct of auditors, legal counsel, and analysts and their potential conflicts of Interest; and (f) increasing civil and criminal penalties for violations of security laws. Second, the mandatory level of compliance with the provisions of the Act regarding corporate governance, accounting, and auditing practices is presumably much higher than the previously practiced level. Third, the Act is intended to improve investor confidence, and its provisions are designed to reduce the information risk perceived by the capital market about the true cash flows of the companies. A reduction in the risk premium reduces the discount rate that the investors use to evaluate companies. Thus, we predict that stock prices will respond to legislative events leading up to the passage of the Act. Although the direction of capital-market reactions to these events is an empirical issue, consistent with Espahbodi et al. 2002, we formulate our first hypothesis as follows: HYPOTHESIS 1. The capital markets reacted positively (negatively) to legislative events that increased (decreased) the likelihood of the passage of the Act. The overall benefit induced by the Act that is, improving investor confidence must be weighted with the imposed compliance costs at the firm-specific level. Brown and Caytor (2004) find that good (poor) corporate governance is associated with higher (lower) profits, less (more) risk, less (more) stock price volatility, higher (lower) values, and larger (smaller) cash payouts. Gompers, Ishii, and Metrick (2003) document that firms with stronger corporate governance experienced higher stock returns than those with weaker corporate governance during the 1990s. The Act requires a poor (good) governance firm to make many (few) changes to its pre-Act governance structure. Thus, compliance with provisions of the Act pertaining to corporate governance, financial reporting, and auditing functions would be more costly to poor governance firms than to good governance firms. Indeed, recent surveys show that the costs of compliance with the Act range from as little as SI million to as high as over $10 million (Business Roundtable 2004). Zhang (2005) estimates that the cost of compliance with section 404 of the Act ranges from 0.12 percent to 0.62 percent of a company's reported revenues, and the average is tower in terms of percentages for larger companies. We assume that all public companies affected by the Act were in equilibrium in the pre-Act period. The Act raised the stock price valuation for all firms by improving investor confidence in tbe capital markets, a pure externality effect that is not firm-specific. For more compliant (MC) firms, ex ante, the induced benefits outweighed the imposed costs, whereas, for less compliant (LC) firms, ex ante, the imposed compliance costs outweighed the induced benefits. Nonetheless, LC firms may still show positive abnormal retums because the positive pure externality (induced by improvement in investor confidence) outweighs the excess of costs over benefits. MC firms, on the other hand, are expected to show even higher positive abnormal retums because of the positive pure extemality effect without any CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

639

major setback on the cost front.^ As with any regulations, shareholder wealth effects of the Act are a function of both the expected benefits and costs imposed on public companies. Our second hypothesis therefore is as follows:

HYPOTHESIS

2. The observed positive capital-market reactions are higher (lower) for firms with more (less) effective corporate governance, financial reports, and audit functions prior to the passage of the Act.

4. Research design Test of Hypothesis 1 (time-series analysis) The Act is applicable to all publicly traded companies. Therefore, we expect the capital market as a whole to react positively (negatively) to the favorable (unfavorable) events around the passage of the Act, as discussed in the previous section. Our initial test focuses on two broad-based market indexes namely, the Standard & Poor's (S&P) 500 index and the Value Line equally weighted index. The test period for our events is from February to July 2002. For each index, abnormal returns around the relevant events are calculated using the constant-mean return model. The estimation period for the normal (benchmark) return starts from 142 trading days before February 2, 2002 and ends 21 trading days before that date. The event-day abnormal returns (ARs) are then calculated as the day's gross return minus the normal return. The 3-day cumulative abnormal returns (CARs) are obtained by adding the abnormal returns on the event day, one day before the event, and one day after the event.** We also examine the solitary and aggregate impacts of 12 congressional events on stock prices using a times-series model based on Ali and Kallapur 2001 and Espahbodi et al. 2002, as follows: 12 PjDj + ej .' (1),

where Rf is average daily stock return of sample firms on date t; a^, is the intercept coefficient that represents the average daily stock return across the 485 nonevent trading days in 2001 - 2 for the S&P 500 portfolio; /3y represents mean-adjusted returns of the portfolio retum for event; minus the portfolio mean return over the nonevent days; D. is a dummy variable that takes a value of I for the event window (r = - 1 . r = 0, / = +1) relative to the announcement date of event j , and 0 other= wise; and e: is random disturbance, which is assumed to be normal and independent of the event. We estimate (1) over the 485 trading days of stock retum data for 2001 and 2002 using raw returns for S&P 500 firms. Unlike Espahbodi et al, 2002, we did not adjust (1) for market return because the Act was intended for ali public companies and the entire market is affected by the Act. We also estimate (, I) for our three event classifications: (a) ambiguous events period (events 1-4, 91 trading CAR Vol. 23 No. 3 (Fall 2006)

640

Contemporary Accounting Research

days); (b) unfavorable events period (events 5-8,9 trading days); and (c) favorable events period (events 9-12, 4 trading days). We also estimate (1) for (d) all congressional 12 events (events 1-12, 115 trading days). Test of Hypothesis 2 (cross-sectional analysis) We perform a cross-sectional analysis to Identify the firm-specific characteristics that influence the magnitude of stock price reactions to congressional events that increased the likelihood of the passage of the Act. Our cross-sectional analysis provides evidence pertaining to the determinants of shareholder wealth effects of the Act. Dependent variable We use the standard event study methodology for the cross-sectional analysis to estimate abnormal retums (AT?,,) as follows: ^it = f^i,-fif-P*if^M,'f^f) (2),

where Rj, is the return on stock / on event date /; ^ is the stock's beta, which measures the sensitivity of a company's stock price to the fluctuation in the S&P 500 index, calculated for a five-year period ending in June 2002 using month-end closing prices including dividends; Rjr is the risk-free rate of retum from treasury bills (T-bills); and Rj^, is the retum on S&P 500 index on the event date. The dependent variable for our second regression is cumulative abnormal retums (CA/?,,), which is obtained by adding the abnormal retums on the event date, one day before the event, and one day after the event. Test variables Provisions of the Act are expected to affect three fundamental attributes of public companies: corporate govemance. financial reporting, and audit functions. We use the three S&P transparency and disclosure (T&D) dimensions of corporate governance ownership structure and investor rights (OSIR). board and management structure and process (BMSP), and financial transparency and information disclosure (FTfD\ along with other explanatory variables, in our cross-sectional analysis. The goal of this analysis is to determine the relation between the observed capital-market reactions and firms' financial attributes and corporate govemance characteristics. Measures of corporate governance Corporate govemance addresses the potential conflicts of interest and agency probiems induced by the separation of ownership and control in corporations (Fama and Jensen 1983). These agency problems may cause conflicts of interest and infonnation asymmetry, which can be costly to shareholders. The Act changes the balance of power between directors, executives, and investors by shifting significant responsibilities from management to the audit committee. These changes are expected to motivate corporate boards, audit committees, and executives to become more vigilant, transparent, and accountable toward financial reports.'' We CAR Vol. 23 No. 3 (Fall 2006)

Tbe Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

641

posit that firms with higher corporate governance scores (OSIR and BMSP) are more positively affected by the Act. Measures of financial reporting Many provisions of the Act are aimed at improving the quality, transparency, and reliability of financial reports from public companies (for example, executive certifications of financial statements and internal controls). We use two measures of financial reporting: (a) S&P T&D scores for financial transparency and disclosure {FTID), and (b) the absolute value of total accruals {ATAC) as proxies for the quality, reliability, and transparency of financial reports. We predict that firms with higher FTID scores are more positively affected by the Act. Prior research (Cohen et al. 2004; Frankel, Johnson, and Nelson 2002) uses magnitude and signs of accruals as a proxy for eamings quality In the examination of eamings management. Thus, we expect a negative relation between the ATAC and the observed market reactions to the Act. Measures of audit functions Several provisions of the Act are aimed at improving audit quality, effectiveness, and credibility, including auditor independence, retention of audit evidence, and oversight of the PCAOB. The Act, by reducing management's influence on audit tenure and prohibiting nonaudit services, can reduce conflicts of interest between management and auditors, which in tum can improve audit credibility and quality. We use the ratio of nonaudit fees to total auditor fees as a proxy for the credibility of audit functions and predict a negative relation between this ratio and the observed capital-market reactions to the Act. Prior research (e.g.. Chaney and Philipich 2002) documents that Arthur Andersen clients experienced negative abnormal returns over a period of negative news disclosure about Enron and Andersen. Thus, we use an Arthur Andersen {AA) variable as a proxy for auditor's reputation and credibility, and predict a negative relation between the AA variable and the observed capital-market reactions to the Act. Control variables We control for several equity characteristics (firm size, performance, and leverage) that have been documented in prior research (e.g., Fama and French 1993) as being associated with securities retums. We control for firm size using market capitalization. Large firms often have more resources and are better equipped to absorb the high compliance costs of the Act, and thus we predict the coefficient on size variable to be positive. We control for firm performance (risk and expected growth) using the market-to-book ratio of common equity (Fama and French 1993), and expect this variable to be positive. We control for financial leverage by using debtto-equity ratio. The agency theory (Jensen and Meckling 1976) suggests that fimis have more incentive to offer increased levels of monitoring when leverage increases. Thus, highly leveraged firms are more likely to benefit from monitoring mechanisms provided by the Act in order to ensure compliance with the restrictive covenants specified in debt agreements. We predict a positive relation for leverage. CAR Vol. 23 No. 3 (Fail 2006)

642

Contemporary Accounting Research

We also control for the cost of compliance with provisions of the Act. As discussed in section 3, the cost is higher for less compliant firms than for firms that are more compliant prior to the passage of the Act. We use audit fees as a proxy for the cost of compliance with the Act because audit fees are estimated to constitute a large portion of the total compliance costs. We predict a negative relation between the audit fee variable {AUT) as a proxy for the compliance cost and the observed capital-market reactions to the Act. Regression models We developed our regression model, which is based on cross-sectional variables, as follows: CARj, - a + ^lOSIRi, + ^j^MSPj, + ^^^FTIDi, + P^ATAC^ + ^sNATAj, + ^jMACi, + p^MTBj, + fi^Vi, + PioAUTi, + ,, (3). Our sample for the cross-sectional analysis consists of 415 S&P 500 firms with available data on test variables (40 firms were excluded for nonexistence of S&P and T&D scores, and another 45 were excluded for unavailability of data on auditor fees). The presence of tbe cross-sectional beteroscedasticity and tbe contemporaneous correlation of the residuals are likely in our data primarily because congressional events leading to tbe passage of the Act affect all sample firms. We employ the generalized method of moments (GMM) estimation, which uses a correct variance-covariance matrix based on residuals, to address the economic issues related to heteroscedastic or correlated error terms. Panel A of Table I defines all test and control variables, and provides descriptive statistics (mean, median, standard deviation, minimum, maximum) for them, and panel B reports correlations between the variables. 5. Results Time-series analysis Table 2 reports the observed daily abnormal retums (ARs) and tbree-day cumulative abnormal retums (CARs), along with their predicted signs, around eacb of the 12 events and for each of the three event periods designated as ambiguous, unfavorable, and favorable. Of the eight dates for which we predict whether the event will increase or decrease the likelihood of the passage of the Act, the sign of the daily abnormal return conforms to our prediction for seven dates. Columns 5 and 6 of panel A present the ARs and tbree-day CARs results of the Value Line index.^ and columns 7 and 8 show ARs and CARs based on the portfolio of 500 firms in the S&P 500 for each of the 12 events. Panel B of Table 2 presents average daily abnormal retums (ADAR) for both models for eacb of the three categories of tbe events and the aggregate impact of all events. Column 3 shows ADAR for the Value Line index, and column 4 presents ADAR for tbe portfolio of S&P 500 stocks. We generally detect negative capital-market reactions to ambiguous events, particularly event number 3 regarding the SEC's plan for a private regulatory board CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxiey Act of 2002 and Capital-Market Behavior 150 371 500 000 5f>4

643

:^

r~ oc en

00

pp d d d d d d d d d

OO

r^ m

d d d

o> o airi

:s c

SN (f N on o o -^^ ot^sNrnr I^ m o m - ( S o

p p p p p p d c i d d d d d d

o o _: _; o

O Ol 'O in 00 ' i I Tt o ' ^ r-i 00 i~- in in <? 00

p p p r-J p

o d c; d d

p p p p p d d d d d d II I I

00 m O o m C O C f^ r-i o N

p p p rn

o <D di CD I I I

o o o

5241 5344 0215

2083

i (^ ^ en (N

00 00 O^ r -

0000

o o o

p p p p

I 1 I

0868 0585

1287 1516

0000

3

d d

I I

ll

UJ a.

B

ffi

CAR Vol. 23 No. 3 (Fall 2006)

644

Contemporary Accounting Research

TABLE I (Continued) Notes: Variables are defined as follows: OSIR = S&P's composite scores for ownership structure and investor rights as of June 30, 2002, ranging from 1 to 10; BMSP = S&P's composite scores for board and management structure and process as of June 30, 2002, ranging from 1 to 10; FTID = S&P's composite scores for financial transparency and information disclosure as of June 30, 2002. ranging from 1 to 10; ATAC = the absolute value of total accruals, equal to net income minus cashflowsfrom operations, deflated by average total assets for thefiscalyear ended December 2001; NATA ^ the ratio of nonaudit fees to total auditor fees for the fiscal year ended December 2001; AA = an indicator variable that takes a value of I iffirm'sfinancialstatements for fiscal year ending December 2001 are audited by Arthur Andersen, and 0 otherwise; MAC = market capitalization of thefirmcalculated as the market value of the equity at the end of June 2002, in trillions of dollars;

MTB = market-to-book ratio of common equity at the end of June 2002. divided by 100; LEV = debt-to-equity ratio calculated for thefiscalyear ended December 2001; and AUT = audit fee for thefiscalyear ending December 2002, in millions of dollars. * Significant at the O.OI level (two-tailed). ^ Significant at the 0.05 level (two-tailed).

to regulate public accounting firms. The detected abnormal retums for these events, except event number 3, are not statistically significant, suggesting that investors did not view the early congressional bills as value-relevant or significant in addressing financial scandals. Tbe SEC proposal (event 3) was considered by investors to be an ineffective reform that would allow the accounting profession too much infiuence over its proposed regulatory board. Panel B of Table 2 shows that tbe average daily abnormal retums during tbe ambiguous events period (events 1 -4) was negative and statistically insignificant, indicating no market reactions to these events. Tbe second category consists of unfavorable events (5, 6, 7, and 8) that either decreased tbe probability of the passage of tbe Act or provided information regarding the difficulty of reaching agreement on the final provisions of tbe Act in tbe House and the Senate. We detect negative abnormal retums for tbese events, as predicted. Investors viewed tbese events as bad news (unfavorable) and the capital markets reacted negatively to these events. Particularly, tbe average daily incremental retums on July 9 and 19, 2002 are 2.41 percent and -3.78 percent, respectively, CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

645

S

II

in O

O^

OO C 4 * d

OO ^

o d o r4

I I I

r^ O ts

I

9 E E

II

O O

t N O O O O O

> O 0 0

(MO

.5

II

I

I

a;

>

0 0 o o c n I I I I I I I I

c u

DO

a

a: X iM

o c _o

o

1

b

B _ O

g o

sal

t/i o

"ij CL aj e^

.3

o

1

c

[Til

.1 -I 9

^ 5

u.

CL a

It

g U

0 0 0 0

r 1

J= CU Cfl r*Ni fsj c^ o l f^ ^ ' ^ o o O ' n o \ v ^ f S r ^ O xi c c id W 3 3 3 3 '* -^ ^ ^ ^^ \ O ' 3 ^^

u u u u

fv| C o l cJ o i c-J M C h ' ^ " ' / ~ i ' C O <NCNr-im ; ^ -^ 3 3 3 3 3 3 ^^ ^^ ^^ ^^ ^^ ^^

o o o o o o o o o o o o

3I

si

. 23 No. 3 (Fall 2006)

thei esi

a

odo

646

Contemporary Accounting Research

O Xi

.o

* o i^. o

U

ao O

i

O

o

33

3

W

+

a

o

p o c^ fN

i

O

O J3

m

O u VI

U

-8 SI

E

y g u V >

' t

<5^ O

Tf (N

"* ~

E ^ 3 a.

- E

o

,o

c

1-;

jj aj

LL

_: _; ^ 3 3 a> > 1 L i .

. .

, .

a u

3 60

S -- g

.g

E 'H

3 p

^

_

3

E

War-.

J2 OJ

11 e 3

^ Ji ^ C

CQ

i I

03 ^ ^

-S "3

2^ I I- g S ^

13

CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

647

which are significant at the 5 percent and the I percent levels. President Bush, on July 9, 2002, went to Wall Street and spoke in support of securities law reform, wbich was viewed negatively by market participants (the three-day CAR for botb models is negative and statistically significant). On July 19. 2002, there were significant uncertainties regarding the form, content, and possibility of passage of the Act. This event sent a signal to the market that the Act may not be forthcoming and, as reported, it did not bave much chance of becoming law (Hilzenrath, Weisman, and Vandhei 2002). We detect negative market reactions to this event: daily and cumulative abnormal retums are negative and statistically significant at the 1 percent level. Panel B of Table 2 indicates tbat the average daily abnormal retums for botb the portfolio of stocks and Value Line index models were negative and significant at the I percent level (-1.33 and -1.51 percent, respectively) during the unfavorable events period (events 5-8). Tbe last group, consisting of favorable events (9 through 12) unambiguously increased the probability of tbe passage of the Act, and the market reacted positively to these events. Between July 24 and July 30, tbe House and the Senate reached a compromise on legislation, and Congress passed tbe Act by a vote of 423-3 in the House and 99-0 in the Senate. The compromised bill was sent to tbe president to sign into law and was eventually enacted on July 30, 2002. We detect positive market reactions to tbese favorable events, suggesting that investors view provisions of the Act as beneficial to them and important in restoring their confidence in corporate govemance, the financial reporting process, and audit functions. Panel B of Table 2 shows tbat the average daily abnormal retums for the portfolio of stocks and Value Line index models during the favorable events period (events 9-12) are 1.20 and 3.11 percent, respectively, and both are significant at the 1 percent level. Tbe Value Line index abnormal return and the average daily incremental returns of the portfolio of S&P 500 companies on July 24, 2002 (Conference report) are 4.34 percent and 5.78 percent, respectively, and are statistically significant at tbe I percent level. The market viewed tbe Conference report as a signal of the increasing likelihood of passage of tbe Act and reacted to this event positively. The positive tbree-day CARs for July 25. 26. and 30 during tbe last week of legislative events are statistically significant, indicating positive market reactions to these events. Overall, our results indicate tbat during the ambiguous events period (February 14-June 25, 2002) and unfavorable events period (July 9-July 19, 2002), tbe capital markets reacted negatively to related legislative events because investors feared either that no bill would be passed or that tbe bill tbat passed would not be tough enough to combat the rash of financial scandals. We detect significant positive cumulative abnormal retums during final legislative events leading up to the enactment of the Act from July 24 to July 30, 2002 (events 9-12), suggesting tbat investors considered these events as conveying good news in ensuring tbe passage of tbe Act. ^ The magnitude, sign, and significance level of our empirical results are confirmed by subsequent studies by Li et al. 2004 and Zbang 2(X)5, altbough the latter study did not test market reactions to our events 11 and 12 when tbe final bill was sent to the president and subsequently signed into law on July 30. 2002. Zhang interprets the significant positive CAR on botb July 24 and 25 as "not surprising ... CAR Vol. 23 No. 3 (Fall 2006)

648

Contemporary Accounting Research

consistent with the explanation that the final announcement eliminated prior concerns for tougher rules" (2005. 20). In the next section, we relate the differences in market reaction of different stocks to firm-specific characteristics. Cross-sectional analysis Our cross-sectional analysis examines whether the magnitude of positive price reaction to favorable events leading up to the passage of the Act varies with a firm's corporate govemance characteristics, financial reporting attributes, and audit functions. Table 3 reports regression results for each of the four favorable events (events 9-12 of Table 2) and for the entire favorable events period. Each column in Table 3 reports the regression coefficients, standard error, significance level, number of observations, and adjusted R^.^ The coefficients for the corporate governance variable {BMSP) are positive and statistically significant. This evidence supports our hypothesis that companies that were closer to compliance with the corporate governance provisions of the Act prior to its passage, on average, experienced greater positive abnormal security prices. Prior research (e.g.. Shleifer and Vishny 1986) documents that large outside blockholders have greater incentives to monitor managers. However, we did not detect a statistically significant relation between the ownership structure and investor rights (OSIR) variable and the observed abnormal retums experienced by public companies resulting from the passage of the Act. We find that the observed capital-market reactions have a positive and significant relation with the financial transparency and information disclosure {FTID) variable and a negative and significant association with absolute value of total accruals {ATAC). We interpret the negative relation between ATAC and the detected abnormal returns as implying that the capital markets view firms with higher accruals as having more opportunities to engage in earnings-management activities. These results suggest that firms with more reliable and transparent financial disclosures experienced higher positive market reaction around events thai increased the likelihood of the passage of the Act. We find a negative and significant relation between the ratio of nonaudit service fees to total auditor fees {NATA) and the observed abnormal returns around events leading up to the passage of the Act. Our findings of a negative coefficient for NATA can be interpreted in two ways. The performance of nonaudit services simultaneously with audit services might be viewed by the market as evidence that auditors' controversial economic bond with their clients could adversely affect audit credibility. Alternatively, the observed negative association can be interpreted as market participants negatively viewing the loss of the perceived value-enhancing nonaudit services from a firm's close business ally post-Act. As for the impact of an auditor's reputation, we do not find any statistically significant impact of Arthur Andersen audits on the observed capital-market reaction to the Act. We detect a positive relation between three of the four control variables {MAC, MTB, and LEV) and the observed abnormal retums. The detected positive coefficient for the leverage variable can be interpreted as highly leveraged companies benefiting more from the Act's provisions regarding off-balance-sheet transactions, CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

( o r N ( * i ^ o o ^ o c s m ' O ' i O r N o o

649

s t

rS w O O O O O O ' O O O O O '"-' O

a.

X

g"

O

^^ C^ ^5 ^3 ^5 ^3 ^5 ^5 ^^ ^O ^D G* ^^ ^^ ^^ ^5 i ' ^ i " ~ ' ""' - - - j ' I ' - ' -^ -

\G 00 ~~ ^^ ""^ 00 00 O^ r* ' ^ ^D ^^ C^ ' ^^ f ^ *^

^ ' \ ^ ^ ^ [^f^l L'J. r 1 1 I I I 1 ^ ^^ ^^ ^^ ^^" 11 f ^ ^^

o o o o o o o o o o o o o o o

lU O ^~' '^ r~-m OS 00

o o o o o o o o o o o o e i o o o

r'l i n o o o ^ 00

I

01

Coel (std.

c u u O 'o t: u

o o o S o

UH

^^or-IOO^ooc^0^r^4oo^^^^O'000

It

o d d d d d d d d o d d d d d d

u

O Tf O

t o o o

O O O O O f ^ O O O O O f N ;

d d d d d d d d d d d d d o d d

u p 5 t:

f

O O ^ O O O

u

5 t

u

u p

O

O c:- G c:'_ o

=0-

I

a: . 23 No. 3 (Fall 2006)

650

Contemporary Accounting Research

r-j

1) O

Qs

(1-)

ij-i

' S fc:

p p p p q o d d d d d p

o

->

u -a U w

o p o o o

'Z fc

U

o o

cr

d d d d d

o fc

u

o fc

1

p q p p o o o o d

i> o

u 3

'o t

(u O

o o o o o

v^ O

r^ * O

' p O O

p P

p O

d d d d d

<U

*5 fc

o o o o o o

u o u fc

o o o o o

.**

ilar _ E g

u S

-S

cB

5

p p q q q p d d d d d d

o U

ob

o .

1 1 o

O

estiimate equa

i> V

cally

a M

in

3 2

"3

(5 5

z . 23 No. 3 (Fall 2006)

Eistically

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

651

possible conflict-of-interest reduction, more control mechanisms, and more effective corporate govemance to ensure compliance with the restrictive covenants specified in debt agreements. The coefficients for MTB and MAC are positive and significant, indicating that the market was upgrading larger firms with high growth potential because these firms were perceived (a) to benefit more from those provisions of the Act intended to control earnings-management activities; and (b) to be better able and equipped to absorb high compliance costs of the Act. We detect a negative relation between the audit fees variable (At/7") as a proxy for the cost of compliance with provisions of the Act and the observed capital-market reactions to the Act. The coefficients of AUT are only statistically significant for the events of July 24, 25, and 26. This lends support to our prediction that the Act was more costly for less compliant firms than for more compliant firms. Limitations and suggestions for future research There are a few caveats to our study. First, the Act affects all publicly traded companies. Thus, we use the constant-mean retums model to investigate the reaction of the entire market portfolio of fimis in the S&P 500 and the Value Line indexes to the events leading up to the passage of the Act. The test of Hypothesis 1 does not rule oul the possibility that events other than congressional actions could have produced the results. However, searches for confounding events reveal that no other relevant event of similar magnitude is known to have occurred around the congressional actions. Future research could identify firms not affected by the Act (for example, similar foreign firms) to carry out experiments with treatment versus control groups. Second, prior studies (e.g., Khanna et al. 2(X)3) caution that S&P scores are not necessarily proxies for corporate governance. We use other variables (for example, ATAC and NATA), in addition to the selected S&P scores, to measure the strength of corporate governance, reliability, and transparency of financial reports. Finally, as with any study of the passage of legislation, our findings should be interpreted with caution primarily because of the difficulty in identifying (a) the timing of information about the Act to the market and (b) fimi-specific effects due to the fact that the Act affects ail firms simultaneously. Future studies could investigate the capital-market reactions to the long-term effects of specific provisions of the Act, particularly mandatory intemal control reporting under sections 302 and 4(>4. 6. Conclusion The Sarbanes-Oxley Act is intended to restore eroded public trust and investor confidence in financial reports by reinforcing corporate accountability and improving corporate governance, financial reports, and audit functions of public companies. This study examines capital-market reactions to the events leading up to the passage of the Act. We detect significantly positive (negative) abnormal returns around the events that increased (decreased) the probability of the passage of the Act. This suggests that the Act created an environment that promotes strong marketplace integrity, and investors considered its enactment as good news. This study also sheds light on the determinants of the observed market reaction using fimi-specific variables. We find that more compliant firms with better corporate governance, CAR Vol. 23 No. 3 (Fall 2006)

652

Contemporary Accounting Research

reliable and transparent financial reports, and more credible audit functions prior to the Act were affected more positively by the Act than were other firms. One interpretation of this finding is that although the Act equally benefits all firms, it imposes higher costs of compliance on firms with poor govemance and lower disclosure standards. The Act has served as a stimulus to encourage initiatives for rebuilding investor confidence in corporate governance, financial reporting and audit functions. Overall, our results suggest that the induced benefits of the Act significantly outweigh its imposed compliance costs as measured by stock prices. Endnotes 1. Turner (2005) argues that the Act has resulted in significant benefits to investors, the capital markets, and public companies. Indeed, the former chair of the Securities and Exchange Commission (SEC), William H. Donaldson, stated that "the Act has effected dramatic change across corporate America and beyond, and is helping to re-establish investor confidence in the integrity of corporate disclosures and linancial reporting" (Donaldson 2005). 2. The WSJI, WSJ, and NYT typically report the press release announcements of these events one day after the event date. The announcement dates listed in Table 2 are from the SEC and congressional websites. To capture the full impact of these events, we use a three-day event window around event dates. 3. We have developed an analytical model that proves that changes in stock prices were higher for MC firms than for LC firms after the passage of the Act. Owing to space limitations, the model is not presented but is available upon request from the authors. 4. The abnormal retums (daily and cumulative) are standardized over the estimation period using the event-induced variance method suggested by Boehmer, Musumeci, andPoulsen 1991. 5. Recent studies (e.g., Khanna, Palepu, and Srinivasan 2003) have employed S&P's T&D scores as proxies for corporate govemance and financial reporting attributes. 6. The S&P 500 market index produces the same results as the Value Line index. 7. We conduct two robustness tests to validate our results. First, we use two alternative market retum measures of the Russell 1000 and 3000 indexes in addition to S&P 500 and Value Line indexes and find that all four market retum measures produce quantitatively similar results. Second, we divide our sample into two portfolios of less compliant (LC) firms and more compliant {MC) firms, using S&P's FTID scores, and find that both portfolios experienced net benefits from the passage of the Act, but MC firms outperformed LC firms. 8. We standardize both the AR and CAR dependent variable in Table 3 over the estimation period using the event-induced variance method suggested hy Boehmer et al. 1991. References Adetunji, J., S. Humes-Schuiz, and P. Spiegel. 2002. White House backs SEC reforms. Financial Times., June 22, 8. Ali, A., and S. Kallapur. 2001. Securities price consequences of the Private Securities Litigation Reform Act of 1995 and related events. The Accounting Review 76 (3): 431-60. CAR Vol. 23 No. 3 (Fall 2006)

The Sarbanes-Oxley Act of 2002 and Capital-Market Behavior

653

Boehmer, E., J. Musumeci, and A. B. Poulsen. 1991. Event-study methodology under conditions of event-induced variance. Journal of Financial Economics 30 (2): 253-72. Brown, L. D.. and M. L. Caylor. 2004. Corporate governance and firm performance. Working paper, Georgia State University. Browning, E. S.. and J. Weil. 2002. Burden of doubt: Stocks take a beating as accounting worries spread beyond Enron. Wall Street Journal, January 30, Al. Business Roundtable. 2004. The Business Roundtable corporate govemance survey highlights July 2003. February 4. Available online at http:// www.businessroundtable.org//ta.skForces/taskforce/document.aspx?qs= 6D35BFI59F94951448I138A74EA185II59169FEB56937B8. Chaney. P. K., and K. L. Philipich. 2002. Shredded reputation: The cost of audit failure. Journal of Accounting Research 40 (4): 1221-45. Charles River Associates (CRA). 2005. Sarbanes-Oxley section 404 costs and remediation of deficiencies: Estimates from a sample of Fortune 1000 companies. CRA no. D06I55-00. Washington, DC: CRA. Cohen, D. A.. A. Dey. and T. Z. Lys. 2004. The effect of the Sarbanes-Oxley Act on eamings management: What has changed.' Paper presented at the 2004 annual meeting of the American Accounting Association (AAA), Orlando, FL. Cunningham. L. A. 2003. The Sarbanes-Oxley yawn: Heavy rhetoric, light reform (and it might just work). University of Connecticut Law Revien' 35 (3): 917-89. Donaldson, W. H. 2005. Chaimian of the SEC's testimony before the House Committee on Financial Services concerning the impact of the Sarbanes-Oxtey Act. April 21. Online at http://www.sec.gov/news/testimony/ts042105whd.htm. Drinkard, J. 2002. Deal reached on business reform. USA Today, July 25, Al. Engel, E., R. M. Hayes, and X. Wang. 2004. The Sarbanes-Oxley Act and firms' goingprivate decisions. Working paper. University of Chicago. Espahbodi. H., P. Espahbodi, Z. Rezaee, and H. Tehranian. 2002. Stock price reaction and value-relevance of recognition vs. disclosure: The case of stock-based compensation. Journal of Accounting and Economics 33 (3): 343-73. Fama, E. R, and K. R. French. 1993. Common risk factors in the retums on bonds and stocks. Journal of Financial Economics 33 {I): 3-53. Fama, E. F., and M. Jensen. 1983. Separation of ownership and controls. Vowrna/ of Law and Economics 26 (2): 301-25. Frankel, R. M.. M. F. Johnson, and K. K. Nelson. 2002. The relation between auditors' fees for non-audit services and eamings management. The Accounting Review 11 (Supplement): 71-105. Geewax, M. 2002a. Accounting reform faces key vote in Senate panel. Cox News Service, May 20. Geewax, M. 2002b. Congress not finished with business reforms, leadere say. Cox News Service, July 25. Gompers, P A., J. L. Ishii, and A. Metrick. 2(X)3. Corporate govemance and equity prices. Quarterly Journal of Economics 118(1): 107-55. Gordon. M. 2002. Congressional negotiators reach compromise on business scandals bill. Associated Press, July 24.

CAR Vol. 23 No. 3 (Fall 2006)

654

Contemporary Accounting Research

Hilzenrath, D. S., J. Weisman. and J. Vandhei. 2002. How Congress rode a "storm" to corporate reform. Washington Post. July 28, AOl. Jain, P. K., J. C. Kim, and Z. Rezaee. 2(X)4. Effects of financial scandals and regulatory responses on market liquidity. Paper presented at the 2004 annual meeting of the American Accounting Association (AAA), Orlando. FL. Jensen, M.. and W. M. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics 3 (4): 305-60. Khanna, T, K. Palepu, and S. Srinivasan. 2003. Disclosure practices of foreign companies interacting with U.S. markets. Working paper. Harvard Business School. Kulish, N. 2002. Questioning the books: The president speaks: Senate panel ties for executives are tougher than Bush's plan. Wall Street Journal. iu\y 10, A8. Langevoort, D. C. 2002. Managing the "expectations gap" in investor protection: The SEC and the post-Enron reform agenda. Working paper, Georgetown University. Li, H., M. Pincus, and S. O. Rego. 2004. Market reaction to events surrounding the Sarbanes-Oxley Act of 2(H)2. Paf)er presented at the 2004 annual meeting of the American Accounting Association (AAA), Orlando, FL. Oppel. R. A. 2002. Negotiators agree on broad changes in business laws. New York Times. July 25. A I. Ribstein, L. E. 2002. Market vs. regulatory responses to corporate fraud: A critique of the Sarhanes-Oxley Act of 2002. Working paper. University of Illinois College of Law. Online at http://ssm.com/iibstractid=33268l. Sarbanes-Oxley Act of 2002. 2002. The Public Company Accounting Reform and Investor Protection Act, Pub. L. no. 107-204. Online at hnp://www.whitehouse.gov/infocus/ corporateresponsibility. Schipper, K., and R. Thompson. 1983. The impact of merger-related regulations on the shareholders of acquiring Urms. Journal of At counting Research 21 (I): 184-221. Schroeder. M. 2002. Accounting industry taken to task. Wall Street Journal. March 8, CI. Shieifer, A., and R. W. Vishny. 1986. Large shareholders and corporate control. Journal of Political Economy 94 (3): 461 -88. Tumer, L. 2005. Costs and benefits of the Sarbanes-Oxley Act. Online at http:// www.glasslewis.com. U.S. Congress. General Accounting Office (GAO). 2002. Financial statement restatements: Trends, market impacts, regulatory response, and remaining challenges. GAO-03-38. Washington, DC: GAO. Weisman, J. 2002. Lobbyists lose clout; business groups find their influence on audit reform legislation shrinking. Washington Post. July 23, AOl. Wiesen, J. 2003. Congress enacts Sarbanes-Oxley Act of 2002: A two-ton gorilla awakes and speaks. Journal of Accounting, Auditing, and Finance 18 (3): 429-48. Zhang, I. X. 2(X)5. Economic consequences of the Sarhanes-Oxley Act of 2002. Working paper. University of Rochester.

CA/f Vol. 23 No. 3 (Fall 2006)

Вам также может понравиться

- Trading Technology and Stock Market Liquidity by Jain and Johnson (2007)Документ14 страницTrading Technology and Stock Market Liquidity by Jain and Johnson (2007)Eleanor RigbyОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Volatility Effects of Institutional Trading in Foreign Stocks, by Chiyachantana Et Al. (2006 JBF) PDFДокумент16 страницVolatility Effects of Institutional Trading in Foreign Stocks, by Chiyachantana Et Al. (2006 JBF) PDFEleanor RigbyОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Speed of Learning About Firms' Profitability and Their Price Multiples A Global PerspectiveДокумент25 страницThe Speed of Learning About Firms' Profitability and Their Price Multiples A Global PerspectiveEleanor RigbyОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Institutional Trading, Chiyachantana Et Al. (2004)Документ9 страницInstitutional Trading, Chiyachantana Et Al. (2004)Eleanor RigbyОценок пока нет

- Tax Environment and Its Effect On Growth, Required Returns, InvestmentsДокумент43 страницыTax Environment and Its Effect On Growth, Required Returns, InvestmentsEleanor RigbyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Shane - Corwin - Paul - Schultz - 2011JF - A Simple Way To Estimate Bid-Ask Spreads From Daily High and Low PricesДокумент84 страницыShane - Corwin - Paul - Schultz - 2011JF - A Simple Way To Estimate Bid-Ask Spreads From Daily High and Low PricesEleanor RigbyОценок пока нет

- Speed of Learning and Price MultiplesДокумент35 страницSpeed of Learning and Price MultiplesEleanor RigbyОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Tax Environment and Its Effect On Growth, Required Returns, InvestmentsДокумент43 страницыTax Environment and Its Effect On Growth, Required Returns, InvestmentsEleanor RigbyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Price Impact Asymmetry - Saar (2001 RFS)Документ31 страницаPrice Impact Asymmetry - Saar (2001 RFS)Eleanor RigbyОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Speed of Learning About Firms' Profitability and Their Price Multiples A Global PerspectiveДокумент41 страницаThe Speed of Learning About Firms' Profitability and Their Price Multiples A Global PerspectiveEleanor RigbyОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Short Selling The Impact of Rule 201 of 2010 Jain - Jain - Mcinish2012Документ29 страницShort Selling The Impact of Rule 201 of 2010 Jain - Jain - Mcinish2012Eleanor RigbyОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Specialist, Designated Market Makers, Mao - Pagano2011JBFДокумент16 страницSpecialist, Designated Market Makers, Mao - Pagano2011JBFEleanor RigbyОценок пока нет

- Peterson 2009 RFS - Mitchell A - Double ClusterДокумент46 страницPeterson 2009 RFS - Mitchell A - Double ClusterEleanor RigbyОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Order Submission Under Asymmetric Information Menkhoff 2010 JBFДокумент13 страницOrder Submission Under Asymmetric Information Menkhoff 2010 JBFEleanor RigbyОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Paper For Review Order Choice TaiwanДокумент47 страницPaper For Review Order Choice TaiwanEleanor RigbyОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Order Dynamics Recent Evidence From The NYSE by Ellul Et Al. (2007 JEF)Документ15 страницOrder Dynamics Recent Evidence From The NYSE by Ellul Et Al. (2007 JEF)Eleanor RigbyОценок пока нет

- Liquidity Indicators of the Financial Crisis and Its ResolutionДокумент45 страницLiquidity Indicators of the Financial Crisis and Its ResolutionEleanor RigbyОценок пока нет

- Perold - The Implementation Shortfall Paper Versus Reality, JPM 1998Документ6 страницPerold - The Implementation Shortfall Paper Versus Reality, JPM 1998Eleanor Rigby100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- NYSE Euronext Section SwitchingДокумент42 страницыNYSE Euronext Section SwitchingEleanor RigbyОценок пока нет

- Order Dynamics Recent Evidence From The NYSE by Ellul Et Al (2007 JEF)Документ26 страницOrder Dynamics Recent Evidence From The NYSE by Ellul Et Al (2007 JEF)Eleanor RigbyОценок пока нет

- Order Dynamics Recent Evidence From The NYSE by Ellul Et Al. (2007 JEF)Документ15 страницOrder Dynamics Recent Evidence From The NYSE by Ellul Et Al. (2007 JEF)Eleanor RigbyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Brunnermeier MKT Fun LiquidityДокумент38 страницBrunnermeier MKT Fun Liquidityfreemind3682Оценок пока нет

- Kyle 1985 EconometricaДокумент21 страницаKyle 1985 EconometricaEleanor RigbyОценок пока нет

- Order Aggressiveness Institutional Vs Individual by Duong Et Al (2007 PBFJ)Документ14 страницOrder Aggressiveness Institutional Vs Individual by Duong Et Al (2007 PBFJ)Eleanor RigbyОценок пока нет

- Measures of Trading Costs by Hu (2009 JFM)Документ20 страницMeasures of Trading Costs by Hu (2009 JFM)Eleanor RigbyОценок пока нет

- Margin Spiral Market Liquidity Funding Liquidity - by Brunnermeier Pedersen - 2009 - RFSДокумент10 страницMargin Spiral Market Liquidity Funding Liquidity - by Brunnermeier Pedersen - 2009 - RFSEleanor RigbyОценок пока нет

- Measures of Implicit Trading Cost Gang Hu - ArchanaДокумент15 страницMeasures of Implicit Trading Cost Gang Hu - ArchanaEleanor RigbyОценок пока нет

- Investor Recognition, Liquidity, Returns, and Performance After Exchange Listings in The Reformed Markets by Jain and Kim (2006 FM)Документ20 страницInvestor Recognition, Liquidity, Returns, and Performance After Exchange Listings in The Reformed Markets by Jain and Kim (2006 FM)Eleanor RigbyОценок пока нет

- International Evidence On Institutional Trading Behavior and Determinants of Price Impact by Chiyachantana Et Al. (2004 JF)Документ14 страницInternational Evidence On Institutional Trading Behavior and Determinants of Price Impact by Chiyachantana Et Al. (2004 JF)Eleanor Rigby0% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Indian Financial SystemДокумент52 страницыIndian Financial SystemSuresh Kumar manoharan86% (7)

- Instructions and 7 questions for business case studyДокумент8 страницInstructions and 7 questions for business case studyvishesh jainОценок пока нет

- Performance of Currency Derivative Market in India: Tom Jacob, Thomas Paul Kattookaran, Sreejith VJДокумент8 страницPerformance of Currency Derivative Market in India: Tom Jacob, Thomas Paul Kattookaran, Sreejith VJManishОценок пока нет

- LeverageДокумент2 страницыLeverageRahul ItankarОценок пока нет

- Ni Et Al. 2018Документ11 страницNi Et Al. 2018muhibbuddin noorОценок пока нет

- Shreya Complete Research PaperДокумент114 страницShreya Complete Research PapermadhuraОценок пока нет

- Unit 2 Cost Concepts and Classifications (BBA)Документ25 страницUnit 2 Cost Concepts and Classifications (BBA)Aayushi KothariОценок пока нет

- Dhvsu Final Take Home QuizДокумент7 страницDhvsu Final Take Home QuizJoy DeocarisОценок пока нет

- CW 13 LTF Key 1Документ6 страницCW 13 LTF Key 1Jedidiah ManglicmotОценок пока нет

- Intellinews - Romania Construction Materials ReportДокумент9 страницIntellinews - Romania Construction Materials ReportmumuletОценок пока нет

- How Institutional Investors Influence R&D Spending to Meet Short-Term Earnings GoalsДокумент30 страницHow Institutional Investors Influence R&D Spending to Meet Short-Term Earnings GoalsNada FaridaОценок пока нет

- PFM Report FinalДокумент20 страницPFM Report FinalSHARSINIGA A/P ANASELVENОценок пока нет

- Bitong v. CAДокумент36 страницBitong v. CAReemОценок пока нет

- Buffettology Sustainable GrowthДокумент12 страницBuffettology Sustainable GrowthLisa KrissОценок пока нет

- Tax Free ExchangeДокумент4 страницыTax Free ExchangeLara YuloОценок пока нет

- MScFE 560 FM - Notes4 - M1 - U4Документ3 страницыMScFE 560 FM - Notes4 - M1 - U4chiranshОценок пока нет

- A Review On Shariah Stock Portfolio OptimizationДокумент16 страницA Review On Shariah Stock Portfolio OptimizationKhalid bel abbesОценок пока нет

- Pacing Guide-Financial LiteracyДокумент6 страницPacing Guide-Financial Literacyapi-377548294Оценок пока нет

- Title 4. Powers of Corporations - RCCДокумент5 страницTitle 4. Powers of Corporations - RCCJezen Esther PatiОценок пока нет

- Acctg 46 - Business Valuation and ManagementДокумент304 страницыAcctg 46 - Business Valuation and ManagementShiela Jane CrismundoОценок пока нет

- Unit 3Документ40 страницUnit 322PBA132 RAVISH.TОценок пока нет

- Chapter 10Документ4 страницыChapter 10suitup666Оценок пока нет

- Taxation Principles for Intra-Corporate Dividends and Sale of Real PropertyДокумент72 страницыTaxation Principles for Intra-Corporate Dividends and Sale of Real PropertyPrince Dkalm PolishedОценок пока нет

- Financial Management - Module 3Документ20 страницFinancial Management - Module 3Jane BiancaОценок пока нет

- Art of Stock Investing Indian Stock MarketДокумент10 страницArt of Stock Investing Indian Stock MarketUmesh Kamath80% (5)

- Marco Mar 19 98-MainДокумент69 страницMarco Mar 19 98-Mainglimmertwins100% (1)

- The Business Pre-Int Answer KeyДокумент18 страницThe Business Pre-Int Answer KeyOlaru IzabelaОценок пока нет