Академический Документы

Профессиональный Документы

Культура Документы

Sdoaip O

Загружено:

Steff ReodiqueОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sdoaip O

Загружено:

Steff ReodiqueАвторское право:

Доступные форматы

Intangible Assets IDENTIFIABILITY Asset must be identifiable in order to distinguish it clearly in goodwill. Asset must be identifiable when : a.

. It is separable , meaning , the asset is capable of being separated from the entity and sold , transferred , licensed , rented or exchange ,either individually or together with a related contract , asset or liability regardless of whether the entity intends to do so. b. It raises from contractual or other leagal rights , regardless of whether these rights and obligations. CONTROL Asseet must be under the control of the entity as a result of a past event.Control is the

Recognition An intangible asset shall be recognized if the following conditions are present: a. It is probable thet future economic benefits attributable tot the asset will flow to the entity. b. The cost of the intangible asset ca be measured reliably. Judgment is usually exercised in assseing th degree of certainity of the future economic benefits.The judgment is based on external evidence.

Measurement Separate Acquisition If an intangible asset is acquired separately ,the cost of the intangible asset can be measured reliably , particularly so if the purchase consideration in the form of cash or other monetary assets.The cost of a separately acquired intangible asset comprises its purchase price , including any import duties and nonrefundable purchase purchase taxes after deducting trade discounts and rebates and any directly attributable costs of preparing the asset for its intended use. If the payment for an itangible asset is deferred beyond normal credit terms its cost is the cash price equivalent.The difference between the cash price equivalent and the total payments is recognized as interest expense over the credit period. Acquisitio as part of business combination a. If an intangible asset is

Amortization The method of amortization shall reflect the pattern in which the future economic benefits from the asset are expected to be consumed by the entity. RESIDUAL VALUE The residual value of an asset shall presumed to be zero , except : a. When a third party is committed to buy the intangible asset at the end of its useful life. b. When there is an acive market for the intangible asset to that its expected residual value can be measured and it is probable that there will be a market for the asset at the end of its useful life.

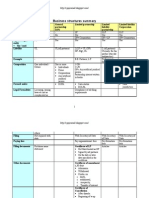

Proforma entries

Change in amortization method and useful life The amotization method and the useful life of an intangible asset shall be reviewed at each

power of the entity to obtain the future economic benefits flowing from the intangible asset and restrict the access of others to those benefits. FUTURE ECONOMIC BENEFITS Future economic benefits may include revenue from the sale of products or services ,cost savings or other bebefits resulting from the use of the asset by the entity.

acquired in a business combination the cost of the intangible asset is based on its fair value on the date of acquisition. b. If there is an active market ,th quoted market price which is usually the current bid price provides the mast reliable estimate of fair value. c. If there is no active market, the fair value of the intangible aaset is equal to the amount which would be paid by the entity for the asset in an arms length transaction between knowledgeable and willing parties. Acquisition by government grant An intangible asset may be acquired by way of a government grant , free of charge or for nominal consideration Acquisition by Exchange One or more intangible assets may be acquired

financial year end. If the expected useful life of the intangible asset is significantly different from yhe previous estimate ,the amortization period shall be changed accordingly.If there has been a significant change in the expected pattern of economic benefits from the asset , the amortization method shall be changed to reflect the new pattern. Such changes shall be accounted for as changes in accounting estimates and therefore , shall be treated currently and prospectively.

in exchange for a non monetary asset or a combination of monetary asset and non monetary asset.The cost of such an intangible asset is measured at fair value unless the exchange transaction lacks commercial substance or the fair value of neither the asset given up nor the asset received is reliably measureable.If exchange transactions lacks commercial substance, the acquired intangible asset is not measured at fair value but its cost is the carrying amount of the asset given up. Acquisitio by selfcreation or internal generation The cost of an internally generated intangible asset comprises all directly attributable costs necessary to create , produce and prepare the asset to be capable of operating it in manner intended by management.

Вам также может понравиться

- 04 Sample LetterДокумент1 страница04 Sample Letterpoornima12345Оценок пока нет

- Olive Ann L. Luna: Position DesiredДокумент2 страницыOlive Ann L. Luna: Position DesiredSteff ReodiqueОценок пока нет

- OJTДокумент1 страницаOJTSteff ReodiqueОценок пока нет

- Cover LetterДокумент1 страницаCover LetterSteff ReodiqueОценок пока нет

- Jiddeh Nidea-Selda, MBA Faculty Member, CBMAДокумент28 страницJiddeh Nidea-Selda, MBA Faculty Member, CBMASteff ReodiqueОценок пока нет

- Monthly Budget For The Month of August, 2014 Stephanie M. ReodiqueДокумент2 страницыMonthly Budget For The Month of August, 2014 Stephanie M. ReodiqueSteff ReodiqueОценок пока нет

- Documenting Information System: Chapter ObjectivesДокумент7 страницDocumenting Information System: Chapter ObjectivesSteff ReodiqueОценок пока нет

- Documenting Information System: Chapter ObjectivesДокумент7 страницDocumenting Information System: Chapter ObjectivesSteff ReodiqueОценок пока нет

- Database Management SystemsДокумент4 страницыDatabase Management SystemsSteff ReodiqueОценок пока нет

- SAP Solution in Detail SAP Enterprise PortalДокумент16 страницSAP Solution in Detail SAP Enterprise PortalSteff ReodiqueОценок пока нет

- Aquinas UniversityДокумент1 страницаAquinas UniversitySteff ReodiqueОценок пока нет

- Accounting Changes1Документ3 страницыAccounting Changes1Steff ReodiqueОценок пока нет

- Financial Accounting Volume Two Valix and Peralta 2008 Edition Solution Manual 1Документ17 страницFinancial Accounting Volume Two Valix and Peralta 2008 Edition Solution Manual 1Emil Julius David100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Chapter 4Документ19 страницChapter 4adhitiyaОценок пока нет

- Chap 17Документ46 страницChap 17Chevalier ChevalierОценок пока нет

- THFJ Europe 50 2011Документ15 страницTHFJ Europe 50 2011nickmontОценок пока нет

- Purchasing Accreditation FormДокумент5 страницPurchasing Accreditation FormCarlos DungcaОценок пока нет

- Behavioral FinanceДокумент184 страницыBehavioral FinanceSatya ReddyОценок пока нет

- Mercatus Energy Advisors - Crude Oil & Natural Gas Hedging StudyДокумент12 страницMercatus Energy Advisors - Crude Oil & Natural Gas Hedging StudyMercatus Energy AdvisorsОценок пока нет

- Hedge Fund Structures PDFДокумент9 страницHedge Fund Structures PDFStanley MunodawafaОценок пока нет

- Portersfiveforcestrategy 131215101901 Phpapp01Документ9 страницPortersfiveforcestrategy 131215101901 Phpapp01Ahmed Jan DahriОценок пока нет

- KhatianДокумент3 страницыKhatianrafiqcuОценок пока нет

- Continental Carriers IncДокумент7 страницContinental Carriers IncYetunde JamesОценок пока нет

- ACCA F7int ATC Study Text 2012Документ562 страницыACCA F7int ATC Study Text 2012hamid2k30100% (4)

- Partnership CE W Control Ans PDFДокумент10 страницPartnership CE W Control Ans PDFRedОценок пока нет

- Changmai Hotel Feasibility StudyДокумент57 страницChangmai Hotel Feasibility StudyJean Aira Del Espiritu100% (4)

- Alfalah Education Consultant (AEC)Документ32 страницыAlfalah Education Consultant (AEC)Kim NisarОценок пока нет

- Mine Economics PDFДокумент28 страницMine Economics PDFBelle Estal PalajosОценок пока нет

- Project Report On SIP in Mutual FundsДокумент76 страницProject Report On SIP in Mutual FundsAnubhav Sood100% (6)

- 1) Income Statement: Nature, Forms and Uses of Income StatementДокумент6 страниц1) Income Statement: Nature, Forms and Uses of Income StatementPaulineBiroselОценок пока нет

- Investment Banking WORDДокумент4 страницыInvestment Banking WORD123SumОценок пока нет

- Firms Forfeit Tax Break To Pay Top Brass 1 Million-Plus PDFДокумент2 страницыFirms Forfeit Tax Break To Pay Top Brass 1 Million-Plus PDFRishabh BansalОценок пока нет

- Business Structures SummaryДокумент5 страницBusiness Structures SummaryMrudula V.100% (2)

- Marriott-Corporation - HBR CaseДокумент4 страницыMarriott-Corporation - HBR CaseAsif RahmanОценок пока нет

- Role of Intermediaries in Primary MarketДокумент24 страницыRole of Intermediaries in Primary MarketAmit Kumar (B.Sc. LLB 15)Оценок пока нет

- BCG MatrixДокумент3 страницыBCG Matrixpriyank1256Оценок пока нет

- Chapter III Feasibility PlanДокумент50 страницChapter III Feasibility Planrathnakotari100% (1)

- Project CycleДокумент11 страницProject CycleLitsatsi Ayanda100% (2)

- Applied Corporate FinanceДокумент7 страницApplied Corporate FinanceGyana SahooОценок пока нет

- Risk and ReturnДокумент70 страницRisk and Returnmiss_hazel85Оценок пока нет

- PT Mustika Ratu TBK.: Summary of Financial StatementДокумент2 страницыPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiОценок пока нет

- Theoretical FrameworkДокумент3 страницыTheoretical Frameworkm_ihamОценок пока нет

- Arpico Insurance IPO - Capital TRUST Research PDFДокумент5 страницArpico Insurance IPO - Capital TRUST Research PDFRandora LkОценок пока нет