Академический Документы

Профессиональный Документы

Культура Документы

Accountancy Test

Загружено:

Gaurav PitaliyaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accountancy Test

Загружено:

Gaurav PitaliyaАвторское право:

Доступные форматы

Page 1 of 9

1. a. b. c. d. 2. a. b. c. d.

Of the following account types, which would be increased by a debit? Liabilities and Expenses Assets and Stockholders Equity Assets and Expenses Stockholders Equity and Expenses

Which of the following equations properly represents a derivation of the fundamental accounting equation Assets + Liabilities = OwnersEquity Assets = Owners Equity Cash = Assets Assets Liabilities = Owners Equity 3. Retained earnings will change over time because of several factors. Which of the following factors would explain an increase in retained earnings? Net loss Net income Dividends paid Investments by stockholders 4. Which of these items would be accounted for as an expense? Repayment of a bank loan Dividends paid to stockholders The purchase of land Payment of the current periods rent

a. b. c. d. a. b. c. d.

5.

a. b. c. d.

Gerald had beginning total stockholders' equity of $160,000. During the year, total assets increased by $240,000 and total liabilities increased by $120,000. Gerald's net income was $180,000. No additional investments were made; however, dividends did occur during the year. How much were the dividends? $20,000 $60,000 $140,000 $220,000 6.

The proper journal entry to record Ransom Company's billing of clients for $500 of services rendered is: a. Cash $500

Page 2 of 9

Accounts Receivable b. Accounts Receivable Common Stock c. Accounts Receivable Service Revenue d. Cash Service Revenue 7. a. b. c. d.

$500 $500 $500 $500 $500 $500 $500

Which of the following errors will be disclosed in the preparation of a trial balance? Recording transactions in the wrong account Duplication of a transaction in the accounting records Posting only the debit portion of a particular journal entry Recording the wrong amount for a transaction to both the account debited and the account credited 8. Blankenship Company pays its employees every Friday for work rendered that week. The payroll is typically $10,000 per week. What journal entry would be recorded (on Wednesday) if the end of the accounting period occurred on a Wednesday? 6,000 6,000 6,000 6,000 6,000 6,000 6,000 6,000

a. Salary Expense Salary Payable b. Salary Expense Cash c. Salary Payable Cash d. Salary Payable Cash

Page 3 of 9

9.

a. b. c. d.

On February 1, Crown Company purchased $2,000 of merchandise, terms 2/10, n/30. Crown uses the gross method of recording purchases. Payment of the accounts payable was made on February 26. Which of the following journal entries is appropriate for the February 26 transaction? Purchases $2,000 Accounts Payable $2,000 Accounts Payable 1,960 Cash 1,960 Accounts Payable 1,960 Purchase discounts lost 40 Accounts Payable 2,000 Accounts Payable 2,000 Cash 2,000

Malory Company provides the following information about the month-end bank reconciliation: Ending cash per bank statement Ending cash per company records Monthly bank service charge Deposits in transit at month-end Outstanding checks at month-end Customer check returned NSF 10. The correct balance is: $4,914 $7,268 $7,313 $7,383 None of the above 11. $1,367 7,383 25 8,345 2,399 45

a. b. c. d. e.

a. b. c. d.

During its first year of operation, Lenton Company acquired three investments in trading securities. Investment A cost $50,000 and had a year-end market value of $60,000. Investment B cost $35,000 and had a year-end market value of $17,000. Investment C cost $26,000 and had a year-end market value of $24,000. The journal entry to record the decline in market value would include A debit to unrealized loss on trading securities. A credit to unrealized gain on trading securities. A debit to trading securities. At least two of the above.

Page 4 of 9

12.

a. b. c. d. e.

Lindy Company uses an allowance method to account for bad debts. Lindy estimates that 5% of the outstanding accounts receivable will be uncollectible. At the end of the year, Lindy has outstanding accounts receivable of $750,000, and a debit balance in the Allowance for Uncollectible Accounts of $9,000. Lindy should record uncollectible accounts expense of: $28,500 $37,500 $46,500 $55,500 None of the above. Wonder Corporation failed to record the purchase of merchandise on account. The merchandise and related accounts payable should have been recorded but were not. What is the effect of these errors on assets, liabilities, retained earnings, and net income, respectively. Understated, understated, no effect, no effect Understated, understated, understated, understated Understated, overstated, overstated, understated Overstated, overstated, understated, overstated. 13.

a. b. c. d.

Bernstein Corporation recently experienced a fire which destroyed all of its inventory. The following data have been reconstructed from partial accounting information, and pertain to the year up to the date of the fire. Beginning inventory Net purchases Sales Gross profit rate $20,000 $45,000 $80,000 40%

14. a. b. c. d.

Using the gross profit method, estimate the dollar amount of inventory which was destroyed in the fire. $17,000 $33,000 $48,000 $65,000 15. Reno Acquisitions Company recently bought a furnished hotel for a lump-sum purchase price of $15,000,000. Separately, the land was valued at $6,000,000, the building at $12,000,000, and the furniture and equipment at $2,000,000. How much cost should Reno assign to the land? $1,000,000 $4,500,000 $6,000,000 $8,000,000

a. b. c. d.

Page 5 of 9

16.

Omni Corporation purchased a new vehicle on January 1, 20X1. The vehicle cost $100,000, has a five-year life, and a $20,000 residual value. Omni has a December 31 year-end. If Omni depreciates the truck by the double-declining balance method, how much should be recorded as depreciation expense during 20X4?

a. b. c. d. e.

$0 $1,600 $8,640 $40,000 None of the above 17. A machine that cost $18,000, with a book value of $4,000, is sold for $3,400. Which of the following is true concerning the journal entry to record the sale? Accumulated Depreciation is debited for $4,000. Machinery is credited for $4,000. Loss on sale of machinery is credited for $600. Accumulated depreciation is debited for $14,000. None of the above. 18. Deep Gold Mining Company recognizes $4 of depletion for each ton of ore mined. This year, 300,000 tons of ore were mined but only 180,000 were sold. The amount of depletion which should be deducted from revenue this year is:

a. b. c. d. e.

a. b. c. d.

$0. $480,000. $720,000. $1,200,000.

19. Which of the following statements regarding goodwill is false? a. The difference between the price paid to purchase a particular company , and the fair value of the underlying identifiable assets received (less liabilities assumed) is goodwill. b. Goodwill should not be amortized but evaluated for impairment. c. Goodwill is an intangible asset. d. Goodwill may be recorded for a company whether purchased or generated internally. e. None of the above. a. b. c. d. 20. Typical current liabilities include: Prepayments by customers Travel advances to employees The principal portion of a mortgage note that is due beyond one year or the operating cycle, whichever is longer. Accumulated depreciation.

Page 6 of 9

21.

a. b. c. d. e.

Assume that Kamchatny Vladimir borrowed $100,000 on January 1 of Year 1, at 5% interest per annum. On December 31, of Year 1, an $8,000 payment is made. On December 31, of year 2, another $8,000 payment is made. Using normal assumptions about interest and principal reduction, how much is the unpaid balance of Vladimir's loan after the second payment? $100,000 $94,000 $93,850 $84,000 None of the above

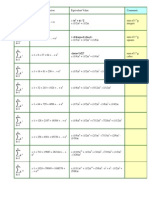

Use the following to answer questions 22-25: Orange Kola, Inc. uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: Beginning inventory (Jan. 1) Purchase (Jan. 11) Purchase (Jan. 20) Total Quantity 19 13 21 53 Unit Cost $ 11 12 17 Total Cost $ 209 156 357 $ 722

On January 14, Orange Kola, Inc. sold 25 units of this product. The other 28 units remained in inventory at January 31. 22. a. b. c. d. Refer to the above data. Assuming that Orange Kola uses the LIFO flow assumption, the cost of goods sold to be recorded at January 14 is:

$405 $222 $288 None of the above. 23. Refer to the above data. Assuming that Orange Kola uses the average cost flow assumption, the cost of goods sold to be recorded at January 14 is (round cost per unit to nearest cent): $287.90 $329.68 $309.35 None of the above. 24. Refer to the above data. Assuming that Orange Kola uses the FIFO flow assumption, the 28 units of this product in inventory at January 31 have a total cost of:

a. b. c. d.

Page 7 of 9

a. b. c. d.

$281 $403 $441 None of the above.

25. The logic behind the lower-of cost or market rule is: a. Inventory gradually becomes obsolete b. Inventory that is unsalable should be written down to zero (or its scrap value). c. An asset is not worth more than it would cost the owner to replace it. d. Inventory that is unsalable should be written down to its replacement cost. 26. a. b. c. d. Recognizing revenue when it is earned and not when cash is received and expenses when the related goods or services are used rather than when paid or is called: Revenue recognition. Accrual accounting. Conservatism. Matching.. 27. Nouveau Corporation purchased a piece of real estate, paying $300,000 cash and financing $600,000 of the purchase price with a 10-year, 15% installment note. The note calls for equal monthly payments that will result in the debt being completely repaid by the end of the tenth year. In this situation: The aggregate amount of the monthly payments is $600,000. Each monthly payment is greater than the amount of interest accruing each month. The portion of each payment representing interest expense will increase over the 10-year period, since principal is being paid off, yet the payment amount does not decrease.. The portion of each montly payment representing repayment of principal remains the same throughout the 10-year period. 28. If a bond is selling at 102, it is selling at: Maturity value and yields a 2% interest rate. A discount. A premium. $102 per bond. None of the above. 29. During the closing process: All income statement accounts are credited to income summary. All income statement accounts are debited to income summary. All revenue accounts are credited and expense accounts are debited. All revenue accounts are debited and expense accounts are credited.

a. b. c. d.

:

a. b. c. d. e. a. b. c. d.

Page 8 of 9

a. b. c. d. e. a. b. c. d.

Which of the following is defined as resources owned or controlled by a company that have expected future benefits? Liability Asset Revenue Expense Equity 31. Adjusting entries: Affect only income statement accounts Affect only balance sheet accounts Affect both income statement and balance sheet accounts Affect only cash accounts. e. None of the above 32. Maxwell Corp. recently acquired a new security system. Which of the following costs associated with the security system should not be debited to the Equipment account? Insurance coverage purchased by Maxwell to cover the computer during shipment from the manufacturer. Wages paid to system programmers hired to prepare the system for use. Replacement of several cameras damaged during installation Installation of new electrical power supplies required for operation during power failures. All of the above should be included in the Equipment account. 33. If the inventory at the end of the current year is understated and the error is never caught, the effect is to:the question here. Understate income this year and overstate income next year. Overstate income this year and understate income next year. Overstate the cost of goods sold, but have no effect on net income Understate income this year with no effect on income next year

30.

a. b. c. d. e.

a. b. c. d.

Page 9 of 9

Вам также может понравиться

- ACCOUNTING COMPETENCY EXAM SAMPLEДокумент12 страницACCOUNTING COMPETENCY EXAM SAMPLEAmber AJОценок пока нет

- Part 1 Recognition Measurement Valuation Disclosure Current AssetsДокумент20 страницPart 1 Recognition Measurement Valuation Disclosure Current AssetsRox accountОценок пока нет

- Fsa Questions FBNДокумент34 страницыFsa Questions FBNsprykizyОценок пока нет

- Accouting ExamДокумент7 страницAccouting ExamThien PhuОценок пока нет

- Objective Questions of AccountingДокумент8 страницObjective Questions of Accountingshobhitgoel0% (1)

- Achievement Test 3.chapters 5&6Документ9 страницAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Acc. P 2 2021 RevisionДокумент8 страницAcc. P 2 2021 RevisionSowda AhmedОценок пока нет

- Old Exam Packet - Acct 284 ExamsДокумент25 страницOld Exam Packet - Acct 284 ExamsHemu JainОценок пока нет

- MCQДокумент19 страницMCQk_Dashy846580% (5)

- Mid Term POA - Test 01Документ8 страницMid Term POA - Test 01Trang Ca CaОценок пока нет

- Wiley - Practice Exam 3 With SolutionsДокумент15 страницWiley - Practice Exam 3 With SolutionsIvan BliminseОценок пока нет

- Practice Final Exam ReviewДокумент200 страницPractice Final Exam ReviewChad Vincent B. BollosaОценок пока нет

- AccountingДокумент3 страницыAccountingVirginia Concepcion JobliОценок пока нет

- ACCT 5103 OL Sample Final ExamДокумент7 страницACCT 5103 OL Sample Final ExamEsther MpyisiОценок пока нет

- Midterm PDFДокумент7 страницMidterm PDFsubash1111@gmail.comОценок пока нет

- Accounting 2 - MCQs (Revison) - AnswerДокумент8 страницAccounting 2 - MCQs (Revison) - Answernemoyassin4Оценок пока нет

- Karnal's cost of sales calculationДокумент14 страницKarnal's cost of sales calculationArslan AlviОценок пока нет

- Soal Test Intermediate 2 MAC 2020Документ6 страницSoal Test Intermediate 2 MAC 2020DikaGustianaОценок пока нет

- Dhvsu Final Take Home QuizДокумент7 страницDhvsu Final Take Home QuizJoy DeocarisОценок пока нет

- Bsec Accounting Challenge 2007Документ10 страницBsec Accounting Challenge 2007Chuột Cao CấpОценок пока нет

- Multiple choice accounting questions and problemsДокумент14 страницMultiple choice accounting questions and problemsmaxzОценок пока нет

- Practice Exam 4 - Chapters 8, 9, - Fall 2012Документ6 страницPractice Exam 4 - Chapters 8, 9, - Fall 2012Vincent ChinОценок пока нет

- Chapter 3 The Double-Entry System: Discussion QuestionsДокумент16 страницChapter 3 The Double-Entry System: Discussion QuestionskietОценок пока нет

- For CDEEДокумент7 страницFor CDEEmikiyas zeyedeОценок пока нет

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Документ10 страницThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellОценок пока нет

- Accounting BLC Review Exam 2 Answers 2013Документ17 страницAccounting BLC Review Exam 2 Answers 2013Hassan TariqОценок пока нет

- Test SamplesДокумент18 страницTest SamplesDen NgОценок пока нет

- FA2 Revision Q 1Документ8 страницFA2 Revision Q 1miss ainaОценок пока нет

- Fa2 Mock 2 Question - 1Документ18 страницFa2 Mock 2 Question - 1sameerjameel678Оценок пока нет

- Ch 5 Quiz Q&AДокумент3 страницыCh 5 Quiz Q&ASumedh KakdeОценок пока нет

- C1 Financial ReportingДокумент10 страницC1 Financial ReportingSteeeeeeeephОценок пока нет

- FAR Questionnaire for Incoming Third YearДокумент27 страницFAR Questionnaire for Incoming Third YearClaire BarbaОценок пока нет

- Workshop 2 Preparation SolutionsДокумент5 страницWorkshop 2 Preparation SolutionsMagnus Blicker LarsenОценок пока нет

- Revision - Gacc102Документ13 страницRevision - Gacc102Khang VũОценок пока нет

- Financial Accounting Canadian 4Th Edition Libby Test Bank Full Chapter PDFДокумент67 страницFinancial Accounting Canadian 4Th Edition Libby Test Bank Full Chapter PDFlucnathanvuz6hq100% (10)

- Chapter 12 Question Review PDFДокумент10 страницChapter 12 Question Review PDFMark Ruzzel VictoriaОценок пока нет

- D PDF Sample Exam 2Документ29 страницD PDF Sample Exam 2seatow6Оценок пока нет

- CHAPTER-9-Principles of AccountingДокумент39 страницCHAPTER-9-Principles of AccountingNguyễn Ngọc AnhОценок пока нет

- PACE Sample ExamДокумент13 страницPACE Sample ExamjhouvanОценок пока нет

- ACCT3000 Optional Multiple Choice QuestionsДокумент10 страницACCT3000 Optional Multiple Choice QuestionsFaizanОценок пока нет

- Important Mcqs Regarding Nts TestsДокумент129 страницImportant Mcqs Regarding Nts Testsk.shaikh100% (3)

- Chapter 4 Question ReviewДокумент11 страницChapter 4 Question ReviewNayan SahaОценок пока нет

- Unit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActДокумент16 страницUnit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActMeredith Eckard100% (1)

- FA 2 Practice Test Set 2Документ12 страницFA 2 Practice Test Set 2Chhour ThalikaОценок пока нет

- Idoc - Pub - Mcq-Fia-Fa1Документ19 страницIdoc - Pub - Mcq-Fia-Fa1marlynrich3652Оценок пока нет

- Recitation Quiz 1Документ5 страницRecitation Quiz 1BlairEmrallafОценок пока нет

- FA 2 Practice Test Set 1Документ14 страницFA 2 Practice Test Set 1Chhour ThalikaОценок пока нет

- ACC 290 Final Exam AnswersДокумент12 страницACC 290 Final Exam AnswerszeshansidraОценок пока нет

- NAU ACCOUNTING SKILLS ASSESSMENT PRACTICE EXAM KEYДокумент11 страницNAU ACCOUNTING SKILLS ASSESSMENT PRACTICE EXAM KEYDanica VetuzОценок пока нет

- Review Questions Financial Accounting 1 StudentsДокумент5 страницReview Questions Financial Accounting 1 StudentsNancy VõОценок пока нет

- Forum ACC WM - Sesi 3 (REV)Документ9 страницForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- CH 13Документ85 страницCH 13Michael Fine100% (3)

- Pilot TestДокумент4 страницыPilot TestTrang Nguyễn QuỳnhОценок пока нет

- 2022 Quiz 2 (Solved)Документ3 страницы2022 Quiz 2 (Solved)Anshuman GuptaОценок пока нет

- Intermediate Accounting 1 Final Grading ExaminationДокумент18 страницIntermediate Accounting 1 Final Grading ExaminationRena Rose Malunes11% (9)

- Intermediate Accounting 1 Final Grading ExaminationДокумент18 страницIntermediate Accounting 1 Final Grading ExaminationKrissa Mae LongosОценок пока нет

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsОт EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsОценок пока нет

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)От EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Оценок пока нет

- GPSS1 PDFДокумент11 страницGPSS1 PDFGaurav PitaliyaОценок пока нет

- J2EE The Complete ReferenceДокумент13 страницJ2EE The Complete ReferenceGaurav Pitaliya0% (1)

- 2 2Документ5 страниц2 2Gaurav Pitaliya100% (1)

- Dda Line AlgorithmДокумент1 страницаDda Line AlgorithmAman KumarОценок пока нет

- Mult DivДокумент5 страницMult DivGaurav PitaliyaОценок пока нет

- The Sine and Cosine FunctionsДокумент4 страницыThe Sine and Cosine FunctionsjanellennuiОценок пока нет

- The Sine and Cosine FunctionsДокумент4 страницыThe Sine and Cosine FunctionsjanellennuiОценок пока нет

- CG NotesДокумент4 страницыCG NotesGaurav PitaliyaОценок пока нет

- Management Schools of Thought PDFДокумент20 страницManagement Schools of Thought PDFsunru24Оценок пока нет

- CsДокумент114 страницCsGaurav PitaliyaОценок пока нет

- CPPДокумент77 страницCPPGaurav PitaliyaОценок пока нет

- System Analysis Tools Multiple Choice QuestionsДокумент6 страницSystem Analysis Tools Multiple Choice QuestionsGaurav PitaliyaОценок пока нет

- Distance From Udaipur, Udaipur Distance ChartДокумент6 страницDistance From Udaipur, Udaipur Distance ChartGaurav PitaliyaОценок пока нет

- ICICI Mobile Banking ApplicationДокумент2 страницыICICI Mobile Banking ApplicationGaurav PitaliyaОценок пока нет

- Port Numbers& IPClassesДокумент2 страницыPort Numbers& IPClassesGaurav PitaliyaОценок пока нет

- UNIT 1 QuestionДокумент3 страницыUNIT 1 QuestionGaurav PitaliyaОценок пока нет

- Booth Multiplication PDFДокумент3 страницыBooth Multiplication PDFkbmn2Оценок пока нет

- Fin 97Документ18 страницFin 97Gaurav Pitaliya0% (1)

- BOOTHДокумент3 страницыBOOTHBharath VijaiОценок пока нет

- Carthymcqs 2003Документ12 страницCarthymcqs 2003Piyush ChavanОценок пока нет

- To Test Your Knowledge About IndiaДокумент29 страницTo Test Your Knowledge About IndiaGaurav PitaliyaОценок пока нет

- 3.3 GrowthofFunctionsAndAsymptoticNotationsДокумент2 страницы3.3 GrowthofFunctionsAndAsymptoticNotationsGaurav PitaliyaОценок пока нет

- Accountancy TestДокумент5 страницAccountancy TestGaurav PitaliyaОценок пока нет

- Power SeriesДокумент1 страницаPower SeriesGaurav PitaliyaОценок пока нет

- 100+ Run CommandsДокумент3 страницы100+ Run CommandsRamu MalayathiОценок пока нет

- Operating Systems: Biyani's Think TankДокумент27 страницOperating Systems: Biyani's Think TankGaurav PitaliyaОценок пока нет

- Inventory ControlДокумент40 страницInventory ControlDinesh KarthickОценок пока нет

- VERBAL COMPREHENSION Directions: Read The Given PassageДокумент7 страницVERBAL COMPREHENSION Directions: Read The Given PassagekumaadityaОценок пока нет

- Bonds PayableДокумент39 страницBonds PayableRuiz, CherryjaneОценок пока нет

- Market Ka Eklavya...Документ104 страницыMarket Ka Eklavya...Golu KumarОценок пока нет

- A Project Report ON "Asset Liability Management in Banks": Submitted ToДокумент19 страницA Project Report ON "Asset Liability Management in Banks": Submitted ToMahesh KhebadeОценок пока нет

- Marketable SecuritiesДокумент5 страницMarketable SecuritiesshivaeasakkuОценок пока нет

- ISSN: 1804-0527 (Online) 1804-0519 (Print) : Study On Relevance of Demographic Factors in Investment DecisionsДокумент14 страницISSN: 1804-0527 (Online) 1804-0519 (Print) : Study On Relevance of Demographic Factors in Investment DecisionsRohini VОценок пока нет

- Public Debt Management Techniques and ObjectivesДокумент21 страницаPublic Debt Management Techniques and ObjectivesAbhishek Nath TiwariОценок пока нет

- Final Investment Banking Black BookДокумент106 страницFinal Investment Banking Black BookVikash Maurya86% (28)

- Investments 8th Edition Bodie Solutions ManualДокумент25 страницInvestments 8th Edition Bodie Solutions ManualJudithHollandxdwj98% (53)

- The Nigerian Insurance SectorДокумент26 страницThe Nigerian Insurance Sectorafashina100% (1)

- GSAA HET 2005-15, Tranche B2 / BSABS 2005-TC2, Tranche M6 - Securitized A Fourth Time in STAtic Res CDO 2005CДокумент191 страницаGSAA HET 2005-15, Tranche B2 / BSABS 2005-TC2, Tranche M6 - Securitized A Fourth Time in STAtic Res CDO 2005CTim Bryant0% (1)

- 5 - Risk and Return: Past and PrologueДокумент39 страниц5 - Risk and Return: Past and PrologueA_StudentsОценок пока нет

- A 17 QuizДокумент5 страницA 17 QuizLei0% (1)

- Class DiscussionДокумент100 страницClass DiscussionMadhav Chowdary Tumpati100% (1)

- MSA 2 Winter 2019 PDFДокумент4 страницыMSA 2 Winter 2019 PDFSuman UroojОценок пока нет

- CRD Trader Fixed IncomeДокумент8 страницCRD Trader Fixed IncomerockstarliveОценок пока нет

- Financial and Managerial Accounting 12th Edition Warren Test Bank 1Документ36 страницFinancial and Managerial Accounting 12th Edition Warren Test Bank 1dakotapearsonyngbdpmzre100% (25)

- Investment BankingДокумент40 страницInvestment BankingCBSE UGC NET EXAMОценок пока нет

- PRIYANKA RAWAT - BLACK BOOK Sem 4Документ70 страницPRIYANKA RAWAT - BLACK BOOK Sem 4m.com22shiudkarsudarshanОценок пока нет

- (Financial Accounting & Reporting 2) : Lecture AidДокумент29 страниц(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteОценок пока нет

- FAR Bonds and Present Value TablesДокумент3 страницыFAR Bonds and Present Value Tablespoet_in_christОценок пока нет

- Defined Contribution PlanДокумент12 страницDefined Contribution Planrap rapadasОценок пока нет

- 54556Документ22 страницы54556rellimnojОценок пока нет

- Book Review - CH 14 - Investment Life CycleДокумент24 страницыBook Review - CH 14 - Investment Life CycleApu DharОценок пока нет

- NoveshДокумент160 страницNoveshAnil BatraОценок пока нет

- CEILI Study Guide (Eng)Документ46 страницCEILI Study Guide (Eng)liksyarnahОценок пока нет

- Risk Management - Sample QuestionsДокумент11 страницRisk Management - Sample QuestionsSandeep Spartacus100% (1)

- Libertyville Sports Complex - BudgetДокумент18 страницLibertyville Sports Complex - BudgetVarun DateОценок пока нет

- FRM 2011 Practice ExamДокумент122 страницыFRM 2011 Practice ExamEakkarat PattrawutthiwongОценок пока нет

- Mutual Fund 1Документ3 страницыMutual Fund 1Lyra Joy CalayanОценок пока нет

- 8.1. Introduction of Rural MarketingДокумент7 страниц8.1. Introduction of Rural MarketingAR Ananth Rohith BhatОценок пока нет