Академический Документы

Профессиональный Документы

Культура Документы

Enbanc: Court Appeals City

Загружено:

joannelegaspi0 оценок0% нашли этот документ полезным (0 голосов)

125 просмотров13 страницCTA

Оригинальное название

CTA Decision

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCTA

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

125 просмотров13 страницEnbanc: Court Appeals City

Загружено:

joannelegaspiCTA

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 13

REPUBLIC OF THE PHILIPPINES

COURT OF TAX APPEALS

QUEZON CITY

ENBANC

FIRST PLANTERS PAWNSHOP, INC.,

Petitioner,

-versus-

CITY TREASURER OF PASA Y CITY

Represented by its former OIC,

Ms. OFELIA M. OLIVA,

Respondent,

CTA EB No. 501

(RTC Civil Case No. 71634)

(MTC Civil Case No. 2838)

Present:

Acosta, PJ,

Castafieda,J r.,

Bautista,

Uy,

Casanova,

Palanca-Enriquez,

Fa bon-Victorino,

Mindaro-Grulla, and

Cotangco-Manalastas, JJ

Promulgated:

X- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - X

DECISION

COTANGCO-MANALASTAS, J. :

On appeal before the Court En Bane by way of Petition for Review

1

filed on

June 26, 2009 by First Planters Pawnshop Inc. ("petitioner"), pursuant to Section 11

of Republic Act (R.A.) No. 1125, as amended by Section 9 of R.A. No. 9282, and

Section 4(c), Rule 8 of the 2005 Revised Rules of the Court ofTax Appeals (RRCTA) ,

are the Decision

2

and Order

3

promulgated on April 15, 2009 and May 27, 2009, ~ -

1

Rollo, CTA EB No. 501 , pp. 1-3 5, with Annexes.

2

Rollo, pp. 12- 15, Annex " 8 "

3

Rollo, pp. 16- 18, Annex "C"

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civi l Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City

Page 2 of 13

respectively, by the Regional Trial Court, Branch 153, Taguig City, dismissing

petitioner's appeal due to failure of petitioner to implead the City Govemment of

Pasay and thus, denying petitioner's claim for refund.

THE FACTS

Based on the record

4

, the facts are as follows:

"Petitioner is a domestic corporation duly organized and existing

under Philippine laws with principal address at No. 28 C-1 Rodriguez Street,

Signal Village, Taguig City.

Respondent City Treasurer of Pasay City, with office address at City

Hall , Pasay City, represented by its former Officer-In-Charge, Ofelia M.

Oliva

5

, oflegal age, Filipino, who is being sued in her official capacity.

On January 4, 2005, petitioner applied for a renewal of its Mayor' s

Permit and business license/tax for the year 2005 and declared as its gross

sales the amount of Two Million Two Hundred Eighty Seven Thousand

Three Hundred Forty Six Pesos (P2,287,346.00) for the year 2004. The

respondent increased the gross sales of the petitioner to Five Million Pesos

(P5,000,000.00). Petitioner paid the amount under protest in order to obtain

the Mayor' s Permit to operate its business in Pasay City.

On February 25, 2005, petitioner made a demand upon the

respondent for the refund of the illegally collected business tax amounting to

Twenty Thousand Three Hundred Forty Four Pesos and Sixty Five Centavos

(sic) (P20,344.90) not P20,335.60 as appearing on the questioned Decision.

Instead of granting the refund, respondent issued a Letter of Authority for the

examination of the books of accounts, financial statements, stubs of used

cash and/or charge invoices, official receipts, mayor's permit, merchandise

inventory, purchase invoices, community tax payments of employees and

other clearances and documents covering the years 2000 to 2004. Despite

the demand for refund of the illegally collected business tax for the year 2005,

respondent failed and refused to refund the same.

In January 2006, petitioner again filed an application for renewal for

its Mayor's Permits for the year 2006 and attached to its application the

Affidavit of Gross Sales/Receipts for the year 2005 and the Branch' s Income

Statement reflecting a gross income of Two Million One Hundred Eighty

Thousand Nine Hundred Fifty Four Pesos (P2, 180,954.00). Instead of using

as tax base the said declared gross income of petitioner, respondent assessed

petitioner using a higher income using the Presumptive Income Level

Assessment Approach of Five Million Pesos (P5,000,000.00), thereby

~

4

Rollo, pp. 1-5.

5

The City Treasurer' s name in the pleadings was reflected as "Ms. Ofelia M. Olivia." However,

perusal of the records, especially correspondence originating from the City Treasurer's Office show

that the correct name is "Ms. Ofelia M. Oliva". Please refer to Rollo, pp. 68 and 70.

DEClSION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 3 of 13

resulting in the over assessment and overpayment of petitioner's business tax

in the amount of Twenty One Thousand One Hundred Forty Two Pesos and

Eighty Five Centavos (P21 , 142.85).

A re-computation of business taxes for the years 2005 and 2006

shows that petitioner overpaid the taxes due for said years amounting

P20,344.90 and P21 , 142.85, respectively. Hence, petitioner' s counsel made

a final demand for the refund of the illegally collected and paid business

taxes . Despite the demands made upon the respondent to refund said illegally

collected and overpaid business taxes, respondent failed and refused to effect

the refund. Petitioner, therefore, through its Vice-President Antonio Ramon

Ongsiako in order to protect its rights and interest, fi led the case which is

covered by the Revised Rules on Summary Procedure.

In a decision dated March 28, 2008, the Presiding Judge of

Metropolitan Trial Court ("MeTC"), Branch 74, Taguig City, dismissed the

case, copy of which was received by petitioner on April 8, 2008 and

immediately and seasonably filed a Notice of Appeal dated April I 0, 2008.

The appeal , however, was dismissed by the appellate comi in its decision

dated April 15, 2009 and the Motion for Reconsideration was denied in an

Order dated May 27, 2009."

Hence, this Petition for Review.

THE ISSUES

1. Whether or not the Regional Trial Court ("RTC") erred in

dismissing the appeal due to the failure of petitioner to

implead the City Government of Pasay;

2. Whether or not the petitioner is entitled to refund of the

illegally collected taxes for the years 2005 and 2006.

THE RULING OF THE COURT EN BANC

Dismissal o(the complaint

by the trial court and appellate court

was proper

On appeal, the appellate court dismissed the petitioner's claim for refund on

the ground that the real party in interest was not made a party to the action, to wit:

"The Court has to strike down the appeal because it was not filed

against the real party in interest. The other issues will no longer be

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City

discussed as they are dependent on the main issue as to whether or

not Ms. Ofelia M. Olivia (sic) is the real party in interest."

6

Page 4 of 13

Section 2, Rule 3 of the Revised Rules of Court provides that a real party in

interest is "the party who stands to be benefited or injured by the judgment in the suit,

or the party entitled to the avails of the suit. Unless otherwise authorized by law or

these Rules, every action must be prosecuted or defended in the name of the real party

in interest." The appellate court and respondent posit that the City Government of

Pasay City should have been made a party to the action. The RTC discussed as

follows:

"And, in case the tax is found to have been illegally collected,

the City Government of Pasay, through the Sangguniang

Panglungsod will have to pass an ordinance appropriating funds for

the payment of the refund, interest, attorney's fees, and actual

damages/costs of liti gation prayed for in the Complaint and it is not

Ms. Olivia (sic) who is empowered to pay these amounts on her

own.''

7

On the other hand, petitioner believes that naming Ms. Ofelia M. Oliva as the

defendant (now respondent) in her capacity as the City Treasurer of Pasay City is

sufficient to comply with Section 2, Rule 3 of the Revised Rules of Court.

This Court agrees with petitioner that the City Treasurer in her official

capacity may be impleaded alone in a claim for refund, without need to include the

City Government in the suit. Questions involving protests and claims for refund of

local business taxes fall squarely with the Office of the City Treasurer. Said Office is

tasked with the implementation of the City Revenue Code, together with the

collection and assessment of business taxes, licenses and other permit fees within the

City. This is supported by a line of cases decided by this Court wherein only the ~

6

Rollo, p. 14.

7

Rollo, p. 15.

DECISION

CTA EB No. 501 (RTC Civi l Case No. 71634 and MTC Civi l Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 5 of 13

Office of the City Treasurer has been named as defendant/respondent in a claim for

refund of local business tax.

8

Thus, it appears that petitioner's suit was not dismissible on the ground of

failure to implead the real party in interest. However, an examination of the record

shows that the trial court dismissed the petitioner's complaint not only for failure to

implead the real party in interest but also for the following grounds: ( 1) failure to

exhaust administrative remedies; (2) failure to attach Articles of Incorporation; and (3)

lack of a proper verification.

With respect to the third ground, it is worth noting that the original complaint

filed with the MeTC contained a "Verification and Certification of Non-Forum

Shopping"

9

in the name of "Lingkod Bayan Pawnshop, Inc." and not the

We agree with the MeTC's discussion, quoted below:

" Under the said verification, Antonio Ramon Ongsiako under

oath declared that he is the Vice-President of Lingkod Bayan

Pawnshop Inc. and he was authorized by the (sic) its Board of

Directors to institute/file the instant case in behalf of the Lingkod

Bayan Pawnshop Inc. However, the Secretary' s Certificate dated

March 10, 2006, attached to complaint, shows that the Board of

Directors of First Planters Pawnshop Inc. authorized Antonio

Ramon Ongsiako to institute the instant complaint. Nowhere in the

complaint, in the verification or the Secretary's Certificate was it

shown that the members of the Board of Directors of the two

pawnshops are the same. ln fact , Ongsiako caused the preparation of

the complaint not as a representative of First Planters Pawnshop Inc.

but of Lingkod Bayan Pawnshop Inc. Therefore, the complaint lacks

a proper verification and is treated herein as an unsigned pleading."

10

Y

8

China Banking Corporation vs. The Treasurer of the City of Manila, CT A EB Case No. 525,

September 13, 20 I 0; Unilever Philippines, Inc. vs. The Treasurer of the City of Manila, CT A A.C. No.

56, June 2, 20 1 0; China Banking Corporation vs. City Treasurer of Manila, CTA EB Case No. 150,

September 15, 2006; A lean Packaging Starpack Corp. vs. The Treasurer of the City of Manila, CT A

A.C. No. 17, September 11 , 2006; China Banking Corporation vs. City Treasurer ofKalookan, CTA

EB Case No. 151 , August 28, 2006; Swedish Match Philippines Inc. vs. The Treasurer of the City of

Manila, CT A A.C. No. 15, Jul y 2 1, 2006; and China Banking Corporation vs. City Treasurer of

Kalookan, CTA A.C. No. 12, August 31 , 2005.

9

Rollo, p. 61.

10

Rollo, p. 28.

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 6 of 13

Apart from the foregoing, the Verification/Certification attached to the

complaint also fails for being made based on "personal knowledge and belief'.

Under Rule 7, Section 4, a pleading is "verified by an affidavit that the affiant

has read the pleading and that the allegations therein are true and correct of his

personal knowledge or based on authentic records. A pleading required to be verified

which contains a verification based on 'information and belief, ' or upon 'knowledge,

information and belief, ' or lacks a proper verification shall be treated as an unsigned

pleading." Mere belief is insufficient and negates the verification which should be on

the basis of personal knowledge or authentic records.

11

Considering also that the certification of non-forum shopping was integrated

m the verification, submission of said Verification/Certification in the name of

another entity, and not the petitioner in the instant case, is equivalent to the lack of a

proper Certification of Non-Forum Shopping, or failure to comply with Rule 7

Section 5 which is a proper cause for dismissal.

12

However, considering that the

substantive issue raised by petitioner is meritorious, in the interest of substantial

justice, we will decide the case on the merits.

Presumptive Income Level

Assessment Approach may

only be used if(inancial data

is not submitted

The petitioner objects to the use of the "Presumptive Income Level

Assessment Approach" ("PILAA") in computing its local business taxes for t h e ~ /

11

Fernando Go vs. Court of Appeals, Pi lar Lim, et. at. , G.R. No. 163745, August 24, 2007 quoting

LOP Marketing Inc. vs. Monter, G.R. No. 159633, January 25,2006.

12

Rules of Court, Rule 7 Section 5. Certification against j01um shopping. - xxx xxx xxx. Fai lure to

comply with the foregoing requirements shall not be curable by mere amendment of the complaint or

other initi atory pleading but shall be cause for the dismi ssal of the case without prejudi ce. xxx xxx

XXX.

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 7 of 13

taxable years 2005 and 2006, despite the submission of its sworn declaration of gross

sales/receipts and branch income statement for 2004 and 2005.

The respondent justifies its use of the PILAA by explaining that it is

commonly practiced in most local government units throughout the country as a tool

for the efficient and effective collection of taxes.

13

The respondent further explains

that the PILAA is used at the height of the renewal of business permits when it has

very limited time to verify the amount of gross sales declared by those applying for

b

. . 14

usmess perm1ts.

We agree with petitioner.

The PILAA is indeed a tax collection tool which enables the local government

units to set a certain income level standard for various business entities based on

industry factors. However, the PILAA does not give the respondent a carte blanche

authority to increase the gross sales/receipts of the taxpayers within its jurisdiction

and on that basis, assess the local business tax.

This Court believes that the PILAA may be used by the respondent in

computing the local business tax only if the taxpayer is unable to provide proof of its

income.

The w o ~ d "presumptive" is defined as "based on a presumption". A

"presumption" is "a legal inference or assumption that a fact exists, based on the

known or proven existence of some other fact or group of facts."

15

Based on the

foregoing definition, the "presumptive income" is a presumed or assumed income

level based on known or proven factors. These factors may include information fromy

13

Rollo, p. 68.

14

Ibid.

15

Black's Law Dictionary, 8

1

h Edition.

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 8 of 13

the industry such as average customers per day, inventory turnover and mark-ups, and

other measurable and verifiable indicators specific to the nature of business.

With the petitioner's submission of its sworn declaration of gross mcome

together with its audited financial statements, the respondent could have sufficiently

computed the local business tax due without resort to the PILAA. There was no need

for the respondent to use a "presumptive income level" since the petitioner has

already provided its actual gross income for the taxable years in question.

If the respondent believed that the petitioner underdeclared its gross income,

the remedy should have been to compute the local business tax on the petitioner' s

declared income and then subsequently issued a Letter of Authority for the

examination and audit of petitioner's books of accounts and other records. If

petitioner fails to present its books of accounts and other records or if the petitioner

has no such records to validate its declared income, then the respondent may use the

presumptive income level for the assessment of deficiency taxes.

It is also noted that the use of the PILAA is not provided for in the Local

Revenue Code of Pasay City

16

. While the Local Government Code of 1991 (LGC)

grants local government units (LGU) the power to create its own sources of revenue

17

,

the same is subject to the limitation that the tax be imposed through an appropriate

ordinance.

18

Admittedly, the City Treasurer of Pasay is authorized to collect local

business taxes under both the LGC and the Pasay Revenue Code. However, if the City /v/

16

Ordinance No. 16/4, Series of 1999 amending certain chapters and sections of Ordinance No. 241,

Series of 1993.

17

Republic Act No. 7160, Sec. 129. Power to Create Sources of Revenue.- Each local government

unit shall exercise its power to create its own sources of revenue and to levy taxes, fees, and charges

subject to the provisions herein, consistent with the basic policy of local autonomy. Such taxes, fees,

and charges shall a<:<crue exclusively to the local government units.

18

Ibid. , Sec. 132. Local Taxing Authority. - The power to impose a tax, fee, or charge or to generate

revenue under this Code shall be exercised by the sanggunian of the local government unit concerned

through an appropriate ordinance.

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City

Page 9 of 13

Treasurer intended to use the PILAA, the same should have been subject to the

procedures provided in the LGC regarding public hearings and publication.

19

This is

to ensure that the taxpayers are properly informed of the factors used in determining

the presumptive income and for the taxpayers to agree to such level of presumptive

income applicable to their industry.

Absent such ordinance authorizing the use of the PILAA and embodying the

presumptive income levels to be used by the City Treasurer, the collection of

additional local business taxes based on such PILAA was illegal and the petitioner

may properly claim the refund of the excess business taxes collected.

Exhaustion of administrative remedies

and entitlement to refund

Respondent, in its Comment

20

, alleges that petitioner failed to exhaust

administrative remedies when petitioner failed to appeal to the Local Board of

Assessment Appeals as required under Section 226

21

of the LGC. Petitioner, on the

other hand, alleges that respondent is relying on LGC provisions relating to ref//

19

Ibid., Sec. 187. Procedure for Approval and Effectivity of Tax Ordinances and Revenue

Measures; Mandatory Public Hearings. - The procedure for approval of local tax ordinances and

revenue measures shall be in accordance with the provisions of this Code: Provided, That public

hearings shall be conducted for the purpose prior to the enactment thereof: xxx xxx xxx.

Sec. 188. Publication of Tax Ordinances and Revenue Measures. - Within ten ( 10) days after

their approval, certified true copies of all provincial , city, and municipal tax ordinances or revenue

measures shall be published in full for three (3) consecutive days in a newspaper of local circulation:

Provided, however, That in provinces, cities and municipalities where there are no newspapers of local

circulation, the same may be posted in at least two (2) conspicuous and publicly accessible places.

20

Rollo, p. 96-1 02.

21

Sec. 226. Local Board of Assessment Appeals. - Any owner or person having legal interest in the

property who is not satisfied with the action of the provincial, city or municipal assessor in the

assessment of his property may, within sixty (60) days from the date of receipt of the written notice of

assessment, appeal to the Board of Assessment Appeals of the province or city by filing a petition

under oath in the form prescribed for the purpose, together with copies of the tax declarations and such

affidavits or documents submitted in support of the appeal.

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 10 of 13

property taxation, which are not applicable to this case.

22

Petitioner believes that the

appropriate provisions should be Sections 195 and 196.

We agree with petitioner. Section 226 of the LGC relied upon by the

respondent falls under Title II of the LGC relating to real property taxation. The

refund being claimed by petitioner relates to overcollected business taxes and not to

real property taxation, thus, the provisions on local government taxation should apply.

Specifically, Section 196 of the LGC provides the procedure in claiming for refund of

erroneously or illegally collected taxes. It provides:

"Sec. 196. Claim for Refund of Tax Credit. No case or

proceeding shall be maintained in any court for the recovery of any

tax, fee, or charge erroneously or illegally collected until a written

claim for refund or credit has been filed with the local treasurer. No

case or proceeding shall be entertai ned in any court after the

expiration of two (2) years from the date of the payment of such tax,

fee, or charge, or from the date the taxpayer is entitled to a refund or

credit."

For a claim for refund to prosper in court, the taxpayer must first file a written

claim for refund or credit with the local treasurer. In the case of China Banking

Corporation vs. City Treasurer of Manila

23

, this Court had occasion to rule as follows:

"Whi le the Court agrees with petitioner' s contention that the

Local Government Code does not require any specific form of the

letter for refund/protest, st ill a letter purporting to be a refund must

inform the respondent of the basis of such claim as to enable the

latter to make an intelligent decision thereon. "

After petitioner's renewal of its 2005 mayor's permit, petitioner filed a letter-

demand

24

for refund with the City Treasurer on Feb. 25, 2005. The claim for refund

was premised on the illegal and erroneous collection of the additional business tax

computed by the City Treasurer upon its unilateral application of the presumptive

income level of P5,000,000.00. On March 3, 2005, respondent explained the use of j/

22

Rollo, p. I 08-111 .

23

C.T.A. E. B. Case No. 150, September I 5, 2006.

24

Rollo, p. 69.

DECISION

CTA EB No. 50 I (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City

Page II ofl 3

the PILAA and informed the petitioner of the examination of its books of accounts in

its letter

25

to petitioner. On March 4, 2005, petitioner received a Letter of Authority

26

for the examination of its books of accounts and other records.

On January 30, 2006, petitioner filed a letter-demand

27

for refund with the

City Treasurer for the overcollected business taxes for taxable years 2005 and 2006.

The letter reiterated petitioner' s objection to the use of the presumptive income level

of P5,000,000.00 on the ground that said presumptive income is "baseless, illegal,

confiscatory, whimsical and contrmy to law". Furthermore, petitioner provided the

computation of the excess business tax and unequivocally demanded its refund, as

follows :

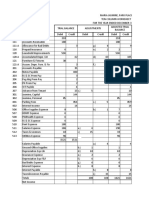

A B c

Year Gross Income Business Tax Due Business Tax Collected Overpayment

(Based on [Ax (75% of 1 %)] based on PIL of P5 [ C - B]

previous Million

year' s [5M x (75% of 1 %)]

income)

2004 2,287,346.00 17,155.10 37,500.00 20,344.90

2005 2, 180,954.00 16,357.15 37,500.00 21,142.85

Total Overpayment of Taxes 41,487.75

These letters demanding for the refund of the overcollected taxes are sufficient

for the purpose of Section 196 and which al so provides enough basis for the City

Treasurer to form its decision. The Court En Bane finds that the petitioner

substantially complied with the requirements of Section 196 thereby exhausting the

administrative remedy under Section 196 of the LGC. Petitioner' s action for refund

filed with the MeTC was not premature and therefore, petitioner is entitled to a refund

of the overcollected business taxes for taxable years 2005 and 2006. )/"

25

Rollo, p. 68.

26

Rollo, p. 70.

27

Rollo, p. 74.

DECISION

CTA EB No. 501 (RTC Civi l Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 12 of 13

WHEREFORE, finding merit in the instant Petition for Review, the is

hereby GRANTED. The assailed Decision and Order dated April 15, 2009 and May

27, 2009, respectively of the Regional Trial Court of Taguig, Branch 153 in Civil

Case No. 71634 are hereby REVERSED. Another one is hereby entered ordering

respondent to REFUND to petitioner the amount of P20,344.90 and P21 ,142.85,

representing excess business taxes collected for years 2005 and 2006.

SO ORDERED.

Associate Justice

WE CONCUR:

0 ._...,._ .._ (s) ()_ ..........-L-

ERNESTO D. ACOSTA

Presiding Justice

.

CfuANITO C. CAST JR.

Associate Justice

ESPE

CAESAR A.

Associate .9fstice

CIELITO N. MINDARO-GRULLA

Associate Justice

DECISION

CTA EB No. 501 (RTC Civil Case No. 71634 and MTC Civil Case No. 2838)

First Planters Pawnshop, Inc. vs. City Treasurer of Pasay City Page 13 of 13

CERTIFICATION

Pursuant to Section 13, Article VIII of the Constitution, it is hereby certified

that the above Decision has been reached in consultation with the members of the

Court En Bane before the case was assigned to the writer of the opinion of the Court.

L - ~ . o . . ~

ERNESTO D. ACOSTA

Presiding Justice

Вам также может понравиться

- Microbrewery Business PlanДокумент28 страницMicrobrewery Business PlanTom TronconeОценок пока нет

- Five Simple Scalping Strategies Tested on Euro CurrencyДокумент61 страницаFive Simple Scalping Strategies Tested on Euro CurrencyDebashish GhoshОценок пока нет

- Basic legal forms captionsДокумент44 страницыBasic legal forms captionsDan ChowОценок пока нет

- Basic legal forms captionsДокумент44 страницыBasic legal forms captionsDan ChowОценок пока нет

- United States v. Rutkin, 208 F.2d 647, 3rd Cir. (1954)Документ18 страницUnited States v. Rutkin, 208 F.2d 647, 3rd Cir. (1954)Scribd Government DocsОценок пока нет

- Case Digest TaxationДокумент8 страницCase Digest Taxationtats100% (4)

- Responsive Pleading Is ServedДокумент3 страницыResponsive Pleading Is ServedJevi RuiizОценок пока нет

- Manila Mandarin Hotels V CIRДокумент3 страницыManila Mandarin Hotels V CIRJerico GodoyОценок пока нет

- G.R. No. L-19761 January 29, 1923 PHILIPPINE TRUST COMPANY, As Assignee in Insolvency of "La Cooperativa Naval Filipina," Plaintiff-Appellee, MARCIANO RIVERA, Defendant-AppellantДокумент2 страницыG.R. No. L-19761 January 29, 1923 PHILIPPINE TRUST COMPANY, As Assignee in Insolvency of "La Cooperativa Naval Filipina," Plaintiff-Appellee, MARCIANO RIVERA, Defendant-AppellantCharisa BelistaОценок пока нет

- Hi-Yield Realty Inc Vs CA - 138978 - September 12, 2002 - J. Corona - Third DivisionДокумент6 страницHi-Yield Realty Inc Vs CA - 138978 - September 12, 2002 - J. Corona - Third DivisiongabbieseguiranОценок пока нет

- Evidence Digest Byron San PedroДокумент5 страницEvidence Digest Byron San PedroIvan LeeОценок пока нет

- Prescription - PenaltiesДокумент13 страницPrescription - PenaltiesFrancisCarloL.FlameñoОценок пока нет

- Cases For Corpo Code DigestДокумент9 страницCases For Corpo Code DigestNILO CULABAN JRОценок пока нет

- Consolidated Syllabus in Taxation - 8!19!2019Документ31 страницаConsolidated Syllabus in Taxation - 8!19!2019Anton GabrielОценок пока нет

- Presentation Akuntansi Lanjutan II Chapter 2 Beams :: ConsolidationДокумент21 страницаPresentation Akuntansi Lanjutan II Chapter 2 Beams :: ConsolidationAndreas JimanОценок пока нет

- Stockholder's Right to Inspect Records Through an AgentДокумент1 страницаStockholder's Right to Inspect Records Through an AgentReese PeraltaОценок пока нет

- RPT and Local Business TaxДокумент48 страницRPT and Local Business TaxGeng SimbolОценок пока нет

- 97 Phil 171Документ9 страниц97 Phil 171asnia07Оценок пока нет

- Philippine Heart Center vs. Local Government of Quezon City GR No. 225409 11 March 2020.Документ15 страницPhilippine Heart Center vs. Local Government of Quezon City GR No. 225409 11 March 2020.TobyОценок пока нет

- p176 Maria JasmineДокумент9 страницp176 Maria JasmineIsaiah Valencia100% (1)

- Legal Counseling TopicsДокумент10 страницLegal Counseling TopicsJean Michael ManuelОценок пока нет

- Special Proceedings Atty Yulo SyllabusДокумент8 страницSpecial Proceedings Atty Yulo SyllabusDiane RoyoОценок пока нет

- Cayetano v. MonsodДокумент2 страницыCayetano v. MonsodEmma Ruby Aguilar-ApradoОценок пока нет

- G.R. No. L-10550. September 19, 1961 KOPPEL (PHILIPPINES) INC., Petitioner-Appellant, VДокумент2 страницыG.R. No. L-10550. September 19, 1961 KOPPEL (PHILIPPINES) INC., Petitioner-Appellant, VBenjie RoqueОценок пока нет

- Escheats - Guardianship - AdoptionДокумент9 страницEscheats - Guardianship - AdoptionIrish AnnОценок пока нет

- Prac 2 - Midterms ReviewerДокумент5 страницPrac 2 - Midterms ReviewerAndiel KyxzОценок пока нет

- Arellano University Civil Procedure SyllabusДокумент9 страницArellano University Civil Procedure SyllabusJollibee Bida BidaОценок пока нет

- Corporate Law MidtermsДокумент34 страницыCorporate Law MidtermsYahiko YamatoОценок пока нет

- Cariño - Art.3 Felonies-Case DigestsДокумент16 страницCariño - Art.3 Felonies-Case DigestsAlan Jay CariñoОценок пока нет

- Uphold Integrity and Dignity of Legal ProfessionДокумент1 страницаUphold Integrity and Dignity of Legal ProfessionPingLomaadEdulanОценок пока нет

- 1 GR 174179Документ2 страницы1 GR 174179Jen AsamaОценок пока нет

- Makati Taxation of Service Contractor ReceiptsДокумент15 страницMakati Taxation of Service Contractor ReceiptsArchie GuevarraОценок пока нет

- Ombudsman's Role in Medical Malpractice CasesДокумент8 страницOmbudsman's Role in Medical Malpractice CasesnoonalawОценок пока нет

- 12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFДокумент8 страниц12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFEmelie Marie DiezОценок пока нет

- Lumanlan Vs CuraДокумент3 страницыLumanlan Vs CuraaceamulongОценок пока нет

- 5) Dulay V CAДокумент11 страниц5) Dulay V CAresjudicataОценок пока нет

- Quezon City Government's assessment, levy and sale of PHC properties assailedДокумент15 страницQuezon City Government's assessment, levy and sale of PHC properties assailedCzarianne GollaОценок пока нет

- Ecsay v. CA, 61 SCRA 369 Digest PDFДокумент1 страницаEcsay v. CA, 61 SCRA 369 Digest PDFLexa L. DotyalОценок пока нет

- Petitioner vs. vs. Respondents Jose W. Diokno Angel M. VecinoДокумент3 страницыPetitioner vs. vs. Respondents Jose W. Diokno Angel M. Vecinopinkblush717Оценок пока нет

- Course Outline in Civil Law Review 1 (Part 1)Документ9 страницCourse Outline in Civil Law Review 1 (Part 1)Gloria Diana DulnuanОценок пока нет

- Legal CounselingДокумент106 страницLegal CounselingCarloErica Austria TambioAdapОценок пока нет

- Special Proceedings SY 2019-2020 Semestral ExaminationДокумент5 страницSpecial Proceedings SY 2019-2020 Semestral ExaminationRalph Ronald CatipayОценок пока нет

- Cir V ManningДокумент12 страницCir V Manningnia_artemis3414Оценок пока нет

- Petitioner Respondent: Commissioner of Internal Revenue, Lee Kiwi Holdings, LLCДокумент9 страницPetitioner Respondent: Commissioner of Internal Revenue, Lee Kiwi Holdings, LLCGilbert John LacorteОценок пока нет

- Supreme Court Holds Gun Store Owner Liable for Student's Death in Shooting AccidentДокумент8 страницSupreme Court Holds Gun Store Owner Liable for Student's Death in Shooting Accidentherbs22225847Оценок пока нет

- Cir V Cebu Toyo CorpДокумент5 страницCir V Cebu Toyo CorpChanel GarciaОценок пока нет

- 5 Red Line Transportation Co V Rural Transit Co., LTDДокумент3 страницы5 Red Line Transportation Co V Rural Transit Co., LTDEK ANGОценок пока нет

- Valencia Vs SandiganbayanДокумент26 страницValencia Vs SandiganbayanisaaabelrfОценок пока нет

- Burgos Vs EsperonДокумент9 страницBurgos Vs EsperonLou StellarОценок пока нет

- Velasco vs. PoizatДокумент2 страницыVelasco vs. Poizatdura lex sed lexОценок пока нет

- Philippine Supreme Court upholds order declaring lost stock certificatesДокумент478 страницPhilippine Supreme Court upholds order declaring lost stock certificatesAia Tibayan MetrilloОценок пока нет

- EVID (First 5 Digests)Документ14 страницEVID (First 5 Digests)doraemonОценок пока нет

- National Exchange Co Vs DexterДокумент2 страницыNational Exchange Co Vs DexterQueenie SabladaОценок пока нет

- SEC v. CJH Development Corp.Документ10 страницSEC v. CJH Development Corp.anneОценок пока нет

- OCA Circular No. 99 2008 PDFДокумент1 страницаOCA Circular No. 99 2008 PDFBDRamosОценок пока нет

- SEC upholds ban on similar corporate namesДокумент3 страницыSEC upholds ban on similar corporate namesRubyОценок пока нет

- SPCL ExtrajudicialCasesДокумент44 страницыSPCL ExtrajudicialCasesMonique Eveleen SalazarОценок пока нет

- 5th BatchДокумент48 страниц5th BatchEmmanuel Enrico de VeraОценок пока нет

- Victorias Milling Co., Inc. vs. Mun. of Victorias, Negros Occidental, 25 SCRA 192, September 27, 1968Документ21 страницаVictorias Milling Co., Inc. vs. Mun. of Victorias, Negros Occidental, 25 SCRA 192, September 27, 1968Daniela SandraОценок пока нет

- 166 Dunlay v. Avenue M. Garage & Repair Co., (Mendoza)Документ2 страницы166 Dunlay v. Avenue M. Garage & Repair Co., (Mendoza)Jovelan EscañoОценок пока нет

- Corporate liability in tort and contract casesДокумент4 страницыCorporate liability in tort and contract casesVan NessaОценок пока нет

- 4 Razon, Jr. v. TagitisДокумент94 страницы4 Razon, Jr. v. TagitisVianice BaroroОценок пока нет

- 242-Castro v. CIR G.R. No. L-12174 April 26, 1962Документ11 страниц242-Castro v. CIR G.R. No. L-12174 April 26, 1962Jopan SJОценок пока нет

- 107-Tan vs. Sec 206 Scra 740Документ8 страниц107-Tan vs. Sec 206 Scra 740wewОценок пока нет

- Formal Legal Truth and Substantive Truth in Judicial Fact-FindingДокумент17 страницFormal Legal Truth and Substantive Truth in Judicial Fact-FindingJuana LoboОценок пока нет

- Jose Emmanuel Guillermo Vs Crisanto UsonДокумент2 страницыJose Emmanuel Guillermo Vs Crisanto UsonCHERELIE BUGARINОценок пока нет

- Cta Eb CV 00501 D 2010dec10 Ref PDFДокумент13 страницCta Eb CV 00501 D 2010dec10 Ref PDFElizalde Teo BobbyОценок пока нет

- Cta Eb CV 00182 D 2006jul17 Ref PDFДокумент14 страницCta Eb CV 00182 D 2006jul17 Ref PDFHenson MontalvoОценок пока нет

- RMC No 79 2014Документ4 страницыRMC No 79 2014Renzo Ross Certeza SarteОценок пока нет

- Vicarious Liability - FranchiseДокумент23 страницыVicarious Liability - FranchisejoannelegaspiОценок пока нет

- RR12 2007Документ2 страницыRR12 2007joannelegaspiОценок пока нет

- Appealing RPT AssessmentДокумент4 страницыAppealing RPT Assessmentjoannelegaspi100% (1)

- NLRC Rules of Procedure 2011Документ30 страницNLRC Rules of Procedure 2011Angela FeliciaОценок пока нет

- RMC 63-2012Документ2 страницыRMC 63-2012joannelegaspiОценок пока нет

- RR12 2007Документ2 страницыRR12 2007joannelegaspiОценок пока нет

- RMC 63-2012Документ2 страницыRMC 63-2012joannelegaspiОценок пока нет

- RR12 2007Документ2 страницыRR12 2007joannelegaspiОценок пока нет

- RR12 2007Документ2 страницыRR12 2007joannelegaspiОценок пока нет

- DAO 7.series 2006.simplified Uniform Procedure For Administrative Cases PDFДокумент26 страницDAO 7.series 2006.simplified Uniform Procedure For Administrative Cases PDFOna DlanorОценок пока нет

- 16.BM - Within, Beyond Scope of Letter of autority.11-27-07.PPPДокумент3 страницы16.BM - Within, Beyond Scope of Letter of autority.11-27-07.PPPjoannelegaspiОценок пока нет

- Documents - Clay County RandomDrugapprovedJan09Документ10 страницDocuments - Clay County RandomDrugapprovedJan09joannelegaspiОценок пока нет

- Consolidation of Peanut and SnoopyДокумент2 страницыConsolidation of Peanut and SnoopyFarrell P. NakegaОценок пока нет

- C2 Marketing EnvironmentДокумент49 страницC2 Marketing EnvironmentDuyen DoanОценок пока нет

- Income Statement of Mahaweli Reach HotelДокумент7 страницIncome Statement of Mahaweli Reach Hotelदेवीना गिरीОценок пока нет

- Square: Prepared & Submitted by Group: 8Документ18 страницSquare: Prepared & Submitted by Group: 8Niloy Rahman0% (1)

- Types of Mutual FundДокумент3 страницыTypes of Mutual FundKhunt DadhichiОценок пока нет

- P&G's Transformation and Growth Under Lafley's LeadershipДокумент7 страницP&G's Transformation and Growth Under Lafley's Leadershippallavbajaj88Оценок пока нет

- Milan Mehta - Quasi Contract Complete InformationДокумент5 страницMilan Mehta - Quasi Contract Complete InformationMilan Mehta0% (1)

- Understanding Key Accounting Concepts and PrinciplesДокумент32 страницыUnderstanding Key Accounting Concepts and PrinciplesKezia Gwyneth Bofill OrisОценок пока нет

- Sunteck Realty LTD.: Earnings Update Q3 FY2019Документ34 страницыSunteck Realty LTD.: Earnings Update Q3 FY2019Imran MulaniОценок пока нет

- Case Digest TaxationДокумент9 страницCase Digest TaxationJC RamosОценок пока нет

- Solutions To Session 6 Practice ProblemsДокумент3 страницыSolutions To Session 6 Practice ProblemsKeshav soodОценок пока нет

- Hedging Foreign Exchange RiskДокумент5 страницHedging Foreign Exchange RiskKarthik ChandrashekarОценок пока нет

- Chapter 1Документ24 страницыChapter 1Nayan Kc100% (1)

- Chapter 1: Financial Management and Financial ObjectivesДокумент15 страницChapter 1: Financial Management and Financial ObjectivesAmir ArifОценок пока нет

- FORM 201 Sales and Purchase DetailsДокумент22 страницыFORM 201 Sales and Purchase DetailsRaju ShahОценок пока нет

- Portfolio Management Process and Life Cycle InvestingДокумент9 страницPortfolio Management Process and Life Cycle InvestingOsama MuzamilОценок пока нет

- Akuntansi Perush DagangДокумент20 страницAkuntansi Perush DagangDANIEL DIBITAUОценок пока нет

- Accounting FEДокумент14 страницAccounting FEWee CanОценок пока нет

- A Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloreДокумент73 страницыA Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloredeepikavemulaОценок пока нет

- Simple InterestДокумент25 страницSimple InterestwillodeeОценок пока нет

- Combined Ratio': Tatutory Combined Ratio. The Statutory Combined Ratio (Expressed As A Percentage) Is Calculated inДокумент3 страницыCombined Ratio': Tatutory Combined Ratio. The Statutory Combined Ratio (Expressed As A Percentage) Is Calculated inTimothy BrownОценок пока нет

- GDP ExamplesДокумент4 страницыGDP ExamplesPRITEEОценок пока нет

- BALANCE SHEET BREAKDOWNДокумент9 страницBALANCE SHEET BREAKDOWNOluwayomi MalomoОценок пока нет

- Revised CF Webcast Slides April 2018Документ16 страницRevised CF Webcast Slides April 2018drew aranasОценок пока нет