Академический Документы

Профессиональный Документы

Культура Документы

Check List For Incorporation

Загружено:

Alen HilarioОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Check List For Incorporation

Загружено:

Alen HilarioАвторское право:

Доступные форматы

Things You'll Need Internet access Articles of Incorporation and Bylaws Registration form Business capital Bank certificate

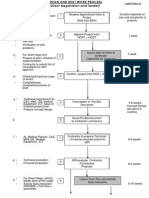

icate of deposit Registration certificate Treasurer's affidavit Incorporator's affidavit to change company name Community tax certificate Barangay clearance Mayor's permit Tax registration forms Social security forms Hide Read more: How to Incorporate a Business in the Philippines | eHow.com http://www.ehow.com/how_6538272_incorporate-businessphilippines.html#ixzz2Istfz7Ti Instructions 1. 1 Check to see if the preferred business name is available. Go to the "Name Verification Unit" at the Securities and Exchange Commission or SEC office. Or visit the SEC website and use the SEC I-Register Facility. Under "Online Transactions," click on "Search for Reserved/Registered Companies" to look up the business name. o 2 Reserve the business name with the Securities and Exchange Commission. On the SEC website under the "Online Transactions" menu, choose "Reserve Company Name." Pay the monthly P40 fee. You will receive a name verification slip. o Sponsored Links Make a blog for free Philippines' easiest blog incl. a personal domain. Try free now! www.simplesite.com o 3 Draft incorporation and bylaws articles. You can hire a lawyer to prepare them for you. o 4 Deposit paid-in capital to a bank. Get a certificate of deposit from the bank. Have it signed and notarized. o 5 Register the company with the Securities and Exchange Commission. On the SEC website, sign up for the SEC I-Register Facility. Fill in the registration forms and print them out. Submit the forms to the SEC office along with the verification slip, the Articles of Incorporation and Bylaws, treasurer's affidavit (authority to verify bank account) and incorporator's affidavit to change the company name. You will receive a SEC Certificate of Registration. o 6 Obtain permission from the local government. Apply for a Community Tax Certificate, Barangay (district or village) Clearance and Mayor's Permit in the city or town where you will be doing business. Fees and procedures may vary from one location to another. o 7 Register for taxes with the Bureau of Internal Revenue. Fill out BIR Form 1903: Application for Registration for Corporations or Partnerships. Attach required documents such as your SEC Registration Certificate and Mayor's Permit. Submit the application to the local BIR office that has jurisdiction over the official business address. Pay the yearly registration fee and documentary stamp tax. You will also need to register

o

accounting books. If you will be printing receipts for the business, apply for authority to print invoices as well. o 8 Register with the Social Security System. Use SSS Form R-1 for business registration. By law, you will be automatically registered with Philippine Health Insurance Company or Philhealth as well. You will receive an employer number, employer card, information booklet and a checklist of the duties and responsibilities as an employer. Submit SSS Form R-1A, Form L-501, Form R-6 and business address sketch. Submit a registration form for each employee you have to Philhealth.

Read more: How to Incorporate a Business in the Philippines | eHow.com http://www.ehow.com/how_6538272_incorporate-businessphilippines.html#ixzz2IstXeWwB

Why the Topic? Okay, so the topic may not be that usual and may not be for everybody. But well, I'm an accountant and part of my job is to help my clients put up their businesses and keep them going. I have experienced first-hand how it is to register a new company and I kind of thought I will share them in hubpages. So here goes... Registering Your Business with the Philippine SEC (for Corporations / Partnerships Only) If you are forming a corporation or a partnership, the first stop is the Philippine Securities and Exchange Commission or the SEC. You need to reserve a unique name for your company (which is good for 30 to 90 days). Once you have reserved your name, you need to place your desired capital (paid-up) in a bank of your choice, have that bank issue a certificate to you, fill up the official SEC form, obtain the signatures of all incorporators (and their tax identification numbers for Filipinos or passport numbers for foreigners) then file the said papers with the SEC. If all goes well, your papers may be approved by the SEC in one week's time. As to the fees, these will depend on the amount of your desired capital. If your desired capital is 1,000,000 pesos (or $20,000), the fees will be approximately $50. You can access an online calculator in the website of the Philippine SEC so that you will not have any problems estimating the fees of your incorporation. Just take note that, if you are a foreigner, there are certain limitations to the percentage of ownership. Some industries limit the percentage of ownership to 20%, others to 40% and still others to 60%. There are also certain limitations on the seats in the board of directors, with the Philippine government usually requiring that the majority of the board should be Filipinos or in accordance with the percentages of ownership. Make sure you consult with a good lawyer who is well-versed with registering companies in the Philippines before you actually put up the corporation. Also, you can obtain more information yourself by going to the Philippine SEC's website. Links to Some of the Various Government Entities Included in This Hub Philippine Securities and Exchange Commission This is the link to the Philippine Securities and Exchange Commission where the corporations and the partnerships are registered. http://www.bir.gov.ph Link to the Bureau of Internal Revenue, the local government unit for collecting taxes. Department of Trade and Industry If you're a sole proprietorship or you simply need to register another business name, you can register your business name here. Registering Your Business - for Sole Proprietorship If you are the only owner of your business (sole or single proprietor), you don't need to go to the SEC to register. Just reserve your name with the Philippine Department of

Trade and Industry. If your name is unique, approval is immediate. The fees here are also minimal (around $10 or so). Next Stop - The Bureau of Internal Revenue Okay, so you have already registered your company with the Philippine SEC (which may take one week if all your requirements are in order). Next step is to register your business with the Bureau of Internal Revenue or the BIR. The BIR is our local equivalent of the United States' IRS. This is where we pay our taxes. As a new corporation, you are required to get your TIN (Tax Identification Number) from the BIR. You cannot transact in the country if you don't have this. Registering your company with the BIR is a fairly easy (and inexpensive) process. It may take only one week and the fee is minimal (less than $30). Again, your accountant can help you with this process. You can also go to the BIR's website for more information. Business Permit You can interchange this next step with the registration with the BIR. Some corporations register first with the BIR when they do not have any transaction yet. Others (which is maybe the majority) choose to register first with the local government where their business is residing. In any case, before registering with the local government (what we call the City Hall), you need to comply first with several requirements (clearances, payments, etc.). Unlike the SEC and the BIR, the fee here is not quite that fixed. The local government fee will depend on the prevailing local laws and the type of business you are in. You need to get your accountant to have this calculated at once so that you'll know how much you need to pay the local government. Once you get your business permit (which is renewed every year), you're ready to start your business. Take Note: Once you are registered with the City Hall and the BIR, they will provide you with certificates evidencing your registration. You are required to post these certificates in your respective offices. This is a requirement under our laws. Failure to do so will subject your company to penalties. A Further Note: If you want to save on taxes, you might want to register your business with the Board of Investments or BOI. It grants income-tax holidays for businesses that are in preferred industries or are pioneers in their industries. Usually, export businesses are given income tax holidays. If you don't want to go to the BOI, go to the local City Hall and the local investment board and apply for a holiday on local taxes. This will save you several years' worth of city taxes. Last Note: Make sure you get a good accountant and/or lawyer since they will be able to help you during your registration, and also do the legwork for you. For local registration requirements (the BIR and the City Hall), my recommendation is to get an accountant / lawyer who is from that city or province because he/she is more wellversed in the ins and outs of their local city hall or BIR. So now, you have seen how it is to register a business in the Philippines. All these may be done within one month if all the requirements are in place. Keep in constant touch with your accountant and/or your lawyer so that you know the status of your registration. It might be better if you yourself have a working knowledge of my country's requirements so that you are aware of what you need to do and what you need to go through when you put up a business and invest in the Philippines.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Comprehensive Agrarian ReformДокумент23 страницыComprehensive Agrarian ReformAlen HilarioОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The 1987 ConstitutionДокумент50 страницThe 1987 ConstitutionAlen HilarioОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Transmutation TableДокумент1 страницаTransmutation TableMaiki Rariza50% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Wage Order No. NCR-15, Effective July 1, 2010 With Implementing RulesДокумент25 страницWage Order No. NCR-15, Effective July 1, 2010 With Implementing RulesPaulino Ungos III100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Canon 22Документ2 страницыCanon 22Alen HilarioОценок пока нет

- Quality Nutrition and Dietetics PracticeДокумент3 страницыQuality Nutrition and Dietetics PracticeNurlienda HasanahОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Quiz EmbryologyДокумент41 страницаQuiz EmbryologyMedShare90% (67)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Grade Eleven Test 2019 Social StudiesДокумент6 страницGrade Eleven Test 2019 Social StudiesClair VickerieОценок пока нет

- Week 6 Blood and Tissue FlagellatesДокумент7 страницWeek 6 Blood and Tissue FlagellatesaemancarpioОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Funds Flow Statement ExplainedДокумент76 страницFunds Flow Statement Explainedthella deva prasad0% (1)

- Request For Review FormДокумент11 страницRequest For Review FormJoel MillerОценок пока нет

- Montgomery County Ten Year Comprehensive Water Supply and Sewerage Systems Plan (2003)Документ228 страницMontgomery County Ten Year Comprehensive Water Supply and Sewerage Systems Plan (2003)rebolavОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- TDS Versimax HD4 15W40Документ1 страницаTDS Versimax HD4 15W40Amaraa DОценок пока нет

- 2020-11 HBG Digital EditionДокумент116 страниц2020-11 HBG Digital EditionHawaii Beverage GuideОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Carpentry Shop: Building, Doors, Windows, Trusses, WorkbenchesДокумент105 страницCarpentry Shop: Building, Doors, Windows, Trusses, WorkbenchesVinod KumarОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Elem. Reading PracticeДокумент10 страницElem. Reading PracticeElissa Janquil RussellОценок пока нет

- 07 Chapter2Документ16 страниц07 Chapter2Jigar JaniОценок пока нет

- 7 Surprising Cyberbullying StatisticsДокумент4 страницы7 Surprising Cyberbullying StatisticsJuby Ann Enconado100% (1)

- Insurance Principles, Types and Industry in IndiaДокумент10 страницInsurance Principles, Types and Industry in IndiaAroop PalОценок пока нет

- Scaffolding Control & MeasuresДокумент3 страницыScaffolding Control & Measuresviswamanoj100% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- UMR Introduction 2023Документ110 страницUMR Introduction 2023tu reves mon filsОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Biology (Paper I)Документ6 страницBiology (Paper I)AH 78Оценок пока нет

- Micdak BackgroundДокумент3 страницыMicdak Backgroundappiah ernestОценок пока нет

- Speaking Coursebook C1.1Документ80 страницSpeaking Coursebook C1.1Yến VõОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Junayed - 19 39800 1Документ11 страницJunayed - 19 39800 1gurujeeОценок пока нет

- ASR1201D ASR1201D-D: Slim Water-Proof RFID ReaderДокумент1 страницаASR1201D ASR1201D-D: Slim Water-Proof RFID ReaderCatalin BailescuОценок пока нет

- Copia de Tissue Response To Dental CariesДокумент7 страницCopia de Tissue Response To Dental Cariesjorefe12Оценок пока нет

- History of The Stethoscope PDFДокумент10 страницHistory of The Stethoscope PDFjmad2427Оценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Bs8161 - Chemistry Laboratory Syllabus: Course ObjectivesДокумент47 страницBs8161 - Chemistry Laboratory Syllabus: Course ObjectiveslevisОценок пока нет

- Design and Built-A4Документ2 страницыDesign and Built-A4farahazuraОценок пока нет

- Jounce Therapeutics Company Events and Start DatesДокумент48 страницJounce Therapeutics Company Events and Start DatesEquity NestОценок пока нет

- 2.assessment of Dental Crowding in Mandibular Anterior Region by Three Different MethodsДокумент3 страницы2.assessment of Dental Crowding in Mandibular Anterior Region by Three Different MethodsJennifer Abella Brown0% (1)

- Material Handling EquipmentsДокумент12 страницMaterial Handling EquipmentsRahul SheelavantarОценок пока нет

- Benefits and Limitations of Vojta ApproachДокумент50 страницBenefits and Limitations of Vojta ApproachAlice Teodorescu100% (3)

- Fuck Your LawnДокумент86 страницFuck Your Lawnhuneebee100% (1)