Академический Документы

Профессиональный Документы

Культура Документы

FINS3625 Applied Corporate Finance: Lecture 4 (Chapter 16) Jared Stanfield March 21, 2012

Загружено:

paula_mon89Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FINS3625 Applied Corporate Finance: Lecture 4 (Chapter 16) Jared Stanfield March 21, 2012

Загружено:

paula_mon89Авторское право:

Доступные форматы

FINS3625

Applied Corporate Finance

Lecture 4 (Chapter 16) Jared Staneld March 21, 2012

Capital Structure Choices

When raising funds from outside investors, a rm must choose what type of security to issue and what capital structure to have.

Capital Structure Choices

Capital structure

The collecMon of securiMes a rm issues to raise capital from investors.

Firms consider whether the securiMes issued:

Will receive a fair price in the market Have tax consequences Entail transacMons costs Change future investment opportuniMes

Capital Structure Choices

A rms debt-to-value raMo is the fracMon of the rms total value that corresponds to debt D / (E+D)

Figure 16.1 Debt-to-Value RaMo [D/(E + D)] for Select Industries

Figure 16.2 Capital Structures of Amazon.com and Barnes & Noble

Measuring the Eects of Leverage on a Business

FOXTEL, a cable company and purveyor of hilariously over-sized remotes, is deciding whether it wants to increase the leverage of its business by compleMng a leveraged recapitalizaMon

Measuring the Eects of Leverage on a Business

Leveraged RecapitalizaMon: a change in capital structure or ownership composiMon involving substanMal debt nancing Examples:

Issuing debt and using the proceeds to nance a large project or acquisiMon Issuing debt and using the proceeds to pay a dividend to equity holders Issuing debt and using the proceeds to repurchase shares

Well get to why a rm would want to do this later

Measuring Eects of Leverage

Key RaMos by RaMng and Industry

Earnings SensiMvity

Can they do it? Why would they want to do it?

16.2 Capital Structure in Perfect Capital Markets

A perfect capital market is a market in which:

SecuriMes are fairly priced No tax consequences or transacMons costs Investment cash ows are independent of nancing choices

Leverage will increase the risk of the rms equity and raise its equity cost of capital

16.2 Capital Structure in Perfect Capital Markets

Modigliani and Miller (MM) with perfect capital markets

In an unlevered rm, cash ows to equity equal the free cash ows from the rms assets. In a levered rm, the same cash ows are divided between debt and equity holders. The total to all investors equals the free cash ows generated by the rms assets.

Figure 16.3 Unlevered Versus Levered Cash Flows with Perfect Capital Markets

16.2 Capital Structure in Perfect Capital Markets

MM ProposiMon I:

In a perfect capital market, the total value of a rm is equal to the market value of the free cash ows generated by its assets and is not aected by its choice of capital structure.

VL= E + D =VU (Eq. 16.1)

Table 16.1 Returns to Equity in Dierent Scenarios with and Without Leverage

Figure 16.4 Unlevered Versus Levered Returns with Perfect Capital Market

16.2 Capital Structure in Perfect Capital Markets

Homemade leverage

Investors use leverage in their own porkolios to adjust rms leverage A perfect subsMtute for rm leverage in perfect capital markets.

16.2 Capital Structure in Perfect Capital Markets

Leverage and the Cost of Capital

Weighted average cost of capital (pretax)

D E rU = rD + rE D+E D+E

(Eq. 16.2)

16.2 Capital Structure in Perfect Capital Markets

MM ProposiMon II: The cost of capital of levered equity:

The Cost of Levered Equity

D rE = rU + (rU rD ) E

(Eq. 16.3)

Cost of levered equity equals the cost of unlevered equity plus a premium proporMonal to the debt-equity raMo.

Figure 16.5 WACC and Leverage with Perfect Capital Markets

CompuMng the Equity Cost of Capital in an MM World

Gemng ready for the release of Hunger Games, you decide to start a gin shop called Hunger Gins. You will carry an assortment of movie-related items such as bows and arrows, futurisMc beard kits, and absolutely zero copies of the Japanese lm Barle Royale

CompuMng the Equity Cost of Capital in an MM World

Your rm has a market value of $75,000. Suppose you borrowed $50,000 when nancing Hunger Gins, your unlevered cost of equity was 12% and your cost of debt was 3%. According to MM ProposiMon II, what will your rms equity cost of capital be?

$50,000 rE = 12% + (12% 4%) = 28% $25,000

The equity cost of capital should be the expected return of the equity holders given the capital structure (with MM assumpMons).

Relaxing the MM AssumpMons

This helps us understand why rms choose their capital structures the way they do Market imperfecMons can create a role for the capital structure.

Corporate taxes:

CorporaMons can deduct interest expenses. Reduces taxes paid

Increases amount available to pay investors. Increases value of the corporaMon.

16.3 Debt and Taxes

Interest Tax Shield

The gain to investors from the tax deducMbility of interest payments

Interest Tax Shield = Corporate Tax Rate Interest Payments

CompuMng the Interest Tax Shield

Hunger Gins pro-forma income statement is below. Given its marginal corporate tax rate of 39%, what is the expected amount of the interest tax shield for Hunger Gins in years 2012 through 2015?

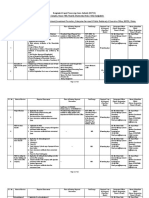

Hunger'Gifts'Income'Statement'($'million) Total&sales Cost&of&sales Selling,&general,&and&administrative&expense Depreciation Operating'income Other&income EBIT Interest&expense Income'before'tax Taxes&(39%) Net'Income 2012 $&&&&&&&& 1,058 $&&&&&&&&&& (670) $&&&&&&&&&& (207) $&&&&&&&&&&&& (64) $&&&&&&&&&&& 117 $&&&&&&&&&&&&&&& 2 $&&&&&&&&&&& 119 $&&&&&&&&&&&& (27) $&&&&&&&&&&&&& 92 $&&&&&&&&&&&& (36) $&&&&&&&&&&&&& 56 2013 $&&&&&&&&& 960 $&&&&&&&& (572) $&&&&&&&& (187) $&&&&&&&&&& (65) $&&&&&&&&& 136 $&&&&&&&&&&&&& 7 $&&&&&&&&& 143 $&&&&&&&&&& (29) $&&&&&&&&& 114 $&&&&&&&&&& (44) $&&&&&&&&&&& 70 2014 $&&&&&&&& 1,036 $&&&&&&&&&& (621) $&&&&&&&&&& (195) $&&&&&&&&&&&& (65) $&&&&&&&&&&& 155 $&&&&&&&&&&&&&&& 1 $&&&&&&&&&&& 156 $&&&&&&&&&&&& (32) $&&&&&&&&&&& 124 $&&&&&&&&&&&& (48) $&&&&&&&&&&&&& 76 2015 $&&&&&&&& 1,117 $&&&&&&&&&& (634) $&&&&&&&&&& (193) $&&&&&&&&&&&& (59) $&&&&&&&&&&& 231 $&&&&&&&&&&&&&&& 9 $&&&&&&&&&&& 240 $&&&&&&&&&&&& (35) $&&&&&&&&&&& 205 $&&&&&&&&&&&& (80) $&&&&&&&&&&& 125

CompuMng the Interest Tax Shield

Plan:

From Eq. 16.4, the interest tax shield is the tax rate of 39% mulMplied by the interest payments in each year.

CompuMng the Interest Tax Shield

Execute:

($million) Interest'expense Interest'tax'shield'(39%''interest'expense)

2012 $''''''''''''' 27 $'''''''''' 10.5

2013 $''''''''''' 29 $''''''''' 11.3

2014 $''''''''''''' 32 $'''''''''' 12.5

2015 $''''''''''''' 35 $'''''''''' 13.7

CompuMng the Interest Tax Shield

Evaluate:

By using debt, Hunger Gins is able to reduce its taxable income and therefore decreased its total tax payments by $48.0 million over the four- year period. Thus the total amount of cash ows available to all investors (debtholders and equity holders) is $48.0 million higher over the four-year period.

16.3 Debt and Taxes

When a rm uses debt, the interest tax shield provides a corporate tax benet each year. To determine the benet, compute the present value of the stream of future interest tax shields.

! Cash Flows to Investors$ ! Cash Flows to Investors$ # & = # without Leverage & + (Interest Tax Shield) " with Leverage % " %

Figure 16.6 The Cash Flows of the Unlevered and Levered Firm

16.3 Debt and Taxes

By increasing the cash ows paid to debt holders through interest payments, a rm reduces the amount paid in taxes. The increase in total cash ows paid to investors is the interest tax shield.

16.3 Debt and Taxes

Value of the Interest Tax Shield

Cash ows of the levered rm are equal to the sum of the cash ows from the unlevered rm plus the interest tax shield. By the ValuaMon Principle the same must be true for the present values of these cash ows.

16.3 Debt and Taxes

Value of the Interest Tax Shield

MM ProposiMon I with taxes: The total value of the levered rm exceeds the value of the rm without leverage due to the present value of the tax savings from debt: VL = VU + PV(Interest Tax Shield) (Eq. 16.5)

16.3 Debt and Taxes

Interest Tax Shield with Permanent Debt

The level of future interest payments varies due to:

changes in the amount of debt outstanding, changes in the interest rate on that debt, changes in the rms marginal tax rate, and the risk that the rm may default and fail to make an interest payment.

16.3 Debt and Taxes

Weighted Average Cost of Capital with Taxes

Another way to incorporate the benet of the rms future interest tax shield Weighted Average Cost of Capital with Taxes

16.3 Debt and Taxes

The reducMon in the WACC increases with the amount of debt nancing. The higher the rms leverage, the more the rm exploits the tax advantage of debt, and the lower its WACC.

Figure 16.7 The WACC with and without Corporate Taxes

Relaxing More AssumpMons: Costs of Financial Distress

If increasing debt increases the value of the rm, why not shin to 100% debt? With more debt, there is a greater chance that the rm will default on its debt obligaMons. A rm that has trouble meeMng its debt obligaMons is in nancial distress.

Relaxing More AssumpMons: Costs of Financial Distress

Direct Costs of Bankruptcy

Each country has a bankruptcy code designed to provide an orderly process for serling a rms debts.

However, the process is sMll complex, Mme-consuming, and costly. Outside professionals are generally hired. The creditors may also incur costs during the process. They onen wait several years to receive payment.

Relaxing More AssumpMons: Costs of Financial Distress

Direct Costs of Bankruptcy

Average direct costs are 3% to 4% of the pre- bankruptcy market value of total assets.

Likely to be higher for rms with more complicated business operaMons and for rms with larger numbers of creditors.

Relaxing More AssumpMons: Costs of Financial Distress

Indirect Costs of Financial Distress

Dicult to measure accurately, and onen much larger than the direct costs of bankruptcy.

Onen occur because the rm may renege on both implicit and explicit commitments and contracts.

EsMmated potenMal loss of 10% to 20% of value Many indirect costs may be incurred even if the rm is not yet in nancial distress, but simply faces a signicant possibility that it may occur in the future.

Relaxing More AssumpMons: Costs of Financial Distress

Examples:

Loss of customers:

Customers may be unwilling to purchase products whose value depends on future support or service from the rm.

Loss

of

suppliers:

Suppliers

may

be

unwilling

to

provide

a

rm

with

inventory

if

they

fear

they

will

not

be

paid

Relaxing More AssumpMons: Costs of Financial Distress

Examples:

Cost to employees:

Most rms oer their employees explicit long- term employment contracts. During bankruptcy these contracts and commitments are onen ignored and employees can be laid o

Fire Sales of Assets:

Companies in distress may be forced to sell assets quickly.

OpMmal Capital Structure: The Tradeo Theory

Tradeo Theory:

Total value of a levered rm equals the value of the rm without leverage plus the present value of the tax savings from debt, less the present value of nancial distress costs:

V L = VU + PV (Interest Tax Shield) PV (Financial Distress Costs)

(Eq. 16.10)

16.5 OpMmal Capital Structure: The Tradeo Theory

Key qualitaMve factors determine the present value of nancial distress costs:

The probability of nancial distress

Depends on the likelihood that a rm will default. Increases with the amount of a rms liabiliMes (relaMve to its assets). It increases with the volaMlity of a rms cash ows and asset values.

16.5 OpMmal Capital Structure: The Tradeo Theory

Key qualitaMve factors determine the present value of nancial distress costs:

The magnitude of the direct and indirect costs related to nancial distress that the rm will incur.

Depend on the relaMve importance of the sources of these costs and likely to vary by industry.

16.5 OpMmal Capital Structure: The Tradeo Theory

As debt increases, tax benets of debt increase unMl interest expense exceeds EBIT. Probability of default, and hence present value of nancial distress costs, also increases. The opMmal level of debt, D*, occurs when these the value of the levered rm is maximized. D* will be lower for rms with higher costs of nancial distress.

Figure 16.8 OpMmal Leverage with Taxes and Financial Distress Costs

16.5 OpMmal Capital Structure: The Tradeo Theory

Costs of nancial distress reduce the value of the levered rm.

Amount of the reducMon increases with probability of default, which increases with debt level.

16.5 OpMmal Capital Structure: The Tradeo Theory

Tradeo Theory:

rms should increase their leverage unMl it reaches the maximizing level. The tax savings that result from increasing leverage are just oset by the increased probability of incurring the costs of nancial distress. With higher costs of nancial distress, it is opMmal for the rm to choose lower leverage.

16.5 OpMmal Capital Structure: The Tradeo Theory

The Tradeo Theory helps to resolve two important facts about leverage:

The presence of nancial distress costs can explain why rms choose debt levels that are too low to fully exploit the interest tax shield. Dierences in the magnitude of nancial distress costs and the volaMlity of cash ows can explain the dierences in the use of leverage across industries.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Agency

costs:

costs

that

arise

when

there

are

conicts

of

interest

between

stakeholders.

Managerial

Entrenchment:

managers

onen

own

shares

of

the

rm,

but

usually

own

only

a

very

small

fracMon

of

the

outstanding

shares.

Shareholders

have

the

power

to

re

managers.

In

pracMce,

they

rarely

do

so.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

SeparaMon of ownership and control creates the possibility of management entrenchment

Managers may make decisions that:

Benet themselves at investors expense, Reduce their eort, Spend excessively on perks Engage in empire building.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

If

these

decisions

have

negaMve

NPV

for

the

rm,

they

are

a

form

of

agency

cost.

Debt

provides

incenMves

for

managers

to

run

the

rm

eciently:

Ownership

may

remain

more

concentrated,

improving

monitoring

of

management.

Since

interest

and

principle

payments

are

required,

debt

reduces

the

funds

available

at

managements

discreMon

to

use

wastefully.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Equity-Debt Holder Conicts

A conict of interest exists if investment decisions have dierent consequences for the value of equity and the value of debt.

most likely to occur when the risk of nancial distress is high. managers may take acMons that benet shareholders but harm creditors and lower the total value of the rm.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Agency costs for a company in distress that will likely default:

Excessive risk-taking

A risky project could save the rm even if the expected outcome is so poor that it would normally be rejected.

Under-investment

problem

Shareholders

could

decline

new

projects.

Management

could

distribute

as

much

as

possible

to

the

shareholders

before

the

bondholders

take

over.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

As debt increases, rm value increases

Interest tax shield (TCD) Improvements in managerial incenMves.

If leverage is too high, rm value is reduced by

present value of nancial distress costs agency costs

The opMmal level of debt, D*, balances these benets and costs of leverage.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Asymmetric

informaMon

Managers

informaMon

about

the

rm

and

its

future

cash

ows

is

likely

to

be

superior

to

that

of

outside

investors.

This

may

moMvate

managers

to

alter

a

rms

capital

structure.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Leverage as a Credible Signal

Managers use leverage to convince investors that the rm will grow, even if they cannot provide veriable details. The use of leverage as a way to signal good informaMon is known as the signaling theory of debt.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Market

Timing

Managers

sell

new

shares

when

they

believe

the

stock

is

overvalued,

and

rely

on

debt

and

retained

earnings

if

they

believe

the

stock

is

undervalued.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

Adverse SelecMon and the Pecking Order Hypothesis

Suppose managers issue equity when it is overpriced. Knowing this, investors will discount the price they are willing to pay for the stock. Managers do not want to sell equity at a discount so they may seek other forms of nancing.

Relaxing More AssumpMons: Agency Issues and InformaMon Costs

The pecking order hypothesis states:

Managers have a preference to fund investment using retained earnings, followed by debt, and will only choose to issue equity as a last resort.

Relaxing More AssumpMons: Financial Flexibility

So

far

these

decisions

have

been

largely

from

the

perspecMve

that

nancing

decisions

are

one-Mme

events

A

broader

perspecMve

views

these

individual

events

within

the

context

of

a

longer-run

nancing

strategy

If

a

rm

will

always

be

able

to

raise

debt

and

equity

capital

on

acceptable

terms,

this

is

a

non- issue

Relaxing More AssumpMons: Financial Flexibility

More

realisMc

is

a

rm

has

to

worry

about

how

nancing

decisions

today

will

aect

future

access

to

capital

markets

Say

the

Hunger

Games

is

a

big

hit

and

becomes

a

huge

franchise

(a

la

Star

Wars

or

Lord

of

the

Rings).

Hunger

Gins

becomes

a

rapidly

growing

business

in

conMnuing

need

of

nancing.

Even

if

an

immediate

debt

issue

appears

arracMve,

extensive

reliance

on

debt

nancing

will

close

o

the

top

Unable

to

get

more

debt

without

addiMonal

equity

Relaxing More AssumpMons: Financial Flexibility

Whats the problem with that?

Think about the market-Mming story we talked about earlier

Equity can be a ckle source of nancing

Depending on market condiMons and previous performance, equity may not be available at a reasonable price (or any price)

16.7 Capital Structure: Pumng It All Together

Use the interest tax shield if your rm has consistent taxable income Balance tax benets of debt against costs of nancial distress Consider short-term debt for external nancing when agency costs are signicant. Increase leverage to signal condence in the rms ability to meet its debt obligaMons.

16.7 Capital Structure: Pumng It All Together

Be mindful that investors are aware that you have an incenMve to issue securiMes that you know are overpriced Rely rst on retained earnings, then debt, and nally equity Do not change the rms capital structure unless it departs signicantly from the opMmal level.

Вам также может понравиться

- 10th Week of Lectures: Financial Management - MGT201Документ15 страниц10th Week of Lectures: Financial Management - MGT201Syed Abdul Mussaver ShahОценок пока нет

- Sample MidtermДокумент6 страницSample MidtermJake FeigelesОценок пока нет

- Capital Structure - 1Документ17 страницCapital Structure - 1amit chavariaОценок пока нет

- 0.MF.06.CORPFINACE.12 - Clase 12. Mfclass12 - OK - S+üBADO 7MZOДокумент16 страниц0.MF.06.CORPFINACE.12 - Clase 12. Mfclass12 - OK - S+üBADO 7MZOYariko ChieОценок пока нет

- AFM 373 Hayes Lecture 8 Capital Structure & WAACДокумент53 страницыAFM 373 Hayes Lecture 8 Capital Structure & WAACAniket PatelОценок пока нет

- Chapter 3 Cost of CapitalДокумент30 страницChapter 3 Cost of CapitalMELAT ROBELОценок пока нет

- Cost of CapitalДокумент53 страницыCost of CapitalDiNesh PrajapatiОценок пока нет

- CF FinalДокумент141 страницаCF FinalmonilОценок пока нет

- CostOfCapital RDДокумент24 страницыCostOfCapital RDSephardОценок пока нет

- WK - 5 - Cost of Capital Capital Structure PDFДокумент40 страницWK - 5 - Cost of Capital Capital Structure PDFreginazhaОценок пока нет

- From Its Financial Statements (Marks 03) EBIT Rs 50,000/-Return of Equity 12% Amount of Equity Rs 100,000/ - Tax Rate 35%Документ13 страницFrom Its Financial Statements (Marks 03) EBIT Rs 50,000/-Return of Equity 12% Amount of Equity Rs 100,000/ - Tax Rate 35%Syed Abdul Mussaver ShahОценок пока нет

- Cost of Capital: What Number Goes in The Denominator?Документ74 страницыCost of Capital: What Number Goes in The Denominator?Kenneth RobledoОценок пока нет

- Financial Management: Lecture No. 29 Weighted Average Cost of Capital (WACC)Документ110 страницFinancial Management: Lecture No. 29 Weighted Average Cost of Capital (WACC)Shahid SaeedОценок пока нет

- MA2 T2 MD Cost of CapitalДокумент57 страницMA2 T2 MD Cost of CapitalMangoStarr Aibelle VegasОценок пока нет

- Lecture 4 Ch16 1Документ20 страницLecture 4 Ch16 1Linda VoОценок пока нет

- Cost of CapitalДокумент3 страницыCost of CapitalAbhishek Zaware IIОценок пока нет

- Parrino 2e PowerPoint Review Ch13Документ55 страницParrino 2e PowerPoint Review Ch13Khadija AlkebsiОценок пока нет

- Cost of CapitalДокумент15 страницCost of CapitalCyrine JemaaОценок пока нет

- Capital Structure and Cost of CapitalДокумент6 страницCapital Structure and Cost of CapitalSam DevineОценок пока нет

- 20PT31 Cf-IiДокумент4 страницы20PT31 Cf-IiSakthivelayudham BhyramОценок пока нет

- Valuation: Aswath DamodaranДокумент100 страницValuation: Aswath DamodaranhsurampudiОценок пока нет

- Fundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DДокумент55 страницFundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DRohit GandhiОценок пока нет

- Finance 2 TiUДокумент17 страницFinance 2 TiURoy SarkisОценок пока нет

- Chapter Three 3 (MJ)Документ7 страницChapter Three 3 (MJ)leul habtamuОценок пока нет

- Finance 351 NotesДокумент14 страницFinance 351 NotesCindy YinОценок пока нет

- CH 9-The Cost of Capital by IM PandeyДокумент36 страницCH 9-The Cost of Capital by IM PandeyJyoti Bansal89% (9)

- The Cost of Capital, Capital Structure and Dividend PolicyuitsДокумент33 страницыThe Cost of Capital, Capital Structure and Dividend PolicyuitsArafath RahmanОценок пока нет

- Cost of Capital Further DetailДокумент57 страницCost of Capital Further Detaildeigcorr22Оценок пока нет

- 1.011 Project Evaluation Choosing A Discount RateДокумент31 страница1.011 Project Evaluation Choosing A Discount RateTimotei BolojanОценок пока нет

- Valuation: Aswath DamodaranДокумент100 страницValuation: Aswath DamodaranAsif IqbalОценок пока нет

- Dividend DecisionsДокумент55 страницDividend Decisionsparth kОценок пока нет

- Chap1 - Manager Profits and MarketsДокумент39 страницChap1 - Manager Profits and MarketsMary Jescho Vidal AmpilОценок пока нет

- CH19 SguideДокумент14 страницCH19 Sguidezyra liam stylesОценок пока нет

- Group 5 PresentationДокумент73 страницыGroup 5 PresentationSourabh Arora100% (4)

- Financial Structure and International DebtДокумент27 страницFinancial Structure and International Debtshivakumar N100% (1)

- RW J Chapter 14 Problem SolutionsДокумент6 страницRW J Chapter 14 Problem SolutionsAlexandro Lai100% (1)

- Nike Case AnalysisДокумент9 страницNike Case AnalysisFami FamzОценок пока нет

- Cost of Capital, CH 14Документ39 страницCost of Capital, CH 14202110782Оценок пока нет

- Cost of Capital and Project ValuationДокумент24 страницыCost of Capital and Project ValuationJordanОценок пока нет

- Damodaran On Valuation PDFДокумент102 страницыDamodaran On Valuation PDFmanishpawar11Оценок пока нет

- CH 9 Capital StructureДокумент35 страницCH 9 Capital StructureAsmi SinglaОценок пока нет

- Estimating The Cost of CapitalДокумент50 страницEstimating The Cost of CapitalTaVuKieuNhiОценок пока нет

- Ch6 EДокумент39 страницCh6 Ehuy anh leОценок пока нет

- MM ModelДокумент91 страницаMM ModelBenjamin TanОценок пока нет

- An Overview of Financial ManagementДокумент46 страницAn Overview of Financial ManagementKiran IfciОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case Analysisshamayita sahaОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysisRizka HendrawanОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysistimbulmanaluОценок пока нет

- Nike Case Analysis PDFДокумент9 страницNike Case Analysis PDFSrishti PandeyОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysisNic AurthurОценок пока нет

- Nike Case Solution PDFДокумент9 страницNike Case Solution PDFKunal KumarОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysisOktoОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysisKwame Obeng SikaОценок пока нет

- 1900cccc74252345 Nike Case AnalysisДокумент9 страниц1900cccc74252345 Nike Case AnalysistimbulmanaluОценок пока нет

- Overview of WaccДокумент19 страницOverview of Waccসুজয় দত্তОценок пока нет

- Notes For CFДокумент214 страницNotes For CFKristian ListОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysisUyen Thao Dang96% (54)

- Cost of Capital (English)Документ11 страницCost of Capital (English)Absalom OtienoОценок пока нет

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Lecture1 PDFДокумент50 страницLecture1 PDFpaula_mon89Оценок пока нет

- FINS3625 Applied Corporate Finance: Lecture 3 (Chapter 13) Jared Stanfield March 14, 2012Документ58 страницFINS3625 Applied Corporate Finance: Lecture 3 (Chapter 13) Jared Stanfield March 14, 2012paula_mon89Оценок пока нет

- FINS3625 Applied Corporate Finance: Lecture 2 (Chapter 10) Jared Stanfield February 29, 2012Документ80 страницFINS3625 Applied Corporate Finance: Lecture 2 (Chapter 10) Jared Stanfield February 29, 2012paula_mon89Оценок пока нет

- Diagnostics PDFДокумент14 страницDiagnostics PDFpaula_mon89Оценок пока нет

- Frederick Copleston - A History of Philosophy, Vol. I PDFДокумент534 страницыFrederick Copleston - A History of Philosophy, Vol. I PDFVitor Assis100% (1)

- Secret Recipe ReportДокумент6 страницSecret Recipe ReportAzizi Gji80% (5)

- GM 4Q W4Документ24 страницыGM 4Q W4Charmaine GatchalianОценок пока нет

- Sapbpc NW 10.0 Dimension Data Load From Sap BW To Sap BPC v1Документ84 страницыSapbpc NW 10.0 Dimension Data Load From Sap BW To Sap BPC v1lkmnmkl100% (1)

- Pt4onlinepresentation Medina 170815105639Документ19 страницPt4onlinepresentation Medina 170815105639Roxas Marry GraceОценок пока нет

- Problem NoДокумент6 страницProblem NoJayvee BalinoОценок пока нет

- Edgar Cokaliong Shipping Lines vs. UCPB General InsuranceДокумент6 страницEdgar Cokaliong Shipping Lines vs. UCPB General InsuranceVincent BernardoОценок пока нет

- Multiculturalism, Crime, and Criminal Justice PDFДокумент449 страницMulticulturalism, Crime, and Criminal Justice PDFJames Keyes Jr.100% (2)

- Brokenshire College: Form C. Informed Consent Assessment FormДокумент2 страницыBrokenshire College: Form C. Informed Consent Assessment Formgeng gengОценок пока нет

- Bangladesh Export Processing Zones AuthorityДокумент16 страницBangladesh Export Processing Zones AuthoritySohel Rana SumonОценок пока нет

- PTC Mathcad Prime Installation and Administration GuideДокумент60 страницPTC Mathcad Prime Installation and Administration GuideHector Ariel HNОценок пока нет

- MechanicalДокумент609 страницMechanicalMohammed100% (1)

- Tcode GTSДокумент28 страницTcode GTSKishor BodaОценок пока нет

- Public OfficerДокумент12 страницPublic OfficerCatОценок пока нет

- 09 10 CalendarДокумент1 страница09 10 CalendardhdyerОценок пока нет

- Sermon Guide: Jesus: The Chief CupbearerДокумент16 страницSermon Guide: Jesus: The Chief CupbearerRahul JOshiОценок пока нет

- 100 Republic Vs Dimarucot PDFДокумент2 страницы100 Republic Vs Dimarucot PDFTon Ton CananeaОценок пока нет

- Barangay ProfilesДокумент3 страницыBarangay ProfilesMello Jane Garcia DedosinОценок пока нет

- September 21 Sales Digests PDFДокумент23 страницыSeptember 21 Sales Digests PDFAnonymous bOG2cv3KОценок пока нет

- The Missing Children in Public Discourse On Child Sexual AbuseДокумент8 страницThe Missing Children in Public Discourse On Child Sexual AbuseJane Gilgun100% (1)

- Canlas v. CAДокумент10 страницCanlas v. CAPristine DropsОценок пока нет

- The First World WarДокумент3 страницыThe First World Warabhishek biswasОценок пока нет

- Maiden NameДокумент17 страницMaiden Nameapi-3708784Оценок пока нет

- Bill of Lading - 2023-11-17T111055.919Документ1 страницаBill of Lading - 2023-11-17T111055.919Lissa PerezОценок пока нет

- MTLBДокумент121 страницаMTLBKIM KYRISH DELA CRUZОценок пока нет

- CS-Fin Mkts-Buyback of Shares by MNCs in IndiaДокумент9 страницCS-Fin Mkts-Buyback of Shares by MNCs in IndiaPramod Kumar MitraОценок пока нет

- #Caracol Industrial Park Social and Gender Impacts of Year One of #Haiti's Newest IFI-funded Industrial ParkДокумент46 страниц#Caracol Industrial Park Social and Gender Impacts of Year One of #Haiti's Newest IFI-funded Industrial ParkLaurette M. BackerОценок пока нет

- IPRA Case DigestДокумент14 страницIPRA Case DigestElden ClaireОценок пока нет

- Chapter 6 Financial AssetsДокумент6 страницChapter 6 Financial AssetsAngelica Joy ManaoisОценок пока нет

- Maharashtra Public Trust ActДокумент72 страницыMaharashtra Public Trust ActCompostОценок пока нет

- Omni MedSci Patent Suit Targeting Apple WatchДокумент21 страницаOmni MedSci Patent Suit Targeting Apple WatchMikey Campbell100% (1)