Академический Документы

Профессиональный Документы

Культура Документы

Cement: United States

Загружено:

Michael WarnerАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cement: United States

Загружено:

Michael WarnerАвторское право:

Доступные форматы

Freedonia Focus Reports

US Collection

Cement: United States

Highlights

CH

UR

E

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

December 2012

Industry Overview

Market Size and Trends | Product Segmentation | Market Segmentation

Technology Trends | Legal and Regulatory Environment | Trade | Global Overview

BR

O

Demand Forecasts

Market Environment | Product Forecasts | Market Forecasts

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure

Industry Composition | Industry Leaders | Additional Companies Cited

www.freedoniafocus.com

Cement: United States

ABOUT THIS REPORT

Sources

Cement: United States is based on World Cement, a comprehensive industry study

published by The Freedonia Group in November 2011. Reported findings represent the

synthesis of data from various primary, secondary, macroeconomic, and demographic

sources including:

firms participating in the industry

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated August 2012

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Scope and Method

This report analyzes US demand for hydraulic cement the binding agent used in

concrete and mortar, which sets and hardens in a chemical reaction with water.

Demand is provided in metric tons and is segmented by product in terms of:

portland cement

blended cement

other cement such as fly ash, masonry cement used for stucco and

mortar, and specialty items.

Total demand is also provided in terms of market by:

ready-mix concrete

concrete products

construction contractors

consumer and other.

Excluded from the scope of this report are cement additives and clinker sold separately,

as well as all types of non-hydraulic cementitious materials (eg, asphalt or bitumen).

Supplementary cementitious materials (SCMs) are not considered cement products for

the purposes of this report. Unless otherwise indicated, the term concrete refers to

concrete made using hydraulic cement as the binder, as opposed to asphaltic concrete.

Total demand and the various segments are sized at five-year intervals for historical

2012 by The Freedonia Group, Inc.

Cement: United States

years 2006 and 2011 with a forecast to 2016. Forecasts emanate from the identification

and analysis of pertinent statistical relationships and other historical trends/events as

well as their expected progression/impact over the forecast period. Changes in

quantities between reported years of a given total or segment are typically provided in

terms of five-year compound annual growth rates (CAGRs). For the sake of brevity,

forecasts are generally stated in smoothed CAGR-based descriptions to the forecast

year, such as demand is projected to rise 3.2% annually through 2016. The result of

any particular year over that period, however, may exhibit volatility and depart from a

smoothed, long-term trend, as historical data typically illustrate.

Key macroeconomic indicators are also provided at five-year intervals with CAGRs for

the years corresponding to other reported figures. Other various topics, including

profiles of pertinent leading suppliers, are covered in this report. A full outline of report

items by page is available in the Table of Contents.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

324122

2952

3241

3272

3273

327310

327320

327999

Asphalt Shingle and Coating Materials

Manufacturing

Cement Manufacturing

Ready-Mix Concrete Manufacturing

All Other Miscellaneous Nonmetallic

Mineral Product Manufacturing

Asphalt Felts and Coatings

Cement, Hydraulic

Concrete Products, Except Block and Brick

Ready-Mixed Concrete

Copyright and Licensing

The full report is protected by copyright laws of the United States of America and

international treaties. The entire contents of the publication are copyrighted by The

Freedonia Group, Inc.

2012 by The Freedonia Group, Inc.

Cement: United States

Table of Contents

Section

Page

Highlights....................................................................................................................................................... 1

Industry Overview ......................................................................................................................................... 2

Market Size & Trends .............................................................................................................................. 2

Chart 1 | United States: Cement Demand Trends, 2001-2011 .......................................................... 2

Product Segmentation ............................................................................................................................. 3

Chart 2 | United States: Cement Demand by Product, 2011 .............................................................. 3

Portland Cement. ................................................................................................................................ 3

Blended Cement. ................................................................................................................................ 4

Other Cement. .................................................................................................................................... 4

Market Segmentation ............................................................................................................................... 5

Chart 3 | United States: Cement Demand by Market, 2011 ............................................................... 5

Ready-Mix Concrete Market. .............................................................................................................. 5

Concrete Product Market. ................................................................................................................... 5

Construction Contractor Market. ......................................................................................................... 6

Consumer & Other Markets. ............................................................................................................... 6

Technology Trends .................................................................................................................................. 7

Legal & Regulatory Environment ............................................................................................................. 9

Trade ...................................................................................................................................................... 10

Chart 4 | United States: Cement Net Imports (million metric tons) ................................................... 10

Global Overview ..................................................................................................................................... 11

Chart 5 | Cement Demand by Region, 2011 .................................................................................... 11

Demand Forecasts ...................................................................................................................................... 12

Market Environment ............................................................................................................................... 12

Table 1 | United States: Key Indicators for Cement Demand (billion US 2005 dollars) ................... 12

Product Forecasts .................................................................................................................................. 13

Table 2 | United States: Cement Demand by Product (million metric tons) ..................................... 13

Portland Cement. .............................................................................................................................. 13

Blended Cement. .............................................................................................................................. 14

Other Cement. .................................................................................................................................. 14

Market Forecasts ................................................................................................................................... 15

Table 3 | United States: Cement Demand by Market (million metric tons) ...................................... 15

Ready-Mix Concrete Market. ............................................................................................................ 15

Concrete Product Market. ................................................................................................................. 15

Construction Contractor Market. ....................................................................................................... 15

Consumer & Other Markets. ............................................................................................................. 16

Industry Structure ........................................................................................................................................ 17

Industry Composition ............................................................................................................................. 17

Industry Leaders .................................................................................................................................... 18

CEMEX SAB de CV .......................................................................................................................... 18

Holcim Limited .................................................................................................................................. 19

Lafarge SA ........................................................................................................................................ 20

Additional Companies Cited................................................................................................................... 21

Resources ................................................................................................................................................... 22

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

2012 by The Freedonia Group, Inc.

Вам также может понравиться

- Salt: United StatesДокумент4 страницыSalt: United StatesMichael WarnerОценок пока нет

- Polyurethane: United StatesДокумент4 страницыPolyurethane: United StatesMichael WarnerОценок пока нет

- World SaltДокумент4 страницыWorld SaltMichael WarnerОценок пока нет

- World Medical DisposablesДокумент4 страницыWorld Medical DisposablesMichael WarnerОценок пока нет

- World Motor Vehicle BiofuelsДокумент4 страницыWorld Motor Vehicle BiofuelsMichael WarnerОценок пока нет

- Specialty Biocides: United StatesДокумент4 страницыSpecialty Biocides: United StatesMichael WarnerОценок пока нет

- Motor Vehicle Biofuels: United StatesДокумент4 страницыMotor Vehicle Biofuels: United StatesMichael WarnerОценок пока нет

- World LabelsДокумент4 страницыWorld LabelsMichael WarnerОценок пока нет

- Aluminum Pipe: United StatesДокумент4 страницыAluminum Pipe: United StatesMichael WarnerОценок пока нет

- World Material Handling ProductsДокумент4 страницыWorld Material Handling ProductsMichael WarnerОценок пока нет

- World Lighting FixturesДокумент4 страницыWorld Lighting FixturesMichael WarnerОценок пока нет

- World GraphiteДокумент4 страницыWorld GraphiteMichael WarnerОценок пока нет

- Jewelry, Watches, & Clocks: United StatesДокумент4 страницыJewelry, Watches, & Clocks: United StatesMichael WarnerОценок пока нет

- Labels: United StatesДокумент4 страницыLabels: United StatesMichael WarnerОценок пока нет

- Education: United StatesДокумент4 страницыEducation: United StatesMichael WarnerОценок пока нет

- Public Transport: United StatesДокумент4 страницыPublic Transport: United StatesMichael WarnerОценок пока нет

- Graphite: United StatesДокумент4 страницыGraphite: United StatesMichael WarnerОценок пока нет

- World BearingsДокумент4 страницыWorld BearingsMichael WarnerОценок пока нет

- Plastic Pipe: United StatesДокумент4 страницыPlastic Pipe: United StatesMichael WarnerОценок пока нет

- Caps & Closures: United StatesДокумент4 страницыCaps & Closures: United StatesMichael WarnerОценок пока нет

- Ceilings: United StatesДокумент4 страницыCeilings: United StatesMichael WarnerОценок пока нет

- Housing: United StatesДокумент4 страницыHousing: United StatesMichael WarnerОценок пока нет

- Pharmaceutical Packaging: United StatesДокумент4 страницыPharmaceutical Packaging: United StatesMichael WarnerОценок пока нет

- Industrial & Institutional Cleaning Chemicals: United StatesДокумент4 страницыIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerОценок пока нет

- World Specialty SilicasДокумент4 страницыWorld Specialty SilicasMichael WarnerОценок пока нет

- Industrial & Institutional Cleaning Chemicals: United StatesДокумент4 страницыIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerОценок пока нет

- Municipal Solid Waste: United StatesДокумент4 страницыMunicipal Solid Waste: United StatesMichael WarnerОценок пока нет

- Motor Vehicles: United StatesДокумент4 страницыMotor Vehicles: United StatesMichael WarnerОценок пока нет

- World HousingДокумент4 страницыWorld HousingMichael WarnerОценок пока нет

- World Drywall & Building PlasterДокумент4 страницыWorld Drywall & Building PlasterMichael WarnerОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Local Business EnvironmentДокумент3 страницыLocal Business EnvironmentJayMoralesОценок пока нет

- IBT-REVIEWERДокумент10 страницIBT-REVIEWERBrenda CastilloОценок пока нет

- Rajasthan Board ResultsДокумент8 страницRajasthan Board ResultsPrabhat AgarwalОценок пока нет

- Akpk SlideДокумент13 страницAkpk SlideizzatiОценок пока нет

- Forex - Nnet Vs RegДокумент6 страницForex - Nnet Vs RegAnshik BansalОценок пока нет

- Economics Notes For - Test - NovemberДокумент2 страницыEconomics Notes For - Test - NovemberWai HponeОценок пока нет

- Volume II AppendicesДокумент378 страницVolume II AppendicesGus BovaОценок пока нет

- Consumption FunctionДокумент22 страницыConsumption FunctionSagar BhardwajОценок пока нет

- Types of EntrepreneursДокумент32 страницыTypes of EntrepreneursabbsheyОценок пока нет

- Container Corporation India LTD - Initiating Coverage - Dalal and Broacha - BuyДокумент15 страницContainer Corporation India LTD - Initiating Coverage - Dalal and Broacha - BuyvineetwinsОценок пока нет

- Phoenix Pallasio Lucknow Presentation 04-09-2019Документ41 страницаPhoenix Pallasio Lucknow Presentation 04-09-2019T PatelОценок пока нет

- Fanshawe College Application FormДокумент2 страницыFanshawe College Application Formdaljit8199Оценок пока нет

- E@@e ®@@e ®@@e: M.A. ECONOMICS (With Specialization in World Economy)Документ27 страницE@@e ®@@e ®@@e: M.A. ECONOMICS (With Specialization in World Economy)SimeonОценок пока нет

- Od 429681727931176100Документ5 страницOd 429681727931176100shubhamsshinde01Оценок пока нет

- Macroeconomic Analysis of USA: GDP, Inflation & UnemploymentДокумент2 страницыMacroeconomic Analysis of USA: GDP, Inflation & UnemploymentVISHAL GOYALОценок пока нет

- Blstone 2Документ508 страницBlstone 2Kasper AchtonОценок пока нет

- A Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalДокумент10 страницA Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalMonika MonaОценок пока нет

- Masura 2Документ2 156 страницMasura 2ClaudiuОценок пока нет

- Nepal's 2072 Trade Policy GoalsДокумент11 страницNepal's 2072 Trade Policy GoalsBinay AcharyaОценок пока нет

- Reading: Time Allowed: 90 Minutes Maximum Marks: 40 General InstructionsДокумент5 страницReading: Time Allowed: 90 Minutes Maximum Marks: 40 General InstructionssayedОценок пока нет

- Pip (Program Implementation Plan)Документ2 страницыPip (Program Implementation Plan)sureesicОценок пока нет

- Signature Global Park 5 Apartment Details and Payment PlansДокумент2 страницыSignature Global Park 5 Apartment Details and Payment Planssanyam ralliОценок пока нет

- Setsco Training PDFДокумент12 страницSetsco Training PDFJeganeswaranОценок пока нет

- Inter-regional disparities in industrial growthДокумент100 страницInter-regional disparities in industrial growthrks_rmrctОценок пока нет

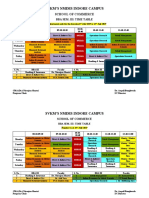

- Time-Table - BBA 3rd SemesterДокумент2 страницыTime-Table - BBA 3rd SemesterSunny GoyalОценок пока нет

- Sieving TableДокумент1 страницаSieving TableDani DanialОценок пока нет

- Status Report Example 021606110036 Status Report-ExampleДокумент5 страницStatus Report Example 021606110036 Status Report-ExampleAhmed Mohamed Khattab100% (2)

- TCC Midc Company ListДокумент4 страницыTCC Midc Company ListAbhishek SinghОценок пока нет

- Bridge Over Bhagirathi AllotmentДокумент6 страницBridge Over Bhagirathi AllotmentKyle CruzОценок пока нет

- 10.18.2017 LiabiltiesДокумент4 страницы10.18.2017 LiabiltiesPatOcampoОценок пока нет