Академический Документы

Профессиональный Документы

Культура Документы

Relaxo Footwear, 7th February, 2013

Загружено:

Angel BrokingАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Relaxo Footwear, 7th February, 2013

Загружено:

Angel BrokingАвторское право:

Доступные форматы

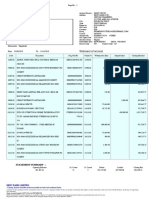

3QFY2013 Result Update | Footwear

February 6, 2012

Relaxo Footwear

Quarter impacted but outlook remains positive

Y/E March (` cr) Total Income EBITDA EBITDA margin (%) Reported PAT

Source: Company, Angel Research

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta Net debt (` cr) 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

(7.9) (21.7) (148)bp (41.0)

`750 `897

12 Months

3QFY2013 3QFY2012 % chg (yoy) 2QFY2013 % chg (qoq) 223 19 8.4 6 204 18 8.6 6 9.2 7.2 (16)bp 0.7 242 24 9.9 10

Relaxo Footwear (Relaxo) reported lower-than-expected numbers for 3QFY2013. The revenue for the quarter stood at `223cr, 9.2% higher yoy, but substantially lower than our expectation of `250cr. This was due to the new initiative of product specific distribution not getting popular among dealers; hence the impact on sales. The EBITDA margin witnessed marginal contraction of 16bp yoy to 8.4% during the quarter which was lower than our expectation of 10.3%. Subsequently, the profit for the quarter stood flat yoy at `6cr, declined by 41.0% on a sequential basis, and was 49.9% lower than our estimate of `12cr. Capacity expansion and brand revamp to drive volume: The company incurred a capex of `60cr for the construction of a PU (Polyurethane) footwear plant which commenced in January, 2013. This development has increased the capacity by ~30,000 pairs per day totalling to 4.0 lakh pairs per day. In addition, the company plans to open 25-30 retail stores each year. Moreover, the company has successfully built a strong brand image with leading celebrities endorsing its brands; ie Salman Khan endorsing Hawaii, Katrina Kaif tied up for Flite and Akshay Kumar roped in to endorse the Sparx brand. We expect capacity expansion and aggressive marketing to complement each other and drive volume in the future. Outlook and valuation: We expect Relaxo to post a revenue CAGR of 15.5% over FY2012-14E to `1,148cr with an operating margin of 11.6% in FY2014E. The PAT is expected to grow at a CAGR of 29.8% to `67cr for the same period. At the current market price, Relaxo is trading at 13.4x FY2014E earnings. We maintain our Buy recommendation on the stock with a revised target price of `897, based on a target PE of 16x for FY2014E.

Footwear 900 0.5 144 917 / 285 2,364 5 19,640 5,959 RLXO.BO RLXF IN

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 75.0 16.1 1.4 7.6

Abs.(%) Sensex Relaxo

3m 4.4

1yr 10.9

3yr 23.4

(6.5) 125.0 306.0

Key financials

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA margin (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2010 554 35.9 38 160.2 13.8 31.4 23.9 8.2 41.0 21.8 1.9 13.7

FY2011 686 23.9 27 (28.8) 9.6 22.4 33.5 6.7 22.0 14.3 1.5 15.9

FY2012 860 25.4 40 48.5 10.5 33.3 22.5 5.2 26.0 19.5 1.2 11.6

FY2013E 989 15.0 50 26.1 10.7 41.9 17.9 4.1 25.6 20.1 1.1 10.0

FY2014E 1,148 16.1 67 33.7 11.6 56.1 13.4 3.1 26.5 23.0 0.9 7.8

Tejashwini Kumari

30940000 ext: 6856 tejashwini.kumari@angelbroking.com

Please refer to important disclosures at the end of this report

3QFY2013 Result Update | Relaxo Footwear

Exhibit 1: 3QFY2012 performance

Y/E March (` cr) Net Sales Net raw material (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (% of Sales) Tax (% of PBT) Reported PAT PATM Equity capital (` cr) EPS (`)

Source: Company, Angel Research

3QFY13 223 101 45.4 36 15.9 68 30.3 204 19 8.4 5 6 1 9 4.0 3 31.8 6 2.7 6 10.1

3QFY12 204 110 53.7 26 12.5 51 25.2 187 18 8.6 5 6 2 9 4.2 3 29.6 6 3.0 6 10.0

% chg (yoy) 9.2 (7.7) 38.9 31.3 9.4 7.2 (16)bp (1.6) 8.1 (30.4) 4.0 11.8 0.7

2QFY13 242 115 47.3 37 15.4 66 27.4 218 24 9.9 4 6 1 15 6.2 5 31.5 10 4.3 6

% chg (qoq) (7.9) (11.8) (4.5) 1.7 (6.4) (21.7) (148)bp 16.9 2.4 (8.6) (40.8) (40.2) (41.0)

9MFY13 714 336 47.0 110 15.4 195 27.3 641 73 10.2 12 19 4 46 6.4 15 31.7 31 4.4 6

9MFY12 618 335 54.1 77 12.4 150 24.3 562 56 9.1 14 18 4 29 4.7 8 26.8 21 3.4 6 35.2

% chg 15.4 0.3 43.1 29.6 14.0 29.6 111bp (12.5) 6.1 (3.4) 59.5 88.5 48.8

0.7

17.2

(41.0)

52.4

48.8

Company witnessed pressure on all fronts

Relaxo reported a revenue of `223cr, 9.2% higher yoy, but substantially lower than our expectation of `250cr, since the new policy of product specific dealership didnt find acceptance among dealers. Also, there was a substantial price hike in the Sparx brand of shoes (contributing ~30% to revenue) which was not accepted by customers. The EBITDA margin witnessed a marginal contraction of 16bp yoy to 8.4% during the quarter; and was lower than our expectation of 10.3%. On a sequential basis, the operating margin contracted by 148bp from 9.9% in 2QFY2013 on account of higher employee cost and other expenses (mainly advertisement expense) as a percentage of net sales. Subsequently, the profit for the quarter stood flat yoy at `6cr; it declined by 41.0% on a sequential basis, and was 49.9% lower than our estimate of `12cr.

Exhibit 2: Actual vs. Estimate

Y/E March (` cr) Net sales EBITDA EBITDA margin (%) Reported PAT

Source: Company, Angel Research

3QFY13 223 19 8.4 6

Angel est. 250 26 10.3 12

% diff (10.7) (27.1) (189)bp (49.9)

February 6, 2012

3QFY2013 Result Update | Relaxo Footwear

Product specific distribution impacted the sales

The company had switched to product specific dealership in order to drive sales. However, the same was not accepted by dealers and led to a fall in sales. The management is reviewing the initiatives to overcome the challenges faced during implementation and is confident that performance of company will be on track in coming months.

Exhibit 3: Revenue impacted due to experimentation

300 250 200 (` cr) 150 100 50 0 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 13.3 10.3 201 215 199 204 242 248 242 25.6 39.5 33.5 21.8 15.6 9.2 223 21.6 45 40 35 30

Exhibit 4: Margin declined fourth time in a row

35 30 25 (` cr) (%) 20 15 10 24.0 14 17 23 16 18 33 30 5 0 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 18.8 9.1 8.5 10.7 7.9 8.6 13.7 12.1 9.9 8.4 16 14 12 10 8 6 4 2 0 (%)

25 20 15 10 5 0

154

Revenue (LHS)

yoy growth (RHS)

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Investment rationale

Aggressive capacity expansion

The company incurred a capex of `60cr for the construction of a PU (Polyurethane) footwear plant which commenced in January 18, 2013. This development has increased the capacity by ~30,000 pairs per day to 4.0 lakh pairs per day. In addition, the company is also planning to construct a warehouse, with a capex of `25cr, which is expected to be completed by FY2014E.

Retail store expansion to enhance brand visibility

The company plans to open 25-30 retail stores (Relaxo Shoppe) every year which will help in increasing direct reach to customers, brand building and increase in sales.

Brand revamping to boost growth

Relaxo has roped in three Bollywood stars to endorse its brands ie Salman Khan for Hawaii, Katrina Kaif for Flite and Akshay Kumar for Sparx. This has helped the company in brand building and visibility. However, it will take time for the enhanced brand image to deliver sales as the company faces stiff completion in all its segments. For the current year, FY2013E, the total planned advertisement expenditure is ~`50cr.

Changing revenue mix to drive profit

With the changing revenue mix, the profitability is expected to improve in the coming years. Sparx has increased its contribution from a mere 4.2% in FY2008 to 24.3% in FY2011; on the other hand, Flite has maintained its contribution at ~2530%. Hawaii, being a mass brand, adds to the volume, however, Sparx and Flite help in improving the companys profitability. Going forward we expect the mix to

February 6, 2012

3QFY2013 Result Update | Relaxo Footwear

further improve with the new ads and celebrity endorsements helping in increasing brand visibility. The company is also planning to launch new products in the high margin segment.

Exhibit 5: Sales break up Brand-wise

100.0 14.7 80.0 60.0 (%) 40.0 20.0 0.0 FY2008 FY2009 Hawaii Source: Company, Angel Research Note: * Others includes - Other brands, outsourced, & traded goods, #Expected FY2010 Flite Sparx FY2011 Others* FY2012# 49.2 44.4 40.8 4.2 31.9 18.9 7.5 29.1 15.1 15.3 14.5 24.3 7.0 28.0

28.9

25.8

35.0

35.5

30.0

February 6, 2012

3QFY2013 Result Update | Relaxo Footwear

Financial performance

Assumptions

Exhibit 6: Key assumptions

FY2013E Volume Growth (%) Realisation Growth (%) Change in raw material prices (%) Ethyl Vinyl Acetate (EVA) Rubber

Source: Angel Research

FY2014E 8.6 7.0 5.0 5.0

4.6 10.0 (5.0) (5.0)

Exhibit 7: Change in estimates

Y/E March (` cr) Net sales OPM (%) Adj. PAT

Source: Angel Research

Earlier estimates FY2013E 1,019 11.0 56 FY2014E 1,208 12.5 80

Revised estimates FY2013E FY2014E 989 10.7 50 1,148 11.6 67

% chg FY2013E (3.0) (31)bp (10.7) FY2014E (5.0) (90)bp (15.9)

We expect the companys revenue to grow at a CAGR of 15.5% over FY2012-14E, from `860cr in FY2012 to `1,148cr in FY2014E, mainly on the back of growth triggers, which include 1) capacity expansion plans, 2) store expansion, 3) improved sales mix, 4) brand revamping and 5) continuous product development. With the cooling off of raw material prices, we expect the net raw material cost as a percentage of sales to decline from 53.4% in FY2012 to 47.2% in FY2014E. Simultaneously, we expect employee cost and other expenses to increase on account of expansion and advertisement spending respectively. We expect a 118bp expansion in the operating margin to 11.6% in FY2014E, mainly on account of fall in raw material prices, stabilizing ad spends and improvement in value mix (with Sparx and Flite contributing ~60% of sales). The companys profit is expected to grow at a CAGR of 29.8% over FY2012-14E, from `40cr in FY2012 to `67cr in FY2014E.

Exhibit 8: Revenue to be driven by volume growth

1,400 1,200 1,000 800 29.6 23.9 25.4 15.0 16.1 30 20 10 0 33.3 35.9 40

Exhibit 9: Margin to improve with decreasing RM price

160 140 120 100 10.3 10.1 9.6 10.5 10.7 11.6 13.8 16 14 12 10 8 6 4

(` cr)

(`cr)

600 400

80 60 40

(%)

(%)

306

407

554

686

860

106

31

41

76

66

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

90

20

134

200

989

1,148

2 0

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013E

Revenue (LHS)

Revenue growth (RHS)

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

February 6, 2012

FY2014E

3QFY2013 Result Update | Relaxo Footwear

Outlook and valuation

Based on 3QFY2013 results, we have downgraded our numbers. However, with growth triggers like 1) capacity expansion plans, 2) store expansion, 3) improved sales mix 4) brand revamping and 5) continuous product development intact, we remain positive on the companys future. We expect Relaxo to post a revenue CAGR of 15.5% over FY2012-14 to `1,148cr with an operating margin of 11.6% in FY2014E. The PAT is expected to grow at a CAGR of 29.8% to `67cr for the same period. At the current market price, Relaxo is trading at 13.4x FY2014E earnings. We maintain our Buy recommendation on the stock with a revised target price of `897, based on a target PE of 16x for FY2014E.

Exhibit 10: One-year forward PE

1000 800 600

(`)

400 200 0

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

Jul-08

Jul-09

Jul-10

Jul-11

Oct-08

Oct-09

Oct-10

Oct-11

Jul-12

Oct-12

Jan-09

Jan-10

Jan-11

Jan-12

Price (`)

4x

8x

12x

16x

Source: Company, Angel Research

Exhibit 11: Comparative analysis

Company Relaxo footwear Bata India* Year end FY2013E FY2014E CY2012E CY2013E

Source: Company, Angel Research, *Bloomberg

Mcap (` cr) 900 900 4,871 4,871

Sales (` cr) 989 1,148 1,968 1,804

OPM (%) 10.7 11.6 16.1 32.8

PAT (` cr) 50 67 183 184

EPS (`) 41.9 56.1 28.5 28.7

RoE (%) 25.6 26.5 27.1 19.3

P/E (x) 17.9 13.4 27.3 22.6

P/BV (x) 4.1 3.1 7.2 5.8

EV/EBITDA (x) 10.0 7.8 15.4 8.2

EV/Sales (x) 1.1 0.9 2.5 2.7

Risks

Rise in raw material prices and depreciating rupee

The prices of key raw materials EVA and rubber had reached their peak in the last financial year to ~`149/kg and ~`243/kg respectively, which impacted the operating margin. However, the prices of both the raw materials have started declining, with the current price for rubber at ~170/kg and EVA at ~`117/kg. Any rise in the prices can put margins under pressure. Also, Relaxo imports its entire EVA requirement, so any further depreciation in the rupee can pose a risk to the operating margin and thereby impact the profitability of the company.

February 6, 2012

Jan-13

3QFY2013 Result Update | Relaxo Footwear

Exhibit 12: Depreciating rupee a concern for EVA cost

58 56 54 53.2

USD/INR

52 50 48 46 44 42 Jan-12 Mar-12 May-12 Jul-12 Sep-12 Nov-12 Jan-13 49.5

Source: Angel Research, Bloomberg

Competition from both, branded and unorganised sector

Relaxo competes with both, branded as well as the unorganised market. Hawaii, the mass product faces stiff competition from the unorganised market. On the other hand, Sparx faces competition from branded shoes. The company has priced its products considering competition. Any price cut by competitors can put pressure on Relaxos sales and margin.

Company background

Relaxo is a key player in the retail footwear industry, with a strong foothold in the slippers market and a strong distribution channel of 700 distributors and more than 46,000 retailers. The company presently has 158 company-owned outlets across India, with a concentrated presence in Delhi, Rajasthan, Gujarat, Haryana, Punjab, Uttar Pradesh and Uttarakhand. It has nine manufacturing plants, seven in Bahadurgarh (Haryana) and one each in Bhiwadi (Rajasthan) and Haridwar (Uttaranchal). Currently, the company sells its products under three major brands Hawaii, Flite and Sparx.

February 6, 2012

3QFY2013 Result Update | Relaxo Footwear

Profit & Loss Statement (Standalone)

Y/E March (` cr)

Total operating income % chg Net Raw Materials % chg Other Mfg costs % chg Personnel % chg Other % chg Total Expenditure EBITDA % chg (% of Net Sales) Depreciation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of sales) Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg Dividend Retained Earning FY2010 554 35.9 290 33.0 33 (34.3) 55 65.7 99 52.8 477 76 85.2 13.8 15 61 98.0 11.0 11 4 0.7 50 132.0 (0.0) 54 16 30.0 38 38 160.2 6.8 31.4 31.4 160.2 2 36 FY2011 686 23.9 375 29.4 43 31.8 74 34.5 127 27.6 620 66 (13.2) 9.6 21 45 (25.5) 6.6 16 6 0.9 30 (40.5) 0.0 36 9 24.7 27 27 (28.8) 3.9 22.4 22.4 (28.8) 2 25 FY2012 860 25.4 459 22.3 55 26.8 106 42.6 150 18.6 770 90 35.9 10.5 23 67 47.7 7.8 19 5 0.6 48 62.8 0.0 53 14 25.4 40 40 48.5 4.6 33.3 33.3 48.5 2 38 FY2013E 989 15.0 471 2.6 63 15.6 151 42.5 198 31.6 883 106 17.4 10.7 25 81 21.2 8.2 17 6 0.6 64 32.6 0.0 70 19 27.9 50 50 26.1 5.1 41.9 41.9 26.1 2 49 FY2014E 1,148 16.1 541 14.9 73 16.1 176 16.1 224 13.2 1014 134 26.5 11.6 28 105 30.1 9.2 16 6 0.6 89 40.0 0.0 96 28 29.8 67 67 33.7 5.9 56.1 56.1 33.7 2 65

February 6, 2012

3QFY2013 Result Update | Relaxo Footwear

Balance Sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Total Loans Other Long Term Liabilities Long Term Provisions Deferred Tax (Net) Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Lease adjustment Goodwill Investments Long Term Loans and adv. Other Non-current asset Current Assets Cash Loans & Advances Inventory Debtors Other current assets Current liabilities Net Current Assets Misc. Exp. not written off Total Assets 286 64 222 7 116 1 27 67 21 69 47 275 353 84 268 1 11 158 2 16 117 23 1 123 35 316 379 108 272 21 12 1 169 1 15 128 23 2 131 38 344 455 132 323 25 12 1 212 2 18 162 27 3 169 42 403 500 160 340 25 12 1 246 9 23 179 31 3 167 80 457 6 104 110 147 18 275 6 129 135 156 2 22 316 6 166 172 146 3 22 344 6 215 221 156 4 22 403 6 280 286 145 4 22 457 FY2010 FY2011 FY2012 FY2013E FY2014E

February 6, 2012

3QFY2013 Result Update | Relaxo Footwear

Cash Flow (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Direct taxes paid Others Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments (Inc.)/Dec. in LT loans & adv. Others Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2010 54 15 (16) (16) 34 72 (80) (5) (85) 39 (2) (25) 11 (2) 3 1 FY2011 36 21 13 (9) 36 97 (62) 11 (12) (63) 10 (2) (41) (33) 1 1 2 FY2012 53 23 (4) (14) (5) 54 (46) 1 3 (42) (11) (2) (13) (1) 2 1 FY2013E 70 25 (3) (19) (6) 66 (80) 7 (73) 10 (2) 8 1 1 2 FY2014E 96 28 (30) (28) (6) 59 (45) 7 (39) (11) (2) (13) 7 2 9

February 6, 2012

10

3QFY2013 Result Update | Relaxo Footwear

Standalone Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover Inventory / Sales (days) Receivables (days) Payables (days) WC (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage 1.3 1.9 5.5 1.1 2.3 2.9 0.8 1.6 3.6 0.7 1.5 4.7 0.5 1.0 6.6 2.3 35 13 44 25 2.1 49 12 57 21 2.4 52 10 60 14 2.4 54 10 70 13 2.4 54 10 60 17 21.8 22.4 41.0 14.3 14.5 22.0 19.5 20.8 26.0 20.1 21.6 25.6 23.0 24.9 26.5 11.0 0.7 2.0 15.7 5.3 1.4 29.6 6.6 0.8 2.2 10.9 7.5 1.2 15.0 7.8 0.7 2.7 15.5 9.6 1.0 21.4 8.2 0.7 2.6 15.5 7.9 0.8 21.4 9.2 0.7 2.7 17.5 7.7 0.6 23.2 31.4 31.4 44.3 1.5 91.6 22.4 22.4 39.9 1.5 112.2 33.3 33.3 52.5 1.5 143.7 41.9 41.9 62.4 1.5 184.1 56.1 56.1 79.6 1.5 238.7 23.9 16.9 8.2 0.2 1.9 13.7 3.8 33.5 18.8 6.7 0.2 1.5 15.9 3.3 22.5 14.3 5.2 0.2 1.2 11.6 3.0 17.9 12.0 4.1 0.2 1.1 10.0 2.6 13.4 9.4 3.1 0.2 0.9 7.8 2.3 FY2010 FY2011 FY2012 FY2013E FY2014E

February 6, 2012

11

3QFY2013 Result Update | Relaxo Footwear

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Relaxo Footwear No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

February 6, 2012

12

Вам также может понравиться

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- Relaxo Footwear 1QFY2013RU 070812Документ12 страницRelaxo Footwear 1QFY2013RU 070812Angel BrokingОценок пока нет

- Relaxo Footwears: Promising FutureДокумент13 страницRelaxo Footwears: Promising FutureIrfan ShaikhОценок пока нет

- L&T 4Q Fy 2013Документ15 страницL&T 4Q Fy 2013Angel BrokingОценок пока нет

- Colgate: Performance HighlightsДокумент10 страницColgate: Performance HighlightsAngel BrokingОценок пока нет

- Marico 4Q FY 2013Документ11 страницMarico 4Q FY 2013Angel BrokingОценок пока нет

- Persistent, 29th January 2013Документ12 страницPersistent, 29th January 2013Angel BrokingОценок пока нет

- Marico: Performance HighlightsДокумент12 страницMarico: Performance HighlightsAngel BrokingОценок пока нет

- Dishman 2QFY2013RUДокумент10 страницDishman 2QFY2013RUAngel BrokingОценок пока нет

- DB Corp 4Q FY 2013Документ11 страницDB Corp 4Q FY 2013Angel BrokingОценок пока нет

- Cera Sanitaryware: Increasing Brand Visibility To Be Key DriverДокумент14 страницCera Sanitaryware: Increasing Brand Visibility To Be Key DriverTirthajit SinhaОценок пока нет

- PAGE Industries 4Q FY 2013Документ13 страницPAGE Industries 4Q FY 2013Angel BrokingОценок пока нет

- DB Corp.: Performance HighlightsДокумент11 страницDB Corp.: Performance HighlightsAngel BrokingОценок пока нет

- CSL 4Q Fy 2013Документ15 страницCSL 4Q Fy 2013Angel BrokingОценок пока нет

- Page Industries: Upgrade To Accumulate'Документ14 страницPage Industries: Upgrade To Accumulate'Angel BrokingОценок пока нет

- Colgate: Performance HighlightsДокумент9 страницColgate: Performance HighlightsAngel BrokingОценок пока нет

- Page Industries, 18th February, 2013Документ14 страницPage Industries, 18th February, 2013Angel BrokingОценок пока нет

- Colgate 2QFY2013RUДокумент10 страницColgate 2QFY2013RUAngel BrokingОценок пока нет

- FAG Bearings Result UpdatedДокумент10 страницFAG Bearings Result UpdatedAngel BrokingОценок пока нет

- Cravatex: Performance HighlightsДокумент14 страницCravatex: Performance HighlightsAngel BrokingОценок пока нет

- Tech Mahindra 4Q FY13Документ12 страницTech Mahindra 4Q FY13Angel BrokingОценок пока нет

- Satyam 4Q FY 2013Документ12 страницSatyam 4Q FY 2013Angel BrokingОценок пока нет

- Britannia: Performance HighlightsДокумент10 страницBritannia: Performance HighlightsajujkОценок пока нет

- KEC International 4Q FY 2013Документ11 страницKEC International 4Q FY 2013Angel BrokingОценок пока нет

- AngelBrokingResearch SetcoAutomotive 4QFY2015RUДокумент10 страницAngelBrokingResearch SetcoAutomotive 4QFY2015RUvijay4victorОценок пока нет

- Britannia, 18th February, 2013Документ10 страницBritannia, 18th February, 2013Angel BrokingОценок пока нет

- GSK Consumer, 21st February, 2013Документ10 страницGSK Consumer, 21st February, 2013Angel BrokingОценок пока нет

- Colgate Result UpdatedДокумент10 страницColgate Result UpdatedAngel BrokingОценок пока нет

- Hexaware Result UpdatedДокумент13 страницHexaware Result UpdatedAngel BrokingОценок пока нет

- Infosys 4Q FY 2013, 12.04.13Документ15 страницInfosys 4Q FY 2013, 12.04.13Angel BrokingОценок пока нет

- TVS Srichakra Result UpdatedДокумент16 страницTVS Srichakra Result UpdatedAngel Broking0% (1)

- United Spirits 4Q FY 2013Документ10 страницUnited Spirits 4Q FY 2013Angel BrokingОценок пока нет

- Shoppers Stop 4qfy11 Results UpdateДокумент5 страницShoppers Stop 4qfy11 Results UpdateSuresh KumarОценок пока нет

- Relaxo Footwear: Performance HighlightsДокумент16 страницRelaxo Footwear: Performance HighlightsAngel BrokingОценок пока нет

- Finolex Cables: Performance HighlightsДокумент10 страницFinolex Cables: Performance HighlightsAngel BrokingОценок пока нет

- CeraSanitaryware 1QFY2014RU - PDF 110713Документ15 страницCeraSanitaryware 1QFY2014RU - PDF 110713nit111Оценок пока нет

- KPIT Cummins: Performance HighlightsДокумент13 страницKPIT Cummins: Performance HighlightsAngel BrokingОценок пока нет

- Dabur India Result UpdatedДокумент12 страницDabur India Result UpdatedAngel BrokingОценок пока нет

- Asian Paints Result UpdatedДокумент10 страницAsian Paints Result UpdatedAngel BrokingОценок пока нет

- Cravatex: Strategic Partnerships To Be Key DriverДокумент14 страницCravatex: Strategic Partnerships To Be Key DriverAngel BrokingОценок пока нет

- Siyaram Silk Mills Result UpdatedДокумент9 страницSiyaram Silk Mills Result UpdatedAngel BrokingОценок пока нет

- Nestle India: Performance HighlightsДокумент9 страницNestle India: Performance HighlightsAngel BrokingОценок пока нет

- Abbott India, 2Q CY 2013Документ12 страницAbbott India, 2Q CY 2013Angel BrokingОценок пока нет

- DLF 1Q Fy 2014Документ10 страницDLF 1Q Fy 2014Angel BrokingОценок пока нет

- TCS, 1Q Fy 2014Документ14 страницTCS, 1Q Fy 2014Angel BrokingОценок пока нет

- Tech Mahindra: Performance HighlightsДокумент11 страницTech Mahindra: Performance HighlightsAngel BrokingОценок пока нет

- Britannia 2QFY2013RUДокумент10 страницBritannia 2QFY2013RUAngel BrokingОценок пока нет

- JP Associates 4Q FY 2013Документ13 страницJP Associates 4Q FY 2013Angel BrokingОценок пока нет

- Bajaj Electricals, 1Q FY 2014Документ14 страницBajaj Electricals, 1Q FY 2014Angel BrokingОценок пока нет

- Godrej Consumer Products: Performance HighlightsДокумент11 страницGodrej Consumer Products: Performance HighlightsAngel BrokingОценок пока нет

- Mindtree, 1Q FY 2014Документ12 страницMindtree, 1Q FY 2014Angel BrokingОценок пока нет

- DB Corp, 1Q FY 2014Документ11 страницDB Corp, 1Q FY 2014Angel BrokingОценок пока нет

- GSK Consumer: Performance HighlightsДокумент9 страницGSK Consumer: Performance HighlightsAngel BrokingОценок пока нет

- Jagran Prakashan Result UpdatedДокумент11 страницJagran Prakashan Result UpdatedAngel BrokingОценок пока нет

- Dabur India: Performance HighlightsДокумент10 страницDabur India: Performance HighlightsAngel BrokingОценок пока нет

- DB Corp: Performance HighlightsДокумент11 страницDB Corp: Performance HighlightsAngel BrokingОценок пока нет

- Asian Paints Result UpdatedДокумент10 страницAsian Paints Result UpdatedAngel BrokingОценок пока нет

- DB Corp Result UpdatedДокумент10 страницDB Corp Result UpdatedAngel BrokingОценок пока нет

- United Spirits: Performance HighlightsДокумент11 страницUnited Spirits: Performance HighlightsAngel BrokingОценок пока нет

- Britannia 1QFY2013RU 140812Документ10 страницBritannia 1QFY2013RU 140812Angel BrokingОценок пока нет

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- Technical & Derivative Analysis Weekly-14092013Документ6 страницTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Commodities Weekly Outlook 16-09-13 To 20-09-13Документ6 страницCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingОценок пока нет

- Metal and Energy Tech Report November 12Документ2 страницыMetal and Energy Tech Report November 12Angel BrokingОценок пока нет

- Special Technical Report On NCDEX Oct SoyabeanДокумент2 страницыSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingОценок пока нет

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Commodities Weekly Tracker 16th Sept 2013Документ23 страницыCommodities Weekly Tracker 16th Sept 2013Angel BrokingОценок пока нет

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Derivatives Report 16 Sept 2013Документ3 страницыDerivatives Report 16 Sept 2013Angel BrokingОценок пока нет

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Sugar Update Sepetmber 2013Документ7 страницSugar Update Sepetmber 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- Technical Report 13.09.2013Документ4 страницыTechnical Report 13.09.2013Angel BrokingОценок пока нет

- Market Outlook 13-09-2013Документ12 страницMarket Outlook 13-09-2013Angel BrokingОценок пока нет

- TechMahindra CompanyUpdateДокумент4 страницыTechMahindra CompanyUpdateAngel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- MarketStrategy September2013Документ4 страницыMarketStrategy September2013Angel BrokingОценок пока нет

- IIP CPIDataReleaseДокумент5 страницIIP CPIDataReleaseAngel BrokingОценок пока нет

- MetalSectorUpdate September2013Документ10 страницMetalSectorUpdate September2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 06 2013Документ2 страницыDaily Agri Tech Report September 06 2013Angel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- SDL NSDLДокумент2 страницыSDL NSDLNeha KrishnaniОценок пока нет

- Subject: Financial Management: Yes Bank CrisisДокумент9 страницSubject: Financial Management: Yes Bank Crisisaryan sharmaОценок пока нет

- E 14-6 Acquisition-Excess Allocation and Amortization EffectДокумент13 страницE 14-6 Acquisition-Excess Allocation and Amortization EffectRizkina MoelОценок пока нет

- Himatnagar Telecom District: Account SummaryДокумент2 страницыHimatnagar Telecom District: Account SummaryRahul ShuklaОценок пока нет

- IB - Sessions Private EquityДокумент4 страницыIB - Sessions Private EquityDivya Jain50% (2)

- Instructions For Using Excel PowerДокумент3 страницыInstructions For Using Excel PowerAbhijit NairОценок пока нет

- Basic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingДокумент107 страницBasic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingKang JoonОценок пока нет

- BBG Adj HighlightsДокумент1 страницаBBG Adj HighlightsMaria Pia Rivas LozadaОценок пока нет

- Eco 112 Course Outline 2021Документ5 страницEco 112 Course Outline 2021Midzy BitzОценок пока нет

- Citi BankДокумент68 страницCiti Bankdilip504Оценок пока нет

- ECON 1610 Course OutlineДокумент8 страницECON 1610 Course OutlineShammo AhzОценок пока нет

- REG NotesДокумент119 страницREG NotesYash MhatreОценок пока нет

- 7.advanced WR 7.5+ Strategy 7.softening & Hedging StatementsДокумент5 страниц7.advanced WR 7.5+ Strategy 7.softening & Hedging StatementsKhanh LinhОценок пока нет

- Fundamental & Technical Analysis of Selected Commodities (Gold & Silver)Документ4 страницыFundamental & Technical Analysis of Selected Commodities (Gold & Silver)Raghava PrusomulaОценок пока нет

- Other SourceДокумент43 страницыOther SourceJai RajОценок пока нет

- Final accounts of sole traderДокумент32 страницыFinal accounts of sole tradervickramravi16Оценок пока нет

- Its Just Time Martin ArmstrongДокумент87 страницIts Just Time Martin ArmstrongkgsbhavaniprasadОценок пока нет

- Managing Risks in Financial Inclusion and Agency BankingДокумент30 страницManaging Risks in Financial Inclusion and Agency BankingEmmanuel Moore AboloОценок пока нет

- Balance SheetДокумент16 страницBalance SheetGautamОценок пока нет

- Assignment On Payment Methods: Submitted byДокумент6 страницAssignment On Payment Methods: Submitted bySanam ChouhanОценок пока нет

- Equity - Reading 47 PDFДокумент11 страницEquity - Reading 47 PDFKiraОценок пока нет

- Everything You Should KNOW ABOUT DAGCOINДокумент20 страницEverything You Should KNOW ABOUT DAGCOINaldiОценок пока нет

- Global Power and Global Government by Andrew Gavin MarshallДокумент96 страницGlobal Power and Global Government by Andrew Gavin MarshallsylodhiОценок пока нет

- Bank Statement FinalДокумент2 страницыBank Statement FinalShemeem SОценок пока нет

- Credit ReportДокумент34 страницыCredit ReportsophiaОценок пока нет

- LiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Документ25 страницLiquiLoans - Prime Retail Fixed Income Investment Opportunity - Oct. 2022Vivek SinghalОценок пока нет

- StandardДокумент29 страницStandardlpsw2007Оценок пока нет

- Unit 4 Derivatives Part 1Документ19 страницUnit 4 Derivatives Part 1UnathiОценок пока нет

- Module 2 Investment Property and FundsДокумент6 страницModule 2 Investment Property and FundsCharice Anne VillamarinОценок пока нет

- Income Statement 2018-2019 %: Sources of FundsДокумент8 страницIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeОценок пока нет

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4 из 5 звезд4/5 (2)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsОт EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsРейтинг: 5 из 5 звезд5/5 (2)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldОт Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldРейтинг: 5 из 5 звезд5/5 (19)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedОт EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedРейтинг: 4.5 из 5 звезд4.5/5 (38)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelОт EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelРейтинг: 5 из 5 звезд5/5 (51)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryОт EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryРейтинг: 4 из 5 звезд4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureОт EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureРейтинг: 4.5 из 5 звезд4.5/5 (100)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:От EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Рейтинг: 5 из 5 звезд5/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeОт EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeРейтинг: 4.5 из 5 звезд4.5/5 (30)

- Without a Doubt: How to Go from Underrated to UnbeatableОт EverandWithout a Doubt: How to Go from Underrated to UnbeatableРейтинг: 4 из 5 звезд4/5 (23)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsОт EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsРейтинг: 4 из 5 звезд4/5 (6)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesОт EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesРейтинг: 5 из 5 звезд5/5 (21)

- Your Next Five Moves: Master the Art of Business StrategyОт EverandYour Next Five Moves: Master the Art of Business StrategyРейтинг: 5 из 5 звезд5/5 (795)

- Anything You Want: 40 lessons for a new kind of entrepreneurОт EverandAnything You Want: 40 lessons for a new kind of entrepreneurРейтинг: 5 из 5 звезд5/5 (46)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsОт EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsРейтинг: 5 из 5 звезд5/5 (48)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouОт EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouРейтинг: 5 из 5 звезд5/5 (1)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursОт EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (23)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesОт EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesРейтинг: 4.5 из 5 звезд4.5/5 (99)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceОт EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceРейтинг: 5 из 5 звезд5/5 (363)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizОт EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizРейтинг: 4.5 из 5 звезд4.5/5 (112)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessОт EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessРейтинг: 4.5 из 5 звезд4.5/5 (24)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andОт EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andРейтинг: 4.5 из 5 звезд4.5/5 (708)

- Summary of The 33 Strategies of War by Robert GreeneОт EverandSummary of The 33 Strategies of War by Robert GreeneРейтинг: 3.5 из 5 звезд3.5/5 (20)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeОт EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeРейтинг: 5 из 5 звезд5/5 (22)

- AI Money Machine: Unlock the Secrets to Making Money Online with AIОт EverandAI Money Machine: Unlock the Secrets to Making Money Online with AIОценок пока нет