Академический Документы

Профессиональный Документы

Культура Документы

Form ITR-V

Загружено:

Sumit ManglaniАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form ITR-V

Загружено:

Sumit ManglaniАвторское право:

Доступные форматы

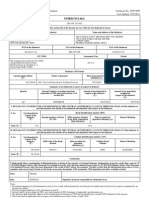

FORM

INDIAN INCOME TAX RETURN VERIFICATION FORM

Assessment Year

ITR-V

[Where the data of the Return of Income in Forms Saral-II (ITR-1), ITR-2, ITR-3, ITR4, ITR-5 & ITR-6 transmitted electronically without digital signature]

(Please see Rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

2010 - 11

PERSONALINFORMATION AND THE DATE OF ELECTRONIC TRANSMISSION

Name

PAN

Flat/Door/Block No

Name Of Premises/Building/Village

Road/Street/Post Office Town/City/District

Area/Locality State

Form No. which has been electronically transmitted (fill the code)

Status (fill the code) Original or Revised

Date(DD/MM/YYYY)

1 2 3 3a 4 5 6

Designation of Assessing Officer (Ward/ Circle) E-filing Acknowledgement Number

1 2 3

Gross total income Deductions under Chapter-VI-A Total Income

3a Current Year loss (if any) COMPUTATION OF INCOME AND TAX THEREON 4 5 6

Net tax payable Interest payable Total tax and interest payable Taxes Paid a b c d e Advance Tax TDS TCS Self Assessment Tax Total Taxes Paid (7a+7b+7c +7d) 7a 7b 7c 7d

7e 8 9

8 9

Tax Payable (6-7e) Refund (7e-6)

VERIFICATION name in block letters), son/ daughter of I, _________________________________________________(full ____________________________________________, permanent account number __________________solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for the previous year relevant to the assessment year 2010-11. I further declare that I am making this return in my capacity as ___________ and I am also competent to make this return and verify it.

Sign here Date Place

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Name of TRP Counter Signature of TRP Identification No. of TRP

For Office Use Only Receipt No Date Seal and Signature of receiving official

Government of India

INCOME-TAX DEPARTMENT ACKNOWLEDGEMENT

Received with thanks from _______________________________________________________________ a return of income in Form No. ITR for assessment year 2010-11, having the following particulars.

Name

PERSONALINFORMATION

PAN

Flat/Door/Block No

Name Of Premises/Building/Village

Road/Street/Post Office

Area/Locality

Town/City/District

State

Status (fill the code) Original or Revised

1 2 3 3a 4 5 6

Designation of Assessing Officer (Ward/ Circle)

1 2 3

Gross total income Deductions under Chapter-VI-A Total Income

3a Current Year loss (if any) COMPUTATION OF INCOME AND TAX THEREON 4 5 6

Net tax payable Interest payable Total tax and interest payable Taxes Paid a b c d e Advance Tax TDS TCS Self Assessment Tax Total Taxes Paid (7a+7b+7c +7d) 7a 7b 7c 7d

7e 8 9 Seal and Signature of receiving official

8 9 Receipt No Date

Tax Payable (6-7e) Refund (7e-6)

Вам также может понравиться

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- Form ITR-VДокумент1 страницаForm ITR-VSanjeev BansalОценок пока нет

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- Itr-V: Indian Income Tax Return Verification FormДокумент1 страницаItr-V: Indian Income Tax Return Verification Formbha_goОценок пока нет

- Itr-V: Indian Income Tax Return Verification FormДокумент1 страницаItr-V: Indian Income Tax Return Verification Formbha_goОценок пока нет

- XXXPH2966X ITRV - UnlockedДокумент1 страницаXXXPH2966X ITRV - UnlockedVivek HaldarОценок пока нет

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- XXXPD3353X Itrv PDFДокумент1 страницаXXXPD3353X Itrv PDFDaljeet KaurОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionОценок пока нет

- 2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFДокумент1 страница2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFMadhabi MohapatraОценок пока нет

- Form ITR-1Документ3 страницыForm ITR-1Rajeev PuthuparambilОценок пока нет

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1От EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Оценок пока нет

- Sudha Singh Itr V 13Документ1 страницаSudha Singh Itr V 13Anurag SinghОценок пока нет

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Документ1 страницаItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaОценок пока нет

- Acknowledgement UnlockedДокумент1 страницаAcknowledgement UnlockedcachandhiranОценок пока нет

- Kondala Rao Sankarasetty 06-Aug-2016 398914990Документ1 страницаKondala Rao Sankarasetty 06-Aug-2016 398914990Venkatesh BandaruОценок пока нет

- Itr-V: Indian Income Tax Return Verification FormДокумент1 страницаItr-V: Indian Income Tax Return Verification FormNishant VermaОценок пока нет

- Xxxpi5752x ItrvДокумент1 страницаXxxpi5752x ItrvIngole DeepakОценок пока нет

- Aaaco1111l Form16a 2011-12 Q3Документ1 страницаAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniОценок пока нет

- Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)Документ6 страницSrnoin Form 15G Srnoin Form 15H Particulars (Required Details)priyaradhiОценок пока нет

- ITR62 Form 15 CAДокумент5 страницITR62 Form 15 CAMohit47Оценок пока нет

- IT Return 2011 2012Документ3 страницыIT Return 2011 2012swapnil6121986Оценок пока нет

- Ahrpv0731f 2013-14Документ2 страницыAhrpv0731f 2013-14Shiva KumarОценок пока нет

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Документ22 страницыSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaОценок пока нет

- Tax Applicable (Tick One) 2 8 1Документ7 страницTax Applicable (Tick One) 2 8 1Gaurav BajajОценок пока нет

- Form 16A NewДокумент2 страницыForm 16A NewKovidh GoyalОценок пока нет

- 15 G Form (Pre-Filled)Документ8 страниц15 G Form (Pre-Filled)pankaj_electricalОценок пока нет

- 2015 Itr1 PR3Документ18 страниц2015 Itr1 PR3shubham sharmaОценок пока нет

- 15 CaДокумент8 страниц15 CadamanОценок пока нет

- 15h Form (1) - CompressedДокумент4 страницы15h Form (1) - Compressedrekha safarirОценок пока нет

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateДокумент3 страницыAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinОценок пока нет

- Form IiibДокумент2 страницыForm Iiibvishnucnk25% (4)

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Документ3 страницыSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarОценок пока нет

- Gross Total Income (1+2+3) 4: System CalculatedДокумент8 страницGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamОценок пока нет

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Документ4 страницыPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilОценок пока нет

- New Form No 15GДокумент4 страницыNew Form No 15GDevang PatelОценок пока нет

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageДокумент1 страницаIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSudeshОценок пока нет

- P.P.T On Duties - Responsibilities of DDO For GSTДокумент30 страницP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaОценок пока нет

- (See Rule 31 (1) (B) ) : Printed From WWW - Incometaxindia.gov - in Page 1 of 2Документ2 страницы(See Rule 31 (1) (B) ) : Printed From WWW - Incometaxindia.gov - in Page 1 of 2Anonymous SMqp9rZuОценок пока нет

- Income Tax Returns Filing: Marked Fields Are MandatoryДокумент18 страницIncome Tax Returns Filing: Marked Fields Are MandatoryashwinmjoshiОценок пока нет

- Gross Total Income (1+2c) 4: Import Previous VersionДокумент4 страницыGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailОценок пока нет

- DeclarationДокумент2 страницыDeclarationCA Deepak JainОценок пока нет

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceДокумент2 страницыForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanОценок пока нет

- PT Challan MTR 6Документ1 страницаPT Challan MTR 6mak_palkar772Оценок пока нет

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidДокумент7 страницSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaОценок пока нет

- Assessment Year Indian Income Tax Return: I - IndividualДокумент6 страницAssessment Year Indian Income Tax Return: I - IndividualManjunath YvОценок пока нет

- BIR FormДокумент4 страницыBIR FormfyeahОценок пока нет

- OBC Bank Form - 15H PDFДокумент2 страницыOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Kaushik Sarkar Form 16 DynProДокумент5 страницKaushik Sarkar Form 16 DynProKaushik SarkarОценок пока нет

- Form 16Документ2 страницыForm 16Mithun KumarОценок пока нет

- (See Rule 31 (1) (B) ) : Form No. 16AДокумент38 страниц(See Rule 31 (1) (B) ) : Form No. 16AsamОценок пока нет

- 2011 ITR1 r2Документ3 страницы2011 ITR1 r2Zafar IqbalОценок пока нет

- Application For EmploymentДокумент4 страницыApplication For EmploymentManav GaneshОценок пока нет

- Biodata Format FinalДокумент40 страницBiodata Format FinalSumit ManglaniОценок пока нет

- Nature and Importance of LeadershipДокумент7 страницNature and Importance of LeadershipFaryal Ibrahim AbbasОценок пока нет

- Flexible AC Transmission Systems: Roll No 16223Документ13 страницFlexible AC Transmission Systems: Roll No 16223Sumit ManglaniОценок пока нет

- Absorp 120404020404 Phpapp01Документ20 страницAbsorp 120404020404 Phpapp01Sumit ManglaniОценок пока нет

- Biodata Format FinalДокумент2 страницыBiodata Format Finalanon-90865197% (120)

- Form ITR-7Документ15 страницForm ITR-7Sumit ManglaniОценок пока нет

- Apollo MunichДокумент52 страницыApollo MunichSumit ManglaniОценок пока нет

- Claim FormДокумент3 страницыClaim FormSumit ManglaniОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент8 страницITR-3 Indian Income Tax Return: Part A-GENRahul SharmaОценок пока нет

- Currency Derivatives Project - LavnishДокумент64 страницыCurrency Derivatives Project - LavnishLavnish Jaitly60% (5)

- FoodchainДокумент14 страницFoodchainSumit ManglaniОценок пока нет

- Bussiness Letter FormatДокумент2 страницыBussiness Letter FormatSumit ManglaniОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент8 страницITR-3 Indian Income Tax Return: Part A-GENRahul SharmaОценок пока нет

- Cost ControlДокумент62 страницыCost ControlSumit ManglaniОценок пока нет

- Projectreportoncurrencyderivatives2 100906082432 Phpapp02Документ49 страницProjectreportoncurrencyderivatives2 100906082432 Phpapp02Sumit ManglaniОценок пока нет

- Cost ConntorlДокумент23 страницыCost ConntorlSumit Manglani0% (1)

- Currency DerivativesДокумент27 страницCurrency DerivativesPriya SubramanianОценок пока нет

- Currency DerivativesДокумент27 страницCurrency DerivativesPriya SubramanianОценок пока нет

- Currency DerivativesДокумент19 страницCurrency DerivativesSumit ManglaniОценок пока нет

- Cost ControlДокумент62 страницыCost ControlSumit ManglaniОценок пока нет

- Franchising 1 05Документ26 страницFranchising 1 05Sumit ManglaniОценок пока нет

- Cost ControlДокумент62 страницыCost ControlSumit ManglaniОценок пока нет

- Projectreportoncurrencyderivatives2 100906082432 Phpapp02Документ49 страницProjectreportoncurrencyderivatives2 100906082432 Phpapp02Sumit ManglaniОценок пока нет

- FoodchainДокумент14 страницFoodchainSumit ManglaniОценок пока нет

- Isssue 3Документ6 страницIsssue 3Sumit ManglaniОценок пока нет

- Environment and Health in IndiaДокумент10 страницEnvironment and Health in IndiaSumit ManglaniОценок пока нет

- SR - No. Date Branch Location Name of Customer Contact No. ProfileДокумент3 страницыSR - No. Date Branch Location Name of Customer Contact No. ProfileSumit ManglaniОценок пока нет

- Environment and Health in IndiaДокумент10 страницEnvironment and Health in IndiaSumit ManglaniОценок пока нет

- Consolidaton EntriesДокумент14 страницConsolidaton Entriesask_raoОценок пока нет

- KSFC ProfileДокумент143 страницыKSFC ProfilenishaarjunОценок пока нет

- Module 5 Using Mathematical TechniquesДокумент57 страницModule 5 Using Mathematical Techniquessheryl_morales100% (5)

- GaneshBenzoplastdraftlof PДокумент30 страницGaneshBenzoplastdraftlof PjayОценок пока нет

- Taxation, Imposition of Compulsory Levies On Individuals or Entities by Governments. Taxes AreДокумент5 страницTaxation, Imposition of Compulsory Levies On Individuals or Entities by Governments. Taxes AreIlly Zue Zaine GangosoОценок пока нет

- Maersk GlossaryДокумент28 страницMaersk GlossaryPrashant BhardwajОценок пока нет

- Financial Management: I. Concept NotesДокумент6 страницFinancial Management: I. Concept NotesDanica Christele AlfaroОценок пока нет

- SAP FI Basic SettingsДокумент43 страницыSAP FI Basic SettingsManjunath RaoОценок пока нет

- Golden Ribbon Lumber Company V City of ButuanДокумент2 страницыGolden Ribbon Lumber Company V City of ButuanGabriel GaspanОценок пока нет

- C.O.Capital - Capital Budgeting (OK Na!)Документ8 страницC.O.Capital - Capital Budgeting (OK Na!)Eunice BernalОценок пока нет

- Accounting 2 - Chapter 14 - Notes - MiuДокумент4 страницыAccounting 2 - Chapter 14 - Notes - MiuAhmad Osama MashalyОценок пока нет

- New Construction Development Plan For XYZДокумент5 страницNew Construction Development Plan For XYZRoyОценок пока нет

- PU 4 YEARS BBA IV Semester SyllabusДокумент15 страницPU 4 YEARS BBA IV Semester SyllabushimalayabanОценок пока нет

- Nguyen Huong A 12Документ8 страницNguyen Huong A 12Quỳnh Hương NguyễnОценок пока нет

- Notre Dame Educational Association: Mock Board Examination TaxationДокумент10 страницNotre Dame Educational Association: Mock Board Examination TaxationirishjadeОценок пока нет

- Sun Life ProspectusДокумент39 страницSun Life ProspectusAiza CabolesОценок пока нет

- Chapter 1 IAPM-IntroductionДокумент15 страницChapter 1 IAPM-IntroductionPrachi KulkarniОценок пока нет

- Jun 2003 - Qns Mod BДокумент13 страницJun 2003 - Qns Mod BHubbak KhanОценок пока нет

- International Accounting 6Th International Student Edition Edition Timothy Doupnik Full ChapterДокумент67 страницInternational Accounting 6Th International Student Edition Edition Timothy Doupnik Full Chaptertimothy.parrott698100% (4)

- REED FileДокумент4 страницыREED FileJake VargasОценок пока нет

- Chapter 1 - Accounting For PartnershipДокумент13 страницChapter 1 - Accounting For PartnershipKim EllaОценок пока нет

- On May 5 2012 You Were Hired by Gavin Inc PDFДокумент1 страницаOn May 5 2012 You Were Hired by Gavin Inc PDFFreelance WorkerОценок пока нет

- School FeasibilityДокумент14 страницSchool FeasibilitySaba AliОценок пока нет

- Agri Economics Question For Ao TNPSC ExamДокумент77 страницAgri Economics Question For Ao TNPSC ExamecodheepuОценок пока нет

- RAK Ceramics PJSC CFS Q2 2020 EnglishДокумент34 страницыRAK Ceramics PJSC CFS Q2 2020 Englishahme farОценок пока нет

- 2 Statement of Comprehensive IncomeДокумент27 страниц2 Statement of Comprehensive IncomeMichael Lalim Jr.Оценок пока нет

- CIR V LingayenДокумент2 страницыCIR V LingayenlittlemissbelieverОценок пока нет

- Income Tax On Intraday TradingДокумент7 страницIncome Tax On Intraday Tradingkrutarth patelОценок пока нет

- Test Bank Financial Accounting and Reporting TheoryДокумент58 страницTest Bank Financial Accounting and Reporting TheoryAngelie De LeonОценок пока нет

- Lesson 1 - The Accountancy ProfessionДокумент52 страницыLesson 1 - The Accountancy ProfessionAllen GonzagaОценок пока нет