Академический Документы

Профессиональный Документы

Культура Документы

Press 20130212e

Загружено:

ran2013Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Press 20130212e

Загружено:

ran2013Авторское право:

Доступные форматы

Communications Department

30, Janadhipathi Mawatha, Colombo 01, Sri Lanka. Tel : 2477424, 2477423, 2477311 Fax: 2346257, 2477739 E-mail: dcommunications@cbsl.lk, communications@cbsl.lk Web: www.cbsl.gov.lk

Press Release

Issued By Date

Economic Research Department 12-02-2013

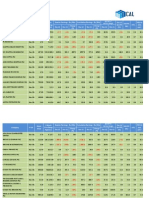

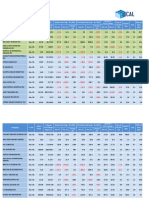

Monetary Policy Review February 2013 12-12-2012 Data from the monetary sector and the external sector for the full year of 2012 reflects the effect of the tight policy measures adopted in February/March 2012. In the monetary sector, broad money growth continued to moderate to 17.6 per cent in December from a peak growth of 22.9 per cent in April 2012. Growth of credit extended to the private sector also decelerated to 17.6 per cent by end 2012 from 34.5 per cent at end 2011. However, with increased borrowing by the Government and public corporations from the banking sector, the overall expansion of domestic credit remained at 21.7 per cent at end 2012. In the external sector, the tight policy measures resulted in a marked decline in non-oil imports, narrowing the deficit in the trade account in 2012. Increased workers remittances, service inflows, and inflows to the capital and financial account resulted in a surplus in the Balance of Payments (BOP). Consequently, the external reserves of the country expanded while the rupee strengthened against major currencies. With the macroeconomic stabilisation objectives of the February/March 2012 policy package being realised, the Central Bank was able to relax its monetary policy stance in December 2012. The reduction in policy interest rates and the expiration of

1

the credit ceiling in December 2012 are now expected to support the economy to move towards its full potential in 2013. Compared to the increase of credit of Rs. 352 billion extended to the private sector by commercial banks in 2012, the Central Bank expects credit to the private sector to increase by around Rs. 435 billion (a year-onyear growth of 18.5 per cent) in 2013. Since such a credit growth will be compatible with the anticipated expansion in economic activity, it is not expected to fuel any demand driven inflationary pressures during the year. In the meantime, short term money market interest rates have declined sharply in response to the relaxation of monetary policy, although deposit rates and lending rates are yet to adjust downwards. However, it is expected that these essential adjustments will take place in the ensuing weeks, which will stimulate private sector economic activity. At the same time, inflation has remained at single digit levels over the past four years, although rising to 9.8 per cent, year-on-year, in January 2013, due to adverse weather conditions affecting vegetable prices, revisions to administratively determined prices and the base effect. Although vegetable prices have already declined substantially, year-on-year inflation in February is expected to remain at around the current level before decelerating thereafter. Based on the above, the Monetary Board at its meeting held on 11 February 2013 was of the view that the current monetary policy stance was appropriate, and accordingly, the Monetary Board decided to maintain the Repurchase rate and the Reverse Repurchase rate of the Central Bank unchanged at 7.50 per cent and 9.50 per cent, respectively. The date for the release of the next regular statement on monetary policy will be announced in due course.

Вам также может понравиться

- Thetford c250 InstallationДокумент19 страницThetford c250 InstallationCatalin Bejan100% (1)

- Press 20130117eДокумент2 страницыPress 20130117eran2013Оценок пока нет

- Road MapДокумент7 страницRoad Mapran2013Оценок пока нет

- State Bank of Pakistan: Monetary Policy DecisionДокумент2 страницыState Bank of Pakistan: Monetary Policy DecisionSumeet MetaiОценок пока нет

- Bangladesh Bank Monetary Policy For FY 2012Документ13 страницBangladesh Bank Monetary Policy For FY 2012Nurul Mostofa100% (1)

- Press 20140408eaДокумент7 страницPress 20140408eaRandora LkОценок пока нет

- Press Release: Communications DepartmentДокумент2 страницыPress Release: Communications DepartmentRandora LkОценок пока нет

- Policy 2013Документ13 страницPolicy 2013IPS Sri LankaОценок пока нет

- Monetary Policy Statement: State Bank of PakistanДокумент42 страницыMonetary Policy Statement: State Bank of PakistanScorpian MouniehОценок пока нет

- UBL Financial StatementsДокумент23 страницыUBL Financial StatementsUsmAn MajeedОценок пока нет

- Press Release: Communications DepartmentДокумент4 страницыPress Release: Communications DepartmentRandora LkОценок пока нет

- Monetary Policy Statement: State Bank of PakistanДокумент32 страницыMonetary Policy Statement: State Bank of Pakistanbenicepk1329Оценок пока нет

- MPS Oct 2012 EngДокумент2 страницыMPS Oct 2012 EngQamar AftabОценок пока нет

- Prospects 2012Документ7 страницProspects 2012IPS Sri LankaОценок пока нет

- Assignment On:: Context of Monetary Policy of BangladeshДокумент8 страницAssignment On:: Context of Monetary Policy of BangladeshIbrahim KholilОценок пока нет

- Monetary Policy, Inflation and Liquidity Crisis: Bangladesh Economic UpdateДокумент17 страницMonetary Policy, Inflation and Liquidity Crisis: Bangladesh Economic UpdateMuhammad Hasan ParvajОценок пока нет

- Mar 282012 GseДокумент4 страницыMar 282012 GseAhmed NirobОценок пока нет

- MPS Apr 2012 EngДокумент3 страницыMPS Apr 2012 Engbeyond_ecstasyОценок пока нет

- BIMBSec - Economics - OPR at 2nd MPC Meeting 2012 - 20120312Документ3 страницыBIMBSec - Economics - OPR at 2nd MPC Meeting 2012 - 20120312Bimb SecОценок пока нет

- ICRA Macro and PolicyДокумент5 страницICRA Macro and PolicyVinit MehtaОценок пока нет

- Central Bank-Monetary Policy ReviewДокумент6 страницCentral Bank-Monetary Policy ReviewAda DeranaОценок пока нет

- Macroeconomic and Monetary Developments First Quarter Review 2013-14Документ3 страницыMacroeconomic and Monetary Developments First Quarter Review 2013-14anjan_debnathОценок пока нет

- Prepared For: Dr. Zaid Bakht, Professor, MBA Program North South UniversityДокумент11 страницPrepared For: Dr. Zaid Bakht, Professor, MBA Program North South UniversityTanjeemОценок пока нет

- MPC Press Release 22 September 2022Документ2 страницыMPC Press Release 22 September 2022Ebtsam MohamedОценок пока нет

- FixedIncome January 2012Документ3 страницыFixedIncome January 2012jayaram_mca83Оценок пока нет

- RBI Review of Economy Jan 2013Документ4 страницыRBI Review of Economy Jan 2013Amit MishraОценок пока нет

- Bank of CanadaДокумент1 страницаBank of CanadaZerohedgeОценок пока нет

- Press Release: Communications DepartmentДокумент3 страницыPress Release: Communications DepartmentRandora LkОценок пока нет

- Fag 3qcy2012ruДокумент6 страницFag 3qcy2012ruAngel BrokingОценок пока нет

- Burundi: Second Review Under The Extended Credit Facility-Debt Sustainability AnalysisДокумент16 страницBurundi: Second Review Under The Extended Credit Facility-Debt Sustainability AnalysisBharat SethОценок пока нет

- Press 20140321eДокумент3 страницыPress 20140321eRandora LkОценок пока нет

- Third Quarter Review of Monetary Policy 2012-13 - Statement by Dr. D. Subbarao, Governor, Reserve Bank of IndiaДокумент6 страницThird Quarter Review of Monetary Policy 2012-13 - Statement by Dr. D. Subbarao, Governor, Reserve Bank of IndiaNarayanan GopalacharyОценок пока нет

- RBIPolicy CRISIL 170912Документ4 страницыRBIPolicy CRISIL 170912Meenakshi MittalОценок пока нет

- Key Highlights:: Inflationary Pressures Overrides Downside Risks To GrowthДокумент6 страницKey Highlights:: Inflationary Pressures Overrides Downside Risks To Growthsamyak_jain_8Оценок пока нет

- Red Jun 2014Документ38 страницRed Jun 2014hrnanaОценок пока нет

- MPS-Jul-2014-Eng 1 PDFДокумент41 страницаMPS-Jul-2014-Eng 1 PDFzahidmushtaq13Оценок пока нет

- RBI BulletinДокумент118 страницRBI Bulletintheresa.painter100% (1)

- Monetary Policy Guidelines For 2020 - 2022: MoscowДокумент135 страницMonetary Policy Guidelines For 2020 - 2022: MoscowMary Femina KSОценок пока нет

- January-June: Bangladesh BankДокумент14 страницJanuary-June: Bangladesh BankzsadiqueОценок пока нет

- India Monetary Policy Review 17 June 2013Документ3 страницыIndia Monetary Policy Review 17 June 2013Jhunjhunwalas Digital Finance & Business Info LibraryОценок пока нет

- Monetary Policy of PakistanДокумент8 страницMonetary Policy of PakistanWajeeha HasnainОценок пока нет

- Budget PublicationДокумент50 страницBudget PublicationAmit RajputОценок пока нет

- Acroeconomic Cenario: Source: Please See AnnexureДокумент2 страницыAcroeconomic Cenario: Source: Please See AnnexureehsankabirОценок пока нет

- Slide - 1: 2009. Between March 2010 and October 2011 The Reserve Bank Raised Its Policy RepoДокумент3 страницыSlide - 1: 2009. Between March 2010 and October 2011 The Reserve Bank Raised Its Policy RepoGarrima ParakhОценок пока нет

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigДокумент9 страницMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadОценок пока нет

- Fatur Mulya Muis - 29319068 - Entree17 - Business Economics (Individual Task)Документ1 страницаFatur Mulya Muis - 29319068 - Entree17 - Business Economics (Individual Task)Fatur Mulya MuisОценок пока нет

- DirectorДокумент49 страницDirectorrohitkoliОценок пока нет

- Fiscal PolicyДокумент11 страницFiscal PolicySatheesh ArumugamОценок пока нет

- NH-2022-Indonesia Market-Outlook-Final PDFДокумент82 страницыNH-2022-Indonesia Market-Outlook-Final PDFUdan RMОценок пока нет

- Monetary and Fiscal Policies in IndiaДокумент5 страницMonetary and Fiscal Policies in Indiarakeshgopinath4999Оценок пока нет

- Budget Impact - MacroДокумент3 страницыBudget Impact - MacroAkhilesh PanwarОценок пока нет

- Cps Nep 2013 2017 Ea SummaryДокумент7 страницCps Nep 2013 2017 Ea Summaryakyadav123Оценок пока нет

- RBI Monetary Policy 17.04.2012Документ6 страницRBI Monetary Policy 17.04.2012avcmanagementОценок пока нет

- Highligts of Monetary PolicyДокумент7 страницHighligts of Monetary PolicySandesh KhatiwadaОценок пока нет

- U BL Financial Statements Ann DecДокумент122 страницыU BL Financial Statements Ann DecRehan NasirОценок пока нет

- Indian Banks Note (Revised)Документ19 страницIndian Banks Note (Revised)zainab bharmalОценок пока нет

- State Bank of Pakistan Monetary Policy DecisionДокумент2 страницыState Bank of Pakistan Monetary Policy DecisionShahid JavaidОценок пока нет

- Monetary Policy - July-December, 2018Документ3 страницыMonetary Policy - July-December, 2018মোঃ আশিকুর রহমান শিবলুОценок пока нет

- Daily Exchange Rates-CommiДокумент1 страницаDaily Exchange Rates-Commiran2013Оценок пока нет

- Current T Bill Press Release 25-03-2013Документ1 страницаCurrent T Bill Press Release 25-03-2013Randora LkОценок пока нет

- Daily Trade Journal - 06.03Документ7 страницDaily Trade Journal - 06.03ran2013Оценок пока нет

- Daily Exchange Rates-Commi 28Документ1 страницаDaily Exchange Rates-Commi 28ran2013Оценок пока нет

- Daily Trade Journal - 04.03Документ7 страницDaily Trade Journal - 04.03ran2013Оценок пока нет

- Daily Exchange Rates-Commi 28Документ1 страницаDaily Exchange Rates-Commi 28ran2013Оценок пока нет

- Daily Trade Journal - 05.03Документ7 страницDaily Trade Journal - 05.03ran2013Оценок пока нет

- Daily Exchange Rates-Commi 28Документ1 страницаDaily Exchange Rates-Commi 28ran2013Оценок пока нет

- Daily Exchange Rates-20092011Документ1 страницаDaily Exchange Rates-20092011LBTodayОценок пока нет

- Daily Trade Journal - 01.03Документ7 страницDaily Trade Journal - 01.03ran2013Оценок пока нет

- Daily Trade Journal - 28.02Документ13 страницDaily Trade Journal - 28.02ran2013Оценок пока нет

- Daily Exchange Rates-Commi 28Документ1 страницаDaily Exchange Rates-Commi 28ran2013Оценок пока нет

- Legal OpinionДокумент63 страницыLegal Opinionran2013Оценок пока нет

- NBF Sector - February 2013Документ27 страницNBF Sector - February 2013ran2013Оценок пока нет

- CCPI Feb 2013Документ2 страницыCCPI Feb 2013ran2013Оценок пока нет

- Daily Trade Journal - 26.02Документ13 страницDaily Trade Journal - 26.02ran2013Оценок пока нет

- Daily Trade Journal - 27.02Документ12 страницDaily Trade Journal - 27.02ran2013Оценок пока нет

- Daily Trade Journal - 21.02Документ12 страницDaily Trade Journal - 21.02ran2013Оценок пока нет

- Daily Exchange Rates-20092011Документ1 страницаDaily Exchange Rates-20092011LBTodayОценок пока нет

- Daily Trade Journal - 20.02Документ12 страницDaily Trade Journal - 20.02ran2013Оценок пока нет

- CAL UPI Introduction - 20 Feb 2013Документ8 страницCAL UPI Introduction - 20 Feb 2013ran2013Оценок пока нет

- Daily Trade Journal - 22.02Документ12 страницDaily Trade Journal - 22.02ran2013Оценок пока нет

- DIAL-Earnings Note 2012-Faster and Cheaper Data-BUYДокумент6 страницDIAL-Earnings Note 2012-Faster and Cheaper Data-BUYran2013Оценок пока нет

- Results Update - Dec 2012 19.02Документ14 страницResults Update - Dec 2012 19.02ran2013Оценок пока нет

- Daily Trade Journal - 19.02Документ13 страницDaily Trade Journal - 19.02ran2013Оценок пока нет

- Daily Exchange Rates-20092011Документ1 страницаDaily Exchange Rates-20092011LBTodayОценок пока нет

- Current T Bill Press Release 25-03-2013Документ1 страницаCurrent T Bill Press Release 25-03-2013Randora LkОценок пока нет

- Results Update - Dec 2012 20.02Документ15 страницResults Update - Dec 2012 20.02ran2013Оценок пока нет

- Plantations Sector 19.02Документ3 страницыPlantations Sector 19.02ran2013Оценок пока нет

- Daily Exchange Rates-20092011Документ1 страницаDaily Exchange Rates-20092011LBTodayОценок пока нет

- Progress Test-The 7-Th GradeДокумент2 страницыProgress Test-The 7-Th GradebabystelutaОценок пока нет

- Chem 152 Lab ReportДокумент21 страницаChem 152 Lab Reportapi-643022375Оценок пока нет

- Under The SHODH Program For ResearchДокумент3 страницыUnder The SHODH Program For ResearchSurya ShuklaОценок пока нет

- K. Subramanya - Engineering Hy-Hill Education (India) (2009) 76Документ1 страницаK. Subramanya - Engineering Hy-Hill Education (India) (2009) 76ramsinghmahatОценок пока нет

- TM GUIDE (Basic Competencies)Документ19 страницTM GUIDE (Basic Competencies)Emelito T. ColentumОценок пока нет

- Content and Context Analysis of Selected Primary SourccesДокумент3 страницыContent and Context Analysis of Selected Primary SourccesToshi CodmОценок пока нет

- Facility Layout Case StudyДокумент8 страницFacility Layout Case StudyHitesh SinglaОценок пока нет

- Bleeding Disorders in Pregnancy: Table 1Документ7 страницBleeding Disorders in Pregnancy: Table 1KharismaNisaОценок пока нет

- Student Exploration: Magnetism (Find Gizmo Icon On Eclass)Документ4 страницыStudent Exploration: Magnetism (Find Gizmo Icon On Eclass)Abdel Majeed Tuffaha0% (1)

- Business English IДокумент8 страницBusiness English ILarbi Ben TamaОценок пока нет

- Sullair VARIABLE SPEED - 1800-2200-1800V-1809V-2200V-25-30HPДокумент70 страницSullair VARIABLE SPEED - 1800-2200-1800V-1809V-2200V-25-30HPJose MontielОценок пока нет

- Historic Trial of Ali Brothers and Shankaracharya-1921Документ276 страницHistoric Trial of Ali Brothers and Shankaracharya-1921Sampath Bulusu100% (3)

- Commissioning 1. Commissioning: ES200 EasyДокумент4 страницыCommissioning 1. Commissioning: ES200 EasyMamdoh EshahatОценок пока нет

- Competency #14 Ay 2022-2023 Social StudiesДокумент22 страницыCompetency #14 Ay 2022-2023 Social StudiesCharis RebanalОценок пока нет

- Performace Task 2 Electric Field LinesДокумент31 страницаPerformace Task 2 Electric Field LinesStephanie Nichole Ian CasemОценок пока нет

- Egalitarianism As UK: Source: Hofstede Insights, 2021Документ4 страницыEgalitarianism As UK: Source: Hofstede Insights, 2021kamalpreet kaurОценок пока нет

- Hunk (Aakc) - (Nov 2015)Документ68 страницHunk (Aakc) - (Nov 2015)Russell RiderОценок пока нет

- Fluid Management in NicuДокумент56 страницFluid Management in NicuG Venkatesh100% (2)

- Bashar CitateДокумент7 страницBashar CitateCristiana ProtopopescuОценок пока нет

- Pyrethroids April 11Документ15 страницPyrethroids April 11MadhumithaОценок пока нет

- Chinese MedicineДокумент16 страницChinese MedicineTrisОценок пока нет

- Jerehy's ReportДокумент65 страницJerehy's Reportkupetroleum3Оценок пока нет

- Buzan, Barry - Security, The State, The 'New World Order' & BeyondДокумент15 страницBuzan, Barry - Security, The State, The 'New World Order' & Beyondyossara26100% (3)

- Sector San Juan Guidance For RepoweringДокумент12 страницSector San Juan Guidance For RepoweringTroy IveyОценок пока нет

- AP1 Q4 Ip9 v.02Документ4 страницыAP1 Q4 Ip9 v.02Fayenah Pacasum Mindalano100% (1)

- Itf EssayДокумент18 страницItf EssayTharshiОценок пока нет

- Free Vibration of SDOFДокумент2 страницыFree Vibration of SDOFjajajajОценок пока нет

- Text Ranslation and TradicitonДокумент283 страницыText Ranslation and TradicitonSCAF55100% (4)

- Daftar PustakaДокумент1 страницаDaftar PustakaUlul Azmi Rumalutur NeinaОценок пока нет