Академический Документы

Профессиональный Документы

Культура Документы

Nairobi Star 27th Jan 2009

Загружено:

SymbioticИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Nairobi Star 27th Jan 2009

Загружено:

SymbioticАвторское право:

Доступные форматы

16 NAIROBI STAR Tuesday, 27 January 2009

STAR BIZ

Practical tips on handling

personal finance

NEWS YOU CAN USE, EVERY DAY.

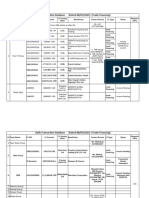

▼ FOREX Exchange Rates

CURRENCY MEAN BUY SELL

Stage set for new bank mergers

US DOLLAR 79.7167 79.6500 79.7833 BY JAMES MBUGUA Sh1 billion by 2012. The move follows the “return” on their sav-

STG POUND 108.5179 108.4191 108.6167 “All institutions whose passage of the Finance ings accounts. By custom,

KENYA’S 43-bank core capital is currently Bill 2008 and subsequent Islamic banks do not pay

EURO 103.0086 102.9071 103.1100 landscape may witness below Sh1bn should sub- signing into law by Presi- interest on savings.

SA RAND 7.8265 7.8104 7.8427 a sea-change with likely mit to the Central Bank of dent Kibaki on December Banks will from now

consolidations and merg- Kenya, a time bound core 15. make their licence renewal

KES / USHS 25.2536 25.1307 25.3765

ers after the CBK for- capital build up plan by Other regulations that applications within three

KES / TSHS 16.7003 16.6185 16.7820 mally published guidelines 1st March 2009,” CBK in are now codified into law months before the expiry

AE DIRHAM 21.4359 21.4110 21.4608 requiring all banks to be a statement posted on its include the requireament of their current licences on

capitalised to the tune of website said yesterday. by Islamic banks to pay a December 31.

JPY(100) 86.7108 86.6104 86.8112

WHY MOI NOTES

IND RUPEE 1.6215 1.6195 1.6234

CHINESE YUAN 11.5178

Source: Commercial banks

11.5051 11.5306 ▼ BRIEFS

Kenya gets US

STOCKS

BIGGEST MOVERS ARE BACK IN tourism boost

Two prominent American

CIRCULATION

SHS

personalities have endorsed

Kenya as the next major

CROWN BERGER 6.67 24.00 destination for American

BAMBURI CEMENT 3.20 154.80 tourists. Former Congress-

man of the State of Georgia,

CFC STANBIC 2.68 57.50 Andrew Young and Bishop

NBK 1.82 39.20 BY JAMES MBUGUA Eddie Long of the New

Birth Missionary Baptist

ATHI RIVER MINING 1.53 92.90

THE reappearance of cur- Church, in Atlanta, have

rency notes bearing former both pledged to visit Kenya

BIGGEST LOSERS President Moi’s image is

nothing to worry about, the

this year to support tour-

ism. The two met separately

SHS Central Bank has assured. with tourism Minister

The return of notes bear- Najib Balala in Washington

PAN AFRICA -8.62 53.00

ing the former president’s DC where he is leading

OLYMPIA CAPITAL -4.17 9.20 portrait has raised specu- the tourism marketing

lation that CBK was being campaign in the US. The

TPS EA SERENA -3.92 49.00

forced to go back to the American market has a

COOPERATIVE BANK -3.41 8.50 archives to sustain the na- huge potential for Kenya.

KENYA OIL -3.19 57.60 tion’s cash circulation.

The notes started disap-

pearing in 2003 when notes

bearing former President Shilling stable

Bread firm profits Kenyatta’s portrait made a

comeback.

Responding to queries,

BACK IN ACTION: CBK forced to sustain cash circulation versus the dollar

rise ahead of IPO the director, Currency Op-

erations and Branch ad-

ministration at the Central

have been brought back to

meet a shortfall, especially

in view of the scandal that

The reserve bank is man-

dated by law to control

the circulation of money

THE Kenya shilling was

unchanged against the

dollar on Monday as

BY PETER KIRAGU months reached Sh463 Bank, James Teko Lopoye- hit the CBK over a decision in the country by issuing banks assessed the market

million compared to Sh616 tum, said yesterday that to grant currency printer, and withdrawing currency after highly erratic trade

DPL Festive, the small million recorded in the people should not read too Thomas De la Rue, a con- notes as and when it is ap- in the previous session

bread maker that is prepar- full year ending 31 March much into the reappearance tract to print bank notes at propriate. following the appoint-

ing to issue an IPO, has 2008. of the notes as they were what was considered an ex- Sometime in 2007, the ment of a new finance

announced that its pre-tax DPL chief executive still legal tender. orbitant rate. bank decided to move into minister. Banks traded the

profit rose to Sh62 mil- Dipesh Shah said the results “We have never demon- “Any money that we new generation currency shilling at 79.75/85 per

lion in the six months to have been achieved despite etised any notes. At the time have issued before has not notes with added security dollar unchanged from

September 2008. the challenges experienced, when we introduced the been demonetised. They features to thwart fraud Friday’s close. The unit

This represents a 225 including the post-election portrait of the former presi- will circulate in the system and counterfeiting of notes. traded in a 79.65-80.00

per cent rise compared to upheavals and the dwin- dent (Kenyatta) we did not so long as they are clean,” “We only issue new bank band. Last Friday, the

Sh19 million recorded in dling disposable incomes demonetise these notes,” said Teko. “We are not re- notes as a top up,” he said shilling saw volatile trade

the previous year. This is a among consumers. said Teko. leasing anything new. They adding that CBK would as some traders panicked

major boost in its finan- The firm’s listing at the Teko dismissed sugges- (Moi bank notes) were just print new notes if it deemed after the naming of Uhuru

cial outlook as it awaits Nairobi Stock Exchange is tions that the money may held.” it necessary. as new finance minister.

approval of its impending awaiting approval by the

initial public offer. market regulators. It wants

Revenues for the six to raise Sh500 million.

IMF warns Africa over tough times

Did you invest in the CO-OP shares? POLICYMAKERS in developing countries that and export revenue. cautions that there is no

Keep track of your investment with real sub-Saharan Africa should had at first appeared resil- “Economic growth in the guarantee that this resil-

prepare for tough times ient to the downturn. countries of sub-Saharan ience can be maintained

time prices sent directly to your mobile. ahead, with no guarantee The IMF said in a state- Africa has been surpris- and that this will require a

SMS "COOP" to 5544. To get updates on that the resilience shown ment on its website higher ingly resilient in the face of determined response from

companies you own shares, SMS the so far to global economic food and fuel costs had put the latest shocks hitting the the economic policymak-

company name i.e. KCB to 5544. CO-OP shocks will continue, the pressure on inflation and global economy, notably ers, governments as well as

to 5544 International Monetary

Fund said yesterday.

external balances in sub-

Saharan Africa, and the

the food and fuel price

increases and financial

central banks.”

IMF Africa Director An-

Major world economies deepening financial turmoil market turbulence,” the toinette Monsio Sayeh said

are in recession, stung by a that has hit world growth IMF said in a statement. policymakers should try

global credit squeeze, and could knock growth “However, the Inter- maintain economic stability

BE THE FIRST TO KNOW

growth is now slowing in through lower capital flows national Monetary Fund while protecting the poor.

Вам также может понравиться

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankДокумент1 страницаTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorОценок пока нет

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaДокумент1 страницаThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorОценок пока нет

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomДокумент1 страницаThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorОценок пока нет

- Estatement-202306 20230720092822Документ1 страницаEstatement-202306 20230720092822Rakhib AwapОценок пока нет

- Stockquotes 07172017Документ9 страницStockquotes 07172017Alexander AbonadoОценок пока нет

- Commercial Law FAQsДокумент43 страницыCommercial Law FAQsJanine GarciaОценок пока нет

- 13th April, 2021Документ6 страниц13th April, 2021gohoji4169Оценок пока нет

- Stockquotes 08162017 PDFДокумент9 страницStockquotes 08162017 PDFEdgar LayОценок пока нет

- 63.qatari Law Batters Non-Islamic BanksДокумент12 страниц63.qatari Law Batters Non-Islamic BanksWana MaliОценок пока нет

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldДокумент1 страницаTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorОценок пока нет

- The Largest 100 Credit UnionsДокумент6 страницThe Largest 100 Credit Unionseduluz1976Оценок пока нет

- TheEnvironmentalFactorFA-10-05 Accounts For December 2009Документ18 страницTheEnvironmentalFactorFA-10-05 Accounts For December 2009uncleadolphОценок пока нет

- Market Update 17th Aug 2018Документ1 страницаMarket Update 17th Aug 2018Anonymous FnM14a0Оценок пока нет

- Loida Page 2Документ3 страницыLoida Page 2Aina HermoОценок пока нет

- 25th April, 2021Документ8 страниц25th April, 2021gohoji4169Оценок пока нет

- Bank Statement Bulan 12Документ9 страницBank Statement Bulan 12Yun MiliОценок пока нет

- Stockquotes 08152017 PDFДокумент9 страницStockquotes 08152017 PDFEdgar LayОценок пока нет

- The Philippine Stock Exchange, Inc. Daily Quotation Report: December 24, 2021Документ11 страницThe Philippine Stock Exchange, Inc. Daily Quotation Report: December 24, 2021craftersxОценок пока нет

- ASTL-Sched 10.14.21Документ37 страницASTL-Sched 10.14.21Guile Gabriel AlogОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018Документ9 страницThe Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018hezeОценок пока нет

- Liban AnalyseДокумент12 страницLiban AnalyseSatish ReddyОценок пока нет

- Annex: Table A.51 Islamic Banking System: Financing ActivitiesДокумент1 страницаAnnex: Table A.51 Islamic Banking System: Financing ActivitiesAli FarhanОценок пока нет

- The Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021Документ11 страницThe Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021craftersxОценок пока нет

- Estatement-202311 20240118082649Документ3 страницыEstatement-202311 20240118082649jooamir70Оценок пока нет

- 2021-2022 PT Jayatama (Job Sheet)Документ32 страницы2021-2022 PT Jayatama (Job Sheet)rila yantiОценок пока нет

- Statement Date Account No Branch: 31/01/23 1 OF 1 11022024304855 Miri Tarikh Penyata Halaman Nombor Akaun CawanganДокумент1 страницаStatement Date Account No Branch: 31/01/23 1 OF 1 11022024304855 Miri Tarikh Penyata Halaman Nombor Akaun Cawangankanjou zokuОценок пока нет

- The Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022Документ11 страницThe Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022craftersxОценок пока нет

- Thesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeДокумент1 страницаThesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeImpulsive collectorОценок пока нет

- Paycor Stadium Renovation PresentationДокумент45 страницPaycor Stadium Renovation PresentationWVXU NewsОценок пока нет

- RBI OrderДокумент1 страницаRBI Orderbabbles9Оценок пока нет

- StatementДокумент3 страницыStatementamyra izzatiОценок пока нет

- Bri-Success Stories Micro Banking in Asia-Haru KoesmahargyoДокумент27 страницBri-Success Stories Micro Banking in Asia-Haru KoesmahargyoIlham AgustioОценок пока нет

- Upcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingДокумент8 страницUpcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingJames FranklinОценок пока нет

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Документ11 страницThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxОценок пока нет

- 8th MAy, 2021Документ7 страниц8th MAy, 2021gohoji4169Оценок пока нет

- TheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaДокумент1 страницаTheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaImpulsive collectorОценок пока нет

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementДокумент1 страницаThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorОценок пока нет

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueДокумент1 страницаTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorОценок пока нет

- Aqib CCДокумент1 страницаAqib CCSayed Ariful AshrafОценок пока нет

- Estatement-202211 20221226162232Документ5 страницEstatement-202211 20221226162232Ain NatasyaОценок пока нет

- NIFTY Bank Dec2021Документ1 страницаNIFTY Bank Dec2021shivam3119Оценок пока нет

- Consolidated Trial Balance: Summery/Details: DДокумент37 страницConsolidated Trial Balance: Summery/Details: Djasim khanОценок пока нет

- Wachov) A: Dec-14-2006 From-Wachovia Governkent 267-321-1649 1-945Документ8 страницWachov) A: Dec-14-2006 From-Wachovia Governkent 267-321-1649 1-945LancasterFirstОценок пока нет

- Kunci Jawaban CV RaunДокумент37 страницKunci Jawaban CV RaunDela SafitriОценок пока нет

- Vineet TibrewalДокумент21 страницаVineet Tibrewalvineet tibrewalОценок пока нет

- TD Bank Statement - Scott W Springer#2Документ2 страницыTD Bank Statement - Scott W Springer#2fehijan689Оценок пока нет

- Market Update 26th February 2018Документ1 страницаMarket Update 26th February 2018Anonymous iFZbkNwОценок пока нет

- BNI Mobile Banking: Histori TransaksiДокумент1 страницаBNI Mobile Banking: Histori Transaksilutfi desiОценок пока нет

- Origin of BankingДокумент6 страницOrigin of BankingamaznsОценок пока нет

- Sbi Canada BankДокумент1 страницаSbi Canada BankBeautiful PaccoОценок пока нет

- Liquidation ReportДокумент21 страницаLiquidation Reportemdi19Оценок пока нет

- Rbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/IndiaepapersДокумент14 страницRbi Gives Nbfcs Room To Hold On To Realty Hopes: Telegram T.Me/Indiaepapersaashmeen25Оценок пока нет

- Thesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesДокумент1 страницаThesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesImpulsive collectorОценок пока нет

- BOB - Bank of Baroda Plans To Step Up Corporate LoansДокумент5 страницBOB - Bank of Baroda Plans To Step Up Corporate LoansStarОценок пока нет

- Cy 22 Return OpenДокумент20 страницCy 22 Return Openhamadashraf.swhccОценок пока нет

- The Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020Документ9 страницThe Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020craftersxОценок пока нет

- Wallstreetjournal 20170801 TheWallStreetJournal PDFДокумент30 страницWallstreetjournal 20170801 TheWallStreetJournal PDFVijačni kompresori- Prodaja i servisОценок пока нет

- FA-10-01 Accounts For November 2009Документ17 страницFA-10-01 Accounts For November 2009uncleadolphОценок пока нет

- 2023 04 27 PH S BankingДокумент5 страниц2023 04 27 PH S BankingEugene M. BijeОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009Symbiotic100% (1)

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009 CoverДокумент1 страницаNairobi Star 27th Jan 2009 CoverSymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009Symbiotic100% (1)

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Nairobi Star 27th Jan 2009Документ1 страницаNairobi Star 27th Jan 2009SymbioticОценок пока нет

- Statement PDFДокумент4 страницыStatement PDFSanta Dela Cruz NaluzОценок пока нет

- Ucsp W7Документ7 страницUcsp W7prancineОценок пока нет

- BOQ Video Conference EquipmentsДокумент10 страницBOQ Video Conference Equipmentsamhosny64Оценок пока нет

- Thackwell v. BarclaysДокумент12 страницThackwell v. BarclaysJayant SinghОценок пока нет

- Dishonest of ChequeДокумент14 страницDishonest of ChequeRaghuveer Rajput100% (1)

- INFOLINK UNIVERSITY COLLEG1 Reaserch Paper ProposlДокумент7 страницINFOLINK UNIVERSITY COLLEG1 Reaserch Paper ProposlGulilat lemi100% (1)

- As Per Nepal Rastra BankДокумент2 страницыAs Per Nepal Rastra BankMandil BhandariОценок пока нет

- Turnkey Case StudyДокумент20 страницTurnkey Case Studyharsh kumarОценок пока нет

- Art England Under The Heel of The JewДокумент24 страницыArt England Under The Heel of The JewAnonymous gdJiDHОценок пока нет

- Currency Chest RavishДокумент14 страницCurrency Chest Ravishravish419Оценок пока нет

- Customers' Satisfaction Towards Automated Teller Machine: ManagementДокумент4 страницыCustomers' Satisfaction Towards Automated Teller Machine: ManagementmohitОценок пока нет

- Extending Private Banking: C P ChandrasekharДокумент2 страницыExtending Private Banking: C P ChandrasekharSP SINGHОценок пока нет

- MIS in Service NsectorsДокумент40 страницMIS in Service NsectorsSourav Kumar ShawОценок пока нет

- RFBT - Chapter 5 - Philippine Deposit Insurance CorporationДокумент6 страницRFBT - Chapter 5 - Philippine Deposit Insurance Corporationlaythejoylunas21Оценок пока нет

- Customers Satisfaction Towards CRM Practices Adhered by Public Sector Banks in E-Banking EraДокумент6 страницCustomers Satisfaction Towards CRM Practices Adhered by Public Sector Banks in E-Banking EraIAEME PublicationОценок пока нет

- 025457167Документ307 страниц025457167MOHAMMAD AL-QASWIN ASAОценок пока нет

- PDFДокумент2 страницыPDFSunil RameshОценок пока нет

- Corporate GovernanceДокумент30 страницCorporate GovernanceMehdi BouaniaОценок пока нет

- Money and BankingДокумент7 страницMoney and Bankingaamiralishiasbackup1Оценок пока нет

- Comparison Between MY V NZLДокумент6 страницComparison Between MY V NZLSerena JamesОценок пока нет

- National State Bank, Elizabeth, N. J. v. LongДокумент9 страницNational State Bank, Elizabeth, N. J. v. LongSamuel RichardsonОценок пока нет

- Credit DIGEST - Producers Bank Vs CAДокумент2 страницыCredit DIGEST - Producers Bank Vs CACari Mangalindan Macaalay100% (1)

- Impact of Rightsizing On Shareholders Value in Micro Finance Banks in Lagos State, NigeriaДокумент10 страницImpact of Rightsizing On Shareholders Value in Micro Finance Banks in Lagos State, NigeriaIjahss JournalОценок пока нет

- Ibps Po Mains Cracker - 2016Документ51 страницаIbps Po Mains Cracker - 2016Vimal PokalОценок пока нет

- Bank Transfer Receipt TemplateДокумент1 страницаBank Transfer Receipt TemplateFerdee FerdОценок пока нет

- A Segregation of Duties Case StudyДокумент20 страницA Segregation of Duties Case StudyHazra Sabbir HossainОценок пока нет

- Credit Statement (Form 26AS) OnlineДокумент8 страницCredit Statement (Form 26AS) Onlinemevrick_guyОценок пока нет

- 04 Priyanka Biswas (PW) TYBMSДокумент91 страница04 Priyanka Biswas (PW) TYBMSmk khaniОценок пока нет

- Fair MoneyДокумент223 страницыFair MoneyCoy HopperОценок пока нет

- Gateka Ella SandraДокумент119 страницGateka Ella SandrashjahsjanshaОценок пока нет