Академический Документы

Профессиональный Документы

Культура Документы

Gujarat Gas Company Limited (GGCL) Key Financial Ratios

Загружено:

Ajinkya KateИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gujarat Gas Company Limited (GGCL) Key Financial Ratios

Загружено:

Ajinkya KateАвторское право:

Доступные форматы

Gujarat Gas Company Limited (GGCL) About GGCL GGCL holds the distinction of being Indias largest private

sector player in the natural gas transmission and distribution business. Incorporated in 1980 with the primary objective to procure, distribute and utilize natural gas and allied technology GGCL pioneered the concept of compressed natural gas distribution to the industrial, commercial and domestic customers. Today it supplies gas to more than 349296 domestic, industrial and commercial customers and serves over 175757 compressed natural gas users. The corporate office of GGCL is in Ahmedabad and its area of operations is spread in the districts of Surat and Bharuch. In 1989 company began its operations in the industrial hotspot of Ankaleshwar. In 1991, GGCL expanded its operations to surat. The first CNG station was setup in Surat. The company has been a part of BG group portfolio since 1997. BG group has a 66% controlling stake in GGCL. FIs, FIIs and public hold the remaining 34% stake. Profitability Ratios of GGCL: 2007 Operating Profit Margin (%) Gross Profit Margin (%) Net Profit Margin (%) Return On Capital Employed (%) 21.38 23.04 13.10 42.68 2008 19.17 16.05 12.01 33.25 2009 20.26 17.01 12.11 34.63 2010 22.83 19.95 13.86 46.46 2011 16.25 14.37 11.15 49.47

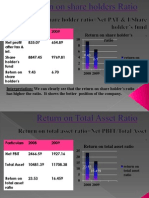

Return On Net Worth (%) 28.25 25.08 23.58 31.54 35.88 Operating profit margin is a ratio of EBIT to sales revenue, from above table it can be observed that in 2008 and 2011 it has been decreased. This is because the operating profit is decreased in those years. In 2011 it decreased sharply because of a decrease in the operating profit, and the net sales hardly increased from

30.22% to 30.87%.This might be because of the increase in operating expenses (15%) especially cost of raw material in 2011. Gross profit margin is also observed to be decreased as the variable cost for producing a product is observed to be increased(13% ) in 2011 and (7%) in 08. Net profit margin ratio has also observed to be followed the same trend, but though here both the net profit and net sales are increasing the later is increasing in more proportion to the former. ROCE initially observed to be deceased and then increased showing the capital structure that they have employed to increase their operating profit and Return on net worth decreased in first 3 years because of the increase in capital inflow through equity share capital as compared to the increase in PAT. Liquidity and solvency ratios: 2007 Current Ratio Quick Ratio Debt Equity Ratio Long Term Debt Equity Ratio 0.649 0.66 0.03 0.03 2008 0.71 0.68 0.02 0.02 2009 0.66 0.63 0.02 0.02 2010 0.64 0.62 0.02 0.02 2011 0.64 0.63 0.02 0.02

The current ratio observed to be decreased from 08 because of the 15% increase in current liabilities than that of 10% increase in current assets in 09 and its also less than the standard current ratio (1:1) showing company is less capable of paying its short term obligations. Quick ratio is also observed to follow the same trend wherein even after reducing the inventory which showed a sizeable increase, the liability side is more indicating company is relying on other means than profit to meet its current financial obligations and facing problems in paying bills on time.

Debt to equity ratio and long term debt ratio are very miniscule because the company is hardly making the use of long term debt for financing their operations. Debt coverage ratios: 2007 2008 2009 2010 2011

Interest Coverage 1297.93 2088.84 1921.42 839.75 2588.36 Total Debt to Owners Fund 0.03 0.02 0.02 0.02 0.02 Interest coverage ratio is observed to be decreased sharply in 10 because the interest payable is increased in proportion to its EBIT. In 11 however it is increased because of increase in operating profit showing a good position. Debt to owners fund ratio is decreasing showing company is relying more on equity for its financing purpose. Cash flow indicators: 2007 2008 2009 2010 2011

Dividend Payout Ratio 14.67 14.38 68.84 69.49 120.26 Earning Retention Ratio 85.55 85.51 31.34 30.49 25.61 Earnings Per Share 24.64 24.60 13.57 20.09 21.27 Dividend payout ratio is increasing showing the Company is increasing the percentage of the dividend paid to their shareholders out of total net income over the years. In 11 it is suddenly increased showing the industry is matured and there is a little room for growth of the industry and paying higher dividends is the best use of their profits. EPS is less in 2009 because at that point in time % of number of shares issued was much higher (nearly double from the previous year) than the % increase in their profit after tax (hardly 13%).

Вам также может понравиться

- Series 1: 1. Profit Margin RatioДокумент10 страницSeries 1: 1. Profit Margin RatioPooja WadhwaniОценок пока нет

- Financial Analysis of Indigo Airlines From Lender's PerspectiveДокумент12 страницFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Документ40 страницStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamОценок пока нет

- Understanding Financial Ratios of Top FMCG CompaniesДокумент15 страницUnderstanding Financial Ratios of Top FMCG CompaniesVivek MaheshwaryОценок пока нет

- Asyad Holding Company Balance Sheets and Income Statements 2007-2010Документ9 страницAsyad Holding Company Balance Sheets and Income Statements 2007-2010shawktОценок пока нет

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsДокумент16 страницSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991Оценок пока нет

- Financial Ratio AnalysisДокумент26 страницFinancial Ratio AnalysisMujtaba HassanОценок пока нет

- Ratio Analysis of Tata SteelДокумент11 страницRatio Analysis of Tata SteelUtkarsh GuptaОценок пока нет

- Financial Ratio AnalysisДокумент5 страницFinancial Ratio AnalysisIrin HaОценок пока нет

- Ratio Analysis of ITCДокумент22 страницыRatio Analysis of ITCDheeraj Girase100% (1)

- Financial Analysis of du Telecom Company UAEДокумент13 страницFinancial Analysis of du Telecom Company UAELokesh ThadhaniОценок пока нет

- Data Analysis and Interpretation Calculation and Interpretation of RatiosДокумент27 страницData Analysis and Interpretation Calculation and Interpretation of RatiosGGUULLSSHHAANNОценок пока нет

- Jatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghДокумент18 страницJatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghJatin JoharОценок пока нет

- Project Report FAM HULДокумент16 страницProject Report FAM HULSagar PanchalОценок пока нет

- Financial Analysis of OGDCLДокумент16 страницFinancial Analysis of OGDCLsehrish_sadaqat7873100% (1)

- Al NoorДокумент12 страницAl NoorRehmatullah Abdul AzizОценок пока нет

- Financial Analysis P&GДокумент10 страницFinancial Analysis P&Gsayko88Оценок пока нет

- Gul Ahmed ReportДокумент1 страницаGul Ahmed ReportfahadaijazОценок пока нет

- Financial Analysis - ITC - AsimBhawsinghka PDFДокумент13 страницFinancial Analysis - ITC - AsimBhawsinghka PDFAsim BhawsinghkaОценок пока нет

- FAC Thomas CookДокумент11 страницFAC Thomas CookAkshay UtkarshОценок пока нет

- SGT Vertical & Horizontal AnalysisДокумент11 страницSGT Vertical & Horizontal AnalysisHa LinhОценок пока нет

- Financial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedДокумент41 страницаFinancial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedGovindraj PrabhuОценок пока нет

- BLUESTAR ANNUAL REPORT ANALYSISДокумент16 страницBLUESTAR ANNUAL REPORT ANALYSISKunal NegiОценок пока нет

- Ratio AnalysisДокумент10 страницRatio AnalysisSandesha Weerasinghe0% (1)

- Liquidity and Profitability Ratios of Attock Petroleum 2010-2014Документ10 страницLiquidity and Profitability Ratios of Attock Petroleum 2010-2014Ali AmarОценок пока нет

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaДокумент24 страницыAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyОценок пока нет

- Draft f6r Jamuna OilДокумент4 страницыDraft f6r Jamuna Oilmukulful2008Оценок пока нет

- Financial AnalysisДокумент5 страницFinancial AnalysisAnalyn Joy TrinidadОценок пока нет

- Ratio Analysis DG Khan Cement CompanyДокумент6 страницRatio Analysis DG Khan Cement CompanysaleihasharifОценок пока нет

- PIDILITE INDUSTRIES FINANCIAL ANALYSISДокумент2 страницыPIDILITE INDUSTRIES FINANCIAL ANALYSISronaldweasley6Оценок пока нет

- Financial Statement Analysis Paper ExampleДокумент7 страницFinancial Statement Analysis Paper ExampleUsaid Khan100% (1)

- Vladi FAF Financial ReportДокумент4 страницыVladi FAF Financial ReportVladi DimitrovОценок пока нет

- Analyze Asset Turnover Ratios of KBC and FLCДокумент5 страницAnalyze Asset Turnover Ratios of KBC and FLCĐỗ ViệtОценок пока нет

- Ratio Analysis SeimensДокумент2 страницыRatio Analysis SeimensSarwat KhanОценок пока нет

- Goodyear Result UpdatedДокумент14 страницGoodyear Result UpdatedAngel BrokingОценок пока нет

- Abbott India: Performance HighlightsДокумент13 страницAbbott India: Performance HighlightsAngel BrokingОценок пока нет

- Company Profile Company Overview Caely Holding BerhadДокумент20 страницCompany Profile Company Overview Caely Holding BerhadAnonymous qnKORAm3KОценок пока нет

- A. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andДокумент28 страницA. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andYugendra Babu KОценок пока нет

- Analysis PsoДокумент3 страницыAnalysis PsoTrend SetterОценок пока нет

- Ratio Analysis FINALДокумент10 страницRatio Analysis FINALPuja SharmaОценок пока нет

- Company AnalysisДокумент20 страницCompany AnalysisRamazan BarbariОценок пока нет

- Inventory Turn Over Ratio Inventory Turnover Is A Showing How Many Times A Company's Inventory Is Sold andДокумент23 страницыInventory Turn Over Ratio Inventory Turnover Is A Showing How Many Times A Company's Inventory Is Sold andrajendranSelviОценок пока нет

- Days Sales Outstanding: Introduction To Business Finance Assignment No 1Документ10 страницDays Sales Outstanding: Introduction To Business Finance Assignment No 1Varisha AlamОценок пока нет

- Case Study - Star River Electronic LTDДокумент12 страницCase Study - Star River Electronic LTDNell Mizuno100% (2)

- Analysis of Annual Report - UnileverДокумент7 страницAnalysis of Annual Report - UnileverUmair KhizarОценок пока нет

- Common Size AnalysisДокумент5 страницCommon Size Analysissu2nil0% (2)

- Liquidity and Profitability Ratios for Adelaide BrightonДокумент5 страницLiquidity and Profitability Ratios for Adelaide BrightonAtul GirhotraОценок пока нет

- Financial Analysis ProtonДокумент9 страницFinancial Analysis Protonmoonernest100% (2)

- 2001 2002 2003 Liquidity RatioДокумент1 страница2001 2002 2003 Liquidity RatioChole LeeОценок пока нет

- ON Financial Analysis OF Infosys: Prepared By:-Shruti Patil (30) Ami ThakkarДокумент5 страницON Financial Analysis OF Infosys: Prepared By:-Shruti Patil (30) Ami ThakkarShruti PatilОценок пока нет

- Hero Motocorp LTD: Hum Mein Hain HeroДокумент22 страницыHero Motocorp LTD: Hum Mein Hain HeroSaurabh VermaОценок пока нет

- Eastern insurance ratio analysisДокумент16 страницEastern insurance ratio analysistaijulshadinОценок пока нет

- Abm Presentai0nДокумент9 страницAbm Presentai0nadnan_708nОценок пока нет

- Final Report On Attock - IbfДокумент25 страницFinal Report On Attock - IbfSanam Aamir0% (1)

- Blue Star Limited: Accounting Policies Followed by The CompanyДокумент8 страницBlue Star Limited: Accounting Policies Followed by The CompanyRitika SorengОценок пока нет

- Lucky Cement AnalysisДокумент6 страницLucky Cement AnalysisKhadija JawedОценок пока нет

- Ratio Analysis 2Документ15 страницRatio Analysis 2Azmira RoslanОценок пока нет

- Equity Ratio, Debt to Equity Ratio, Dividend Cover Ratio Analysis for Lucky Cement and Maple LeafДокумент3 страницыEquity Ratio, Debt to Equity Ratio, Dividend Cover Ratio Analysis for Lucky Cement and Maple LeafSalman EjazОценок пока нет

- Ratios: 0.95 0.78 0.76 0.66 0.72 0.52 0.48 0.45 0.34 0.38 Current Ratio Quick RatioДокумент2 страницыRatios: 0.95 0.78 0.76 0.66 0.72 0.52 0.48 0.45 0.34 0.38 Current Ratio Quick RatioAjinkya KateОценок пока нет

- Organizational Behaviour - FinalДокумент27 страницOrganizational Behaviour - FinalAjinkya KateОценок пока нет

- BS II ArticleДокумент3 страницыBS II ArticleAjinkya KateОценок пока нет

- Balance Score Card at PhilipsДокумент35 страницBalance Score Card at PhilipsAjinkya KateОценок пока нет

- OscarДокумент1 страницаOscarAjinkya KateОценок пока нет

- SCM - KrunalДокумент3 страницыSCM - KrunalAjinkya KateОценок пока нет

- SCM - KrunalДокумент3 страницыSCM - KrunalAjinkya KateОценок пока нет

- Mis 01 0443Документ13 страницMis 01 0443Ajinkya KateОценок пока нет

- Mis 01 0443Документ13 страницMis 01 0443Ajinkya KateОценок пока нет

- Mis 01 0443Документ13 страницMis 01 0443Ajinkya KateОценок пока нет

- Treating and Preventing Ear Infections in ChildrenДокумент4 страницыTreating and Preventing Ear Infections in ChildrenbehrangОценок пока нет

- Safety Toolbox Project ProposalДокумент33 страницыSafety Toolbox Project ProposalShaffizi Boboy100% (1)

- Rockaway Times 11-21-19Документ44 страницыRockaway Times 11-21-19Peter MahonОценок пока нет

- Honey Nut Baklava Filo Pastry TreatsДокумент2 страницыHoney Nut Baklava Filo Pastry TreatsiantperОценок пока нет

- The DrunktionaryДокумент239 страницThe DrunktionaryRed Rex 2015Оценок пока нет

- Police Constable - GK MCQsДокумент56 страницPolice Constable - GK MCQsSk Abdur RahmanОценок пока нет

- 1.4 Market FailureДокумент42 страницы1.4 Market FailureRuban PaulОценок пока нет

- BG Nexus Storm 2G Twin WP22RCD IP66 Weatherproof Outdoor Switched Socket 13AДокумент4 страницыBG Nexus Storm 2G Twin WP22RCD IP66 Weatherproof Outdoor Switched Socket 13AAnonymous 8guZVX3AОценок пока нет

- Study To Assess The Effectiveness of Planned Teaching Programme Regarding Knowledge of Traffic Rules Among Higher Secondary Students 15 18 Years in Selected Schools of DehradunДокумент14 страницStudy To Assess The Effectiveness of Planned Teaching Programme Regarding Knowledge of Traffic Rules Among Higher Secondary Students 15 18 Years in Selected Schools of DehradunEditor IJTSRDОценок пока нет

- List of PharmaДокумент4 страницыList of PharmaJamielle SanchezОценок пока нет

- Properties of X-Rays and Gamma RaysДокумент13 страницProperties of X-Rays and Gamma RaysjishnusajiОценок пока нет

- UntitledДокумент77 страницUntitledVedranL84Оценок пока нет

- CSHP Template For Small Construction Projects Residential Project/S (2 Storey and Below) or Minor Repair WorksДокумент5 страницCSHP Template For Small Construction Projects Residential Project/S (2 Storey and Below) or Minor Repair WorksZeny BocadОценок пока нет

- Chapter 2 ManojДокумент4 страницыChapter 2 ManojBro FistoОценок пока нет

- Maternal and Child Health Nursing, 8 Edition.: LESSON PREVIEW/REVIEW (5 Minutes)Документ7 страницMaternal and Child Health Nursing, 8 Edition.: LESSON PREVIEW/REVIEW (5 Minutes)raker boiОценок пока нет

- TDDДокумент4 страницыTDDJay VibhaniОценок пока нет

- R02.4 Standard III (A) - AnswersДокумент11 страницR02.4 Standard III (A) - AnswersShashwat DesaiОценок пока нет

- Microsoft Word - SOP ON DispensingДокумент4 страницыMicrosoft Word - SOP ON DispensingPalawan Baptist HospitalОценок пока нет

- NPD High Level Status: Concept Development FeasibilityДокумент22 страницыNPD High Level Status: Concept Development FeasibilityRaviОценок пока нет

- Mini-Pitch Session Exceptionalities and InclusionДокумент18 страницMini-Pitch Session Exceptionalities and Inclusionapi-486583325Оценок пока нет

- Social Learning TheoryДокумент23 страницыSocial Learning TheoryJacqueline Lacuesta100% (2)

- Catalogo Presentacion Johnial UltimoДокумент10 страницCatalogo Presentacion Johnial UltimoEmerson BermudezОценок пока нет

- LESSON 2 - TRANSMUTATION - Louise Peralta - 11 - FairnessДокумент2 страницыLESSON 2 - TRANSMUTATION - Louise Peralta - 11 - FairnessLouise Joseph PeraltaОценок пока нет

- Knowing God: Prayer and Fasting 2013Документ40 страницKnowing God: Prayer and Fasting 2013ccforgph100% (4)

- Analysis of Grape and WineДокумент116 страницAnalysis of Grape and WineElenaTrofimОценок пока нет

- Success On The Wards 2007Документ32 страницыSuccess On The Wards 2007mnОценок пока нет

- Food and Beverage Suggestive SellingДокумент4 страницыFood and Beverage Suggestive SellingMichael Aborot Dela Torre0% (1)

- Lecture 3 FertilityДокумент30 страницLecture 3 Fertilityანთეა აბრამიშვილიОценок пока нет

- High Voltage - WikipediaДокумент7 страницHigh Voltage - WikipediaMasudRanaОценок пока нет

- Peaditrician All IndiaДокумент66 страницPeaditrician All IndiaGIRISH JOSHIОценок пока нет