Академический Документы

Профессиональный Документы

Культура Документы

Shrinking Indian Market Has Compelled Manufactures To Explore Global Markets

Загружено:

Sakshi MehraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Shrinking Indian Market Has Compelled Manufactures To Explore Global Markets

Загружено:

Sakshi MehraАвторское право:

Доступные форматы

Shrinking Indian market has compelled manufactures to explore global markets

Today, global manufacturers dont just merely import and sell products into India. They customize &adapt it to meet the Indian market special needs, says Glenville da Silva, President, ICEMA & Vice President Business Development Asia, Volvo Construction Equipment in an interview with Lovina Kinny. What is your overview on the current growth scenario of the construction equipment industry? The growth of construction equipment industry is directly linked to the construction and infrastructure development of the country. With the exception for the year 2008 09 in which we felt the impact of global recession, this industry has shown healthy double growth over the last 10 years. This growth clearly reflected Indias emphasis on developing its infrastructure. Unfortunately, 2012 has run contrary to the past. For the first time the industry has actually experienced a reduction. Two main equipment categories that dominate the CE industry with a 60 70% presence have actually reduced or flattened in size in 2012. While final figures for 2012 are still awaited, going by recent trends, demand for both these product categories have weakenedwhich is a clear indication of the contraction of the CE industry. Moreover, other categories of construction equipment, such as Compaction equipment, Wheel loaders, have seen a fall in demand for the second consecutive year. This market contraction could be attributed to a variety of reasons all unfortunately are internal & largely self-induced. To mention a few, delay in execution of road projects, the slow reform process which has resulted in project stoppage due to issues like land acquisition and environment clearances, stoppage of mining and high interest rates have created a negative sentiment around this industry. Although the ongoing metro projects havecontinued to fuel some demand for concrete equipment, the overall market for concrete equipmenthas remained flat. The report Vision 2020: Commanding New Heightsreleased by CII-ICEMA states that equipment sales volumes will increase from 60,000 units to 3, 30,000 units These figures were projected considering the booming industry in 2011and based on the Governments projections for infrastructure spends. At that time when the study was undertaken in 2010-11 hardly anyone could have imagined that the next year itself would see all the ambitious infrastructure project executions come to standstill. Nevertheless, the opportunity still exists; if the projects are revived, progress fast tracked and monitored, the CE industry will be back on growth track. How do you view the deeper engagements of original equipment manufacturers in India? What are the steps OEMs should take for the robust growth of CE industry?

Global OEMs have invested heavily in India setting up manufacturing, distribution and service facilities. They have a strong engagement & commitment to this market based on potential growth projections. We just hope that the climate of uncertainty and indecision goes away and we are back on the growth path. Can you throw light on the R&D and innovations amongst the domestic manufacturers? Because what can be seen is that most of the equipment which are manufactured here in India withercopies globally successful equipment or is manufactured by international players who have set up their base in India or have formed technical collaboration with Indian manufacturers? Reliability, durability and energy efficiency are the primary drivers of Earthmoving and Construction Equipment. To achieve this needs large investments in R&D. Given the economies of scale that we have in India, it becomes extremely difficult for local manufacturers to invest in the scale of R&D required. Thus local manufacturers are generally constrained to niche areas & smaller equipment which may not need technologically intensive R&D investment. Global manufacturers who have established their base in India spend heavily on R&D to customize their products to suit Indian market requirements. Today, global manufacturers dont just merely import and sell products in India. They customize & adapt to meet the Indian market special needs. This also enables manufacturers to explore similar market beyond India. Similar emerging markets that have needs similar to India, offer us an export opportunity. Thus investing in adaptive R&D provides dual opportunity the Indian market as well as other similar markets. Can we see India becoming an export hub for construction equipment and components in near future? India has become an export hub. The shrinking Indian market has compelled manufactures to explore similar global markets. Although the China and European market is undergoing a slowdown, there are other opportunities in South East Asia, Middle East, Africa, South America and other countries in the Indian subcontinent. Any major changes can be seen in shortage of manpower and skill development? Today as the market is witnessing a slowdown, the number of equipment deployed has reduced. Therefore, the problem of shortage of manpower is not acute at the moment. However, as soon as the projects are fast tracked, equipment will be back in operation and the issues related to shortage of skilled manpower will surface again. Manpower skilling continues to be a major problem for the industry growth. ICEMA is in the process of putting forward to NSDC (National Skills Development Corporation) a proposal to set up a Construction Equipment skills council which will focus initially on machine operation & service skills. We hope to have the proposal ready in the next 10 -12 weeks. How difficult is it to obtain funding during purchase and leasing the equipment? Finance is a very crucial part in the whole equipment procurement because substantial viz. over 90% of the equipment is directly financed. As a result finance companies have become a partner in procurement process. In last few months,with liquidity tighteningcoupled with the slowdown

and payment delays, funds availability became difficult. Finance companies have been much more cautious in their risk appetite. Nonetheless this will change rapidly as the market improves and everybody connected with the industry senses the opportunity reemerging. The implementation of Good Service Tax (GST) in construction and mining equipment industry was being widely discussed recently. What is the stand of Indian Construction Equipment Manufacturers Association (ICEMA) on this issue? We have been advocating for quick passage of GST from past few years. Like other industries, we foresee that GST will provide substantial benefit to consumers; it will avoid double-triple taxation, help mobility of equipment across state borders, and help better utilization of equipment. We believe it will change the way the industry works in terms of deployment of equipment. Unfortunately the current political situation does not seem to be conducive to get this important legislation passed. We will continue our advocacy role with both the central and state government at every opportunity. There has been a change in emission norms but there are certain old machines that continue to exist on present regulatory norms The emission norms have been made applicable to wheeled machines or typical machines which are wheeled with rubber tyres or steel drums. Wheeled machines are brought under these norms because these are governed by the automotive rules whereas the steel track machines are not brought under these emission norms. However, as customers and manufacturers get more conscious of providing sustainable infrastructure, we think there will be a self-induced drive to ensure all equipment conforms to the same emission norms. What has been ICEMAs role in boosting CE industry? We continue to work with the government to ensure that the bottlenecks & constraints are eased & eliminated. Through our different panels, we represent to government issues that affect the industry growth and also provide suggestions on policy changes that could leverage growth opportunities. As mentioned earlier, we see availably of trained people as a major impediment going forward. We are working with NSDC to help create programs in skill development and thereby help with employment. We are also working with different technical bodies to create standards in safety for equipment & operation as well as environment protection standards. Moreover, we are working with Department of Heavy Industry on a proposal for the creation of a testing center for Construction Equipment on similar lines as the Automotive Research Association of India (ARAI) which primarily meant for the automotive sector. Today we use ARAI facilities to test construction equipment. However as ARAI caters primarily to the automotive industry, their equipment is limited in size. Thus large construction equipmentcannot be tested and this can be deterrent to the companies developing larger equipment. This testing center also be a big support to local manufacturers that are developing from their own technology.

ICEMA also provides to Government budget recommendations. We have advocated in the past for GST implementation, special status to Construction equipment, regulation of used equipment, providing level playing field to support local manufacture, issues that can actually boost& grow the industry. What is your outlook on market change? Our outlook for 2013 is one of cautious optimism. It is widely expected that the forthcoming budget will be an election budget. Will the budget only provide goodies to all or will there be some measures to promote growth & development? We will have to follow wait and watch as this budget will actually determine the industrys growth for rest of the year. At this point, everybody is cautious. However from a long term perspective, India is still an attractive market. The current situation might have compelled companies to alter or tone down some of their investment plans. Global OEMs still find this market interesting and will continue to invest to enter or to grow in this market.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Rory Delap Causing The 2008 Global Financial Crash DissДокумент62 страницыRory Delap Causing The 2008 Global Financial Crash DissBorat BoratОценок пока нет

- Behavior Modification PlanДокумент20 страницBehavior Modification PlanAryaОценок пока нет

- Browne v. Grand Junction OrderДокумент10 страницBrowne v. Grand Junction OrderMichael_Lee_RobertsОценок пока нет

- JurisprudenceДокумент20 страницJurisprudenceAkshita SaxenaОценок пока нет

- Mufon Ufo JournalДокумент21 страницаMufon Ufo JournalSAB78Оценок пока нет

- Framework of 5SДокумент31 страницаFramework of 5STapesh100% (21)

- FIBA TABLE OFFICIALS MANUAL 2019 (ΑΓΓΛΙΚΗ ΕΚΔΟΣΗ)Документ132 страницыFIBA TABLE OFFICIALS MANUAL 2019 (ΑΓΓΛΙΚΗ ΕΚΔΟΣΗ)ΣΥΝΔΕΣΜΟΣ ΚΡΙΤΩΝ ΚΑΛΑΘΟΣΦΑΙΡΙΣΗΣ ΚΡΗΤΗΣОценок пока нет

- Report in Educ. 201Документ23 страницыReport in Educ. 201Neil BaltarОценок пока нет

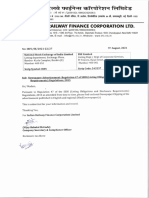

- Indian Railway Finance Corporation LTD.: Azama: 011-24100385Документ5 страницIndian Railway Finance Corporation LTD.: Azama: 011-24100385yashОценок пока нет

- Employee Motivation and Retention Strategies at MicrosoftДокумент14 страницEmployee Motivation and Retention Strategies at MicrosoftJay DixitОценок пока нет

- CETF Broadband Guide For Local GovernmentДокумент36 страницCETF Broadband Guide For Local GovernmentRachelle ChongОценок пока нет

- Flight AttendatsДокумент7 страницFlight AttendatsPutri Gusti6Оценок пока нет

- LESSON 1 To 3 SCIENCEДокумент51 страницаLESSON 1 To 3 SCIENCECasey Dela FuenteОценок пока нет

- The Essence of Leadership NarayanamoorthyДокумент3 страницыThe Essence of Leadership NarayanamoorthyVikram AnandОценок пока нет

- Countertrade: A Presentation BY Dr. P. K. Chugan Former Professor Institute of Management Nirma University AhmedabadДокумент25 страницCountertrade: A Presentation BY Dr. P. K. Chugan Former Professor Institute of Management Nirma University AhmedabadRishiОценок пока нет

- AP DraftДокумент3 страницыAP DraftVictoriaОценок пока нет

- Music Licensing Representation AgreementДокумент7 страницMusic Licensing Representation AgreementDigital Music News100% (8)

- Competitive Advantage of Nsu: Project OnДокумент41 страницаCompetitive Advantage of Nsu: Project OnTanvir KhanОценок пока нет

- GAIN - Flight Safety HandbookДокумент180 страницGAIN - Flight Safety HandbookDennis Groves100% (4)

- Rifts d20 Conversion Manual v34Документ192 страницыRifts d20 Conversion Manual v34bossloki67% (3)

- Reading PlanДокумент3 страницыReading PlanMark Andrew FernandezОценок пока нет

- AInsley Dye - ResumeДокумент2 страницыAInsley Dye - ResumeAinsley DyeОценок пока нет

- Autism Certificate of Achievement Tu1yqzaДокумент2 страницыAutism Certificate of Achievement Tu1yqzaapi-441221942100% (1)

- Category No: 752/2021 - 768/2021Документ4 страницыCategory No: 752/2021 - 768/2021Nandagopan GОценок пока нет

- Guarantees of The Right To Arms in State ConstitutionsДокумент5 страницGuarantees of The Right To Arms in State ConstitutionsBuckeyeFirearmsAssociationОценок пока нет

- Vodafone Case StudyДокумент2 страницыVodafone Case StudySugandhaОценок пока нет

- Systems Analysis & Design 7th EditionДокумент45 страницSystems Analysis & Design 7th Editionapi-24535246100% (1)

- PN CC Link Coupler Spec - 2822 - V100 - Mar17Документ69 страницPN CC Link Coupler Spec - 2822 - V100 - Mar17Clear MindОценок пока нет

- Formality in Writing: Aspect of Professional and Academic LanguageДокумент62 страницыFormality in Writing: Aspect of Professional and Academic LanguageTimОценок пока нет

- Role of A Reporting OfficerДокумент8 страницRole of A Reporting OfficerAla DanОценок пока нет