Академический Документы

Профессиональный Документы

Культура Документы

What Are The Sensex & The Nifty?: How To Calculate BSE SENSEX?

Загружено:

Manoj BansalИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

What Are The Sensex & The Nifty?: How To Calculate BSE SENSEX?

Загружено:

Manoj BansalАвторское право:

Доступные форматы

What are the Sensex & the Nifty?

The Sensex is an "index". What is an index? An index is basically an indicator. It gives you a general idea about whether most of the stocks have gone up or most of the stocks have gone down. The Sensex is an indicator of all the major companies of the BSE. The Nifty is an indicator of all the major companies of the NSE. If the Sensex goes up, it means that the prices of the stocks of most of the major companies on the BSE have gone up. If the Sensex goes down, this tells you that the stock price of most of the major stocks on the BSE have gone down. Just like the Sensex represents the top stocks of the BSE, the Nifty represents the top stocks of the NSE. Just in case you are confused, the BSE, is the Bombay Stock Exchange and the NSE is the National Stock Exchange. The BSE is situated at Bombay and the NSE is situated at Delhi. These are the major stock exchanges in the country. There are other stock exchanges like the Calcutta Stock Exchange etc. but they are not as popular as the BSE and the NSE.Most of the stock trading in the country is done though the BSE & the NSE. Besides Sensex and the Nifty there are many other indexes. There is an index that gives you an idea about whether the mid-cap stocks go up and down. This is called the BSE Mid-cap Index. There are many other types of indexes. There is an index for the metal stocks. There is an index for the FMCG stocks. There is an index for the automobile stocks etc. If you are interested in knowing how the SENSEX is actually calculated...you must check-out our "How to calculate BSE SENSEX?" article!

But, before we go ahead and try to understand "How to make money in the stock market?" you MUST read the next page....

How to calculate BSE SENSEX?

Requested by: Lt Col Ashis Kumar Mishra This article explains how the value of the BSE Sensex or sensitive index is calculated. If you are not sure what we mean by the Sensex or what the Sensex is all about, you can find this out by reading our How to make money in the stock market? article. The Sensex has a very important function. The Sensex is supposed to be an indicator of the stocks in the BSE. It is supposed to show whether the stocks are generally going up, or generally going down. To show this accurately, the Sensex is calculated taking into consideration stock prices of 30 different BSE listed companies. It is calculated using the freefloat market capitalization method. This is a world wide accepted method as one of the best methods for calculating a stock market index. Please note: The method used for calculating the Sensex and the 30 companies that are taken into consideration are changed from time to time. This is done to make the Sensex an accurate index and so that it represents the BSE stocks properly. To really understand how the Sensex is calculated, you simply need to understand what the term free-float market capitalization means. (As we said earlier, the Sensex is calculated on basis of the free-float market capitalization method) But, before we understand what free-float market capitalization means, you first need to understand what market capitalization means.

What is "market capitalization"?

You probably think that you have never heard of the term market capitalization before. You have! When you are talking about mid-cap, small-cap and large-cap stocks, you are talking about market capitalization! Market cap or market capitalization is simply the worth of a company in terms of its shares! To put it in a simple way, if you were to buy all the shares of a particular company, what is the amount you would have to pay? That amount is called the market capitalization! To calculate the market cap of a particular company, simply multiply the current share price by the number of shares issued by the company! Just to give you an idea, ONGC, has a market cap of Rs.170,705.21 Cr (when this article was written) Depending on the value of the market cap, the company will either be a mid-cap or large-cap or small-cap company! Now the question is, how do YOU calculate the market cap of a particular company? You dont! Just go to a website like MoneyControl.com and look up the company whose market cap you are interested in finding out! The figure in front of Mkt. Cap will be the market cap value. Having seen what market cap is and how to find out the market cap of a particular company, let us try to understand the concept of free-float market cap Next - What is "free float market cap"? >>

What is "free-float market capitalization"?

Many different types of investors hold the shares of a company! The Govt. may hold some of the shares. Some of the shares may be held by the founders or directors of the company. Some of the shares may be held by the FDIs etc. etc! Now, only the open market shares that are free for trading by anyone, are called the free-float shares. When we are calculating the Sensex, we are interested in these free-float shares! A particular company, may have certain shares in the open market and certain shares that are not available for trading in the open market. According the BSE, any shares that DO NOT fall under the following criteria, can be considered to be open market shares: Holdings by founders/directors/ acquirers which has control element Holdings by persons/ bodies with "controlling interest" Government holding as promoter/acquirer Holdings through the FDI Route Strategic stakes by private corporate bodies/ individuals Equity held by associate/group companies (cross-holdings) Equity held by employee welfare trusts Locked-in shares and shares which would not be sold in the open market in normal course.

A company has to submit a complete report about who has how many of the companys shares to the BSE. On the basis of this, the BSE will decide the freefloat factor of the company. The free-float factor is a very valuable number! If you multiply the "free-float factor" with the market cap of that company, you

will get the free-float market cap which is the value of the shares of the company in the open market! A simple way to understand the free-float market cap would be, the total cost of buying all the shares in the open market! So, having understood what the free float market cap is, now what? How do you find out the value of the Sensex at a particular point? Well, its pretty simple. First: Find out the free-float market cap of all the 30 companies that make up the Sensex! Second: Add all the free-float market caps of all the 30 companies! Third: Make all this relative to the Sensex base. The value you get is the Sensex value! The third step probably confused you. To understand it, you will need to understand ratios and proportions from 5th standard mathematics. Think of it this way: Suppose, for a free-float market cap of Rs.100,000 Cr... the Sensex value is 4000 Then, for a free-float market cap of Rs.150,000 Cr... the Sensex value will be..

So, the Sensex value will be 6000 if the free-float market cap comes to Rs.150,000 Cr! Please Note: Every time one of the 30 companies has a stock split or a "bonus" etc. appropriate changes are

made in the market cap calculations.

Now, there is only one question left to be answered, which 30 companies, why those 30 companies, why no other companies? The 30 companies that make up the Sensex are selected and reviewed from time to time by an index committee. This index committee is made up of academicians, mutual fund managers, finance journalists, independent governing board members and other participants in the financial markets.

How to make money in the stock market?

Inroduction This article is a COMPLETE guide to the basics of making money in the stock market! If you are considering investing in the stock market, you MUST read this article! We have explained all the concepts and talked about all the "myths" that people have about the stock market! What are stocks? Definition: Plain and simple, a stock is a share in the ownership of a company. A stock represents a claim on the company's assets and earnings. As you acquire more stocks, your ownership stake in the company becomes greater. Note: Some times different words like shares, equity, stocks etc. are used. All these words mean the same thing.

So what does ownership of a company give you? Holding a company's stock means that you are one of the many owners (shareholders) of a company and, as such, you have a claim to everything the company owns. This means that technically you own a tiny little piece of all the furniture, every trademark, and every contract of the company. As an owner, you are entitled to your share of the company's earnings as well. These earnings will be given to you. These earnings are called dividends and are given to the shareholders from time to time. A stock is represented by a "stock certificate". This is a piece of paper that is proof of your ownership. However, now-a-days you could also have a demat account. This means that there will be no stock

certificates. Everything will be done though the computer electronically. Selling and buying stocks can be done just by a few clicks. Being a shareholder of a public company does not mean you have a say in the day-to-day running of the business. Instead, one vote per share to elect the board of directors of the company at annual meetings is all you can do. For instance, being a Microsoft shareholder doesn't mean you can call up Bill Gates and tell him how you think the company should be run. The management of the company is supposed to increase the value of the firm for shareholders. If this doesn't happen, the shareholders can vote to have the management removed. In reality, individual investors like you and I don't own enough shares to have a material influence on the company. It's really the big boys like large institutional investors and billionaire entrepreneurs who make the decisions. For ordinary shareholders, not being able to manage the company isn't such a big deal. After all, the idea is that you don't want to have to work to make money, right? The importance of being a shareholder is that you are entitled to a portion of the companys profits and have a claim on assets. Profits are sometimes paid out in the form of dividends as mentioned earlier. The more shares you own, the larger the portion of the profits you get. Your claim on assets is only relevant if a company goes bankrupt. In case of liquidation, you'll receive what's left after all the creditors have been paid. Another extremely important feature of stock is "limited liability", which means that, as an owner of a stock, you are "not personally liable" if the company is not able to pay its debts. In other legal structures such as partnerships, if the partnership firm goes bankrupt the creditors can come after the partners personally and sell off their house, car, furniture, etc. To understand all this in more detail you could read our How to incorporate?

article. Owning stock means that, no matter what happens to the company, the maximum value you can lose is the value of your stocks. Even if a company of which you are a shareholder goes bankrupt, you can never lose your personal assets. Why would the founders share the profits with thousands of people when they could keep profits to themselves? This is the obvious question that comes up next. This is what the next section is all about!

Why does a company issue stocks?

Why would the founders share the profits with thousands of people when they could keep profits to themselves? The reason is that at some point every company needs to "raise money". To do this, companies can either borrow it from somebody or raise it by selling part of the company, which is known as issuing stock. A company can borrow by taking a loan from a bank or by issuing bonds. Both methods come under "debt financing". On the other hand, issuing stock is called equity financing. Issuing stock is advantageous for the company because it does not require the company to pay back the money or make interest payments along the way. All that the shareholders get in return for their money is the hope that the shares will someday be worth more than what they paid for them. The first sale of a stock, which is issued by the private company itself, is called the initial public offering (IPO). It is important that you understand the distinction between a company financing through debt and financing through equity. When you buy a debt investment such as a bond, you are guaranteed the return of your money (the principal) along with promised interest payments. This isn't the case with an equity investment. By

becoming an owner, you assume the risk of the company not being successful - just as a small business owner isn't guaranteed a return, neither is a shareholder. Shareholders earn a lot if a company is successful, but they also stand to lose their entire investment if the company isn't successful. Its a tricky game! Note that: There are no guarantees when it comes to individual stocks. Some companies pay out dividends, but many others do not. And there is no obligation to pay out dividends. Without dividends, an investor can make money on a stock only through its appreciation of the stock price in the open market. On the downside, any stock may go bankrupt, in which case your investment is worth nothing. Having understood this, we now want to know what makes stock prices rise and fall? If we know this, we will know which stocks to buy. In the next section we will try to understand what makes stock prices go up and down.

What makes stock prices go "up" and "down"?

Stock prices change every day because of market forces. By this we mean that stock prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up! Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall. (Basics of economics!) Understanding supply and demand is easy. What is difficult to understand is what makes people like a particular stock and dislike another stock. If you understand this, you will know what people are buying

and what people are selling. If you know this you will know what prices go up and what prices go down!

To figure out the likes and dislikes of people, you have to figure out what news is positive for a company and what news is negative and how any news about a company will be interpreted by the people. The most important factor that affects the value of a company is its earnings. Earnings are the profit a company makes, and in the long run no company can survive without them. It makes sense when you think about it. If a company never makes money, it isn't going to stay in business. Public companies are required to report their earnings four times a year (once each quarter). Dalal Street watches with great attention at these times, which are referred to as earnings seasons. The reason behind this is that analysts base their future value of a company on their earnings projection. If a company's results are better than expected, the price jumps up. If a company's results disappoint and are worse than expected, then the price will fall. Of course, it's not just earnings that can change the feeling people have about a stock. It would be a rather simple world if this were the case! During the dotcom bubble, for example, the stock price of dozens of internet companies rose without ever making even the smallest profit. As we all know, these high stock prices did not hold, and most internet companies saw their values shrink to a fraction of their highs. Still, this fact demonstrates that there are factors other than current earnings that influence stocks. So, what are "all the factors" that affect the stocks price? The best answer is that nobody really knows for sure. Some believe that it isn't possible to predict how stock prices will change, while others think that by drawing charts and looking at past price movements, you can determine when to buy and sell. The only thing we do know is that stocks are volatile and can

change in price very very rapidly. Just remember this: At the most fundamental level, supply and demand in the market determines stock price. There are many types of techniques and methods that investors use to figure out whether a stock price will go up or down! We will try to give you an introduction to these techniques in this article. But before we go into the concepts of stocks picking, and the techniques of analysis, let us understand one last basic thing....

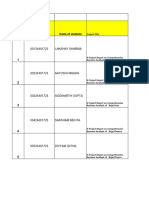

The main criteria for selecting the 30 stocks is as follows: Market capitalization: The company should have a market capitalization in the Top 100 market capitalizations of the BSE. Also the market capitalization of each company should be more than 0.5% of the total market capitalization of the Index. Trading frequency: The company to be included should have been traded on each and every trading day for the last one year. Exceptions can be made for extreme reasons like share suspension etc. Number of trades: The scrip should be among the top 150 companies listed by average number of trades per day for the last one year. Industry representation: The companies should be leaders in their industry group. Listed history: The companies should have a listing history of at least one year on BSE. Track record: In the opinion of the index committee, the company should have an acceptable track record. Having understood all this, you now know how the Sensex is calculated.

Вам также может понравиться

- What Are The Sensex & The Nifty?: Requested By: LT Col Ashis Kumar MishraДокумент10 страницWhat Are The Sensex & The Nifty?: Requested By: LT Col Ashis Kumar MishraMotakatla NarasareddyОценок пока нет

- What Are The SensexДокумент10 страницWhat Are The Sensexchaitali111Оценок пока нет

- What Are The SensexДокумент13 страницWhat Are The SensexprasanjeetbОценок пока нет

- Bombay SensexДокумент41 страницаBombay SensexAkhilesh ModiОценок пока нет

- Stock Market Indicies AssingmentДокумент11 страницStock Market Indicies AssingmenttullipsОценок пока нет

- Stock MarketДокумент7 страницStock Marketaryan4321Оценок пока нет

- How To Make Money in The Stock Market?: InroductionДокумент15 страницHow To Make Money in The Stock Market?: InroductionmarwahsanjeevОценок пока нет

- How To Start in Share Market.Документ15 страницHow To Start in Share Market.amit_shahidОценок пока нет

- How To Make Money in Stock MarketДокумент16 страницHow To Make Money in Stock MarketGanapatibo GanapatiОценок пока нет

- Chapter - 1 Introduction and Design of The StudyДокумент75 страницChapter - 1 Introduction and Design of The StudyGLOBAL INFO-TECH KUMBAKONAMОценок пока нет

- ch-6 Jmod-1 Jbeg JBasics of Stock MarketДокумент5 страницch-6 Jmod-1 Jbeg JBasics of Stock Marketvamsirokkam0Оценок пока нет

- Calculation of SensexДокумент6 страницCalculation of SensexHarshad KatariyaОценок пока нет

- How To Make Profit in Stock Market, Guide To Profit in Indian Stock Market. Stock Market SecretsДокумент7 страницHow To Make Profit in Stock Market, Guide To Profit in Indian Stock Market. Stock Market SecretsDinesh JeyaseelanОценок пока нет

- Money Investment: in Share MarketДокумент27 страницMoney Investment: in Share Markettarunyadav3Оценок пока нет

- Know The Sensex: Romendra Singh NegiДокумент9 страницKnow The Sensex: Romendra Singh NegiRavi SharmaОценок пока нет

- Stock Market Practical Knowledge-The Art of InvestmentДокумент26 страницStock Market Practical Knowledge-The Art of InvestmentNitinJaiswal100% (2)

- Final Project On IpoДокумент58 страницFinal Project On IpoFarzana SayyedОценок пока нет

- Functions of Stock Exchange in India: Prepared By: Arpit Shah Sybbi 26Документ11 страницFunctions of Stock Exchange in India: Prepared By: Arpit Shah Sybbi 26arpitshah32_46837757Оценок пока нет

- What's A Stock/Share?Документ8 страницWhat's A Stock/Share?mailrahulrajОценок пока нет

- MHBJHBДокумент3 страницыMHBJHBShashank DoveriyalОценок пока нет

- Data AnalysisДокумент71 страницаData AnalysisNageshwar SinghОценок пока нет

- Stock Market of INDIA.Документ10 страницStock Market of INDIA.Wajahat AslamОценок пока нет

- Handout-Operations of Indian Stock MarketДокумент8 страницHandout-Operations of Indian Stock MarketDrsumit Sharma100% (1)

- About Stock MarketДокумент5 страницAbout Stock MarketPragati ChouguleОценок пока нет

- What Is Stock MarketДокумент20 страницWhat Is Stock MarketAgrawal Market GurukulОценок пока нет

- How To Calculate IndexДокумент5 страницHow To Calculate Indexmoorthys1966Оценок пока нет

- Stock ExchangeДокумент43 страницыStock ExchangeGaurav JindalОценок пока нет

- Basics of The Share Market - Stock Market TutorialДокумент28 страницBasics of The Share Market - Stock Market TutorialKalimuthu PaulpandianОценок пока нет

- ArcadiaДокумент51 страницаArcadiaJohn MarkОценок пока нет

- Bombay Stock ExchangeДокумент18 страницBombay Stock Exchangethe crashОценок пока нет

- SENSEXДокумент10 страницSENSEXMohamed ImranОценок пока нет

- Calculation of SENSEXДокумент5 страницCalculation of SENSEXDerick SharonОценок пока нет

- Bombay Stock ExchangeДокумент18 страницBombay Stock Exchangethe crashОценок пока нет

- Arcadia - ANKIT SHAHДокумент51 страницаArcadia - ANKIT SHAHpallavcОценок пока нет

- Data AnalysisДокумент73 страницыData AnalysisrathnakotariОценок пока нет

- Industry Profile:: The Definition of A StockДокумент23 страницыIndustry Profile:: The Definition of A StockVikash KumawatОценок пока нет

- What Is The Stock ExchangeДокумент11 страницWhat Is The Stock Exchangeabdulhadiqureshi100% (3)

- Stock Exchange Scam in IndiaДокумент61 страницаStock Exchange Scam in IndiaAshish Thakkar67% (3)

- Stock 1Документ24 страницыStock 1Rohit KaweriОценок пока нет

- A Study On Performances and Volatility of Equity Prices in BSE Index in Specialization With Banking Sector.Документ87 страницA Study On Performances and Volatility of Equity Prices in BSE Index in Specialization With Banking Sector.ananthi.r siimsОценок пока нет

- Green Shoe OptionДокумент9 страницGreen Shoe OptionVikash GuptaОценок пока нет

- Stock Market: Presented by Zaid ShahsahebДокумент16 страницStock Market: Presented by Zaid ShahsahebZaid Ismail ShahОценок пока нет

- Original Presentation by Hamza ShahДокумент56 страницOriginal Presentation by Hamza ShahHamza BukhariОценок пока нет

- What Is SENSEX?: Company Name (Industry)Документ3 страницыWhat Is SENSEX?: Company Name (Industry)Inza NsaОценок пока нет

- Equity Market Analysis - Aman Sharma - IFMRДокумент31 страницаEquity Market Analysis - Aman Sharma - IFMRmegamegeshОценок пока нет

- Workshop: Basic Understanding of Share Market & Its Future and ScopeДокумент23 страницыWorkshop: Basic Understanding of Share Market & Its Future and Scopesarfaraz kОценок пока нет

- History of The Stock Broking IndustryДокумент72 страницыHistory of The Stock Broking IndustryLalit KumarОценок пока нет

- Basics of Stock Market-S1Документ36 страницBasics of Stock Market-S1shivam4822Оценок пока нет

- Chapter 7Документ10 страницChapter 7Sasikumar ThangaveluОценок пока нет

- Fundamentals of StockДокумент77 страницFundamentals of StockwhoiamiОценок пока нет

- Know Your Index: SensexДокумент2 страницыKnow Your Index: SensexChiragDahiyaОценок пока нет

- Basics Fundamental AnalysisДокумент5 страницBasics Fundamental AnalysispudiwalaОценок пока нет

- Finance AssignmentДокумент12 страницFinance AssignmentrekhaОценок пока нет

- Index Fund Investing 101Документ100 страницIndex Fund Investing 101newmexicoomfs100% (8)

- Nabi ProjectДокумент3 страницыNabi Projectpravinkumar70Оценок пока нет

- Stock Market Indices in India: Raghunandan HelwadeДокумент38 страницStock Market Indices in India: Raghunandan HelwadeRaghunandan HelwadeОценок пока нет

- Idea SourcingДокумент4 страницыIdea Sourcingthepwner23Оценок пока нет

- Investing In Stock Market For Beginners: understanding the basics of how to make money with stocksОт EverandInvesting In Stock Market For Beginners: understanding the basics of how to make money with stocksРейтинг: 4 из 5 звезд4/5 (13)

- Pharmaceutical Sciences, Pfizer Global Research & DevelopmentДокумент1 страницаPharmaceutical Sciences, Pfizer Global Research & DevelopmentManoj BansalОценок пока нет

- Extrusion GuideДокумент8 страницExtrusion GuideManoj BansalОценок пока нет

- Rheology of SuspensionsДокумент16 страницRheology of SuspensionsManoj Bansal100% (1)

- Advanced Plastic Testing Technologies PDFДокумент20 страницAdvanced Plastic Testing Technologies PDFManoj BansalОценок пока нет

- INCOTERMS 2000 - Chart of ResponsibilityДокумент3 страницыINCOTERMS 2000 - Chart of ResponsibilityManoj BansalОценок пока нет

- MDO FilmsДокумент5 страницMDO FilmsManoj Bansal100% (1)

- Labour LawДокумент38 страницLabour Lawaravindh14novОценок пока нет

- Cert RefДокумент31 страницаCert RefManoj BansalОценок пока нет

- Teamwork SuccessДокумент31 страницаTeamwork SuccessManoj BansalОценок пока нет

- The Global Circulation of African FashionДокумент224 страницыThe Global Circulation of African FashionManoj Bansal100% (2)

- Satanic SymbolsДокумент16 страницSatanic SymbolsManoj BansalОценок пока нет

- Civil CodeДокумент9 страницCivil CodeManoj BansalОценок пока нет

- Incoterms 2000Документ6 страницIncoterms 2000Manoj BansalОценок пока нет

- Cert RefДокумент31 страницаCert RefManoj BansalОценок пока нет

- Sensex Crashes 1,000 Pts On Mounting Inflation Worries: Ruling Authority For Direct Tax Cases On CardsДокумент16 страницSensex Crashes 1,000 Pts On Mounting Inflation Worries: Ruling Authority For Direct Tax Cases On CardsRahulMIBОценок пока нет

- R. Wadiwala: Morning NotesДокумент7 страницR. Wadiwala: Morning NotesRWadiwala SecОценок пока нет

- Final Project On IpoДокумент58 страницFinal Project On IpoFarzana SayyedОценок пока нет

- Scenario of Indian Stock MarketДокумент12 страницScenario of Indian Stock Marketnayak_ramesh330Оценок пока нет

- Sbi Po Final ResultДокумент2 страницыSbi Po Final Resultanandanuj656Оценок пока нет

- Mkts Dip 2% As Omicron Variant Spooks Investors: BusinessДокумент1 страницаMkts Dip 2% As Omicron Variant Spooks Investors: BusinessAvi SaiОценок пока нет

- Develop India Year 4, Vol. 1, Issue 195, 29 April - 6 May, 2012Документ8 страницDevelop India Year 4, Vol. 1, Issue 195, 29 April - 6 May, 2012sangram_singh06100% (1)

- Impact of FII and FDI On Indian Stock Market: A Project ReportДокумент75 страницImpact of FII and FDI On Indian Stock Market: A Project ReportJake AlwinОценок пока нет

- Bs English PDFДокумент13 страницBs English PDFS M KalishОценок пока нет

- Shekhar Final Project Report On Share MarketДокумент63 страницыShekhar Final Project Report On Share MarketSanket VaidyaОценок пока нет

- A Synopsis On Stock Trading ProjectДокумент14 страницA Synopsis On Stock Trading ProjectDuke CyraxОценок пока нет

- A Study On Customer Satisfaction Towards On-Line Share Trading With Special Reference To Coimbatore CityДокумент47 страницA Study On Customer Satisfaction Towards On-Line Share Trading With Special Reference To Coimbatore CityVISHNU141289% (37)

- All India HDFC Ifsc CodeДокумент156 страницAll India HDFC Ifsc CodeBunty ShahОценок пока нет

- A Study On Indian Stock Market: Nse and Bse"Документ88 страницA Study On Indian Stock Market: Nse and Bse"Ankita SolankiОценок пока нет

- Motilal 9th WealthДокумент40 страницMotilal 9th WealthDhritimanDasОценок пока нет

- Plot BlockДокумент24 страницыPlot BlockDishaОценок пока нет

- Indian Stock Markets - Project ReportДокумент38 страницIndian Stock Markets - Project ReportcrazyayushОценок пока нет

- BSE - (Bombay Stock Exchange)Документ11 страницBSE - (Bombay Stock Exchange)Neel MkpcbmОценок пока нет

- Lakshay Sharma: Bba Ii ND E1Документ11 страницLakshay Sharma: Bba Ii ND E1Uday GuptaОценок пока нет

- 110821-Network Grievance Redressal Nodal Officer - EnglishДокумент2 страницы110821-Network Grievance Redressal Nodal Officer - EnglishLearn AutoОценок пока нет

- A Study On The Objective and Implementation of Demonetisation.Документ4 страницыA Study On The Objective and Implementation of Demonetisation.PRATEEK VERMA 1631320Оценок пока нет

- Stocks Watch ListДокумент9 страницStocks Watch ListUpsc 2018Оценок пока нет

- 0609170312main - Afd DL - 6 Sep 17 - All PDFДокумент267 страниц0609170312main - Afd DL - 6 Sep 17 - All PDFNishant MishraОценок пока нет

- Profit&loss Report 216286 2021Документ12 страницProfit&loss Report 216286 2021ThiruppathirajanОценок пока нет

- Fresco Apartment AddressessДокумент52 страницыFresco Apartment Addressessttt100% (1)

- Comparative Study of Brokerage Plans of Religare Securities Ltd. With Various Brokerage Firms-1Документ83 страницыComparative Study of Brokerage Plans of Religare Securities Ltd. With Various Brokerage Firms-1vibhatiwari31Оценок пока нет

- PG DissertationДокумент39 страницPG Dissertationavikalmanitripathi2023Оценок пока нет

- Bse Sensex: Navigation Search Improve This Article Talk PageДокумент11 страницBse Sensex: Navigation Search Improve This Article Talk PageankitashettyОценок пока нет

- Hindustan Times 1st September, 2021Документ35 страницHindustan Times 1st September, 2021VENOM GAMINGОценок пока нет

- Log File For The BhavДокумент6 страницLog File For The BhavAtul KapoorОценок пока нет