Академический Документы

Профессиональный Документы

Культура Документы

Oil - PL PDF

Загружено:

Darshan MaldeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Oil - PL PDF

Загружено:

Darshan MaldeАвторское право:

Доступные форматы

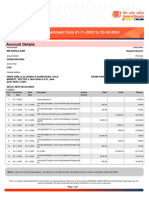

TataConsultancyServices

Commentarystable,Seasonalitytoimpactquarter

December18,2012 Shashi Bhusan shashibhusan@plindia.com +91-22-66322300 Pratik Shah pratikshah@plindia.com +91-22-66322256 Rating Price Target Price Implied Upside Sensex Nifty (PricesasonDecember17,2012) Tradingdata Market Cap. (Rs bn) Shares o/s (m) 3M Avg. Daily value (Rs m) Majorshareholders Promoters Foreign Domestic Inst. Public & Other StockPerformance (%) 1M 6M Absolute (6.3) (5.3) Relative (11.4) (18.8) HowwedifferfromConsensus EPS(Rs) PL Cons. 2013 70.0 69.3 2014 78.2 76.5 Accumulate Rs1,206 Rs1,400 16.1% 19,244 5,858

~3% negative impact due to lower working days and furloughs: According to the management, the quarter will be impacted by lower working days (1 day) and furloughs (~1.5 days). 1) Q3 generally witnesses furloughs from Hi-tech, manufacturing and telecom clients. 2) BFSI also witnesses furloughs in the quarter. However, the furloughs are not an indication of any budget cuts. 3) Lower growth in Europe due to weakness in telecom vertical 4) North America likely to deliver positive volume growth despite usual headwinds including Sandy 5) In terms of service line, the growth is likely to be evenly poised. 6) There is no pricing pressure, but didnt rule out volume discount. Grossadditionlikelytobelower,butfresheradditionstrong: The company is will have weak laterals additions but strong fresher additions. The management does not expect any spill-over in fresher addition to FY14. Moreover, guidance for FY14 fresher addition of 25k is retained. Also, the supply-side constraint will continue pushing subcontracting cost but at a slower pace. Margindeclinetocontinue,butstrictvigilon27%operatingmarginguidance: The management expects decline in margin due to lower working days, higher fresher intakes and forex movement. However, they reiterated their goal of 27% EBIT margin. The management was confident of recouping margin in Q4FY13. Q2FY13 & Q1FY13 operating margins were 26.8% and 27.5%, respectively. Taxratestable,forexlossduetopremiumchargedforoption: The hedging loss for Q3FY13 is likely to be Rs340-350m, compared to gain of Rs130m in Q2FY13. There will be positive asset translation impact in the quarter due to currency movement. Tax rate for the quarter is likely to be stable. Valuation&Recommendation: We retain our Accumulate rating.

Keyfinancials(Y/eMarch) Revenues (Rs m) Growth(%) EBITDA (Rs m) PAT (Rs m) EPS (Rs) Growth(%) Net DPS (Rs) Profitability&Valuation EBITDAmargin(%) RoE(%) RoCE(%) EV / sales (x) EV / EBITDA (x) PE (x) P / BV (x) Netdividendyield(%) Source:CompanyData;PLResearch 2011 373,245 24.3 111,984 91,395 46.7 39.3 23.3 2011 30.0 39.4 38.6 6.2 20.6 25.8 9.3 1.9 2012 488,938 31.0 144,176 106,441 54.4 16.5 19.8 2012 29.5 36.7 35.1 4.7 16.0 22.2 7.3 1.6 2013E 629,467 28.7 178,881 136,991 70.0 28.7 25.0 2013E 28.4 37.0 37.1 3.6 12.7 17.2 5.7 2.1

2,359.4 1,957.2 1679 73.98% 14.63% 6.71% 4.68% 12M 5.8 (18.4) %Diff. 1.1 2.2

PricePerformance(RIC:TCS.BO,BB:TCSIN)

(Rs) 1,600 1,400 1,200 1,000 800 600 400 200 0

2014E 704,834 12.0 198,814 153,088 78.2 11.8 28.0 2014E 28.2 33.0 33.4 3.2 11.2 15.4 4.6 2.3

Dec-11

Feb-12

Source:Bloomberg

Prabhudas Lilladher Pvt. Ltd. and/or its associates (the 'Firm') does and/or seeks to do business with companies covered in its research reports. As a result investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision. Please refer to important disclosures and disclaimers at the end of the report

Dec-12

Jun-12

Aug-12

Apr-12

Oct-12

AnalystMeetUpdate

We attended Tata Consultancy Services (TCS) Sell Side Analysts Meet on December 17, 2012. The management retained its stance on a stable outlook for FY13. However, Q3FY13 performance is likely to be impacted by lower number of working days and furloughs. The company didnt share median consensus expectationforthequarter.Wetweakourmodelforhighertaxrate,hencerevise ourtargetpricetoRs1,400(fromRs1,450).

Tata Consultancy Services

IncomeStatement(Rsm) Y/eMarch 2011

NetRevenue Raw Material Expenses Gross Profit Employee Cost Other Expenses EBITDA Depr. & Amortization Net Interest Other Income ProfitbeforeTax Total Tax ProfitafterTax Ex-Od items / Min. Int. Adj.PAT Avg.SharesO/S(m) EPS(Rs.) 373,245 204,296 168,949 56,965 111,984 7,214 (4,229) 9,553 114,324 21,739 92,585 (1,190) 91,395 1,957.2 46.7

2012

488,938 264,580 224,358 80,182 144,176 9,035 4,041 139,181 31,688 107,493 (1,052) 106,441 1,957.2 54.4

2013E

629,467 358,421 271,046 92,165 178,881 11,327 (9,206) 10,756 178,310 40,120 138,190 (1,200) 136,991 1,957.2 70.0

2014E

704,834 400,478 304,357 105,542 198,814 13,029 (11,744) 13,512 199,297 44,842 154,455 (1,367) 153,088 1,957.2 78.2

BalanceSheetAbstract(Rsm) Y/eMarch 2011

Shareholder's Funds Total Debt Other Liabilities TotalLiabilities Net Fixed Assets Goodwill Investments Net Current Assets Cash&Equivalents OtherCurrentAssets CurrentLiabilities Other Assets TotalAssets 254,155 380 13,742 268,278 51,996 34,064 18,390 105,726 47,350 116,406 58,030 58,101 268,278

2012

325,233 1,154 16,428 342,815 64,548 34,929 14,781 153,217 59,879 162,514 69,175 75,340 342,815

2013E

414,494 1,154 16,428 432,075 79,659 34,929 14,781 227,367 87,365 215,794 75,793 75,340 432,075

2014E

514,147 1,154 16,428 531,729 96,233 34,929 14,781 310,446 131,549 251,642 72,745 75,340 531,729

CashFlowAbstract(Rsm) Y/eMarch

C/F from Operations C/F from Investing C/F from Financing Inc. / Dec. in Cash Opening Cash Closing Cash FCFF FCFE

2011

69,148 (18,663) (13,384) 37,101 10,249 47,350 60,567 60,836

2012

75,440 (29,498) (1,602) 44,341 15,538 59,878 57,921 58,694

2013E

102,855 (26,438) (48,930) 27,487 59,878 87,365 75,218 75,218

2014E

128,588 (29,603) (54,802) 44,183 87,365 131,549 97,618 97,618

QuarterlyFinancials(Rsm) Y/eMarch Q1FY12

NetRevenue EBITDA %ofrevenue Depr. & Amortization Net Interest Other Income ProfitbeforeTax Total Tax ProfitafterTax Adj.PAT 107,970 30,310 28.1 2,049 2,886 31,147 7,063 23,803 23,803

Q2FY12

116,335 33,829 29.1 2,286 997 32,540 7,913 24,390 24,390

Q4FY12

132,594 39,116 29.5 2,397 1,078 37,796 8,174 29,382 29,382

Q2FY13

156,208 44,404 28.4 2,615 (2,264) 3,103 44,892 9,443 35,396 35,396

KeyFinancialMetrics Y/eMarch Growth

Revenue (%) EBITDA (%) PAT (%) EPS (%)

2011

24.3 29.0 39.3 39.3

2012

31.0 28.7 16.5 16.5

2013E

28.7 24.1 28.7 28.7

2014E

12.0 11.1 11.8 11.8 28.2 21.7 33.4 33.0 (0.3) 15.4 4.6 11.2 3.2 22.5 6.8 8.0 63.8

KeyOperatingMetrics Y/eMarch

Volume (persons month) Pricing (US$ / Hr) Currency (USDINR) SW Devp. Cost (% of Sales) SG&A (% of Sales) Revenue (US$ m) EBITDA Margin Expansion/(Erosion) (bps) Tax Rate (%) Source:CompanyData,PLResearch.

2011

2012

2013E

2014E

1,588,419 1,968,865 2,283,883 2,603,627 33.5 33.9 33.5 34.1 45.6 48.1 54.0 52.0 54.7 54.1 56.9 56.8 15.3 16.4 14.6 15.0 8,186 110 19.0 10,171 (52) 22.8 11,657 (107) 22.5 13,555 (21) 22.5

Profitability

EBITDA Margin (%) PAT Margin (%) RoCE (%) RoE (%) 30.0 24.5 38.6 39.4

29.5 21.8 35.1 36.7

28.4 21.8 37.1 37.0

BalanceSheet

Net Debt : Equity Net Wrkng Cap. (days) (0.2)

(0.2)

(0.2)

Valuation

PER (x) P / B (x) EV / EBITDA (x) EV / Sales (x) 25.8 9.3 20.6 6.2

22.2 7.3 16.0 4.7

17.2 5.7 12.7 3.6

EarningsQuality

Eff. Tax Rate 19.0 Other Inc / PBT 8.4 Eff. Depr. Rate (%) 8.6 FCFE / PAT 66.6 Source:CompanyData,PLResearch.

22.8 2.9 8.5 55.1

22.5 6.0 8.5 54.9

December 18, 2012

Tata Consultancy Services

Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 RatingDistributionofResearchCoverage

60%

53.7%

%ofTotalCoverage

50% 40% 30% 20% 10% 0% BUY Accumulate Reduce

20.7%

24.8%

0.8% Sell

Accumulate Sell TradingSell UnderReview(UR) : : : : Outperformance to Sensex over 12-months Over 15% underperformance to Sensex over 12-months Over 10% absolute decline in 1-month Rating likely to change shortly

PLsRecommendationNomenclature

BUY Reduce TradingBuy NotRated(NR) : : : :

Over 15% Outperformance to Sensex over 12-months Underperformance to Sensex over 12-months Over 10% absolute upside in 1-month No specific call on the stock

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

December 18, 2012

Вам также может понравиться

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Balance Sheet Strain, Slower Project Execution: Reuters: HCNS - BO Bloomberg: HCC INДокумент4 страницыBalance Sheet Strain, Slower Project Execution: Reuters: HCNS - BO Bloomberg: HCC INAnanya DuttaОценок пока нет

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryОт EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- BIMBSec - Hartalega 4QFY12 Results 20120509Документ3 страницыBIMBSec - Hartalega 4QFY12 Results 20120509Bimb SecОценок пока нет

- Bartronics Anand RathiДокумент2 страницыBartronics Anand RathisanjeevmohankapoorОценок пока нет

- AgilityДокумент5 страницAgilityvijayscaОценок пока нет

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Документ4 страницыNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkОценок пока нет

- Singtel - : No Myanmar, No ProblemДокумент4 страницыSingtel - : No Myanmar, No Problemscrib07Оценок пока нет

- Hexaware CompanyUpdateДокумент3 страницыHexaware CompanyUpdateAngel BrokingОценок пока нет

- Persistent Systems LTD.: IT Services - Q3 FY12 Result Update 27 January 2012Документ4 страницыPersistent Systems LTD.: IT Services - Q3 FY12 Result Update 27 January 2012shahavОценок пока нет

- Ascendas Reit - DaiwaДокумент5 страницAscendas Reit - DaiwaTerence Seah Pei ChuanОценок пока нет

- Wah Seong 4QFY11 20120223Документ3 страницыWah Seong 4QFY11 20120223Bimb SecОценок пока нет

- Bartronics LTD (BARLTD) : Domestic Revenues Take A HitДокумент4 страницыBartronics LTD (BARLTD) : Domestic Revenues Take A HitvaluelettersОценок пока нет

- City DevelopmentsДокумент6 страницCity DevelopmentsJay NgОценок пока нет

- File 28052013214151 PDFДокумент45 страницFile 28052013214151 PDFraheja_ashishОценок пока нет

- DLF IdbiДокумент5 страницDLF IdbivivarshneyОценок пока нет

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandДокумент4 страницыHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152Оценок пока нет

- Wilmar International: Outperform Price Target: SGD 4.15Документ4 страницыWilmar International: Outperform Price Target: SGD 4.15KofikoduahОценок пока нет

- Comfort Delgro - NomuraДокумент28 страницComfort Delgro - NomuraTerence Seah Pei ChuanОценок пока нет

- FXCM Q3 Slide DeckДокумент20 страницFXCM Q3 Slide DeckRon FinbergОценок пока нет

- Goodpack LTDДокумент3 страницыGoodpack LTDventriaОценок пока нет

- Singapore Company Focus: HOLD S$3.70Документ9 страницSingapore Company Focus: HOLD S$3.70LuiYuKwangОценок пока нет

- DB Corp: Key Management TakeawaysДокумент6 страницDB Corp: Key Management TakeawaysAngel BrokingОценок пока нет

- Ho Bee Investment LTD: Positive 1Q2013 ResultsДокумент9 страницHo Bee Investment LTD: Positive 1Q2013 ResultsphuawlОценок пока нет

- Symphony LTD.: CompanyДокумент4 страницыSymphony LTD.: CompanyrohitcoepОценок пока нет

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Документ2 страницыBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecОценок пока нет

- Blue Dart Express LTD.: CompanyДокумент5 страницBlue Dart Express LTD.: CompanygirishrajsОценок пока нет

- TRIVENI140509 Wwwmon3yworldblogspotcomДокумент3 страницыTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraОценок пока нет

- Press Meet Q4 FY12Документ30 страницPress Meet Q4 FY12Chintan KotadiaОценок пока нет

- BIMBSec - Digi Company Update - 20120502Документ3 страницыBIMBSec - Digi Company Update - 20120502Bimb SecОценок пока нет

- Starhill Global REIT Ending 1Q14 On High NoteДокумент6 страницStarhill Global REIT Ending 1Q14 On High NoteventriaОценок пока нет

- Market Outlook, 5th February, 2013Документ15 страницMarket Outlook, 5th February, 2013Angel BrokingОценок пока нет

- Hap Seng Plantations 4QFY11Result 20120215Документ3 страницыHap Seng Plantations 4QFY11Result 20120215Bimb SecОценок пока нет

- Exide Industries: Top Line Disappoints Hinting at Possible Loss of Market ShareДокумент5 страницExide Industries: Top Line Disappoints Hinting at Possible Loss of Market ShareRinku RinkyuerОценок пока нет

- Investment Idea HDFCLTD Hold 101021001914 Phpapp01Документ2 страницыInvestment Idea HDFCLTD Hold 101021001914 Phpapp01yogi3250Оценок пока нет

- MOSt - Multi Commodity Exchange - 3QFY13 Results Update - 2 February 2013Документ6 страницMOSt - Multi Commodity Exchange - 3QFY13 Results Update - 2 February 2013ndet01Оценок пока нет

- Project Report On: By-Deepak Verma Amrit Kumar Shubham Gupta PriyaДокумент12 страницProject Report On: By-Deepak Verma Amrit Kumar Shubham Gupta PriyaDeepzz SanguineОценок пока нет

- Yes Bank: Emergin G StarДокумент5 страницYes Bank: Emergin G StarAnkit ModaniОценок пока нет

- Kingfisher Airlines LTD.: Result UpdateДокумент4 страницыKingfisher Airlines LTD.: Result UpdateSagar KavdeОценок пока нет

- Axis Bank Q4FY12 Result 30-April-12Документ8 страницAxis Bank Q4FY12 Result 30-April-12Rajesh VoraОценок пока нет

- CIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Документ5 страницCIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Gaayaatrii BehuraaОценок пока нет

- Indiabulls Gilt FundДокумент4 страницыIndiabulls Gilt FundYogi173Оценок пока нет

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingДокумент4 страницыGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlОценок пока нет

- Financial Analysis of Samsung PLCДокумент17 страницFinancial Analysis of Samsung PLCROHIT SETHI90% (10)

- 2013 6 June Monthly Report TPOUДокумент1 страница2013 6 June Monthly Report TPOUSharonWaxmanОценок пока нет

- SAMP - 1H2013 Earnings Note - BUY - 27 August 2013Документ4 страницыSAMP - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkОценок пока нет

- TCS LTD Q2'13 Earning EstimateДокумент2 страницыTCS LTD Q2'13 Earning EstimateSuranjoy SinghОценок пока нет

- Kaveri SeedsДокумент5 страницKaveri SeedsNandeesh KodimallaiahОценок пока нет

- CRISIL Event UpdateДокумент4 страницыCRISIL Event UpdateAdarsh Sreenivasan LathikaОценок пока нет

- 7jul11 - Tiger AirwaysДокумент3 страницы7jul11 - Tiger AirwaysmelyeapОценок пока нет

- Infosys Technologies: Cautious in The Realm of Rising UncertaintyДокумент7 страницInfosys Technologies: Cautious in The Realm of Rising UncertaintyAngel BrokingОценок пока нет

- SPH Reit - Hold: Upholding Its StrengthДокумент5 страницSPH Reit - Hold: Upholding Its StrengthventriaОценок пока нет

- Lippo Malls Indonesia Retail Trust: 2Q 2013 Results Presentation (Updated)Документ15 страницLippo Malls Indonesia Retail Trust: 2Q 2013 Results Presentation (Updated)RogerHuangОценок пока нет

- Research Sample - IREДокумент7 страницResearch Sample - IREIndepResearchОценок пока нет

- KPIT 2QFY16 Outlook ReviewДокумент5 страницKPIT 2QFY16 Outlook ReviewgirishrajsОценок пока нет

- Opening Bell: Key Points Index Movement (Past 5 Days)Документ14 страницOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandОценок пока нет

- 1Q12 Investor InformationДокумент58 страниц1Q12 Investor Informationvishan_sharmaОценок пока нет

- ValueResearchFundcard HDFCTop200 2011oct05Документ6 страницValueResearchFundcard HDFCTop200 2011oct05SUNJOSH09Оценок пока нет

- ICICI KotakДокумент4 страницыICICI KotakwowcoolmeОценок пока нет

- Multi Commodity Exchange of IndiaДокумент6 страницMulti Commodity Exchange of Indianit111Оценок пока нет

- Thermax: Hold Target Price (INR) 564 Revenue Decelerates, Order Inflows SteadyДокумент6 страницThermax: Hold Target Price (INR) 564 Revenue Decelerates, Order Inflows SteadyDarshan MaldeОценок пока нет

- Epbabi Iim RanchiДокумент6 страницEpbabi Iim RanchiDarshan MaldeОценок пока нет

- National Peroxide - Q3FY13 Result UpdateДокумент2 страницыNational Peroxide - Q3FY13 Result UpdateDarshan MaldeОценок пока нет

- DailymarketOutlook 1january2013Документ3 страницыDailymarketOutlook 1january2013Darshan MaldeОценок пока нет

- Panditvani (Astrological View On Market)Документ2 страницыPanditvani (Astrological View On Market)Darshan MaldeОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Axisdirect DT 01-01-13Документ5 страницAxisdirect DT 01-01-13Darshan MaldeОценок пока нет

- Money Trend - 1 Jan - 12 - 0101130948Документ6 страницMoney Trend - 1 Jan - 12 - 0101130948Darshan MaldeОценок пока нет

- Axisdirect Dms 01-01-13Документ3 страницыAxisdirect Dms 01-01-13Darshan MaldeОценок пока нет

- Money Derilook-010113 - 14 - 0101130925Документ6 страницMoney Derilook-010113 - 14 - 0101130925Darshan MaldeОценок пока нет

- Corporation Bank Q3FY13 Result UpdateДокумент5 страницCorporation Bank Q3FY13 Result UpdateDarshan MaldeОценок пока нет

- Technical Stock Pick Zee Entertainment February 08, 2013: Retail ResearchДокумент2 страницыTechnical Stock Pick Zee Entertainment February 08, 2013: Retail ResearchDarshan MaldeОценок пока нет

- Granzo DLL Genmathmath11 Week7Документ12 страницGranzo DLL Genmathmath11 Week7KIMBERLYN GRANZOОценок пока нет

- Valuation Methods - 3Документ6 страницValuation Methods - 3mohd shariqОценок пока нет

- CapitaLand Limited SGX C31 Financials Income StatementДокумент3 страницыCapitaLand Limited SGX C31 Financials Income StatementElvin TanОценок пока нет

- OutputДокумент37 страницOutputTrisha RafalloОценок пока нет

- The History of Paper Money in China (Pp. 136-142) John PickeringДокумент8 страницThe History of Paper Money in China (Pp. 136-142) John Pickeringzloty941Оценок пока нет

- Multinational Corporations: Some of Characteristics of Mncs AreДокумент7 страницMultinational Corporations: Some of Characteristics of Mncs AreMuskan KaurОценок пока нет

- Estmt 01 26 2012Документ3 страницыEstmt 01 26 2012Sundeep NukarajuОценок пока нет

- Assignment No 8Документ12 страницAssignment No 8Tasneem ShafiqОценок пока нет

- Contact Us NewayДокумент1 страницаContact Us Newayhr pslОценок пока нет

- Money Receipt: Kogta Financial (India) LimitedДокумент2 страницыMoney Receipt: Kogta Financial (India) LimitedMARKOV BOSSОценок пока нет

- FDATA Open Banking in North America US VersionДокумент33 страницыFDATA Open Banking in North America US VersionsdfgОценок пока нет

- Session 1 - FM Function and Basic Investment Appraisal: ACCA F9 Financial ManagementДокумент8 страницSession 1 - FM Function and Basic Investment Appraisal: ACCA F9 Financial ManagementKodwoPОценок пока нет

- The Determinant Factors of Indonesian Government Bond ReturnsДокумент2 страницыThe Determinant Factors of Indonesian Government Bond Returnsdebby pratiwiОценок пока нет

- Understanding Money ManagementДокумент58 страницUnderstanding Money ManagementJulie SuazoОценок пока нет

- Assurance Auditing and Related ServicesДокумент182 страницыAssurance Auditing and Related Servicesmoon2fielОценок пока нет

- 349191compund Intrest Sheet-3 - CrwillДокумент9 страниц349191compund Intrest Sheet-3 - Crwillmadhuknl8674Оценок пока нет

- Equity Research Summer ProjectДокумент66 страницEquity Research Summer Projectpajhaveri4009Оценок пока нет

- CH 09Документ27 страницCH 09Imtiaz PiasОценок пока нет

- Financial Analysis of Tesco PLCДокумент7 страницFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- XXXXXXXXXX0009 20240128150640302188 UnlockedДокумент6 страницXXXXXXXXXX0009 20240128150640302188 Unlockedr6540073Оценок пока нет

- Readiness Guide Managing Liquidity in An Instant Payments WorldДокумент3 страницыReadiness Guide Managing Liquidity in An Instant Payments WorldLaLa BanksОценок пока нет

- Convertibles, Exchangeables, - and WarrantsДокумент26 страницConvertibles, Exchangeables, - and WarrantsPankaj ShahОценок пока нет

- Tender Documnet ICTДокумент54 страницыTender Documnet ICTMusharaf Habib100% (1)

- Unit 3 Money and Budgeting: Ebe 1 Adina Oana NicolaeДокумент15 страницUnit 3 Money and Budgeting: Ebe 1 Adina Oana NicolaedanielaОценок пока нет

- Accountancy Syllabus For Half Yearly Examinations: Chapter No Weightage 1Документ2 страницыAccountancy Syllabus For Half Yearly Examinations: Chapter No Weightage 1Amanjot SinghОценок пока нет

- PrivateEquity Seminar - PEI Media's Private Equity - A Brief Overview - 318Документ14 страницPrivateEquity Seminar - PEI Media's Private Equity - A Brief Overview - 318thomas.mkaglobalОценок пока нет

- Principles of AccountingДокумент8 страницPrinciples of AccountingDanish MuradОценок пока нет

- Project Management MSC 2016 Assignment 1 - DoneДокумент9 страницProject Management MSC 2016 Assignment 1 - DonesizzlacalunjiОценок пока нет

- Sec Form LcfsДокумент15 страницSec Form LcfsMeanne Waga Salazar100% (1)

- MT 760 Bank InstrumentsДокумент1 страницаMT 760 Bank InstrumentskdelaozОценок пока нет