Академический Документы

Профессиональный Документы

Культура Документы

Housing Example Sheet

Загружено:

Dewita SoeharjonoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Housing Example Sheet

Загружено:

Dewita SoeharjonoАвторское право:

Доступные форматы

Support Under the Homeowner Affordability and Stability Plan: Three Cases

Family A: Access to Refinancing

In 2006: Family A took a 30-year fixed rate mortgage of $207,000 on a house worth $260,000 at the

time. (The family put just over 20% down.) They received a Fannie Mae conforming loan with an

interest rate of 6.50%.

Today: Family A has about $200,000 remaining on their mortgage but their home value has fallen 15

percent to $221,000.

o Their “loan-to-value” ratio is now 90%, making them ineligible for a Fannie Mae

refinancing.

Under the Refinancing Plan: Family A can refinance to a rate of 5.16%. This would reduce their

annual payments by nearly $2,350.

Existing Mortgage Refinancing

Balance $199,584 $203,575

Remaining Years 27 30

Interest Rate 6.50% 5.16%

Monthly Payment $1,308 $1,113

Savings $196 per month, $2,347 per year

Family B: Access to Refinancing

In 2006: Family B took a 30-year fixed rate mortgage of $350,000 on a house worth $475,000 at the

time. (The family put just over 26% down.) They received a Fannie Mae conforming loan with an

interest rate of 6.50%.

Today: Family B has about $337,460 remaining on their mortgage but their home value has fallen to

$400,000.

o Their “loan-to-value” ratio is now 84%, making them ineligible for a Fannie Mae

refinancing.

Under the Refinancing Plan: Family B can refinance to a rate of 5.16%. This would reduce their

annual payments by nearly $4,000.

Existing Mortgage Refinancing

Balance $337,460 $344,210

Remaining Years 27 30

Interest Rate 6.50% 5.16%

Monthly Payment $2,212 $1,882

Savings $331 per month, $3,968 per year

Family C: Eligible for Homeowner Stability Initiative

In 2006: Family C took out a 30-year subprime mortgage of $220,000, on a house worth $230,000

at the time (they put less than 5% down). Their mortgage broker – Mom & Pop Mortgage – sold

their loan to Investment Bank. The interest rate on their mortgage is 7.5%.

Today: Family C has $214,016 remaining on their mortgage but their home value has fallen -18%

to $189,000. Also, in November, one parent in Family C was moved from full-time to part-time

work, causing a significant negative shock to their income.

o Their loan is now 113% the value of their home, making them “underwater” and unable to

sell their house.

o Meanwhile, their monthly mortgage payment is $1,538 and their monthly income has fallen

to $3,650, meaning the ratio of their monthly mortgage debt to income is 42%.

Under the Homeowner Stability Initiative: Family C can get a government sponsored

modification that – for five years – will reduce their mortgage payment by $406 a month. After

those five years, Family C’s mortgage payment will adjust upward at a moderate, phased-in level.

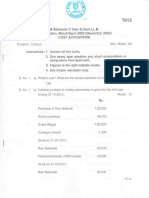

Existing Mortgage Loan Modification

Balance $213,431 $213,431

Remaining Years 27 27

Interest Rate 7.50% 4.42%

Monthly Payment $1,538 $1,132

Savings: $406 per month, $4,870 per year

Homeowner Stability Initiative: How the Program Works for the Lender, Government and Borrower

First, Investment Bank (working through a mortgage servicer) reduces the interest rate so that the

Family C’s monthly debt-to-income ratio drops from 42% to 38%. This means that Investment

Bank must reduce the interest rate from 7.50% to 6.38%, bringing down Family C’s monthly

payment from $1,538 to $1,387.

Second, the government and Investment Bank share the cost of further reducing the interest rate

so that the Family C’s monthly debt-to-income level is lowered to 31%. Any dollar the bank spends

is matched by the government. At this stage, Family C’s interest rate is reduced from 6.41% to

4.43%. In total, Family C’s monthly payment has fallen from $1,538 to $1,132.

If Family C remains current on their payments, they will receive incentive payments up to $1,000 a

year, or $5,000 over five years, that would go towards reducing the principal they owe.

Additionally, the mortgage servicer can earn an up-front incentive fee of $1,000, plus up to $1,000

per year in “Pay for Success” fees for three years, so long as Family C remains current.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Microeconomics Practice TestДокумент9 страницMicroeconomics Practice TestSonataОценок пока нет

- A Beginner's Guide To Altcoin Day TradingДокумент16 страницA Beginner's Guide To Altcoin Day Tradingblowinzips67% (6)

- 10 Business Models For This DecadeДокумент83 страницы10 Business Models For This DecadeDewita SoeharjonoОценок пока нет

- UNEP Campaign GuideДокумент68 страницUNEP Campaign GuideFuterra Sustainability CommunicationsОценок пока нет

- Sustainable CitiesДокумент136 страницSustainable CitiesDewita Soeharjono33% (3)

- Need To Know Vol1Документ11 страницNeed To Know Vol1Dewita SoeharjonoОценок пока нет

- 2011-06 Trend Watching Innovation ExtravaganzaДокумент12 страниц2011-06 Trend Watching Innovation ExtravaganzaLuis AsenjoОценок пока нет

- Tinner Hill Blues Festival 2012Документ3 страницыTinner Hill Blues Festival 2012Dewita SoeharjonoОценок пока нет

- Need To Know Vol2Документ10 страницNeed To Know Vol2Dewita SoeharjonoОценок пока нет

- 5 Population Trends That Can Either Disrupt or Transform Your Business (And Career)Документ6 страниц5 Population Trends That Can Either Disrupt or Transform Your Business (And Career)Dewita SoeharjonoОценок пока нет

- CMOcom Social Media Landscape 2011Документ1 страницаCMOcom Social Media Landscape 2011Dewita SoeharjonoОценок пока нет

- List of (Almost) 40 Anti-Environmental Proposals in GOP Debt PlanДокумент4 страницыList of (Almost) 40 Anti-Environmental Proposals in GOP Debt PlanDewita SoeharjonoОценок пока нет

- Trend Watching: 67 Innovation InsanityДокумент22 страницыTrend Watching: 67 Innovation InsanityDewita SoeharjonoОценок пока нет

- Carbon Market Weekly June 21 2010Документ9 страницCarbon Market Weekly June 21 2010Dewita SoeharjonoОценок пока нет

- Green Game Change ReportДокумент36 страницGreen Game Change ReportDewita SoeharjonoОценок пока нет

- EXCEPTIONALL: 50+ Must See Consumers Innovators & Innovations From Emerging MarketsДокумент20 страницEXCEPTIONALL: 50+ Must See Consumers Innovators & Innovations From Emerging MarketsDewita SoeharjonoОценок пока нет

- 20 Global Trends That Can Have An Impact On Your BusinessДокумент3 страницы20 Global Trends That Can Have An Impact On Your BusinessDewita SoeharjonoОценок пока нет

- Product Water Footprint AssessmentsДокумент48 страницProduct Water Footprint AssessmentsDewita SoeharjonoОценок пока нет

- The Economics of Ecosystems and Biodiversity: Executive SummaryДокумент27 страницThe Economics of Ecosystems and Biodiversity: Executive SummaryDewita SoeharjonoОценок пока нет

- World Conservation - Saving BiodiversityДокумент24 страницыWorld Conservation - Saving BiodiversityDewita SoeharjonoОценок пока нет

- The Biosphere EconomyДокумент28 страницThe Biosphere EconomyDewita SoeharjonoОценок пока нет

- WBCSD - Exploring The Role of Business Through Vision 2050Документ80 страницWBCSD - Exploring The Role of Business Through Vision 2050Eric Britton (World Streets)Оценок пока нет

- Breaking New Ground Using The Internet To ScaleДокумент18 страницBreaking New Ground Using The Internet To ScaleDewita SoeharjonoОценок пока нет

- PEW Energy Efficiency ExSummaryДокумент3 страницыPEW Energy Efficiency ExSummaryfdrz200887Оценок пока нет

- Business & EcosystemsДокумент20 страницBusiness & EcosystemstbeedleОценок пока нет

- Flow Rate BPДокумент2 страницыFlow Rate BPZerohedgeОценок пока нет

- Made in USA! Domestic Manufacturing SharesДокумент6 страницMade in USA! Domestic Manufacturing SharesDewita SoeharjonoОценок пока нет

- NOVA 2020 Trans Plan MapДокумент1 страницаNOVA 2020 Trans Plan MapDewita SoeharjonoОценок пока нет

- TedPAD WhiteДокумент1 страницаTedPAD WhiteDewita SoeharjonoОценок пока нет

- Fairfax Leader Q1 2010Документ8 страницFairfax Leader Q1 2010Dewita SoeharjonoОценок пока нет

- Clean Energy Trends 2010Документ22 страницыClean Energy Trends 2010Dewita SoeharjonoОценок пока нет

- Jobs For AmericaДокумент65 страницJobs For AmericaDewita SoeharjonoОценок пока нет

- A Study On Customer Preference Towards Brand FactoryДокумент21 страницаA Study On Customer Preference Towards Brand FactoryH.Arokiaraj100% (2)

- Savvy Entrepreneurial Firm: Pandora: What's Possible When An Entire Company Has "Tenacity"Документ1 страницаSavvy Entrepreneurial Firm: Pandora: What's Possible When An Entire Company Has "Tenacity"Faizan MujahidОценок пока нет

- Homework Week 10Документ13 страницHomework Week 10LОценок пока нет

- PDF DocumentДокумент2 страницыPDF DocumentNavya RaiОценок пока нет

- IFRS 5 Non-Current Assets Held For Sale and Discontinued OperationsДокумент12 страницIFRS 5 Non-Current Assets Held For Sale and Discontinued Operationsanon_419651076Оценок пока нет

- Session 3 AUDITING AND ASSURANCE PRINCIPLESДокумент29 страницSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100Оценок пока нет

- Death of Big LawДокумент55 страницDeath of Big Lawmaxxwe11Оценок пока нет

- A Futures Contract Based On Brent Crude OilДокумент4 страницыA Futures Contract Based On Brent Crude OilJean-Louis KouassiОценок пока нет

- Balance NordeaДокумент216 страницBalance NordeasdfasdfaОценок пока нет

- Account StatementДокумент18 страницAccount StatementLollyОценок пока нет

- 3rd Sem Cost Accounting Apr 2023Документ8 страниц3rd Sem Cost Accounting Apr 2023Chandan GОценок пока нет

- Benefits AccountingДокумент4 страницыBenefits AccountingJulian Christopher Torcuator50% (2)

- Credit Card VS Debit CardДокумент3 страницыCredit Card VS Debit CardS K MahapatraОценок пока нет

- Tesla FSAPДокумент20 страницTesla FSAPSihongYanОценок пока нет

- Unit 1 Final PresentationДокумент111 страницUnit 1 Final PresentationVandana SharmaОценок пока нет

- Yash - i5M&P - YASH KALA PGP 2021-23 BatchДокумент5 страницYash - i5M&P - YASH KALA PGP 2021-23 BatchkshiОценок пока нет

- Global RRL of AbesnteeismДокумент4 страницыGlobal RRL of AbesnteeismelijahjosephhmesadaОценок пока нет

- Hire Purchase and Credit Sale Act 2013Документ35 страницHire Purchase and Credit Sale Act 2013karlpragassenОценок пока нет

- First Report of InjuryДокумент2 страницыFirst Report of Injurykari lyonsОценок пока нет

- Micro Analysis of CERA SenetaryДокумент98 страницMicro Analysis of CERA SenetaryDhimant0% (1)

- M1 Post-Task Essay On The History of GlobalizationДокумент2 страницыM1 Post-Task Essay On The History of GlobalizationJean SantosОценок пока нет

- Tomato ProductsДокумент5 страницTomato ProductsDan Man100% (1)

- 1 - Working Capital Management (Aditi)Документ50 страниц1 - Working Capital Management (Aditi)Preet PreetОценок пока нет

- 1.1 Introduction To EconomicsДокумент9 страниц1.1 Introduction To EconomicsManupa PereraОценок пока нет

- Gordon College College of Business and Accountancy Financial Accounting TheoriesДокумент15 страницGordon College College of Business and Accountancy Financial Accounting TheoriesKylie Luigi Leynes BagonОценок пока нет

- Sugar Crisis in Egypt, 2016: Important InfoДокумент3 страницыSugar Crisis in Egypt, 2016: Important InfoyoussraselimОценок пока нет

- Engineering Economy: (7th Edition)Документ2 страницыEngineering Economy: (7th Edition)Joyce HerreraОценок пока нет