Академический Документы

Профессиональный Документы

Культура Документы

Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (BCV) Attracts Deposits and Offers Retail, Private, And Corporate Banking Services. BCV Operates Primarily in the Canton of Vaud

Загружено:

Q.M.S Advisors LLCИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (BCV) Attracts Deposits and Offers Retail, Private, And Corporate Banking Services. BCV Operates Primarily in the Canton of Vaud

Загружено:

Q.M.S Advisors LLCАвторское право:

Доступные форматы

20.02.

2013

Company Analysis - Overview

Ticker:

Banque Cantonale Vaudoise

BCVN SW

SIX Swiss Ex: BCVN, Currency: CHF

Currency:

Sector: Financials

Benchmark:

SWISS MARKET INDEX (SMI)

Industry: Commercial Banks

Year:

Telephone

41-21-212-1000

Revenue (M)

Website

www.bcv.ch

No of Employees

Address

Place Saint-Francois 14 Case postale 300 Lausanne, 1001 Switzerland

Share Price Performance in CHF

Price

522.00

1M Return

52 Week High

524.00

6M Return

52 Week Low

436.94

52 Wk Return

52 Wk Beta

0.67

YTD Return

Credit Ratings

Bloomberg

S&P

Moody's

Fitch

1'321

1'967

6.9%

3.4%

14.9%

7.7%

IG3

AA

-

Date

Date

Date

12/09

11.8x

2.6x

1.4x

5.1%

12/10

13.5x

3.1x

1.7x

4.5%

12/11

13.0x

2.9x

1.5x

7.0%

12/12

13.4x

3.2x

1.6x

6.6%

12/13E

14.4x

4.4x

1.3x

6.1%

12/14E

14.2x

4.3x

1.2x

6.2%

12/15E

13.7x

4.2x

1.3x

6.3%

12/09

Gross Margin

EBITDA Margin

Operating Margin

35.0

Profit Margin

28.8

Return on Assets

0.8

Return on Equity

12.1

Leverage and Coverage Ratios

12/09

Current Ratio

Quick Ratio

EBIT/Interest

Tot Debt/Capital

0.8

Tot Debt/Equity

3.2

Eff Tax Rate %

22.6

12/10

36.5

29.1

0.9

12.4

12/11

34.5

27.7

0.8

11.8

12/12

36.5

29.1

0.8

12.0

12/13E

51.6

30.3

0.9

9.3

12/14E

52.5

30.1

0.9

9.3

12/15E

51.4

30.4

0.9

9.4

12/10

0.7

3.0

22.9

12/11

0.8

3.1

23.0

12/12

0.8

3.2

22.8

05.12.2011

-

Outlook

Outlook

Outlook

Banque Cantonale Vaudoise (BCV) attracts deposits and offers retail, private, and

corporate banking services. The Bank offers consumer loans, treasury management,

pension funds, and investment management services, trades in commodities, advises

on mergers and acquisitions, and offers securities brokerage services. BCV operates

primarily in the Canton of Vaud.

Business Segments in CHF

Wealth Management

Corporate Banking

Retail Banking

Corporate Center

Trading

Sales (M)

368

287

214

86

62

Geographic Segments in CHF

Switzerland

Rest of the World

Sales (M)

1

6%

NEG

STABLE

-

8%

37%

Valuation Ratios

P/E

EV/EBIT

EV/EBITDA

P/S

P/B

Div Yield

Profitability Ratios %

21%

28%

100%

Wealth Management

Corporate Banking

Retail Banking

Switzerland

Corporate Center

Trading

Current Capitalization in CHF

Common Shares Outstanding (M)

Market Capitalization (M)

Cash and ST Investments (M)

Total Debt (M)

Preferred Equity (M)

LT Investments in Affiliate Companies (M)

Investments (M)

Enterprise Value (M)

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

8.6

4492.4

6738.0

8850.0

0.0

0.0

20.0

6624.4

Company Analysis - Analysts Ratings

Banque Cantonale Vaudoise

Buy and Sell Recommendations vs Price and Target Price

100%

0%

20%

80%

33%

0%

17%

20%

600

0%

17%

17%

17%

20%

33%

40%

80%

67%

100%

500

400

400

83%

80%

300

100%

83%

83%

83%

Brokers' Target Price

600

500

60%

100%

Price

300

200

80%

200

67%

100

20%

100

0%

fvr.12

mars.12

avr.12

mai.12

0%

0%

0%

0%

0%

juin.12

juil.12

aot.12

sept.12

oct.12

Buy

Date

31-Jan-13

31-Dec-12

30-Nov-12

31-Oct-12

28-Sep-12

31-Aug-12

31-Jul-12

29-Jun-12

31-May-12

30-Apr-12

30-Mar-12

29-Feb-12

Hold

Sell

Price

0%

0%

0%

nov.12

dc.12

janv.13

Target Price

Buy

Hold

Sell

Date

0%

0%

0%

0%

0%

0%

0%

0%

0%

0%

0%

0%

80%

83%

100%

83%

83%

83%

100%

100%

80%

80%

67%

67%

20%

17%

0%

17%

17%

17%

0%

0%

20%

20%

33%

33%

20-Feb-13

19-Feb-13

18-Feb-13

15-Feb-13

14-Feb-13

13-Feb-13

12-Feb-13

11-Feb-13

8-Feb-13

7-Feb-13

6-Feb-13

5-Feb-13

4-Feb-13

1-Feb-13

31-Jan-13

30-Jan-13

29-Jan-13

28-Jan-13

25-Jan-13

24-Jan-13

23-Jan-13

22-Jan-13

21-Jan-13

18-Jan-13

17-Jan-13

16-Jan-13

15-Jan-13

14-Jan-13

11-Jan-13

10-Jan-13

Price Target Price

Broker

Analyst

522.00

512.00

505.50

496.00

503.00

471.25

481.00

488.25

485.50

486.25

487.00

490.75

488.75

489.75

486.25

485.25

486.75

493.75

488.75

486.25

486.25

489.00

490.00

488.50

491.75

487.00

486.75

491.25

493.00

491.25

EVA Dimensions

Bank Vontobel AG

Zuercher Kantonalbank

Main First Bank AG

Helvea

AUSTIN BURKETT

TERESA NIELSEN

ANDREAS VENDITTI

KILIAN MAIER

TIM DAWSON

515.00

515.00

501.67

507.50

507.50

492.50

492.50

492.50

491.67

491.67

491.67

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

475.00

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Recommendation

sell

hold

market perform

underperform

neutral

Helvea

0%

Main First

Bank AG

0%

Zuercher

Kantonalbank

0%

Bank Vontobel

AG

0

0%

EVA

Dimensions

Broker Recommendation

Target price in CHF

Target

530.00

490.00

525.00

Date

20-Feb-13

19-Feb-13

15-Feb-13

14-Feb-13

14-Feb-13

20.02.2013

Banque Cantonale Vaudoise

Company Analysis - Ownership

Ownership Type

Ownership Statistics

Shares Outstanding (M)

Float

Short Interest (M)

Short Interest as % of Float

Days to Cover Shorts

Institutional Ownership

Retail Ownership

Insider Ownership

8.6

32.7%

25%

74.88%

24.81%

0.30%

75%

Institutional Ownership

Retail Ownership

Insider Ownership

Pricing data is in CHF

Top 20 Owners:

Holder Name

CANTON OF VAUD

UBS FUND MANAGEMENT

BLACKROCK

VANGUARD GROUP INC

JUPITER ASSET MANAGE

CREDIT SUISSE ASSET

THORNBURG INVESTMENT

SWISSCANTO FONDSLEIT

NEW JERSEY DIVISION

PICTET & CIE

ALLIANZ ASSET MANAGE

SCHRODER INVESTMENT

BNP PARIBAS INV PART

VONTOBEL ASSET MANAG

SCHRODER INVESTMENT

BARING FUND MANAGERS

PRUDENTIAL FINANCIAL

INTERNATIONAL VALUE

SARASIN

STEIMER OLIVIER

Switzerland

United States

Britain

Luxembourg

Unknown Country

Germany

France

Others

93.03%

3.08%

1.47%

1.34%

0.40%

0.15%

0.14%

0.40%

Institutional Ownership Distribution

Government

Investment Advisor

Mutual Fund Manager

Individual

Others

89.05%

7.37%

2.79%

0.40%

0.39%

STEIMER OLIVIER

KIENER PASCAL

ACHARD AIME

SCHWARZ JEAN-FRANCOIS

SAGER BERTRAND

0%0%0%

0%

1%

1%

4%

94%

Switzerland

United States

Britain

Luxembourg

Unknown Country

Germany

France

Others

TOP 20 ALL

Position

5'762'252

99'092

58'620

55'668

54'169

45'660

44'400

31'940

24'618

23'611

22'742

18'595

18'469

16'600

16'170

12'574

10'122

9'890

9'201

8'074

Position Change

0

-291

7'662

1'997

-11'500

775

0

-514

0

0

0

3'950

-113

3'350

0

0

0

-5'912

0

0

Market Value

3'007'895'544

51'726'024

30'599'640

29'058'696

28'276'218

23'834'520

23'176'800

16'672'680

12'850'596

12'324'942

11'871'324

9'706'590

9'640'818

8'665'200

8'440'740

6'563'628

5'283'684

5'162'580

4'802'922

4'214'628

% of Ownership

66.95%

1.15%

0.68%

0.65%

0.63%

0.53%

0.52%

0.37%

0.29%

0.27%

0.26%

0.22%

0.21%

0.19%

0.19%

0.15%

0.12%

0.11%

0.11%

0.09%

Report Date

Position

Position Change

Market Value

% of Ownership

Report Date

01.01.2012

31.10.2012

15.02.2013

31.12.2012

31.07.2012

28.12.2012

31.12.2012

30.11.2012

30.06.2012

31.10.2012

31.12.2012

30.06.2012

30.11.2012

31.10.2012

28.09.2012

31.10.2012

31.12.2012

31.03.2012

30.11.2012

31.12.2011

Source

Co File

MF-AGG

ULT-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

ULT-AGG

MF-AGG

ULT-AGG

MF-AGG

MF-AGG

MF-AGG

ULT-AGG

MF-AGG

ULT-AGG

Co File

Top 5 Insiders:

Holder Name

Geographic Ownership

Geographic Ownership Distribution

0%

8'074

7'177

1'642

1'583

1'566

4'214'628

3'746'394

857'124

826'326

817'452

0.09%

0.08%

0.02%

0.02%

0.02%

Source

31.12.2011

31.12.2011

31.12.2011

31.12.2011

31.12.2011

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Co File

Co File

Co File

Co File

Co File

Country

SWITZERLAND

SWITZERLAND

UNITED STATES

UNITED STATES

BRITAIN

SWITZERLAND

UNITED STATES

SWITZERLAND

UNITED STATES

SWITZERLAND

GERMANY

BRITAIN

FRANCE

SWITZERLAND

SWITZERLAND

BRITAIN

UNITED STATES

UNITED STATES

n/a

Institutional Ownership

0%

3%

0%

7%

90%

Government

Investment Advisor

Individual

Others

Mutual Fund Manager

Company Analysis - Financials I/IV

Banque Cantonale Vaudoise

Financial information is in CHF (M)

Periodicity:

Fiscal Year

Equivalent Estimates

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

12/13E

12/14E

12/15E

1'604

1'516

1'438

1'499

1'590

1'727

1'566

1'371

1'352

1'352

1'321

1'029

1'050

1'074

856

732

674

643

656

645

589

590

608

622

611

-977

156

427

378

433

429

325

365

393

377

391

531

551

552

-36

-18

-12

-210

-247

-287

-134

-24

-14

-14

-12

Pretax Income

- Income Tax Expense

-1'192

8

174

17

359

22

477

20

558

23

576

99

459

101

390

88

407

93

391

90

403

92

414

424

433

Income Before XO Items

- Extraordinary Loss Net of Tax

- Minority Interests

-1'200

0

0

157

0

3

337

0

2

457

0

3

534

477

4

301

0

1

314

0

1

301

358

0

1

311

0

0

312

36.18

32.00

0.88

316

36.66

32.25

0.88

326

38.22

33.00

0.86

Income Statement

Revenue

- Cost of Goods Sold

Gross Income

- Selling, General & Admin Expenses

(Research & Dev Costs)

Operating Income

- Interest Expense

- Foreign Exchange Losses (Gains)

- Net Non-Operating Losses (Gains)

Diluted EPS Before XO Items

Net Income Adjusted*

EPS Adjusted

Dividends Per Share

Payout Ratio %

Total Shares Outstanding

Diluted Shares Outstanding

-1

41.40

34.93

36.39

35.10

36.14

-1'200

(141.39)

0.00

154

6.98

2.00

40.4

335

39.31

3.00

7.6

356

41.36

4.50

8.5

410

47.85

7.00

11.4

473

55.28

14.00

25.5

330

38.39

20.00

48.3

279

32.41

21.00

60.1

313

36.39

22.00

60.4

302

35.10

32.00

91.2

304

35.28

32.00

88.6

22

9

9

9

9

9

9

9

9

9

9

EBITDA

*Net income excludes extraordinary gains and losses and one-time charges.

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Financials II/IV

Periodicity:

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

399

1'142

368

1'360

400

1'489

282

1'806

321

2'116

353

2'146

546

702

1'404

485

388

2'413

1'711

601

4'735

693

1'508

1'539

1'573

1'697

1'669

1'671

1'634

2'951

2'966

2'975

3'153

424

3'373

410

2'714

392

2'413

381

4'244

365

1'857

286

2'037

283

1'897

597

515

588

710

628

895

621

633

Total Current Liabilities

+ Accounts Payable

+ Short Term Borrowings

+ Other Short Term Liabilities

3'318

2'250

2'987

2'130

2'458

1'854

3'554

4'925

2'091

2'336

2'477

2'084

2'361

1'592

2'243

926

1'994

974

2'749

944

2'447

867

Total Long Term Liabilities

+ Long Term Borrowings

+ Other Long Term Borrowings

9'255

254

7'628

253

6'331

332

5'475

484

6'684

628

6'938

765

6'508

1'076

5'937

704

5'582

704

5'202

704

5'968

704

31'618

0

20

1'695

-814

29'789

0

21

1'714

575

27'950

0

14

1'722

853

32'088

0

15

1'596

1'176

30'176

0

14

1'345

1'495

32'816

0

15

891

1'615

33'138

0

13

613

1'847

33'215

0

14

529

1'975

33'018

0

14

445

2'108

35'306

0

20

446

2'131

37'189

0

1

361

2'249

901

2'310

2'588

2'787

2'855

2'521

2'473

2'518

2'567

2'597

2'611

Total Liabilities & Equity

32'519

32'098

30'537

34'875

33'031

35'337

35'611

35'733

35'585

37'903

39'800

Book Value Per Share

Tangible Book Value Per Share

103.78

89.84

104.24

100.82

304.18

293.24

325.40

314.24

331.73

329.80

291.80

290.44

286.37

285.73

291.49

290.95

297.12

296.69

300.04

295.97

303.28

298.98

12/13E

12/14E

12/15E

410.56

418.23

402.06

Balance Sheet

Total Current Assets

+ Cash & Near Cash Items

+ Short Term Investments

+ Accounts & Notes Receivable

+ Inventories

+ Other Current Assets

Total Long-Term Assets

+ Long Term Investments

Gross Fixed Assets

Accumulated Depreciation

+ Net Fixed Assets

+ Other Long Term Assets

Total Liabilities

+ Long Preferred Equity

+ Minority Interest

+ Share Capital & APIC

+ Retained Earnings & Other Equity

Total Shareholders Equity

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Financials III/IV

Periodicity:

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

12/13E

12/14E

12/15E

-1'200

1'357

224

-34

154

262

-9

6

335

1

82

-6

454

-77

119

-30

530

-110

130

1

473

-175

144

85

356

35

3

-79

301

102

-1

-11

313

58

2

25

302

98

-1

-22

311

313

316

323

347

413

412

467

551

527

315

391

397

377

Cash Flows

Net Income

+ Depreciation & Amortization

+ Other Non-Cash Adjustments

+ Changes in Non-Cash Capital

Cash From Operating Activities

+ Disposal of Fixed Assets

+ Capital Expenditures

+ Increase in Investments

+ Decrease in Investments

+ Other Investing Activities

Cash From Investing Activities

+ Dividends Paid

+ Change in Short Term Borrowings

+ Increase in Long Term Borrowings

+ Decrease in Long Term Borrowings

+ Increase in Capital Stocks

+ Decrease in Capital Stocks

+ Other Financing Activities

-121

Cash From Financing Activities

-121

Net Changes in Cash

Free Cash Flow (CFO-CAPEX)

Free Cash Flow To Firm

Free Cash Flow To Equity

Free Cash Flow per Share

347

413

412

467

525

498

304

379

377

353

40.87

18.71

48.33

54.50

61.09

57.90

35.34

43.99

43.77

41.02

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Financials IV/IV

Periodicity:

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

12/13E

12/14E

12/15E

20.2x

5.2x

7.1x

12.2x

12.8x

7.7x

11.8x

13.5x

13.0x

13.4x

14.4x

14.2x

13.7x

0.4x

0.8x

0.0%

2.1x

1.4x

1.4%

1.2x

0.7x

1.5%

2.2x

1.2x

1.2%

3.2x

1.8x

1.2%

2.5x

1.7x

2.8%

1.7x

1.1x

6.3%

2.6x

1.4x

5.1%

3.1x

1.7x

4.5%

2.9x

1.5x

7.0%

3.2x

1.6x

6.6%

4.4x

1.3x

6.1%

4.3x

1.2x

6.2%

4.2x

1.3x

6.3%

-103.7%

-127.3%

-3.6%

-104.4%

15.3%

15.1%

0.5%

9.7%

41.7%

32.7%

1.1%

13.8%

33.9%

40.8%

1.4%

17.0%

36.8%

45.1%

1.6%

18.9%

36.7%

40.5%

1.4%

17.7%

32.4%

35.5%

1.0%

14.3%

35.0%

28.8%

0.8%

12.1%

36.5%

29.1%

0.9%

12.4%

34.5%

27.7%

0.8%

11.8%

36.5%

29.1%

0.8%

12.0%

0.93

13.95

0.82

4.60

0.77

3.40

0.76

3.24

0.75

3.07

0.79

3.73

0.78

3.59

0.76

3.25

0.75

2.95

0.75

3.06

0.76

3.22

0.05

0.05

0.05

0.05

0.05

0.05

0.04

0.04

0.04

0.04

0.03

9.6%

6.1%

4.3%

4.2%

17.1%

22.1%

22.6%

22.9%

23.0%

22.8%

Ratio Analysis

Valuation Ratios

Price Earnings

EV to EBIT

EV to EBITDA

Price to Sales

Price to Book

Dividend Yield

Profitability Ratios

Gross Margin

EBITDA Margin

Operating Margin

Profit Margin

Return on Assets

Return on Equity

Leverage & Coverage Ratios

Current Ratio

Quick Ratio

Interest Coverage Ratio (EBIT/I)

Tot Debt/Capital

Tot Debt/Equity

Others

Asset Turnover

Accounts Receivable Turnover

Accounts Payable Turnover

Inventory Turnover

Effective Tax Rate

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

51.6%

30.3%

0.9%

9.3%

52.5%

30.1%

0.9%

9.3%

51.4%

30.4%

0.9%

9.4%

Company Analysis - Peers Comparision

BANQUE CANTOREG

Latest Fiscal Year:

52-Week High

52-Week High Date

52-Week Low

52-Week Low Date

Daily Volume

Current Price (2/dd/yy)

52-Week High % Change

52-Week Low % Change

Total Common Shares (M)

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

UBS AG-REG

CREDIT SUISS-REG BANK SARASIN-B GAM HOLDING AG

VONTOBEL HLDGVERWALTUNGS-ULIECHTENSTEIN-BR ST GALLER KA-REG EFG INTERNAT AG

R

BR

12/2012

524.00

20.02.2013

456.96

07.03.2012

17'955

12/2012

16.39

25.01.2013

9.69

24.07.2012

6'729'041

12/2012

27.85

07.02.2013

15.97

03.08.2012

4'236'189

12/2011

28.80

20.02.2012

24.50

08.10.2012

1'193

12/2011

16.25

15.02.2013

9.92

25.05.2012

327'314

12/2012

33.00

20.02.2013

17.80

28.06.2012

62'761

12/2011

42.45

22.02.2012

25.50

16.11.2012

9'127

12/2012

404.50

19.02.2013

320.75

21.05.2012

1'546

522.00

15.31

27.34

27.00

16.15

-0.4%

14.2%

8.6

-6.6%

58.1%

3'747.4

-1.8%

71.2%

1'292.7

-6.2%

10.2%

62.9

-0.6%

62.8%

177.1

33.00

31.80

0.0%

85.4%

63.4

-25.1%

24.7%

28.4

VZ HOLDING AG

12/2011

11.95

20.02.2013

4.77

24.07.2012

94'015

12/2011

84.00

20.02.2012

60.00

21.11.2012

5'665

12/2011

130.00

11.02.2013

85.00

26.07.2012

3'371

401.00

11.70

80.25

-0.9%

25.0%

5.5

-2.1%

145.3%

146.7

-4.5%

33.8%

5.8

BASLER KANTONPC

LUZERNER KANREG

VALIANT HLDG AG

PARTNERS GROUP

J

12/2011

111.64

02.03.2012

74.35

31.08.2012

38'297

12/2011

223.70

11.01.2013

157.20

04.06.2012

26'033

12/2011

113.60

27.04.2012

98.00

16.11.2012

794

12/2012

360.00

06.02.2013

311.00

29.02.2012

2'056

129.50

98.90

360.00

87.35

213.50

-0.4%

52.4%

7.8

-12.9%

0.9%

29.9

0.0%

15.8%

8.5

-21.8%

17.5%

15.8

-4.6%

35.8%

25.4

4'492.4

58'727.0

36'111.5

1'698.3

2'961.2

2'145.0

979.4

2'234.9

1'716.0

474.7

1'036.0

3'096.7

3'060.0

1'379.5

5'700.5

8'415.0

1.0

6'742.0

267'400.0

4'353.0

66'383.0

330'510.0

6'786.0

63'708.0

2'024.9

37.4

2'764.8

17.5

600.1

7'456.5

2'999.6

1'844.5

101.2

7'716.7

5'065.0

2'183.0

1'269.7

24.6

3'286.2

928.9

19.0

5'389.3

1.4

361.2

7'662.3

361.6

3'907.4

5'639.3

2'920.5

6'379.3

1'946.1

0.8

96.7

264'097.0

6'978.0

804.8

5'605.2

38'313.0

38'313.0

26'558.3

27'461.6

831.5

795.5

680.7

741.3

812.2

983.4

581.8

621.8

0.77

0.84

2.70

3.11

32.5x

12.3x

10.1x

8.8x

(10.3%)

30.2%

-

1.63

1.04

1.62

1.83

26.0x

26.0x

16.6x

14.8x

(2.3%)

(5.5%)

-

4.5x

4.3x

-0.52

-0.32

0.87

1.09

18.6x

14.8x

(15.8%)

-

890.7

861.4

842.4

912.0

6.8x

7.0x

213.9

202.6

28.2x

29.8x

1.76

1.55

2.32

2.68

21.3x

20.6x

14.2x

12.3x

(5.5%)

(9.9%)

23.5%

-

555.0

569.7

407.0

407.0

501.6

501.6

509.0

523.0

1'078.2

1'146.3

791.2

796.1

320.7

314.0

217.0

221.0

935.8

940.7

672.0

648.0

685.4

685.4

427.0

437.0

693.4

663.4

386.0

391.0

0.75

2.07

2.69

4.51

38.8x

38.8x

29.8x

17.8x

(7.7%)

(13.5%)

-

143.8

144.3

148.5

170.7

2.7x

2.7x

66.4

64.7

65.3

80.5

5.8x

5.9x

6.48

6.33

6.40

7.69

20.5x

20.6x

20.2x

16.8x

8.1%

10.2%

3.9%

44.9%

44.0%

47.2%

5.99

7.37

9.34

7.75

13.4x

14.0x

10.6x

12.8x

(6.6%)

(3.5%)

-

19.51

19.79

21.85

22.48

18.2x

15.2x

16.5x

16.0x

(4.7%)

(4.1%)

-

6.85

7.90

7.28

6.84

11.1x

14.4x

12.0x

12.8x

(1.9%)

(0.2%)

-

448.8

480.4

425.0

509.3

9.3x

8.7x

13.2x

10.9x

236.2

250.0

267.2

324.7

17.6x

16.6x

20.9x

17.1x

7.75

8.46

9.67

11.69

25.2x

25.7x

22.1x

18.3x

0.3%

13.9%

(26.4%)

7.6%

52.0%

62.9%

63.7%

0.38

1.34

2.91

3.60

23.7x

23.7x

10.9x

8.8x

(8.3%)

(7.6%)

-

27.28

27.28

30.88

31.97

14.7x

14.7x

13.0x

12.5x

(28.6%)

(16.3%)

-

-0.52

-2.21

0.79

0.93

14.9x

12.6x

80.6%

399.5%

-

271.9%

73.1%

-

128.7%

55.7%

-

105.6%

50.8%

-

0.7%

0.7%

0.068x

-3.575x

-

283.6%

71.4%

-

364.2%

78.5%

-

351.2%

77.8%

-

0.0%

0.0%

0.000x

-0.384x

-

Aa1

02.12.2003

A24.02.2009

-

AA+

18.10.2001

-

AA+

12.09.2008

-

Valuation

Total Revenue

EV/Total Revenue

EBITDA

EV/EBITDA

EPS

P/E

Revenue Growth

EBITDA Growth

EBITDA Margin

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

1 Year

5 Year

1 Year

5 Year

LTM

CY+1

CY+2

1'321.2

1'321.2

1'029.3

1'050.3

35.48

36.14

36.18

36.66

14.4x

14.7x

14.4x

14.2x

(2.3%)

(4.5%)

-

37'392.0

37'470.0

26'730.4

27'411.1

6.9x

6.9x

17'464.0

17'575.0

14.8x

16.1x

1.68

-0.75

0.93

1.21

15.3x

16.5x

12.6x

(8.5%)

(10.7%)

(29.1%)

47.0%

-

322.4%

76.3%

-

582.6%

84.2%

18.434x

9.520x

-

927.6%

88.6%

-

164.7%

61.5%

-

0.8%

0.8%

-

498.2%

83.3%

34.709x

23.855x

-

AA

05.12.2011

-

A

29.11.2011

A2

21.06.2012

A

19.12.2008

(P)A2

21.06.2012

A

17.12.2012

-

A

30.03.2009

-

Leverage/Coverage Ratios

Total Debt / Equity %

Total Debt / Capital %

Total Debt / EBITDA

Net Debt / EBITDA

EBITDA / Int. Expense

119.7%

52.9%

-

Credit Ratings

S&P LT Credit Rating

S&P LT Credit Rating Date

Moody's LT Credit Rating

Moody's LT Credit Rating Date

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Вам также может понравиться

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFДокумент103 страницыFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFДокумент227 страницFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFQ.M.S Advisors LLCОценок пока нет

- qCIO Global Macro Hedge Fund Strategy - November 2014Документ31 страницаqCIO Global Macro Hedge Fund Strategy - November 2014Q.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Документ227 страницFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Q.M.S Advisors LLCОценок пока нет

- Directory - All ETC Exchange Traded Commodities - Worldwide PDFДокумент40 страницDirectory - All ETC Exchange Traded Commodities - Worldwide PDFQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFДокумент103 страницыFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCОценок пока нет

- Financial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfДокумент8 страницFinancial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapДокумент205 страницFundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapQ.M.S Advisors LLCОценок пока нет

- TPX 1000 Index - Dividends and Implied Volatility Surfaces Parameters PDFДокумент8 страницTPX 1000 Index - Dividends and Implied Volatility Surfaces Parameters PDFQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryДокумент205 страницFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesДокумент205 страницFundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesQ.M.S Advisors LLC100% (1)

- Fundamental Analysis & Analyst Recommendations - QMS Global Agribusiness FlexIndexДокумент103 страницыFundamental Analysis & Analyst Recommendations - QMS Global Agribusiness FlexIndexQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapДокумент205 страницFundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapQ.M.S Advisors LLCОценок пока нет

- Fundamental Analysis & Analyst Recommendations - EM Frontier Myanmar BasketДокумент25 страницFundamental Analysis & Analyst Recommendations - EM Frontier Myanmar BasketQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryДокумент205 страницFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCОценок пока нет

- Financial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesДокумент8 страницFinancial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesQ.M.S Advisors LLCОценок пока нет

- Financial Analysis - EDF SA (Electricite de France) Produces, Transmits, Distributes, Imports and Exports Electricity. the Company, Using Nuclear Power, Coal and Gas, Provides Electricity for French Energy ConsumersДокумент8 страницFinancial Analysis - EDF SA (Electricite de France) Produces, Transmits, Distributes, Imports and Exports Electricity. the Company, Using Nuclear Power, Coal and Gas, Provides Electricity for French Energy ConsumersQ.M.S Advisors LLCОценок пока нет

- Fundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaДокумент205 страницFundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaQ.M.S Advisors LLCОценок пока нет

- Company Analysis - Overview: Nuance Communications IncДокумент8 страницCompany Analysis - Overview: Nuance Communications IncQ.M.S Advisors LLCОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Ch11 Kieso Ifrs Test BankДокумент40 страницCh11 Kieso Ifrs Test BankTrinh LêОценок пока нет

- Accounting Multiple Choice Questions#1: A) B) C) D)Документ13 страницAccounting Multiple Choice Questions#1: A) B) C) D)Gunjan RajdevОценок пока нет

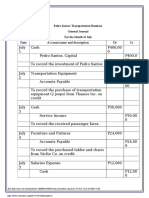

- Pedro Santos' Transportation Business General Journal For The Month of JulyДокумент8 страницPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლОценок пока нет

- Wharton Business Foundations Intro To FiДокумент4 страницыWharton Business Foundations Intro To FiasdfghjОценок пока нет

- Week 4 - AEC 201 - Activities-PrelimДокумент12 страницWeek 4 - AEC 201 - Activities-PrelimNathalie HeartОценок пока нет

- FA2 Question BookДокумент59 страницFA2 Question BookNam LêОценок пока нет

- Week 1 Lab WorkДокумент6 страницWeek 1 Lab WorkSimran DeolОценок пока нет

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Документ5 страницPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaОценок пока нет

- Csec Poa June 2006 p1Документ10 страницCsec Poa June 2006 p1Dianna Lawrence100% (1)

- Igcse Accounting Prepayments Accruals Questions AnswersДокумент16 страницIgcse Accounting Prepayments Accruals Questions AnswersInnocent GwangwaraОценок пока нет

- Busfi Chp17 Oddnum ProblemsДокумент8 страницBusfi Chp17 Oddnum ProblemsmaggieОценок пока нет

- Three Methods of Estimating Doubtful AccountsДокумент8 страницThree Methods of Estimating Doubtful AccountsJay Lou PayotОценок пока нет

- PRIA AFAR03003 Corporate Liquidation and Home Office and Branch Accounting No AnswerДокумент33 страницыPRIA AFAR03003 Corporate Liquidation and Home Office and Branch Accounting No AnswerViannice Acosta100% (3)

- Cfas MidtermДокумент192 страницыCfas MidtermIamkitten 00Оценок пока нет

- Final AccountsДокумент23 страницыFinal AccountsRajat srivastavaОценок пока нет

- Suspension Balance SheetДокумент2 страницыSuspension Balance SheetNadia Syamira SaaidiОценок пока нет

- Module 4 Loans and ReceivablesДокумент55 страницModule 4 Loans and Receivableschuchu tvОценок пока нет

- Regina Company, IncДокумент18 страницRegina Company, IncMelviana KloatubunОценок пока нет

- From The Following Balance Sheet of Mayur Ltd. AnДокумент1 страницаFrom The Following Balance Sheet of Mayur Ltd. AnJaymala ShahiОценок пока нет

- Ezz Steel Ratio Analysis - Fall21Документ10 страницEzz Steel Ratio Analysis - Fall21farahОценок пока нет

- Financial PlanДокумент13 страницFinancial Planseleen16yahoo.comОценок пока нет

- WORKSHEET (Lembar Jawaban)Документ10 страницWORKSHEET (Lembar Jawaban)I Gede Wahyu krisna DarmaОценок пока нет

- Sol. Man. - Chapter 7 - Posting To The LedgerДокумент7 страницSol. Man. - Chapter 7 - Posting To The LedgerMae Ann Tomimbang MaglinteОценок пока нет

- JLRM Financal StatmentsДокумент33 страницыJLRM Financal StatmentsEsha ChaudharyОценок пока нет

- Fs AnalysisДокумент14 страницFs Analysisyusuf pashaОценок пока нет

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Документ8 страницSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuОценок пока нет

- Financial Plan - JanaДокумент4 страницыFinancial Plan - JanajemmieОценок пока нет

- FMA AssignmentДокумент2 страницыFMA AssignmentGetahun MulatОценок пока нет

- Equation Expanded To Show Operating ActivitiesДокумент21 страницаEquation Expanded To Show Operating ActivitiesShaila MarceloОценок пока нет

- Internship 3Документ30 страницInternship 3Sumithra K - Kodaikanal centerОценок пока нет