Академический Документы

Профессиональный Документы

Культура Документы

September Capital Home Financing 101

Загружено:

heinztein0 оценок0% нашли этот документ полезным (0 голосов)

46 просмотров5 страницSeptember Capital Home Financing 101

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSeptember Capital Home Financing 101

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

46 просмотров5 страницSeptember Capital Home Financing 101

Загружено:

heinzteinSeptember Capital Home Financing 101

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Home Iinancing J0J

1hinking o buying a house lere are some tips in getting a mortgage.

By leinz Bulos

September 2002

ow is the best time to buy a

house. \hether you`re a young

I1 proessional thinking out to

buy a condo unit or a ast-rising middle

manager looking or your irst house,

things hae neer looked this good or a

long time. \hateer your reasons or

buying a lot, condo, or house -

upgrading to a higher standard o liing

or inestment purposes - or een i you

just plan to make home improements,

construct a house on an owned lot or

reinance your existing mortgage, the

time is ripe.

Interest rates on loans are the lowest or

a number o years. \ou can get a

mortgage as low 8.5 nowadays, a ar

cry to a ew years ago when interest on

consumer loans were twice or een

thrice the preailing rates today. Banks

are also quite aggressie in promoting

their housing loan products and they are

out to get your business. 1he residential

real estate market is also beginning to

look good, with quite a number o

ertical and community projects

underway.

Unless you`re mega-rich and pay spot

cash, the best alternatie in inancing a

home purchase is to get a bank

mortgage. \our home will probably be

the most expensie asset you`ll eer own

and it will surely drain your resources

or more than a decade. So it would be

olly to rush through the process o

buying and borrowing just so you could

buy that dream house o yours. \hile

you shouldn`t be dragging your eet

during this ideal period or inancing a

home, you also shouldn`t grab the next

oer you get. 1ake your time, but don`t

take too long.

Beore going to all those open house

eents or calling up brokers to gie you

a tour o Metro Manila, you should start

irst with a reality check. It doesn`t make

sense looking at houses or projects, then

realizing much later that you can`t aord

them. Start irst with estimating how

much you can aord beore een

deciding on your moe. \ho knows,

you might accept the act that you need

to stay at your parents` house or keep on

paying rent a ew more years.

1hese are the things you need to ask

yoursel:

How much am I earning every

month? \our income leel is a key

actor or banks to determine how much

they can lend you. 1he rule o thumb is

your monthly amortization should be

less than 30 o your net income or

take home pay. So i you`re making

P50,000 a month - and most banks use

that as a minimum - your maximum

monthly amortization is P15,000.

loweer, some banks nowadays are

more conseratie. Len i you know

you can aord the monthly payment,

they will approe a much lower amount.

How much cash and other liquid

assets do I have? 1his is important to

know because banks will not lend 100

o the market alue o the property

you`re interested in. I it`s a lot or house

and lot, they`ll lend a maximum o 0,

or condominiums, it`s 60. In the

same way, sellers and deelopers require

a 30 down payment, although others

oer just 10. So i you`re buying a P1

million condo unit, you need P400

thousand as your equity because you can

only borrow up to P600 thousand. Most

likely, you need to pay up or the down

payment yoursel, and that would come

N

rom your saings. Some property

deelopers hae in-house inancing een

or the down payment, which they

spread out to six months. But to aoid

paying interest, it`s best to pay this in

cash outright. Keep in mind that some

sellers also require a reseration ee that

you can later apply to your down

payment. 1here are other ees related to

registration that aren`t exactly cheap

either.

How much debt and expenses do I

have? \ou hae to inorm your bank

about your monthly expenses and

current loans you hae, as those will gie

them a better idea how much you can

aord. Be honest about this because you

don`t want to be in a tight squeeze later

on. Consider also expenses in the

oreseeable uture. I you`re planning or

a wedding, a big acation, or college

tuition, take these into account. Len i

you`re sure your income will increase as

the years go by, it`s better to be on the

conseratie side.

Do I have a good credit record? Do

you oten miss your credit card

payments, or pay just the minimum all

the time Did you eer deault on your

car loan Banks share a negatie

databank, so Bank A would know your

credit record in Bank B. \our bank will

also send a credit inestigator to check

your credit history. Make sure you keep

at least three months worth o credit

card statements and deposit account

statements, which you`d be required to

submit.

Ater learning about the current state o

your inances, you need to know what

your mortgage options are. lere are

some things to understand:

Loan amount. Most banks allow up to

0 o the market alue o the property

,60 or condos, as the maximum loan

amount. 1hey also hae a minimum loan

amount, such as P400 thousand. \ou

can o course borrow less than 0 i

you can aord it. \ou can also make

balloon payments eery year to decrease

your loan or een pre-terminate the

entire loan. But make sure you don`t use

too much o your cash, as you hae to

consider other expenses. Don`t put all

your saings into the equity o your

home. \ou need to hae enough saings

or daily needs and emergency expenses.

\ou don`t want to be house-rich and

cash-poor. laing considered that, do

put in more equity as reasonable to

lessen the interest payment on your

loan. \ou also might need to do this i

you want a more expensie property

than what your banker will allow you to

buy. So een i you`re sure you can

aord a P3 million house and the

corresponding monthly amortization

based on your own calculation, but your

bank lets you borrow less than that, then

increase your equity so your loan

amount decreases.

Interest rates. 1here are ixed rates

yearly, or 2 years, 3 years, and 5 years.

Some banks oer quarterly rates.

Obiously, the longer the term, the

higher the rate. Interest rates nowadays

are at their lowest or a long time. And it

seems they will stay stable or the

oreseeable uture. I that`s your bet,

then ix your rate or 1 year or get the

quarterly repricing rate. But i you think

interest rates will shoot up suddenly,

hae it ixed or 2, 3 or 5 years. 1he

ixed rate or 5 years is between 12 to

14.5. So i the interest rate 3 years

rom now goes up more than 15,

you`re better o. 1he downside is i

rates will stay at the current 9 and

you`re paying 14.5. 1here are also two

options: straight-line declining-balance.

Straight-line means your monthly

payments are ixed. Declining-balance

means you start o paying higher

amortization in the irst ew years and

much lesser as you near the end o the

term. 1he latter results to lesser total

interest. 1he other two things to

consider about interest rates is the eect

on your monthly amortization and your

total cost. 1he lower the rate, the

smaller your amortization and total

interest at the end o the loan, and ice-

ersa. Getting a lower rate ixed or a

shorter period also means you can

qualiy or a bigger loan, as your

equialent monthly amortization would

be within the bank`s lending limit, which

is a percentage o your income.

1erm. Monthly amortizations can be

steep, so the rule is to spread the

payments as long as possible. 1he term

or loans can be as short as 1 year to as

long as 20 years. 1he longer the term,

the smaller your monthly amortization

but the higher your interest expense. I

you max out your loan to 20 years, your

dream house, which seemed such a

bargain, can turn out to be too

expensie when you include interest,

which can be add a quarter to hal o

your total costs. \ou also hae to

consider i you want to pay o your

loan as ast as possible. I you use a lot

o your income, say, in the next ten

years, you`d be sacriicing a lot o other

things. Ater the term, on the other

hand, you`ll hae lots o cash lying

around. But there`s an opportunity cost

o not being able to sae and inest

what you spent on your amortizations

early on. So you need to ind a balance.

\ou don`t want to pay too much or

interest and you don`t want to squeeze

your monthly budget.

Irequency of payment. \ou can pay

your amortization monthly, quarterly, or

ortnightly, i.e. eery two weeks. 1he

good thing about paying ortnightly is

that you can budget it along with your

payroll period. It also doesn`t seem as

big compared to paying monthly or

quarterly. Best o all, because you`re in

eect making extra payments ,2 extra

since there are 26 payments in a 365-day

year, equialent to 13 months,, your

term will shorten and so will your total

interest. Now, remember, you can tell

your banker your preerence, not just in

requency, but also the loan amount,

interest rate, and term. And don`t be

araid o making a mistake. On your

anniersary ,your loan, not your

wedding, date, you can reinance your

loan or a small ee and make changes to

the terms o your loan. Also, you can

choose how you pay your amortization.

Banks let you pay by check or automatic

debit to your account, a more

conenient option.

Other fees. Don`t oerlook the

miscellaneous ees that the property

seller and your bank charge. 1he

deeloper charges you or the

registration ee, documentary stamps,

transer tax, serice ee, lot plan,

issuance o title, maintenance ee, and

real property tax. \our bank charges you

or Mortgage Redemption Insurance

,MRI,, ire insurance, handling ee,

appraisal ee, documentary stamps,

notarial ee, and mortgage registration.

Ask your deeloper and bank which ees

apply and i they`re willing to waie

some o them. \ou can sae a little

money by doing the leg work or title

registration, but it`s usually not worth it.

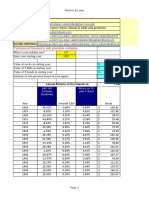

\ou will know what kind o property

you`ll be able to aord by doing your

homework aboe. Keep a record o your

personal inances to know how much

equity you can put in and discuss with

your bank how much they`re willing to

lend you. O course, beore they do that,

you would hae already submitted your

loan application. 1o get a rough estimate

o how much you can borrow, go to the

banks` web sites. Some o them hae

loan calculators that compute your

amortization or loan amount. \hat you

want to ind out is the loan amount, so

you need to plug in the monthly

payments you can aord. Remember

that the amortization you`ll plug in

should include an estimate o the

monthly interest. Multiply 0 o your

monthly net income. Input the igure in

the loan calculator to get the loan

amount. But the result is not really the

loan amount, since it should incorporate

interest. Remoe 25 rom the total i

your term is 15 years, and you`ll hae an

estimate o your loan amount. Add your

equity and that`s the house or condo you

should be looking or.

Now that you know what to ask loan

oicers rom the banks you`re

considering, it`s up to you which bank

you want to apply a housing loan rom.

\hat should you consider lere are

some suggestions:

Mortgage options. \ou want a bank

that oers lexible terms. O course,

banks that oer low interest rates are

strong contenders, but that`s not the

only actor. \ou also want to make sure

they`ll let you reinance on your

anniersary date.

Service. \ou want a bank that has loan

oicers who are accommodating and

helpul and good in explaining and

answering the dumbest questions you

can ask. Len i the rate oered is

attractie but oicers are rude or

diicult to contact, orget it. \ou also

want a bank that can process your loan

in a week or less. Once you pay your

deeloper a reseration ee, it won`t be

reunded i your loan is disapproed.

Usually, deelopers gie you 30 days

ater you make a reseration to pay the

entire purchase price. So you`d want

time to apply to another bank i

necessary.

Reputation. Certainly, you want a

stable bank. \ou don`t want to borrow

rom a bank that`s in trouble. \ou also

want a bank that`s known or their

housing loan program. 1hat means a lot

o people trust them and that they`e

been airly successul lending to people

who buy homes. It also helps i the bank

has good relations with the deeloper. I

they are some sort o one o the

oicial` banks or the project, so much

the better. Coordination and acilitation

o documents and payment are quicker

and more conenient.

Convenience. \ou want a bank that

oers conenience. Some banks delier

and pick up documents rom your house

or oice. \ou also want to track your

loan balance and payments by phone

and online. It would be nice i the

bank`s web site has an alert eature that

e-mails or texts you your balance, to

make sure you don`t miss payments.

lere are the top banks that oer

excellent housing loan programs:

BPI is well-known or its consumer

loan programs. 1hey oer low rates,

lower minimum loan amount, ast

processing, and conenient payment

methods. www.bpi.com.ph

Chinatrust is the most aggressie,

oering BPI`s clients to transer their

mortgage to them, oering a 2 cut on

their interest rate.

www.chinatrust.com.ph

HSBC has one o the best programs

around. 1hey match BPI`s rate and oer

great customer serice. 1hey hae

lexible terms ,they also promote their

ortnightly payment option which most

banks don`t, as it means less interest

income or them, and conenient ways

or paying and checking your

amortization. 1hey also use their

Simulated Loan Calculator so clients can

see on the spot their amortization and

total cost using dierent combinations

o rate, term, and requency o payment.

www.hsbc.com.ph

Lquitable PCI Bank has an Own-a-

lome program, which requires a lower

monthly income to qualiy and oers

competitie rates.

www.equitablepcib.com

Metrobank . Its saings bank

subsidiary, PSBank, has an interesting

program that promises to pay your

entire principal at the end o your loan.

1hat means, howeer, there`s an add-on

to your interest rate. 1he extra income

will be used to und their later reund o

your principal. www.metrobank.com.ph

1ake adantage o the current

enironment i you really plan to inance

or reinance your uture or current

home. 1his primer should gie you a

basic understanding o home inancing.

But our best adice is: go to a bank that

will take the time to explain these to

you. It`s a buyer`s market or residential

projects and it`s a borrower`s market or

housing loans as well. 1hat means you`re

the boss. Don`t settle or anything less.

Вам также может понравиться

- Weaving The WebДокумент15 страницWeaving The WebheinzteinОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- What Can You Do With One Billion PesosДокумент17 страницWhat Can You Do With One Billion PesosheinzteinОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Wall of ShameДокумент3 страницыWall of ShameheinzteinОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Audio VocaДокумент2 страницыAudio VocaheinzteinОценок пока нет

- Union BankДокумент10 страницUnion BankheinzteinОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The First Million Is Always The HardestДокумент8 страницThe First Million Is Always The HardestheinzteinОценок пока нет

- The Right Mutual Funds For YouДокумент2 страницыThe Right Mutual Funds For YouheinzteinОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Web Movers and ShakersДокумент13 страницThe Web Movers and ShakersheinzteinОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Take 5Документ7 страницTake 5heinzteinОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Walk The PlankДокумент15 страницWalk The PlankheinzteinОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Race For The Last MileДокумент19 страницThe Race For The Last MileheinzteinОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- CДокумент5 страницCheinzteinОценок пока нет

- SurvivorДокумент9 страницSurvivorheinzteinОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- SiemensДокумент3 страницыSiemensheinzteinОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Sony Cybershot Dsc-p100Документ2 страницыSony Cybershot Dsc-p100heinzteinОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Ship AhoyДокумент7 страницShip AhoyheinzteinОценок пока нет

- StarbucksДокумент6 страницStarbucksheinzteinОценок пока нет

- SapДокумент6 страницSapheinzteinОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Sex SellsДокумент7 страницSex Sellsheinztein100% (1)

- ShakeysДокумент4 страницыShakeysheinzteinОценок пока нет

- Pirates of Digital ValleyДокумент10 страницPirates of Digital ValleyheinzteinОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- PalДокумент10 страницPalheinzteinОценок пока нет

- SchwarzwalderДокумент2 страницыSchwarzwalderheinzteinОценок пока нет

- Rediscovering BaguioДокумент4 страницыRediscovering BaguioheinzteinОценок пока нет

- Ramon MagsaysayДокумент4 страницыRamon MagsaysayheinzteinОценок пока нет

- Rate Shopping For A Housing LoanДокумент4 страницыRate Shopping For A Housing LoanheinzteinОценок пока нет

- OperaДокумент5 страницOperaheinzteinОценок пока нет

- Olympus Camedia c5060Документ2 страницыOlympus Camedia c5060heinzteinОценок пока нет

- INVESTMENTSДокумент9 страницINVESTMENTSKrisan RiveraОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Investor Presentation February 2021 IssuanceДокумент29 страницInvestor Presentation February 2021 IssuanceSylvain BlanchardОценок пока нет

- The Intelligent Investor Chapter 6Документ3 страницыThe Intelligent Investor Chapter 6Michael PullmanОценок пока нет

- Stocks ValuationДокумент76 страницStocks ValuationDaniel HunksОценок пока нет

- Investment advice for client seeking retirement planningДокумент16 страницInvestment advice for client seeking retirement planningJaihindОценок пока нет

- Fa 2 1Документ8 страницFa 2 1Quỳnh Anh NguyễnОценок пока нет

- GS 2011 Annual ReportДокумент228 страницGS 2011 Annual ReportEric PlattОценок пока нет

- Legislative History of United States Tax Conventions Vol. 4: Model Tax ConventionsДокумент712 страницLegislative History of United States Tax Conventions Vol. 4: Model Tax ConventionscaplibraryОценок пока нет

- Rate Shock Pandemic Spreading - Juggling DynamiteДокумент3 страницыRate Shock Pandemic Spreading - Juggling DynamiteOwm Close CorporationОценок пока нет

- Customized Geometric Risk Premium EstimatorДокумент40 страницCustomized Geometric Risk Premium EstimatorVíctor GómezОценок пока нет

- Investor's Share in Associate Profits and Inventory TransactionsДокумент7 страницInvestor's Share in Associate Profits and Inventory Transactionsaryan nicoleОценок пока нет

- Audit of LiabilitiesДокумент33 страницыAudit of Liabilitiesxxxxxxxxx96% (28)

- Systematic Credit InvestingДокумент16 страницSystematic Credit Investingbfortuna94Оценок пока нет

- Omega Advisors Inc. Letter To Investors 9.21.16Документ5 страницOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Keith Weiner The Swiss Franc Will CollapseДокумент16 страницKeith Weiner The Swiss Franc Will CollapseTREND_7425Оценок пока нет

- CH 14Документ13 страницCH 14Ranjan PradhanОценок пока нет

- Investment PolicyДокумент23 страницыInvestment Policyrj5307Оценок пока нет

- Cash and Cash EquivalentsДокумент3 страницыCash and Cash EquivalentsBeat KarbОценок пока нет

- Quiz 2 ReviewerДокумент4 страницыQuiz 2 ReviewerMariel Garra0% (1)

- Guingona Vs CaragueДокумент11 страницGuingona Vs CaragueMirzi Rio DamoleОценок пока нет

- Compound Financial Instruments Pas 32 Pfrs 9Документ14 страницCompound Financial Instruments Pas 32 Pfrs 9SamОценок пока нет

- Senate Hearing, 109TH Congress - Examining The Role of Credit Rating Agencies in The Captial MarketsДокумент206 страницSenate Hearing, 109TH Congress - Examining The Role of Credit Rating Agencies in The Captial MarketsScribd Government DocsОценок пока нет

- Unit - 4: Capital Gains: After Studying This Unit, You Would Be Able ToДокумент124 страницыUnit - 4: Capital Gains: After Studying This Unit, You Would Be Able ToGayatri KhedkarОценок пока нет

- Non Banking Financial BookДокумент297 страницNon Banking Financial BookSamad HussainОценок пока нет

- COMMERCE KEY TERMSДокумент50 страницCOMMERCE KEY TERMSSami Jee50% (2)

- 2015 - Valuation of SharesДокумент31 страница2015 - Valuation of SharesGhanshyam KhandayathОценок пока нет

- Simple Interest Compounded Interest Population Growth Half LifeДокумент32 страницыSimple Interest Compounded Interest Population Growth Half LifeCarmen GoguОценок пока нет

- PRELIMINARY OFFICIAL STATEMENT DATED MARCH 6, 2014 CommonwealthPRGO2014SeriesA-POSFinalДокумент250 страницPRELIMINARY OFFICIAL STATEMENT DATED MARCH 6, 2014 CommonwealthPRGO2014SeriesA-POSFinalJohn E. MuddОценок пока нет

- Tutorial 1 - Q&AДокумент5 страницTutorial 1 - Q&Arosario correiaОценок пока нет

- Risk Reduction Through The Active Management of A Bond PortfolioДокумент1 страницаRisk Reduction Through The Active Management of A Bond PortfolioAmit PandeyОценок пока нет

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedОт EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedРейтинг: 4.5 из 5 звезд4.5/5 (38)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4 из 5 звезд4/5 (2)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsОт EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsРейтинг: 5 из 5 звезд5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelОт EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelРейтинг: 5 из 5 звезд5/5 (51)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesОт EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesРейтинг: 4.5 из 5 звезд4.5/5 (99)

- Anything You Want: 40 lessons for a new kind of entrepreneurОт EverandAnything You Want: 40 lessons for a new kind of entrepreneurРейтинг: 5 из 5 звезд5/5 (46)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureОт EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureРейтинг: 4.5 из 5 звезд4.5/5 (100)